Key Insights

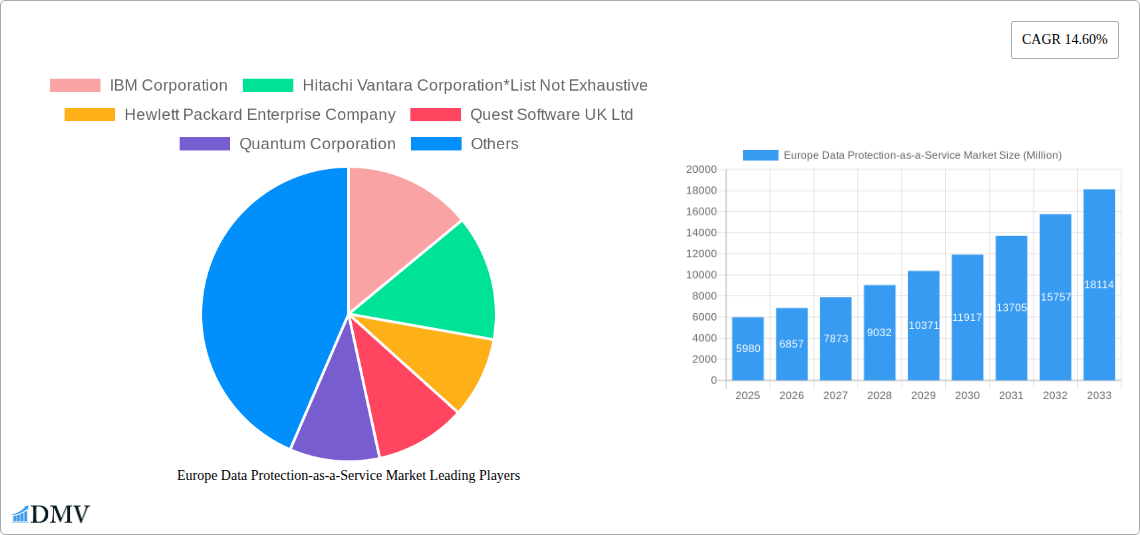

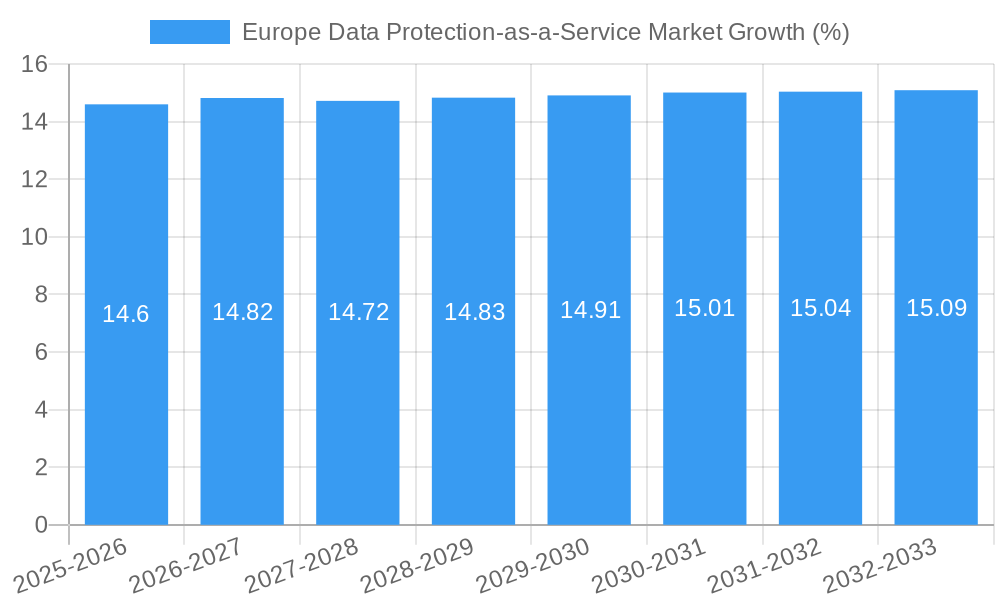

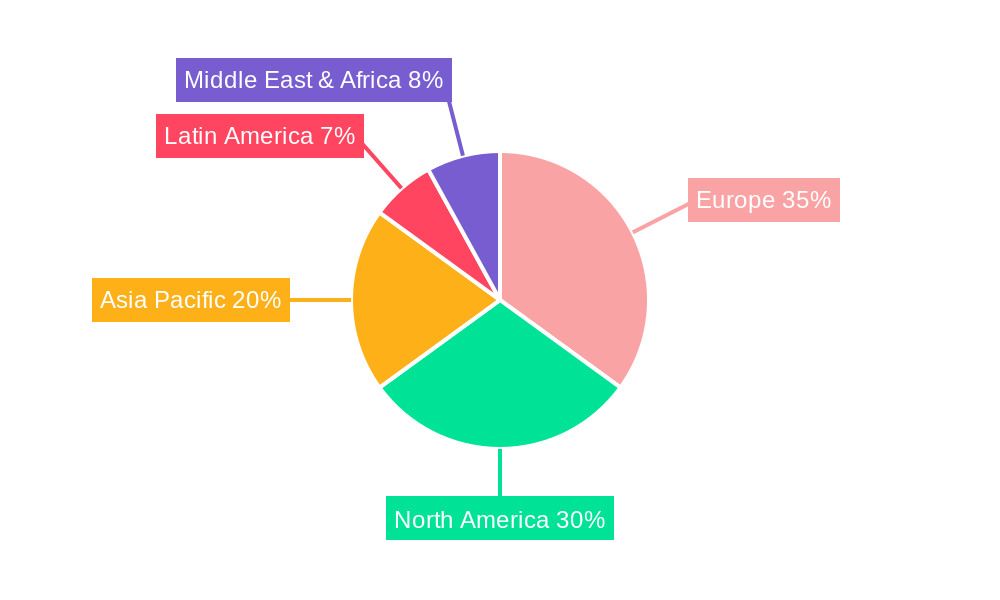

The Europe Data Protection-as-a-Service (DPaaS) market is poised for significant expansion, projected to reach a substantial USD 5.98 billion by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 14.60% between 2019 and 2033, indicating a strong and sustained demand for comprehensive data protection solutions across the continent. Key drivers behind this surge include the escalating volume of data generated by businesses and individuals, coupled with increasingly stringent data privacy regulations such as GDPR, which mandate robust protection and compliance. Furthermore, the growing threat landscape, encompassing cyberattacks, ransomware, and data breaches, compels organizations to adopt advanced DPaaS solutions to safeguard their critical information assets. The widespread adoption of cloud computing, particularly public, private, and hybrid cloud deployments, also acts as a significant enabler, providing the scalable and flexible infrastructure required for DPaaS.

The market is segmented into various service offerings, with Storage-as-a-Service, Backup-as-a-Service, and Disaster Recovery-as-a-Service emerging as dominant segments. These services are crucial for businesses of all sizes to ensure data availability, business continuity, and rapid recovery in the event of disruptions. The IT and Telecom sector, alongside BFSI and Healthcare, are leading the charge in DPaaS adoption due to the sensitive nature of their data and the critical need for uninterrupted operations. The forecast period (2025-2033) anticipates continued innovation in DPaaS, with an emphasis on enhanced security features, AI-driven analytics for threat detection, and more sophisticated data recovery capabilities. While the market is largely driven by technological advancements and regulatory pressures, potential restraints such as integration complexities and the perceived cost of migration to cloud-based DPaaS solutions will require strategic attention from service providers. Major players like IBM Corporation, Hitachi Vantara Corporation, Hewlett Packard Enterprise Company, and Amazon Web Services Inc. are actively shaping the market landscape through continuous product development and strategic partnerships.

This comprehensive report offers an in-depth analysis of the Europe Data Protection-as-a-Service (DPaaS) market, providing critical insights into its dynamics, growth trajectory, and future potential. Spanning from 2019 to 2033, with a specific focus on the base year of 2025 and the forecast period of 2025–2033, this study is an essential resource for stakeholders seeking to navigate the evolving landscape of secure, cloud-based data protection solutions across Europe.

Europe Data Protection-as-a-Service Market Market Composition & Trends

The Europe Data Protection-as-a-Service Market is characterized by a dynamic interplay of market concentration, innovation catalysts, and a robust regulatory framework. The increasing volume and sensitivity of data, coupled with stringent compliance mandates like GDPR, are the primary drivers fueling the adoption of DPaaS. Innovation is being spurred by advancements in cloud technologies, AI-driven threat detection, and specialized service offerings. While the market is competitive, with key players like IBM Corporation, Hitachi Vantara Corporation, and Oracle Corporation vying for market share, there's a notable trend towards strategic partnerships and acquisitions aimed at expanding service portfolios and geographical reach. M&A activities in the recent past have seen deal values ranging from tens of millions to hundreds of millions of Euros, reflecting the strategic importance of acquiring robust DPaaS capabilities. Understanding the competitive landscape, including the market share distribution of key service providers and the emergence of niche players, is crucial for strategic planning.

- Market Concentration: Moderate to high, with established players holding significant market share.

- Innovation Catalysts: AI/ML for threat intelligence, ransomware protection, hybrid cloud integration, and advanced encryption techniques.

- Regulatory Landscapes: GDPR, NIS2 Directive, and country-specific data sovereignty laws heavily influence market strategies.

- Substitute Products: On-premises data protection solutions, though increasingly less favored due to cost and agility limitations.

- End-User Profiles: Diverse, with a strong presence in BFSI, Healthcare, and Government sectors, demanding high levels of security and compliance.

- M&A Activities: Driven by the need for expanded capabilities, market consolidation, and acquisition of innovative technologies.

Europe Data Protection-as-a-Service Market Industry Evolution

The Europe Data Protection-as-a-Service Market has undergone a significant transformation, evolving from basic backup solutions to comprehensive, multi-faceted data protection strategies. Over the historical period of 2019–2024, the market witnessed a steady ascent driven by increasing awareness of cyber threats and the growing adoption of cloud computing. The base year of 2025 marks a pivotal point, with accelerated growth expected as businesses mature in their digital transformation journeys and embrace the inherent advantages of DPaaS. This evolution is characterized by several key trends. Firstly, the shift from traditional, on-premises data protection to flexible, scalable, and cost-effective cloud-based services has been a dominant narrative. Organizations are increasingly outsourcing their data protection responsibilities to specialized providers, allowing them to focus on core business operations while ensuring robust security and compliance.

Secondly, technological advancements have played a crucial role. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into DPaaS platforms has enabled proactive threat detection, intelligent data tiering, and automated recovery processes. This not only enhances security but also optimizes operational efficiency. The adoption of advanced encryption techniques, immutability features, and immutable backups has become paramount in combating the rising tide of ransomware attacks, which have seen a surge in sophistication and frequency.

Thirdly, a significant shift in consumer demands is evident. Businesses are no longer seeking mere data backup; they require comprehensive data resilience solutions that encompass disaster recovery, business continuity, data archiving, and compliance management. This has led to the development of integrated DPaaS offerings that address the entire data lifecycle. The rise of hybrid and multi-cloud environments has also necessitated DPaaS solutions capable of seamlessly protecting data across diverse infrastructures. The market growth rate, which stood at a healthy xx% during the historical period, is projected to accelerate to xx% annually during the forecast period of 2025–2033. Adoption metrics, such as the percentage of European SMEs and enterprises utilizing DPaaS for critical data protection, have steadily climbed, with projections indicating further substantial increases in the coming years. The increasing complexity of data regulations across Europe, such as the GDPR and upcoming directives, has further propelled the demand for compliant and robust DPaaS solutions, making it a critical component of any modern business's IT strategy.

Leading Regions, Countries, or Segments in Europe Data Protection-as-a-Service Market

Within the Europe Data Protection-as-a-Service Market, several regions, countries, and segments stand out due to their market leadership, driven by a confluence of economic, regulatory, and technological factors.

Dominant Segments by Service:

- Backup-as-a-Service (BaaS): This remains a cornerstone of DPaaS, with a market share of approximately xx%. Its dominance stems from the fundamental need for data backup across all organizations, amplified by increasing data volumes and the constant threat of data loss due to hardware failures, human error, or cyberattacks. The ease of implementation and predictable cost structure make BaaS an attractive entry point for many businesses into DPaaS.

- Key Drivers:

- Ubiquitous data protection requirements.

- Cost-effectiveness compared to on-premises solutions.

- Simplified management and scalability.

- Disaster Recovery-as-a-Service (DRaaS): Experiencing the fastest growth, DRaaS accounts for an estimated xx% of the market. The increasing frequency and impact of disruptive events, including cyberattacks and natural disasters, are driving demand for robust DRaaS solutions that ensure business continuity and minimize downtime. European organizations are recognizing the critical need for rapid recovery capabilities to maintain operational resilience.

- Key Drivers:

- Rising cyber threats and ransomware.

- Focus on business continuity and resilience.

- Stringent RTO/RPO (Recovery Time Objective/Recovery Point Objective) mandates.

- Storage-as-a-Service (STaaS): While not exclusively a DPaaS segment, STaaS plays a vital supporting role, accounting for approximately xx% of the DPaaS market share, particularly for cold storage and long-term archival needs. Its integration with backup and recovery services provides a comprehensive data management solution.

- Key Drivers:

- Scalable and cost-effective data storage.

- Support for archiving and compliance.

- Integration with backup and recovery workflows.

Dominant Segments by Deployment:

- Hybrid Cloud: This deployment model currently leads the market with an estimated xx% share. The flexibility of hybrid cloud allows organizations to leverage public cloud benefits for scalability and cost efficiency while retaining sensitive data or critical applications on private infrastructure for enhanced control and compliance. This balance is highly appealing to many European enterprises.

- Key Drivers:

- Balancing security, compliance, and cost.

- Phased cloud adoption strategies.

- Flexibility for diverse workloads.

- Public Cloud: Rapidly gaining traction, the public cloud segment is projected to grow significantly, holding an estimated xx% share. The inherent scalability, accessibility, and often lower upfront costs of public cloud DPaaS solutions are making them increasingly attractive, especially for small and medium-sized businesses.

- Key Drivers:

- Scalability and on-demand resources.

- Cost-effectiveness for SMBs.

- Accessibility and ease of deployment.

- Private Cloud: While less dominant in terms of overall market share at approximately xx%, private cloud DPaaS solutions remain crucial for organizations with highly stringent security and regulatory requirements, particularly within government and defense sectors.

- Key Drivers:

- Enhanced data control and security.

- Meeting specific regulatory compliance.

- Dedicated infrastructure for sensitive data.

Dominant End-User Industries:

- BFSI (Banking, Financial Services, and Insurance): This sector represents the largest end-user segment, accounting for roughly xx% of the DPaaS market. The highly regulated nature of BFSI, coupled with the critical need for data integrity, security, and rapid recovery from financial disruptions and cyber threats, makes DPaaS indispensable. Compliance with stringent financial regulations is a major driver.

- Key Drivers:

- Strict regulatory compliance (e.g., PSD2, GDPR).

- High volume of sensitive financial data.

- Need for uninterrupted service and rapid recovery.

- Healthcare: Another significant segment, the healthcare industry (approx. xx% market share) relies heavily on DPaaS for securing sensitive patient data (PHI) and ensuring compliance with regulations like GDPR and national health data privacy laws. The criticality of patient care and the potential impact of data breaches drive the demand for robust backup and disaster recovery solutions.

- Key Drivers:

- Protection of sensitive patient data (PHI).

- Compliance with healthcare data regulations.

- Ensuring continuity of care.

- Government and Defense: This segment (approx. xx% market share) demands the highest levels of security and data sovereignty. DPaaS solutions that offer strong encryption, on-premises or private cloud options, and compliance with national security standards are particularly sought after.

- Key Drivers:

- National security and data sovereignty requirements.

- Protection of classified and sensitive government data.

- Compliance with defense industry standards.

Europe Data Protection-as-a-Service Market Product Innovations

- Key Drivers:

- Ubiquitous data protection requirements.

- Cost-effectiveness compared to on-premises solutions.

- Simplified management and scalability.

- Key Drivers:

- Rising cyber threats and ransomware.

- Focus on business continuity and resilience.

- Stringent RTO/RPO (Recovery Time Objective/Recovery Point Objective) mandates.

- Key Drivers:

- Scalable and cost-effective data storage.

- Support for archiving and compliance.

- Integration with backup and recovery workflows.

- Hybrid Cloud: This deployment model currently leads the market with an estimated xx% share. The flexibility of hybrid cloud allows organizations to leverage public cloud benefits for scalability and cost efficiency while retaining sensitive data or critical applications on private infrastructure for enhanced control and compliance. This balance is highly appealing to many European enterprises.

- Key Drivers:

- Balancing security, compliance, and cost.

- Phased cloud adoption strategies.

- Flexibility for diverse workloads.

- Key Drivers:

- Public Cloud: Rapidly gaining traction, the public cloud segment is projected to grow significantly, holding an estimated xx% share. The inherent scalability, accessibility, and often lower upfront costs of public cloud DPaaS solutions are making them increasingly attractive, especially for small and medium-sized businesses.

- Key Drivers:

- Scalability and on-demand resources.

- Cost-effectiveness for SMBs.

- Accessibility and ease of deployment.

- Key Drivers:

- Private Cloud: While less dominant in terms of overall market share at approximately xx%, private cloud DPaaS solutions remain crucial for organizations with highly stringent security and regulatory requirements, particularly within government and defense sectors.

- Key Drivers:

- Enhanced data control and security.

- Meeting specific regulatory compliance.

- Dedicated infrastructure for sensitive data.

- Key Drivers:

Dominant End-User Industries:

- BFSI (Banking, Financial Services, and Insurance): This sector represents the largest end-user segment, accounting for roughly xx% of the DPaaS market. The highly regulated nature of BFSI, coupled with the critical need for data integrity, security, and rapid recovery from financial disruptions and cyber threats, makes DPaaS indispensable. Compliance with stringent financial regulations is a major driver.

- Key Drivers:

- Strict regulatory compliance (e.g., PSD2, GDPR).

- High volume of sensitive financial data.

- Need for uninterrupted service and rapid recovery.

- Healthcare: Another significant segment, the healthcare industry (approx. xx% market share) relies heavily on DPaaS for securing sensitive patient data (PHI) and ensuring compliance with regulations like GDPR and national health data privacy laws. The criticality of patient care and the potential impact of data breaches drive the demand for robust backup and disaster recovery solutions.

- Key Drivers:

- Protection of sensitive patient data (PHI).

- Compliance with healthcare data regulations.

- Ensuring continuity of care.

- Government and Defense: This segment (approx. xx% market share) demands the highest levels of security and data sovereignty. DPaaS solutions that offer strong encryption, on-premises or private cloud options, and compliance with national security standards are particularly sought after.

- Key Drivers:

- National security and data sovereignty requirements.

- Protection of classified and sensitive government data.

- Compliance with defense industry standards.

Europe Data Protection-as-a-Service Market Product Innovations

- Key Drivers:

- Strict regulatory compliance (e.g., PSD2, GDPR).

- High volume of sensitive financial data.

- Need for uninterrupted service and rapid recovery.

- Key Drivers:

- Protection of sensitive patient data (PHI).

- Compliance with healthcare data regulations.

- Ensuring continuity of care.

- Key Drivers:

- National security and data sovereignty requirements.

- Protection of classified and sensitive government data.

- Compliance with defense industry standards.

Product innovation in the Europe Data Protection-as-a-Service Market is centered on enhancing security, simplifying management, and expanding capabilities. Recent advancements include the introduction of AI-powered ransomware detection and remediation, immutable backup solutions for enhanced data integrity, and seamless integration with multi-cloud environments. Companies are also focusing on granular data recovery options, automated compliance reporting, and edge computing data protection. For instance, platforms now offer advanced threat intelligence that proactively identifies and neutralizes emerging cyber threats, reducing the risk of data breaches. Furthermore, the development of policy-driven data protection, where security and recovery policies are automatically applied based on data classification, is streamlining operations and ensuring consistent protection across diverse data assets.

Propelling Factors for Europe Data Protection-as-a-Service Market Growth

Several key factors are propelling the growth of the Europe Data Protection-as-a-Service Market. The escalating volume and complexity of data generated by businesses across all sectors necessitate robust and scalable protection solutions. Furthermore, the stringent and ever-evolving regulatory landscape in Europe, particularly the General Data Protection Regulation (GDPR) and forthcoming data security directives, mandates compliance and drives the adoption of secure, auditable data protection services. The increasing sophistication and frequency of cyberattacks, especially ransomware, highlight the critical need for effective backup and disaster recovery capabilities. Economic factors, such as the shift towards operational expenditure (OpEx) models and the desire for cost predictability, also favor the 'as-a-service' consumption model over high upfront capital investments in on-premises infrastructure. Technological advancements in cloud computing and cybersecurity further enable more advanced and accessible DPaaS offerings.

Obstacles in the Europe Data Protection-as-a-Service Market Market

Despite robust growth, the Europe Data Protection-as-a-Service Market faces several obstacles. Data sovereignty concerns and varying national regulations within the EU can create complexities for service providers and users alike, requiring tailored solutions. The perceived complexity of cloud migration and integration with existing on-premises infrastructure can also be a deterrent for some organizations. Furthermore, the threat of increasingly sophisticated cyberattacks, including zero-day exploits, poses a continuous challenge for DPaaS providers to stay ahead of evolving threats. Intense competition within the market, leading to pricing pressures, and the need for continuous investment in R&D to maintain a competitive edge are also significant hurdles. The potential for vendor lock-in, although diminishing, remains a concern for some businesses, influencing their choice of DPaaS provider.

Future Opportunities in Europe Data Protection-as-a-Service Market

The Europe Data Protection-as-a-Service Market presents significant future opportunities. The ongoing digital transformation across industries will continue to generate vast amounts of data, increasing the demand for sophisticated protection. The growing adoption of AI and IoT devices will create new data protection challenges and corresponding service opportunities. Emerging markets within Eastern Europe, with increasing digitalization, represent untapped potential. Furthermore, the development of specialized DPaaS solutions for niche sectors, such as edge computing, industrial IoT, and the metaverse, offers considerable growth prospects. The increasing focus on data privacy and security compliance, driven by new regulations, will also fuel demand for certified and compliant DPaaS offerings.

Major Players in the Europe Data Protection-as-a-Service Market Ecosystem

- IBM Corporation

- Hitachi Vantara Corporation

- Hewlett Packard Enterprise Company

- Quest Software UK Ltd

- Quantum Corporation

- Veritas Technologies UK Ltd

- Amazon Web Services Inc

- Oracle Corporation

- VMware Inc

- Cisco Inc

- Commvault Systems Inc

- Dell Technologies

Key Developments in Europe Data Protection-as-a-Service Market Industry

- July 2023: Thales introduced the CipherTrust Data Security Platform, a cloud-based subscription-as-a-service model designed to simplify data security operations by utilizing data security and lifecycle management tools to defend against external cyber threats. The platform offers access to a partner ecosystem for integrations with various security vendors, storage, servers, databases, applications, and clouds.

- June 2023: Oracle's EU Sovereign Cloud became accessible, offering enhanced data privacy and sovereignty control to public and commercial sector entities across the European Union. This cloud offering, part of Oracle Cloud Infrastructure's (OCI) distributed cloud approach, provides all OCI services at the same cost, support, and SLAs, enabling workloads to run under stringent regulatory compliance and hybrid cloud solutions.

Strategic Europe Data Protection-as-a-Service Market Market Forecast

The strategic forecast for the Europe Data Protection-as-a-Service Market indicates sustained and robust growth throughout the 2025–2033 period. This expansion will be primarily fueled by the increasing imperative for regulatory compliance, the ever-present threat of sophisticated cyberattacks, and the continuous growth of data volumes across all industries. Key growth catalysts include the ongoing digital transformation, the widespread adoption of cloud and hybrid cloud infrastructures, and the growing demand for advanced data resilience and business continuity solutions. Service providers that can offer integrated, AI-enhanced, and highly compliant DPaaS offerings, with a focus on seamless multi-cloud integration and comprehensive data lifecycle management, are poised to capture significant market share. The market's future is characterized by innovation in ransomware protection, edge data security, and specialized solutions catering to the evolving needs of sectors like healthcare and BFSI.

Europe Data Protection-as-a-Service Market Segmentation

-

1. Service

- 1.1. Storage-as-a-Service

- 1.2. Backup-as-a-Service

- 1.3. Disaster Recovery-as-a-Service

-

2. Deployment

- 2.1. Public Cloud

- 2.2. Private Cloud

- 2.3. Hybrid Cloud

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Government and Defense

- 3.4. IT and Telecom

- 3.5. Other End-user Industries

Europe Data Protection-as-a-Service Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Data Protection-as-a-Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Focus on Third-party Risk Management; Stringent Regulations

- 3.2.2 such as GDPR Prompting the Adoption of Data Protection Solutions; Increasing Awareness among EU Institutions

- 3.3. Market Restrains

- 3.3.1. Increasing Hidden Costs of Cloud-based Storage

- 3.4. Market Trends

- 3.4.1. BFSI Industry is Expected to Grow at a Significant Rate Throughout the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage-as-a-Service

- 5.1.2. Backup-as-a-Service

- 5.1.3. Disaster Recovery-as-a-Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Public Cloud

- 5.2.2. Private Cloud

- 5.2.3. Hybrid Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Government and Defense

- 5.3.4. IT and Telecom

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Germany Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 IBM Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Vantara Corporation*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hewlett Packard Enterprise Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Quest Software UK Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Quantum Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Veritas Technologies UK Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Amazon Web Services Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Oracle Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 VMware Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cisco Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Commvault Systems Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Dell Technologies

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 IBM Corporation

List of Figures

- Figure 1: Europe Data Protection-as-a-Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Data Protection-as-a-Service Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Service 2019 & 2032

- Table 15: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Data Protection-as-a-Service Market?

The projected CAGR is approximately 14.60%.

2. Which companies are prominent players in the Europe Data Protection-as-a-Service Market?

Key companies in the market include IBM Corporation, Hitachi Vantara Corporation*List Not Exhaustive, Hewlett Packard Enterprise Company, Quest Software UK Ltd, Quantum Corporation, Veritas Technologies UK Ltd, Amazon Web Services Inc, Oracle Corporation, VMware Inc, Cisco Inc, Commvault Systems Inc, Dell Technologies.

3. What are the main segments of the Europe Data Protection-as-a-Service Market?

The market segments include Service, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Third-party Risk Management; Stringent Regulations. such as GDPR Prompting the Adoption of Data Protection Solutions; Increasing Awareness among EU Institutions.

6. What are the notable trends driving market growth?

BFSI Industry is Expected to Grow at a Significant Rate Throughout the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Hidden Costs of Cloud-based Storage.

8. Can you provide examples of recent developments in the market?

July 2023 - Thales, a France-based IT company, introduced the CipherTrust Data Security Platform to the market, and the company currently offers it through a cloud-based subscription-as-a-service model. According to Thales, the platform simplifies data security operations for organizations by utilizing data security and lifecycle management tools to help them defend against external cyber threats and other security risks. Additionally, the platform gives users access to a partner ecosystem for integrations with security vendors, enterprise storage, servers, databases, applications, and clouds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Data Protection-as-a-Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Data Protection-as-a-Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Data Protection-as-a-Service Market?

To stay informed about further developments, trends, and reports in the Europe Data Protection-as-a-Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence