Key Insights

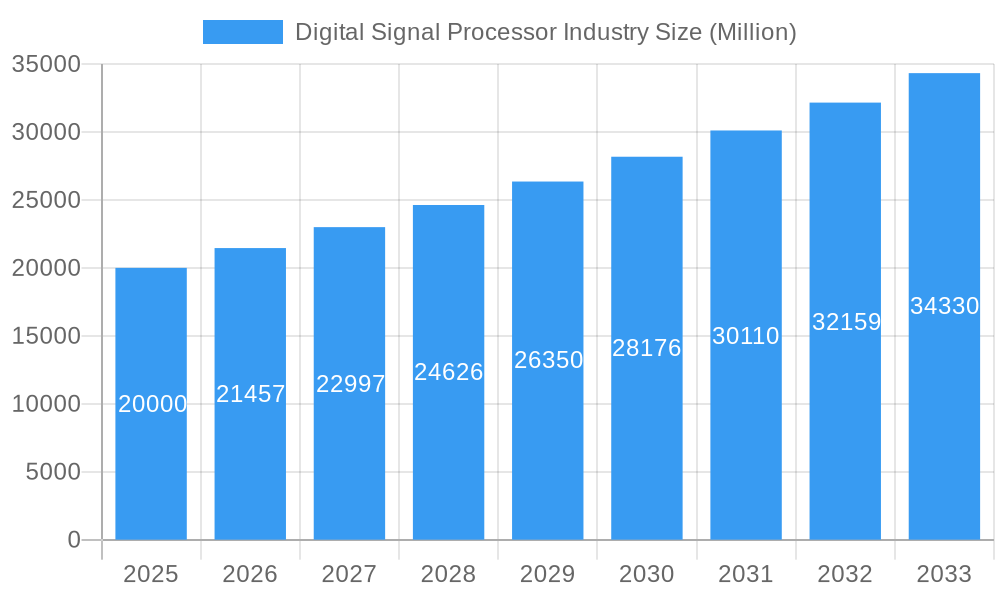

The global Digital Signal Processor (DSP) market is poised for substantial growth, projected to reach an estimated USD 20,000 Million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) exceeding 7.28%. This expansion is primarily fueled by the relentless demand for advanced processing capabilities across a multitude of end-user industries. The burgeoning adoption of sophisticated communication technologies, including 5G deployment and the Internet of Things (IoT), necessitates high-performance DSPs for efficient data handling and signal manipulation. The automotive sector's increasing reliance on advanced driver-assistance systems (ADAS), infotainment, and electric vehicle (EV) technologies also presents a significant growth avenue. Furthermore, the proliferation of smart consumer electronics, from high-fidelity audio devices to advanced wearables, further bolsters market momentum. The industrial sector's drive towards automation, smart manufacturing, and predictive maintenance, along with critical applications in aerospace & defense and healthcare for sophisticated imaging and monitoring, are all contributing factors to this upward trajectory.

Digital Signal Processor Industry Market Size (In Billion)

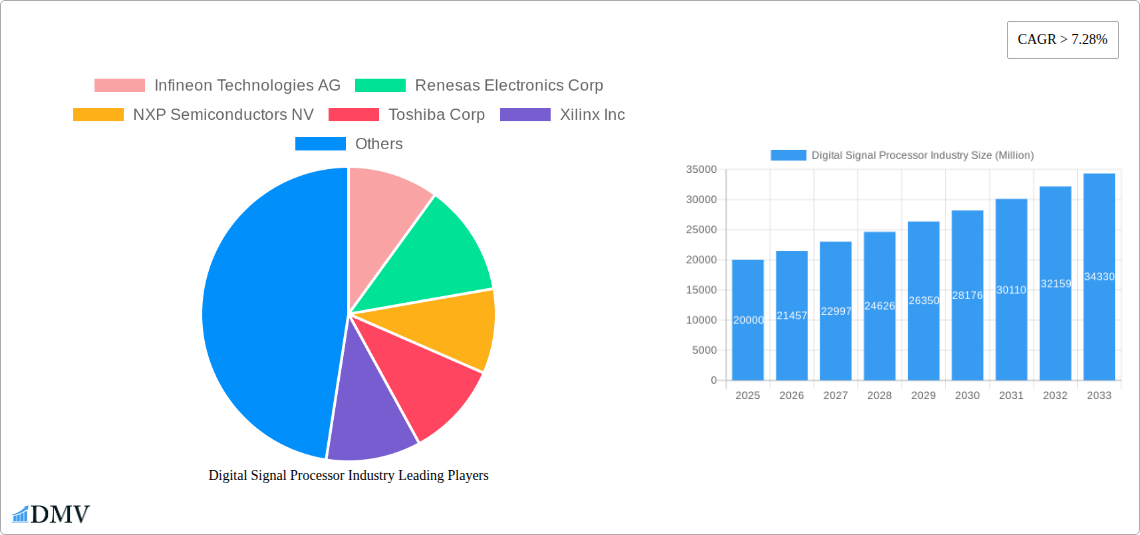

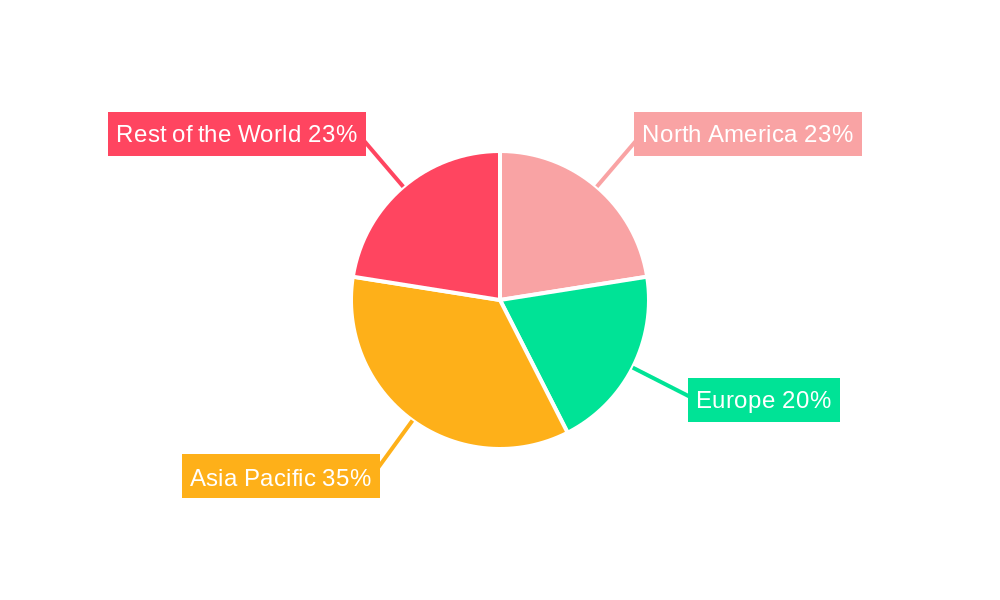

The market is characterized by a dynamic competitive landscape, with major players like Infineon Technologies AG, Renesas Electronics Corp, NXP Semiconductors NV, Texas Instruments Inc, and Intel Corporation at the forefront, continuously innovating to meet evolving industry needs. The evolution of DSP architectures, with a particular emphasis on multi-core processors offering enhanced parallel processing power, is a key trend shaping the market. This allows for more complex algorithms and real-time data processing essential for next-generation applications. While the market enjoys strong growth drivers, potential restraints include the increasing integration of DSP functionalities into general-purpose processors like CPUs and GPUs, which could lead to some consolidation in specific niches. However, the specialized nature and performance advantages of dedicated DSPs are expected to maintain their relevance and drive continued market expansion throughout the forecast period of 2025-2033. The Asia Pacific region is expected to lead in market share due to its strong manufacturing base and rapid technological adoption.

Digital Signal Processor Industry Company Market Share

Digital Signal Processor (DSP) Industry Market Analysis Report: Forecast to 2033

This comprehensive Digital Signal Processor (DSP) industry report provides an in-depth analysis of market dynamics, DSP market trends, and future outlook for the period 2019–2033. Leveraging insights from leading companies such as Texas Instruments Inc, Analog Devices Inc, NXP Semiconductors NV, Infineon Technologies AG, and STMicroelectronics N V, this report details the current market composition, DSP industry evolution, and the impact of technological advancements across key end-user industries including Communication, Automotive, and Consumer Electronics. With a base year of 2025 and a detailed forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand the global DSP market, its growth drivers, and emerging opportunities.

Digital Signal Processor Industry Market Composition & Trends

The Digital Signal Processor (DSP) market is characterized by a dynamic interplay of innovation, regulatory shifts, and evolving end-user demands. Market concentration is evident among key players such as Texas Instruments Inc., Analog Devices Inc., and NXP Semiconductors NV, who collectively hold a significant share of the DSP silicon market. Innovation catalysts are primarily driven by advancements in artificial intelligence (AI), the proliferation of the Internet of Things (IoT), and the increasing demand for high-performance computing in edge devices. Regulatory landscapes, particularly concerning data privacy and energy efficiency, are also shaping product development and market access. Substitute products, while present in the form of general-purpose processors with some signal processing capabilities, are increasingly being outperformed by dedicated DSPs for specialized applications. End-user profiles are diverse, spanning the critical Communication, rapidly evolving Automotive, and pervasive Consumer Electronics sectors, with significant contributions also from Industrial, Aerospace & Defense, and Healthcare. Mergers and acquisitions (M&A) activities continue to be a crucial aspect of market consolidation and strategic expansion, exemplified by recent significant deals. The market's trajectory is further influenced by the continuous pursuit of lower power consumption and smaller form factors, directly impacting the design and deployment of embedded systems. The overall market size is estimated to reach over $XX Million by 2033.

- Market Concentration: Dominated by a few key players with substantial intellectual property and manufacturing capabilities.

- Innovation Catalysts: AI integration, IoT adoption, edge computing, and demand for high-performance, low-power solutions.

- Regulatory Landscapes: Focus on data security, energy efficiency standards, and increasingly, AI ethics.

- Substitute Products: General-purpose processors with some signal processing capabilities; dedicated DSPs maintain an edge in performance and efficiency.

- End-User Profiles: Diverse, with key segments including Communication, Automotive, Consumer Electronics, Industrial, Aerospace & Defense, and Healthcare.

- M&A Activities: Strategic acquisitions aimed at expanding product portfolios, market reach, and technological capabilities.

Digital Signal Processor Industry Industry Evolution

The Digital Signal Processor (DSP) industry has undergone a profound evolution, driven by relentless technological advancements and shifting consumer and industrial demands. From its early days focused on audio and telecommunications, the DSP market has expanded exponentially, underpinning critical functionalities in a vast array of applications. The historical period, from 2019 to 2024, witnessed significant growth fueled by the increasing digitization of various sectors and the burgeoning demand for real-time data processing. For instance, the Automotive industry's adoption of advanced driver-assistance systems (ADAS) and in-car infotainment required increasingly sophisticated DSP capabilities for sensor fusion, radar processing, and audio enhancement. Similarly, the Communication sector, with the rollout of 5G networks, necessitated high-performance DSPs for base stations and user equipment, handling complex modulation schemes and massive data throughput. The Consumer Electronics market has been a consistent driver, with DSPs becoming integral to smartphones, smart home devices, wearables, and high-fidelity audio equipment, enabling features like noise cancellation, voice recognition, and advanced imaging.

Technological advancements have been a cornerstone of this evolution. The transition from single-core to multi-core DSP architectures has been pivotal, offering parallel processing capabilities that dramatically enhance performance and efficiency for computationally intensive tasks. This shift has been crucial for applications demanding simultaneous signal processing and AI inference, a trend that gained significant momentum in the years leading up to the base year of 2025. The development of specialized DSPs tailored for AI and machine learning workloads, often referred to as AI DSPs or AI accelerators, has further propelled the industry forward. These processors are optimized for neural network computations, enabling on-device AI, reducing latency, and enhancing privacy. The study period, spanning from 2019 to 2033, is expected to see continued exponential growth in the DSP market size. By 2025, the market is projected to reach an estimated $XX Million, demonstrating a robust compound annual growth rate (CAGR) that is projected to continue throughout the forecast period (2025–2033). This sustained growth is attributed to the expanding use cases in areas such as industrial automation, healthcare diagnostics, and immersive entertainment technologies. The integration of DSPs with other processing units, like CPUs and GPUs, within heterogeneous computing architectures is also a key trend, allowing for optimized performance across diverse workloads. Furthermore, advancements in semiconductor manufacturing, leading to smaller process nodes and improved power efficiency, have made DSPs more accessible and viable for a wider range of battery-powered and embedded applications. The industry's evolution is a testament to the indispensable role of digital signal processing in modern technology.

Leading Regions, Countries, or Segments in Digital Signal Processor Industry

The global Digital Signal Processor (DSP) market is characterized by regional dominance and significant growth across various segments, driven by distinct economic, technological, and industrial factors. North America, particularly the United States, and Asia-Pacific, led by China, South Korea, and Japan, stand out as leading regions in the DSP industry.

In North America, the dominance is attributed to strong R&D investments, a robust semiconductor ecosystem, and the presence of major technology companies that are early adopters of advanced DSP technologies. The Communication segment, with extensive investments in 5G infrastructure and satellite communications, is a significant growth engine. The Aerospace & Defense sector also contributes substantially, requiring high-reliability and high-performance DSPs for radar systems, electronic warfare, and navigation. Furthermore, the burgeoning AI and machine learning research and development in the region fuels the demand for advanced DSPs capable of handling complex computational tasks for edge AI applications.

The Asia-Pacific region is a powerhouse in DSP consumption and manufacturing, propelled by its vast manufacturing capabilities and a rapidly expanding consumer electronics market. China's sheer scale in Consumer Electronics, from smartphones and smart home devices to advanced computing hardware, makes it a colossal market for DSPs. South Korea and Japan are at the forefront of innovation in display technologies, telecommunications equipment, and advanced robotics, all of which rely heavily on sophisticated DSP solutions. The Automotive industry in this region is also rapidly adopting advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies, driving demand for specialized automotive-grade DSPs. The growth in industrial automation within countries like Japan and South Korea further fuels the demand for DSPs in control systems, robotics, and smart manufacturing.

Analyzing the segments, the Multi-core DSP segment is experiencing a surge in demand compared to single-core processors. This is driven by the increasing complexity of applications that require parallel processing capabilities for tasks such as high-definition video processing, advanced audio codecs, real-time AI inference, and complex communication protocols. The Automotive end-user industry is a particularly strong driver for multi-core DSPs, as ADAS systems require simultaneous processing of data from multiple sensors (cameras, lidar, radar) for object detection, tracking, and decision-making. The Communication segment also heavily relies on multi-core architectures for managing increasingly complex wireless standards and network infrastructure. The Industrial sector's push towards Industry 4.0 and smart factories, involving real-time monitoring, control systems, and predictive maintenance, also benefits significantly from the parallel processing power of multi-core DSPs. The ability of multi-core DSPs to handle diverse and demanding workloads efficiently makes them the preferred choice for next-generation applications across all major end-user industries.

Key Drivers for Regional Dominance:

- North America: Strong R&D, presence of leading tech giants, significant investments in 5G and AI.

- Asia-Pacific: Extensive manufacturing base, massive consumer electronics market, rapid adoption of automotive and industrial technologies.

Key Drivers for Segment Dominance (Multi-core):

- Automotive: Demand for ADAS, infotainment, and EV power management.

- Communication: 5G infrastructure, complex signal processing, and massive MIMO.

- Industrial: Industry 4.0 automation, robotics, and smart manufacturing.

Digital Signal Processor Industry Product Innovations

Product innovations in the Digital Signal Processor (DSP) industry are centered on enhancing processing power, reducing power consumption, and enabling advanced functionalities like artificial intelligence at the edge. Companies are developing highly integrated DSPs that combine sensor processing capabilities with AI accelerators on a single chip, such as STMicroelectronics' Intelligent Sensor Processing Unit (ISPU). This integration leads to significant reductions in device size and power consumption, by up to 80%, enabling more intelligent electronic decision-making directly at the application edge. Furthermore, innovations are focused on heterogeneous computing, where DSPs work in tandem with CPUs and GPUs to optimize complex workloads. Performance metrics are continuously improving, with advancements in clock speeds, specialized instruction sets for signal processing, and increased memory bandwidth. The unique selling proposition lies in the ability of these DSPs to handle real-time, computationally intensive tasks with unparalleled efficiency, paving the way for sophisticated applications in areas such as autonomous driving, advanced audio processing, and medical imaging.

Propelling Factors for Digital Signal Processor Industry Growth

Several key growth drivers are propelling the Digital Signal Processor (DSP) industry forward.

- Technological Advancements: The relentless evolution of AI and machine learning algorithms demands increasingly powerful and efficient processors, with DSPs playing a crucial role in on-device inference and real-time data processing. The expansion of 5G networks requires high-performance DSPs for base stations and user equipment to handle complex modulation and high data rates.

- Economic Influences: Growing demand for smart and connected devices across consumer electronics, industrial automation, and automotive sectors fuels the need for embedded processing capabilities. Government initiatives promoting digitalization and smart infrastructure further stimulate market growth.

- Expanding End-User Applications: The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies in the automotive sector, coupled with the proliferation of wearables and IoT devices in consumer electronics, are major growth catalysts. The healthcare sector's demand for advanced medical imaging and diagnostic tools also contributes significantly.

Obstacles in the Digital Signal Processor Industry Market

Despite robust growth, the Digital Signal Processor (DSP) industry faces several obstacles.

- Supply Chain Disruptions: The global semiconductor shortage and geopolitical tensions continue to pose significant challenges, impacting production capacity and lead times for DSP components. This can lead to increased costs and delayed product launches for end-users.

- Intensifying Competition: The market is highly competitive, with established players and emerging companies vying for market share. This necessitates continuous innovation and aggressive pricing strategies, potentially impacting profit margins.

- Talent Acquisition and Retention: The specialized nature of DSP development requires highly skilled engineers in areas like hardware design, algorithm development, and embedded software. Attracting and retaining this talent can be a significant challenge for many companies.

- Increasing Complexity of Design: As DSPs become more powerful and feature-rich, the complexity of designing and verifying these chips increases, requiring substantial investment in R&D and sophisticated design tools.

Future Opportunities in Digital Signal Processor Industry

The Digital Signal Processor (DSP) industry is poised for significant future opportunities driven by emerging technologies and evolving market demands.

- Edge AI Expansion: The increasing demand for on-device AI processing in IoT devices, wearables, and autonomous systems presents a vast opportunity for DSPs optimized for AI inference. This trend enables lower latency, enhanced privacy, and reduced cloud dependency.

- Advanced Automotive Applications: The continued evolution of autonomous driving, connected car technologies, and in-vehicle infotainment systems will require increasingly sophisticated and power-efficient DSP solutions for sensor fusion, AI, and complex signal processing.

- Healthcare Innovations: Growing applications in medical imaging, wearable health monitors, and remote patient monitoring systems offer significant growth potential for specialized DSPs designed for high accuracy and low power consumption.

- Metaverse and Extended Reality (XR): The development of immersive metaverse experiences and augmented/virtual reality applications will require powerful DSPs for real-time audio-visual processing, spatial computing, and haptic feedback.

Major Players in the Digital Signal Processor Industry Ecosystem

- Infineon Technologies AG

- Renesas Electronics Corp

- NXP Semiconductors NV

- Toshiba Corp

- Xilinx Inc

- Texas Instruments Inc

- Samsung Electronics Co Ltd

- Cirrus Logic Inc

- STMicroelectronics N V

- Broadcom Inc

- Analog Devices Inc

- Intel Corporation

Key Developments in Digital Signal Processor Industry Industry

- February 2022: STMicroelectronics launched Intelligent Sensor Processing Unit (ISPU), combining a DSP suitable for running AI algorithms and a MEMS sensor on the same silicon. This innovation reduces system-in-package device size and power consumption by up to 80%, enabling electronic decision-making at the application edge.

- July 2021: Cirrus Logic announced its plan to acquire Lion Semiconductor for USD 335 million. This acquisition aims to enhance Cirrus Logic's mixed-signal business, providing it with a robust product portfolio and intellectual property for consumer and mobile applications, while opening doors to new markets.

Strategic Digital Signal Processor Industry Market Forecast

The Digital Signal Processor (DSP) industry is set for substantial growth driven by an convergence of powerful factors. The ongoing digital transformation across industries, coupled with the pervasive adoption of IoT and the rapid advancements in AI and machine learning, are creating an insatiable demand for efficient and high-performance signal processing capabilities. The Automotive sector's transition to electric and autonomous vehicles, the expansion of Communication networks (particularly 5G and beyond), and the continuous innovation in Consumer Electronics are significant growth catalysts. Furthermore, the increasing trend towards edge computing, where data processing occurs closer to the source, presents a massive opportunity for specialized, low-power DSPs. Strategic investments in R&D, coupled with favorable regulatory environments promoting digitalization, will further fuel this expansion, positioning the DSP market for a robust and sustained growth trajectory throughout the forecast period.

Digital Signal Processor Industry Segmentation

-

1. Core

- 1.1. Single-core

- 1.2. Multi-core

-

2. End-user Industry

- 2.1. Communication

- 2.2. Automotive

- 2.3. Consumer Electronics

- 2.4. Industrial

- 2.5. Aerospace & Defense

- 2.6. Healthcare

Digital Signal Processor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Digital Signal Processor Industry Regional Market Share

Geographic Coverage of Digital Signal Processor Industry

Digital Signal Processor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Significant developments in wireless infrastructure; Growing demand for VoIP and IP video; Rise in adoption of connected devices

- 3.3. Market Restrains

- 3.3.1 High complexity and initial development costs; Trade-off between performance

- 3.3.2 power consumption

- 3.3.3 and price

- 3.4. Market Trends

- 3.4.1. Growing Applications in Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core

- 5.1.1. Single-core

- 5.1.2. Multi-core

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Communication

- 5.2.2. Automotive

- 5.2.3. Consumer Electronics

- 5.2.4. Industrial

- 5.2.5. Aerospace & Defense

- 5.2.6. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Core

- 6. North America Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core

- 6.1.1. Single-core

- 6.1.2. Multi-core

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Communication

- 6.2.2. Automotive

- 6.2.3. Consumer Electronics

- 6.2.4. Industrial

- 6.2.5. Aerospace & Defense

- 6.2.6. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Core

- 7. Europe Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core

- 7.1.1. Single-core

- 7.1.2. Multi-core

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Communication

- 7.2.2. Automotive

- 7.2.3. Consumer Electronics

- 7.2.4. Industrial

- 7.2.5. Aerospace & Defense

- 7.2.6. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Core

- 8. Asia Pacific Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core

- 8.1.1. Single-core

- 8.1.2. Multi-core

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Communication

- 8.2.2. Automotive

- 8.2.3. Consumer Electronics

- 8.2.4. Industrial

- 8.2.5. Aerospace & Defense

- 8.2.6. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Core

- 9. Rest of the World Digital Signal Processor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core

- 9.1.1. Single-core

- 9.1.2. Multi-core

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Communication

- 9.2.2. Automotive

- 9.2.3. Consumer Electronics

- 9.2.4. Industrial

- 9.2.5. Aerospace & Defense

- 9.2.6. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Core

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Renesas Electronics Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors NV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toshiba Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Xilinx Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Texas Instruments Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Samsung Electronics Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cirrus Logic Inc *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 STMicroelectronics N V

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Broadcom Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Analog Devices Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Intel Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Digital Signal Processor Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 3: North America Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 4: North America Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 9: Europe Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 10: Europe Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 15: Asia Pacific Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 16: Asia Pacific Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Digital Signal Processor Industry Revenue (undefined), by Core 2025 & 2033

- Figure 21: Rest of the World Digital Signal Processor Industry Revenue Share (%), by Core 2025 & 2033

- Figure 22: Rest of the World Digital Signal Processor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Digital Signal Processor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Digital Signal Processor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Digital Signal Processor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 2: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Digital Signal Processor Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 5: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 8: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 11: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Digital Signal Processor Industry Revenue undefined Forecast, by Core 2020 & 2033

- Table 14: Global Digital Signal Processor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Digital Signal Processor Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Signal Processor Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Digital Signal Processor Industry?

Key companies in the market include Infineon Technologies AG, Renesas Electronics Corp, NXP Semiconductors NV, Toshiba Corp, Xilinx Inc, Texas Instruments Inc, Samsung Electronics Co Ltd, Cirrus Logic Inc *List Not Exhaustive, STMicroelectronics N V, Broadcom Inc, Analog Devices Inc, Intel Corporation.

3. What are the main segments of the Digital Signal Processor Industry?

The market segments include Core, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Significant developments in wireless infrastructure; Growing demand for VoIP and IP video; Rise in adoption of connected devices.

6. What are the notable trends driving market growth?

Growing Applications in Automotive Industry.

7. Are there any restraints impacting market growth?

High complexity and initial development costs; Trade-off between performance. power consumption. and price.

8. Can you provide examples of recent developments in the market?

In February 2022, STMicroelectronics launched Intelligent Sensor Processing Unit (ISPU), which combines a DSP suitable for running AI algorithms and MEMS sensor on the same silicon. Apart from reducing the size of system-in-package devices and power consumption by up to 80%, merging sensors and AI poses electronic decision-making in the application Edge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Signal Processor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Signal Processor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Signal Processor Industry?

To stay informed about further developments, trends, and reports in the Digital Signal Processor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence