Key Insights

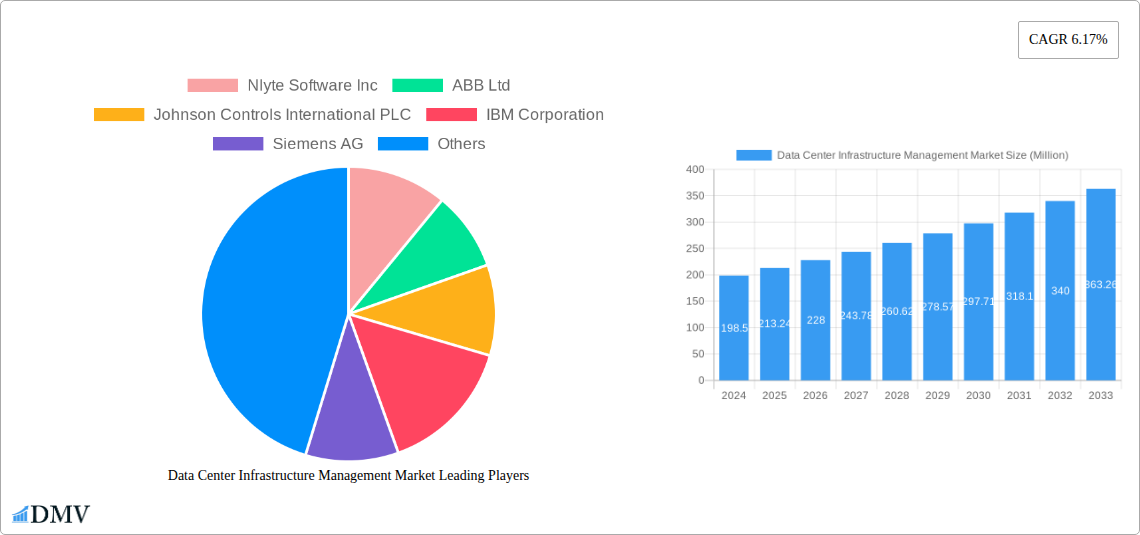

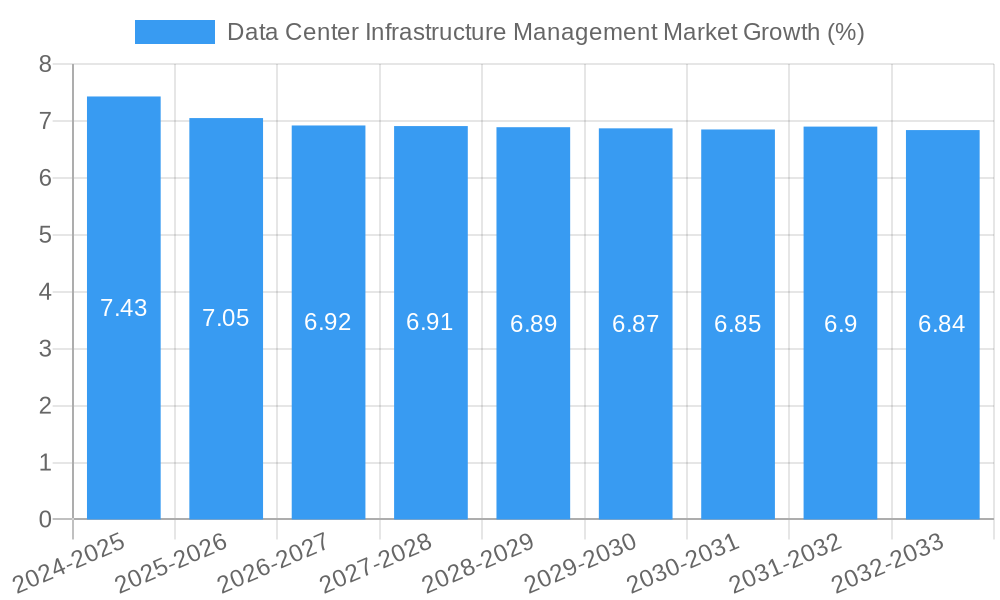

The Data Center Infrastructure Management (DCIM) market is poised for significant expansion, projected to reach a substantial market size and demonstrating a robust Compound Annual Growth Rate (CAGR) of 6.17%. This growth is primarily fueled by the escalating demand for efficient and optimized data center operations. Key drivers include the continuous proliferation of data, the increasing adoption of cloud computing services, and the critical need for enhanced energy efficiency and sustainability within data centers. As businesses globally rely more heavily on digital infrastructure, the complexity of managing these resources intensifies, making sophisticated DCIM solutions indispensable for maintaining operational continuity, minimizing downtime, and controlling costs. The market's trajectory is further supported by the ongoing digital transformation initiatives across various industries, from BFSI and IT & Telecom to manufacturing and healthcare, all of which are investing heavily in expanding their data center capabilities.

The DCIM market's landscape is characterized by distinct segments catering to diverse operational needs. Small- and medium-sized data centers, large data centers, and enterprise data centers each present unique challenges and opportunities for DCIM providers. Furthermore, the deployment types, including on-premise and colocation facilities, influence the demand for specific DCIM functionalities. While on-premise deployments require comprehensive control over physical and virtual assets, colocation environments necessitate robust tools for managing shared resources and ensuring compliance. The market is also influenced by factors such as the increasing need for advanced analytics, AI-powered automation for predictive maintenance, and the integration of IoT devices for real-time monitoring. However, potential restraints include the high initial investment costs associated with some advanced DCIM solutions and the complexity of integration with existing IT infrastructures, which may slow down adoption in certain segments or regions. Despite these challenges, the overarching trend towards smarter, more efficient data center management ensures a dynamic and growing market.

Here's an SEO-optimized report description for the Data Center Infrastructure Management (DCIM) Market, designed to captivate stakeholders and boost search visibility without requiring further modification.

Dive deep into the burgeoning Data Center Infrastructure Management (DCIM) market with this definitive industry report. Covering the expansive period of 2019–2033, with a focused Base Year of 2025 and a robust Forecast Period of 2025–2033, this analysis dissects market dynamics, growth trajectories, and future opportunities. This report provides actionable insights for stakeholders navigating the complex landscape of data center operations, IT infrastructure management, and energy efficiency solutions. Explore critical segments including Small- and Medium-sized Data Centers, Large Data Centers, and Enterprise Data Centers, alongside deployment models such as On-premise and Colocation.

Data Center Infrastructure Management Market Market Composition & Trends

The Data Center Infrastructure Management (DCIM) market is characterized by a moderately consolidated structure, with leading players like Nlyte Software Inc, ABB Ltd, Johnson Controls International PLC, IBM Corporation, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, FNT GmbH, Vertiv Group Corp, and Itracs Corporation Inc (CommScope Inc) vying for market share. Innovation remains a key catalyst, driven by the escalating demand for enhanced operational efficiency, power management, and cooling optimization. Regulatory landscapes are increasingly favoring sustainability and energy conservation, pushing for advanced DCIM solutions. Substitute products, while present in niche areas, struggle to offer the holistic integration and real-time visibility that comprehensive DCIM platforms provide. End-user profiles span a diverse range, from large enterprises and colocation providers to burgeoning hyperscalers, all seeking to streamline their data center management software and IT asset management. Mergers and acquisitions (M&A) activities are prevalent, with significant deal values reflecting the strategic importance of DCIM capabilities. For instance, recent M&A activities indicate a market consolidation trend, with an estimated XX million in deal values for key acquisitions in the historical period. Market share distribution is dynamic, with specialized providers capturing significant portions of their respective niches.

Data Center Infrastructure Management Market Industry Evolution

The Data Center Infrastructure Management (DCIM) market has witnessed a remarkable evolutionary arc, propelled by the insatiable growth of digital infrastructure and the critical need for efficient management. From its nascent stages focused on basic asset tracking, DCIM has matured into sophisticated platforms offering real-time monitoring, predictive analytics, and automated workflows for data center operations. The historical period (2019–2024) saw a steady increase in adoption driven by rising energy costs and the imperative for greater uptime. For example, energy consumption monitoring solutions within DCIM saw an adoption rate increase of approximately 15% year-over-year during this period. Technological advancements have been pivotal, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing predictive maintenance and capacity planning. Cloud adoption has also influenced deployment strategies, leading to the rise of SaaS-based DCIM solutions that offer scalability and flexibility. Consumer demand has shifted towards solutions that not only ensure operational continuity but also contribute to significant cost savings through optimized resource utilization and reduced environmental impact. The Base Year of 2025 represents a critical juncture where advanced analytics and AI-driven insights are becoming standard features, leading to a projected market growth rate of XX% for the Forecast Period (2025–2033). This sustained growth is underpinned by the increasing complexity of modern data centers, the proliferation of IoT devices generating massive data volumes, and the ongoing digital transformation across all industries.

Leading Regions, Countries, or Segments in Data Center Infrastructure Management Market

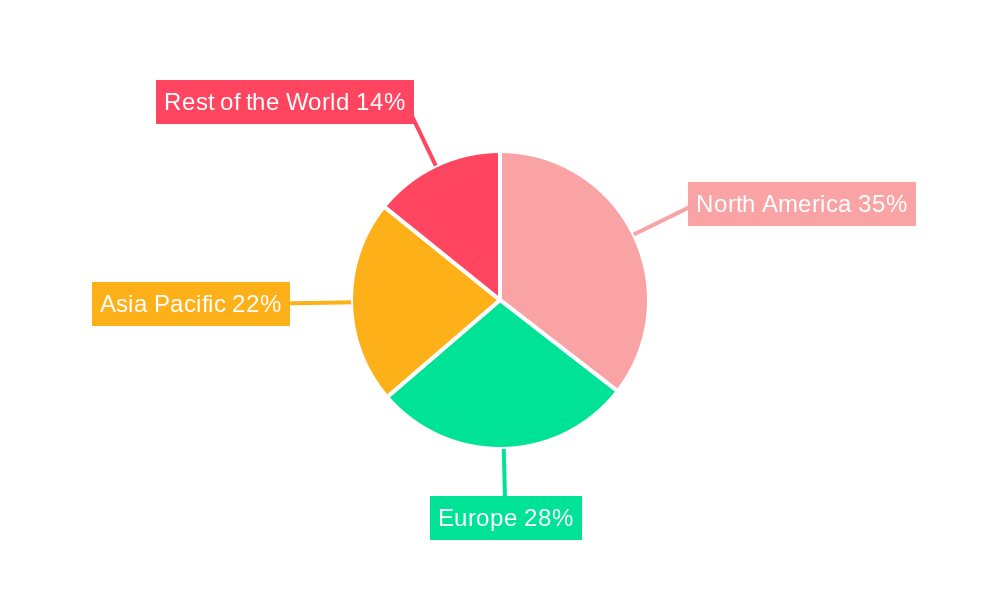

North America currently stands as the dominant region in the Data Center Infrastructure Management (DCIM) market, driven by its mature digital infrastructure, substantial investments in hyperscale and enterprise data centers, and a strong focus on technological innovation. The United States, in particular, spearheads this dominance due to the presence of major cloud providers and a robust ecosystem of technology companies actively developing and adopting advanced DCIM solutions.

Key Drivers of Dominance in North America:

- High Data Center Density and Investment: North America boasts the highest concentration of data centers globally, leading to significant ongoing investments in infrastructure upgrades and management solutions.

- Technological Innovation Hubs: Leading technology companies are headquartered in this region, fostering rapid development and adoption of cutting-edge DCIM capabilities.

- Stringent Uptime Requirements: Industries in North America often have stringent uptime mandates, necessitating robust DCIM solutions for continuous monitoring and proactive issue resolution.

- Energy Efficiency Mandates: Growing awareness and regulatory pressure concerning energy consumption are pushing data centers to adopt energy-efficient DCIM tools.

Among the segments, Large Data Centers are experiencing the most substantial demand for comprehensive DCIM solutions. These facilities, characterized by massive scale and complex operational requirements, benefit immensely from centralized management, real-time performance analytics, and automated capacity planning offered by advanced DCIM platforms. The ability to optimize power distribution, cooling efficiency, and resource allocation in such environments directly translates to significant operational cost savings and enhanced reliability.

The Colocation deployment type also represents a significant growth area. As more businesses opt for colocation services, the need for efficient management of shared infrastructure becomes paramount. DCIM solutions enable colocation providers to offer transparent, reliable, and cost-effective services to their tenants while also optimizing their own internal operations. The demand for DCIM in this segment is fueled by the need for robust security, uptime guarantees, and efficient resource utilization across multiple clients.

Data Center Infrastructure Management Market Product Innovations

Product innovation in the Data Center Infrastructure Management (DCIM) market is rapidly advancing, focusing on predictive analytics, AI-driven automation, and enhanced energy management capabilities. Solutions are increasingly integrating with IoT sensors for granular environmental monitoring, offering real-time insights into temperature, humidity, and power usage down to the rack level. Unique selling propositions now include self-healing capabilities, where DCIM software can proactively identify and resolve potential issues before they impact operations. Technological advancements are enabling seamless integration with existing IT and building management systems, creating a unified operational view. For instance, new software versions are demonstrating up to a 30% improvement in proactive issue identification and a 15% reduction in energy consumption through optimized cooling strategies.

Propelling Factors for Data Center Infrastructure Management Market Growth

The Data Center Infrastructure Management (DCIM) market is experiencing robust growth driven by several key factors. The exponential increase in data generation and consumption, fueled by cloud computing, big data analytics, and the Internet of Things (IoT), necessitates more sophisticated management of data center resources. Furthermore, rising energy costs and growing environmental concerns are pushing organizations to adopt DCIM solutions for enhanced energy efficiency and sustainability. The demand for higher uptime and improved operational reliability in mission-critical data centers also plays a crucial role. Regulatory mandates and industry best practices that emphasize data center security and compliance further propel the adoption of integrated DCIM platforms.

Obstacles in the Data Center Infrastructure Management Market Market

Despite its growth trajectory, the Data Center Infrastructure Management (DCIM) market faces certain obstacles. The high initial investment cost for comprehensive DCIM solutions can be a deterrent for small and medium-sized enterprises. Integrating DCIM software with legacy IT systems and diverse hardware can also present significant technical challenges, requiring specialized expertise. Cybersecurity concerns related to centralized management platforms, and the potential for data breaches, necessitate robust security protocols. Furthermore, a shortage of skilled professionals capable of effectively implementing and managing DCIM systems can hinder widespread adoption. Supply chain disruptions affecting hardware availability for monitoring and control can also impact deployment timelines.

Future Opportunities in Data Center Infrastructure Management Market

The future of the Data Center Infrastructure Management (DCIM) market is brimming with opportunities. The increasing adoption of edge computing and the expansion of 5G networks will create a demand for distributed DCIM solutions that can manage smaller, localized data centers efficiently. The growing trend of sustainability and the push for greener data centers will further drive demand for DCIM solutions focused on energy optimization and carbon footprint reduction. The integration of AI and machine learning for advanced predictive analytics and autonomous data center operations presents a significant opportunity for intelligent DCIM platforms. Moreover, the expanding market for specialized DCIM solutions tailored for specific industries, such as healthcare and finance, will open new avenues for growth.

Major Players in the Data Center Infrastructure Management Market Ecosystem

- Nlyte Software Inc

- ABB Ltd

- Johnson Controls International PLC

- IBM Corporation

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- FNT GmbH

- Vertiv Group Corp

- Itracs Corporation Inc (CommScope Inc)

Key Developments in Data Center Infrastructure Management Market Industry

- May 2022: Siemens implemented integrated data center management software in the Baltic region's largest and most energy-efficient data center. Greenergy Data Centers benefited from building management software (BMS), energy and power management software (EPMS), and White Space Cooling Optimization (WSCO) to reduce energy consumption, maintain thermal protection, and manage the reliable functioning of essential infrastructure, marking a significant step in energy-efficient data center operations.

- January 2022: Delta's UPS and Data Centre solutions allied with DATABOX, a renowned provider of IT channels. Through this collaboration, DATABOX will provide Delta's energy-efficient Uninterruptible Power Supplies and Data Centre Infrastructure Solutions to IT resellers and system integrators throughout Portugal, enhancing the reach of critical power and infrastructure management solutions.

Strategic Data Center Infrastructure Management Market Market Forecast

The strategic forecast for the Data Center Infrastructure Management (DCIM) market is exceptionally positive, projecting sustained growth driven by the relentless digital transformation and the escalating demand for efficient and reliable data center operations. The continuous evolution of technologies like AI, IoT, and edge computing will necessitate more intelligent and integrated DCIM solutions. Projections indicate a market value reaching XX billion by 2033, with a compound annual growth rate (CAGR) of approximately XX% during the forecast period. Key growth catalysts include the increasing adoption of cloud services, the growing complexity of IT environments, and a global push towards greater energy efficiency and sustainability in data center management. Investment trends indicate a strong focus on predictive analytics and automation to minimize downtime and optimize operational expenditures.

Data Center Infrastructure Management Market Segmentation

-

1. Data Center Type

- 1.1. Small- and Medium-sized Data Centers

- 1.2. Large Data Centers

- 1.3. Enterprise Data Centers

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Colocation

Data Center Infrastructure Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Data Center Infrastructure Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Manage Energy Consumption Across Data Centers; Increase in the Number of Data Centers

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Small and Medium Sized Data Centers is Expected to hold Significant Growth rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Data Center Type

- 5.1.1. Small- and Medium-sized Data Centers

- 5.1.2. Large Data Centers

- 5.1.3. Enterprise Data Centers

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Colocation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Data Center Type

- 6. North America Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Data Center Type

- 6.1.1. Small- and Medium-sized Data Centers

- 6.1.2. Large Data Centers

- 6.1.3. Enterprise Data Centers

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. On-premise

- 6.2.2. Colocation

- 6.1. Market Analysis, Insights and Forecast - by Data Center Type

- 7. Europe Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Data Center Type

- 7.1.1. Small- and Medium-sized Data Centers

- 7.1.2. Large Data Centers

- 7.1.3. Enterprise Data Centers

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. On-premise

- 7.2.2. Colocation

- 7.1. Market Analysis, Insights and Forecast - by Data Center Type

- 8. Asia Pacific Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Data Center Type

- 8.1.1. Small- and Medium-sized Data Centers

- 8.1.2. Large Data Centers

- 8.1.3. Enterprise Data Centers

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. On-premise

- 8.2.2. Colocation

- 8.1. Market Analysis, Insights and Forecast - by Data Center Type

- 9. Rest of the World Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Data Center Type

- 9.1.1. Small- and Medium-sized Data Centers

- 9.1.2. Large Data Centers

- 9.1.3. Enterprise Data Centers

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. On-premise

- 9.2.2. Colocation

- 9.1. Market Analysis, Insights and Forecast - by Data Center Type

- 10. North America Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Data Center Infrastructure Management Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Nlyte Software Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 ABB Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Johnson Controls International PLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 IBM Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Siemens AG

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Schneider Electric SE

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Eaton Corporation PLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 FNT GmbH

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Vertiv Group Corp

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Itracs Corporation Inc (CommScope Inc)*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Nlyte Software Inc

List of Figures

- Figure 1: Global Data Center Infrastructure Management Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2024 & 2032

- Figure 11: North America Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2024 & 2032

- Figure 12: North America Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 13: North America Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 14: North America Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2024 & 2032

- Figure 17: Europe Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2024 & 2032

- Figure 18: Europe Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 19: Europe Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 20: Europe Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2024 & 2032

- Figure 23: Asia Pacific Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2024 & 2032

- Figure 24: Asia Pacific Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 25: Asia Pacific Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 26: Asia Pacific Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Data Center Infrastructure Management Market Revenue (Million), by Data Center Type 2024 & 2032

- Figure 29: Rest of the World Data Center Infrastructure Management Market Revenue Share (%), by Data Center Type 2024 & 2032

- Figure 30: Rest of the World Data Center Infrastructure Management Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 31: Rest of the World Data Center Infrastructure Management Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 32: Rest of the World Data Center Infrastructure Management Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Data Center Infrastructure Management Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 3: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 4: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Data Center Infrastructure Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Data Center Infrastructure Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Data Center Infrastructure Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Data Center Infrastructure Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 14: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 15: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 17: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 18: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 20: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 21: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 23: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 24: Global Data Center Infrastructure Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Infrastructure Management Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the Data Center Infrastructure Management Market?

Key companies in the market include Nlyte Software Inc, ABB Ltd, Johnson Controls International PLC, IBM Corporation, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, FNT GmbH, Vertiv Group Corp, Itracs Corporation Inc (CommScope Inc)*List Not Exhaustive.

3. What are the main segments of the Data Center Infrastructure Management Market?

The market segments include Data Center Type, Deployment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Manage Energy Consumption Across Data Centers; Increase in the Number of Data Centers.

6. What are the notable trends driving market growth?

Small and Medium Sized Data Centers is Expected to hold Significant Growth rate.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

May 2022 - Siemens has implemented integrated data center management software in the Baltic region's largest and most energy-efficient data center. Greenergy Data Centers benefit from building management software (BMS), energy and power management software (EPMS), and White Space Cooling Optimization (WSCO) to reduce energy consumption, maintain thermal protection, and manage the reliable functioning of essential infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Infrastructure Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Infrastructure Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Infrastructure Management Market?

To stay informed about further developments, trends, and reports in the Data Center Infrastructure Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence