Key Insights

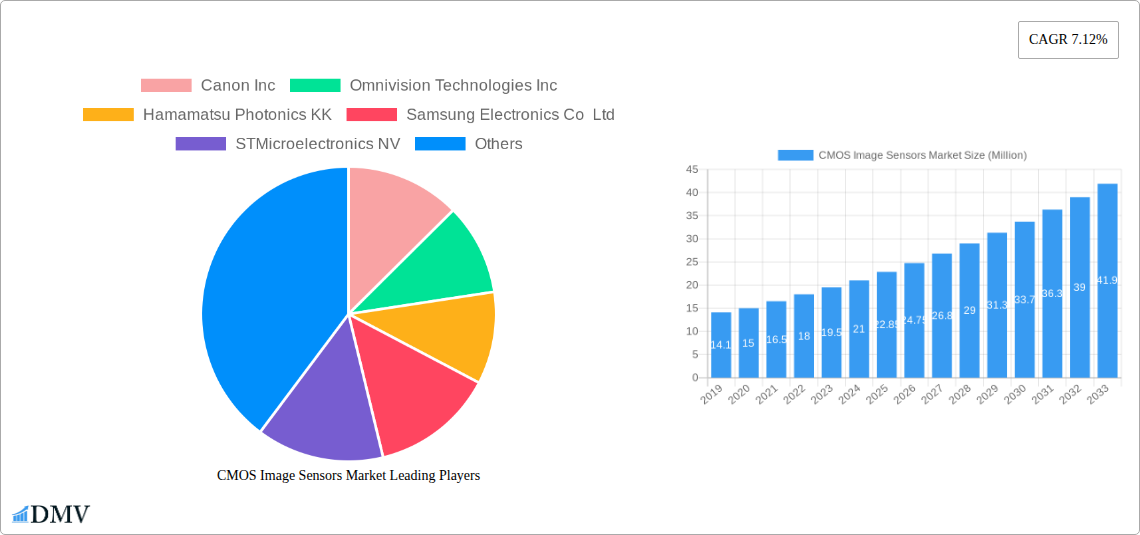

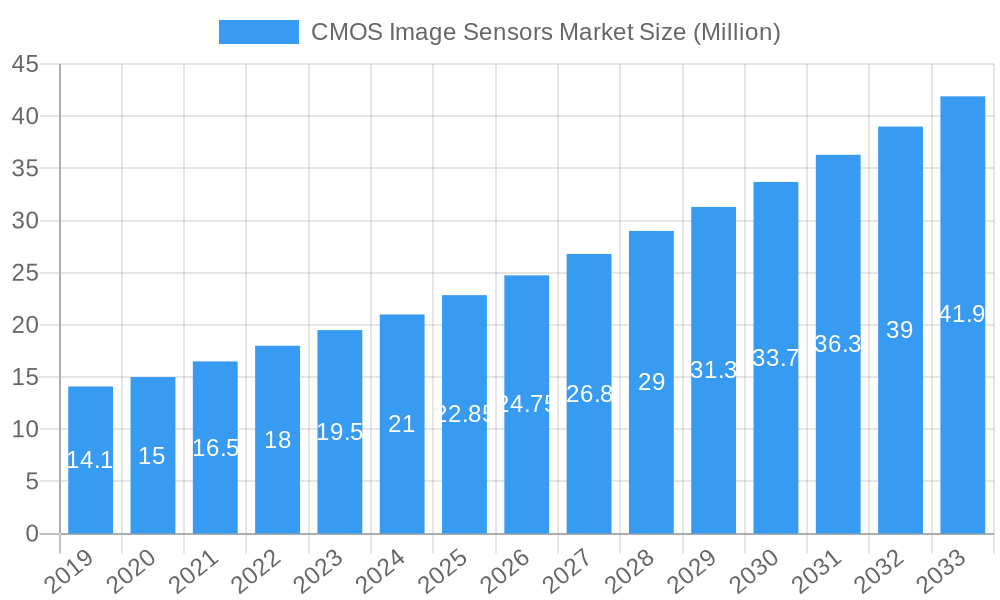

The global CMOS Image Sensor market is poised for robust expansion, projected to reach an estimated market size of USD 22.85 billion in 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 7.12% expected to propel the market significantly through the forecast period ending in 2033. The burgeoning demand for advanced imaging capabilities across a multitude of end-user industries serves as a primary catalyst. Consumer electronics, particularly smartphones and digital cameras, continue to be significant contributors, driven by consumer appetite for higher resolution, faster frame rates, and enhanced low-light performance. The healthcare sector is increasingly adopting CMOS image sensors for diagnostic imaging, minimally invasive surgical tools, and wearable health monitors, leveraging their compact size and low power consumption. Furthermore, the automotive industry's rapid integration of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies heavily relies on sophisticated imaging solutions for object detection, recognition, and navigation, a key driver for market growth. Industrial applications, including automation, machine vision, and quality control, also represent a substantial growth area, demanding precise and reliable imaging for enhanced operational efficiency.

CMOS Image Sensors Market Market Size (In Million)

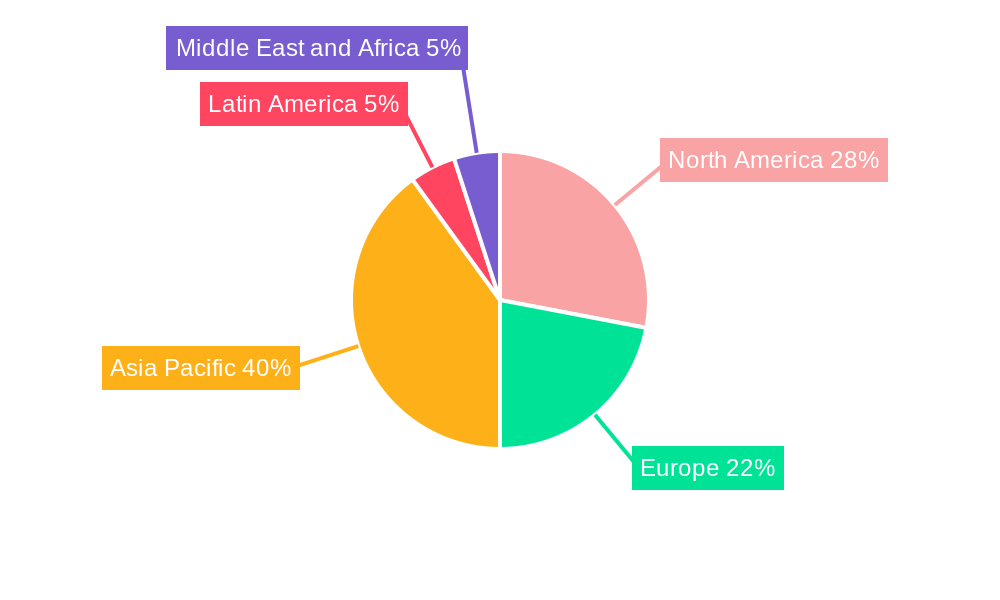

The market dynamics are further shaped by critical trends such as the increasing adoption of AI and machine learning within imaging systems, leading to smarter and more autonomous image processing. Miniaturization and power efficiency remain paramount, enabling the integration of advanced imaging into an ever-wider array of devices. The development of novel sensor architectures, including stacked CMOS technology and back-illuminated sensors, is pushing the boundaries of image quality and performance. However, certain restraints, such as intense price competition and the high cost associated with research and development of cutting-edge technologies, could pose challenges to market expansion. Geographically, the Asia Pacific region is anticipated to lead market growth, driven by its strong manufacturing base for consumer electronics and a rapidly expanding automotive sector. North America and Europe will also remain significant markets, fueled by technological innovation and the widespread adoption of advanced imaging in professional and industrial sectors.

CMOS Image Sensors Market Company Market Share

CMOS Image Sensors Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

Dive deep into the rapidly evolving CMOS image sensor market with this authoritative report. Covering a comprehensive study period from 2019 to 2033, with a detailed analysis of the base year 2025 and a robust forecast extending to 2033, this report provides unparalleled insights for stakeholders in the semiconductor, electronics, automotive, healthcare, and security industries. Discover market dynamics, technological breakthroughs, leading players, and emerging trends shaping the future of image sensing. This report is your definitive guide to navigating the complexities and capitalizing on the opportunities within the global CMOS image sensor landscape.

CMOS Image Sensors Market Market Composition & Trends

The CMOS image sensor market is characterized by a dynamic competitive landscape and a strong emphasis on technological innovation. Leading companies are engaged in strategic collaborations and acquisitions to enhance their product portfolios and expand their market reach. Regulatory frameworks continue to evolve, impacting product development and market entry strategies. The proliferation of high-resolution imaging in consumer electronics, the increasing demand for advanced vision systems in automotive and industrial applications, and the stringent requirements of healthcare and aerospace sectors are key drivers influencing market composition. Substitute products, while emerging, are yet to significantly challenge the dominance of CMOS technology in most high-performance applications. Understanding these intricate elements is crucial for stakeholders to chart a successful path forward.

- Market Concentration: Highly competitive with a few dominant players.

- Innovation Catalysts: Driven by demand for higher resolution, faster frame rates, and enhanced low-light performance.

- Regulatory Landscapes: Evolving standards for data privacy and performance benchmarks in specific applications.

- Substitute Products: Emerging technologies being monitored, but CMOS remains the preferred choice for most mainstream applications.

- End-User Profiles: Diverse, ranging from individual consumers to large-scale industrial and governmental organizations.

- M&A Activities: Ongoing, with a focus on acquiring specialized technologies and expanding market share.

- Market Share Distribution: Analysis of key players' estimated market share (value and volume) for 2025.

- M&A Deal Values: Insights into recent significant merger and acquisition transactions and their strategic implications.

CMOS Image Sensors Market Industry Evolution

The CMOS image sensor industry has witnessed remarkable evolution over the historical period of 2019-2024, driven by relentless technological advancements and the insatiable demand for sophisticated imaging capabilities across a myriad of end-user industries. From their inception, CMOS sensors have continually pushed the boundaries of performance, offering advantages such as lower power consumption, higher integration capabilities, and cost-effectiveness compared to their CCD counterparts. This evolution has been marked by significant leaps in resolution, dynamic range, sensitivity, and frame rates, making them indispensable components in modern electronic devices.

The study period of 2019-2033 will see this trajectory accelerate. The base year, 2025, stands as a pivotal point where current trends solidify and future innovations are poised for widespread adoption. We are observing a sustained growth in demand from the consumer electronics sector, fueled by the proliferation of smartphones, smart cameras, and augmented/virtual reality devices, each demanding higher fidelity imaging. Simultaneously, the automotive industry's embrace of advanced driver-assistance systems (ADAS) and autonomous driving technologies has created a substantial and rapidly expanding market for high-performance CMOS sensors capable of operating reliably in diverse and challenging environmental conditions. The industrial sector is also a significant contributor, leveraging CMOS sensors for automation, quality control, robotics, and machine vision. Healthcare applications, including medical imaging, endoscopy, and wearable health monitors, are increasingly relying on the precision and miniaturization offered by CMOS technology.

Furthermore, the security and surveillance sector continues to be a cornerstone market, demanding enhanced low-light performance, wider dynamic range, and intelligent image processing capabilities for effective monitoring and threat detection. The aerospace and defense sector, while a niche market, requires extremely robust and high-performance sensors for critical applications. The computing segment, encompassing laptops, tablets, and webcams, is also experiencing a demand for improved imaging quality. This pervasive integration across diverse industries underscores the fundamental importance of CMOS image sensors in today's technology-driven world. The forecast period of 2025-2033 is expected to witness further innovation, including the widespread adoption of stacked sensor architectures, enhanced AI integration for on-sensor processing, and advancements in spectral imaging.

Leading Regions, Countries, or Segments in CMOS Image Sensors Market

The Consumer Electronics segment emerges as the dominant force within the global CMOS image sensors market, exhibiting unparalleled demand and driving innovation. This dominance is fueled by the ubiquitous presence of smartphones, digital cameras, and the burgeoning wearable technology market. The relentless consumer desire for higher resolution, superior low-light performance, and advanced photographic features in their personal devices directly translates into a massive and sustained demand for sophisticated CMOS image sensors. The sheer volume of units produced and sold within this segment positions it as the primary growth engine and the largest revenue generator for CMOS image sensor manufacturers.

- Dominant Segment: Consumer Electronics

- Key Drivers:

- Smartphone Penetration: Billions of smartphones manufactured annually, each equipped with multiple high-resolution CMOS sensors.

- Advancements in Mobile Photography: Continuous demand for improved image quality, AI-powered features, and new camera functionalities (e.g., periscope lenses, larger sensors).

- Growth of Wearable Technology: Smartwatches, fitness trackers, and AR/VR headsets increasingly incorporating imaging capabilities.

- Digital Camera Market: Despite market shifts, dedicated digital cameras and camcorders still represent a significant demand for high-end CMOS sensors.

- Content Creation: The rise of social media and vlogging fuels the need for high-quality imaging devices.

- In-Depth Analysis of Dominance Factors: The consumer electronics sector's dominance is a multifaceted phenomenon. The cyclical nature of smartphone upgrades, coupled with the introduction of new models every year, ensures a consistent and substantial order volume for CMOS sensor manufacturers. Companies are constantly innovating to offer larger pixel sizes, backside-illuminated (BSI) technology, stacked sensor architectures for faster data readout, and improved on-chip processing for features like computational photography. Furthermore, the miniaturization and power efficiency of CMOS sensors are critical for integration into compact and portable devices. The competitive landscape within consumer electronics compels manufacturers to differentiate their products through superior camera performance, making advanced CMOS sensors a key selling point. This relentless pursuit of better imaging experiences for consumers creates a powerful and sustained demand that no other segment can currently match in terms of sheer volume and revenue generation for CMOS image sensors. While other segments like automotive and industrial are experiencing rapid growth, the sheer scale of consumer electronics production solidifies its leading position.

CMOS Image Sensors Market Product Innovations

Product innovations in the CMOS image sensor market are sharply focused on enhancing performance metrics and enabling new applications. Recent advancements include the development of sensors with significantly wider dynamic range (e.g., >120 dB), crucial for capturing detail in both bright and dark areas simultaneously, especially vital for automotive and security applications. Stacked sensor architectures are becoming mainstream, enabling faster readout speeds for higher frame rates and 8K video capture, benefiting professional videography and high-speed industrial inspection. Innovations in backside illumination (BSI) and quantum efficiency improvements are boosting low-light sensitivity, making sensors more effective in challenging illumination conditions. Furthermore, on-chip AI processing capabilities are emerging, allowing for intelligent image analysis directly within the sensor, reducing latency and computational load on external processors.

Propelling Factors for CMOS Image Sensors Market Growth

The growth of the CMOS image sensor market is propelled by a confluence of technological, economic, and market-specific factors. The relentless pursuit of higher resolution, superior low-light performance, and wider dynamic range in imaging devices across consumer electronics, automotive, and security applications is a primary driver. The expanding adoption of advanced driver-assistance systems (ADAS) and the advent of autonomous vehicles necessitate sophisticated imaging solutions, creating a robust demand for automotive-grade CMOS sensors. The increasing deployment of smart surveillance systems, driven by security concerns and the Internet of Things (IoT) ecosystem, further fuels market expansion. Economic factors, such as the growing disposable income in emerging economies, translate into increased consumer spending on advanced electronic devices equipped with high-quality cameras.

- Technological Advancements: Continuous improvements in sensor resolution, frame rates, dynamic range, and low-light sensitivity.

- Automotive Industry Demand: The rise of ADAS, autonomous driving, and in-cabin monitoring systems.

- Security and Surveillance Growth: Increasing demand for intelligent, high-performance cameras in public and private spaces.

- Consumer Electronics Proliferation: The omnipresence of smartphones, smart cameras, and AR/VR devices.

- IoT Expansion: Integration of imaging capabilities into a wider range of connected devices.

Obstacles in the CMOS Image Sensors Market Market

Despite its robust growth, the CMOS image sensor market faces several obstacles. Geopolitical tensions and trade disputes can disrupt supply chains and impact raw material availability, leading to price volatility and production delays. The increasing complexity and cost of developing cutting-edge CMOS sensor technology require significant R&D investments, posing a barrier for smaller players and potentially consolidating the market further among larger corporations. Intense competition can lead to price wars, squeezing profit margins. Moreover, the market is susceptible to economic downturns, which can reduce consumer spending on electronics and impact demand from various end-user industries.

- Supply Chain Vulnerabilities: Dependence on specific regions for raw materials and manufacturing.

- High R&D Costs: The continuous need for innovation requires substantial capital investment.

- Intense Competition: Leading to potential price erosion and margin pressure.

- Economic Sensitivity: Susceptibility to global economic slowdowns impacting end-user demand.

Future Opportunities in CMOS Image Sensors Market

The future of the CMOS image sensor market is ripe with opportunities driven by emerging technologies and evolving consumer demands. The continued miniaturization and integration of sensors into an even wider array of devices, including wearables, drones, and smart home appliances, presents significant growth potential. Advancements in AI and machine learning are paving the way for "smart cameras" with on-sensor processing capabilities, enabling real-time object recognition, anomaly detection, and predictive analytics. The growing demand for multispectral and hyperspectral imaging in agriculture, healthcare, and environmental monitoring opens new avenues for specialized CMOS sensor development. Furthermore, the metaverse and augmented reality industries are poised to become major consumers of high-fidelity, low-latency CMOS image sensors for immersive experiences.

- Smart Cameras & On-Sensor AI: Enhanced capabilities for real-time intelligent image analysis.

- Emerging Wearable Devices: Integration into a broader range of health, fitness, and communication gadgets.

- Multispectral & Hyperspectral Imaging: Applications in diverse fields like agriculture, healthcare, and industrial inspection.

- Metaverse & AR/VR Expansion: Demand for high-performance sensors for immersive virtual and augmented realities.

Major Players in the CMOS Image Sensors Market Ecosystem

- Canon Inc

- Omnivision Technologies Inc

- Hamamatsu Photonics KK

- Samsung Electronics Co Ltd

- STMicroelectronics NV

- ON Semiconductor Corporation

- SK Hynix Inc

- Teledyne Technologies Inc

- Panasonic Corporation

- GalaxyCore Shanghai Limited Corporation

- Sony Corporation

Key Developments in CMOS Image Sensors Market Industry

- March 2023: Onsemi announced the launch of a new, innovative image sensor – the AR0822. The device features an embedded High Dynamic Range (HDR) and optimized near-infrared response, necessary for applications in harsh lighting conditions such as security and surveillance, body cameras, doorbell cameras, and robotics. The sensor’s low-power architecture and Wake-on-Motion features are designed to significantly reduce system power consumption. The AR0822 is an 8-megapixel stacked 1/1.8-inch (8.81mm diagonal) back-side illuminated CMOS digital image sensor based on a 2.0 µm pixel. It boasts an active-pixel array of 3840 (H) x 2160 (V) and can capture 4K video at 60 frames-per-second, offering image capture in either linear or eHDR modes (120 dB) with a rolling-shutter readout. This launch highlights Onsemi's commitment to advancing imaging for critical applications, enhancing performance in challenging environments.

- January 2023: Canon Inc. announced the development of a 1.0-inch, back-illuminated stacked CMOS sensor for monitoring applications. This sensor achieves an effective pixel count of approximately 12.6 million pixels (4,152 x 3,024) and provides a dynamic range of 148 decibels. Notably, the new sensor divides the image into 736 areas and autonomously determines the best exposure settings for each area. This development underscores Canon's focus on high-performance imaging for surveillance and monitoring, offering enhanced adaptability to varied lighting conditions and pushing the boundaries of dynamic range.

Strategic CMOS Image Sensors Market Market Forecast

The strategic forecast for the CMOS image sensor market indicates sustained and robust growth, driven by the pervasive integration of imaging technology across an ever-expanding range of applications. Key growth catalysts include the insatiable demand for higher resolution and advanced imaging capabilities in consumer electronics, particularly smartphones, and the burgeoning market for advanced driver-assistance systems (ADAS) and autonomous vehicles. The increasing global focus on security and surveillance, coupled with the growth of the Internet of Things (IoT) ecosystem, will continue to fuel demand for sophisticated CMOS sensors. Emerging opportunities in areas such as augmented reality, virtual reality, and specialized industrial and medical imaging applications are expected to contribute significantly to the market's expansion. The market is poised for continued innovation in sensor architecture, on-chip processing, and low-light performance, ensuring its critical role in shaping the technological landscape for years to come.

CMOS Image Sensors Market Segmentation

-

1. End-user Industry

- 1.1. Consumer Electronics

- 1.2. Healthcare

- 1.3. Industrial

- 1.4. Security and Surveillance

- 1.5. Automotive and Transportation

- 1.6. Aerospace and Defense

- 1.7. Computing

CMOS Image Sensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

CMOS Image Sensors Market Regional Market Share

Geographic Coverage of CMOS Image Sensors Market

CMOS Image Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Implementation of CMOS Image Sensors in the Consumer Electronics Segment; Emergence of 4K Pixel Technology in the Security and Surveillance Sector

- 3.3. Market Restrains

- 3.3.1. Competition from CCD Sensor

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Industry to be the Fastest Growing End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CMOS Image Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Consumer Electronics

- 5.1.2. Healthcare

- 5.1.3. Industrial

- 5.1.4. Security and Surveillance

- 5.1.5. Automotive and Transportation

- 5.1.6. Aerospace and Defense

- 5.1.7. Computing

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America CMOS Image Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Consumer Electronics

- 6.1.2. Healthcare

- 6.1.3. Industrial

- 6.1.4. Security and Surveillance

- 6.1.5. Automotive and Transportation

- 6.1.6. Aerospace and Defense

- 6.1.7. Computing

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe CMOS Image Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Consumer Electronics

- 7.1.2. Healthcare

- 7.1.3. Industrial

- 7.1.4. Security and Surveillance

- 7.1.5. Automotive and Transportation

- 7.1.6. Aerospace and Defense

- 7.1.7. Computing

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific CMOS Image Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Consumer Electronics

- 8.1.2. Healthcare

- 8.1.3. Industrial

- 8.1.4. Security and Surveillance

- 8.1.5. Automotive and Transportation

- 8.1.6. Aerospace and Defense

- 8.1.7. Computing

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America CMOS Image Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Consumer Electronics

- 9.1.2. Healthcare

- 9.1.3. Industrial

- 9.1.4. Security and Surveillance

- 9.1.5. Automotive and Transportation

- 9.1.6. Aerospace and Defense

- 9.1.7. Computing

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa CMOS Image Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Consumer Electronics

- 10.1.2. Healthcare

- 10.1.3. Industrial

- 10.1.4. Security and Surveillance

- 10.1.5. Automotive and Transportation

- 10.1.6. Aerospace and Defense

- 10.1.7. Computing

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Canon Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Omnivision Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hamamatsu Photonics KK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung Electronics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 STMicroelectronics NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ON Semiconductor Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SK Hynix Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Teledyne Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Panasonic Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GalaxyCore Shanghai Limited Corporation*List Not Exhaustive 8 2 Vendor Market Share Analysi

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sony Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Canon Inc

List of Figures

- Figure 1: Global CMOS Image Sensors Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America CMOS Image Sensors Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America CMOS Image Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America CMOS Image Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America CMOS Image Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe CMOS Image Sensors Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe CMOS Image Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe CMOS Image Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe CMOS Image Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific CMOS Image Sensors Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific CMOS Image Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific CMOS Image Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific CMOS Image Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America CMOS Image Sensors Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Latin America CMOS Image Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Latin America CMOS Image Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America CMOS Image Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa CMOS Image Sensors Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa CMOS Image Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa CMOS Image Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa CMOS Image Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global CMOS Image Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global CMOS Image Sensors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global CMOS Image Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global CMOS Image Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global CMOS Image Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global CMOS Image Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global CMOS Image Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global CMOS Image Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global CMOS Image Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global CMOS Image Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global CMOS Image Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global CMOS Image Sensors Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CMOS Image Sensors Market?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the CMOS Image Sensors Market?

Key companies in the market include Canon Inc, Omnivision Technologies Inc, Hamamatsu Photonics KK, Samsung Electronics Co Ltd, STMicroelectronics NV, ON Semiconductor Corporation, SK Hynix Inc, Teledyne Technologies Inc, Panasonic Corporation, GalaxyCore Shanghai Limited Corporation*List Not Exhaustive 8 2 Vendor Market Share Analysi, Sony Corporation.

3. What are the main segments of the CMOS Image Sensors Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Implementation of CMOS Image Sensors in the Consumer Electronics Segment; Emergence of 4K Pixel Technology in the Security and Surveillance Sector.

6. What are the notable trends driving market growth?

Automotive and Transportation Industry to be the Fastest Growing End User.

7. Are there any restraints impacting market growth?

Competition from CCD Sensor.

8. Can you provide examples of recent developments in the market?

March 2023: Onsemi announced the launch of a new, innovative image sensor – the AR0822. The device features an embedded High Dynamic Range (HDR) and optimized near-infrared response, necessary for applications in harsh lighting conditions such as security and surveillance, body cameras, doorbell cameras, and robotics. The sensor’s low-power architecture and Wake-on-Motion features are designed to significantly reduce system power consumption. The AR0822 is an 8-megapixel stacked 1/1.8-inch (8.81mm diagonal) back-side illuminated CMOS digital image sensor based on a 2.0 µm pixel. It boasts an active-pixel array of 3840 (H) x 2160 (V) and can capture 4K video at 60 frames-per-second, offering image capture in either linear or eHDR modes (120 dB) with a rolling-shutter readout.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CMOS Image Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CMOS Image Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CMOS Image Sensors Market?

To stay informed about further developments, trends, and reports in the CMOS Image Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence