Key Insights

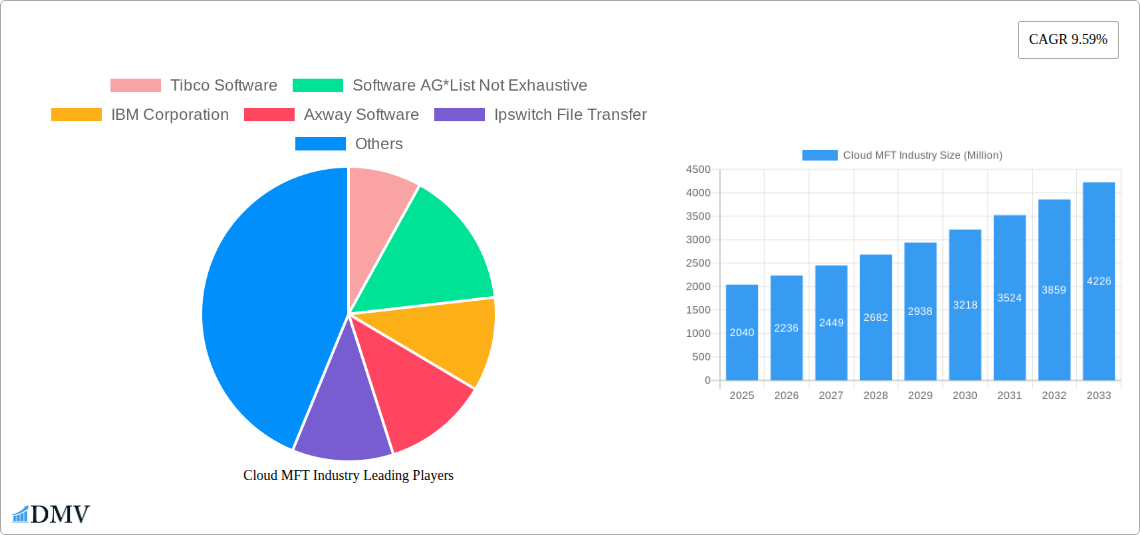

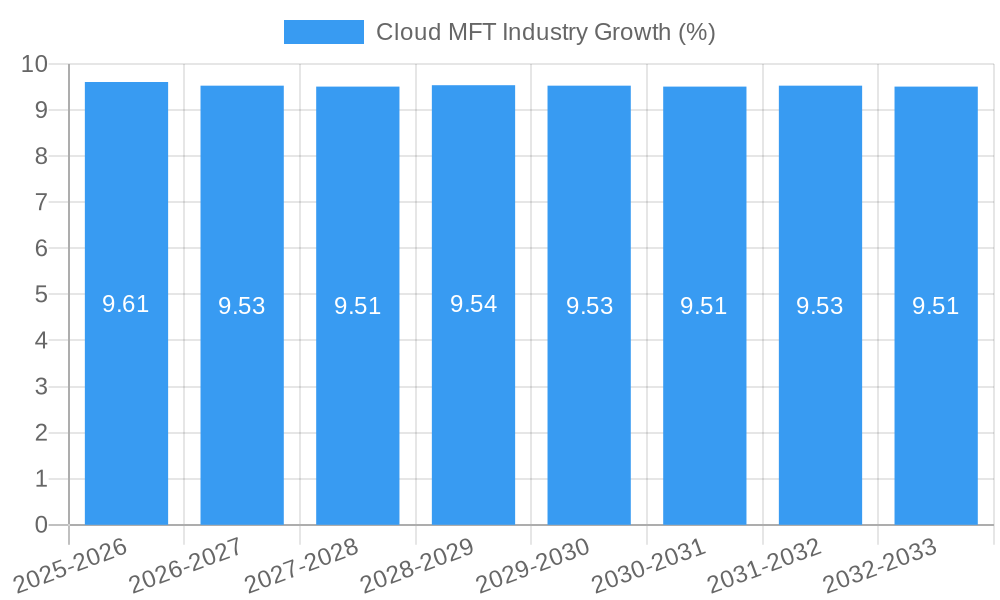

The Cloud Managed File Transfer (MFT) market is poised for substantial growth, projected to reach an estimated \$2.04 billion by 2025. This robust expansion is fueled by a compelling Compound Annual Growth Rate (CAGR) of 9.59% throughout the forecast period of 2025-2033. The escalating need for secure, reliable, and scalable data exchange across diverse industries is the primary driver behind this upward trajectory. Organizations are increasingly migrating their critical file transfer operations to cloud-based MFT solutions to enhance efficiency, reduce operational costs, and improve compliance with stringent data regulations. The inherent benefits of cloud MFT, such as centralized management, automated workflows, and advanced security features like encryption and audit trails, are critical in addressing the growing complexities of digital data. Furthermore, the proliferation of remote work models and the demand for seamless integration with existing IT infrastructures are further accelerating the adoption of these solutions.

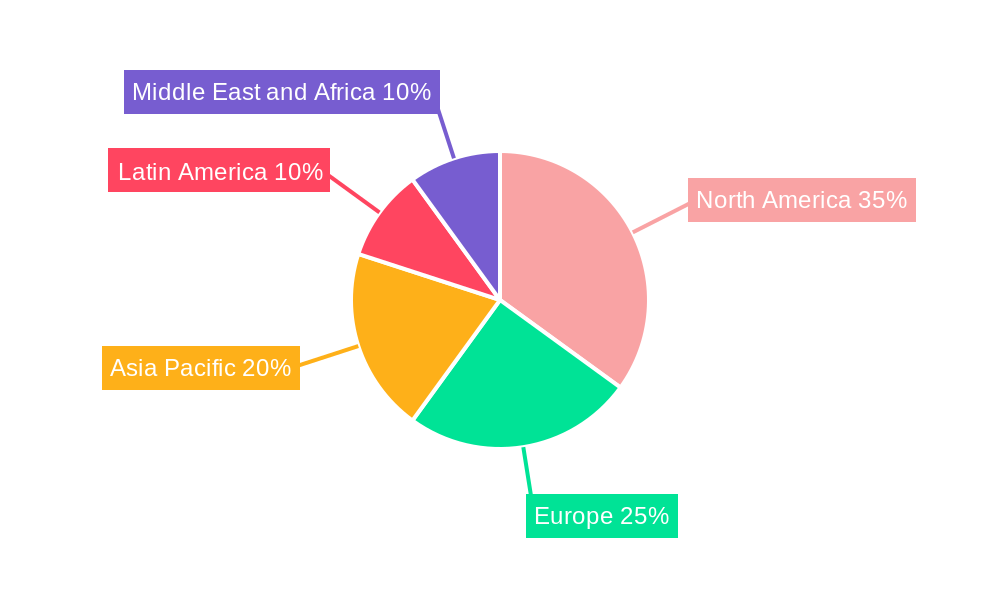

Key industry segments are witnessing significant traction within the Cloud MFT landscape. The BFSI (Banking, Financial Services, and Insurance) sector, due to its inherent need for high-security and regulatory compliance, is a major adopter. Similarly, the Telecommunication, Retail, and Government sectors are actively investing in Cloud MFT to streamline their operations and secure sensitive customer data. The manufacturing industry's increasing reliance on complex supply chain management and the energy utility sector's need for robust data exchange for operational efficiency are also contributing to market expansion. Geographically, North America is expected to lead the market, driven by early adoption and the presence of major technology players. The Asia Pacific region, with its rapidly growing economies and increasing digital transformation initiatives, presents a significant growth opportunity. While the market is generally robust, potential restraints might include concerns around data sovereignty and the initial investment costs for some smaller enterprises, though these are increasingly mitigated by the long-term cost-effectiveness of cloud solutions.

Cloud MFT Industry Market Composition & Trends

The Cloud Managed File Transfer (MFT) industry is a dynamic and rapidly evolving sector, projected to reach $XX Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is fueled by increasing adoption of cloud technologies, stringent data security regulations, and the critical need for secure and reliable data exchange across diverse enterprises. Market concentration is moderate, with key players like IBM Corporation, Tibco Software, and Broadcom Inc. (CA Technologies Inc) holding significant market share, alongside agile innovators such as Axway Software and Oracle Corporation. Innovation catalysts include advancements in encryption protocols, AI-driven threat detection, and seamless integration capabilities with existing IT infrastructures. The regulatory landscape, driven by GDPR, CCPA, and HIPAA, mandates robust MFT solutions, thereby propelling market demand. Substitute products, such as basic FTP or email attachments, are increasingly being phased out due to their inherent security risks and lack of scalability. End-user profiles span across Government, Retail, Manufacturing, Energy Utility, Telecommunication, BFSI, and other industries, each with unique data transfer requirements and security mandates. Mergers and acquisitions (M&A) are a key feature, with recent activities indicating a trend towards consolidation and strategic partnerships aimed at expanding service portfolios and geographic reach. For instance, IBM's acquisition of Polar Security in May 2023 signifies a move towards comprehensive data security platforms.

Cloud MFT Industry Industry Evolution

The Cloud Managed File Transfer (MFT) industry has undergone a significant transformation from its nascent stages to its current robust market position. The historical period (2019-2024) witnessed a steady increase in cloud adoption, driven by the inherent benefits of scalability, cost-efficiency, and enhanced accessibility offered by MFT solutions. Initially, many organizations were hesitant to migrate critical data transfer processes to the cloud due to security concerns. However, continuous advancements in encryption technologies, secure protocols like SFTP and FTPS, and stringent compliance requirements from regulatory bodies across various sectors, including BFSI and Healthcare, gradually built trust and encouraged migration. The base year 2025 marks a pivotal point, with a substantial portion of enterprises having already integrated cloud MFT into their core operations, recognizing its superiority over traditional on-premises solutions.

Technological advancements have been a primary driver of this evolution. The development of sophisticated features such as automated workflows, real-time monitoring, audit trails, and advanced analytics has made Cloud MFT indispensable for modern businesses. Integration capabilities have also improved dramatically, allowing seamless connection with various enterprise applications, ERP systems, and data lakes. The rise of hybrid cloud environments has further spurred innovation, with providers offering solutions that can operate across public, private, and hybrid cloud infrastructures, catering to the diverse needs and legacy systems of businesses.

Shifting consumer demands have also played a crucial role. The increasing volume and velocity of data, coupled with the growing emphasis on data privacy and protection, have necessitated more robust and secure file transfer mechanisms. Businesses are now demanding solutions that not only facilitate efficient data exchange but also provide comprehensive visibility and control over their data flows. The proliferation of remote workforces has also amplified the need for secure, accessible, and centralized file transfer solutions. Emerging technologies like AI and machine learning are being integrated to enhance threat detection, automate compliance checks, and optimize transfer speeds. For example, Broadcom Inc.'s CA 1 Flexible Storage solution, released in December 2022, addresses the growing need for secure mainframe data storage in hybrid IT environments, showcasing an adaptation to evolving enterprise infrastructure needs. Oracle's unveiling of Oracle Alloy in October 2022 further exemplifies the trend of cloud platforms enabling service providers and businesses to offer enhanced cloud services, including secure data transfer capabilities. The market is on a trajectory of continuous innovation, driven by the imperative for secure, compliant, and efficient data management in an increasingly digital world, projecting a strong growth trajectory through the forecast period of 2025-2033.

Leading Regions, Countries, or Segments in Cloud MFT Industry

The Cloud Managed File Transfer (MFT) industry exhibits distinct regional and segmental leadership, driven by a confluence of economic factors, regulatory landscapes, and technological adoption rates. North America, particularly the United States, stands as a dominant region in the Cloud MFT market. This leadership is attributed to its highly developed digital infrastructure, substantial investment in advanced technologies, and a stringent regulatory environment that necessitates robust data security and transfer solutions across key industries. The presence of a large number of enterprises in sectors like BFSI, Healthcare, and Government, which are heavy users of MFT solutions, further solidifies its leading position.

Within the End-user Industry segment, the BFSI (Banking, Financial Services, and Insurance) sector consistently emerges as a frontrunner in Cloud MFT adoption. This dominance is propelled by the highly sensitive nature of financial data, the rigorous regulatory compliance requirements (such as PCI DSS), and the constant need for secure, high-volume, and real-time data exchange between various financial institutions, payment gateways, and customers. The sector's substantial IT budgets and proactive approach to adopting advanced security measures make it a prime market for sophisticated Cloud MFT solutions.

- Key Drivers for BFSI Dominance:

- Stringent Regulatory Compliance: Mandates like SOX, GDPR, and various regional banking regulations necessitate auditable and secure data transfer.

- High Volume and Velocity of Transactions: The sheer volume of financial transactions requires scalable and efficient data transfer mechanisms.

- Data Sensitivity and Risk of Fraud: Protecting sensitive customer financial data from breaches and fraud is paramount, driving demand for robust encryption and security features.

- Interoperability and Integration: Seamless integration with core banking systems, trading platforms, and payment processors is critical.

The Public Cloud Type segment also demonstrates significant growth and adoption within the Cloud MFT market. This is largely due to its inherent advantages of scalability, cost-effectiveness, and ease of deployment, making it an attractive option for a wide range of businesses looking to optimize their IT expenditures. As cloud security technologies mature and provider offerings become more comprehensive, enterprises are increasingly comfortable entrusting their critical data transfers to public cloud environments.

- Key Drivers for Public Cloud Dominance:

- Cost Efficiency: Reduced capital expenditure on hardware and infrastructure.

- Scalability and Elasticity: Ability to quickly scale resources up or down based on demand.

- Accessibility and Collaboration: Enables secure file sharing and collaboration for distributed workforces.

- Vendor Expertise and Innovation: Cloud providers continuously invest in security and feature enhancements.

Furthermore, the Telecommunication industry is a significant contributor to the Cloud MFT market. Telecommunication companies manage vast amounts of customer data, network traffic, and operational information, all of which require secure and efficient transfer. The increasing demand for 5G services, IoT data management, and sophisticated customer service platforms necessitates reliable and scalable MFT solutions.

- Key Drivers for Telecommunication Sector Growth:

- Massive Data Volumes: Handling subscriber data, network logs, and service-related information.

- Real-time Data Exchange: Critical for network operations and customer service.

- Security of Customer Information: Protecting sensitive billing and personal data.

While Public Cloud and BFSI are leading segments, the report also highlights strong growth across other sectors and cloud types. Government entities are increasingly adopting Cloud MFT for secure information sharing and citizen services, while Manufacturing leverages it for supply chain management and inter-site data transfer. Hybrid cloud solutions are gaining traction as organizations seek to balance security, flexibility, and cost.

Cloud MFT Industry Product Innovations

Product innovations in the Cloud MFT industry are primarily focused on enhancing security, streamlining workflows, and improving user experience. Key advancements include the integration of AI and machine learning for proactive threat detection and anomaly identification, sophisticated end-to-end encryption with support for advanced cryptographic algorithms, and enhanced audit trails for comprehensive compliance reporting. Many solutions now offer secure gateways and APIs for seamless integration with a vast array of enterprise applications, including CRM, ERP, and data analytics platforms. Furthermore, the development of user-friendly interfaces and intuitive workflow automation tools empowers non-technical users to manage file transfers efficiently, while features like automated data validation and error correction minimize manual intervention and reduce operational risks. The emphasis is on creating a holistic data transfer ecosystem that is both highly secure and operationally efficient.

Propelling Factors for Cloud MFT Industry Growth

The Cloud MFT industry is propelled by several key growth drivers. Firstly, the escalating cybersecurity threats and the ever-increasing stringency of data privacy regulations globally, such as GDPR and CCPA, compel organizations to adopt robust MFT solutions for secure data exchange. Secondly, the widespread adoption of cloud computing across enterprises has created a natural demand for cloud-native MFT services that offer scalability, flexibility, and cost-efficiency. Thirdly, the digital transformation initiatives and the growth of the Internet of Things (IoT) are generating vast amounts of data that require secure and reliable transfer mechanisms. Finally, the increasing need for seamless integration with existing IT infrastructure and third-party applications further fuels the demand for advanced MFT solutions that can facilitate smooth data flow across diverse systems.

Obstacles in the Cloud MFT Industry Market

Despite its robust growth, the Cloud MFT industry faces several obstacles. A significant challenge is the perceived security risk associated with cloud-based solutions, particularly for organizations with highly sensitive data or stringent legacy compliance requirements, leading to a slower adoption rate in certain sectors. Integration complexity with existing, often disparate, on-premises IT systems can also be a barrier, requiring significant technical expertise and investment. Furthermore, the cost of implementation and ongoing subscription fees can be substantial, especially for small and medium-sized enterprises (SMEs), posing a financial hurdle. A shortage of skilled professionals with expertise in cloud security and MFT administration also presents a challenge for widespread adoption and efficient management of these solutions. Regulatory fragmentation across different geographies adds complexity for global organizations aiming for unified MFT strategies.

Future Opportunities in Cloud MFT Industry

The future of the Cloud MFT industry is ripe with opportunities. The increasing adoption of hybrid and multi-cloud strategies presents a significant avenue for growth, requiring MFT solutions that can seamlessly operate across diverse cloud environments. The Internet of Things (IoT) ecosystem, with its massive data generation, offers a vast untapped market for secure data ingestion and transfer. Advancements in AI and machine learning will unlock further opportunities for intelligent automation, predictive analytics for file transfer performance, and enhanced security threat detection. The growing demand for secure file sharing in remote and hybrid work models will continue to drive adoption. Furthermore, specialized MFT solutions tailored for emerging industries like biotechnology, advanced manufacturing, and autonomous vehicles will create niche market opportunities.

Major Players in the Cloud MFT Industry Ecosystem

- Tibco Software

- Software AG

- IBM Corporation

- Axway Software

- Ipswitch File Transfer

- Hightail

- Saison Information System Co Ltd

- Oracle Corporation

- Citrix ShareFile

- Broadcom Inc (CA Technologies Inc)

- Accellion Inc

Key Developments in Cloud MFT Industry Industry

- May 2023: IBM announced the acquisition of Polar Security, integrating its Data Security Posture Management (DSPM) technology into IBM Security Guardium to provide a comprehensive data security platform across SaaS, on-premises, and public cloud environments. This development enhances IBM's capabilities in securing diverse data types and locations.

- December 2022: Broadcom Inc. introduced a new solution enabling enterprises to store mainframe data anywhere, including the cloud. Their CA 1 Flexible Storage solution aims to achieve significant cost savings and ransomware protection for hybrid IT environments.

- October 2022: Oracle unveiled Oracle Alloy, a new cloud infrastructure platform designed to empower service providers, ISVs, and other businesses to offer new cloud services to their clients, including enhanced data management and secure transfer capabilities.

Strategic Cloud MFT Industry Market Forecast

The strategic Cloud MFT industry forecast indicates a sustained period of robust growth, driven by an increasing reliance on digital infrastructure and the imperative for secure data management. Key growth catalysts include the ongoing digital transformation initiatives across all sectors, the escalating need to comply with stringent global data privacy regulations, and the continuous evolution of cloud technologies. The demand for hybrid and multi-cloud compatible MFT solutions is expected to surge, as organizations seek greater flexibility and control over their data. Furthermore, the expansion of the IoT landscape and the generation of massive data volumes will necessitate advanced and scalable MFT services. Strategic partnerships, mergers, and acquisitions will continue to shape the market, fostering innovation and consolidation. The focus will remain on delivering solutions that offer enhanced security, seamless integration, and operational efficiency, ensuring the continued relevance and expansion of the Cloud MFT market throughout the forecast period.

Cloud MFT Industry Segmentation

-

1. Cloud Type

- 1.1. Public

- 1.2. Private

- 1.3. Hybrid

-

2. End-user Industry

- 2.1. Government

- 2.2. Retail

- 2.3. Manufacturing

- 2.4. Energy Utility

- 2.5. Telecommunication

- 2.6. BFSI

- 2.7. Other End-user Industries

Cloud MFT Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Cloud MFT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased demand for Hybrid Cloud services; Increasing Need for Secure File Transfer; Need for Reducing Data Transfer Costs and Maintain Corporate Agility

- 3.3. Market Restrains

- 3.3.1. Heavy Dependence on Legacy FTPS and Stiff Competition from Competitors

- 3.4. Market Trends

- 3.4.1. Hybrid Cloud to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cloud Type

- 5.1.1. Public

- 5.1.2. Private

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government

- 5.2.2. Retail

- 5.2.3. Manufacturing

- 5.2.4. Energy Utility

- 5.2.5. Telecommunication

- 5.2.6. BFSI

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Cloud Type

- 6. North America Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cloud Type

- 6.1.1. Public

- 6.1.2. Private

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Government

- 6.2.2. Retail

- 6.2.3. Manufacturing

- 6.2.4. Energy Utility

- 6.2.5. Telecommunication

- 6.2.6. BFSI

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Cloud Type

- 7. Europe Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cloud Type

- 7.1.1. Public

- 7.1.2. Private

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Government

- 7.2.2. Retail

- 7.2.3. Manufacturing

- 7.2.4. Energy Utility

- 7.2.5. Telecommunication

- 7.2.6. BFSI

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Cloud Type

- 8. Asia Pacific Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cloud Type

- 8.1.1. Public

- 8.1.2. Private

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Government

- 8.2.2. Retail

- 8.2.3. Manufacturing

- 8.2.4. Energy Utility

- 8.2.5. Telecommunication

- 8.2.6. BFSI

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Cloud Type

- 9. Latin America Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cloud Type

- 9.1.1. Public

- 9.1.2. Private

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Government

- 9.2.2. Retail

- 9.2.3. Manufacturing

- 9.2.4. Energy Utility

- 9.2.5. Telecommunication

- 9.2.6. BFSI

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Cloud Type

- 10. Middle East and Africa Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Cloud Type

- 10.1.1. Public

- 10.1.2. Private

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Government

- 10.2.2. Retail

- 10.2.3. Manufacturing

- 10.2.4. Energy Utility

- 10.2.5. Telecommunication

- 10.2.6. BFSI

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Cloud Type

- 11. North America Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Cloud MFT Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Tibco Software

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Software AG*List Not Exhaustive

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 IBM Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Axway Software

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Ipswitch File Transfer

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Hightail

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Saison Information System Co Ltd

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Oracle Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Citrix ShareFile

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Broadcom Inc (CA Technologies Inc )

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Accellion Inc

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Tibco Software

List of Figures

- Figure 1: Global Cloud MFT Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cloud MFT Industry Revenue (Million), by Cloud Type 2024 & 2032

- Figure 15: North America Cloud MFT Industry Revenue Share (%), by Cloud Type 2024 & 2032

- Figure 16: North America Cloud MFT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Cloud MFT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Cloud MFT Industry Revenue (Million), by Cloud Type 2024 & 2032

- Figure 21: Europe Cloud MFT Industry Revenue Share (%), by Cloud Type 2024 & 2032

- Figure 22: Europe Cloud MFT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe Cloud MFT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cloud MFT Industry Revenue (Million), by Cloud Type 2024 & 2032

- Figure 27: Asia Pacific Cloud MFT Industry Revenue Share (%), by Cloud Type 2024 & 2032

- Figure 28: Asia Pacific Cloud MFT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Asia Pacific Cloud MFT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Asia Pacific Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Cloud MFT Industry Revenue (Million), by Cloud Type 2024 & 2032

- Figure 33: Latin America Cloud MFT Industry Revenue Share (%), by Cloud Type 2024 & 2032

- Figure 34: Latin America Cloud MFT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Latin America Cloud MFT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Latin America Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Cloud MFT Industry Revenue (Million), by Cloud Type 2024 & 2032

- Figure 39: Middle East and Africa Cloud MFT Industry Revenue Share (%), by Cloud Type 2024 & 2032

- Figure 40: Middle East and Africa Cloud MFT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Middle East and Africa Cloud MFT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Middle East and Africa Cloud MFT Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Cloud MFT Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud MFT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud MFT Industry Revenue Million Forecast, by Cloud Type 2019 & 2032

- Table 3: Global Cloud MFT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Cloud MFT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Cloud MFT Industry Revenue Million Forecast, by Cloud Type 2019 & 2032

- Table 51: Global Cloud MFT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: United States Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Canada Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Cloud MFT Industry Revenue Million Forecast, by Cloud Type 2019 & 2032

- Table 56: Global Cloud MFT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 57: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Germany Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: UK Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: France Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Spain Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Europe Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Cloud MFT Industry Revenue Million Forecast, by Cloud Type 2019 & 2032

- Table 64: Global Cloud MFT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 65: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: China Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Japan Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: India Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Australia Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Asia Pacific Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Global Cloud MFT Industry Revenue Million Forecast, by Cloud Type 2019 & 2032

- Table 72: Global Cloud MFT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 73: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Brazil Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Mexico Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Argentina Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Latin America Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Global Cloud MFT Industry Revenue Million Forecast, by Cloud Type 2019 & 2032

- Table 79: Global Cloud MFT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 80: Global Cloud MFT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 81: UAE Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Saudi Arabia Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 83: South Africa Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Rest of Middle East and Africa Cloud MFT Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud MFT Industry?

The projected CAGR is approximately 9.59%.

2. Which companies are prominent players in the Cloud MFT Industry?

Key companies in the market include Tibco Software, Software AG*List Not Exhaustive, IBM Corporation, Axway Software, Ipswitch File Transfer, Hightail, Saison Information System Co Ltd, Oracle Corporation, Citrix ShareFile, Broadcom Inc (CA Technologies Inc ), Accellion Inc.

3. What are the main segments of the Cloud MFT Industry?

The market segments include Cloud Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased demand for Hybrid Cloud services; Increasing Need for Secure File Transfer; Need for Reducing Data Transfer Costs and Maintain Corporate Agility.

6. What are the notable trends driving market growth?

Hybrid Cloud to Witness High Growth.

7. Are there any restraints impacting market growth?

Heavy Dependence on Legacy FTPS and Stiff Competition from Competitors.

8. Can you provide examples of recent developments in the market?

May 2023 : IBM has announced it has acquired Polar Security, an IBM Security Guardium will provide safety teams with a secure data security platform covering all types of data in any location that stores it, via SaaS, on premises and public cloud environments by integrating Polar Security's DSPM technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud MFT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud MFT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud MFT Industry?

To stay informed about further developments, trends, and reports in the Cloud MFT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence