Key Insights

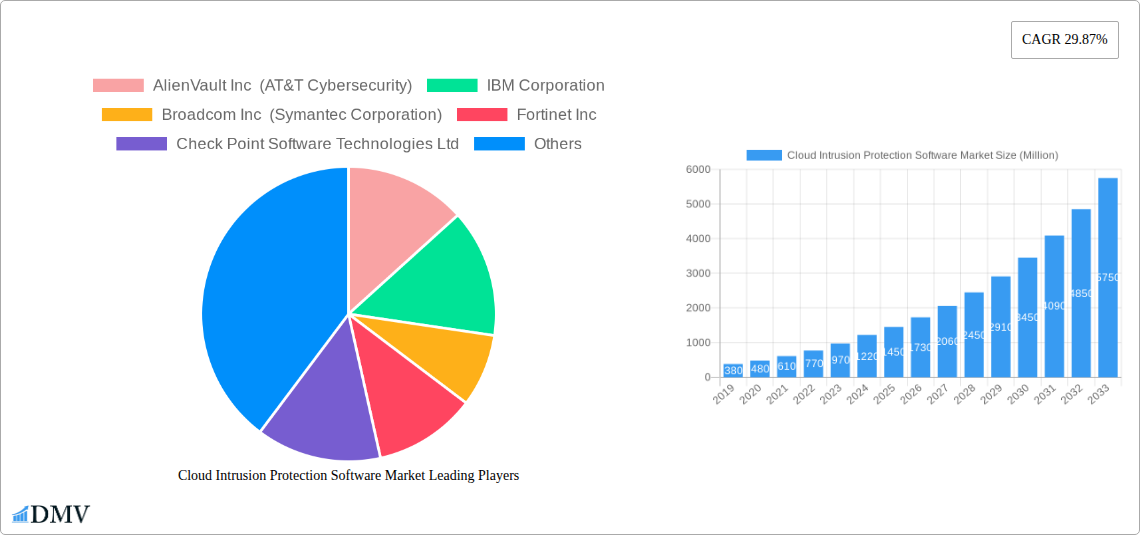

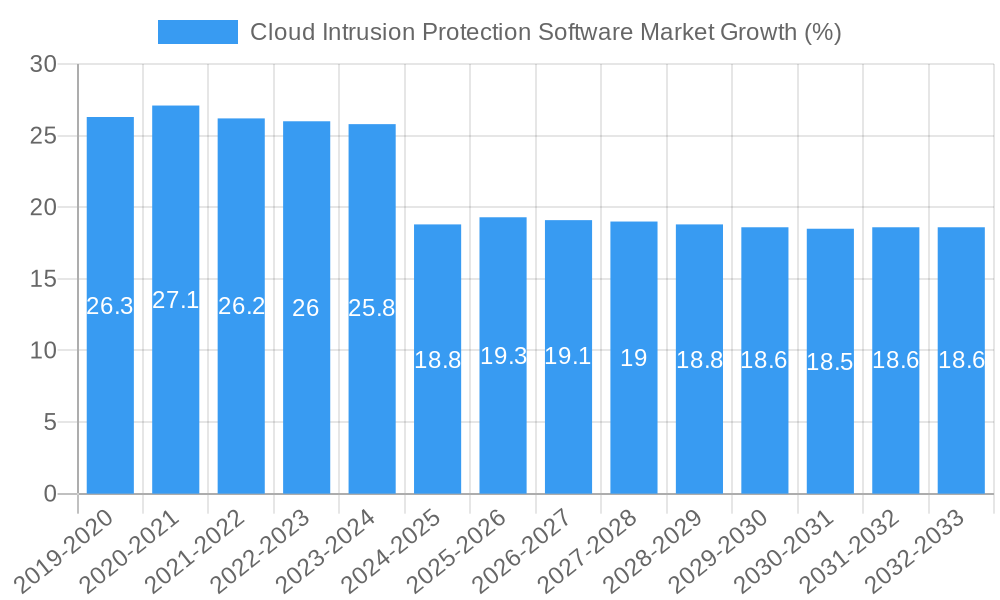

The Cloud Intrusion Protection Software Market is experiencing explosive growth, projected to reach $1.45 billion by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 29.87% through 2033. This surge is primarily driven by the escalating sophistication and frequency of cyber threats targeting cloud environments, coupled with the rapid adoption of cloud computing across all industries. Organizations are increasingly recognizing the critical need for robust security solutions to safeguard sensitive data and maintain operational continuity. The "XX" drivers, representing advanced threat detection, automated response mechanisms, and the growing demand for compliance with stringent data protection regulations, are propelling this market forward. Furthermore, the pervasive shift towards hybrid and multi-cloud architectures necessitates integrated intrusion protection capabilities that can span diverse cloud infrastructures.

Key trends shaping the Cloud Intrusion Protection Software Market include the rise of AI and machine learning for predictive threat analysis, the integration of intrusion protection with other security services like threat intelligence and security orchestration, and a growing preference for managed security services (MSSPs) for cloud security. The market is segmented across various service types, with Consulting, Managed Services, and Design & Integration services expected to witness significant demand as organizations seek expert guidance and support for their cloud security strategies. Industry verticals such as Telecom and Information Technology, Banking and Financial Services, and Healthcare are leading the adoption due to the high value and sensitivity of their data. While the market presents immense opportunities, it faces certain "XX" restraints, including the complexity of cloud environments, a shortage of skilled cybersecurity professionals, and potential budget constraints for some organizations. However, the overwhelming imperative for enhanced cloud security is expected to mitigate these challenges.

Here is the SEO-optimized, insightful report description for the Cloud Intrusion Protection Software Market, meticulously crafted to boost search visibility and captivate stakeholders.

Gain unparalleled insights into the dynamic Cloud Intrusion Protection Software Market with our comprehensive report. Analyzing the period from 2019 to 2033, with a deep dive into the base year of 2025 and a robust forecast period of 2025–2033, this study dissects the evolving landscape of cloud security. Understand the critical role of advanced intrusion detection and prevention systems in safeguarding digital assets across diverse industries. This report is essential for cybersecurity professionals, IT decision-makers, investors, and strategic planners seeking to navigate the complexities of cloud security threats and opportunities.

Cloud Intrusion Protection Software Market Market Composition & Trends

The Cloud Intrusion Protection Software Market is characterized by a moderate to high level of concentration, with key players continuously innovating to address sophisticated cyber threats. Innovation catalysts include the escalating sophistication of cyberattacks, the rapid adoption of cloud computing services, and stringent data privacy regulations globally. The regulatory landscape, driven by entities like GDPR and CCPA, is a significant factor shaping market dynamics, compelling organizations to invest heavily in robust protection. Substitute products, such as traditional on-premise security solutions, are gradually losing ground to more agile and scalable cloud-native options. End-user profiles span across all industries, with a notable emphasis on sectors with high data sensitivity. Merger and acquisition (M&A) activities are prevalent as larger entities seek to consolidate market share and expand their security portfolios. For instance, the M&A landscape has seen deals valued in the hundreds of millions to billions of dollars as companies like Broadcom (Symantec Corporation) and AT&T Cybersecurity (AlienVault Inc.) strategically acquire capabilities.

- Market Share Distribution: Dominated by a mix of established cybersecurity giants and specialized cloud security providers.

- M&A Deal Values: Significant investments, ranging from tens of millions to over a billion dollars, indicating strategic consolidation.

- Innovation Catalysts: Rising cyber threats, cloud migration, and regulatory compliance.

- Regulatory Impact: Increasing demand for compliance-driven security solutions.

Cloud Intrusion Protection Software Market Industry Evolution

The Cloud Intrusion Protection Software Market has witnessed remarkable evolution, driven by an ever-increasing volume of data, the pervasive adoption of hybrid and multi-cloud environments, and the sophistication of cyber adversaries. Over the historical period of 2019–2024, the market demonstrated a steady growth trajectory, fueled by organizations recognizing the inherent vulnerabilities of cloud infrastructure and the imperative for proactive threat mitigation. The base year of 2025 is expected to see this growth accelerate, with an estimated compound annual growth rate (CAGR) of approximately 15% projected for the forecast period of 2025–2033. This robust expansion is directly attributable to technological advancements in artificial intelligence (AI), machine learning (ML), and behavioral analytics, which are now integral to effective intrusion detection and prevention. Shifting consumer demands, particularly from enterprises prioritizing business continuity and data integrity, have further propelled the adoption of advanced cloud security solutions. The migration of critical business operations to the cloud necessitates sophisticated tools that can not only detect but also rapidly respond to threats in real-time, minimizing potential damage and downtime. This shift from reactive to proactive security postures has redefined the market, leading to higher adoption rates for cloud-native, AI-powered intrusion protection software. The increasing complexity of cloud architectures, coupled with the rise of shadow IT, further amplifies the need for comprehensive visibility and control offered by these specialized solutions. Consequently, businesses are increasingly allocating larger portions of their IT budgets towards cloud security, anticipating a significant market size exceeding $50,000 million by 2033.

Leading Regions, Countries, or Segments in Cloud Intrusion Protection Software Market

The Cloud Intrusion Protection Software Market is witnessing pronounced dominance from the Telecom and Information Technology industry vertical, closely followed by the Banking and Financial Service sector. These segments lead due to the sheer volume of sensitive data they handle, the critical nature of their operations, and the ever-present threat landscape they navigate. The increasing reliance on cloud infrastructure for service delivery, data storage, and customer interactions in these verticals necessitates robust intrusion protection. The Government sector is also a significant driver, driven by national security concerns, the need to protect critical infrastructure, and compliance with stringent data handling regulations.

- Telecom and Information Technology:

- Key Drivers: Proliferation of cloud-based services, massive data generation, evolving threat vectors targeting network infrastructure.

- Dominance Factors: Extensive adoption of Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) models, requiring comprehensive cloud security. Investment trends show a continuous increase in cybersecurity spending to protect vast customer bases and proprietary information.

- Banking and Financial Service:

- Key Drivers: High value of financial data, stringent regulatory compliance (e.g., PCI DSS), need for secure online transactions, and protection against sophisticated financial fraud.

- Dominance Factors: Continuous investment in advanced threat detection and prevention to maintain customer trust and regulatory adherence. The market size in this sector is projected to reach over $10,000 million by 2033.

- Government:

- Key Drivers: National security imperatives, protection of citizen data, critical infrastructure defense, and adherence to mandates for cloud adoption in public services.

- Dominance Factors: Significant government initiatives and funding allocated towards enhancing cybersecurity capabilities. Regulatory support plays a crucial role, mandating specific security protocols.

Among the service segments, Managed Service offerings are experiencing substantial growth. Organizations increasingly prefer outsourcing their cloud security management to specialized providers who can offer 24/7 monitoring, rapid incident response, and expert handling of complex intrusion protection systems. This trend is driven by a shortage of skilled cybersecurity professionals and the desire for cost-effectiveness and operational efficiency. The estimated market size for managed services is projected to exceed $25,000 million by 2033.

Cloud Intrusion Protection Software Market Product Innovations

Product innovations in the Cloud Intrusion Protection Software Market are centered on enhancing threat detection accuracy, accelerating response times, and improving integration capabilities. Advanced AI and ML algorithms are now core components, enabling predictive threat intelligence and behavioral anomaly detection. Solutions are increasingly offering unified dashboards for managing security across hybrid and multi-cloud environments, simplifying oversight for IT teams. Unique selling propositions include real-time threat correlation, automated remediation workflows, and sophisticated sandboxing for malware analysis. Performance metrics are constantly being refined, with a focus on minimizing false positives and reducing mean time to detect (MTTD) and mean time to respond (MTTR) to critical incidents, often achieving sub-minute response times for high-priority threats.

Propelling Factors for Cloud Intrusion Protection Software Market Growth

The Cloud Intrusion Protection Software Market is propelled by a confluence of technological, economic, and regulatory factors. The exponential growth of cloud adoption across all industries, driven by its scalability, flexibility, and cost-efficiency, inherently expands the attack surface, necessitating advanced protection. The increasing sophistication and frequency of cyber threats, including ransomware, phishing, and advanced persistent threats (APTs), compel organizations to invest in robust security solutions. Economic factors such as digital transformation initiatives and the need to maintain business continuity in the face of disruptions further fuel demand. Regulatory mandates, such as GDPR and CCPA, that enforce strict data protection and breach notification requirements, are significant drivers, pushing companies to adopt comprehensive cloud security measures.

Obstacles in the Cloud Intrusion Protection Software Market Market

Despite robust growth, the Cloud Intrusion Protection Software Market faces several obstacles. Regulatory complexity and evolving compliance landscapes can create challenges for vendors and end-users alike, requiring continuous adaptation. The shortage of skilled cybersecurity professionals limits the effective implementation and management of advanced intrusion protection systems for many organizations. Integration challenges with existing legacy IT infrastructures and diverse cloud environments can also impede seamless deployment. Furthermore, concerns over data privacy and sovereignty in cloud environments, coupled with potential vendor lock-in, can create hesitation among some potential adopters, impacting market penetration in certain regions. The competitive pressure from numerous vendors also leads to pricing challenges, with some SMBs finding advanced solutions cost-prohibitive.

Future Opportunities in Cloud Intrusion Protection Software Market

Emerging opportunities in the Cloud Intrusion Protection Software Market lie in the continued expansion of AI-driven anomaly detection and behavioral analytics, which offer more proactive threat identification. The growing adoption of serverless computing and containerized environments presents a new frontier for specialized intrusion protection solutions. Furthermore, the increasing demand for unified security platforms that offer comprehensive visibility and control across all cloud services and on-premise infrastructure presents a significant opportunity for integrated solutions. The rise of the Internet of Things (IoT), with its inherent security vulnerabilities, also opens new avenues for cloud-based intrusion protection. Emerging markets in developing economies are also poised for significant growth as cloud adoption accelerates.

Major Players in the Cloud Intrusion Protection Software Market Ecosystem

- AlienVault Inc (AT&T Cybersecurity)

- IBM Corporation

- Broadcom Inc (Symantec Corporation)

- Fortinet Inc

- Check Point Software Technologies Ltd

- Cisco Systems Inc

- HP Inc

- Trustwave Corporation

- Dell Inc

- McAfee Inc (Intel Corporation)

Key Developments in Cloud Intrusion Protection Software Market Industry

- July 2023: Salve Regina University, in collaboration with NWN Carousel, unveiled a cutting-edge networking infrastructure designed to provide exceptional availability and performance. This infrastructure supports Salve Regina's nationally renowned Esports gaming lineup. The partnership also encompasses the implementation of round-the-clock AI intrusion prevention and detection measures, reinforcing the university's comprehensive cybersecurity safeguards across its entire campus. Additionally, cloud Unified Communications have been integrated to facilitate a flexible work-and-learn-from-anywhere environment.

- March 2023: Vectra AI, a prominent leader in AI-driven hybrid cloud threat response and detection, introduced Vectra Match. This innovation incorporates incursion detection signature settings into Vectra Network Detection and Response (NDR), enabling security teams to expedite their transition to AI-driven threat response and detection while safeguarding their previous investments in signatures.

Strategic Cloud Intrusion Protection Software Market Market Forecast

- July 2023: Salve Regina University, in collaboration with NWN Carousel, unveiled a cutting-edge networking infrastructure designed to provide exceptional availability and performance. This infrastructure supports Salve Regina's nationally renowned Esports gaming lineup. The partnership also encompasses the implementation of round-the-clock AI intrusion prevention and detection measures, reinforcing the university's comprehensive cybersecurity safeguards across its entire campus. Additionally, cloud Unified Communications have been integrated to facilitate a flexible work-and-learn-from-anywhere environment.

- March 2023: Vectra AI, a prominent leader in AI-driven hybrid cloud threat response and detection, introduced Vectra Match. This innovation incorporates incursion detection signature settings into Vectra Network Detection and Response (NDR), enabling security teams to expedite their transition to AI-driven threat response and detection while safeguarding their previous investments in signatures.

Strategic Cloud Intrusion Protection Software Market Market Forecast

The strategic forecast for the Cloud Intrusion Protection Software Market is exceptionally strong, driven by the persistent and escalating nature of cyber threats. Future growth will be significantly propelled by the increasing adoption of AI and machine learning for advanced threat detection, enabling proactive defense mechanisms. The expanding use of hybrid and multi-cloud environments will necessitate integrated security solutions, creating opportunities for platforms offering comprehensive visibility and management. Furthermore, the continuous evolution of attack vectors and the ever-present need for regulatory compliance will ensure sustained demand for sophisticated intrusion protection software. The market is poised for substantial expansion, with an estimated market size reaching over $60,000 million by 2033, indicating a robust and promising future for this critical segment of cybersecurity.

Cloud Intrusion Protection Software Market Segmentation

-

1. Service

- 1.1. Consulting

- 1.2. Managed Service

- 1.3. Design and Integration

- 1.4. Training and Education

-

2. Industry Vertical

- 2.1. Telecom and Information Technology

- 2.2. Banking and Financial Service

- 2.3. Oil and Gas

- 2.4. Manufacturing

- 2.5. Healthcare

- 2.6. Government

- 2.7. Travel and Transport

- 2.8. Retail

- 2.9. Entertainment and Media

- 2.10. Other Industry Verticals

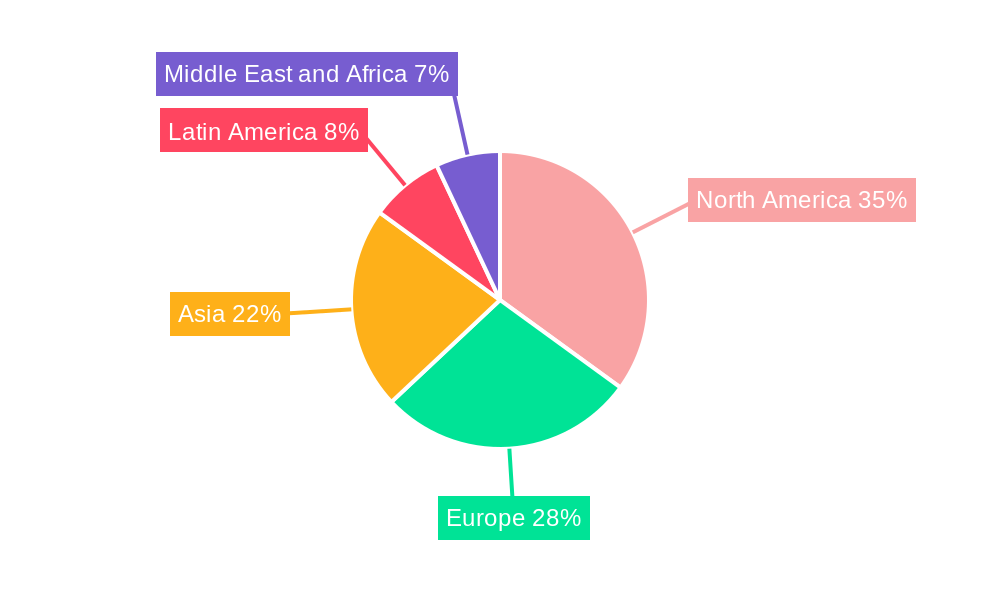

Cloud Intrusion Protection Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Cloud Intrusion Protection Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 29.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cyber Threats and Hacking Attempts; Increased IT Spending on Network Security

- 3.3. Market Restrains

- 3.3.1. Detection of False Positives and False Negatives; Loss of Network Performance Due to Multiple Checks

- 3.4. Market Trends

- 3.4.1. Telecom and Information Technology Expected to Grow Exponentially

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Consulting

- 5.1.2. Managed Service

- 5.1.3. Design and Integration

- 5.1.4. Training and Education

- 5.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.2.1. Telecom and Information Technology

- 5.2.2. Banking and Financial Service

- 5.2.3. Oil and Gas

- 5.2.4. Manufacturing

- 5.2.5. Healthcare

- 5.2.6. Government

- 5.2.7. Travel and Transport

- 5.2.8. Retail

- 5.2.9. Entertainment and Media

- 5.2.10. Other Industry Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Consulting

- 6.1.2. Managed Service

- 6.1.3. Design and Integration

- 6.1.4. Training and Education

- 6.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.2.1. Telecom and Information Technology

- 6.2.2. Banking and Financial Service

- 6.2.3. Oil and Gas

- 6.2.4. Manufacturing

- 6.2.5. Healthcare

- 6.2.6. Government

- 6.2.7. Travel and Transport

- 6.2.8. Retail

- 6.2.9. Entertainment and Media

- 6.2.10. Other Industry Verticals

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Consulting

- 7.1.2. Managed Service

- 7.1.3. Design and Integration

- 7.1.4. Training and Education

- 7.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.2.1. Telecom and Information Technology

- 7.2.2. Banking and Financial Service

- 7.2.3. Oil and Gas

- 7.2.4. Manufacturing

- 7.2.5. Healthcare

- 7.2.6. Government

- 7.2.7. Travel and Transport

- 7.2.8. Retail

- 7.2.9. Entertainment and Media

- 7.2.10. Other Industry Verticals

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Consulting

- 8.1.2. Managed Service

- 8.1.3. Design and Integration

- 8.1.4. Training and Education

- 8.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.2.1. Telecom and Information Technology

- 8.2.2. Banking and Financial Service

- 8.2.3. Oil and Gas

- 8.2.4. Manufacturing

- 8.2.5. Healthcare

- 8.2.6. Government

- 8.2.7. Travel and Transport

- 8.2.8. Retail

- 8.2.9. Entertainment and Media

- 8.2.10. Other Industry Verticals

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Consulting

- 9.1.2. Managed Service

- 9.1.3. Design and Integration

- 9.1.4. Training and Education

- 9.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.2.1. Telecom and Information Technology

- 9.2.2. Banking and Financial Service

- 9.2.3. Oil and Gas

- 9.2.4. Manufacturing

- 9.2.5. Healthcare

- 9.2.6. Government

- 9.2.7. Travel and Transport

- 9.2.8. Retail

- 9.2.9. Entertainment and Media

- 9.2.10. Other Industry Verticals

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Consulting

- 10.1.2. Managed Service

- 10.1.3. Design and Integration

- 10.1.4. Training and Education

- 10.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.2.1. Telecom and Information Technology

- 10.2.2. Banking and Financial Service

- 10.2.3. Oil and Gas

- 10.2.4. Manufacturing

- 10.2.5. Healthcare

- 10.2.6. Government

- 10.2.7. Travel and Transport

- 10.2.8. Retail

- 10.2.9. Entertainment and Media

- 10.2.10. Other Industry Verticals

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. North America Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Cloud Intrusion Protection Software Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 AlienVault Inc (AT&T Cybersecurity)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 IBM Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Broadcom Inc (Symantec Corporation)

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Fortinet Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Check Point Software Technologies Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Cisco Systems Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 HP Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Trustwave Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Dell Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 McAfee Inc (Intel Corporation)

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 AlienVault Inc (AT&T Cybersecurity)

List of Figures

- Figure 1: Global Cloud Intrusion Protection Software Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Cloud Intrusion Protection Software Market Revenue (Million), by Service 2024 & 2032

- Figure 15: North America Cloud Intrusion Protection Software Market Revenue Share (%), by Service 2024 & 2032

- Figure 16: North America Cloud Intrusion Protection Software Market Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 17: North America Cloud Intrusion Protection Software Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 18: North America Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Cloud Intrusion Protection Software Market Revenue (Million), by Service 2024 & 2032

- Figure 21: Europe Cloud Intrusion Protection Software Market Revenue Share (%), by Service 2024 & 2032

- Figure 22: Europe Cloud Intrusion Protection Software Market Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 23: Europe Cloud Intrusion Protection Software Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 24: Europe Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Cloud Intrusion Protection Software Market Revenue (Million), by Service 2024 & 2032

- Figure 27: Asia Cloud Intrusion Protection Software Market Revenue Share (%), by Service 2024 & 2032

- Figure 28: Asia Cloud Intrusion Protection Software Market Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 29: Asia Cloud Intrusion Protection Software Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 30: Asia Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Cloud Intrusion Protection Software Market Revenue (Million), by Service 2024 & 2032

- Figure 33: Latin America Cloud Intrusion Protection Software Market Revenue Share (%), by Service 2024 & 2032

- Figure 34: Latin America Cloud Intrusion Protection Software Market Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 35: Latin America Cloud Intrusion Protection Software Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 36: Latin America Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Cloud Intrusion Protection Software Market Revenue (Million), by Service 2024 & 2032

- Figure 39: Middle East and Africa Cloud Intrusion Protection Software Market Revenue Share (%), by Service 2024 & 2032

- Figure 40: Middle East and Africa Cloud Intrusion Protection Software Market Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 41: Middle East and Africa Cloud Intrusion Protection Software Market Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 42: Middle East and Africa Cloud Intrusion Protection Software Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Cloud Intrusion Protection Software Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 4: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Cloud Intrusion Protection Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Service 2019 & 2032

- Table 51: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 52: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Service 2019 & 2032

- Table 54: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 55: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Service 2019 & 2032

- Table 57: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 58: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Service 2019 & 2032

- Table 60: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 61: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Service 2019 & 2032

- Table 63: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 64: Global Cloud Intrusion Protection Software Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Intrusion Protection Software Market?

The projected CAGR is approximately 29.87%.

2. Which companies are prominent players in the Cloud Intrusion Protection Software Market?

Key companies in the market include AlienVault Inc (AT&T Cybersecurity), IBM Corporation, Broadcom Inc (Symantec Corporation), Fortinet Inc, Check Point Software Technologies Ltd, Cisco Systems Inc, HP Inc, Trustwave Corporation, Dell Inc, McAfee Inc (Intel Corporation).

3. What are the main segments of the Cloud Intrusion Protection Software Market?

The market segments include Service, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Cyber Threats and Hacking Attempts; Increased IT Spending on Network Security.

6. What are the notable trends driving market growth?

Telecom and Information Technology Expected to Grow Exponentially.

7. Are there any restraints impacting market growth?

Detection of False Positives and False Negatives; Loss of Network Performance Due to Multiple Checks.

8. Can you provide examples of recent developments in the market?

July 2023: Salve Regina University, in collaboration with NWN Carousel, unveiled a cutting-edge networking infrastructure designed to provide exceptional availability and performance. This infrastructure supports Salve Regina's nationally renowned Esports gaming lineup. The partnership also encompasses the implementation of round-the-clock AI intrusion prevention and detection measures, reinforcing the university's comprehensive cybersecurity safeguards across its entire campus. Additionally, cloud Unified Communications have been integrated to facilitate a flexible work-and-learn-from-anywhere environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Intrusion Protection Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Intrusion Protection Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Intrusion Protection Software Market?

To stay informed about further developments, trends, and reports in the Cloud Intrusion Protection Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence