Key Insights

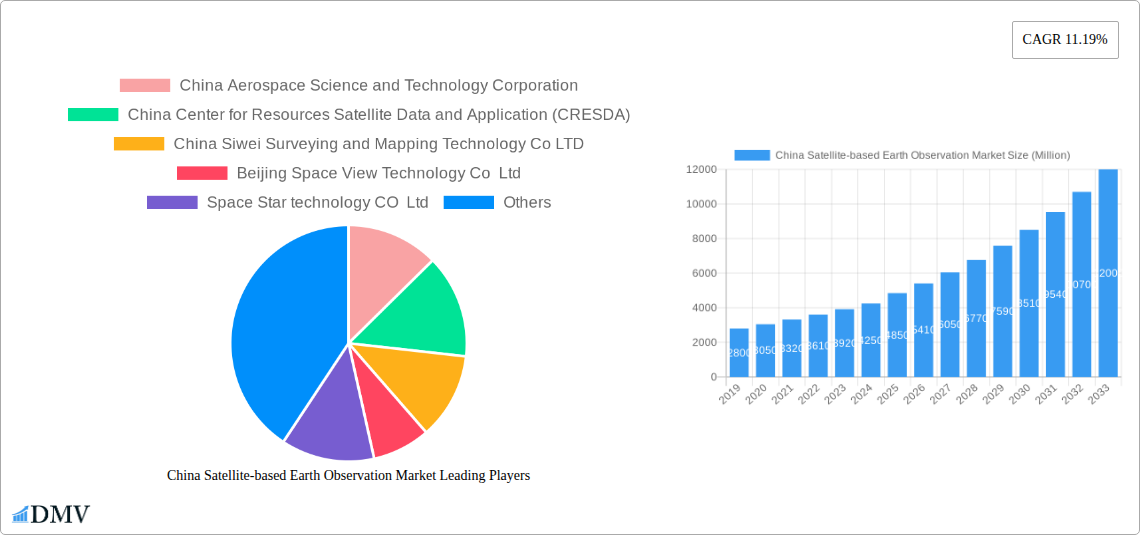

The China Satellite-based Earth Observation Market is poised for robust expansion, projected to reach an impressive market size of approximately $4,850 million by 2025, with a substantial Compound Annual Growth Rate (CAGR) of 11.19% anticipated to sustain this trajectory through 2033. This significant growth is propelled by a confluence of powerful drivers, including the escalating demand for real-time environmental monitoring, the burgeoning applications in precision agriculture for enhanced crop yields and resource management, and the critical need for advanced climate services to address pressing global challenges. Furthermore, the rapid development and deployment of advanced satellite technologies, coupled with substantial government investment in space programs, are instrumental in shaping this dynamic market. The market's segmentation reveals a strong emphasis on Value-Added Services, indicating a shift towards sophisticated data analysis and tailored solutions beyond raw earth observation data. Low Earth Orbit (LEO) satellites are expected to dominate due to their high resolution and revisit capabilities, catering to diverse end-use applications.

China Satellite-based Earth Observation Market Market Size (In Billion)

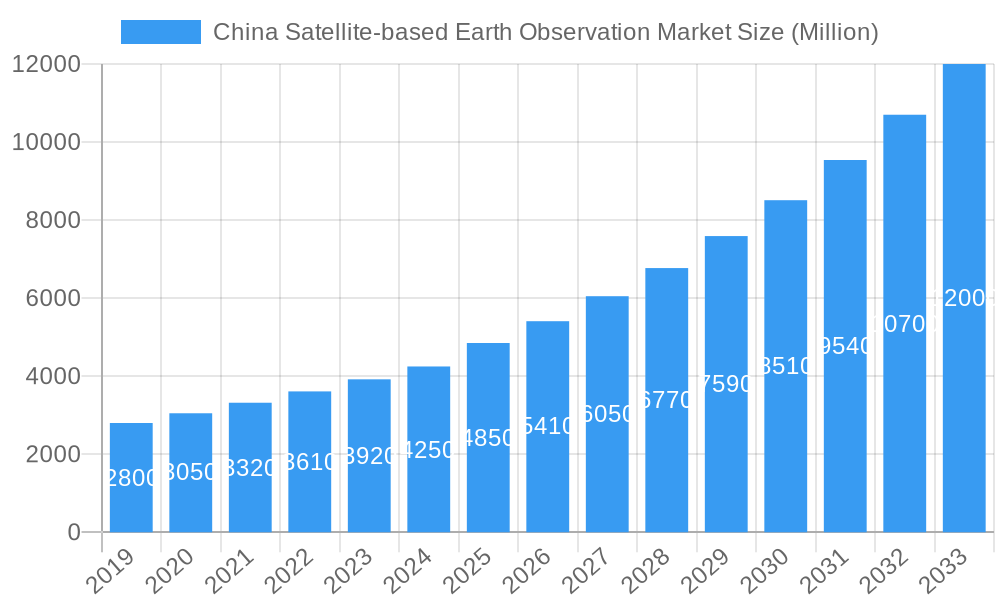

The market's growth will be further fueled by increasing adoption across key sectors such as urban development and cultural heritage preservation, where accurate spatial data is vital for planning and monitoring. The energy and raw materials sector will leverage satellite imagery for resource exploration and environmental impact assessment, while the infrastructure segment will benefit from enhanced project planning and monitoring. Despite the promising outlook, certain restraints, such as the high initial investment costs for satellite technology and the complexities associated with data processing and integration, may pose challenges. However, the vigorous pace of innovation within the industry, evident in the numerous prominent companies actively participating, suggests these hurdles will be progressively overcome. China's strategic focus on developing its domestic satellite capabilities, supported by entities like China Aerospace Science and Technology Corporation and China Center for Resources Satellite Data and Application (CRESDA), positions it as a central player in this burgeoning market.

China Satellite-based Earth Observation Market Company Market Share

Unveiling the Dominant Forces: China Satellite-based Earth Observation Market Analysis (2019–2033)

This comprehensive report delves deep into the burgeoning China Satellite-based Earth Observation Market, offering an in-depth analysis of its current landscape and future trajectory. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report provides unparalleled insights for stakeholders seeking to capitalize on this dynamic sector. We dissect critical market segments including Earth Observation Data and Value Added Services, explore satellite orbits ranging from Low Earth Orbit to Geostationary Orbit, and analyze end-use applications spanning Urban Development and Cultural Heritage, Agriculture, Climate Services, Energy and Raw Materials, and Infrastructure.

China Satellite-based Earth Observation Market Market Composition & Trends

The China Satellite-based Earth Observation Market is characterized by a rapidly evolving and increasingly sophisticated ecosystem. Market concentration is influenced by strategic government initiatives and significant investments in aerospace technology, fostering both competition and collaboration among key players. Innovation catalysts are primarily driven by advancements in sensor technology, data processing algorithms, and the increasing demand for actionable insights across various industries. The regulatory landscape, while evolving, generally supports the growth of the domestic EO sector, prioritizing national security and economic development. Substitute products, such as ground-based remote sensing and aerial surveys, are gradually being outpaced by the scalability and comprehensive coverage offered by satellite-based solutions. End-user profiles are diverse, ranging from governmental agencies and large agricultural enterprises to urban planners and environmental monitoring organizations, each leveraging EO data for distinct applications. Merger and acquisition (M&A) activities, though perhaps not as prevalent as in more mature markets, are expected to increase as companies seek to consolidate capabilities, expand market reach, and acquire specialized technologies. The market share distribution within China's EO sector is dynamic, with a significant portion held by state-owned enterprises, while private entities are steadily gaining ground through innovation and niche market penetration. M&A deal values are anticipated to reflect the growing strategic importance of satellite-derived data and services.

China Satellite-based Earth Observation Market Industry Evolution

The China Satellite-based Earth Observation Market has witnessed a remarkable evolution, transforming from a nascent sector into a global powerhouse. Over the historical period of 2019–2024, the market experienced robust growth, fueled by consistent government support and a burgeoning domestic demand for high-resolution imagery and geospatial intelligence. Technological advancements have been a primary driver, with China consistently pushing the boundaries in satellite design, launch capabilities, and remote sensing payload development. This includes the miniaturization of satellites, the enhancement of imaging resolution, and the integration of diverse sensor types, such as optical, SAR, and hyperspectral, enabling a wider array of applications. Shifting consumer demands, particularly from industries like agriculture, urban planning, and environmental monitoring, have also played a crucial role. As these sectors increasingly recognize the value of precise, real-time data for decision-making, the adoption of satellite-based EO solutions has accelerated. The market growth trajectory has been consistently upward, with compound annual growth rates (CAGRs) projected to remain strong in the coming years. Adoption metrics for EO data and services, while not always publicly disclosed, are demonstrably increasing across various end-use industries, indicating a deeper integration of these technologies into mainstream operations. The increasing accessibility and affordability of EO data, coupled with the development of user-friendly platforms, have further democratized its use, attracting a broader range of clients. This sustained evolution underscores China's commitment to building a self-sufficient and globally competitive satellite-based Earth observation industry.

Leading Regions, Countries, or Segments in China Satellite-based Earth Observation Market

The dominance within the China Satellite-based Earth Observation Market is a multifaceted phenomenon, with specific segments and regions emerging as frontrunners. Among the Type segments, Earth Observation Data itself holds a pivotal position, serving as the foundational element for all subsequent value-added services. The increasing volume and sophistication of data collection capabilities directly translate into market leadership. For Satellite Orbit, Low Earth Orbit (LEO) satellites are currently the most prevalent due to their suitability for high-resolution imaging and frequent revisits, critical for applications requiring near real-time monitoring. In terms of End-use, Infrastructure development and Urban Development and Cultural Heritage are significant drivers of demand, necessitating detailed spatial information for planning, construction, and preservation.

- Key Drivers for Earth Observation Data Dominance:

- Technological Advancements: Development of advanced sensors, higher resolution imaging, and improved data acquisition techniques.

- Government Investment: Substantial funding allocated to satellite constellation development and data dissemination initiatives.

- Data Accessibility: Efforts to make EO data more readily available to a wider user base through open data policies and platforms.

- Key Drivers for Low Earth Orbit Dominance:

- High Spatial Resolution: LEO satellites are ideal for capturing detailed imagery crucial for urban planning, infrastructure monitoring, and precision agriculture.

- Frequent Revisit Rates: Essential for applications requiring up-to-date information, such as disaster management and environmental change monitoring.

- Cost-Effectiveness: Compared to geostationary satellites, LEO constellations can be more cost-effective to deploy and maintain for certain applications.

- Key Drivers for Infrastructure & Urban Development Dominance:

- Rapid Urbanization: China's ongoing urbanization requires extensive planning, monitoring, and management of infrastructure projects.

- Smart City Initiatives: The growth of smart cities relies heavily on geospatial data for traffic management, resource allocation, and public service delivery.

- Infrastructure Projects: Large-scale infrastructure developments, such as transportation networks and energy facilities, necessitate continuous monitoring and assessment.

- Cultural Heritage Preservation: EO data aids in monitoring and protecting historical sites and cultural landscapes.

While Value Added Services are crucial for unlocking the full potential of EO data, the raw data itself forms the bedrock of the market's current strength. Similarly, while Medium Earth Orbit and Geostationary Orbit satellites play vital roles in navigation and weather forecasting respectively, the demand for high-resolution Earth observation for terrestrial applications primarily favors LEO. The convergence of these factors solidifies the prominence of Earth Observation Data, LEO satellites, and applications in Infrastructure and Urban Development within the Chinese EO market.

China Satellite-based Earth Observation Market Product Innovations

The China Satellite-based Earth Observation Market is experiencing a surge in product innovations driven by advancements in imaging technology and data analytics. Novel satellite designs are enabling higher spatial and temporal resolutions, offering unprecedented detail for various applications. The integration of multi-spectral and hyperspectral sensors allows for sophisticated material identification and environmental monitoring. Furthermore, the development of AI-powered algorithms is revolutionizing data processing, enabling automated feature extraction, change detection, and predictive analysis. These innovations are leading to the creation of sophisticated Value Added Services, such as advanced disaster assessment platforms, precision agriculture management tools, and detailed urban planning solutions, all designed to provide actionable insights from vast amounts of satellite data.

Propelling Factors for China Satellite-based Earth Observation Market Growth

Several key factors are propelling the China Satellite-based Earth Observation Market forward. Firstly, significant technological advancements in satellite design, sensor technology, and data processing are creating more capable and versatile EO systems. Secondly, strong government support and investment through national programs like the BeiDou navigation system and initiatives focused on aerospace exploration foster innovation and market expansion. Economically, the increasing recognition of EO data's value in optimizing resource management, improving agricultural yields, and enhancing disaster response is driving demand across various industries. Regulatory frameworks are increasingly supportive, encouraging domestic development and application of EO technologies.

Obstacles in the China Satellite-based Earth Observation Market Market

Despite its robust growth, the China Satellite-based Earth Observation Market faces certain obstacles. Regulatory challenges related to data sharing policies and international collaboration can sometimes impede broader adoption. Supply chain disruptions, particularly in the global semiconductor industry, can impact the timely production and deployment of satellite components. Furthermore, competitive pressures, both domestically and internationally, necessitate continuous innovation and cost optimization. The high initial investment required for satellite development and launch can also be a barrier for smaller companies entering the market.

Future Opportunities in China Satellite-based Earth Observation Market

The China Satellite-based Earth Observation Market is poised for significant future opportunities. The expansion of constellations offering even higher resolution and more frequent revisits will unlock new applications in precision monitoring and real-time analytics. The growing demand for climate change adaptation and mitigation strategies presents a substantial market for EO data in environmental monitoring and resource management. Furthermore, the increasing integration of AI and machine learning with EO data processing will lead to the development of sophisticated predictive models and intelligent decision-support systems, creating new avenues for Value Added Services. The burgeoning commercial space sector is also expected to foster greater innovation and private sector participation.

Major Players in the China Satellite-based Earth Observation Market Ecosystem

- China Aerospace Science and Technology Corporation

- China Center for Resources Satellite Data and Application (CRESDA)

- China Siwei Surveying and Mapping Technology Co LTD

- Beijing Space View Technology Co Ltd

- Space Star technology CO Ltd

- Aerospace Information Research Institute (AIR)

- Zhuhai Orbita Aerospace Science & Technology Co Ltd

- Chang Guang Satellite Technology Co Ltd

- Beijing Space Eye Innovation Technology Co Ltd

- China Academy of Space Technology (CAST)

- Smart Satellite Technology Co Ltd

- Twenty First Century Aerospace Technology (Asia) Pte Ltd

Key Developments in China Satellite-based Earth Observation Market Industry

- May 2023: China successfully launched two satellites to augment its Beidou navigation system and carry test satellites for scientific research and radar technology. The launch, conducted from the Jiuquan Satellite Launch Centre, included the Luojia-2 (01) Ka-band SAR test satellite for Wuhan University, and the Macau Science Satellite 1A and 1B, designed for Earth's magnetic field studies, underscoring advancements in radar and scientific sensing capabilities.

- April 2023: Chinese researchers achieved a significant milestone by conducting an experiment where an artificial intelligence (AI) system managed a close-to-Earth orbit satellite, Qimingxing 1, autonomously for 24 hours. This landmark experiment, detailed in Geomatics and Information Science of Wuhan University, demonstrated the potential for AI in satellite operation and control, paving the way for enhanced automation in space missions.

Strategic China Satellite-based Earth Observation Market Market Forecast

The strategic forecast for the China Satellite-based Earth Observation Market points towards sustained and accelerated growth. The continuous expansion of satellite constellations, coupled with relentless innovation in sensor technology and data analytics, will drive the market's expansion. A key growth catalyst will be the increasing adoption of EO data and derived services across a wider array of industries, from precision agriculture and intelligent infrastructure management to climate resilience and environmental stewardship. The growing emphasis on national data security and self-sufficiency will further bolster domestic capabilities. Emerging opportunities in AI-driven analytics and specialized satellite applications will unlock significant market potential, making this sector a crucial pillar of China's technological and economic advancement in the coming years.

China Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

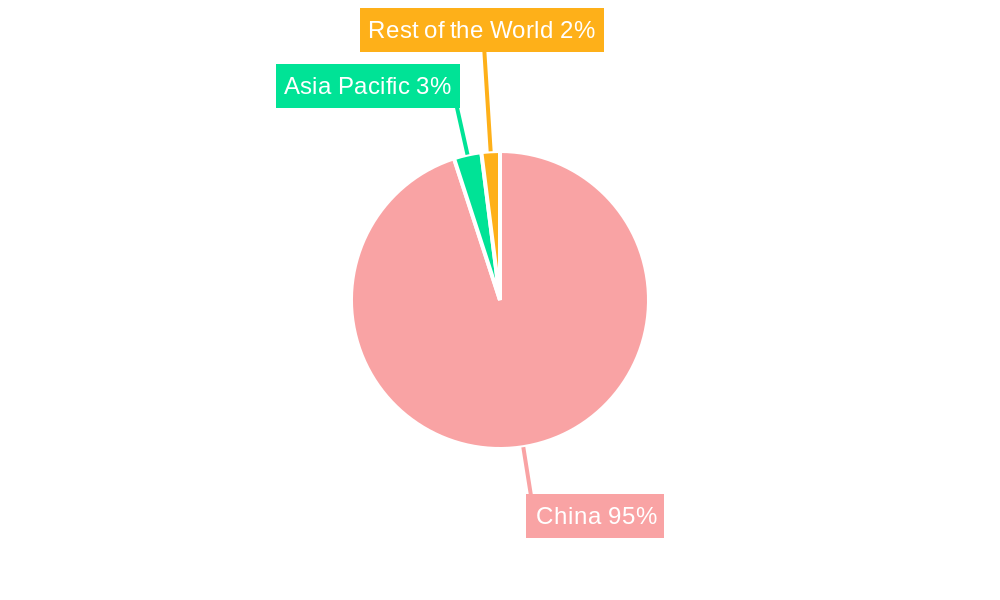

China Satellite-based Earth Observation Market Segmentation By Geography

- 1. China

China Satellite-based Earth Observation Market Regional Market Share

Geographic Coverage of China Satellite-based Earth Observation Market

China Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investments and Government Initiatives; Policy and Regulatory Support

- 3.3. Market Restrains

- 3.3.1. Limited International Cooperation; Complex Data Integration and Interoperability

- 3.4. Market Trends

- 3.4.1. Rising Investments and Government Initiatives to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Aerospace Science and Technology Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Center for Resources Satellite Data and Application (CRESDA)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Siwei Surveying and Mapping Technology Co LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beijing Space View Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Space Star technology CO Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aerospace Information Research Institute (AIR)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZhuhaiOrbita Aerospace Science & Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chang Guang Satellite Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Space Eye Innovation Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Academy of Space Technology (CAST)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Smart Satellite Technology Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Twenty First Century Aerospace Technology (Asia) Pte Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 China Aerospace Science and Technology Corporation

List of Figures

- Figure 1: China Satellite-based Earth Observation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Satellite-based Earth Observation Market Share (%) by Company 2025

List of Tables

- Table 1: China Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2020 & 2033

- Table 3: China Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2020 & 2033

- Table 4: China Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: China Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2020 & 2033

- Table 7: China Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2020 & 2033

- Table 8: China Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Satellite-based Earth Observation Market?

The projected CAGR is approximately 11.19%.

2. Which companies are prominent players in the China Satellite-based Earth Observation Market?

Key companies in the market include China Aerospace Science and Technology Corporation, China Center for Resources Satellite Data and Application (CRESDA), China Siwei Surveying and Mapping Technology Co LTD, Beijing Space View Technology Co Ltd, Space Star technology CO Ltd, Aerospace Information Research Institute (AIR), ZhuhaiOrbita Aerospace Science & Technology Co Ltd , Chang Guang Satellite Technology Co Ltd, Beijing Space Eye Innovation Technology Co Ltd, China Academy of Space Technology (CAST), Smart Satellite Technology Co Ltd, Twenty First Century Aerospace Technology (Asia) Pte Ltd.

3. What are the main segments of the China Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Investments and Government Initiatives; Policy and Regulatory Support.

6. What are the notable trends driving market growth?

Rising Investments and Government Initiatives to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Limited International Cooperation; Complex Data Integration and Interoperability.

8. Can you provide examples of recent developments in the market?

May 2023: China launched two satellites to refuel its Beidou navigation system and place test satellites for science and radar technology in space. The Jiuquan Satellite Launch Centre in the Gobi Desert launched a Long March 2C rocket. The Luojia-2 (01), a Ka-band synthetic aperture radar (SAR) test satellite for Wuhan University, and the Macau Science Satellite 1A and 1B, both of which are intended to study the Earth's magnetic field, were both on board.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the China Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence