Key Insights

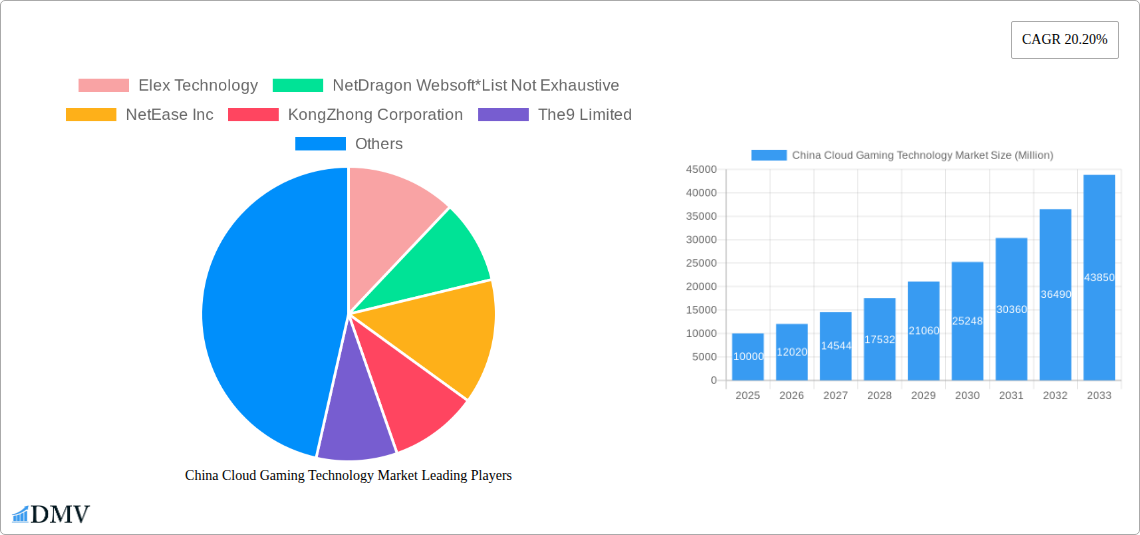

The China cloud gaming technology market is experiencing significant expansion, driven by increased smartphone adoption, widespread high-speed internet access, and a thriving gaming culture. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.68%. With an estimated market size of $11.93 billion in the base year 2025, the sector is poised for sustained substantial growth through 2033. Key growth catalysts include the rising popularity of mobile gaming, advancements in 5G technology enhancing streaming quality, and the increasing affordability of cloud gaming subscriptions. The market demonstrates robust demand across various devices, including smartphones, connected TVs, and computers, with video streaming dominating usage. Leading companies such as Tencent Holdings, NetEase Inc., and Perfect World Games are strategically investing in infrastructure and content to capitalize on this growth. Challenges include the ongoing need for infrastructure development, particularly in less developed regions, and addressing data security concerns.

China Cloud Gaming Technology Market Market Size (In Billion)

The forecast period (2025-2033) indicates continued market expansion, fueled by ongoing technological innovation, government support for digital infrastructure, and evolving gamer preferences. While regulatory shifts and competitive dynamics may influence the market, the overall outlook is positive. The integration of cloud gaming with other entertainment platforms and the growth of esports further contribute to the market's dynamism. Enhancing user experience through superior graphics and reduced latency will be critical for sustained growth and user acquisition. Opportunities exist for tailored content and marketing strategies across diverse device segments. Future success hinges on effectively addressing internet infrastructure and data privacy challenges while fostering sector innovation.

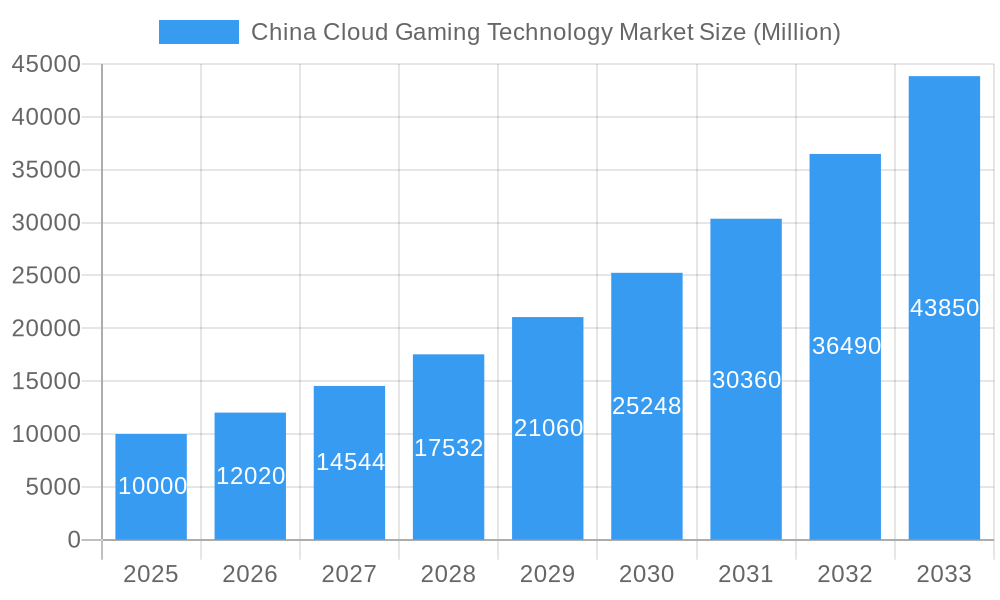

China Cloud Gaming Technology Market Company Market Share

China Cloud Gaming Technology Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic China cloud gaming technology market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on this rapidly evolving market. The market is projected to reach xx Million by 2033, presenting significant opportunities for growth and investment.

China Cloud Gaming Technology Market Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities within the China cloud gaming technology market. The market exhibits a moderately concentrated structure, with key players such as Tencent Holdings and NetEase Inc. holding significant market share. However, the presence of numerous smaller companies indicates a competitive landscape. The market share distribution in 2024 is estimated as follows: Tencent Holdings (30%), NetEase Inc (20%), Other (50%). Innovation is driven by advancements in 5G technology, improved cloud infrastructure, and the rising demand for high-quality gaming experiences. Regulatory changes, particularly concerning data privacy and content moderation, significantly influence market dynamics. The increasing popularity of mobile gaming presents a substantial challenge, but also an opportunity for cloud gaming providers. Recent M&A activities, totaling an estimated value of xx Million in 2024, reflect the consolidation trend within the industry.

- Market Concentration: Moderately concentrated, with significant players holding a major share but a large number of smaller companies contributing to competitiveness.

- Innovation Catalysts: 5G technology, improved cloud infrastructure, rising demand for high-quality gaming experiences.

- Regulatory Landscape: Stringent regulations regarding data privacy and content moderation.

- Substitute Products: Mobile gaming, traditional console gaming.

- End-User Profiles: Primarily young adults and gamers across various socioeconomic backgrounds.

- M&A Activities: Significant M&A activity totaling an estimated xx Million in 2024.

China Cloud Gaming Technology Market Industry Evolution

The China cloud gaming technology market has witnessed exponential growth during the historical period (2019-2024), driven by increasing smartphone penetration, improving internet infrastructure, and the rising popularity of mobile games. The market experienced a compound annual growth rate (CAGR) of xx% during this period. Technological advancements, including the development of more powerful cloud servers and improved streaming technologies, have significantly enhanced the gaming experience. Consumer demand for high-quality, immersive gaming experiences fuels market growth. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace, driven by factors such as expanding 5G coverage and the emergence of new cloud gaming platforms. The market is expected to reach xx Million by 2033, signifying a CAGR of xx% during the forecast period. Technological innovations, such as advancements in artificial intelligence (AI) and virtual reality (VR) integration, are poised to further drive market expansion. Shifting consumer preferences towards more convenient and accessible gaming options contribute positively to the sector's trajectory.

Leading Regions, Countries, or Segments in China Cloud Gaming Technology Market

The dominant segment within the China cloud gaming technology market is video streaming by type, driven by its superior visual quality and wider adoption among gamers. Smartphones are the leading device category, attributed to their widespread accessibility and portability. Key drivers for these segments include:

- Video Streaming: Superior visual quality, broader gamer adoption, robust technological advancements.

- Smartphones: Wide accessibility, portability, increasing processing power, and dedicated gaming features.

While other segments like file streaming, IPTV, computers, consoles, and connected TVs show potential, they lag behind video streaming on smartphones due to factors like higher bandwidth requirements, cost, and technical limitations. The first-tier cities in China lead in market adoption, exhibiting higher internet penetration and disposable incomes.

China Cloud Gaming Technology Market Product Innovations

Recent innovations in cloud gaming technology focus on enhancing visual fidelity, reducing latency, and improving the overall gaming experience. Advancements in compression algorithms and server infrastructure allow for seamless streaming of high-resolution graphics even on lower bandwidth connections. The introduction of features like cross-platform compatibility and cloud saves significantly improves user experience and convenience. The unique selling propositions revolve around providing high-quality gaming experiences without the need for expensive hardware, thereby expanding the gaming market to a wider consumer base.

Propelling Factors for China Cloud Gaming Technology Market Growth

The China cloud gaming technology market's growth is propelled by several key factors: The rapid expansion of 5G infrastructure provides the necessary bandwidth for high-quality streaming. The increasing affordability of smartphones and improving internet accessibility democratizes gaming access. Favorable government policies that encourage technological advancements in the digital entertainment sector contribute to the market growth. Finally, a growing young population with high disposable income fuels demand for entertainment services.

Obstacles in the China Cloud Gaming Technology Market Market

Challenges for the market include the high cost of infrastructure development and maintenance, potentially limiting widespread adoption. Competition from established gaming companies creates pricing pressure and impacts profitability. Strict regulatory requirements on content and data privacy present compliance hurdles and operational complexities for market players.

Future Opportunities in China Cloud Gaming Technology Market

Future opportunities lie in the expansion into rural markets with improved internet connectivity, the integration of cloud gaming with virtual reality (VR) and augmented reality (AR) technologies, and the development of niche gaming experiences targeted at specific user segments. Exploring cloud gaming's potential in esports and competitive gaming scenarios further presents exciting opportunities.

Major Players in the China Cloud Gaming Technology Market Ecosystem

- Elex Technology

- NetDragon Websoft

- NetEase Inc

- KongZhong Corporation

- The9 Limited

- 37 Interactive Entertainment

- Perfect World Games

- Tencent Holdings

- Shanda Games

Key Developments in China Cloud Gaming Technology Market Industry

- November 2022: Tencent announces new cloud computing solutions targeted at foreign markets, seeking new avenues amidst domestic market challenges and regulatory pressures.

- February 2022: Redmi launches the Redmi K50G gaming edition smartphone, showcasing hardware advancements aimed at improving the mobile gaming experience.

Strategic China Cloud Gaming Technology Market Market Forecast

The China cloud gaming technology market is poised for continued growth, driven by technological advancements, increasing internet penetration, and evolving consumer preferences. The market is expected to witness significant expansion in the forecast period (2025-2033), fueled by the adoption of 5G technology and the integration of cloud gaming with emerging technologies like VR and AR. The potential for expansion into untapped markets and the ongoing development of innovative gaming experiences contribute to a positive outlook for this dynamic sector.

China Cloud Gaming Technology Market Segmentation

-

1. Type

- 1.1. Video Streaming

- 1.2. File Streaming

-

2. Device

- 2.1. IPTV

- 2.2. Smartphones

- 2.3. Computers

- 2.4. Consoles

- 2.5. Connected TVs

China Cloud Gaming Technology Market Segmentation By Geography

- 1. China

China Cloud Gaming Technology Market Regional Market Share

Geographic Coverage of China Cloud Gaming Technology Market

China Cloud Gaming Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Advances in Technological Developments is Driving the Market Demand

- 3.3. Market Restrains

- 3.3.1. Fluctuating Government Regulations Regarding Gaming Industry is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Growth of Smartphones to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Cloud Gaming Technology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video Streaming

- 5.1.2. File Streaming

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. IPTV

- 5.2.2. Smartphones

- 5.2.3. Computers

- 5.2.4. Consoles

- 5.2.5. Connected TVs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Elex Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NetDragon Websoft*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NetEase Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KongZhong Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The9 Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 37 Interactive Entertainment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Perfect World Games

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tencent Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shanda Games

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Elex Technology

List of Figures

- Figure 1: China Cloud Gaming Technology Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Cloud Gaming Technology Market Share (%) by Company 2025

List of Tables

- Table 1: China Cloud Gaming Technology Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Cloud Gaming Technology Market Revenue billion Forecast, by Device 2020 & 2033

- Table 3: China Cloud Gaming Technology Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Cloud Gaming Technology Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: China Cloud Gaming Technology Market Revenue billion Forecast, by Device 2020 & 2033

- Table 6: China Cloud Gaming Technology Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Cloud Gaming Technology Market?

The projected CAGR is approximately 10.68%.

2. Which companies are prominent players in the China Cloud Gaming Technology Market?

Key companies in the market include Elex Technology, NetDragon Websoft*List Not Exhaustive, NetEase Inc, KongZhong Corporation, The9 Limited, 37 Interactive Entertainment, Perfect World Games, Tencent Holdings, Shanda Games.

3. What are the main segments of the China Cloud Gaming Technology Market?

The market segments include Type, Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Advances in Technological Developments is Driving the Market Demand.

6. What are the notable trends driving market growth?

Growth of Smartphones to Drive the Market Demand.

7. Are there any restraints impacting market growth?

Fluctuating Government Regulations Regarding Gaming Industry is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: In an effort to find new development opportunities in the face of a downturn in its main online video game industry, Tencent said it would provide new cloud computing solutions targeted at foreign markets. The business will have a launch event for various cloud-based audio and video products, primarily targeted at markets outside of China. With China's economy slowing, Tencent has understood that it needs to find new avenues of development outside of China. A harsher regulatory environment at home is another challenge that Chinese IT companies confront, in addition to ongoing pressure from COVID-19 outbreaks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Cloud Gaming Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Cloud Gaming Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Cloud Gaming Technology Market?

To stay informed about further developments, trends, and reports in the China Cloud Gaming Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence