Key Insights

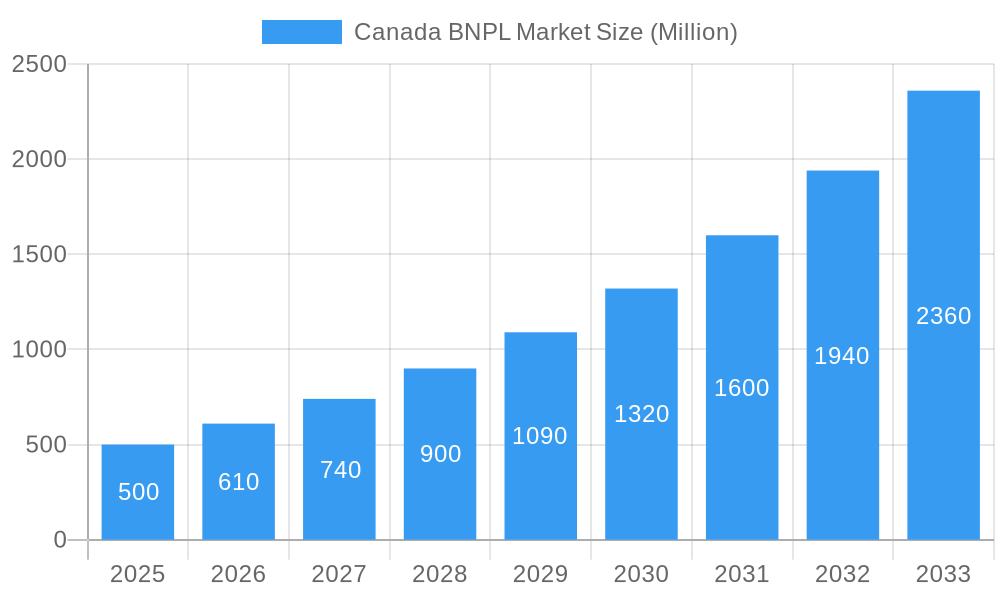

The Canadian Buy Now, Pay Later (BNPL) market is experiencing significant expansion, driven by the increasing adoption of e-commerce, a growing consumer preference for flexible payment solutions, and the broad integration of BNPL services across various sectors. With a projected Compound Annual Growth Rate (CAGR) of 12%, the market is estimated to reach $7.5 billion by 2033, building upon a base market size of $7.5 billion in 2025. Key growth catalysts include the rising popularity of online shopping, particularly among digitally-savvy demographics, the inherent convenience and accessibility of BNPL platforms, and expanding merchant acceptance across industries such as consumer electronics, fashion, financial services, and healthcare. Market segmentation indicates a strong preference for online channels, with significant contributions from enterprise-level adoption reflecting market maturity. However, potential regulatory scrutiny regarding consumer debt and the necessity for robust fraud prevention measures remain critical considerations for sustained growth and consumer trust.

Canada BNPL Market Market Size (In Billion)

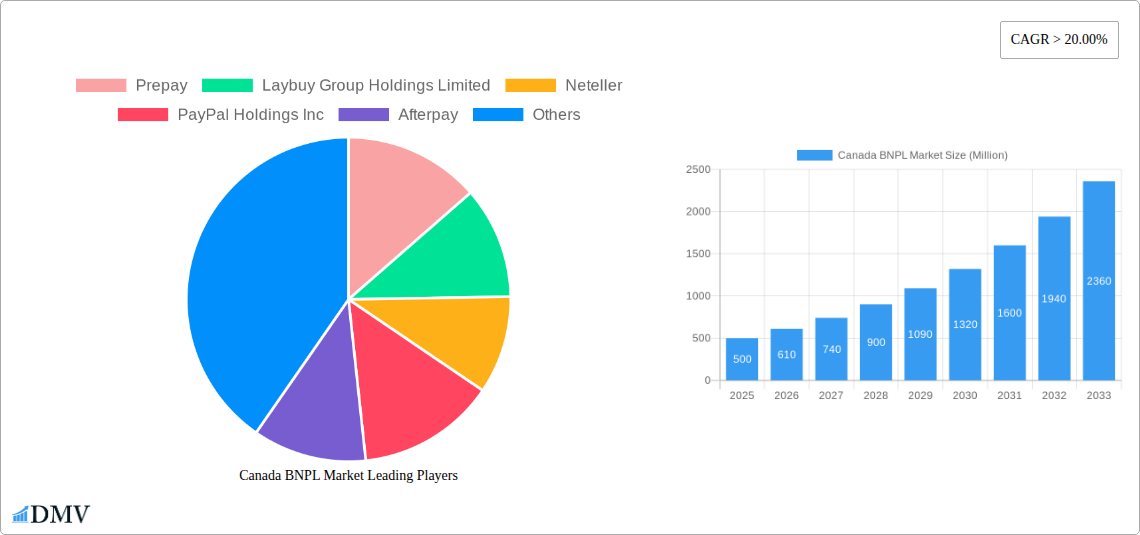

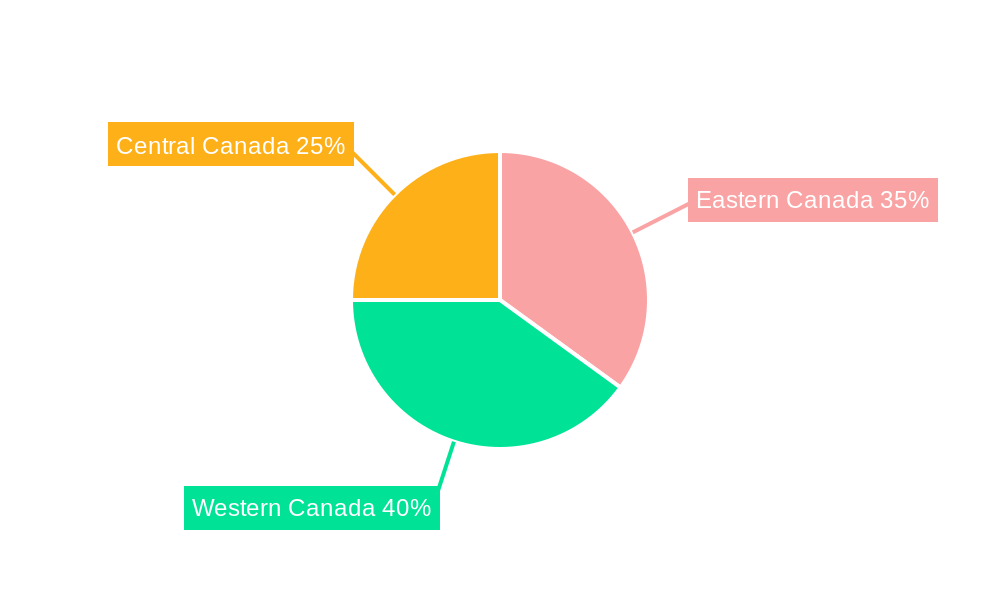

The competitive environment is dynamic, characterized by established global players such as PayPal, Affirm, and Klarna, alongside emerging regional providers. Strategic differentiation is achieved through specialization in niche market segments, such as solutions tailored for small and medium-sized enterprises (SMEs), and the incorporation of innovative features like personalized payment plans and advanced security protocols. Regional adoption patterns within Canada may show variations, with urban centers and areas boasting high internet penetration potentially exhibiting higher utilization rates. Future market trajectory will be influenced by effective marketing strategies targeting specific consumer segments with customized financial solutions and proactive adaptation to evolving regulatory frameworks. The forecast period, from 2025 to 2033, is expected to witness continued expansion fueled by technological advancements, enhanced user experiences, and increased merchant integration of BNPL solutions. Navigating both emerging opportunities and inherent challenges, including rigorous risk management and consumer protection, will be crucial for sustained market success.

Canada BNPL Market Company Market Share

Canada BNPL Market Analysis: Size, Trends, and Future Projections (2025-2033)

This comprehensive market analysis offers critical insights into the dynamic Canadian Buy Now, Pay Later (BNPL) market, providing valuable intelligence for stakeholders. Covering the period from 2025 to 2033, this report details market size, key players, growth drivers, and future opportunities. The Canadian BNPL market is projected to reach $7.5 billion by 2033, presenting substantial investment potential.

Canada BNPL Market Composition & Trends

The Canadian BNPL market exhibits a dynamic interplay of factors shaping its trajectory. Market concentration is currently moderate, with several key players vying for dominance. However, the landscape is ripe for further consolidation through mergers and acquisitions (M&A), as evidenced by recent deals totaling an estimated xx Million in value in the last three years. Innovation is a key catalyst, with companies constantly introducing new features and integrations to enhance user experience and expand market reach. Regulatory scrutiny is increasing, demanding greater transparency and consumer protection. Substitute products, such as traditional installment loans and credit cards, continue to exert competitive pressure. However, BNPL’s convenience and accessibility drive considerable appeal among specific end-user profiles – particularly millennials and Gen Z.

- Market Share Distribution (2024): PayPal Holdings Inc. (xx%), Afterpay (xx%), Klarna (xx%), Affirm (xx%), Others (xx%).

- M&A Activity (2021-2024): Three significant M&A deals valued at approximately xx Million collectively.

- Regulatory Landscape: Increasing focus on responsible lending practices and consumer protection.

- Substitute Products: Traditional installment loans and credit cards remain competitive alternatives.

Canada BNPL Market Industry Evolution

The Canadian BNPL market has witnessed exponential growth since 2019, driven by increased e-commerce adoption, evolving consumer preferences, and the proliferation of mobile payment technologies. From its initial focus on e-commerce, BNPL has expanded into physical point-of-sale (POS) systems, fueling its overall market penetration. The average annual growth rate (AAGR) from 2019 to 2024 was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). Technological advancements such as improved risk assessment algorithms and seamless integration with existing payment gateways have significantly improved efficiency and enhanced customer experience. A notable shift is the increasing adoption of BNPL by businesses across various sectors, including BFSI and healthcare. Consumer demand is primarily driven by the desire for flexible payment options, particularly among younger demographics.

Leading Regions, Countries, or Segments in Canada BNPL Market

The online channel dominates the Canadian BNPL market, accounting for xx% of total transactions in 2024. This is primarily driven by the ease of integration with e-commerce platforms and the widespread adoption of online shopping. The SME segment represents a significant growth opportunity, owing to the relatively lower barrier to entry for BNPL adoption compared to large enterprises. Consumer electronics and fashion & garment sectors demonstrate the highest adoption rates, fueled by consumer preferences for immediate gratification and flexible financing.

- Key Drivers for Online Channel Dominance: High e-commerce penetration, ease of integration with online platforms.

- Key Drivers for SME Segment Growth: Lower adoption barriers, increasing awareness of BNPL benefits.

- Key Drivers for Consumer Electronics & Fashion Adoption: High demand for flexible financing, consumer preference for immediate gratification.

Canada BNPL Market Product Innovations

Recent innovations in the Canadian BNPL market include the integration of advanced fraud detection technologies, personalized repayment plans, and the expansion of BNPL offerings to encompass diverse product categories. These advancements enhance the overall user experience and cater to a wider range of consumer needs. Furthermore, partnerships between BNPL providers and retailers are driving the development of co-branded loyalty programs.

Propelling Factors for Canada BNPL Market Growth

Several factors contribute to the market's robust growth. Technological advancements, such as improved risk assessment models and seamless integration with various platforms, enhance the efficiency and security of transactions. The increasing popularity of e-commerce, coupled with the shifting consumer preference for flexible payment solutions, significantly fuels demand. Supportive regulatory frameworks that encourage responsible lending also contribute to market expansion.

Obstacles in the Canada BNPL Market Market

Despite its growth potential, the market faces challenges, including increasing regulatory scrutiny around consumer protection and responsible lending practices. The potential for increased charge-off rates and the associated credit risk for BNPL providers remains a significant concern. Furthermore, intense competition among established and emerging players creates pressure on pricing and margins.

Future Opportunities in Canada BNPL Market

Future opportunities lie in expanding into underserved market segments, such as rural areas and lower-income demographics, through partnerships with fintech companies and banks. The integration of BNPL services into other financial products, such as loyalty programs and rewards systems, presents significant potential for growth. The adoption of innovative technologies like AI and machine learning for improved risk management and personalized customer experiences will also shape the future.

Key Developments in Canada BNPL Market Industry

- March 2022: Yapstone partners with Sezzle to offer BNPL options for vacation rentals.

- February 2022: Sezzle expands its BNPL service from e-commerce to physical businesses.

Strategic Canada BNPL Market Market Forecast

The Canadian BNPL market is poised for continued expansion, driven by technological innovation, evolving consumer preferences, and increasing merchant adoption. The projected growth trajectory points towards a significant market opportunity, with potential for further consolidation and diversification of offerings. This robust growth will be further fueled by strategic partnerships and the development of new financial products that integrate BNPL services.

Canada BNPL Market Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS

-

2. Enterprise Size

- 2.1. Large

- 2.2. SME

-

3. End Use

- 3.1. Consumer Electronics

- 3.2. Fashion & Garment

- 3.3. BFSI

- 3.4. HealthCare

- 3.5. Others

Canada BNPL Market Segmentation By Geography

- 1. Canada

Canada BNPL Market Regional Market Share

Geographic Coverage of Canada BNPL Market

Canada BNPL Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing IoT Applications and Adoption of Wearable Devices; Increasing Need for Advanced Marketing Tools

- 3.3. Market Restrains

- 3.3.1. Data Privacy Concerns and Data Regulation Adoption Across the World

- 3.4. Market Trends

- 3.4.1. People are Increasingly Using Online Payment Methods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada BNPL Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS

- 5.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.2.1. Large

- 5.2.2. SME

- 5.3. Market Analysis, Insights and Forecast - by End Use

- 5.3.1. Consumer Electronics

- 5.3.2. Fashion & Garment

- 5.3.3. BFSI

- 5.3.4. HealthCare

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Prepay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Laybuy Group Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neteller

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PayPal Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Afterpay

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZIP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Klarna

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Interac

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Affirm

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sezzle

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Prepay

List of Figures

- Figure 1: Canada BNPL Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada BNPL Market Share (%) by Company 2025

List of Tables

- Table 1: Canada BNPL Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: Canada BNPL Market Volume K Unit Forecast, by Channel 2020 & 2033

- Table 3: Canada BNPL Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 4: Canada BNPL Market Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 5: Canada BNPL Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 6: Canada BNPL Market Volume K Unit Forecast, by End Use 2020 & 2033

- Table 7: Canada BNPL Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Canada BNPL Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Canada BNPL Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 10: Canada BNPL Market Volume K Unit Forecast, by Channel 2020 & 2033

- Table 11: Canada BNPL Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 12: Canada BNPL Market Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 13: Canada BNPL Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 14: Canada BNPL Market Volume K Unit Forecast, by End Use 2020 & 2033

- Table 15: Canada BNPL Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Canada BNPL Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada BNPL Market?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Canada BNPL Market?

Key companies in the market include Prepay, Laybuy Group Holdings Limited, Neteller, PayPal Holdings Inc, Afterpay, ZIP, Klarna, Interac, Affirm, Sezzle.

3. What are the main segments of the Canada BNPL Market?

The market segments include Channel, Enterprise Size, End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing IoT Applications and Adoption of Wearable Devices; Increasing Need for Advanced Marketing Tools.

6. What are the notable trends driving market growth?

People are Increasingly Using Online Payment Methods.

7. Are there any restraints impacting market growth?

Data Privacy Concerns and Data Regulation Adoption Across the World.

8. Can you provide examples of recent developments in the market?

In March 2022, Yapstone has teamed with Sezzle to provide its network of vacation rental businesses with Sezzle's Buy Now, Pay Later (BNPL) payment option. Vacationers can pick from hundreds of rental homes served by Yapstone, including enterprise clients such as CiiRUS and Track, using Sezzle's long-term financing with 0% APR options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada BNPL Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada BNPL Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada BNPL Market?

To stay informed about further developments, trends, and reports in the Canada BNPL Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence