Key Insights

Brazil's Factory Automation and Industrial Control market is set for significant expansion. Projected to reach $310.46 billion by 2025, the market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.94% through 2033. This growth is propelled by the widespread adoption of advanced technologies, including Machine Vision, Robotics, and sophisticated Industrial Control Systems (SCADA, DCS). Key sectors like automotive, chemical, petrochemical, power, utilities, and pharmaceuticals are driving demand for enhanced efficiency, production quality, operational safety, and compliance. The increasing need for smart manufacturing solutions, such as IoT integration and data analytics, empowers manufacturers to achieve greater agility and competitiveness. Government initiatives promoting industrial modernization and digital transformation further support this favorable market ecosystem.

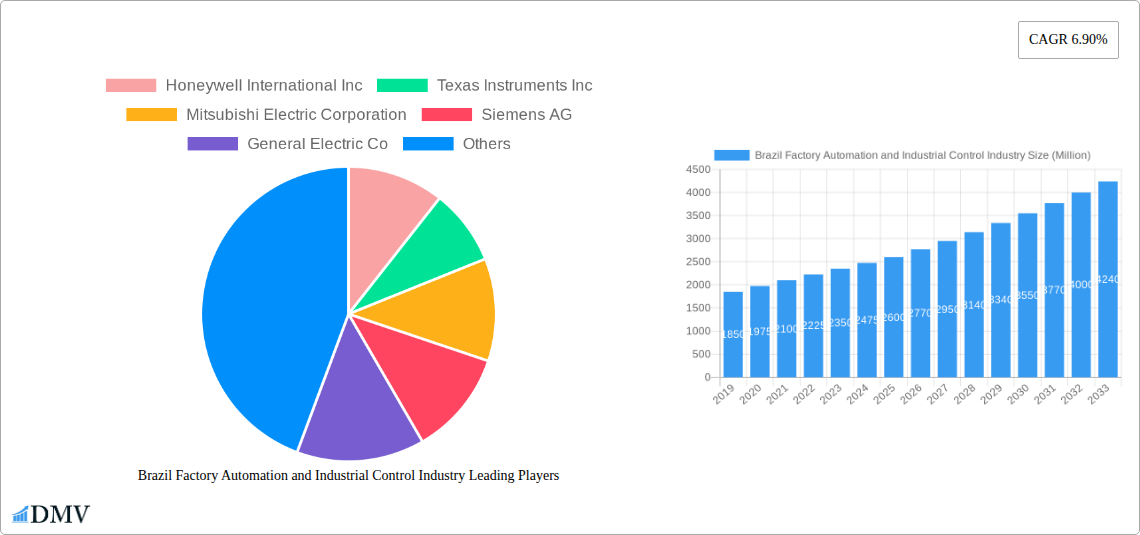

Brazil Factory Automation and Industrial Control Industry Market Size (In Billion)

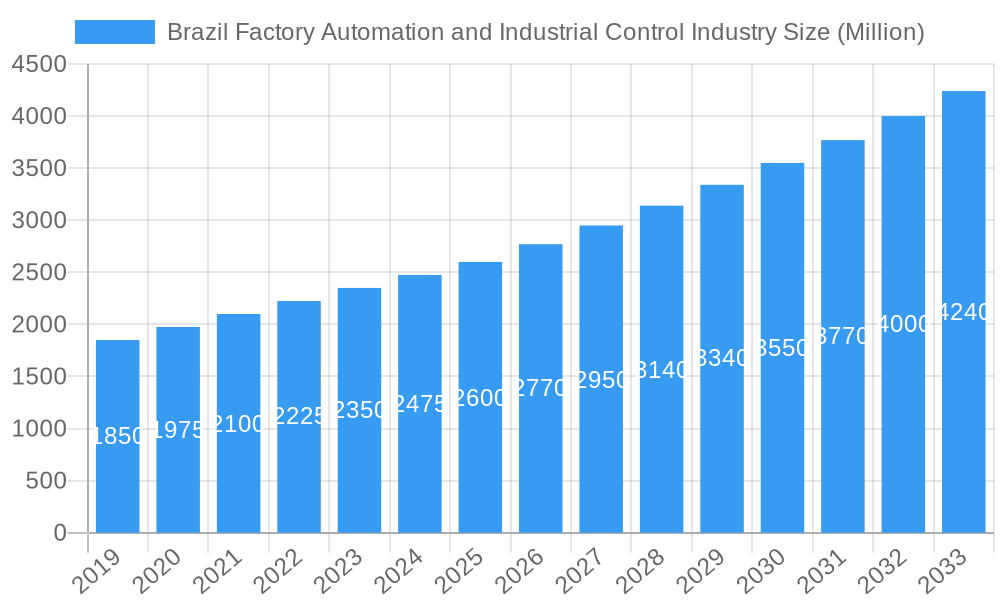

While the outlook is positive, the industry faces challenges including the high initial investment costs for advanced automation technologies, which can be a barrier for SMEs. Furthermore, a skilled workforce is essential for operating and maintaining complex systems, requiring substantial investment in training. However, the pervasive trends of Industry 4.0, emphasizing interconnectivity, real-time data, and intelligent automation, are creating strong momentum to overcome these obstacles. Leading companies such as Siemens AG, Honeywell International Inc., and Rockwell Automation Inc. are actively influencing the market with innovative solutions. The integration of Manufacturing Execution Systems (MES) and Product Lifecycle Management (PLM) systems with core control systems (PLCs, HMIs) is becoming standard practice for more efficient operations. The growing focus on energy efficiency and sustainable manufacturing practices also presents substantial opportunities for automation solutions that optimize resource utilization.

Brazil Factory Automation and Industrial Control Industry Company Market Share

Brazil Factory Automation and Industrial Control Industry Market Composition & Trends

The Brazil factory automation and industrial control market is a dynamic and rapidly evolving sector, projected to reach an estimated $XX Billion by 2033. This comprehensive report delves into the intricate market composition, analyzing key trends that are shaping its trajectory from 2019–2033. We examine market concentration, identifying leading players and their respective shares, alongside critical innovation catalysts driving technological advancements. Understanding the regulatory landscapes is paramount for navigating this market, and this report provides a clear overview. We also evaluate substitute products, assess the diverse end-user profiles, and scrutinize recent M&A activities, with M&A deal values estimated to reach $XXX Million. The market is characterized by a mix of global giants and emerging local players, contributing to a moderately concentrated yet highly competitive environment. Emerging technologies like Industrial IoT (IIoT) and artificial intelligence are becoming central to innovation, enabling greater efficiency and predictive capabilities across various industries.

- Market Share Distribution: Analysis of leading companies' market share.

- M&A Deal Values: Estimated value of mergers and acquisitions.

- Innovation Catalysts: Identification of key technological drivers.

- Regulatory Landscape: Overview of governmental policies and standards.

- Substitute Products Analysis: Assessment of alternative solutions and their impact.

- End-User Profiles: Detailed breakdown of industry-specific adoption patterns.

Brazil Factory Automation and Industrial Control Industry Industry Evolution

The evolution of the Brazil factory automation and industrial control industry is a compelling narrative of technological adoption, economic influence, and shifting industrial demands. Over the study period of 2019–2033, the market has witnessed substantial growth, with the base year of 2025 serving as a critical benchmark for current and future projections. The historical period (2019–2024) laid the foundation for this expansion, characterized by increasing investments in upgrading legacy systems and a growing awareness of the benefits of automation. Growth rates have consistently been robust, driven by the imperative for enhanced productivity, reduced operational costs, and improved product quality. The adoption of advanced technologies such as AI-powered robotics, machine vision systems for quality control, and sophisticated SCADA and DCS platforms has accelerated significantly. Consumer demand for more customized and higher-quality products has also spurred industries to invest in flexible and intelligent manufacturing solutions. The increasing integration of Industrial IoT (IIoT) has further revolutionized the sector, enabling real-time data collection, remote monitoring, and predictive maintenance, thereby optimizing operational efficiency and minimizing downtime. The Brazilian government's focus on industrial modernization and the attraction of foreign direct investment have played a crucial role in facilitating this evolutionary process. Furthermore, the industry's response to global trends, including sustainability and Industry 4.0 principles, has led to the development and implementation of greener and more interconnected manufacturing processes. The estimated market value is projected to climb steadily through the forecast period (2025–2033), fueled by ongoing digital transformation initiatives and the continued push for operational excellence across key manufacturing sectors. This sustained growth trajectory underscores the industry's resilience and its vital role in the Brazilian economy.

Leading Regions, Countries, or Segments in Brazil Factory Automation and Industrial Control Industry

The Brazilian factory automation and industrial control industry exhibits significant regional and segmental dominance, with specific sectors and product categories spearheading growth. São Paulo consistently emerges as the leading region due to its dense industrial concentration, housing a substantial number of automotive, chemical, and food and beverage manufacturers. This region benefits from robust infrastructure, access to skilled labor, and a strong presence of key industry players, fostering a fertile ground for the adoption of advanced automation and control systems.

Within the Product segment, Industrial Control Systems command a significant market share. This is primarily driven by the widespread adoption of PLCs (Programmable Logic Controllers) and SCADA (Supervisory Control and Data Acquisition) systems, essential for managing and monitoring complex industrial processes. The demand for DCS (Distributed Control Systems) is also on the rise, particularly in large-scale operations within the chemical, petrochemical, and power and utilities sectors. The Field Devices segment, particularly Robotics and Sensors, is experiencing rapid expansion, fueled by the need for increased precision, speed, and worker safety in manufacturing environments. Machine Vision is becoming indispensable for quality control and inspection across various industries.

The End-user Industry landscape is dominated by the Automotive sector, which is heavily investing in advanced robotics and automation for assembly lines to meet global competitiveness demands. The Chemical and Petrochemical industry is a strong contender, driven by the need for stringent process control and safety, making robust industrial control systems and specialized field devices crucial. The Power and Utilities sector is also a significant contributor, focusing on smart grid technologies and advanced control systems for efficient energy management and distribution. The Food and Beverage industry is increasingly adopting automation for enhanced hygiene, traceability, and production efficiency, while the Oil and Gas sector leverages automation for exploration, extraction, and refining processes, demanding highly reliable and robust control solutions.

- Key Drivers in Leading Segments:

- Automotive: Global demand for EVs, production efficiency, enhanced safety features.

- Chemical & Petrochemical: Strict safety regulations, need for precise process control, reduction of hazardous operations.

- Power & Utilities: Modernization of infrastructure, integration of renewable energy sources, demand for smart grids.

- Industrial Control Systems (PLC, SCADA, DCS): Growing need for integrated plant management, real-time data analytics, operational optimization.

- Field Devices (Robotics, Sensors, Machine Vision): Pursuit of higher productivity, improved quality control, addressing labor shortages, enhancing worker safety.

Brazil Factory Automation and Industrial Control Industry Product Innovations

Product innovations in the Brazil factory automation and industrial control industry are centered on enhancing connectivity, intelligence, and sustainability. The integration of AI and machine learning into robots and sensors is enabling predictive maintenance and adaptive manufacturing processes. Advanced vision systems are now capable of sophisticated defect detection and guidance for robotic operations. Furthermore, the development of more energy-efficient motors and drivers, coupled with intelligent relay and switch technologies, is contributing to reduced operational costs and environmental impact. The evolution of SCADA, DCS, and PLC systems is moving towards cloud-based platforms and edge computing, allowing for greater scalability, remote access, and real-time data analysis, thereby optimizing overall industrial control.

Propelling Factors for Brazil Factory Automation and Industrial Control Industry Growth

Several key factors are propelling the growth of the Brazil factory automation and industrial control industry. The ongoing push for Industry 4.0 and digital transformation is a primary driver, encouraging manufacturers to adopt advanced technologies for enhanced efficiency and competitiveness. Government initiatives aimed at modernizing the industrial sector and attracting foreign investment also play a significant role. The increasing demand for higher quality products and the need to reduce operational costs are compelling businesses to invest in automation. Furthermore, the growing adoption of robotics and AI in manufacturing is addressing labor shortages and improving worker safety.

Obstacles in the Brazil Factory Automation and Industrial Control Industry Market

Despite the promising growth, the Brazil factory automation and industrial control industry faces several obstacles. High initial investment costs for advanced automation solutions can be a significant barrier, especially for small and medium-sized enterprises (SMEs). The lack of skilled labor proficient in operating and maintaining sophisticated automation systems presents a challenge. Regulatory complexities and bureaucratic hurdles can also slow down the adoption process. Furthermore, economic instability and currency fluctuations can impact investment decisions. Supply chain disruptions, as seen in recent global events, can also affect the availability and cost of essential automation components.

Future Opportunities in Brazil Factory Automation and Industrial Control Industry

The future holds significant opportunities for the Brazil factory automation and industrial control industry. The growing demand for sustainable and eco-friendly manufacturing processes will drive the adoption of energy-efficient automation solutions. The expansion of e-commerce and the need for efficient logistics will boost automation in warehousing and distribution. The increasing focus on localized production and supply chain resilience presents a chance for domestic automation providers to expand their offerings. Emerging technologies like augmented reality (AR) and virtual reality (VR) for training and maintenance, alongside the continued growth of IIoT and edge computing, will open new avenues for innovation and market penetration.

Major Players in the Brazil Factory Automation and Industrial Control Industry Ecosystem

- Honeywell International Inc

- Texas Instruments Inc

- Mitsubishi Electric Corporation

- Siemens AG

- General Electric Co

- Schneider Electric SE

- NOVA SMAR SA

- Autodesk Inc

- Robert Bosch GmbH

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Dassault Systemes SE

- ABB Limited

- Aspen Technology Inc

- Emerson Electric Company

Key Developments in Brazil Factory Automation and Industrial Control Industry Industry

- June 2022: Rockwell Automation partnered with Bravo Motor Company, a California-based company that provides applied innovation in the field of decarbonization, with a focus on the production of batteries, vehicles, and energy storage systems. Through the new alliance, Rockwell Automation will contribute to the provision of advanced solutions for the manufacture of electric vehicles (EVs) and batteries in the Brazilian market.

Strategic Brazil Factory Automation and Industrial Control Industry Market Forecast

The strategic forecast for the Brazil factory automation and industrial control industry indicates sustained and robust growth, propelled by an unwavering commitment to technological advancement and operational excellence. The increasing adoption of Industry 4.0 principles, coupled with substantial government support for industrial modernization, will continue to be significant growth catalysts. The demand for smart manufacturing solutions, driven by sectors like automotive and chemicals, will fuel investments in PLCs, SCADA, robotics, and AI-integrated systems. Furthermore, the burgeoning focus on sustainability and energy efficiency presents a fertile ground for innovative, eco-friendly automation technologies. The market's resilience and adaptability to global trends, alongside emerging opportunities in sectors such as renewable energy and advanced logistics, position the Brazil factory automation and industrial control industry for a prosperous future with considerable market potential.

Brazil Factory Automation and Industrial Control Industry Segmentation

-

1. Product

-

1.1. Field Devices

- 1.1.1. Machine Vision

- 1.1.2. Robotics

- 1.1.3. Sensors

- 1.1.4. Mortor and Drivers

- 1.1.5. Relays and Switches

- 1.1.6. Other Field Devices

-

1.2. Industrial Control Systems

- 1.2.1. SCADA

- 1.2.2. DCS

- 1.2.3. PLC

- 1.2.4. MES

- 1.2.5. PLM

- 1.2.6. ERP

- 1.2.7. HMI

- 1.2.8. Other Industrial Control Systems

-

1.1. Field Devices

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Pharmaceutical

- 2.5. Food and Beverage

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Brazil Factory Automation and Industrial Control Industry Segmentation By Geography

- 1. Brazil

Brazil Factory Automation and Industrial Control Industry Regional Market Share

Geographic Coverage of Brazil Factory Automation and Industrial Control Industry

Brazil Factory Automation and Industrial Control Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Focus Toward Cost-cutting and Business Process Improvement; Increasing Adoption of Internet of Things (IoT) and Machine- to-Machine Technologies

- 3.3. Market Restrains

- 3.3.1. High Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation

- 3.4. Market Trends

- 3.4.1. Automotive is One of the Major Segment Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Factory Automation and Industrial Control Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Field Devices

- 5.1.1.1. Machine Vision

- 5.1.1.2. Robotics

- 5.1.1.3. Sensors

- 5.1.1.4. Mortor and Drivers

- 5.1.1.5. Relays and Switches

- 5.1.1.6. Other Field Devices

- 5.1.2. Industrial Control Systems

- 5.1.2.1. SCADA

- 5.1.2.2. DCS

- 5.1.2.3. PLC

- 5.1.2.4. MES

- 5.1.2.5. PLM

- 5.1.2.6. ERP

- 5.1.2.7. HMI

- 5.1.2.8. Other Industrial Control Systems

- 5.1.1. Field Devices

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Pharmaceutical

- 5.2.5. Food and Beverage

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Electric Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NOVA SMAR SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Autodesk Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rockwell Automation Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yokogawa Electric Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dassault Systemes SE

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ABB Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Aspen Technology Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Emerson Electric Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Brazil Factory Automation and Industrial Control Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Factory Automation and Industrial Control Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Factory Automation and Industrial Control Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Brazil Factory Automation and Industrial Control Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Brazil Factory Automation and Industrial Control Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Factory Automation and Industrial Control Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Brazil Factory Automation and Industrial Control Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Brazil Factory Automation and Industrial Control Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Factory Automation and Industrial Control Industry?

The projected CAGR is approximately 5.94%.

2. Which companies are prominent players in the Brazil Factory Automation and Industrial Control Industry?

Key companies in the market include Honeywell International Inc, Texas Instruments Inc, Mitsubishi Electric Corporation, Siemens AG, General Electric Co, Schneider Electric SE, NOVA SMAR SA*List Not Exhaustive, Autodesk Inc, Robert Bosch GmbH, Rockwell Automation Inc, Yokogawa Electric Corporation, Dassault Systemes SE, ABB Limited, Aspen Technology Inc, Emerson Electric Company.

3. What are the main segments of the Brazil Factory Automation and Industrial Control Industry?

The market segments include Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 310.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Focus Toward Cost-cutting and Business Process Improvement; Increasing Adoption of Internet of Things (IoT) and Machine- to-Machine Technologies.

6. What are the notable trends driving market growth?

Automotive is One of the Major Segment Driving the Market.

7. Are there any restraints impacting market growth?

High Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation.

8. Can you provide examples of recent developments in the market?

June 2022 - Rockwell Automation partnered with Bravo Motor Company, a California-based company that provides applied innovation in the field of decarbonization, with a focus on the production of batteries, vehicles, and energy storage systems. Through the new alliance, Rockwell Automation will contribute to the provision of advanced solutions for the manufacture of electric vehicles (EVs) and batteries in the Brazilian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Factory Automation and Industrial Control Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Factory Automation and Industrial Control Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Factory Automation and Industrial Control Industry?

To stay informed about further developments, trends, and reports in the Brazil Factory Automation and Industrial Control Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence