Key Insights

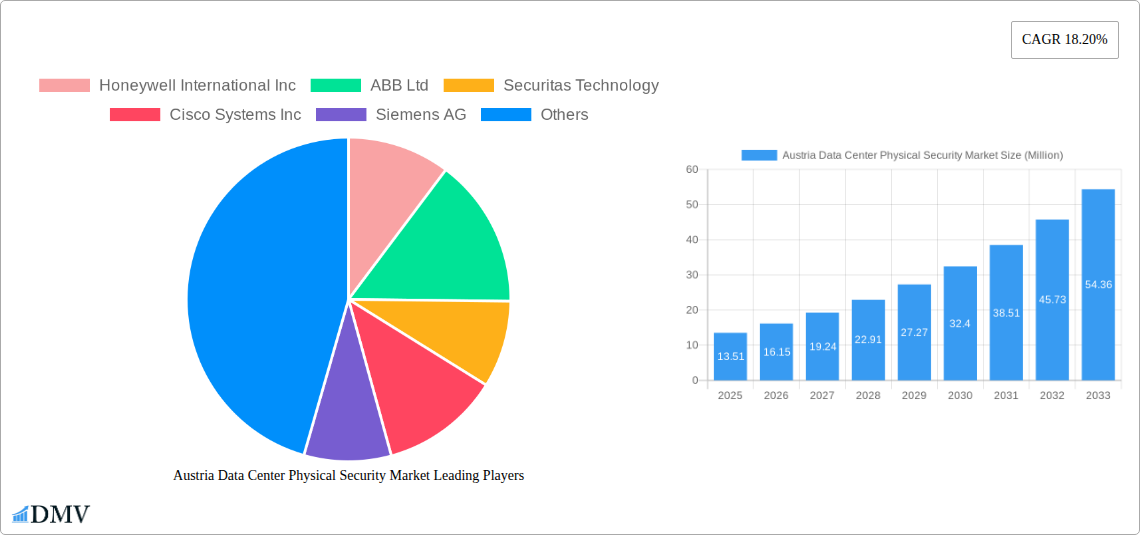

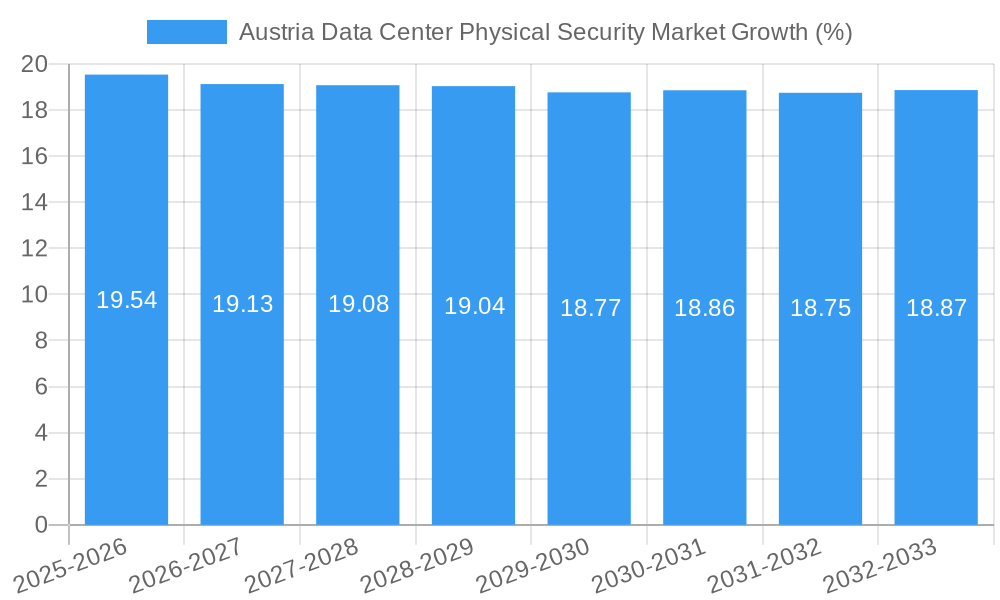

The Austria Data Center Physical Security Market is poised for substantial growth, projected to reach approximately USD 13.51 million with a robust Compound Annual Growth Rate (CAGR) of 18.20% during the forecast period of 2025-2033. This significant expansion is primarily driven by the escalating demand for advanced security solutions to safeguard critical digital infrastructure from evolving threats. The increasing adoption of cloud computing, the proliferation of IoT devices, and the growing volume of sensitive data being processed and stored are compelling data center operators to invest heavily in comprehensive physical security measures. Key segments contributing to this growth include sophisticated video surveillance systems and advanced access control solutions, which are becoming indispensable for maintaining operational integrity and compliance. Furthermore, the demand for specialized consulting and professional services, including system integration, to design and implement these complex security frameworks is also on the rise.

The dynamic market landscape is further shaped by emerging trends such as the integration of AI and machine learning into surveillance and access control for proactive threat detection and enhanced operational efficiency. Cybersecurity concerns, coupled with stringent regulatory compliance requirements across sectors like BFSI and government, are compelling organizations to prioritize robust physical security measures to complement their digital defenses. While the market is experiencing impressive growth, potential restraints include the high initial investment costs associated with cutting-edge security technologies and the ongoing need for skilled personnel to manage and maintain these systems. However, the strategic importance of data centers as the backbone of digital economies, coupled with continuous technological advancements and a growing awareness of security vulnerabilities, is expected to propel the Austria Data Center Physical Security Market to new heights, fostering innovation and driving demand across various end-user industries.

Here's an SEO-optimized and insightful report description for the Austria Data Center Physical Security Market, designed for immediate use:

Austria Data Center Physical Security Market Market Composition & Trends

The Austria Data Center Physical Security Market is characterized by a dynamic competitive landscape, with key players like Honeywell International Inc, ABB Ltd, Securitas Technology, Cisco Systems Inc, Siemens AG, Johnson Controls, Schneider Electric, Bosch Sicherheitssysteme GmbH, Axis Communications AB, AMAG Technology Inc, Dahua Technology Co Ltd, and ASSA ABLOY actively shaping its trajectory. Market concentration is moderate, driven by continuous innovation in video surveillance, access control solutions, and integrated security systems. Regulatory frameworks, particularly concerning data privacy and critical infrastructure protection, play a pivotal role in dictating security investments and compliance. The increasing reliance on cloud services and the growing volume of sensitive data processed within data centers necessitate robust physical security measures, diminishing the threat of substitute products. End-user profiles are diverse, spanning the IT & Telecommunication sector, BFSI, Government, and Healthcare, each with unique security imperatives. Mergers and acquisitions are strategically employed to enhance market share and expand technological capabilities, with recent M&A deal values estimated to be in the hundreds of millions. The market's innovation catalysts include the integration of AI and machine learning for enhanced threat detection, the development of biometric access controls, and the implementation of advanced perimeter security systems.

- Market Share Distribution: While precise figures fluctuate, leading players hold significant cumulative market share, with a gradual increase in smaller, specialized providers gaining traction.

- M&A Activities: Strategic acquisitions focusing on complementary technologies, such as AI-powered analytics and advanced cybersecurity integration, are prevalent, with estimated deal values reaching up to $500 Million in recent years.

- Innovation Catalysts: AI/ML integration, advanced video analytics, biometric authentication, and smart building management system integration.

- Regulatory Landscape: GDPR compliance, national security directives for critical infrastructure, and evolving data protection laws.

Austria Data Center Physical Security Market Industry Evolution

The evolution of the Austria Data Center Physical Security Market has been marked by a significant upward trajectory, driven by escalating data volumes and the critical need to protect highly sensitive information. From 2019 to 2024, the historical period witnessed steady growth, fueled by increased digitalization across all sectors. The base year, 2025, positions the market at a substantial valuation, projected to be around $750 Million, with an estimated growth rate of approximately 8.5%. This growth is intrinsically linked to the burgeoning demand for robust physical security solutions to safeguard data centers against unauthorized access, environmental threats, and operational disruptions. Technological advancements have been a primary engine of this evolution. The transition from traditional CCTV systems to intelligent IP-based video surveillance solutions offering advanced analytics, object recognition, and anomaly detection has been a key feature. Similarly, access control solutions have moved beyond simple keycard systems to incorporate multi-factor authentication, including biometrics, to enhance security layers. The "Others" category, encompassing System Integration Services, has also seen considerable expansion as organizations seek holistic security management platforms.

The adoption of Professional Services, including installation, maintenance, and managed security services, is projected to grow at a CAGR of 9.0% during the forecast period of 2025–2033. Consulting Services are also gaining prominence, as businesses require expert guidance in designing and implementing comprehensive physical security strategies tailored to their specific data center environments. The IT & Telecommunication sector remains a dominant end-user, investing heavily in securing their extensive network infrastructure. However, significant growth is also observed in the BFSI sector, driven by stringent regulatory requirements and the need to protect financial data, and the Government sector, for national security and public service continuity. The Healthcare industry's increasing reliance on digital health records and the growing threat landscape are also spurring greater investment in data center physical security. Shifting consumer demands for data privacy and security have translated into increased pressure on businesses to fortify their data center operations, thus accelerating the adoption of cutting-edge physical security technologies. Projections for 2033 indicate a market size potentially reaching over $1.5 Billion, demonstrating a sustained and robust growth phase. The study period of 2019–2033 encompasses this comprehensive evolution, providing a deep dive into the market's transformative journey.

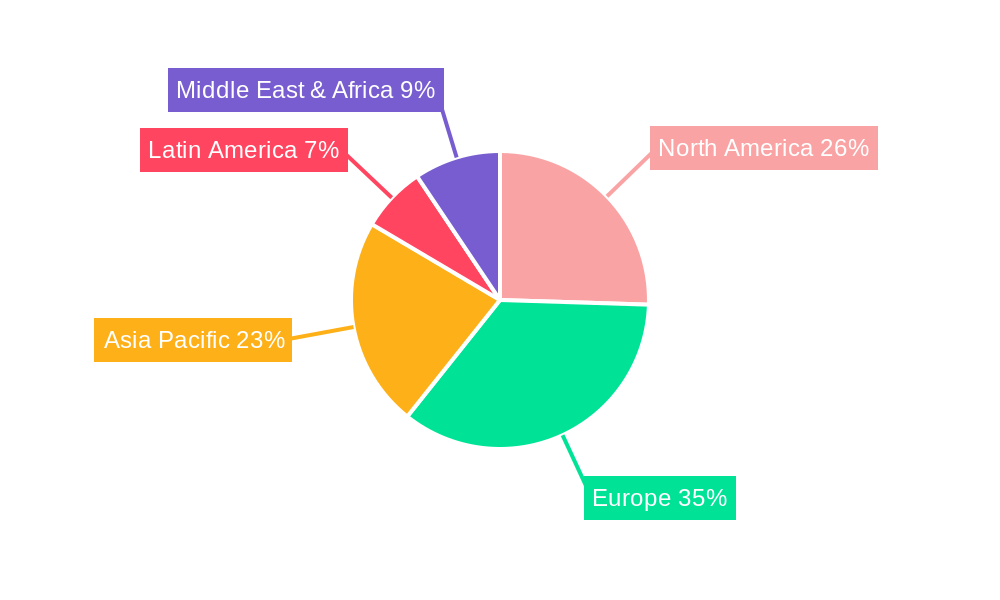

Leading Regions, Countries, or Segments in Austria Data Center Physical Security Market

Within the Austria Data Center Physical Security Market, a dominant position is held by Video Surveillance solutions. This segment is propelled by continuous technological innovation, including high-definition cameras, AI-powered analytics for threat detection and facial recognition, and advanced thermal imaging capabilities, all crucial for real-time monitoring and incident response within data centers. The IT & Telecommunication end-user segment is the primary driver of this dominance, owing to the sheer volume of data centers and the critical nature of the information they house. The BFSI sector also contributes significantly, driven by stringent regulatory compliance and the imperative to protect sensitive financial transactions and customer data.

- Dominant Segment: Video Surveillance Solutions.

- Key Drivers: Advanced analytics (AI/ML-based), high-resolution imaging, remote monitoring capabilities, integration with other security systems.

- End-User Influence: IT & Telecommunication and BFSI sectors are the largest adopters, demanding comprehensive visual oversight and real-time threat identification.

- Investment Trends: Significant investment in intelligent video analytics and scalable surveillance infrastructure.

- Regulatory Support: Compliance with data retention policies and video evidence requirements.

Access Control Solutions represent another vital segment, evolving rapidly to incorporate sophisticated multi-factor authentication methods. This includes advanced biometric readers (fingerprint, iris, facial recognition), smart card technology, and secure physical barriers. The Government and Healthcare sectors are particularly strong proponents of these solutions due to the highly sensitive nature of the data they manage and the need for strict access protocols to prevent breaches. The increasing adoption of converged security platforms, where video surveillance and access control are integrated into a single management system, further enhances the appeal and effectiveness of these solutions.

- Key Segment: Access Control Solutions.

- Key Drivers: Biometric authentication, multi-factor access, intelligent credential management, integration with visitor management systems.

- End-User Influence: Government and Healthcare sectors lead in adopting stringent access controls for classified and patient data protection.

- Investment Trends: Focus on secure, scalable, and integrated access management systems.

- Regulatory Support: Adherence to access control policies for sensitive data environments.

The "Others" category, primarily System Integration Services, plays a crucial role in unifying disparate security systems and providing end-to-end physical security management. This segment is essential for ensuring interoperability between video surveillance, access control, intrusion detection, and building management systems, offering a holistic security posture. Professional Services, including consulting, installation, and ongoing maintenance, are integral to the successful deployment and operation of these complex systems, with a projected growth rate of 9.0% during the forecast period. The continuous expansion of data center infrastructure across Austria, coupled with evolving threat landscapes, ensures sustained demand across all these segments.

Austria Data Center Physical Security Market Product Innovations

Product innovations in the Austria Data Center Physical Security Market are rapidly transforming how data centers are secured. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into video surveillance systems, enabling predictive analytics and anomaly detection, stands out. Advanced access control solutions now incorporate cutting-edge biometric technologies like facial recognition and iris scanning for enhanced authentication accuracy and speed, with performance metrics showing a significant reduction in false positives. Furthermore, the development of intelligent perimeter intrusion detection systems that can differentiate between genuine threats and environmental factors is improving the reliability of security perimeters. Unique selling propositions for these innovations lie in their ability to provide proactive threat mitigation, reduce manual oversight, and ensure seamless integration with existing security infrastructure, thereby offering unparalleled operational efficiency and security assurance.

Propelling Factors for Austria Data Center Physical Security Market Growth

The Austria Data Center Physical Security Market is propelled by several key factors. The relentless growth of data creation and storage demands, fueled by digital transformation initiatives across industries, necessitates more robust data center infrastructure and, consequently, enhanced physical security. Increasing cybersecurity threats and the rising awareness of the potential financial and reputational damage from data breaches compel organizations to prioritize physical security as a foundational element of their overall security strategy. Stringent government regulations and compliance mandates concerning data protection and critical infrastructure security further drive investment in advanced physical security solutions. Technological advancements, such as AI-powered video analytics and advanced access control systems, offer more effective and efficient security measures. Finally, the expanding cloud computing sector and the establishment of new hyperscale data centers create substantial opportunities for physical security providers.

Obstacles in the Austria Data Center Physical Security Market Market

Despite robust growth, the Austria Data Center Physical Security Market faces several obstacles. High initial investment costs for advanced physical security systems can be a deterrent for smaller data center operators. The complexity of integrating new security technologies with legacy systems often requires significant technical expertise and resources. Rapid technological advancements can lead to concerns about obsolescence, prompting organizations to delay investments until technologies mature. Furthermore, a shortage of skilled security professionals capable of designing, implementing, and managing sophisticated physical security systems poses a significant challenge. Supply chain disruptions, particularly for specialized hardware components, can also impact deployment timelines and costs. Competitive pressures among numerous vendors can lead to price erosion, affecting profitability margins for some market players.

Future Opportunities in Austria Data Center Physical Security Market

The future of the Austria Data Center Physical Security Market is ripe with opportunities. The increasing adoption of AI and machine learning for predictive security analytics presents a significant avenue for innovation and market growth. The rise of edge computing and distributed data centers will necessitate tailored physical security solutions for these smaller, more dispersed facilities. Growing demand for integrated security solutions that combine physical and cybersecurity measures offers a substantial opportunity for vendors who can provide comprehensive protection. The expansion of green data centers and smart building technologies also presents opportunities to integrate physical security systems with energy management and sustainability initiatives. Furthermore, the continued growth of the IoT ecosystem will drive the need for secure physical infrastructure to support these connected devices.

Major Players in the Austria Data Center Physical Security Market Ecosystem

- Honeywell International Inc

- ABB Ltd

- Securitas Technology

- Cisco Systems Inc

- Siemens AG

- Johnson Controls

- Schneider Electric

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- AMAG Technology Inc

- Dahua Technology Co Ltd

- ASSA ABLOY

Key Developments in Austria Data Center Physical Security Market Industry

- 2023 October: Siemens AG announced the launch of its new AI-powered video analytics platform for enhanced threat detection in critical infrastructure.

- 2023 September: Johnson Controls acquired a leading provider of access control solutions, strengthening its integrated security offerings.

- 2023 July: Honeywell International Inc introduced a new generation of intelligent perimeter intrusion detection systems with improved accuracy.

- 2023 March: ABB Ltd expanded its portfolio of smart building solutions with advanced physical security integration for data centers.

- 2022 December: Securitas Technology partnered with a major cloud provider to offer enhanced physical security services for cloud data centers.

Strategic Austria Data Center Physical Security Market Market Forecast

The strategic forecast for the Austria Data Center Physical Security Market anticipates sustained robust growth driven by escalating data volumes and the imperative for enhanced data protection. Key growth catalysts include the widespread adoption of AI and machine learning in video surveillance and access control, leading to more proactive threat detection and efficient operations. The ongoing digital transformation across sectors, coupled with stringent regulatory frameworks, will continue to fuel investment in advanced physical security infrastructure. Emerging opportunities lie in the integration of physical and cybersecurity measures, the development of tailored solutions for edge computing environments, and the incorporation of sustainable technologies. The market's potential is projected to reach significant figures by 2033, underscoring its strategic importance in safeguarding Austria's digital future.

Austria Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Austria Data Center Physical Security Market Segmentation By Geography

- 1. Austria

Austria Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Physical Security Infrastructure.

- 3.4. Market Trends

- 3.4.1. Video Surveillance is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Securitas Technology

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Controls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch Sicherheitssysteme GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axis Communications AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AMAG Technology Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ASSA ABLOY

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Austria Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: Austria Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: Austria Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Austria Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Austria Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Austria Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Austria Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 8: Austria Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 9: Austria Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Austria Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Data Center Physical Security Market?

The projected CAGR is approximately 18.20%.

2. Which companies are prominent players in the Austria Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Securitas Technology, Cisco Systems Inc, Siemens AG, Johnson Controls, Schneider Electric, Bosch Sicherheitssysteme GmbH, Axis Communications AB, AMAG Technology Inc, Dahua Technology Co Ltd, ASSA ABLOY.

3. What are the main segments of the Austria Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth.

6. What are the notable trends driving market growth?

Video Surveillance is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

The High Costs Associated with Physical Security Infrastructure..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Austria Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence