Key Insights

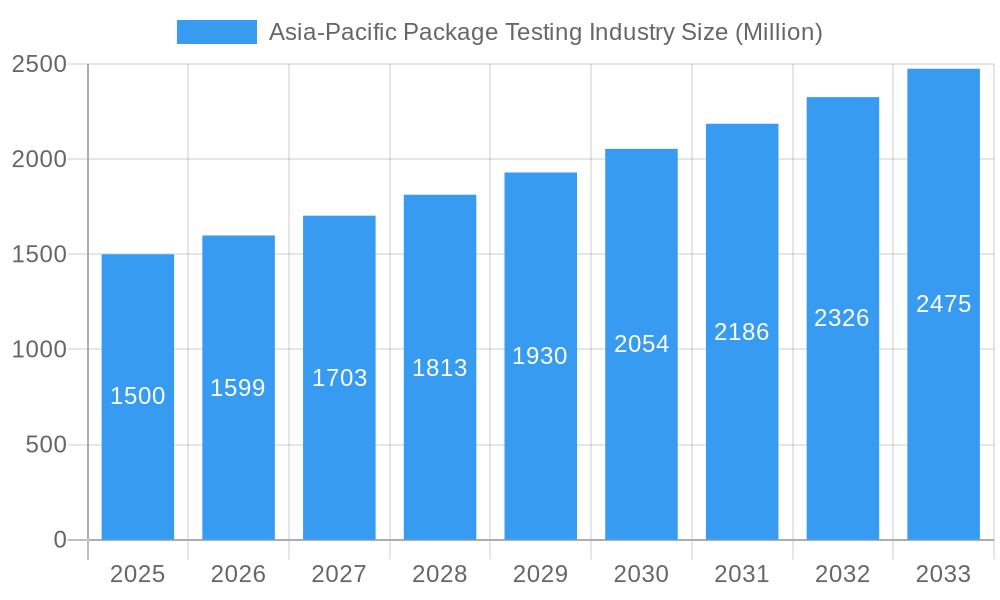

The Asia-Pacific package testing market is poised for significant expansion, projected to reach $21.58 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.25% from the base year 2025. This growth is attributed to the rapid expansion of e-commerce, demanding robust testing for transit integrity and product safety. Increasing consumer demand for sustainable packaging and stringent environmental regulations further drive investment in compliance-focused testing solutions. Key sectors like food & beverage, healthcare, and industrial manufacturing are also contributing to market growth, prioritizing product preservation and safety through advanced packaging. China, Japan, India, and South Korea are leading markets due to their strong manufacturing capabilities and consumer bases.

Asia-Pacific Package Testing Industry Market Size (In Billion)

Market challenges include the high cost of advanced testing equipment and specialized personnel, which may limit adoption by smaller enterprises. The absence of uniform regional testing standards can also impact quality control consistency and international trade. Nevertheless, the Asia-Pacific package testing market demonstrates a positive long-term outlook, supported by ongoing technological advancements in testing methodologies and a growing need for secure and sustainable packaging. Market segmentation by material (glass, paper, plastic, metal), testing type (physical performance, chemical, environmental), and end-user industry offers critical insights for strategic stakeholder engagement and targeted growth initiatives.

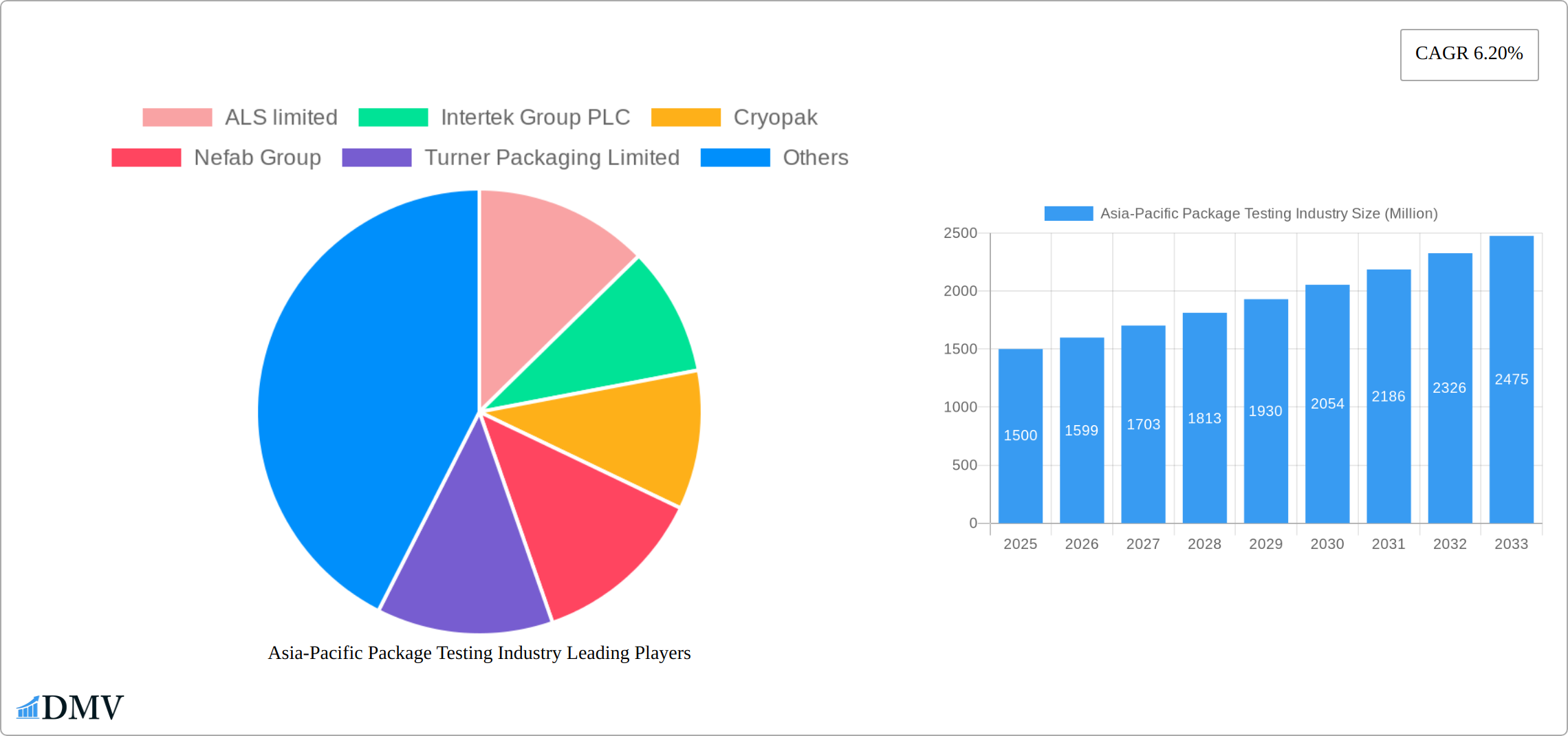

Asia-Pacific Package Testing Industry Company Market Share

Asia-Pacific Package Testing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific package testing industry, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report covers the period 2019-2033, with a focus on 2025 as the base and estimated year. This crucial analysis projects a market valued at xx Million in 2025, poised for significant expansion during the forecast period (2025-2033).

Asia-Pacific Package Testing Industry Market Composition & Trends

The Asia-Pacific package testing market is experiencing dynamic growth, shaped by a complex interplay of competitive forces, technological advancements, and evolving regulatory landscapes. The market demonstrates a moderately concentrated structure, with several key players holding substantial market share. While precise figures require confidential data, the combined share of the top five companies (including ALS Limited, Intertek Group PLC, and SGS SA) is estimated to be significant. This competitive landscape is further influenced by ongoing mergers and acquisitions (M&A) activity, although the frequency and value of deals have fluctuated in recent years.

Innovation is a key driver, with advancements in materials science and automation leading to more efficient and accurate testing methodologies. The industry is also responding to increasingly stringent regulations regarding product safety, environmental sustainability, and the use of eco-friendly packaging materials. This shift towards sustainable packaging is creating significant opportunities for specialized testing services. The adoption of digital technologies, such as cloud-based data management systems and AI-powered analytics, further enhances efficiency and data interpretation.

- Market Share Distribution (Estimated): ALS Limited (xx%), Intertek Group PLC (xx%), SGS SA (xx%), Other (xx%) *(Note: Exact figures are commercially sensitive)*

- M&A Activity (2019-2024): Characterized by fluctuating deal values, reflecting market dynamics and strategic priorities.

- Key End-User Industries: Food & Beverage, Healthcare, E-commerce, Industrial Goods, Personal & Household Products, Cosmetics.

Asia-Pacific Package Testing Industry Industry Evolution

The Asia-Pacific package testing industry has witnessed robust growth throughout the historical period (2019-2024), driven by factors including rising consumer demand for high-quality products, escalating e-commerce adoption, and stringent regulatory compliance needs. The compound annual growth rate (CAGR) during this period is estimated at xx%. Technological advancements, such as automation and advanced analytical techniques, have further propelled the industry's progress. The increasing adoption of sophisticated testing equipment and software solutions has enhanced efficiency and accuracy. Moreover, changing consumer preferences towards sustainable and eco-friendly packaging have created new opportunities for specialized testing services. The forecast period (2025-2033) is expected to see continued growth, driven by an expanding middle class, increasing urbanization, and growing industrial output. We project a CAGR of xx% for the forecast period.

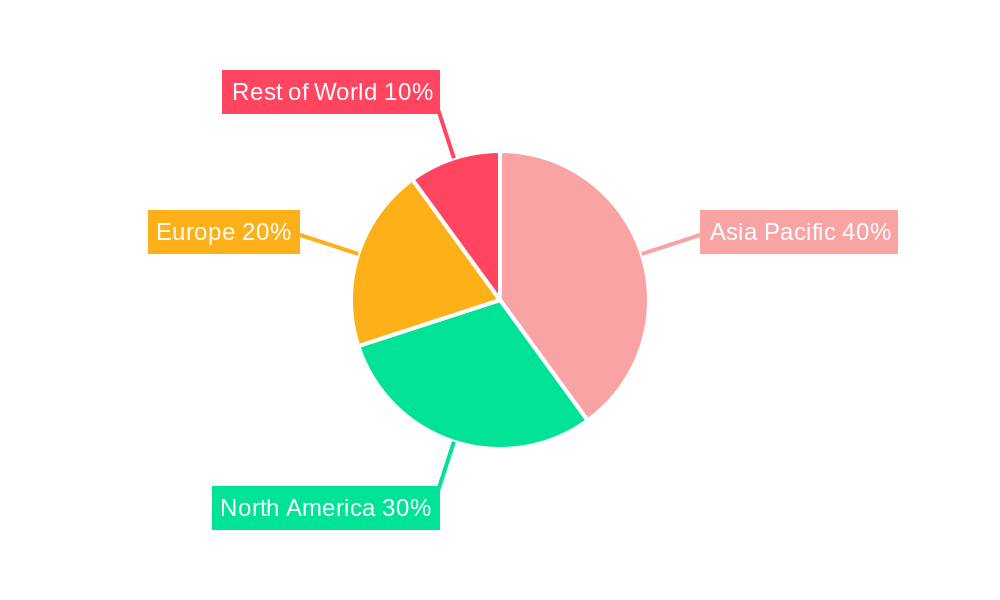

Leading Regions, Countries, or Segments in Asia-Pacific Package Testing Industry

Within the Asia-Pacific region, China and India are currently the leading markets for package testing, driven by their robust manufacturing sectors, expansive populations, and increasing consumer demand for high-quality products. However, other nations within Southeast Asia are showing significant potential for growth. The plastic packaging segment represents a major portion of the market due to the widespread use of plastic in various applications. Physical performance testing remains a crucial service, reflecting the essential need for ensuring product durability and safety. Other important segments include chemical testing, microbiological testing and barrier property testing.

Key Drivers: Significant Investments in manufacturing and infrastructure, Stringent government regulations regarding product safety and environmental impact, Robust growth in e-commerce and related logistics, and rising consumer awareness of product quality and safety, increasing demand for sustainable packaging.

Dominance Factors: Large and growing manufacturing sectors, high population density, rapid economic expansion in key regions, and favorable government policies supporting industrial growth and sustainable practices.

Asia-Pacific Package Testing Industry Product Innovations

The Asia-Pacific package testing industry is witnessing a wave of innovation, driven by the need for increased efficiency, accuracy, and sustainability. Automated testing systems are becoming increasingly prevalent, streamlining processes and reducing human error. Advanced analytical techniques, including spectroscopy and chromatography, provide deeper insights into material properties, enabling better risk assessment and quality control. The integration of digital technologies, such as cloud-based platforms and AI-powered data analytics, is transforming data management and analysis, fostering greater collaboration among stakeholders. This continuous innovation leads to faster turnaround times, improved accuracy, and enhanced data-driven decision-making for clients.

Propelling Factors for Asia-Pacific Package Testing Industry Growth

The growth of the Asia-Pacific package testing industry is primarily propelled by several key factors. Firstly, the burgeoning e-commerce sector demands rigorous testing to ensure product integrity and safety during transit. Secondly, increasing government regulations on product safety and environmental impact drive the need for compliance testing. Finally, technological advancements in testing methodologies and equipment are enhancing efficiency and accuracy.

Obstacles in the Asia-Pacific Package Testing Industry Market

The industry faces challenges such as intense competition among testing service providers, the complexity and cost of regulatory compliance, and potential supply chain disruptions. The impact of these factors is estimated to reduce the market's overall growth by approximately xx% during the forecast period.

Future Opportunities in Asia-Pacific Package Testing Industry

The future of the Asia-Pacific package testing industry is bright, with substantial growth potential across various segments. Specialized testing services focusing on sustainable packaging materials and food safety are experiencing particularly strong demand. Expansion into high-growth markets within Southeast Asia presents significant opportunities for market players. The continued adoption of advanced testing technologies and automation will drive further efficiency gains and market expansion. The increasing focus on e-commerce logistics will also fuel demand for specialized testing services in this area.

Major Players in the Asia-Pacific Package Testing Industry Ecosystem

- ALS Limited

- Intertek Group PLC

- Cryopak

- Nefab Group

- Turner Packaging Limited

- National Technical Systems

- SGS SA

- DDL Inc

- Advance Packaging

- CSZ Testing Services Laboratories

Key Developments in Asia-Pacific Package Testing Industry Industry

- May 2022: Intertek's contract extension for the Bulk and Break Bulk Cargo Clearance Enhancement Program in the Philippines highlights the increasing demand for quality assurance services in international trade.

- January 2023: SGS's expansion of fiber fragmentation testing services to new geographies demonstrates the growing focus on sustainability and environmental impact in the packaging industry.

Strategic Asia-Pacific Package Testing Industry Market Forecast

The Asia-Pacific package testing market is expected to experience continued growth over the forecast period (2025-2033), driven by factors like increasing e-commerce penetration, stricter regulations, and technological innovations. The market will likely see increased consolidation as larger players acquire smaller firms. The focus on sustainable packaging will fuel demand for specialized testing services, leading to niche market growth and overall market expansion.

Asia-Pacific Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Rest of Asia-Pacific

Asia-Pacific Package Testing Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Package Testing Industry Regional Market Share

Geographic Coverage of Asia-Pacific Package Testing Industry

Asia-Pacific Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is Expected to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. China Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 6.1.1. Glass

- 6.1.2. Paper

- 6.1.3. Plastic

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Type of Testing

- 6.2.1. Physical Performance Testing

- 6.2.2. Chemical Testing

- 6.2.3. Environmental Testing

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Healthcare

- 6.3.3. Industrial

- 6.3.4. Personal and Household Products

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 7. India Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 7.1.1. Glass

- 7.1.2. Paper

- 7.1.3. Plastic

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Type of Testing

- 7.2.1. Physical Performance Testing

- 7.2.2. Chemical Testing

- 7.2.3. Environmental Testing

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Healthcare

- 7.3.3. Industrial

- 7.3.4. Personal and Household Products

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 8. Japan Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 8.1.1. Glass

- 8.1.2. Paper

- 8.1.3. Plastic

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Type of Testing

- 8.2.1. Physical Performance Testing

- 8.2.2. Chemical Testing

- 8.2.3. Environmental Testing

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Healthcare

- 8.3.3. Industrial

- 8.3.4. Personal and Household Products

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 9. Rest of Asia Pacific Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 9.1.1. Glass

- 9.1.2. Paper

- 9.1.3. Plastic

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Type of Testing

- 9.2.1. Physical Performance Testing

- 9.2.2. Chemical Testing

- 9.2.3. Environmental Testing

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Healthcare

- 9.3.3. Industrial

- 9.3.4. Personal and Household Products

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ALS limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Intertek Group PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cryopak

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nefab Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Turner Packaging Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 National Technical Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SGS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DDL Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Advance Packaging

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CSZ Testing Services Laboratories

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ALS limited

List of Figures

- Figure 1: Asia-Pacific Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 7: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 8: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 12: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 13: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 17: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 18: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 22: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 23: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Package Testing Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the Asia-Pacific Package Testing Industry?

Key companies in the market include ALS limited, Intertek Group PLC, Cryopak, Nefab Group, Turner Packaging Limited, National Technical Systems, SGS SA, DDL Inc, Advance Packaging, CSZ Testing Services Laboratories.

3. What are the main segments of the Asia-Pacific Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Plastic Packaging is Expected to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

January 2023 - A further five laboratories, located in Bangladesh, India, Turkey, the United States, and Vietnam, have been approved by The Microfibre Consortium (TMC), extending the scope of SGS's fiber fragmentation testing services to new geographies and industries. When TMC initially approved SGS's labs in Hong Kong, Shanghai, and Taipei City in 2021, SGS became the organization's first third-party laboratory. SGS offers practical solutions for the textile industry to reduce fiber fragmentation and its release into the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Package Testing Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence