Key Insights

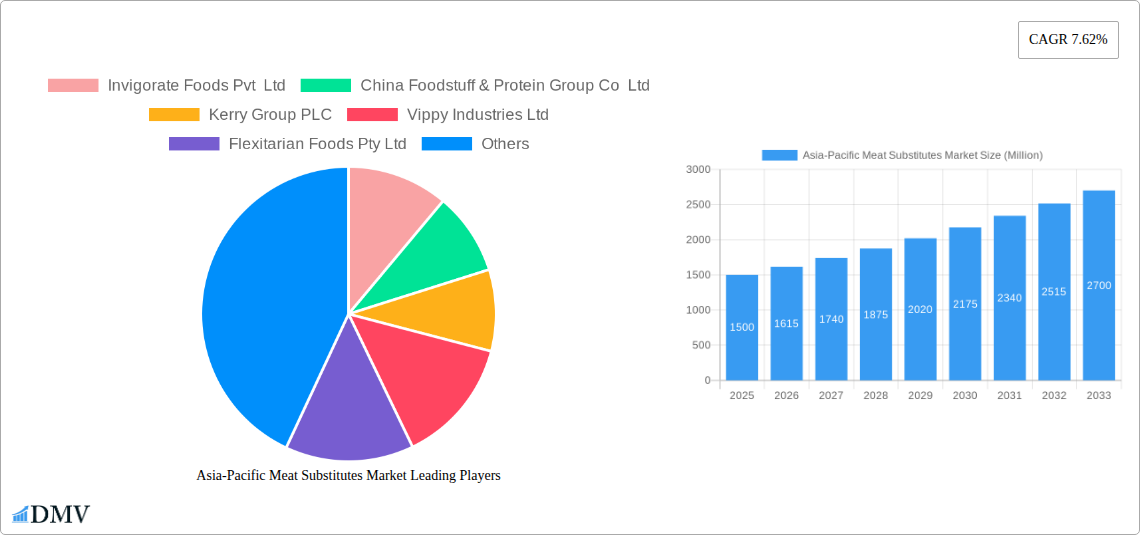

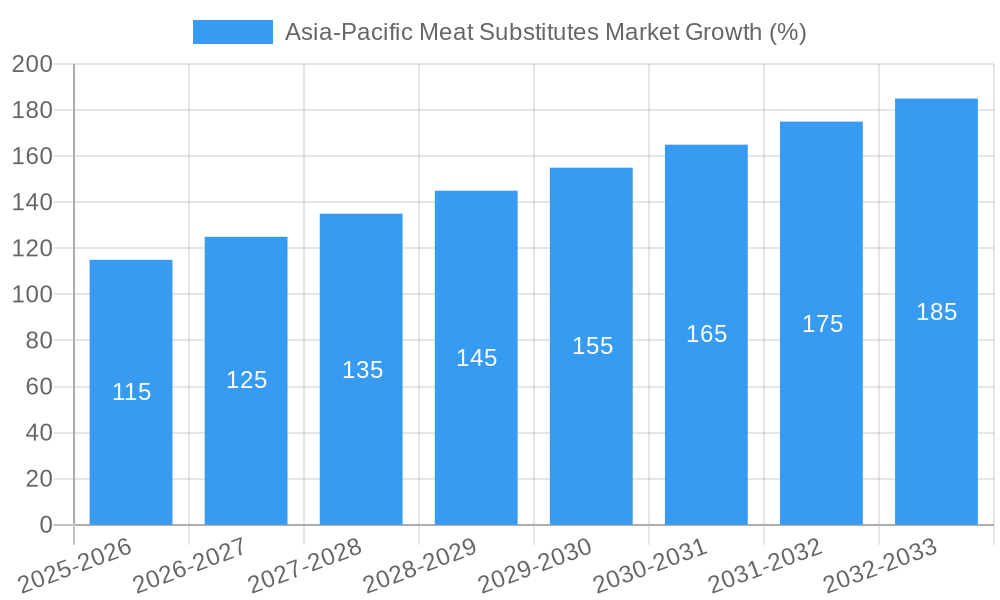

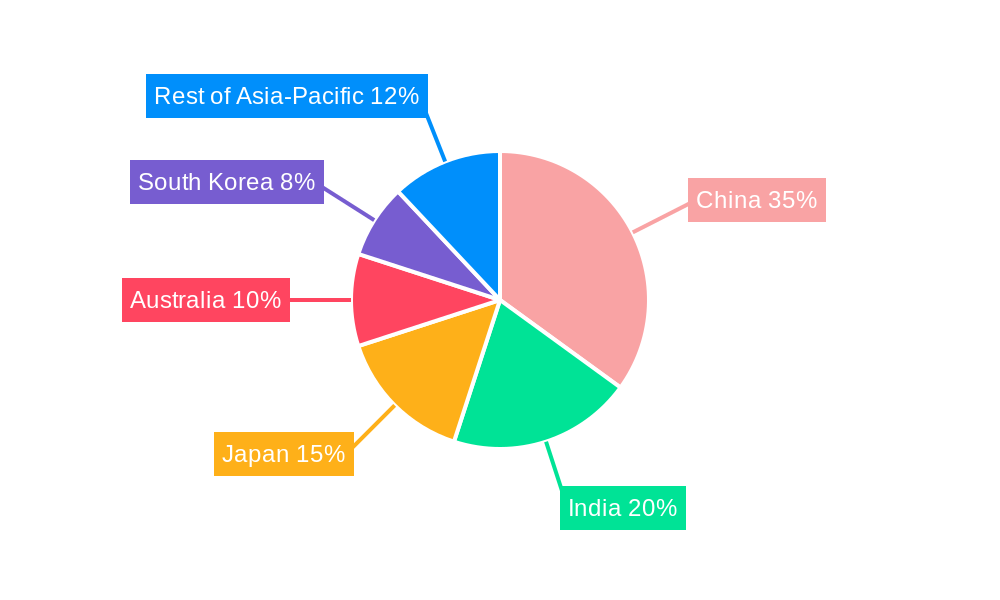

The Asia-Pacific meat substitutes market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 7.62% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer awareness of the environmental impact of meat production, coupled with growing concerns about animal welfare, is fueling demand for plant-based alternatives. Health-conscious consumers are also increasingly seeking protein sources lower in saturated fat and cholesterol, further bolstering market growth. The rising prevalence of vegetarianism and veganism, particularly among younger demographics, significantly contributes to this trend. Furthermore, technological advancements in meat substitute production are leading to products with improved taste, texture, and nutritional profiles, making them more appealing to a wider consumer base. Significant market penetration is observed across diverse segments, including tempeh, tofu, textured vegetable protein, and other meat alternatives, distributed through both off-trade (retail) and on-trade (food service) channels. China, India, and Japan represent major market contributors within the Asia-Pacific region, exhibiting strong growth potential due to their large populations and evolving dietary habits.

However, challenges remain. Price sensitivity among consumers, particularly in developing economies, might hinder widespread adoption. The perception of meat substitutes as inferior in taste and texture compared to traditional meat products also presents a hurdle. Overcoming these challenges requires continuous innovation in product development, focusing on affordability and improving the sensory attributes of meat substitutes. Successful marketing campaigns highlighting the health, environmental, and ethical benefits of these products are also crucial to drive market expansion. The competitive landscape is dynamic, with both established food companies and innovative startups vying for market share. The ongoing expansion of distribution networks and the increasing availability of meat substitutes in mainstream retail outlets will further propel market growth throughout the forecast period. The diverse range of product offerings and the increasing engagement of key players in R&D efforts are expected to lead to more diversified and sustainable solutions within the market.

Asia-Pacific Meat Substitutes Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific meat substitutes market, offering a comprehensive overview of its current state, future trends, and growth potential. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. Valued at xx Million in 2025, the market is poised for significant expansion, driven by increasing consumer awareness of health and sustainability. This report is essential for stakeholders including investors, manufacturers, and market entrants seeking to understand this dynamic and rapidly evolving sector.

Asia-Pacific Meat Substitutes Market Composition & Trends

This section delves into the market's competitive landscape, analyzing market concentration, key innovation drivers, and the regulatory environment shaping its trajectory. We examine substitute products, end-user profiles, and the impact of mergers and acquisitions (M&A) activities. The report provides a granular view of market share distribution amongst key players and analyzes the financial details of significant M&A deals. Market concentration is assessed through the Herfindahl-Hirschman Index (HHI), revealing the level of competition. We examine the influence of factors such as rising health consciousness, growing vegan and vegetarian populations, and increasing concerns about the environmental impact of meat production.

- Market Concentration: xx% of the market is controlled by the top 5 players.

- Innovation Catalysts: Technological advancements in plant-based protein production, coupled with increasing consumer demand for sustainable and ethical food options.

- Regulatory Landscape: Analysis of government regulations and policies impacting the meat substitutes industry across different Asia-Pacific nations.

- Substitute Products: Exploration of alternative protein sources and their competitive impact on the market.

- End-User Profiles: Segmentation of consumers based on dietary habits, demographics, and purchasing behavior.

- M&A Activities: Overview of significant mergers and acquisitions, including deal values (e.g., a xx Million acquisition in 2024).

Asia-Pacific Meat Substitutes Market Industry Evolution

This section provides a thorough analysis of the Asia-Pacific meat substitutes market's growth trajectory, pinpointing technological advancements and evolving consumer preferences. We explore the historical period (2019-2024) and forecast future growth rates. The impact of technological innovations, such as improved protein extraction and texturization techniques, is examined. The shift in consumer attitudes toward health and sustainability is analyzed to understand its effect on market demand. Data points like growth rates (projected at xx% CAGR from 2025-2033), adoption rates of new technologies, and changes in consumer buying behavior will be meticulously presented. The influence of factors like increasing disposable incomes, changing lifestyles, and growing awareness of the environmental impacts of traditional meat production will be explored.

Leading Regions, Countries, or Segments in Asia-Pacific Meat Substitutes Market

This section identifies the leading regions, countries, and segments within the Asia-Pacific meat substitutes market. We will analyze dominance factors for each leading segment (Country: Australia, China, India, Indonesia, Japan, Malaysia, South Korea, Rest of Asia-Pacific; Type: Tempeh, Textured Vegetable Protein, Tofu, Other Meat Substitutes; Distribution Channel: Off-Trade, On-Trade) through in-depth market analysis.

- Key Drivers (Examples):

- Investment Trends: Significant investments in research and development within specific countries.

- Regulatory Support: Government initiatives promoting plant-based foods.

- Consumer Preferences: High demand for specific product types in particular regions.

China is anticipated to hold the largest market share due to its large population, increasing disposable income, and expanding plant-based food industry. Japan shows high potential with increased consumer interest in healthier options. The “Other Meat Substitutes” category shows rapid growth fueled by innovation. The Off-Trade channel dominates due to the ease of access and affordability.

Asia-Pacific Meat Substitutes Market Product Innovations

This section details the latest innovations in meat substitutes, encompassing novel product applications and their performance metrics. We highlight unique selling propositions (USPs) and technological advancements driving market growth. Recent product launches incorporate improved textures, flavors, and nutritional profiles to better mimic traditional meats, expanding consumer appeal. This analysis features examples of innovative products and their success in the market.

Propelling Factors for Asia-Pacific Meat Substitutes Market Growth

Several factors are driving the expansion of the Asia-Pacific meat substitutes market. Technological advancements in plant-based protein production are creating more realistic and palatable products. Rising health consciousness among consumers is leading to increased demand for healthier and more sustainable food options. Favorable government regulations and initiatives supporting plant-based alternatives further propel growth. Economic factors such as increasing disposable incomes and changing dietary habits also contribute significantly.

Obstacles in the Asia-Pacific Meat Substitutes Market

Despite its growth potential, the Asia-Pacific meat substitutes market faces challenges. Regulatory hurdles in certain countries might hinder market penetration. Supply chain disruptions can impact production and distribution, affecting product availability and pricing. Intense competition from established players and emerging startups creates pricing pressures. Consumer perception and acceptance of meat substitutes as a viable alternative to traditional meats still need improvement. These factors are estimated to cause a potential xx% reduction in market growth in 2027.

Future Opportunities in Asia-Pacific Meat Substitutes Market

Future opportunities for the Asia-Pacific meat substitutes market lie in the expansion of product offerings to cater to diverse consumer preferences. This includes exploring new market segments and regions with unmet needs. Technological innovations, such as improved protein extraction and novel ingredient combinations, will continue to drive growth. Emerging trends such as personalized nutrition and sustainable packaging present opportunities for market differentiation. Further research into improving the taste, texture, and nutritional profile of meat substitutes is critical to attract mainstream consumers.

Major Players in the Asia-Pacific Meat Substitutes Market Ecosystem

- Invigorate Foods Pvt Ltd

- China Foodstuff & Protein Group Co Ltd

- Kerry Group PLC

- Vippy Industries Ltd

- Flexitarian Foods Pty Ltd

- Vitasoy International Holdings Lt

- Roquette Freres

- Impossible Foods Inc

- Morinaga Milk Industry Co Ltd

Key Developments in Asia-Pacific Meat Substitutes Market Industry

- October 2022: Roquette Freres launched a new line of organic pea ingredients (organic pea starch and organic pea protein), broadening its product portfolio and catering to growing demand for organic and sustainable food solutions.

- January 2023: Roquette Freres announced investment in DAIZ Inc., a Japanese food tech startup, demonstrating a collaborative approach towards developing improved plant-based ingredients.

- February 2023: Impossible Foods introduced a new plant-based chicken product line, expanding its product portfolio and increasing competition in the market.

Strategic Asia-Pacific Meat Substitutes Market Forecast

The Asia-Pacific meat substitutes market exhibits robust growth potential, driven by continued innovation, increasing consumer awareness, and supportive government policies. Future opportunities will be shaped by technological advancements and the evolution of consumer preferences. The market is expected to experience substantial growth over the forecast period (2025-2033), propelled by a rising demand for healthier, sustainable, and ethical food alternatives. Further penetration into untapped markets and the development of innovative products will continue to drive market expansion, leading to a significantly larger market size by 2033.

Asia-Pacific Meat Substitutes Market Segmentation

-

1. Type

- 1.1. Tempeh

- 1.2. Textured Vegetable Protein

- 1.3. Tofu

- 1.4. Other Meat Substitutes

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Asia-Pacific Meat Substitutes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Meat Substitutes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tempeh

- 5.1.2. Textured Vegetable Protein

- 5.1.3. Tofu

- 5.1.4. Other Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Invigorate Foods Pvt Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 China Foodstuff & Protein Group Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Kerry Group PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Vippy Industries Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Flexitarian Foods Pty Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Vitasoy International Holdings Lt

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Roquette Freres

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Impossible Foods Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Morinaga Milk Industry Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Invigorate Foods Pvt Ltd

List of Figures

- Figure 1: Asia-Pacific Meat Substitutes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Meat Substitutes Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Asia-Pacific Meat Substitutes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Meat Substitutes Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Meat Substitutes Market?

The projected CAGR is approximately 7.62%.

2. Which companies are prominent players in the Asia-Pacific Meat Substitutes Market?

Key companies in the market include Invigorate Foods Pvt Ltd, China Foodstuff & Protein Group Co Ltd, Kerry Group PLC, Vippy Industries Ltd, Flexitarian Foods Pty Ltd, Vitasoy International Holdings Lt, Roquette Freres, Impossible Foods Inc, Morinaga Milk Industry Co Ltd.

3. What are the main segments of the Asia-Pacific Meat Substitutes Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein.

8. Can you provide examples of recent developments in the market?

February 2023: Impossible Foods’ introduced a new plant-based chicken products line-up.January 2023: Roquette Freres announced their investment in DAIZ Inc., a Japanese food tech startup that has developed breakthrough technology utilizing germination of plant seeds combined with an extrusion process to enhance texture, flavor and the nutritional profile for plant-based foods. This partnership will allow Roquette and DAIZ to continue realizing their strong growth ambitions and meet rising global demand for innovative and sustainable plant-based ingredients combining great taste and high-quality nutritional value.October 2022: Roquette Freres announced the launch of a new line of organic pea ingredients: organic pea starch and organic pea protein.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Meat Substitutes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Meat Substitutes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Meat Substitutes Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Meat Substitutes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence