Key Insights

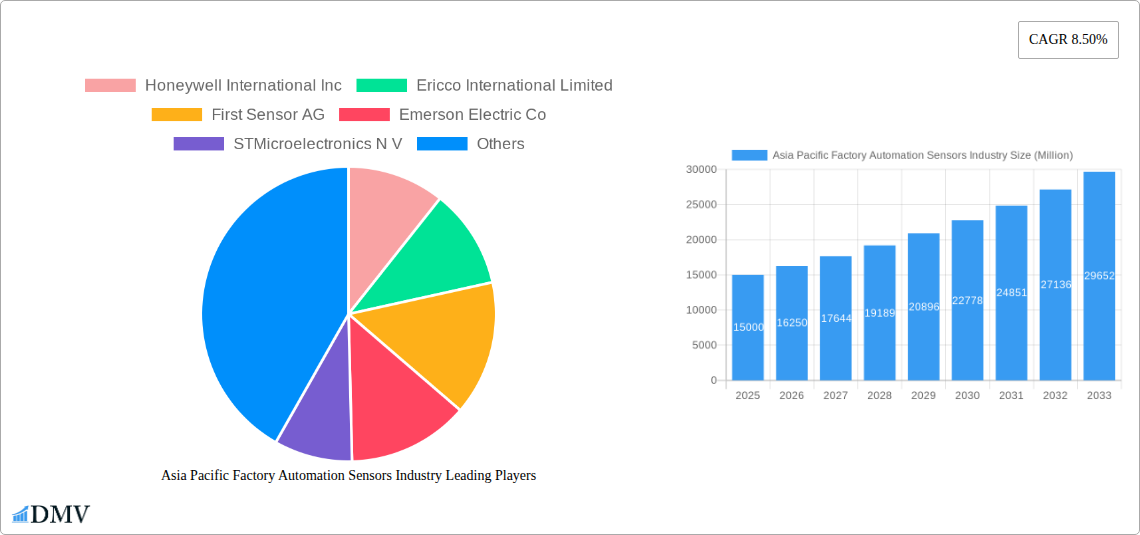

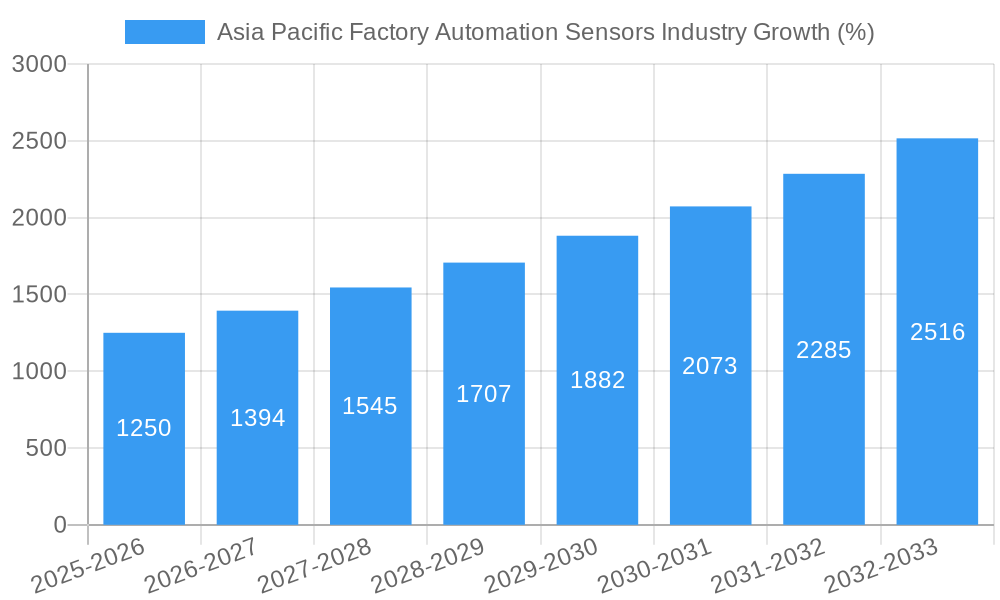

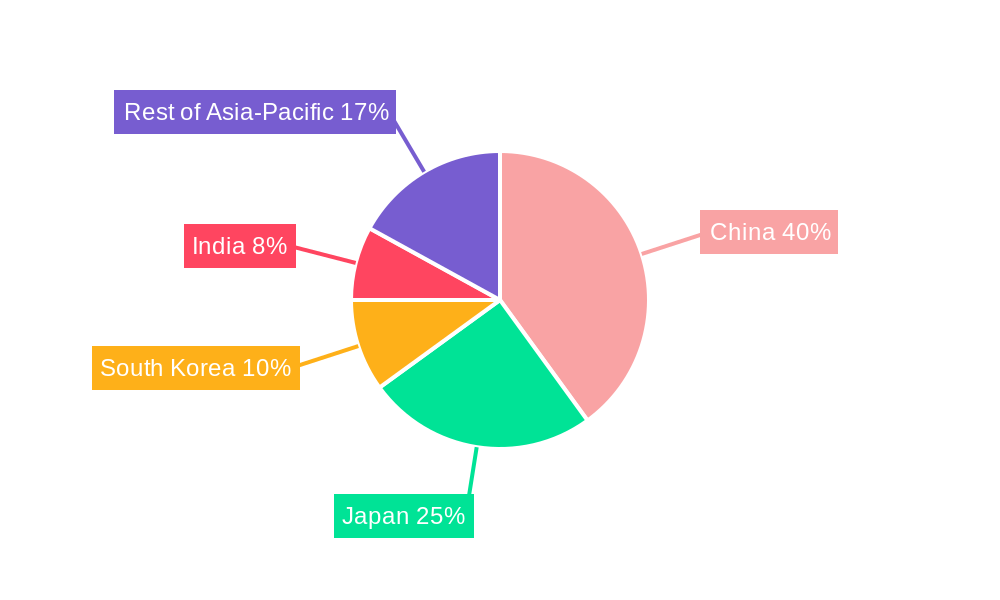

The Asia-Pacific factory automation sensors market is experiencing robust growth, driven by the region's expanding manufacturing sector, particularly in countries like China, Japan, and South Korea. The increasing adoption of Industry 4.0 technologies, including automation and robotics, is a key catalyst. Furthermore, the rising demand for enhanced process efficiency, improved product quality, and reduced operational costs across various end-user industries such as automotive, electronics, and food & beverage is fueling market expansion. A compound annual growth rate (CAGR) of 8.50% from 2019 to 2033 signifies a substantial increase in market value. This growth is further bolstered by government initiatives promoting automation and technological advancements in sensor technology, leading to smaller, more energy-efficient, and cost-effective sensors. However, challenges remain, including the high initial investment costs associated with implementing sensor-based automation systems and the need for skilled workforce training to effectively operate and maintain these technologies. The market segmentation reveals that pressure, temperature, and flow sensors are currently dominant product types, while the automotive and electronics industries are major consumers. Given the ongoing expansion of smart factories and the increasing integration of sensors in various industrial processes, the Asia-Pacific factory automation sensors market is poised for continued significant growth in the coming years. The competitive landscape is characterized by both established global players and regional manufacturers, creating a dynamic environment ripe for innovation and strategic partnerships.

The predicted market size in 2025 forms the base for projecting future growth. Considering the CAGR of 8.50%, we can extrapolate future market size. Growth will vary across segments, with potentially faster growth observed in sectors like food & beverage and water & wastewater due to increased automation in these industries. Specific regional growth within Asia-Pacific will likely see China and Japan maintaining strong leadership roles, but growth in countries like India and South Korea also adds to the overall market expansion. The segment experiencing the most significant growth is anticipated to be the electronics and semiconductor sector due to their highly automated processes and continuous need for precision. Challenges such as supply chain disruptions and potential economic slowdowns could impact growth rate projections, but the overall positive trajectory for automation in the region is expected to sustain market expansion.

Asia Pacific Factory Automation Sensors Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific factory automation sensors industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously forecasts market dynamics from 2025 to 2033, drawing upon data from the historical period (2019-2024). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a significant CAGR. This report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector.

Asia Pacific Factory Automation Sensors Industry Market Composition & Trends

This section delves into the competitive landscape of the Asia Pacific factory automation sensors market, analyzing market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is moderately concentrated, with key players like Honeywell International Inc, Siemens AG, and Rockwell Automation Inc holding significant market share. However, numerous smaller players contribute to a dynamic and competitive environment.

- Market Share Distribution (2025): Honeywell International Inc (15%), Siemens AG (12%), Rockwell Automation Inc (10%), Others (63%).

- Innovation Catalysts: Advancements in sensor technology (e.g., IoT integration, AI-powered analytics) are driving market growth. Stringent environmental regulations are also pushing adoption of advanced sensors for process optimization and emissions monitoring.

- Regulatory Landscape: Varying regulations across Asia-Pacific countries influence the market, requiring compliance and impacting adoption rates.

- Substitute Products: While limited, alternative technologies like image processing and machine vision present some level of competition.

- End-User Profiles: The automotive, electronics & semiconductor, and chemical & petrochemical industries are key end-users, driving demand for specific sensor types.

- M&A Activity (2019-2024): Over xx Million has been invested in M&A deals in the region, reflecting consolidation and strategic expansion efforts. Key deals involved the acquisition of smaller sensor specialists by larger automation companies.

Asia Pacific Factory Automation Sensors Industry Industry Evolution

This section explores the historical and projected growth trajectories of the Asia Pacific factory automation sensors industry, highlighting technological advancements and evolving consumer demands. From 2019 to 2024, the market witnessed a CAGR of xx%, driven by increased automation adoption across various industries. Technological advancements, such as the miniaturization of sensors, improved accuracy and reliability, and the integration of advanced communication protocols (e.g., Industrial IoT), have significantly impacted market growth. The increasing demand for smart factories and Industry 4.0 initiatives has further accelerated adoption. The forecast period (2025-2033) anticipates continued growth, driven by the increasing focus on automation, particularly within emerging economies like India and Vietnam. Adoption rates for advanced sensor technologies are expected to increase significantly, with specific growth metrics varying based on product type and end-user industry. The rising need for real-time data and predictive maintenance solutions fuels the demand for high-performance sensors.

Leading Regions, Countries, or Segments in Asia Pacific Factory Automation Sensors Industry

China dominates the Asia Pacific factory automation sensors market, driven by rapid industrialization and robust government support for technological advancements. Japan and South Korea also hold significant market shares due to their advanced manufacturing sectors.

By Product Type:

- Pressure Sensors: This segment holds the largest market share due to its widespread application across various industries.

- Temperature Sensors: Significant growth due to the increasing demand for precise temperature control in manufacturing processes.

By End-user Industry:

- Automotive: High demand for sensors in advanced driver-assistance systems (ADAS) and autonomous driving technologies.

- Electronics & Semiconductor: Stringent quality control requirements drive high sensor usage in semiconductor manufacturing.

Key Drivers (by Country):

- China: Government initiatives promoting industrial automation and smart manufacturing. Significant investments in infrastructure and technological development.

- Japan: Strong presence of established automation companies and focus on advanced manufacturing technologies.

- South Korea: Technological prowess and the presence of globally competitive electronics manufacturers.

Dominance Factors:

High industrial output, government support for technological advancements, and the presence of established automation companies are key factors contributing to the dominance of China, Japan, and South Korea. The "Rest of Asia-Pacific" region demonstrates significant growth potential, fueled by increasing industrialization and automation investments.

Asia Pacific Factory Automation Sensors Industry Product Innovations

Recent innovations include the development of miniaturized, high-precision sensors with improved signal processing capabilities and enhanced durability. The integration of artificial intelligence and machine learning algorithms enhances data analytics and predictive maintenance capabilities. Wireless sensor networks and IoT connectivity enable real-time monitoring and remote diagnostics, leading to improved operational efficiency and reduced downtime. These advancements enable greater accuracy, reliability, and cost-effectiveness across various applications.

Propelling Factors for Asia Pacific Factory Automation Sensors Industry Growth

Several key factors drive the growth of the Asia Pacific factory automation sensors market. Firstly, the increasing adoption of Industry 4.0 initiatives across various sectors fuels the demand for advanced sensor technologies for real-time monitoring, data analysis, and predictive maintenance. Secondly, rising government investments in infrastructure development and technological advancements provide a favourable environment for market growth. Thirdly, technological advancements such as the development of miniaturized, high-precision sensors, and the integration of AI and IoT connectivity further boost market expansion.

Obstacles in the Asia Pacific Factory Automation Sensors Industry Market

The Asia Pacific factory automation sensors market faces certain challenges. Supply chain disruptions due to geopolitical events and the COVID-19 pandemic have caused production delays and increased costs. Moreover, intense competition among numerous players, including both established and emerging companies, can pressure profit margins. Furthermore, varying regulatory requirements across different countries can increase compliance costs and complexities for businesses operating in the region. These factors could potentially restrain market growth to a certain extent.

Future Opportunities in Asia Pacific Factory Automation Sensors Industry

Emerging opportunities exist in the integration of advanced sensor technologies with cloud computing and big data analytics. The rising adoption of robotics and automation in various industries, coupled with the increasing demand for smart factories and Industry 4.0 solutions, presents significant growth potential. The development of new sensor applications in emerging sectors, such as renewable energy and smart agriculture, also offers exciting possibilities. Furthermore, the focus on improving operational efficiency and reducing production costs through advanced sensor technologies will contribute to sustained market growth.

Major Players in the Asia Pacific Factory Automation Sensors Industry Ecosystem

- Honeywell International Inc

- Ericco International Limited

- First Sensor AG

- Emerson Electric Co

- STMicroelectronics N V

- Siemens AG

- Texas Instruments Incorporated

- Rockwell Automation Inc

- All Sensors Corporation

- ABB Limited

- Amphenol Advanced Sensors

Key Developments in Asia Pacific Factory Automation Sensors Industry Industry

- January 2023: Honeywell launched a new line of industrial sensors with enhanced connectivity features.

- March 2022: Siemens acquired a smaller sensor technology company, expanding its product portfolio.

- June 2021: A significant investment was made in the research and development of next-generation sensors by a consortium of Asian companies.

Strategic Asia Pacific Factory Automation Sensors Industry Market Forecast

The Asia Pacific factory automation sensors market is poised for robust growth over the forecast period (2025-2033). Driven by increasing automation adoption, technological advancements, and government support, the market is expected to witness substantial expansion across various segments and geographies. The continued focus on Industry 4.0 and the growing demand for smart factories will further propel market growth. Opportunities exist in emerging technologies, such as AI-powered sensors and wireless sensor networks, which will contribute significantly to future market expansion.

Asia Pacific Factory Automation Sensors Industry Segmentation

-

1. Product Type

- 1.1. Pressure

- 1.2. Temperature

- 1.3. Level

- 1.4. Flow

- 1.5. Magnetic Field

- 1.6. Acceleration & Yaw Rate

- 1.7. Gas

- 1.8. Other Product Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace & Military

- 2.3. Chemical & Petrochemical

- 2.4. Medical

- 2.5. Electronics & Semiconductor

- 2.6. Power Generation

- 2.7. Oil & Gas

- 2.8. Food & Beverage

- 2.9. Water & Wastewater

- 2.10. Other End Users

Asia Pacific Factory Automation Sensors Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Factory Automation Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of IoT Leading to Demand for Sensing Components; Need for Robust Design and Enhanced Performance in Rugged Environment

- 3.3. Market Restrains

- 3.3.1. ; High Cost of the System

- 3.4. Market Trends

- 3.4.1. Growth in the implementation of automated technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Pressure

- 5.1.2. Temperature

- 5.1.3. Level

- 5.1.4. Flow

- 5.1.5. Magnetic Field

- 5.1.6. Acceleration & Yaw Rate

- 5.1.7. Gas

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Military

- 5.2.3. Chemical & Petrochemical

- 5.2.4. Medical

- 5.2.5. Electronics & Semiconductor

- 5.2.6. Power Generation

- 5.2.7. Oil & Gas

- 5.2.8. Food & Beverage

- 5.2.9. Water & Wastewater

- 5.2.10. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Factory Automation Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ericco International Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 First Sensor AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Emerson Electric Co

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 STMicroelectronics N V

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Siemens AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Texas Instruments Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rockwell Automation Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 All Sensors Corporation*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 ABB Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Amphenol Advanced Sensors

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Factory Automation Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Factory Automation Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Pacific Factory Automation Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Factory Automation Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Factory Automation Sensors Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Asia Pacific Factory Automation Sensors Industry?

Key companies in the market include Honeywell International Inc, Ericco International Limited, First Sensor AG, Emerson Electric Co, STMicroelectronics N V, Siemens AG, Texas Instruments Incorporated, Rockwell Automation Inc, All Sensors Corporation*List Not Exhaustive, ABB Limited, Amphenol Advanced Sensors.

3. What are the main segments of the Asia Pacific Factory Automation Sensors Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of IoT Leading to Demand for Sensing Components; Need for Robust Design and Enhanced Performance in Rugged Environment.

6. What are the notable trends driving market growth?

Growth in the implementation of automated technology.

7. Are there any restraints impacting market growth?

; High Cost of the System.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Factory Automation Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Factory Automation Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Factory Automation Sensors Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Factory Automation Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence