Key Insights

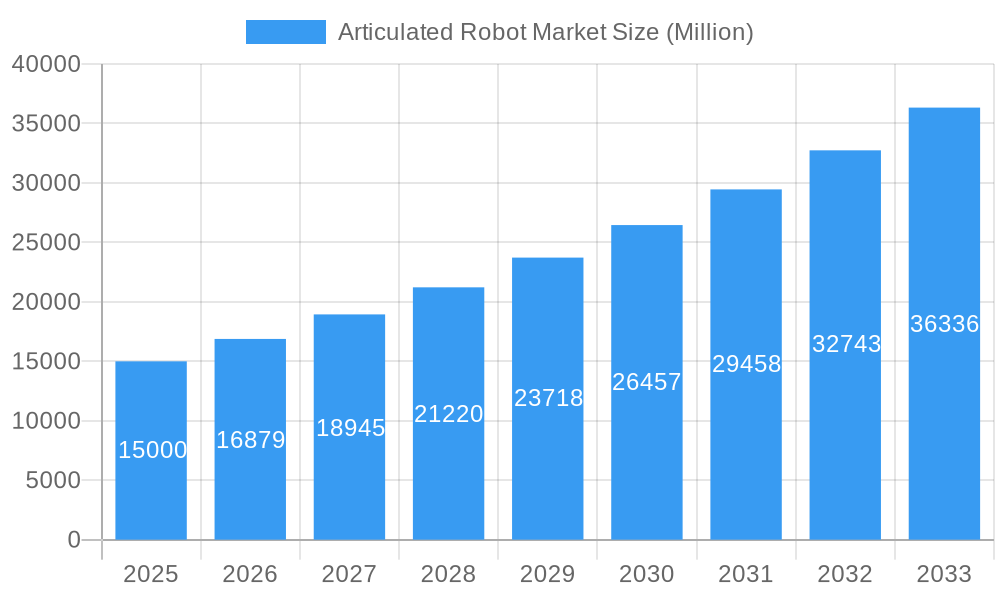

The global articulated robot market is set for significant expansion, projected to reach a market size of $1.9 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 5.58% through 2033. This growth is fueled by the increasing demand for automation across key sectors including automotive, electrical and electronics, and pharmaceuticals. Factors driving adoption include the pursuit of enhanced manufacturing efficiency, superior product quality, and reduced operational costs. The automotive industry, a primary user, benefits from the precision offered by these robots in assembly lines and the rise of electric vehicle production. Similarly, the electrical and electronics sector leverages articulated robots for intricate tasks involving miniaturized components and rigorous quality control. The pharmaceutical industry is also increasing its use for sterile operations, precise dispensing, and sensitive material handling.

Articulated Robot Market Market Size (In Billion)

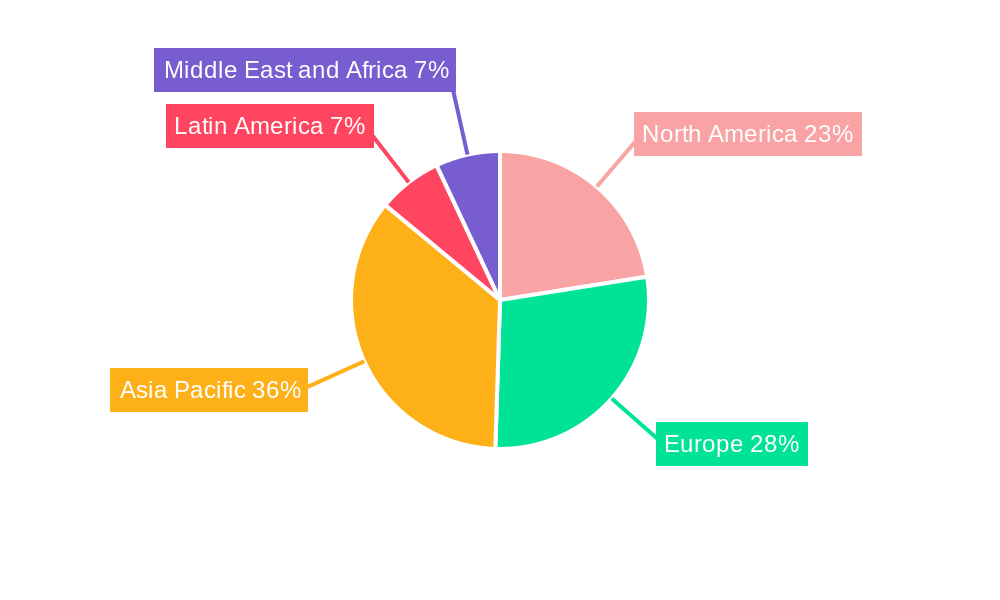

Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are augmenting articulated robot capabilities, enabling more complex operations and adaptability in dynamic manufacturing settings, aligning with Industry 4.0 and smart manufacturing initiatives. While high initial investment, the need for skilled labor, and integration complexities pose challenges, continuous technological progress in robot dexterity, payload capacity, and collaborative robotics (cobots) supports broader market penetration. The Asia Pacific region is anticipated to dominate both market growth and share, attributed to its robust manufacturing base and government support for industrial automation.

Articulated Robot Market Company Market Share

Articulated Robot Market Analysis: Market Size, Growth, and Future Forecast

Articulated Robot Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a panoramic view of the global Articulated Robot Market, delving into its intricate composition, evolutionary trajectory, and promising future. With a meticulous study period spanning 2019–2033, a base year of 2025, and a comprehensive forecast period of 2025–2033, this analysis equips stakeholders with actionable insights into the industrial automation landscape. We dissect critical market dynamics, from technological innovations and end-user adoption to regional dominance and strategic growth catalysts, offering a definitive guide for navigating this rapidly expanding sector. Understand the impact of leading players like ABB Ltd, FANUC CORPORATION, KUKA AG, and more, and leverage our data-driven forecasts to capitalize on emerging opportunities.

Articulated Robot Market Market Composition & Trends

The Articulated Robot Market is characterized by a dynamic interplay of market concentration and ongoing innovation. Leading players such as FANUC CORPORATION and KUKA AG command significant market share, driven by continuous investment in research and development, focusing on advanced capabilities like AI integration and collaborative robotics. Regulatory landscapes are increasingly favoring automation for enhanced safety and productivity, particularly in sectors like automotive and electrical and electronics. Substitute products, while present, are steadily losing ground to the superior flexibility and precision offered by articulated robots. End-user profiles are diversifying, with the pharmaceutical and food and beverages industries emerging as significant growth avenues due to the demand for precision handling and sterile environments. Merger and acquisition (M&A) activities are on the rise, with companies seeking to expand their technological portfolios and market reach. For instance, notable M&A deals are projected to reach values in the hundreds of million dollars, signaling consolidation and strategic expansion within the ecosystem. The market's growth is underpinned by a robust innovation pipeline, addressing specific industry needs and pushing the boundaries of robotic capabilities.

Articulated Robot Market Industry Evolution

The Articulated Robot Market has witnessed a transformative evolution, characterized by consistent year-on-year growth and a relentless pursuit of technological advancement. Throughout the historical period (2019–2024), the market demonstrated robust momentum, fueled by the accelerating adoption of industrial automation across diverse sectors. As we move into the base year (2025) and beyond, the forecast period (2025–2033) anticipates an even steeper growth trajectory. This surge is primarily attributed to the increasing demand for enhanced manufacturing efficiency, improved product quality, and heightened worker safety. Technological advancements have been the bedrock of this evolution. We have observed significant leaps in robotic dexterity, payload capacity, and programming ease, making articulated robots more accessible and versatile than ever before. The integration of artificial intelligence (AI), machine learning (ML), and advanced sensor technologies has enabled robots to perform more complex tasks, adapt to dynamic environments, and collaborate seamlessly with human workers.

Shifting consumer demands, particularly for personalized products and faster delivery cycles, have further propelled the need for flexible and efficient production lines, which articulated robots are uniquely positioned to provide. The automotive industry continues to be a dominant force, leveraging articulated robots for intricate assembly processes, welding, and painting. However, the electrical and electronics sector is rapidly catching up, driven by the miniaturization of components and the need for high-precision pick-and-place operations. The metals and machinery, pharmaceutical, and food and beverages industries are also experiencing a significant uptick in articulated robot adoption, driven by demands for precision, hygiene, and speed. The market's growth rates are projected to remain in the double digits throughout the forecast period, with adoption metrics indicating a substantial increase in the number of articulated robots deployed globally. This sustained expansion underscores the integral role articulated robots are playing in shaping the future of manufacturing and industrial operations.

Leading Regions, Countries, or Segments in Articulated Robot Market

The Articulated Robot Market is currently experiencing dominant growth and adoption within the Automotive end-user industry. This segment's leadership is driven by a confluence of factors including massive investments in smart factories, the increasing complexity of vehicle manufacturing, and the persistent need for high-precision, repetitive tasks like welding, painting, and assembly. Automotive manufacturers are at the forefront of adopting cutting-edge robotic solutions to enhance production efficiency, reduce manufacturing costs, and ensure the consistent quality of their products.

- Key Drivers for Automotive Dominance:

- High Volume Production Demands: The sheer scale of automotive production necessitates automated solutions that can operate tirelessly and with unparalleled accuracy.

- Complex Assembly Processes: Modern vehicles incorporate intricate designs and advanced technologies, requiring robots capable of handling complex manipulators and delicate components.

- Safety and Ergonomics: Articulated robots excel at performing hazardous tasks, thereby improving worker safety and reducing the incidence of workplace injuries.

- Technological Advancements in EVs: The rise of electric vehicles (EVs) has introduced new manufacturing challenges and opportunities, further stimulating the adoption of advanced robotics for battery assembly and specialized component integration.

- Government Incentives and Policies: Many governments worldwide offer incentives to promote advanced manufacturing and automation within the automotive sector, encouraging greater investment in robotics.

Beyond the automotive sector, the Electrical and Electronics industry is emerging as a significant growth segment. The relentless pace of innovation in consumer electronics, coupled with the demand for miniaturization and high-precision handling of sensitive components, is driving the adoption of articulated robots. Companies are leveraging these robots for tasks such as surface mount technology (SMT), intricate assembly of printed circuit boards (PCBs), and quality inspection. The Metals and Machinery sector also represents a substantial market, with articulated robots being employed for heavy-duty applications like material handling, welding, and deburring. The Pharmaceutical industry is increasingly turning to articulated robots for sterile handling of drugs, packaging, and laboratory automation, where precision and contamination control are paramount. The Food and Beverages sector is also witnessing growing adoption for tasks such as packaging, palletizing, and pick-and-place operations, driven by efficiency gains and food safety regulations. While these segments show strong growth potential, the automotive sector’s entrenched position and continuous large-scale investment solidify its current leadership in the global articulated robot market.

Articulated Robot Market Product Innovations

The Articulated Robot Market is continuously shaped by groundbreaking product innovations that enhance capabilities and expand applications. Recent advancements include the development of lighter, more agile robots with increased payload capacities, suitable for a wider range of tasks. Enhanced sensor integration, including advanced vision systems and force feedback, allows robots to perform intricate manipulations and collaborate more safely with human operators. Furthermore, the integration of AI and machine learning is enabling robots to learn from their environment, optimize their movements, and perform predictive maintenance, leading to improved efficiency and reduced downtime. The development of collaborative robots (cobots) with articulated designs is also a significant innovation, making automation more accessible to small and medium-sized enterprises. These innovations are not only improving performance metrics like cycle time and precision but also opening up new application areas in diverse industries.

Propelling Factors for Articulated Robot Market Growth

Several key growth drivers are propelling the Articulated Robot Market forward. Technologically, the continuous advancement in AI, machine learning, and sensor technology is making robots more intelligent, adaptable, and capable of performing complex tasks. Economically, the increasing need for manufacturers to boost productivity, reduce operational costs, and maintain competitiveness in a globalized market is a major impetus. Regulatory influences, such as stricter safety standards and government initiatives promoting automation and Industry 4.0 adoption, are also playing a crucial role. For instance, initiatives aimed at reshoring manufacturing operations often include incentives for adopting advanced automation solutions, further fueling the demand for articulated robots. The growing labor shortage in many developed economies is also a significant factor, pushing industries to rely more on robotic automation.

Obstacles in the Articulated Robot Market Market

Despite its robust growth, the Articulated Robot Market faces several obstacles. High initial investment costs for advanced robotic systems can be a significant barrier, especially for small and medium-sized enterprises (SMEs) with limited capital. The complexity of integration and the need for skilled personnel to program, operate, and maintain these systems can also pose challenges. Furthermore, supply chain disruptions, as witnessed in recent years, can impact the availability of key components and lead to increased lead times and costs. Resistance to change from the workforce and concerns about job displacement, though often overstated, can also create societal hurdles to widespread adoption. Regulatory uncertainties in some regions regarding the deployment and safety standards of advanced robotics may also slow down market penetration.

Future Opportunities in Articulated Robot Market

The Articulated Robot Market is ripe with emerging opportunities. The expansion of IoT and edge computing is paving the way for smarter, more connected robotic systems capable of real-time data analysis and autonomous decision-making. The increasing demand for customized products and flexible manufacturing will drive the adoption of articulated robots that can be easily reprogrammed for different tasks. New markets, particularly in developing economies undergoing industrialization, present significant untapped potential. Furthermore, the growing focus on sustainability and the circular economy will create opportunities for robots in areas like recycling, repair, and remanufacturing. The continued development of human-robot collaboration will also open up new applications where robots augment human capabilities rather than replacing them entirely.

Major Players in the Articulated Robot Market Ecosystem

- ABB Ltd

- Nachi-Fujikoshi Corp

- FANUC CORPORATION

- Mitsubishi Electric Corporation

- Seiko Epson Corporation

- KUKA AG

- Stäubli International

- DENSO Corporation

- Omron Adept Technology Inc

- Kawasaki Heavy Industries Ltd

Key Developments in Articulated Robot Market Industry

- 2023/08: FANUC CORPORATION launches a new series of collaborative articulated robots with enhanced safety features and expanded payload capacities, targeting the SME market.

- 2023/07: KUKA AG announces a strategic partnership with an AI software provider to integrate advanced machine learning capabilities into its articulated robot offerings, aiming for greater operational autonomy.

- 2023/05: ABB Ltd unveils its latest generation of articulated robots featuring modular design for faster deployment and increased flexibility in complex assembly lines.

- 2023/04: Mitsubishi Electric Corporation showcases its new articulated robot arm designed for high-speed, high-precision pick-and-place operations in the electronics manufacturing sector.

- 2022/12: Stäubli International introduces a new range of compact articulated robots optimized for cleanroom applications in the pharmaceutical and biotechnology industries.

- 2022/10: DENSO Corporation expands its portfolio of articulated robots with models featuring improved energy efficiency and reduced footprint for space-constrained facilities.

- 2022/09: Omron Adept Technology Inc announces the integration of its advanced vision systems with articulated robots, enabling sophisticated quality control and defect detection.

- 2022/06: Kawasaki Heavy Industries Ltd unveils a new articulated robot designed for heavy payload applications, specifically for the automotive and aerospace sectors.

- 2021/11: Nachi-Fujikoshi Corp launches a new generation of articulated robots with enhanced dexterity and a wider working envelope, enabling more complex automation tasks.

- 2021/07: Seiko Epson Corporation introduces articulated robots with innovative force control capabilities for delicate assembly and handling tasks in the electronics industry.

Strategic Articulated Robot Market Market Forecast

The strategic outlook for the Articulated Robot Market is exceptionally positive, driven by sustained technological advancements and an unwavering demand for increased efficiency and flexibility in manufacturing. Key growth catalysts include the accelerating integration of AI and IoT, enabling smarter and more autonomous robotic operations. Emerging markets in Asia-Pacific and Latin America represent significant untapped potential, while mature markets continue to drive innovation through the adoption of Industry 4.0 principles. The increasing focus on sustainable manufacturing practices and the growing need for precision in sectors like healthcare and food processing will further bolster market expansion. As articulated robots become more accessible and user-friendly, their adoption by SMEs is expected to surge, democratizing automation and unlocking new avenues for growth, solidifying the market's upward trajectory throughout the forecast period.

Articulated Robot Market Segmentation

-

1. End User Industry

- 1.1. Automotive

- 1.2. Electrical and Electronics

- 1.3. Metals and Machinery

- 1.4. Pharmaceutical

- 1.5. Food and Beverages

- 1.6. Others

Articulated Robot Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Articulated Robot Market Regional Market Share

Geographic Coverage of Articulated Robot Market

Articulated Robot Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments Toward Industrial Automation; Support From Governments To Increase Workplace Safety

- 3.3. Market Restrains

- 3.3.1. High Initial Cost

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Articulated Robot Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Automotive

- 5.1.2. Electrical and Electronics

- 5.1.3. Metals and Machinery

- 5.1.4. Pharmaceutical

- 5.1.5. Food and Beverages

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Articulated Robot Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Automotive

- 6.1.2. Electrical and Electronics

- 6.1.3. Metals and Machinery

- 6.1.4. Pharmaceutical

- 6.1.5. Food and Beverages

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. Europe Articulated Robot Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Automotive

- 7.1.2. Electrical and Electronics

- 7.1.3. Metals and Machinery

- 7.1.4. Pharmaceutical

- 7.1.5. Food and Beverages

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Asia Pacific Articulated Robot Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Automotive

- 8.1.2. Electrical and Electronics

- 8.1.3. Metals and Machinery

- 8.1.4. Pharmaceutical

- 8.1.5. Food and Beverages

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Latin America Articulated Robot Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Automotive

- 9.1.2. Electrical and Electronics

- 9.1.3. Metals and Machinery

- 9.1.4. Pharmaceutical

- 9.1.5. Food and Beverages

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Middle East and Africa Articulated Robot Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Automotive

- 10.1.2. Electrical and Electronics

- 10.1.3. Metals and Machinery

- 10.1.4. Pharmaceutical

- 10.1.5. Food and Beverages

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nachi-Fujikoshi Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FANUC CORPORATION

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seiko Epson Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KUKA AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stäubli International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DENSO Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Omron Adept Technology Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kawasaki Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Articulated Robot Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Articulated Robot Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Articulated Robot Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 4: North America Articulated Robot Market Volume (K Units), by End User Industry 2025 & 2033

- Figure 5: North America Articulated Robot Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 6: North America Articulated Robot Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 7: North America Articulated Robot Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America Articulated Robot Market Volume (K Units), by Country 2025 & 2033

- Figure 9: North America Articulated Robot Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Articulated Robot Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Articulated Robot Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 12: Europe Articulated Robot Market Volume (K Units), by End User Industry 2025 & 2033

- Figure 13: Europe Articulated Robot Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 14: Europe Articulated Robot Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 15: Europe Articulated Robot Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe Articulated Robot Market Volume (K Units), by Country 2025 & 2033

- Figure 17: Europe Articulated Robot Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Articulated Robot Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Articulated Robot Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 20: Asia Pacific Articulated Robot Market Volume (K Units), by End User Industry 2025 & 2033

- Figure 21: Asia Pacific Articulated Robot Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: Asia Pacific Articulated Robot Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 23: Asia Pacific Articulated Robot Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific Articulated Robot Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Asia Pacific Articulated Robot Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Articulated Robot Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America Articulated Robot Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 28: Latin America Articulated Robot Market Volume (K Units), by End User Industry 2025 & 2033

- Figure 29: Latin America Articulated Robot Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 30: Latin America Articulated Robot Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 31: Latin America Articulated Robot Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Latin America Articulated Robot Market Volume (K Units), by Country 2025 & 2033

- Figure 33: Latin America Articulated Robot Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Articulated Robot Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Articulated Robot Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 36: Middle East and Africa Articulated Robot Market Volume (K Units), by End User Industry 2025 & 2033

- Figure 37: Middle East and Africa Articulated Robot Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 38: Middle East and Africa Articulated Robot Market Volume Share (%), by End User Industry 2025 & 2033

- Figure 39: Middle East and Africa Articulated Robot Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Middle East and Africa Articulated Robot Market Volume (K Units), by Country 2025 & 2033

- Figure 41: Middle East and Africa Articulated Robot Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Articulated Robot Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Articulated Robot Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global Articulated Robot Market Volume K Units Forecast, by End User Industry 2020 & 2033

- Table 3: Global Articulated Robot Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Articulated Robot Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Global Articulated Robot Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 6: Global Articulated Robot Market Volume K Units Forecast, by End User Industry 2020 & 2033

- Table 7: Global Articulated Robot Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Articulated Robot Market Volume K Units Forecast, by Country 2020 & 2033

- Table 9: Global Articulated Robot Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Global Articulated Robot Market Volume K Units Forecast, by End User Industry 2020 & 2033

- Table 11: Global Articulated Robot Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Articulated Robot Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Global Articulated Robot Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global Articulated Robot Market Volume K Units Forecast, by End User Industry 2020 & 2033

- Table 15: Global Articulated Robot Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Articulated Robot Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Global Articulated Robot Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 18: Global Articulated Robot Market Volume K Units Forecast, by End User Industry 2020 & 2033

- Table 19: Global Articulated Robot Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Articulated Robot Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Global Articulated Robot Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 22: Global Articulated Robot Market Volume K Units Forecast, by End User Industry 2020 & 2033

- Table 23: Global Articulated Robot Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Articulated Robot Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Articulated Robot Market?

The projected CAGR is approximately 5.58%.

2. Which companies are prominent players in the Articulated Robot Market?

Key companies in the market include ABB Ltd, Nachi-Fujikoshi Corp, FANUC CORPORATION, Mitsubishi Electric Corporation, Seiko Epson Corporation, KUKA AG, Stäubli International, DENSO Corporation, Omron Adept Technology Inc, Kawasaki Heavy Industries Ltd.

3. What are the main segments of the Articulated Robot Market?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments Toward Industrial Automation; Support From Governments To Increase Workplace Safety.

6. What are the notable trends driving market growth?

Automotive Industry is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

High Initial Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Articulated Robot Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Articulated Robot Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Articulated Robot Market?

To stay informed about further developments, trends, and reports in the Articulated Robot Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence