Key Insights

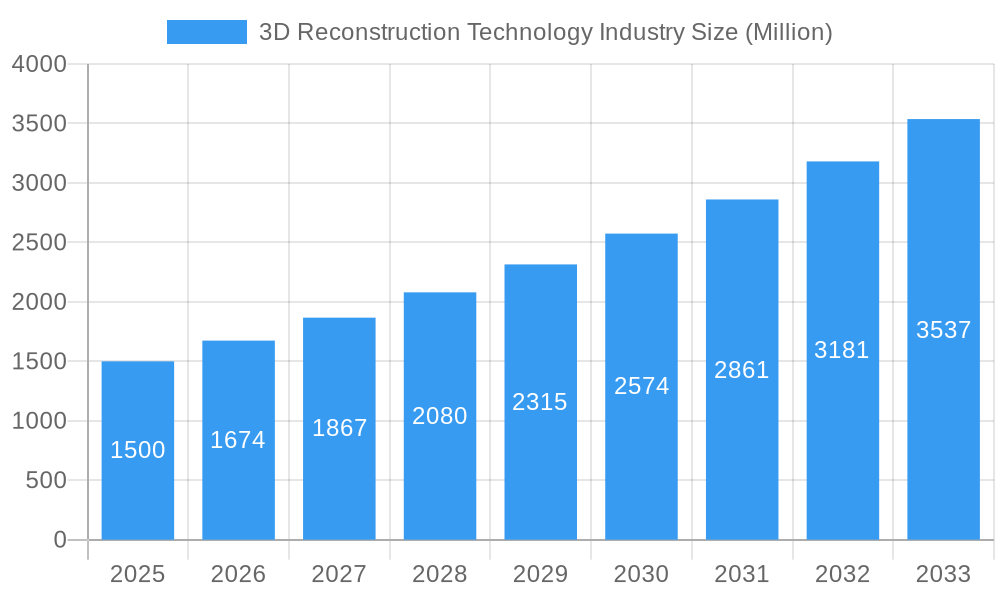

The global 3D Reconstruction Technology market is poised for substantial growth, estimated at a robust USD 1.50 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 11.60% through 2033. This impressive expansion is fueled by a confluence of technological advancements and increasing adoption across diverse sectors. Key drivers include the escalating demand for highly accurate digital twins, the growing need for immersive experiences in entertainment and gaming, and the critical role of precise 3D data in manufacturing for design, prototyping, and quality control. Furthermore, advancements in sensor technology, coupled with increasingly sophisticated algorithms for data processing, are making 3D reconstruction more accessible and cost-effective, thereby accelerating market penetration.

3D Reconstruction Technology Industry Market Size (In Billion)

The market's dynamism is further evidenced by its segmentation. The "Software" segment is expected to lead, driven by innovative AI-powered reconstruction tools and cloud-based platforms. The "Services" segment, encompassing scanning, processing, and consulting, will also witness significant growth as businesses seek expert assistance in leveraging 3D reconstruction. End-user industries such as Media and Entertainment, Aerospace and Defense, Manufacturing, and Healthcare are primary beneficiaries, each contributing uniquely to market expansion. For instance, the aerospace industry utilizes it for complex assembly analysis and inspection, while healthcare benefits from its applications in medical imaging and surgical planning. Emerging applications in architecture, engineering, and construction (AEC) for site surveying and heritage preservation are also emerging as significant growth areas, underscoring the technology's pervasive influence. Restraints such as the initial investment cost for high-end hardware and the need for specialized expertise may present challenges, but the overwhelming benefits and ongoing technological democratization are expected to outweigh these.

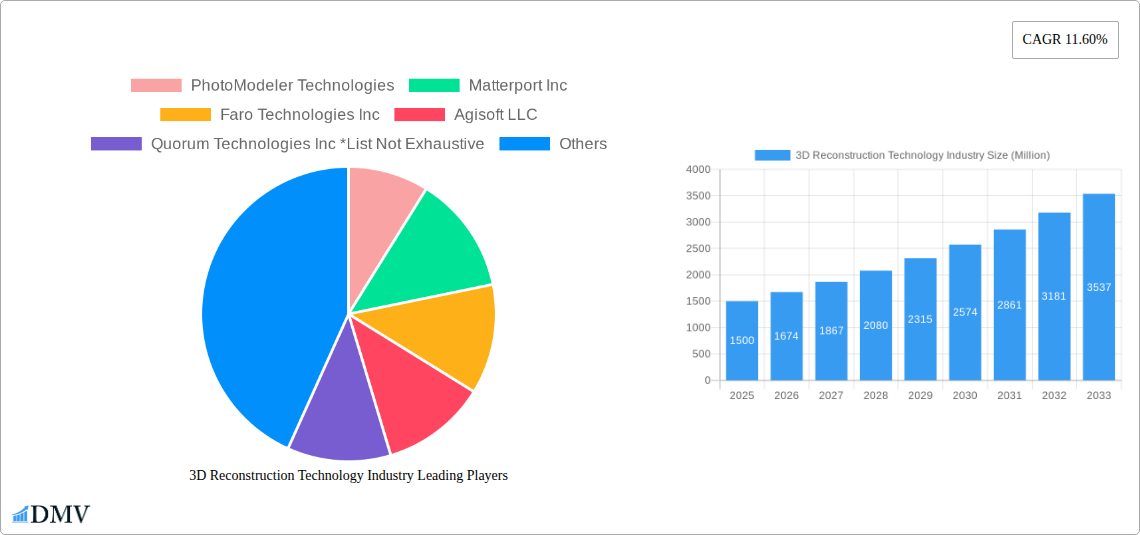

3D Reconstruction Technology Industry Company Market Share

3D Reconstruction Technology Industry Market Composition & Trends

The 3D reconstruction technology industry is characterized by a dynamic market composition driven by relentless innovation and increasing adoption across diverse sectors. While market concentration varies, key players like Autodesk Inc., Faro Technologies Inc., and Matterport Inc. hold significant sway, alongside specialized entities such as PhotoModeler Technologies and Agisoft LLC. The innovation landscape is fueled by advancements in AI, machine learning, and sensor technologies, leading to enhanced accuracy, speed, and accessibility of 3D models. Regulatory frameworks, while still evolving, are largely supportive, focusing on data privacy and intellectual property in the digital realm. Substitute products, such as traditional 2D imaging and manual surveying, are gradually being displaced by the superior visualization and data richness offered by 3D reconstruction. End-user profiles are expanding beyond traditional sectors to include media and entertainment, aerospace and defense, manufacturing, and healthcare, each leveraging 3D reconstruction for distinct applications. Mergers and acquisitions (M&A) are a prevalent trend, with deal values ranging from USD 10 Million to upwards of USD 500 Million, indicating a strong consolidation drive and strategic partnerships aimed at expanding market reach and technological capabilities. For instance, the acquisition of smaller, innovative firms by larger corporations is common, aiming to integrate cutting-edge 3D reconstruction software and hardware solutions into their broader portfolios. The market share distribution is a complex interplay of software providers, hardware manufacturers, and service-based companies, each carving out significant portions based on their technological prowess and market penetration.

3D Reconstruction Technology Industry Industry Evolution

The 3D reconstruction technology industry has witnessed an exponential growth trajectory, evolving from niche academic applications to a mainstream technology transforming numerous sectors. Over the historical period of 2019–2024, the industry has experienced robust market growth rates, with an estimated CAGR of approximately 18% driven by increasing demand for accurate digital twins, immersive experiences, and enhanced data visualization. Technological advancements have been the primary catalyst, with leaps in photogrammetry, LiDAR, structured light scanning, and volumetric capture significantly improving the fidelity and efficiency of 3D model creation. Machine learning algorithms are now integral, enabling automated feature detection, meshing, and texturing, thereby reducing manual intervention and time to completion. The advent of more affordable and portable scanning hardware, coupled with sophisticated cloud-based processing platforms, has democratized access to 3D reconstruction capabilities. Consumer demand is shifting towards more interactive and detailed digital representations of physical assets and environments, from virtual tours of real estate to highly accurate models for industrial design and medical simulations. The base year of 2025 is projected to see continued acceleration, with an estimated market valuation of USD 8,500 Million, paving the way for substantial expansion during the forecast period of 2025–2033. This evolution is marked by a continuous refinement of algorithms for handling complex geometries, improving texture realism, and enabling real-time reconstruction for dynamic environments. The integration of 3D reconstruction with other emerging technologies like augmented reality (AR) and virtual reality (VR) is further fueling adoption, creating new use cases and driving market expansion. Adoption metrics show a significant increase in the number of projects utilizing 3D reconstruction for quality control in manufacturing, historical preservation, and urban planning, underscoring its versatility and impact.

Leading Regions, Countries, or Segments in 3D Reconstruction Technology Industry

The Software segment within the 3D Reconstruction Technology Industry stands as a dominant force, exhibiting exceptional growth and market penetration driven by its accessibility and versatility across a multitude of end-user industries. The Software segment's dominance is a direct consequence of its foundational role in enabling 3D reconstruction workflows, providing the essential algorithms and platforms for processing scan data and generating high-fidelity digital models. Key drivers for this segment's leadership include:

- Rapid Technological Advancements: Continuous innovation in photogrammetry, AI-powered feature extraction, and cloud-based processing platforms by companies like Agisoft LLC and Pix4D SA have made sophisticated 3D reconstruction accessible and efficient.

- Scalability and Affordability: Software solutions offer a scalable and often more cost-effective entry point compared to high-end hardware, attracting a broader user base from startups to large enterprises.

- Integration Capabilities: The ability of 3D reconstruction software to seamlessly integrate with other design, simulation, and visualization tools is a critical factor, fostering wider adoption across industries like Manufacturing, Aerospace and Defense, and Media and Entertainment.

- Growing Demand for Digital Twins: The burgeoning need for accurate digital replicas of physical assets and environments across various sectors fuels the demand for robust and feature-rich 3D reconstruction software.

In terms of end-user industries, Manufacturing is a significant contributor to the Software segment's growth. The ability of 3D reconstruction software to facilitate precise quality control, reverse engineering, rapid prototyping, and factory layout optimization makes it indispensable for modern manufacturing processes. Companies are leveraging these solutions to create detailed digital twins of production lines and products, leading to significant improvements in efficiency and defect reduction. The Media and Entertainment industry also heavily relies on 3D reconstruction software for creating realistic virtual environments, character models, and special effects, further bolstering the segment's dominance. Furthermore, the increasing adoption of 3D scanning hardware by professionals in fields like architecture, engineering, and construction, coupled with the subsequent need for powerful processing software, underscores the software segment's pivotal role. The projected market size for 3D reconstruction software is estimated to reach approximately USD 5,000 Million by 2025, with continued robust growth anticipated throughout the forecast period, solidifying its position as the leading segment within the overall 3D Reconstruction Technology Industry.

3D Reconstruction Technology Industry Product Innovations

Product innovations in 3D reconstruction technology are consistently pushing boundaries, enabling more detailed, accurate, and efficient creation of digital replicas. Recent advancements include AI-driven automated meshing and texturing for faster model generation, alongside the development of real-time reconstruction capabilities for dynamic environments. LiDAR-equipped drones and handheld scanners are now offering unparalleled accuracy and speed in capturing large-scale outdoor environments and intricate indoor spaces. Furthermore, the integration of advanced sensor fusion techniques allows for the combination of data from multiple sources, such as visual cameras and thermal sensors, to create richer, more informative 3D models for applications like industrial inspection and architectural analysis. The performance metrics are demonstrably improving, with point cloud densities increasing by up to 30% and geometric accuracy enhanced by 15% in the last two years.

Propelling Factors for 3D Reconstruction Technology Industry Growth

The growth of the 3D reconstruction technology industry is propelled by several key factors. Technologically, the continuous advancements in sensor technology (e.g., higher resolution cameras, more sensitive LiDAR), coupled with sophisticated AI and machine learning algorithms for data processing, are making 3D reconstruction more accurate, efficient, and accessible. Economically, the decreasing cost of hardware and software, alongside the increasing ROI from applications in manufacturing, healthcare, and media, are driving adoption. Regulatory landscapes, particularly those that encourage digital transformation and data standardization, also play a crucial role. For instance, the push for digital twins in infrastructure management and the growing demand for immersive content in entertainment are significant catalysts. The increasing availability of skilled professionals trained in 3D modeling and data analysis further fuels this expansion.

Obstacles in the 3D Reconstruction Technology Industry Market

Despite its strong growth, the 3D Reconstruction Technology Industry faces certain obstacles. Regulatory challenges, particularly concerning data privacy and intellectual property rights associated with captured 3D data, can slow down adoption in sensitive sectors. Supply chain disruptions, especially for specialized hardware components like advanced sensors and processors, can impact product availability and lead times. Competitive pressures from established players and emerging startups necessitate continuous innovation and competitive pricing. Furthermore, the initial cost of high-end scanning equipment and the specialized expertise required for complex projects can act as a barrier for smaller businesses. The lack of standardized data formats across different software platforms can also lead to interoperability issues, hindering seamless workflow integration.

Future Opportunities in 3D Reconstruction Technology Industry

The future of the 3D reconstruction technology industry is brimming with opportunities. Emerging markets in developing economies are poised for significant adoption as technology becomes more affordable. New technological frontiers, such as AI-powered generative 3D content creation and real-time holographic reconstruction, will open up novel applications. Consumer trends are increasingly favoring personalized and immersive experiences, driving demand for 3D-scanned assets in gaming, virtual reality, and e-commerce. The integration of 3D reconstruction with IoT devices for creating dynamic digital twins of operational assets presents a massive opportunity for predictive maintenance and performance optimization across industries. Furthermore, advancements in mobile 3D scanning will democratize the technology, enabling everyday users to create and share 3D content.

Major Players in the 3D Reconstruction Technology Industry Ecosystem

- PhotoModeler Technologies

- Matterport Inc

- Faro Technologies Inc

- Agisoft LLC

- Quorum Technologies Inc

- Pix4D SA

- Vi3Dim Technologies

- Autodesk Inc

- Koninklijke Philips NV

- General Electric Company

- Intel Corporation

Key Developments in 3D Reconstruction Technology Industry Industry

- September 2022: 3D reconstruction start-up Preimage announced to raise INR 14 crore ( USD 1.7 million) in a seed funding round led by pi Ventures. The 3D reconstruction start-up will use the funding to scale its product build and boost hiring across business functions. The investment will also build a robust go-to-market product for drone-based mapping and surveying.

- May 2022: Dutch medical robotics company Vitestro launched an advanced autonomous blood drawing device. The new device combines ultrasound-guided 3D reconstruction and artificial intelligence (AI) with robotic needle insertion to ensure the precise and secure collection of blood.

Strategic 3D Reconstruction Technology Industry Market Forecast

The strategic market forecast for the 3D reconstruction technology industry is exceptionally promising, driven by ongoing technological advancements and expanding application horizons. The industry is projected to witness substantial growth, fueled by the increasing demand for accurate digital twins, immersive virtual experiences, and efficient data visualization across sectors like manufacturing, media and entertainment, and healthcare. The integration of AI and machine learning is set to further enhance the speed and accuracy of 3D model creation, while the decreasing cost of hardware will democratize access. Emerging opportunities in areas like AR/VR content creation, autonomous systems, and digital heritage preservation will act as significant growth catalysts, ensuring a robust market expansion throughout the forecast period of 2025–2033. The market potential is estimated to reach beyond USD 20,000 Million by 2033.

3D Reconstruction Technology Industry Segmentation

-

1. Type of Construction Solution

- 1.1. Software

- 1.2. Services

-

2. End-user Industry

- 2.1. Media and Entertainment

- 2.2. Aerospace and Defense

- 2.3. Manufacturing

- 2.4. Healthcare

- 2.5. Other End-user Industries

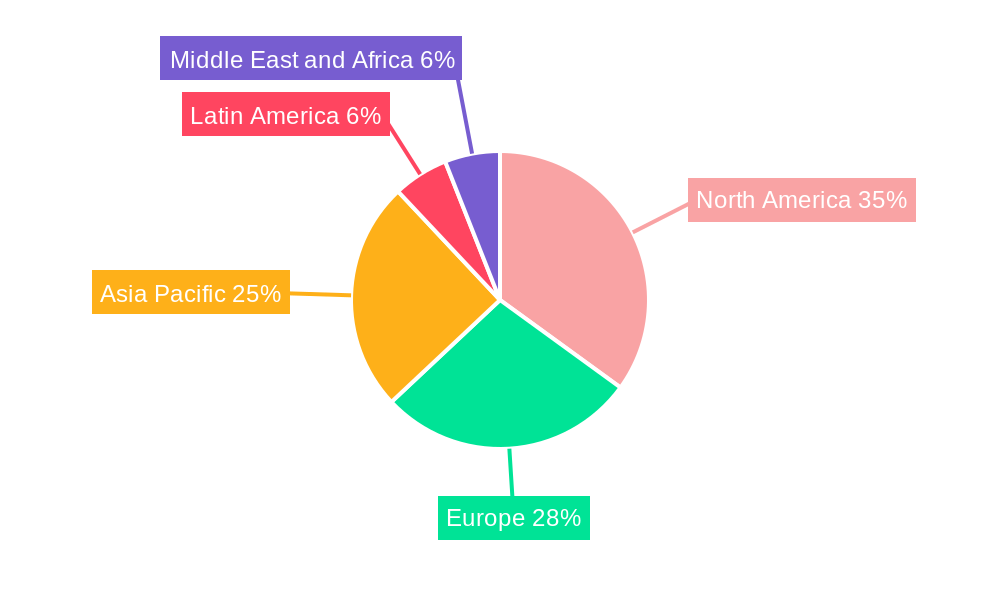

3D Reconstruction Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

3D Reconstruction Technology Industry Regional Market Share

Geographic Coverage of 3D Reconstruction Technology Industry

3D Reconstruction Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption of 3D Technology in Maintenance; Technological Advancements in the Field of Cameras

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. 3D Reconstruction Software Segment is Expected to Gain the Largest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Reconstruction Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 5.1.1. Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Media and Entertainment

- 5.2.2. Aerospace and Defense

- 5.2.3. Manufacturing

- 5.2.4. Healthcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 6. North America 3D Reconstruction Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 6.1.1. Software

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Media and Entertainment

- 6.2.2. Aerospace and Defense

- 6.2.3. Manufacturing

- 6.2.4. Healthcare

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 7. Europe 3D Reconstruction Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 7.1.1. Software

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Media and Entertainment

- 7.2.2. Aerospace and Defense

- 7.2.3. Manufacturing

- 7.2.4. Healthcare

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 8. Asia Pacific 3D Reconstruction Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 8.1.1. Software

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Media and Entertainment

- 8.2.2. Aerospace and Defense

- 8.2.3. Manufacturing

- 8.2.4. Healthcare

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 9. Latin America 3D Reconstruction Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 9.1.1. Software

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Media and Entertainment

- 9.2.2. Aerospace and Defense

- 9.2.3. Manufacturing

- 9.2.4. Healthcare

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 10. Middle East and Africa 3D Reconstruction Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 10.1.1. Software

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Media and Entertainment

- 10.2.2. Aerospace and Defense

- 10.2.3. Manufacturing

- 10.2.4. Healthcare

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type of Construction Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PhotoModeler Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Matterport Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Faro Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Agisoft LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Quorum Technologies Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pix4D SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vi3Dim Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Autodesk Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Intel Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 PhotoModeler Technologies

List of Figures

- Figure 1: Global 3D Reconstruction Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America 3D Reconstruction Technology Industry Revenue (Million), by Type of Construction Solution 2025 & 2033

- Figure 3: North America 3D Reconstruction Technology Industry Revenue Share (%), by Type of Construction Solution 2025 & 2033

- Figure 4: North America 3D Reconstruction Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America 3D Reconstruction Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America 3D Reconstruction Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America 3D Reconstruction Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe 3D Reconstruction Technology Industry Revenue (Million), by Type of Construction Solution 2025 & 2033

- Figure 9: Europe 3D Reconstruction Technology Industry Revenue Share (%), by Type of Construction Solution 2025 & 2033

- Figure 10: Europe 3D Reconstruction Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe 3D Reconstruction Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe 3D Reconstruction Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe 3D Reconstruction Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific 3D Reconstruction Technology Industry Revenue (Million), by Type of Construction Solution 2025 & 2033

- Figure 15: Asia Pacific 3D Reconstruction Technology Industry Revenue Share (%), by Type of Construction Solution 2025 & 2033

- Figure 16: Asia Pacific 3D Reconstruction Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific 3D Reconstruction Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific 3D Reconstruction Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific 3D Reconstruction Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America 3D Reconstruction Technology Industry Revenue (Million), by Type of Construction Solution 2025 & 2033

- Figure 21: Latin America 3D Reconstruction Technology Industry Revenue Share (%), by Type of Construction Solution 2025 & 2033

- Figure 22: Latin America 3D Reconstruction Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America 3D Reconstruction Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America 3D Reconstruction Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America 3D Reconstruction Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa 3D Reconstruction Technology Industry Revenue (Million), by Type of Construction Solution 2025 & 2033

- Figure 27: Middle East and Africa 3D Reconstruction Technology Industry Revenue Share (%), by Type of Construction Solution 2025 & 2033

- Figure 28: Middle East and Africa 3D Reconstruction Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa 3D Reconstruction Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa 3D Reconstruction Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa 3D Reconstruction Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Type of Construction Solution 2020 & 2033

- Table 2: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Type of Construction Solution 2020 & 2033

- Table 5: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Type of Construction Solution 2020 & 2033

- Table 8: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Type of Construction Solution 2020 & 2033

- Table 11: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Type of Construction Solution 2020 & 2033

- Table 14: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Type of Construction Solution 2020 & 2033

- Table 17: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global 3D Reconstruction Technology Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Reconstruction Technology Industry?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the 3D Reconstruction Technology Industry?

Key companies in the market include PhotoModeler Technologies, Matterport Inc, Faro Technologies Inc, Agisoft LLC, Quorum Technologies Inc *List Not Exhaustive, Pix4D SA, Vi3Dim Technologies, Autodesk Inc, Koninklijke Philips NV, General Electric Company, Intel Corporation.

3. What are the main segments of the 3D Reconstruction Technology Industry?

The market segments include Type of Construction Solution, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of 3D Technology in Maintenance; Technological Advancements in the Field of Cameras.

6. What are the notable trends driving market growth?

3D Reconstruction Software Segment is Expected to Gain the Largest Share.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

September 2022 - 3D reconstruction start-up Preimage announced to raise INR 14 crore ( USD 1.7 million) in a seed funding round led by pi Ventures. The 3D reconstruction start-up will use the funding to scale its product build and boost hiring across business functions. The investment will also build a robust go-to-market product for drone-based mapping and surveying.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Reconstruction Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Reconstruction Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Reconstruction Technology Industry?

To stay informed about further developments, trends, and reports in the 3D Reconstruction Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence