Key Insights

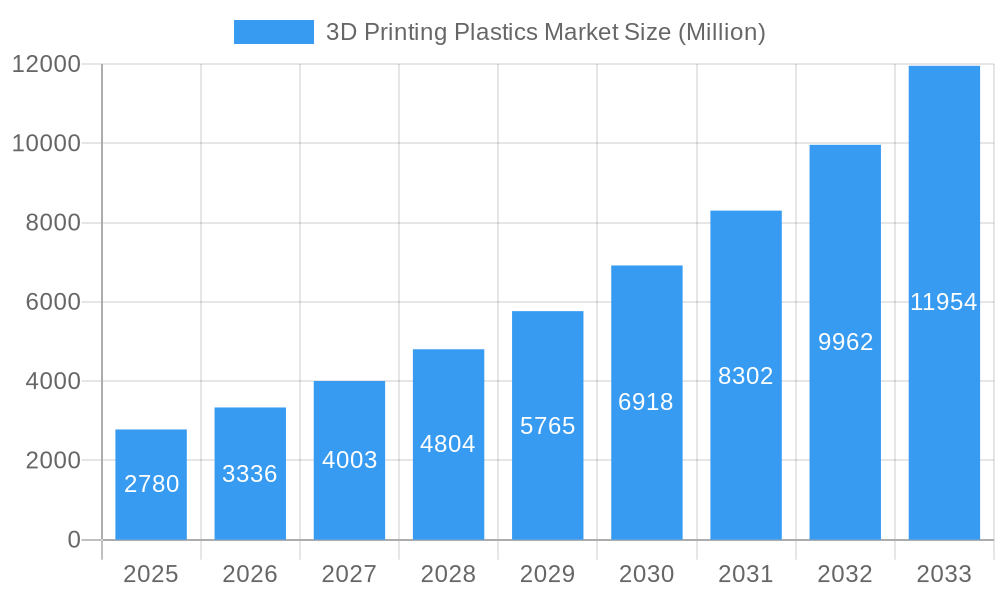

The global 3D printing plastics market is poised for substantial growth, projected to reach USD 2.36 billion in 2025, driven by an impressive compound annual growth rate (CAGR) of 18%. This rapid expansion is fueled by the increasing adoption of additive manufacturing across diverse industries, including automotive, aerospace, healthcare, and construction. The inherent advantages of 3D printing, such as rapid prototyping, mass customization, and the creation of complex geometries, are making plastics an indispensable material in this evolving technological landscape. Key drivers include advancements in polymer science leading to more durable and functional printing materials, alongside a growing demand for lightweight and sustainable components. The automotive sector is leveraging 3D printed plastics for interior components, jigs, and fixtures, while aerospace is utilizing them for intricate parts that reduce weight and improve fuel efficiency. The healthcare industry benefits from the ability to create custom prosthetics, surgical guides, and implants with exceptional precision.

3D Printing Plastics Market Market Size (In Billion)

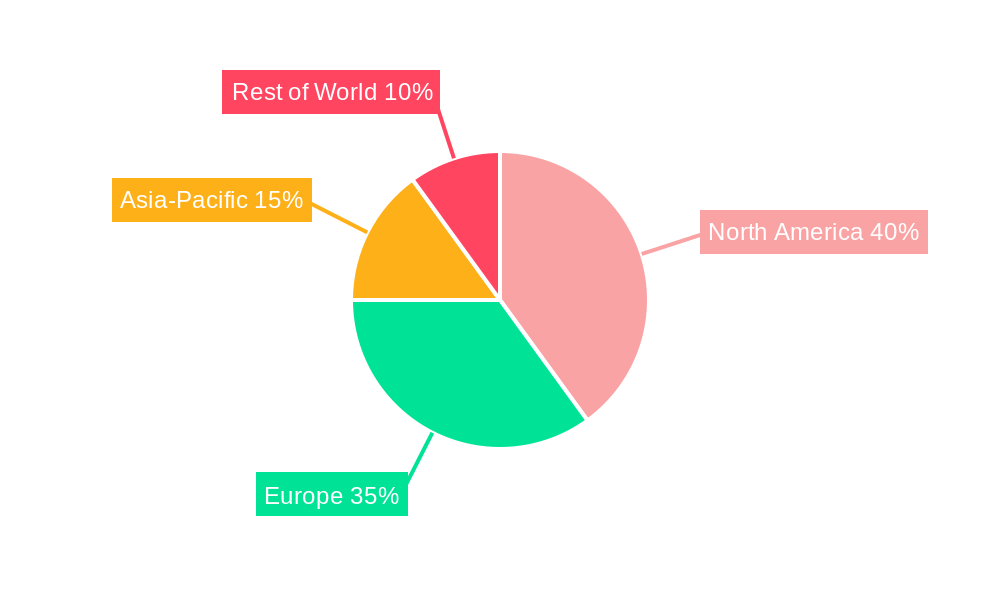

Emerging trends such as the development of advanced composite plastics, biodegradable and recyclable materials, and the integration of AI and machine learning in print optimization are further accelerating market penetration. However, challenges such as the initial cost of high-performance 3D printers and the need for standardized material properties could temper the pace of adoption in certain segments. Despite these restraints, the continuous innovation in material science and printing technologies, coupled with growing investments from key players like Royal DSM, Solvay, and Arkema Group, are expected to propel the market forward. The Asia Pacific region is anticipated to emerge as a significant growth hub due to its burgeoning manufacturing sector and increasing technological investments. North America and Europe, with their established industrial bases and focus on innovation, will continue to be major contributors to market expansion.

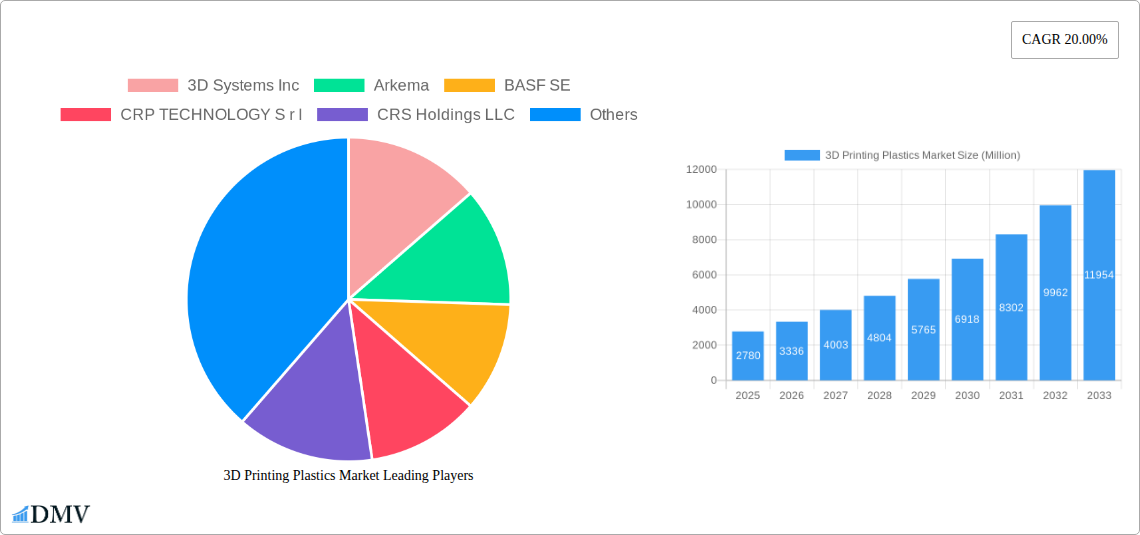

3D Printing Plastics Market Company Market Share

This comprehensive report delves into the dynamic 3D printing plastics market, offering deep insights into its evolution, key players, and future trajectory. Spanning from 2019 to 2033, with a base year of 2025, this study meticulously analyzes market composition, industry trends, and pivotal developments. We forecast a significant growth trajectory, estimated to reach $XX billion by 2033, driven by increasing adoption across diverse end-user industries like automotive, aerospace, healthcare, and construction. Explore market concentration, innovation catalysts, and the impact of regulatory landscapes on the additive manufacturing plastics sector. Our analysis includes an evaluation of substitute products, end-user profiles, and strategic M&A activities, with an estimated M&A deal value of $XX billion.

3D Printing Plastics Market Market Composition & Trends

The 3D printing plastics market exhibits a dynamic composition characterized by evolving material innovations and expanding applications. Market concentration is influenced by a blend of established chemical giants and specialized additive manufacturing material providers. Innovation catalysts are primarily driven by the relentless pursuit of advanced material properties, including enhanced strength, flexibility, thermal resistance, and biocompatibility, crucial for industries like healthcare 3D printing and aerospace additive manufacturing. The regulatory landscape is gradually maturing, with a growing focus on material safety and certification for critical applications. Substitute products, while present in traditional manufacturing, are increasingly being outperformed by the customization and on-demand production capabilities offered by 3D printing plastics. End-user profiles are diversifying, with rapid prototyping evolving into serial production, particularly in sectors demanding lightweight, complex designs. Mergers and acquisitions (M&A) activities, valued at an estimated $XX billion, are strategically reshaping the market, with companies seeking to bolster their material portfolios and expand their technological capabilities.

- Market Share Distribution: Analysis of leading companies' market share and their strategic positioning within the 3D printing filament market and 3D printing resin market.

- Innovation Pipelines: Key focus areas for research and development, including novel polymer formulations and functionalized materials for specialized applications.

- Regulatory Impact: Understanding how evolving standards for materials used in medical devices, automotive components, and aerospace parts influence market entry and growth.

- End-User Application Growth: Tracking the adoption rates of 3D printed plastic parts across automotive, healthcare, consumer goods, and industrial sectors.

- M&A Landscape: Identification of significant acquisitions and partnerships aimed at consolidating market presence and acquiring new technologies in the advanced 3D printing materials space.

3D Printing Plastics Market Industry Evolution

The 3D printing plastics market has witnessed a remarkable industry evolution over the historical period of 2019–2024, with substantial growth projected through the forecast period of 2025–2033. This evolution is intrinsically linked to technological advancements in 3D printing technologies such as fused deposition modeling (FDM), stereolithography (SLA), and selective laser sintering (SLS), which have enabled the wider adoption of plastic-based additive manufacturing. The market has transitioned from a niche sector primarily focused on prototyping to a robust segment supporting serial production and high-value component manufacturing. Shifting consumer demands, particularly for customized products, lightweight designs, and on-demand manufacturing, have significantly propelled the market forward. The estimated compound annual growth rate (CAGR) for the 3D printing plastics market is expected to be robust, reaching approximately XX% during the forecast period, indicating sustained expansion. Growth rates for specific material types, such as high-performance polymers and engineered plastics, are anticipated to outpace general market growth due to their superior mechanical and thermal properties. Adoption metrics, including the number of industrial-grade 3D printers deployed and the volume of plastic materials consumed, are expected to show a significant upward trend, underscoring the increasing integration of additive manufacturing into mainstream production processes. The development of more sophisticated 3D printing software and post-processing techniques further enhances the appeal and utility of 3D printed plastic components, driving further innovation and market penetration.

Leading Regions, Countries, or Segments in 3D Printing Plastics Market

The 3D printing plastics market is experiencing dynamic growth across various regions and segments, with particular dominance observed in North America and Europe. These regions are characterized by significant investments in industrial 3D printing, a strong presence of leading 3D printing material suppliers, and supportive regulatory frameworks that encourage innovation.

Material Segment Dominance: Within the Material: Plastics segment, high-performance polymers like PEEK, ULTEM, and specialized nylons are driving significant value, particularly for demanding applications in aerospace and healthcare.

- Key Drivers: Growing demand for lightweight and durable components in the aerospace industry, stringent requirements for biocompatible materials in healthcare, and the increasing use of 3D printed medical devices and implants.

- Investment Trends: Substantial R&D funding and venture capital investments are directed towards developing advanced plastic formulations with enhanced mechanical, thermal, and chemical resistance properties.

- Regulatory Support: Favorable regulations and certifications for materials used in critical applications are accelerating adoption.

End-User Industry Dominance: The Automotive industry stands out as a leading end-user industry for 3D printed plastics, driven by the need for rapid prototyping, tooling, and the production of lightweight, customized interior and exterior components.

- Key Drivers: The automotive sector's push towards electric vehicles (EVs) and autonomous driving, which necessitates innovative designs and complex parts, directly benefits from the flexibility of additive manufacturing. The ability to produce intricate designs and on-demand parts for customization and low-volume production runs is a significant advantage.

- Investment Trends: Automotive manufacturers are investing heavily in in-house 3D printing capabilities and collaborating with material providers to develop bespoke plastic solutions for their evolving vehicle architectures.

- Regulatory Support: Evolving automotive standards and the demand for sustainable manufacturing practices are indirectly supporting the adoption of 3D printing, which can reduce waste and enable more efficient production processes.

The Aerospace and Defense sector also represents a crucial growth area, leveraging 3D printing plastics for prototyping, tooling, and the production of functional end-use parts due to the high strength-to-weight ratio and complex geometries achievable. The Healthcare industry continues to be a significant adopter, especially for patient-specific implants, surgical guides, and anatomical models. The Construction and Architecture sector, while still in nascent stages of adoption for plastics, is showing increasing interest in applications for formwork, bespoke architectural elements, and façade components.

3D Printing Plastics Market Product Innovations

Product innovations in the 3D printing plastics market are centered on enhancing material performance and expanding application possibilities. This includes the development of advanced photopolymer resins for stereolithography (SLA) and digital light processing (DLP) offering superior toughness and heat resistance, ideal for durable end-use parts. For fused deposition modeling (FDM), novel filament formulations are emerging with improved printability, increased tensile strength, and enhanced chemical resistance, making them suitable for functional prototypes and end-use components in demanding environments. Furthermore, the trend towards sustainable and bio-based 3D printing plastics is gaining momentum, addressing environmental concerns and appealing to eco-conscious industries.

Propelling Factors for 3D Printing Plastics Market Growth

The 3D printing plastics market is propelled by several key factors. Technological advancements in 3D printing machines and materials continue to enhance precision, speed, and material properties, making additive manufacturing a viable solution for serial production. The increasing demand for customization and on-demand manufacturing across industries like automotive, healthcare, and consumer goods is a significant driver, allowing for personalized products and reduced inventory. Government initiatives and industry-specific research funding are fostering innovation and adoption of 3D printing applications. The growing emphasis on lightweight materials for fuel efficiency in aerospace and automotive sectors further bolsters the demand for advanced plastic materials.

Obstacles in the 3D Printing Plastics Market Market

Despite robust growth, the 3D printing plastics market faces several obstacles. High initial investment costs for industrial-grade 3D printers and specialized materials can be a barrier for small and medium-sized enterprises. Scalability for mass production remains a challenge compared to traditional manufacturing methods, although this is improving rapidly. Regulatory hurdles, particularly in highly regulated industries like healthcare and aerospace, require extensive testing and certification for 3D printed plastic parts. Supply chain disruptions and the availability of consistent, high-quality 3D printing feedstock can also impact production timelines. Furthermore, the need for skilled labor to operate and maintain 3D printing equipment and optimize designs presents a workforce development challenge.

Future Opportunities in 3D Printing Plastics Market

Emerging opportunities in the 3D printing plastics market are abundant. The expansion of additive manufacturing into new sectors such as electronics and advanced textiles presents significant growth potential. The development of smart and functional 3D printing materials with embedded sensors or conductive properties will open new avenues for innovation. Increased focus on circular economy principles and the development of recyclable and biodegradable 3D printing plastics will cater to growing environmental concerns. The growing demand for personalized and on-demand manufacturing in emerging economies also represents a substantial untapped market. Advancements in multi-material printing capabilities will enable the creation of more complex and integrated plastic components.

Major Players in the 3D Printing Plastics Market Ecosystem

- Royal DSM N V

- Hoganas AB

- Solvay

- Ultimaker B V

- EnvisionTEC Inc

- Sandvik AB

- Arkema Group

- EOS GmbH Electro Optical Systems

- 3D Systems Inc

- LPW Technology Ltd

- CRP Technology S r l

- General Electric Company

- Stratasys Ltd

Key Developments in 3D Printing Plastics Market Industry

- 2023/04: Royal DSM N.V. launches a new range of high-performance engineering thermoplastics for demanding industrial applications, enhancing the 3D printing polymer portfolio.

- 2023/02: Stratasys Ltd. acquires a leading additive manufacturing solutions provider, expanding its capabilities in 3D printing resins and systems.

- 2022/11: Solvay introduces a new carbon fiber-reinforced composite material for additive manufacturing, offering superior strength and stiffness for aerospace components.

- 2022/09: Ultimaker B.V. announces advancements in its 3D printing filament technology, improving print reliability and material performance for industrial users.

- 2022/07: EOS GmbH Electro Optical Systems introduces a new generation of selective laser sintering (SLS) machines optimized for processing advanced 3D printing plastics.

- 2022/05: Arkema Group expands its offerings of high-performance polymers for 3D printing applications, focusing on sustainability and recyclability.

- 2021/12: General Electric Company showcases innovative 3D printed plastic parts for its aerospace engines, highlighting the material's growing role in critical applications.

- 2021/10: 3D Systems Inc. announces enhanced material compatibility and processing for its SLA and SLS platforms, broadening the scope for 3D printing polymer usage.

Strategic 3D Printing Plastics Market Market Forecast

The strategic 3D printing plastics market forecast indicates a period of accelerated growth driven by ongoing technological advancements and expanding application frontiers. The continuous development of novel polymer formulations with enhanced mechanical, thermal, and functional properties will unlock new possibilities across industries. The increasing adoption of additive manufacturing for production parts will transition the market from primarily prototyping to significant serial manufacturing. Investment in sustainable and bio-based plastics is expected to grow, aligning with global environmental initiatives. Emerging markets and underserved sectors present substantial opportunities for market penetration. The synergistic advancement of 3D printing hardware, software, and materials will collectively propel the market towards an estimated $XX billion valuation by 2033, solidifying its position as a cornerstone of modern manufacturing.

3D Printing Plastics Market Segmentation

-

1. Material

- 1.1. Plastics

- 1.2. Ceramics

- 1.3. Metals

- 1.4. Other Material Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Healthcare

- 2.4. Construction and Architecture

- 2.5. Other End-user Industries

3D Printing Plastics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

3D Printing Plastics Market Regional Market Share

Geographic Coverage of 3D Printing Plastics Market

3D Printing Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage in Manufacturing Applications; Mass Customization Associated with 3D Printing; Government Support for Research and Development

- 3.3. Market Restrains

- 3.3.1. High Capital Investment Requirement

- 3.4. Market Trends

- 3.4.1. Increasing Applications in the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastics

- 5.1.2. Ceramics

- 5.1.3. Metals

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Healthcare

- 5.2.4. Construction and Architecture

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastics

- 6.1.2. Ceramics

- 6.1.3. Metals

- 6.1.4. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Aerospace and Defense

- 6.2.3. Healthcare

- 6.2.4. Construction and Architecture

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastics

- 7.1.2. Ceramics

- 7.1.3. Metals

- 7.1.4. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Aerospace and Defense

- 7.2.3. Healthcare

- 7.2.4. Construction and Architecture

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastics

- 8.1.2. Ceramics

- 8.1.3. Metals

- 8.1.4. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Aerospace and Defense

- 8.2.3. Healthcare

- 8.2.4. Construction and Architecture

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastics

- 9.1.2. Ceramics

- 9.1.3. Metals

- 9.1.4. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Aerospace and Defense

- 9.2.3. Healthcare

- 9.2.4. Construction and Architecture

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastics

- 10.1.2. Ceramics

- 10.1.3. Metals

- 10.1.4. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Aerospace and Defense

- 10.2.3. Healthcare

- 10.2.4. Construction and Architecture

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Royal DSM N V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hoganas AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ultimaker B V *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EnvisionTEC Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sandvik AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arkema Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EOS GmbH Electro Optical Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3D Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LPW Technology Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CRP Technology S r l

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 General Electric Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Stratasys Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Royal DSM N V

List of Figures

- Figure 1: Global 3D Printing Plastics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America 3D Printing Plastics Market Revenue (undefined), by Material 2025 & 2033

- Figure 3: North America 3D Printing Plastics Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe 3D Printing Plastics Market Revenue (undefined), by Material 2025 & 2033

- Figure 9: Europe 3D Printing Plastics Market Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific 3D Printing Plastics Market Revenue (undefined), by Material 2025 & 2033

- Figure 15: Asia Pacific 3D Printing Plastics Market Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America 3D Printing Plastics Market Revenue (undefined), by Material 2025 & 2033

- Figure 21: Latin America 3D Printing Plastics Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Latin America 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Latin America 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa 3D Printing Plastics Market Revenue (undefined), by Material 2025 & 2033

- Figure 27: Middle East and Africa 3D Printing Plastics Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global 3D Printing Plastics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 5: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 8: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 11: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 14: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 17: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing Plastics Market?

The projected CAGR is approximately 18%.

2. Which companies are prominent players in the 3D Printing Plastics Market?

Key companies in the market include Royal DSM N V, Hoganas AB, Solvay, Ultimaker B V *List Not Exhaustive, EnvisionTEC Inc, Sandvik AB, Arkema Group, EOS GmbH Electro Optical Systems, 3D Systems Inc, LPW Technology Ltd, CRP Technology S r l, General Electric Company, Stratasys Ltd.

3. What are the main segments of the 3D Printing Plastics Market?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage in Manufacturing Applications; Mass Customization Associated with 3D Printing; Government Support for Research and Development.

6. What are the notable trends driving market growth?

Increasing Applications in the Automotive Industry.

7. Are there any restraints impacting market growth?

High Capital Investment Requirement.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Printing Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Printing Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Printing Plastics Market?

To stay informed about further developments, trends, and reports in the 3D Printing Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence