Key Insights

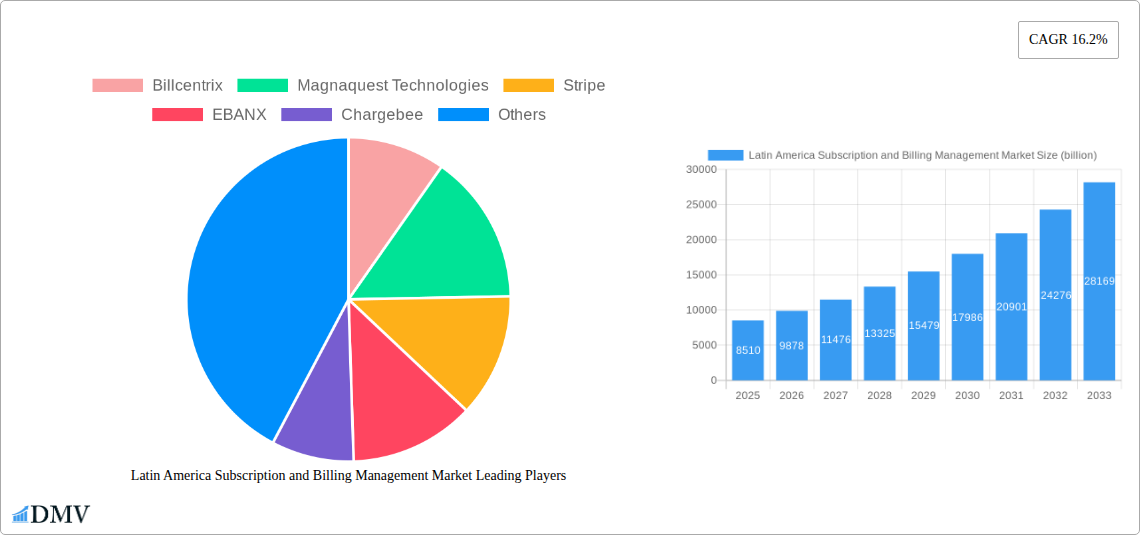

The Latin America Subscription and Billing Management Market is poised for substantial growth, projected to reach USD 8.51 billion in 2025. This expansion is fueled by a robust CAGR of 16.2%, indicating a dynamic and rapidly evolving landscape. Key drivers for this surge include the increasing adoption of digital services across various sectors, the growing preference for subscription-based models over traditional one-time purchases, and the imperative for businesses to streamline complex billing processes and enhance customer experience. Small and Medium Enterprises (SMEs) are increasingly leveraging these solutions to compete with larger players, while large enterprises are seeking sophisticated platforms for scalability and revenue optimization. The BFSI, Retail & E-commerce, and IT & Telecommunication sectors are leading the charge, recognizing the critical role of efficient subscription and billing management in customer retention and recurring revenue generation. Emerging economies within Latin America, such as Brazil, Mexico, and Colombia, are demonstrating particularly strong adoption rates, driven by growing internet penetration and a burgeoning digital consumer base.

Latin America Subscription and Billing Management Market Market Size (In Billion)

Further analysis reveals that the market is experiencing significant trends towards cloud-based deployment, offering greater flexibility, scalability, and cost-effectiveness compared to on-premise solutions. This shift is particularly attractive for SMEs with limited IT resources. Emerging trends also include the integration of AI and machine learning for intelligent pricing, churn prediction, and personalized customer journeys. While the market benefits from strong demand, potential restraints such as data security concerns, regulatory complexities, and the need for skilled IT professionals could pose challenges. However, the continuous innovation from key players like Stripe, Chargebee, and Oracle, alongside regional specialists like EBANX and Kushki, is actively addressing these concerns and driving the market forward, promising a transformative period for subscription and billing management across Latin America.

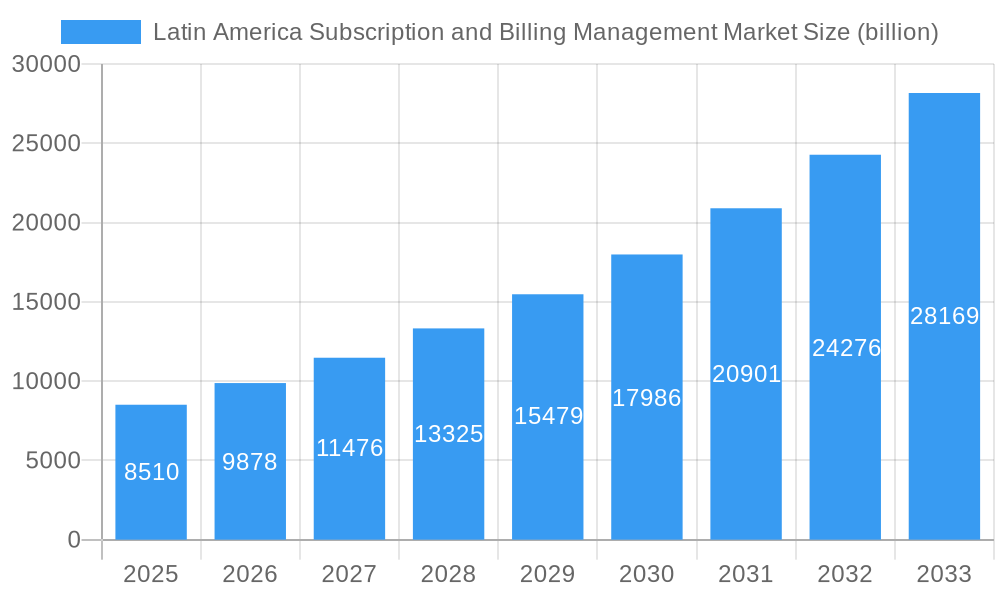

Latin America Subscription and Billing Management Market Company Market Share

Latin America Subscription and Billing Management Market Market Composition & Trends

The Latin America Subscription and Billing Management Market is characterized by a dynamic and evolving landscape, driven by increasing digitalization and evolving consumer preferences for subscription-based services. Market concentration is observed among key players offering comprehensive solutions, with a growing emphasis on recurring revenue models across diverse industries. Innovation catalysts include the widespread adoption of cloud technologies, the demand for automated billing processes, and the need for robust fraud prevention mechanisms. The regulatory environment is gradually maturing, with a focus on data privacy and consumer protection, impacting how subscription services are offered and managed. Substitute products, such as traditional one-time purchase models, are steadily losing ground as subscription services offer greater convenience and value. End-user profiles range from small and medium enterprises seeking cost-effective and scalable solutions to large enterprises requiring sophisticated, integrated billing platforms. Mergers and acquisitions (M&A) activities are on the rise as companies look to expand their market reach and enhance their product portfolios. For instance, the acquisition of Telxius's infrastructure by American Tower for USD 9.4 billion in January 2021, while not directly billing management, signifies significant investment and infrastructure growth that will underpin digital service expansion. The market share distribution is tilting towards cloud-based solutions, which offer greater flexibility and lower upfront costs. The overall market value is projected to reach XXX billion by 2033.

- Market Concentration: Dominated by a mix of established global players and agile local providers.

- Innovation Catalysts: Cloud adoption, AI-powered analytics, enhanced customer experience features, and real-time payment processing.

- Regulatory Landscape: Growing focus on data protection, PCI DSS compliance, and consumer rights related to subscriptions.

- Substitute Products: Traditional transactional sales, pay-per-use models in certain sectors.

- End-User Profiles: Diverse, from startups to large corporations across BFSI, Retail & E-Commerce, IT, and Media.

- M&A Activities: Increasing, aimed at market consolidation and technological integration.

- Market Share Distribution: Significant shift towards cloud deployment models.

Latin America Subscription and Billing Management Market Industry Evolution

The Latin America Subscription and Billing Management Market has undergone a significant transformation over the study period (2019–2033), evolving from nascent adoption to a mature and indispensable component of the digital economy. In its historical phase (2019–2024), the market witnessed early adoption driven by the rise of Software-as-a-Service (SaaS) and the growing popularity of digital content streaming. Small and medium enterprises (SMEs) were early adopters, seeking cost-effective ways to manage recurring revenue and streamline their operations. Large enterprises, initially more cautious, began to invest in robust billing systems to manage complex subscription models and improve customer retention. The base year (2025) marks a pivotal point where the market's growth trajectory is firmly established, fueled by increased internet penetration, smartphone usage, and a growing acceptance of subscription models across a wider array of consumer goods and services.

Technological advancements have been a primary driver of this evolution. The migration from on-premise solutions to cloud-based platforms has accelerated, offering unparalleled scalability, flexibility, and reduced IT overhead. This shift is evident in the strategic decision by Amdocs Media to migrate its Vindicia subscription management portfolio to Amazon Web Services (AWS) in May 2021. This move underscores the industry's commitment to leveraging cloud infrastructure for enhanced agility and growth, enabling subscription businesses to build stronger customer relationships and achieve sustainable long-term expansion. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into billing management systems is revolutionizing the market. These technologies are enabling predictive analytics for churn prevention, personalized pricing strategies, and automated revenue recognition, leading to more efficient and profitable operations.

Shifting consumer demands have also played a crucial role. Latin American consumers are increasingly valuing convenience, personalized experiences, and flexible payment options. Subscription models, by their nature, cater to these demands by offering predictable costs, access to a continuous stream of value, and the ability to tailor services to individual needs. This has propelled the growth of subscription services in sectors like media and entertainment, retail and e-commerce, and even in the provision of essential services. The market's growth rates have been consistently strong, with an estimated compound annual growth rate (CAGR) of XX% during the forecast period (2025–2033). Adoption metrics show a clear upward trend, with over XX% of businesses in key sectors now utilizing some form of subscription management software by 2025. The continued expansion of digital infrastructure, such as the strategic investments in telecommunications sites across the region, further solidifies the foundation for sustained growth in subscription and billing management. The market is poised to reach an estimated XXX billion by 2033, reflecting its critical role in the modern digital economy.

Leading Regions, Countries, or Segments in Latin America Subscription and Billing Management Market

The Latin America Subscription and Billing Management Market exhibits distinct patterns of dominance across its various segments, with the Cloud deployment model and the Retail and E-Commerce end-user industry emerging as significant leaders. The dominance of Cloud deployment is a testament to the region's increasing embrace of digital transformation and its inherent advantages in terms of scalability, cost-effectiveness, and accessibility for businesses of all sizes.

- Deployment: Cloud: This segment is witnessing robust growth, driven by its ability to provide flexible and scalable solutions that adapt to fluctuating business demands. Cloud-based platforms offer lower upfront investment compared to on-premise solutions, making them particularly attractive to SMEs in Latin America. The ease of integration with other cloud services and the availability of advanced features like AI-powered analytics and real-time reporting further solidify its leadership. The rapid expansion of internet infrastructure and increasing digital literacy across the region are also significant contributors to the widespread adoption of cloud-based subscription and billing management.

- End Users: Retail and E-Commerce: The burgeoning e-commerce sector in Latin America is a primary growth engine for subscription and billing management solutions. As online retailers increasingly adopt subscription boxes, curated product deliveries, and membership models, the demand for sophisticated billing and payment processing becomes paramount. These businesses require platforms that can handle a high volume of transactions, manage recurring payments, offer personalized customer experiences, and provide detailed analytics to optimize sales and customer retention. The convenience and variety offered by subscription services align perfectly with evolving consumer shopping habits in the region.

While Cloud deployment and Retail & E-Commerce lead, other segments are also experiencing substantial growth and contributing to the overall market dynamism.

- Organization: Large Enterprises: These organizations are adopting advanced subscription management solutions to handle complex billing scenarios, global compliance requirements, and to foster deeper customer relationships through personalized service offerings. Their investments often drive innovation and push the boundaries of what subscription management platforms can achieve.

- End Users: BFSI: The financial sector is increasingly leveraging subscription models for various services, from wealth management to insurance. Subscription billing platforms are crucial for managing these recurring revenue streams securely and efficiently, ensuring compliance with stringent financial regulations.

- End Users: IT and Telecommunication: This sector has been an early adopter of subscription models, and the demand for sophisticated billing and subscription management continues to grow with the expansion of cloud services, managed IT solutions, and telecommunication packages.

- Deployment: On-premise: While experiencing slower growth compared to cloud, on-premise solutions remain relevant for large enterprises with specific security or integration requirements, offering greater control over their data and infrastructure.

The market forecast indicates a sustained upward trend for both Cloud deployment and the Retail and E-Commerce sector, driven by continued digitalization, evolving consumer behavior, and the inherent benefits these segments offer in the Latin American context. The combined market value for these leading segments is projected to constitute a significant portion of the XXX billion overall market by 2033.

Latin America Subscription and Billing Management Market Product Innovations

Product innovations in the Latin America Subscription and Billing Management Market are primarily focused on enhancing customer experience, streamlining operational efficiency, and enabling greater personalization. Key advancements include the integration of AI and machine learning for predictive analytics, enabling businesses to forecast churn rates, optimize pricing, and personalize offers with remarkable accuracy. Real-time payment processing and multi-currency support are crucial for a diverse region like Latin America, ensuring seamless transactions for both businesses and consumers. Furthermore, the development of robust self-service portals and intuitive customer dashboards empowers users to manage their subscriptions, update payment details, and access support independently, significantly reducing support overhead. The introduction of flexible billing models, such as usage-based pricing and tiered subscriptions, caters to the diverse needs of businesses and their customers, driving adoption and revenue growth.

Propelling Factors for Latin America Subscription and Billing Management Market Growth

The Latin America Subscription and Billing Management Market is propelled by several significant factors. The increasing adoption of digital business models across all industries, driven by evolving consumer preferences for convenience and value, is a primary catalyst. Rapid digitalization and internet penetration in the region are expanding the addressable market for subscription services. Technological advancements, including AI, machine learning, and cloud computing, are enabling more sophisticated, scalable, and cost-effective billing solutions. Furthermore, government initiatives promoting digital transformation and financial inclusion are creating a more conducive environment for the growth of subscription-based economies. The economic growth and rising disposable income in certain Latin American countries are also contributing to increased consumer spending on subscription services.

Obstacles in the Latin America Subscription and Billing Management Market Market

Despite its robust growth, the Latin America Subscription and Billing Management Market faces several obstacles. Regulatory complexities and varying compliance requirements across different countries can pose challenges for businesses operating regionally. Cybersecurity concerns and data privacy regulations require significant investment and robust infrastructure to ensure the protection of sensitive customer information. Economic volatility and currency fluctuations in some Latin American nations can impact consumer spending power and the profitability of subscription-based businesses. Low credit card penetration and a preference for cash-based transactions in certain segments can hinder the adoption of purely digital subscription models. Finally, fierce competition and the need for continuous innovation demand significant resources and strategic planning from market players.

Future Opportunities in Latin America Subscription and Billing Management Market

The Latin America Subscription and Billing Management Market presents numerous future opportunities. The expansion of subscription models into new verticals, such as healthcare, education, and home services, offers significant untapped potential. The growing adoption of IoT devices and the increasing demand for data-driven insights will create opportunities for usage-based billing and personalized subscription packages. The continued development of FinTech solutions and alternative payment methods will further streamline transactions and enhance customer experience. Furthermore, the untapped potential of smaller economies within Latin America and the increasing demand for localized and culturally relevant subscription services present substantial growth avenues for agile and adaptive market players.

Major Players in the Latin America Subscription and Billing Management Market Ecosystem

- Billcentrix

- Magnaquest Technologies

- Stripe

- EBANX

- Chargebee

- Cloudmore

- SAP

- Kushki

- Oracle

- OneBill

- Vindicia

Key Developments in Latin America Subscription and Billing Management Market Industry

- April 2022: Stripe, a financial infrastructure platform for businesses, announced the Stripe Partner Ecosystem, a new partnership program with premier companies whose services help Stripe users succeed in the digital economy. Accenture, Amazon Web Services, IBM, Merkle, MuleSoft, ServiceNow, Slalom, Snowflake, and WPP are among the Stripe Partner Ecosystem members.

- May 2021: Amdocs announced the migration of Amdocs Media's Vindicia subscription management portfolio to Amazon Web Services, which will provide subscription-based businesses with enhanced flexibility, scalability, and growth (AWS). As part of the deal, Amdocs provides customers access to its cloud-based, microservices architecture running on AWS, allowing subscription businesses to establish an engaged customer base and build long-term subscription business growth.

- January 2021: American Tower has agreed to buy 31,000 communications sites in Argentina, Brazil, Chile, Germany, Peru, and Spain from Telefónica's infrastructure company Telxius for USD 9.4 billion.

Strategic Latin America Subscription and Billing Management Market Market Forecast

The strategic forecast for the Latin America Subscription and Billing Management Market is overwhelmingly positive, driven by sustained economic digitalization and evolving consumer behavior. The increasing integration of advanced technologies like AI and machine learning will empower businesses with unprecedented data-driven insights for churn prediction and personalized service delivery, further solidifying the value proposition of subscription models. The expansion into new, untapped industry verticals and the growing preference for flexible payment solutions will fuel market penetration. As the region's digital infrastructure continues to mature, and regulatory frameworks adapt to support digital commerce, the market is poised for robust and sustained growth, reaching an estimated XXX billion by 2033, representing a significant opportunity for businesses to capitalize on the recurring revenue economy.

Latin America Subscription and Billing Management Market Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Organization

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. End users

- 3.1. BFSI

- 3.2. Retail and E-Commerce

- 3.3. IT and Telecommunication

- 3.4. Public Sector and Utilities

- 3.5. Media and Entertainment

- 3.6. Other End-user Industries

Latin America Subscription and Billing Management Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Subscription and Billing Management Market Regional Market Share

Geographic Coverage of Latin America Subscription and Billing Management Market

Latin America Subscription and Billing Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Adoption of Subscription business models; Increasing need for Updating Legacy Systems

- 3.3. Market Restrains

- 3.3.1. High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Significant Adoption Is Expected in the Media and Entertainment Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Subscription and Billing Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Organization

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End users

- 5.3.1. BFSI

- 5.3.2. Retail and E-Commerce

- 5.3.3. IT and Telecommunication

- 5.3.4. Public Sector and Utilities

- 5.3.5. Media and Entertainment

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Billcentrix

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Magnaquest Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stripe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EBANX

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chargebee

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cloudmore

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kushki

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OneBill

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vindicia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Billcentrix

List of Figures

- Figure 1: Latin America Subscription and Billing Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Subscription and Billing Management Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Subscription and Billing Management Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Latin America Subscription and Billing Management Market Revenue billion Forecast, by Organization 2020 & 2033

- Table 3: Latin America Subscription and Billing Management Market Revenue billion Forecast, by End users 2020 & 2033

- Table 4: Latin America Subscription and Billing Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Subscription and Billing Management Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 6: Latin America Subscription and Billing Management Market Revenue billion Forecast, by Organization 2020 & 2033

- Table 7: Latin America Subscription and Billing Management Market Revenue billion Forecast, by End users 2020 & 2033

- Table 8: Latin America Subscription and Billing Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Subscription and Billing Management Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Subscription and Billing Management Market?

The projected CAGR is approximately 16.2%.

2. Which companies are prominent players in the Latin America Subscription and Billing Management Market?

Key companies in the market include Billcentrix, Magnaquest Technologies, Stripe, EBANX, Chargebee, Cloudmore, SAP, Kushki, Oracle, OneBill, Vindicia.

3. What are the main segments of the Latin America Subscription and Billing Management Market?

The market segments include Deployment, Organization, End users.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Adoption of Subscription business models; Increasing need for Updating Legacy Systems.

6. What are the notable trends driving market growth?

Significant Adoption Is Expected in the Media and Entertainment Industry.

7. Are there any restraints impacting market growth?

High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

April 2022 - Stripe, a financial infrastructure platform for businesses, has announced the Stripe Partner Ecosystem, a new partnership program with premier companies whose services help Stripe users succeed in the digital economy. Accenture, Amazon Web Services, IBM, Merkle, MuleSoft, ServiceNow, Slalom, Snowflake, and WPP are among the Stripe Partner Ecosystem members.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Subscription and Billing Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Subscription and Billing Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Subscription and Billing Management Market?

To stay informed about further developments, trends, and reports in the Latin America Subscription and Billing Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence