Key Insights

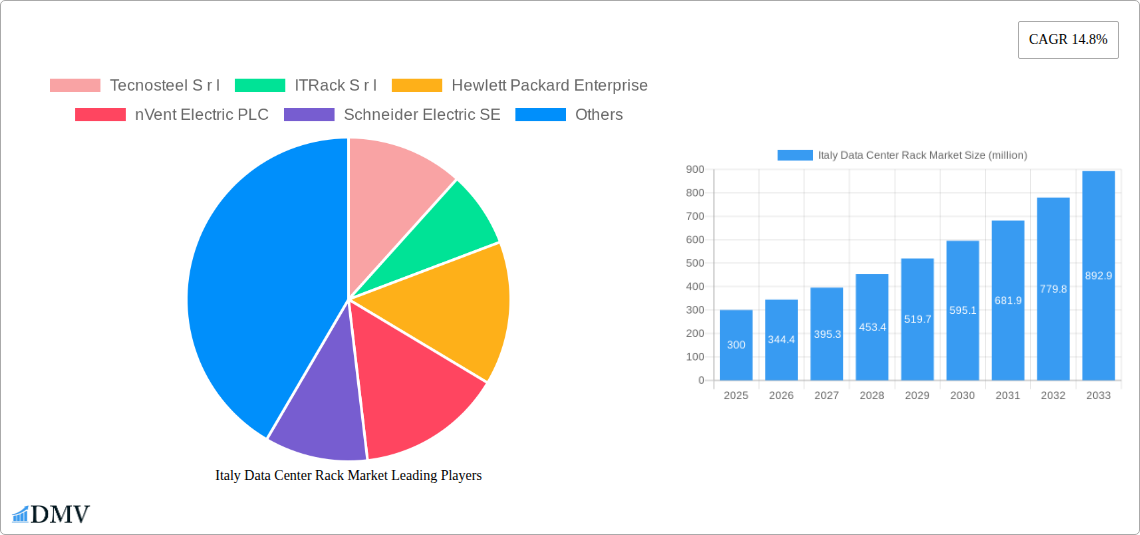

The Italian data center rack market is poised for substantial growth, projected to reach a market size of €300 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 14.8% over the forecast period of 2025-2033. This robust expansion is primarily driven by the escalating demand for robust IT infrastructure to support the burgeoning digital economy. Key drivers include the continuous expansion of cloud computing services, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) which necessitate high-density computing power, and the ongoing digital transformation initiatives across various sectors. Furthermore, the proliferation of 5G networks is creating a need for more distributed and localized data processing, thereby boosting the demand for compact and efficient rack solutions, particularly in the Quarter Rack and Half Rack segments.

Italy Data Center Rack Market Market Size (In Million)

Several key trends are shaping the Italian data center rack landscape. The market is witnessing a significant shift towards intelligent and modular rack solutions that offer enhanced cooling, power management, and physical security features. Companies are increasingly seeking flexible and scalable infrastructure to adapt to rapidly evolving technological needs. The IT & Telecommunication, BFSI, and Government sectors are emerging as the primary end-users, accounting for a substantial portion of the market share due to their extensive data processing and storage requirements. While the market enjoys strong growth, potential restraints include rising operational costs associated with advanced cooling and power infrastructure, and the ongoing need for skilled labor to manage and maintain these sophisticated facilities. Nonetheless, the strategic importance of data localization and the growing emphasis on data sovereignty are expected to further fuel investments in domestic data center capacity, solidifying the positive growth trajectory for the Italian data center rack market.

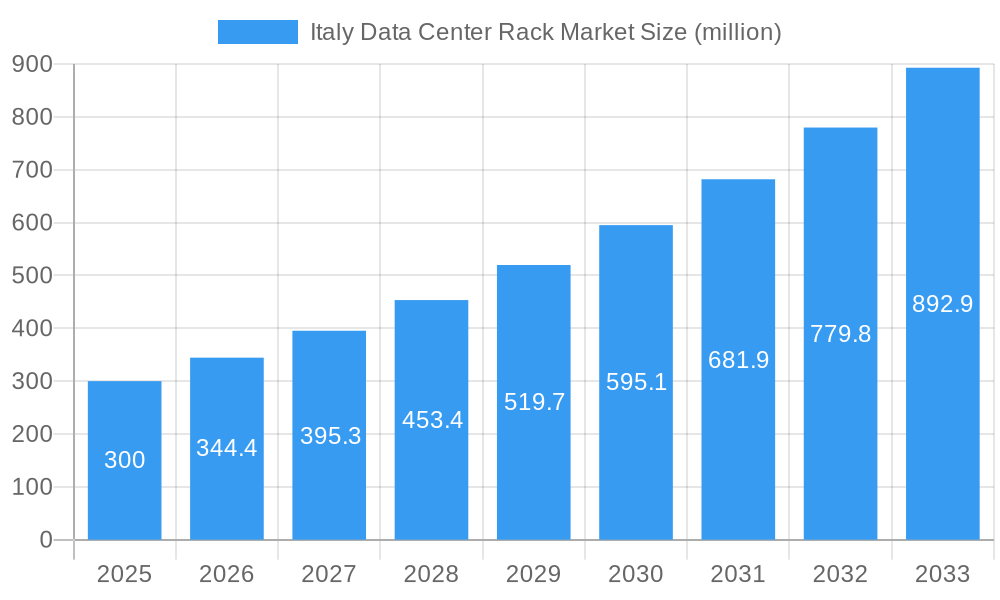

Italy Data Center Rack Market Company Market Share

This in-depth report provides a strategic analysis of the Italy Data Center Rack Market, offering crucial insights into market dynamics, growth trajectories, and future potential. Covering the study period of 2019–2033, with a base year of 2025, this research meticulously examines market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, opportunities, and key players. Stakeholders seeking to understand the Italian data center infrastructure, colocation market, and server rack solutions will find this report indispensable for informed decision-making. The report leverages precise data for the estimated year 2025 and provides an extensive forecast period from 2025–2033, building upon the historical period of 2019–2024.

Italy Data Center Rack Market Market Composition & Trends

The Italy Data Center Rack Market exhibits a dynamic composition, characterized by significant investment in hyperscale and enterprise data centers, driving demand for robust data center racks and enclosures. Market concentration is influenced by a blend of established global players and emerging local manufacturers, each vying for market share through innovation and strategic partnerships. Catalysts for innovation include the increasing adoption of AI, IoT, and big data analytics, necessitating higher rack density and advanced cooling solutions. The regulatory landscape, while evolving to support digital transformation, presents opportunities and challenges for market participants. Substitute products, such as pre-fabricated modular data centers, are gaining traction but have yet to displace traditional rack deployments significantly. End-user profiles are diverse, with IT & Telecommunication and BFSI sectors leading in data center rack procurement, followed by government initiatives and the burgeoning Media & Entertainment industry. Merger and acquisition (M&A) activities, valued at approximately EUR 1,200 million in the historical period, are shaping market consolidation, with key players seeking to expand their product portfolios and geographical reach. The market share distribution indicates a competitive environment, with leading companies capturing substantial portions through specialized offerings and integrated solutions.

Italy Data Center Rack Market Industry Evolution

The evolution of the Italy Data Center Rack Market is a testament to the nation's accelerating digital transformation and its strategic importance as a European data hub. Over the study period 2019–2033, the market has witnessed a significant upward trajectory, propelled by sustained growth in data consumption, the proliferation of cloud computing, and the ongoing digitalization of businesses across various sectors. The historical period (2019–2024) saw an average annual growth rate of approximately 8.5%, fueled by initial investments in modernizing existing data center facilities and constructing new ones. Technological advancements have been pivotal, with a noticeable shift towards higher density racks capable of housing more powerful and compact IT equipment. This includes the increasing adoption of advanced cooling technologies integrated into rack designs to manage the heat generated by high-performance computing.

The estimated year 2025 is projected to see the market continue its robust expansion, with an estimated compound annual growth rate (CAGR) of 9.2% during the forecast period 2025–2033. This sustained growth is underpinned by several factors. Firstly, the increasing demand for cloud services from Italian enterprises, driven by the need for scalability, resilience, and cost-efficiency, directly translates to a higher demand for data center racks to house this expanding infrastructure. Secondly, the Italian government's strategic focus on fostering a digital economy, including initiatives related to data sovereignty and cybersecurity, is encouraging significant investments in local data center capacity.

Shifting consumer demands are also playing a crucial role. The surge in demand for high-definition streaming, online gaming, and the continuous growth of e-commerce necessitates lower latency and higher bandwidth, compelling organizations to invest in more sophisticated and efficient data center infrastructure. This translates to a growing preference for full rack and half rack solutions that offer greater capacity and flexibility. Furthermore, the development of edge computing solutions is creating a niche demand for smaller form factor racks, though their impact on overall market volume remains incremental compared to larger deployments. The industry's evolution is also marked by a greater emphasis on sustainability, with manufacturers developing energy-efficient server rack designs and integrated power and cooling solutions to reduce the environmental footprint of data centers. This ongoing evolution ensures that the Italy Data Center Rack Market remains a dynamic and critical component of the nation's technological advancement.

Leading Regions, Countries, or Segments in Italy Data Center Rack Market

The Italy Data Center Rack Market demonstrates clear leadership within specific segments and geographical regions, driven by robust investment trends and targeted regulatory support.

Rack Size Dominance:

Full Rack: This segment holds the dominant market share, accounting for an estimated 55% of the total market value in 2025.

- Drivers: Large enterprises, cloud providers, and colocation facilities require the extensive capacity and scalability offered by full racks to house their growing server infrastructure and meet the demands of cloud services and hyperscale operations. The increasing density of IT equipment also favors the robust support and cooling capabilities of full racks.

- Analysis: The insatiable demand for data storage and processing power, especially from the IT & Telecommunication and BFSI sectors, directly fuels the adoption of full racks. Investments in hyperscale data centers, as highlighted by the Microsoft and Aruba developments, are predominantly utilizing full rack configurations. The inherent modularity of full racks allows for efficient expansion and customization, making them the preferred choice for large-scale deployments.

Half Rack: The second-largest segment, capturing approximately 30% of the market value in 2025.

- Drivers: Medium-sized enterprises, organizations with specific departmental needs, and colocation providers looking for flexible deployment options often opt for half racks. They offer a balance between capacity and space efficiency, making them suitable for a wide range of applications.

- Analysis: Half racks provide a cost-effective solution for organizations that do not require the full capacity of a standard rack but still need significant space for their IT equipment. They are also popular for supporting specific workloads or for edge data center deployments where space is a constraint.

Quarter Rack: This segment represents the remaining 15% of the market value in 2025.

- Drivers: Smaller businesses, specific research and development facilities, and niche applications requiring limited server capacity typically utilize quarter racks. Their compact footprint is ideal for smaller office environments or specialized deployments.

- Analysis: While the volume of quarter racks is smaller, they serve a critical purpose in enabling smaller organizations to establish or expand their IT infrastructure without the substantial investment required for larger racks.

End-User Dominance:

IT & Telecommunication: This sector is the largest consumer of data center racks in Italy, projected to hold around 35% of the market value in 2025.

- Drivers: The continuous expansion of network infrastructure, the deployment of 5G technology, and the relentless growth of cloud services make this sector the primary driver of demand for data center racks. Companies in this sector are at the forefront of adopting new technologies and require massive, scalable data center capacity.

- Analysis: Telecom operators and IT service providers are constantly upgrading and expanding their data centers to handle the ever-increasing traffic and demand for digital services. This necessitates a continuous procurement of racks for new server deployments and upgrades.

BFSI (Banking, Financial Services, and Insurance): This sector is the second-largest end-user, accounting for an estimated 25% of the market value in 2025.

- Drivers: The stringent requirements for data security, high availability, and regulatory compliance in the BFSI sector drive significant investment in robust and secure data center infrastructure. The adoption of digital banking and fintech solutions further amplifies this demand.

- Analysis: Financial institutions require highly reliable and secure data centers to manage sensitive customer data and critical financial transactions. The need for low latency for trading platforms and robust disaster recovery solutions makes the BFSI sector a consistent and significant buyer of data center racks.

Government: The government sector is a growing consumer, expected to account for approximately 15% of the market value in 2025.

- Drivers: Initiatives like digital transformation programs, cybersecurity enhancements, and the establishment of secure data repositories for public services are fueling government investment in data center infrastructure.

- Analysis: The Italian government's commitment to modernizing its public services and enhancing national cybersecurity is leading to increased investments in data centers. This includes the creation of secure cloud regions and the modernization of existing government IT facilities.

Media & Entertainment: This sector is a significant and growing consumer, projected to hold about 10% of the market value in 2025.

- Drivers: The increasing demand for high-quality streaming services, content creation, and digital distribution platforms necessitates robust data center capabilities for storing and processing large media files.

- Analysis: The rise of streaming giants and the proliferation of digital content are creating a substantial demand for data center capacity. This sector requires high-bandwidth solutions and often utilizes high-density racks for their content delivery networks.

Other End-Users: This segment, including manufacturing, healthcare, and research institutions, collectively accounts for the remaining 15% of the market value in 2025.

- Drivers: The broader trend of digitalization across industries, including the adoption of IoT in manufacturing, digital health records in healthcare, and advanced computing in research, is contributing to the demand for data center racks.

- Analysis: As more industries embrace digital technologies, their reliance on data centers grows. This diverse group of end-users contributes to a steady demand for various types of data center rack solutions, often tailored to specific industry needs.

Italy Data Center Rack Market Product Innovations

The Italy Data Center Rack Market is witnessing a wave of product innovations focused on enhancing efficiency, density, and sustainability. Manufacturers are developing advanced server rack enclosures with integrated thermal management solutions, including liquid cooling capabilities and optimized airflow designs, to support the increasing power demands of modern IT equipment. Innovations in modular rack designs allow for greater flexibility and faster deployment, catering to the evolving needs of cloud providers and enterprise data centers. Enhanced security features, such as intelligent locking mechanisms and environmental monitoring within the rack, are also becoming standard. Performance metrics are consistently improving, with racks now supporting higher load capacities and offering more versatile cable management systems to ensure optimal network performance and ease of maintenance. The unique selling proposition of leading products lies in their ability to combine robust structural integrity with intelligent features that reduce operational costs and improve data center efficiency.

Propelling Factors for Italy Data Center Rack Market Growth

Several key factors are propelling the Italy Data Center Rack Market forward. The burgeoning demand for cloud services, driven by digital transformation initiatives across all business sectors, is a primary catalyst. The increasing adoption of advanced technologies like Artificial Intelligence (AI), Internet of Things (IoT), and Big Data analytics necessitates greater data processing and storage capabilities, directly translating to increased demand for data center racks. Furthermore, government initiatives promoting digital infrastructure development and data localization policies are encouraging significant investments in new data centers and the expansion of existing facilities. The growth of the IT & Telecommunication and BFSI sectors, as outlined in the end-user analysis, also plays a crucial role. Finally, the ongoing trend towards hyperscale data center deployments, supported by substantial foreign and domestic investment, creates a consistent demand for high-capacity and technologically advanced rack solutions.

Obstacles in the Italy Data Center Rack Market Market

Despite the positive growth trajectory, the Italy Data Center Rack Market faces certain obstacles. Regulatory complexities and evolving data privacy laws can present challenges for market participants seeking to establish and operate data centers. The supply chain for specialized components can be subject to disruptions, impacting production timelines and costs. Intense competition among local and international players can lead to price pressures, affecting profit margins. Furthermore, the significant upfront investment required for data center infrastructure, including racks, can be a barrier for smaller enterprises looking to expand their IT capabilities. The increasing demand for power and the associated environmental concerns also pose a challenge, pushing manufacturers to develop more energy-efficient solutions and data centers to adopt sustainable practices.

Future Opportunities in Italy Data Center Rack Market

The Italy Data Center Rack Market is ripe with future opportunities. The continued expansion of cloud infrastructure, particularly the development of new cloud regions and edge data centers, will drive sustained demand for racks. The growing adoption of AI and machine learning applications will necessitate higher density racks and advanced cooling solutions. Furthermore, increasing investments in smart city initiatives and the Internet of Things (IoT) will create new demand centers for localized data processing and storage, opening avenues for specialized rack deployments. The ongoing digital transformation within sectors like healthcare and manufacturing presents opportunities for tailored rack solutions designed to meet specific industry needs. Collaboration between rack manufacturers and data center operators to develop integrated and intelligent infrastructure solutions also represents a significant growth avenue.

Major Players in the Italy Data Center Rack Market Ecosystem

- Tecnosteel S r l

- ITRack S r l

- Hewlett Packard Enterprise

- nVent Electric PLC

- Schneider Electric SE

- Black Box Corporation

- Vertiv Group Corp

- Econnex Camparison

- Rittal GMBH & Co KG

- Eaton Corporation

Key Developments in Italy Data Center Rack Market Industry

- June 2023: Microsoft announced the upcoming availability of Italy's first cloud region, giving Italian businesses access to scalable, available, and resilient cloud services. Composed of his three data centers in Lombardy, the new cloud region guarantees the highest security, data protection, and performance levels. This development is expected to significantly boost demand for data center racks to support the new infrastructure.

- December 2022: Aruba launched 2 new data centers at its Bergamo campus in Lombardy. The company reported its IT3 technology campus in Ponte San Pietro outside Milan is also home to two further 'future-proof' data centers. The company mentioned investing EUR 500 million (USD 521.9 million) in the new facilities. This expansion signifies a substantial increase in the need for data center racks and related infrastructure.

Strategic Italy Data Center Rack Market Market Forecast

The Italy Data Center Rack Market is poised for robust growth, driven by the accelerating pace of digital transformation and substantial investments in data center infrastructure. The forecast period from 2025 to 2033 anticipates a sustained expansion fueled by the increasing demand for cloud services, the proliferation of AI and IoT technologies, and government-backed digital initiatives. Strategic investments in new cloud regions and the expansion of hyperscale facilities, as evidenced by recent developments, will continue to be significant growth catalysts. The market's future potential lies in its ability to adapt to evolving technological demands, including higher rack densities and advanced cooling solutions, while also addressing the growing emphasis on sustainability. The integration of intelligent rack management systems and the development of tailored solutions for emerging sectors like edge computing will further shape the market's trajectory, ensuring a dynamic and promising outlook for stakeholders.

Italy Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Italy Data Center Rack Market Segmentation By Geography

- 1. Italy

Italy Data Center Rack Market Regional Market Share

Geographic Coverage of Italy Data Center Rack Market

Italy Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased use of E-commerce platform and online banking; Fiber Connectivity Network Expansion in the country

- 3.3. Market Restrains

- 3.3.1. Increasing stringent data security laws in the country

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication sector accounted for majority market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Data Center Rack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tecnosteel S r l

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ITRack S r l

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett Packard Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 nVent Electric PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black Box Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vertiv Group Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Econnex Camparison

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rittal GMBH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eaton Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tecnosteel S r l

List of Figures

- Figure 1: Italy Data Center Rack Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Italy Data Center Rack Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Data Center Rack Market Revenue million Forecast, by Rack Size 2020 & 2033

- Table 2: Italy Data Center Rack Market Revenue million Forecast, by End-User 2020 & 2033

- Table 3: Italy Data Center Rack Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Italy Data Center Rack Market Revenue million Forecast, by Rack Size 2020 & 2033

- Table 5: Italy Data Center Rack Market Revenue million Forecast, by End-User 2020 & 2033

- Table 6: Italy Data Center Rack Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Data Center Rack Market?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the Italy Data Center Rack Market?

Key companies in the market include Tecnosteel S r l, ITRack S r l, Hewlett Packard Enterprise, nVent Electric PLC, Schneider Electric SE, Black Box Corporation, Vertiv Group Corp, Econnex Camparison, Rittal GMBH & Co KG, Eaton Corporation.

3. What are the main segments of the Italy Data Center Rack Market?

The market segments include Rack Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 300 million as of 2022.

5. What are some drivers contributing to market growth?

Increased use of E-commerce platform and online banking; Fiber Connectivity Network Expansion in the country.

6. What are the notable trends driving market growth?

IT & Telecommunication sector accounted for majority market share.

7. Are there any restraints impacting market growth?

Increasing stringent data security laws in the country.

8. Can you provide examples of recent developments in the market?

June 2023: Microsoft announced the upcoming availability of Italy's first cloud region, giving Italian businesses access to scalable, available, and resilient cloud services. Composed of his three data centers in Lombardy, the new cloud region guarantees the highest security, data protection, and performance levels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Italy Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence