Key Insights

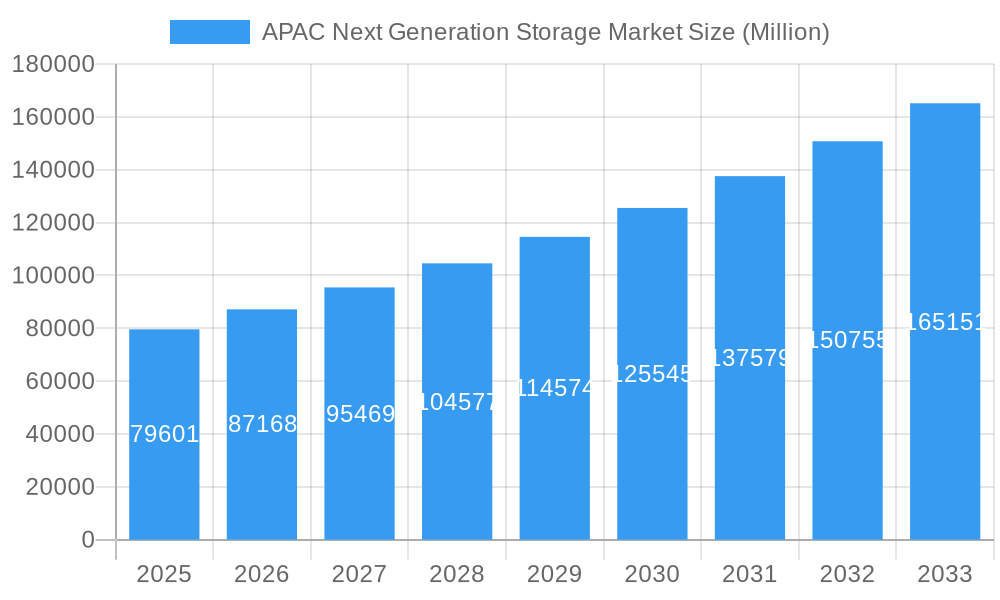

The APAC Next Generation Storage Market is poised for substantial expansion, projected to reach an estimated USD 79.601 billion by 2025. This growth is fueled by a compelling CAGR of 9.5% anticipated over the forecast period from 2025 to 2033. The region's burgeoning digital economy, characterized by rapid advancements in cloud computing, big data analytics, and the Internet of Things (IoT), is a primary catalyst. Enterprises across diverse sectors are increasingly adopting advanced storage solutions to manage escalating data volumes and extract actionable insights. Key drivers include the escalating demand for high-performance computing, the proliferation of data-intensive applications, and the growing need for robust data security and compliance measures. The BFSI, IT and Telecom, and Healthcare sectors are leading this adoption, driven by digital transformation initiatives and the critical importance of data integrity and accessibility.

APAC Next Generation Storage Market Market Size (In Billion)

The market's trajectory is further shaped by evolving storage architectures and system types. File and Object-based Storage (FOBS) is gaining prominence due to its scalability and flexibility in handling unstructured data, complementing traditional Block Storage solutions. Within storage systems, Network Attached Storage (NAS) and Storage Area Network (SAN) continue to be crucial for enterprise-level data management, while Direct Attached Storage (DAS) finds its niche in specific application scenarios. The competitive landscape features major global players such as Samsung Electronics, Toshiba Corporation, Dell Inc., and IBM, alongside regional specialists, all vying to capture market share through innovation and strategic partnerships. The Asia Pacific region, with China and India at the forefront of digital innovation, represents a significant growth hub, with other nations like Japan, South Korea, and ASEAN countries contributing substantially to the overall market dynamism.

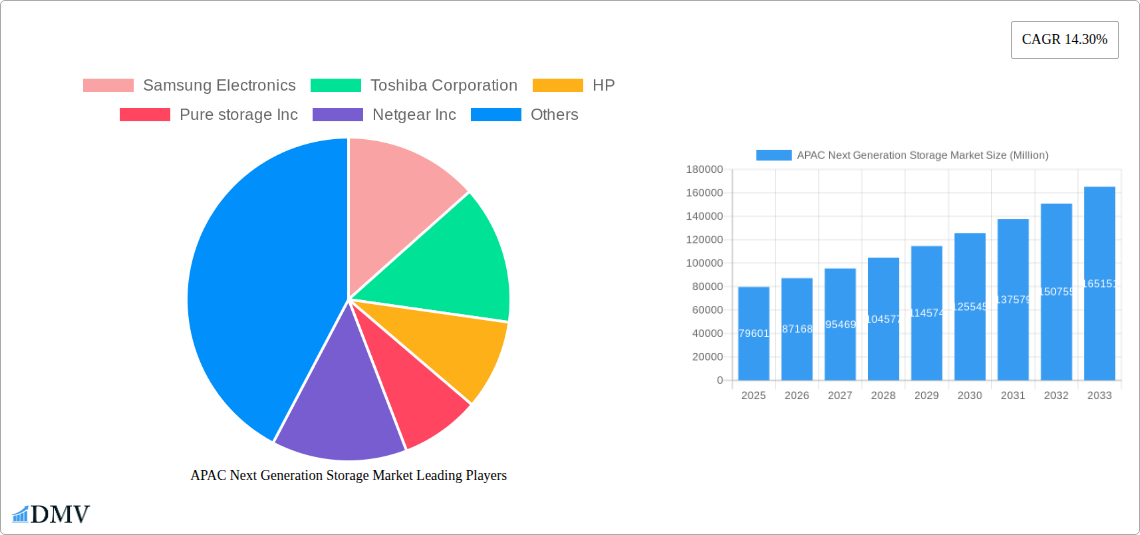

APAC Next Generation Storage Market Company Market Share

This in-depth report provides an unparalleled analysis of the APAC Next Generation Storage Market, offering strategic insights and actionable intelligence for stakeholders. Delving into market composition, industry evolution, leading segments, and product innovations, this study equips businesses with the knowledge to navigate the dynamic landscape and capitalize on emerging opportunities. With a comprehensive forecast period from 2025 to 2033, informed by historical data from 2019–2024 and a base year of 2025, this report is an essential resource for understanding market trends, competitive dynamics, and future growth trajectories.

APAC Next Generation Storage Market Market Composition & Trends

The APAC Next Generation Storage Market is characterized by a dynamic interplay of established giants and agile innovators, driving a robust growth trajectory. Market concentration remains moderate, with key players like Samsung Electronics, Toshiba Corporation, HP, Pure Storage Inc., Netgear Inc., Dell Inc., NetApp Inc., Hitachi Lt, SanDisk Corporation, and IBM actively vying for market share. Innovation catalysts are primarily fueled by the escalating demand for high-performance, scalable, and secure storage solutions across diverse end-user industries. The regulatory landscape is evolving, with governments increasingly focusing on data sovereignty and cybersecurity, influencing storage architecture choices. Substitute products, while present, are gradually being outpaced by the advanced capabilities of next-generation storage. End-user profiles are diversifying, with BFSI, Retail, IT and Telecom, Healthcare, and Media and Entertainment sectors leading adoption. Mergers and acquisitions (M&A) activities, valued in the billions, are strategically shaping the market, consolidating expertise and expanding product portfolios. The market share distribution indicates a steady increase in adoption of advanced storage systems, with a notable shift towards software-defined storage and cloud-integrated solutions. XXX

APAC Next Generation Storage Market Industry Evolution

The APAC Next Generation Storage Market has undergone a transformative evolution, driven by rapid technological advancements and an insatiable demand for data management solutions. Over the historical period of 2019–2024, the market witnessed a significant upward trend, fueled by the explosion of data generation across all sectors. This era saw the maturation of technologies like flash storage, enabling unprecedented speed and efficiency, and the rise of cloud-native storage solutions, offering unparalleled scalability and accessibility. The base year of 2025 marks a critical juncture, with the market poised for accelerated growth in the forecast period of 2025–2033. This evolution is intrinsically linked to the increasing adoption of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), all of which necessitate robust and responsive storage infrastructure. Consumer demand has shifted from mere capacity to sophisticated data analytics capabilities, real-time data processing, and enhanced data security. Growth rates are projected to remain strong, with adoption metrics for advanced storage architectures, such as File and Object-based Storage (FOBS), expected to surge. The industry's trajectory is further shaped by increasing investments in data centers and the growing sophistication of enterprise IT strategies, prioritizing agility, cost-efficiency, and disaster recovery. The integration of hybrid and multi-cloud strategies is also a key factor driving the demand for flexible and interoperable next-generation storage solutions. This continuous innovation cycle, coupled with strategic partnerships and evolving business needs, paints a picture of a highly dynamic and rapidly expanding market.

Leading Regions, Countries, or Segments in APAC Next Generation Storage Market

The APAC Next Generation Storage Market showcases a clear dominance of IT and Telecom as the leading end-user industry, driven by the insatiable demand for high-performance, scalable, and secure data storage solutions. This sector's continuous need to manage vast amounts of data generated by cloud services, mobile networks, and digital applications makes it a primary driver for next-generation storage adoption.

- Key Drivers for IT and Telecom Dominance:

- Exponential Data Growth: The proliferation of digital services, streaming content, and connected devices within the IT and Telecom sector generates an unprecedented volume of data, necessitating advanced storage capabilities.

- Cloud Infrastructure Expansion: The massive build-out of cloud infrastructure, essential for providing diverse digital services, requires sophisticated and scalable storage systems to support massive datasets and high transaction volumes.

- 5G Network Rollout: The ongoing deployment of 5G networks generates immense data traffic, requiring low-latency, high-throughput storage solutions to process and manage this data effectively.

- Digital Transformation Initiatives: Companies across the IT and Telecom sector are undergoing rapid digital transformation, with a significant focus on data analytics, AI, and machine learning, all of which rely heavily on robust storage infrastructure.

- Regulatory Compliance and Data Security: Stringent regulations regarding data privacy and security in many APAC countries compel telecom operators and IT service providers to invest in advanced, secure storage solutions.

Beyond the IT and Telecom sector, the BFSI (Banking, Financial Services, and Insurance) industry also plays a crucial role, driven by the need for secure transaction processing, fraud detection, regulatory compliance, and advanced analytics for personalized financial services. The Healthcare sector is witnessing a surge in demand due to the digitization of patient records, medical imaging, and the growing adoption of telemedicine, requiring secure and compliant storage.

In terms of Storage Systems, Network Attached Storage (NAS) and Storage Area Network (SAN) solutions are experiencing significant traction, offering centralized data access and high-performance capabilities for enterprise workloads. Within Storage Architectures, File and Object-based Storage (FOBS) is gaining prominence due to its scalability, flexibility, and cost-effectiveness, particularly for unstructured data. Block Storage continues to be critical for high-performance applications and transactional databases.

The leading country within the APAC region for next-generation storage adoption is generally considered to be China, owing to its massive digital economy, extensive cloud infrastructure development, and significant investment in emerging technologies. South Korea and Japan also represent major markets due to their advanced technological ecosystems and early adoption of innovative solutions. India, with its rapidly growing digital economy and increasing data consumption, is emerging as a key growth market. Investment trends are heavily skewed towards advanced storage solutions that can support data-intensive workloads, edge computing, and the growing need for real-time data analytics. Regulatory support for data localization and cybersecurity initiatives further bolsters the adoption of robust storage solutions across various countries.

APAC Next Generation Storage Market Product Innovations

Product innovations in the APAC Next Generation Storage Market are revolutionizing data management. We are witnessing advancements in all-flash arrays offering unprecedented performance and reduced latency for critical applications. Software-defined storage (SDS) solutions are gaining traction, providing greater flexibility, scalability, and cost-efficiency by abstracting hardware. Innovations in object storage are addressing the challenges of unstructured data growth, enabling massive scalability and cost-effective data archiving. Furthermore, advancements in data protection and resilience, including intelligent data deduplication and automated disaster recovery, are enhancing data security and availability. Edge storage solutions are emerging to address the increasing data processing needs at the network edge, supporting IoT and real-time analytics. These innovations collectively enhance application performance, streamline data management, and improve overall IT infrastructure agility.

Propelling Factors for APAC Next Generation Storage Market Growth

The APAC Next Generation Storage Market is propelled by several key factors. The exponential growth of data generation from digital transformation initiatives, IoT devices, and AI/ML applications is a primary driver. Increasing adoption of cloud computing and hybrid cloud environments necessitates scalable and flexible storage solutions. Government initiatives promoting digitalization and smart city projects further fuel demand. Technological advancements, such as the development of faster solid-state drives (SSDs) and efficient data compression techniques, are enhancing storage capabilities. The growing emphasis on data analytics and business intelligence requires robust storage infrastructure to process and analyze large datasets effectively. Furthermore, the rising demand for enhanced data security and compliance with evolving regulations are critical growth catalysts.

Obstacles in the APAC Next Generation Storage Market Market

Despite its robust growth, the APAC Next Generation Storage Market faces several obstacles. The high initial cost of implementing advanced storage solutions can be a barrier for small and medium-sized enterprises (SMEs). Concerns about data privacy and security in cross-border data transfers and cloud deployments remain significant. The complexity of managing diverse storage environments and the shortage of skilled IT professionals capable of managing next-generation storage technologies pose challenges. Interoperability issues between different vendor solutions can also hinder seamless integration. Additionally, the evolving regulatory landscape in various APAC countries, while driving adoption, can also create compliance complexities. Supply chain disruptions, exacerbated by geopolitical factors, can impact the availability and cost of hardware components.

Future Opportunities in APAC Next Generation Storage Market

Emerging opportunities in the APAC Next Generation Storage Market are abundant. The expanding adoption of edge computing presents a significant opportunity for distributed and intelligent storage solutions. The growing demand for data-intensive applications like AI, ML, and big data analytics will continue to drive innovation in high-performance storage. The increasing focus on sustainability and energy-efficient storage solutions offers a niche for eco-friendly technologies. Furthermore, the development of advanced data management platforms that integrate storage, analytics, and security will unlock new avenues for growth. The untapped potential in emerging economies within APAC also presents significant expansion opportunities for market players.

Major Players in the APAC Next Generation Storage Market Ecosystem

- Samsung Electronics

- Toshiba Corporation

- HP

- Pure Storage Inc.

- Netgear Inc.

- Dell Inc.

- NetApp Inc.

- Hitachi Lt

- SanDisk Corporation

- IBM

Key Developments in APAC Next Generation Storage Market Industry

- October 2021: Alibaba Cloud, a part of Alibaba Group, announced its new and first local data center in South Korea. The initiative aims to offer more secure, scalable, and reliable cloud services to its customers across the region. Moreover, following the development, the new data center will extend the Alibaba Cloud's offerings, that range from a database, storage, elastic compute, network services, and security to ML and data analytics capabilities, in the South Korea region.

- November 2021: Oracle Corporation and Bharti Airtel announced to support India's growing digital economy and extend their partnership to introduce a range of cloud solutions for enterprise customers. According to the partnership agreement, Oracle will expand its west region capacity in India with Nxtra, the data center subsidiary of Airtel.

Strategic APAC Next Generation Storage Market Market Forecast

The strategic APAC Next Generation Storage Market forecast for 2025–2033 is exceptionally promising, driven by an amalgamation of powerful growth catalysts. The continued digital transformation across industries, coupled with the ever-increasing volume of data generated by emerging technologies like AI, IoT, and 5G, will sustain robust demand for advanced storage solutions. The expansion of cloud infrastructure and the adoption of hybrid and multi-cloud strategies will necessitate flexible, scalable, and high-performance storage. Governments' focus on data security, sovereignty, and digital economy growth will further encourage investments in next-generation storage. The market's potential lies in its ability to support critical business operations, enable advanced data analytics, and drive innovation, positioning it for sustained and significant expansion throughout the forecast period.

APAC Next Generation Storage Market Segmentation

-

1. Storage System

- 1.1. Direct Attached Storage (DAS)

- 1.2. Network Attached Storage (NAS)

- 1.3. Storage Area Network (SAN)

-

2. Storage Architecture

- 2.1. File and Object-based Storage (FOBS)

- 2.2. Block Storage

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. Healthcare

- 3.5. Media and Entertainment

- 3.6. Other End-User Industries

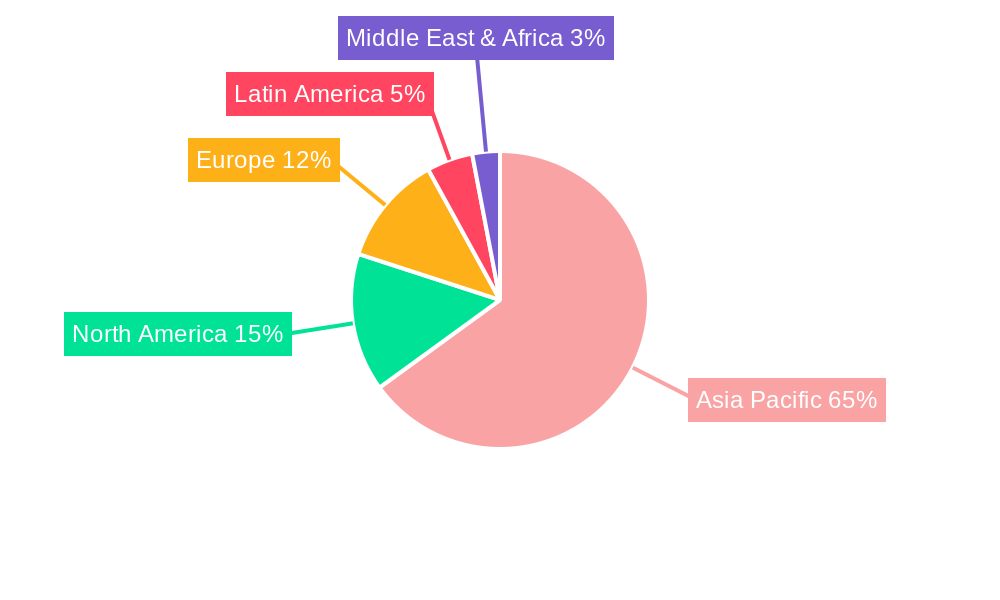

APAC Next Generation Storage Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN

- 1.6. Oceania

- 1.7. Rest of Asia Pacific

APAC Next Generation Storage Market Regional Market Share

Geographic Coverage of APAC Next Generation Storage Market

APAC Next Generation Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing digitalization across the banking industry; Rising e-commerce industry

- 3.3. Market Restrains

- 3.3.1. Data security concerns

- 3.4. Market Trends

- 3.4.1. Retail end-use industry is expected to register significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Next Generation Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 5.1.1. Direct Attached Storage (DAS)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Storage Area Network (SAN)

- 5.2. Market Analysis, Insights and Forecast - by Storage Architecture

- 5.2.1. File and Object-based Storage (FOBS)

- 5.2.2. Block Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. Healthcare

- 5.3.5. Media and Entertainment

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung Electronics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pure storage Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Netgear Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dell Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NetApp Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SanDisk Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IBM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Samsung Electronics

List of Figures

- Figure 1: APAC Next Generation Storage Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: APAC Next Generation Storage Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Next Generation Storage Market Revenue undefined Forecast, by Storage System 2020 & 2033

- Table 2: APAC Next Generation Storage Market Revenue undefined Forecast, by Storage Architecture 2020 & 2033

- Table 3: APAC Next Generation Storage Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 4: APAC Next Generation Storage Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: APAC Next Generation Storage Market Revenue undefined Forecast, by Storage System 2020 & 2033

- Table 6: APAC Next Generation Storage Market Revenue undefined Forecast, by Storage Architecture 2020 & 2033

- Table 7: APAC Next Generation Storage Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: APAC Next Generation Storage Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China APAC Next Generation Storage Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India APAC Next Generation Storage Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Japan APAC Next Generation Storage Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: South Korea APAC Next Generation Storage Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: ASEAN APAC Next Generation Storage Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Oceania APAC Next Generation Storage Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific APAC Next Generation Storage Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Next Generation Storage Market?

The projected CAGR is approximately 9.5%.

2. Which companies are prominent players in the APAC Next Generation Storage Market?

Key companies in the market include Samsung Electronics, Toshiba Corporation, HP, Pure storage Inc, Netgear Inc, Dell Inc, NetApp Inc, Hitachi Lt, SanDisk Corporation, IBM.

3. What are the main segments of the APAC Next Generation Storage Market?

The market segments include Storage System, Storage Architecture, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing digitalization across the banking industry; Rising e-commerce industry.

6. What are the notable trends driving market growth?

Retail end-use industry is expected to register significant growth.

7. Are there any restraints impacting market growth?

Data security concerns.

8. Can you provide examples of recent developments in the market?

October 2021 - Alibaba Cloud, a part of Alibaba Group, announced its new and first local data center in South Korea. The initiative aims to offer more secure, scalable, and reliable cloud services to its customers across the region. Moreover, following the development, the new data center will extend the Alibaba Cloud's offerings, that range from a database, storage, elastic compute, network services, and security to ML and data analytics capabilities, in the South Korea region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Next Generation Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Next Generation Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Next Generation Storage Market?

To stay informed about further developments, trends, and reports in the APAC Next Generation Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence