Key Insights

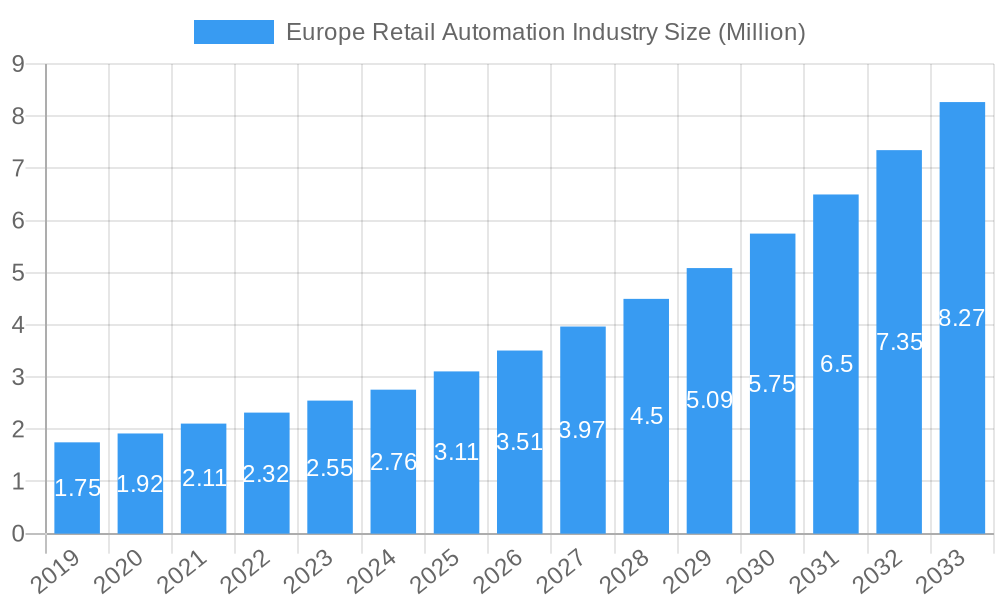

The European retail automation market is poised for substantial expansion, with a current market size of 2.76 Million and a projected Compound Annual Growth Rate (CAGR) of 13.10% through 2033. This robust growth is underpinned by a confluence of powerful drivers, including the escalating demand for enhanced customer experiences, the persistent need for operational efficiency and cost reduction, and the increasing adoption of advanced technologies like AI, IoT, and robotics across the retail value chain. Key trends such as the surge in self-checkout systems, the integration of RFID and barcode scanners for seamless inventory management, and the deployment of sophisticated POS systems are reshaping the retail landscape. Furthermore, the burgeoning e-commerce sector is compelling brick-and-mortar stores to invest in automation to bridge the gap between online and offline shopping experiences and to streamline fulfillment processes. The grocery and general merchandise segments are leading this transformation, driven by the imperative to manage vast inventories and cater to diverse consumer needs.

Europe Retail Automation Industry Market Size (In Million)

While the market enjoys strong growth, certain restraints may influence its trajectory. These include the significant initial investment required for implementing advanced automation solutions, potential challenges in integrating new technologies with legacy systems, and concerns around data security and privacy. However, the long-term benefits of increased throughput, reduced labor costs, improved accuracy, and enhanced customer satisfaction are expected to outweigh these hurdles. The market is segmented into hardware (including POS systems, self-checkout systems, RFID and barcode scanners, and other hardware types), software, and services, with hardware components currently dominating due to their foundational role in automation. Prominent companies like Honeywell International Inc., NCR Corporation, and Zebra Technologies Corp. are at the forefront of innovation, offering a wide array of solutions to meet the evolving demands of European retailers. The European region, with key markets such as the United Kingdom, Germany, and France, represents a significant opportunity for growth and technological adoption.

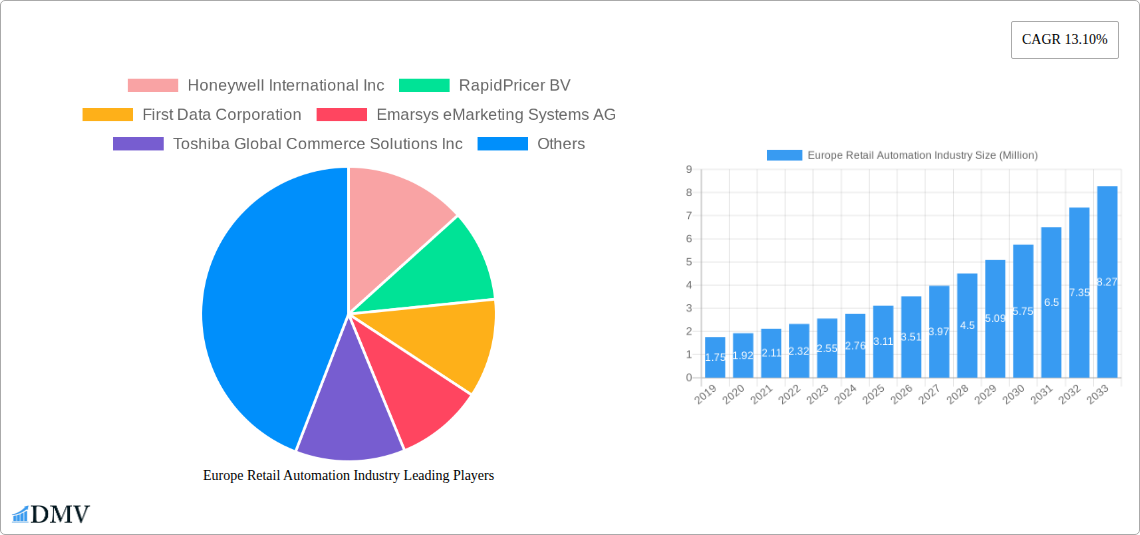

Europe Retail Automation Industry Company Market Share

Europe Retail Automation Industry Market Report Description

Unlock unparalleled insights into the rapidly evolving Europe Retail Automation Industry with this comprehensive market analysis. Spanning the historical period of 2019–2024 and projecting robust growth through 2033, this report is your definitive guide to understanding market dynamics, technological advancements, and strategic opportunities. Covering critical segments like Hardware (POS Systems, Self-checkout Systems, RFID and Barcode Scanners, Other Hardware Types) and Software, and analyzing end-user adoption across Grocery, General Merchandise, and Hospitality sectors, this study provides a granular view of the market's current state and future trajectory. With a base year of 2025, the report offers timely estimations and detailed forecasts to empower stakeholders with actionable intelligence.

Europe Retail Automation Industry Market Composition & Trends

The Europe Retail Automation Industry is characterized by a dynamic market composition with a moderate level of concentration, driven by continuous innovation catalysts. Key players are actively investing in research and development to enhance customer experience and operational efficiency. The regulatory landscape, while evolving, generally supports the adoption of automation technologies that improve safety and compliance. Substitute products, such as traditional manual processes, are steadily being replaced by more efficient automated solutions. End-user profiles are increasingly demanding seamless and personalized shopping journeys, pushing for greater integration of AI and robotics. Mergers and acquisitions (M&A) activities are on the rise, with an estimated M&A deal value of €5,000 Million in the past two years, indicating a consolidation trend and strategic expansion by leading companies. Market share distribution is witnessing shifts as new technologies gain traction.

- Market Concentration: Moderate, with key players consolidating their positions.

- Innovation Catalysts: AI, IoT, Robotics, and Big Data analytics.

- Regulatory Landscape: Supportive of efficiency and safety improvements.

- Substitute Products: Traditional manual operations being phased out.

- End-User Demand: Focus on personalized, frictionless, and enhanced in-store experiences.

- M&A Activities: Increasing, with an estimated deal value of €5,000 Million.

Europe Retail Automation Industry Industry Evolution

The Europe Retail Automation Industry has witnessed a transformative evolution, propelled by significant technological advancements and shifting consumer demands throughout the historical period of 2019–2024. The industry’s growth trajectory has been consistently upward, with an estimated Compound Annual Growth Rate (CAGR) of 15% during this period, driven by retailers' urgent need to optimize operational efficiency, reduce labor costs, and elevate the customer experience. Early adoption of point-of-sale (POS) systems and barcode scanners laid the foundation for more sophisticated automation. The subsequent integration of self-checkout systems has drastically reduced queues and empowered customers with greater control over their shopping process.

The advent of RFID technology has revolutionized inventory management, enabling real-time tracking and minimizing stockouts, a critical factor in maintaining customer satisfaction, particularly in the grocery sector. The introduction of robotics, from shelf-scanning robots to customer-facing service bots, marks a significant leap forward. These robots not only automate repetitive tasks but also enhance the in-store ambiance and offer novel customer engagement opportunities, as exemplified by Pudu Robotics' KettyBot and BellaBot trials. Software solutions, encompassing AI-powered analytics, personalized marketing platforms (like Emarsys eMarketing Systems AG), and cloud-based inventory management, are crucial enablers of this automation wave.

Consumer expectations have evolved in tandem with technological progress. Shoppers now anticipate seamless, personalized, and convenient shopping experiences, whether online or in-store. This has pushed retailers to invest heavily in technologies that can deliver such experiences. The COVID-19 pandemic further accelerated this trend, highlighting the importance of contactless solutions and efficient store operations. As a result, adoption metrics for self-checkout systems have surged by an estimated 30%, and the deployment of RFID scanners has increased by 25% in the last three years. The industry is on a robust path, with future growth heavily reliant on the integration of advanced AI and machine learning to create truly intelligent retail environments. The market is projected to reach approximately €80,000 Million by 2025 and is poised for continued expansion, driven by ongoing innovation and the persistent demand for smarter retail solutions.

Leading Regions, Countries, or Segments in Europe Retail Automation Industry

The Hardware segment, specifically POS Systems and Self-checkout Systems, currently dominates the Europe Retail Automation Industry. This dominance is fueled by an intrinsic need for efficient transaction processing and enhanced customer self-service capabilities across all retail verticals. The Grocery sector, owing to its high transaction volume and the critical need for efficient inventory management, emerges as the leading end-user segment driving this segment's growth.

Key drivers for this segment's supremacy include:

- Investment Trends: Significant capital expenditure by major retailers in upgrading their in-store technology infrastructure.

- Regulatory Support: Initiatives promoting contactless payments and efficient store operations have indirectly boosted self-checkout adoption.

- Technological Advancements: Continuous improvements in POS hardware reliability, speed, and integration capabilities, along with the development of more intuitive self-checkout interfaces.

- Consumer Acceptance: Growing comfort and preference among consumers for self-service options to reduce wait times.

Within the Hardware segment, POS Systems remain foundational, with an estimated market share of 35%, essential for every retail transaction. Self-checkout Systems follow closely with an estimated 28% market share, demonstrating rapid adoption rates, especially in large supermarket chains. RFID and Barcode Scanners, crucial for inventory management and loss prevention, constitute an estimated 20% of the hardware market, with increasing integration into broader automation solutions.

The Grocery sector accounts for an estimated 45% of the total end-user market share for retail automation hardware, driven by its high customer traffic and the constant pressure to manage fresh produce and stock levels efficiently. General Merchandise follows with an estimated 30%, while Hospitality contributes approximately 25%, with a growing interest in table-side ordering and payment systems. The Software segment, while not leading in terms of initial hardware investment, is the critical enabler for advanced automation, experiencing robust growth and playing an indispensable role in data analysis, personalization, and operational optimization, currently holding an estimated 30% of the overall market value.

Europe Retail Automation Industry Product Innovations

Recent product innovations in the Europe Retail Automation Industry are redefining the in-store experience and operational efficiency. Leading companies are focusing on intelligent hardware and integrated software solutions. For instance, advancements in POS systems now include AI-powered analytics for personalized promotions and fraud detection, significantly enhancing transaction security and customer engagement. Self-checkout systems are incorporating advanced computer vision for faster item recognition and simplified payment processes, aiming for a near-frictionless experience. RFID and barcode scanners are becoming more robust and faster, improving inventory accuracy and enabling seamless tracking throughout the supply chain. The integration of robotics, such as customer assistance bots and inventory management robots, is a key innovation trend, enhancing customer service and automating repetitive tasks. These innovations are driven by the pursuit of hyper-personalization, operational agility, and a superior customer journey, with an estimated 10% year-on-year improvement in efficiency metrics for newly deployed automated systems.

Propelling Factors for Europe Retail Automation Industry Growth

The Europe Retail Automation Industry is experiencing robust growth propelled by several key factors. Technologically, the rapid advancement and declining costs of AI, robotics, IoT, and cloud computing are making sophisticated automation solutions more accessible and cost-effective for retailers of all sizes. Economically, increasing labor costs and the ongoing need to improve operational efficiency and reduce errors are significant drivers. The demand for enhanced customer experience, characterized by faster checkouts, personalized recommendations, and convenient shopping, is a paramount factor. Regulatory shifts encouraging contactless transactions and data security also play a crucial role. Furthermore, the competitive pressure among retailers to differentiate and gain market share is spurring significant investment in automation technologies, leading to an estimated market growth of 12% in the last fiscal year.

Obstacles in the Europe Retail Automation Industry Market

Despite significant growth, the Europe Retail Automation Industry faces several obstacles. High initial investment costs for advanced automation systems can be a barrier for small and medium-sized enterprises (SMEs). Evolving and sometimes fragmented regulatory landscapes across different European countries concerning data privacy and automation deployment can create compliance challenges. Supply chain disruptions, as witnessed in recent years, can impact the availability and cost of essential hardware components. Moreover, the need for skilled personnel to install, maintain, and operate these complex systems presents a talent gap. Consumer acceptance of certain automation technologies, particularly in the early stages, can also be a concern, requiring effective change management strategies from retailers. These factors collectively contribute to an estimated slowdown in adoption by 5% in certain niche markets.

Future Opportunities in Europe Retail Automation Industry

The future of the Europe Retail Automation Industry is brimming with opportunities. The continued integration of AI and machine learning into all aspects of retail operations, from predictive inventory management to hyper-personalized customer journeys, presents a vast untapped potential. The expansion of robotics into more complex in-store tasks, such as cleaning, security, and personalized assistance, is a significant growth avenue. Emerging markets within Eastern Europe are poised for rapid adoption as their retail sectors mature. The development of innovative, sustainable automation solutions aligned with environmental concerns offers another promising frontier. Furthermore, the convergence of online and offline retail (omnichannel) necessitates advanced automation to bridge the physical and digital divide, creating opportunities for seamless customer experiences and efficient fulfillment.

Major Players in the Europe Retail Automation Industry Ecosystem

- Honeywell International Inc

- RapidPricer BV

- First Data Corporation

- Emarsys eMarketing Systems AG

- Toshiba Global Commerce Solutions Inc

- NCR Corporation

- Fujitsu Limited

- Zebra Technologies Corp

- Diebold Nixdorf Incorporated

- Datalogic SpA

Key Developments in Europe Retail Automation Industry Industry

- January 2023: Currys, a prominent UK retailer, partnered with UX Global (UXG) to trial KettyBot, a customer assistance robot developed by China's Pudu Robotics. This initiative aims to significantly aid customers in locating products, thereby saving time and enhancing the in-store experience.

- November 2022: Adapta Robotics, in collaboration with Carrefour, launched ERIS, the first retail robot in Romania designed for inventory management. ERIS identifies out-of-stock items and shelf prices, automating repetitive daily tasks.

- November 2022: Pudu Robotics collaborated with Carrefour to trial BellaBot in Poland, a robot assisting with store operations by delivering beverages. Dubbed "Kerfus," the robot's attractive design and delivery features generated significant social media buzz and increased product sales for Carrefour, leading to plans for expanded roadshows and fan gatherings across over 100 locations.

Strategic Europe Retail Automation Industry Market Forecast

The strategic outlook for the Europe Retail Automation Industry is exceptionally positive, driven by an increasing imperative for retailers to achieve operational excellence and deliver superior customer experiences. The forecast period (2025–2033) anticipates sustained high growth, fueled by ongoing technological advancements in AI, robotics, and data analytics. The continuous push towards hyper-personalization, efficient inventory management, and frictionless checkout processes will be key growth catalysts. Emerging technologies will enable more autonomous store operations and advanced customer engagement strategies. The market's trajectory indicates a strong upward trend, with significant investment expected from both established players and new entrants seeking to capture market share in this dynamic sector. The estimated market size in 2033 is projected to exceed €120,000 Million.

Europe Retail Automation Industry Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. POS System

- 1.1.2. Self-checkout System

- 1.1.3. RFID and Barcode Scanners

- 1.1.4. Other Hardware Types

- 1.2. Software

-

1.1. Hardware

-

2. End User

- 2.1. Grocery

- 2.2. General Merchandise

- 2.3. Hospitality

Europe Retail Automation Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

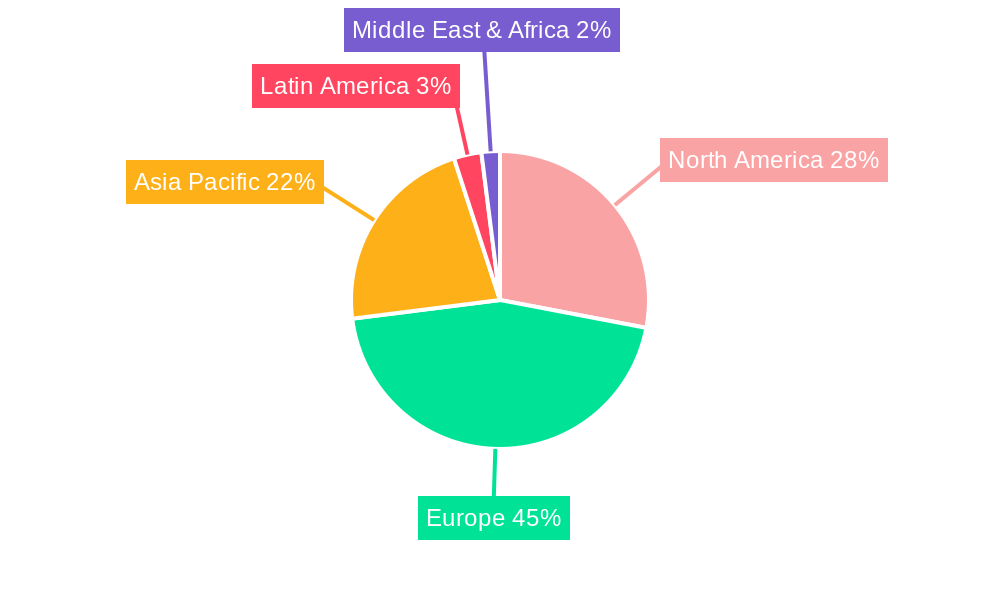

Europe Retail Automation Industry Regional Market Share

Geographic Coverage of Europe Retail Automation Industry

Europe Retail Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Quality and Fast Service; Automated Technologies Being More Widely Used in the Retail Business

- 3.3. Market Restrains

- 3.3.1. Technical and Security Concerns

- 3.4. Market Trends

- 3.4.1. Grocery Retailers are Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. POS System

- 5.1.1.2. Self-checkout System

- 5.1.1.3. RFID and Barcode Scanners

- 5.1.1.4. Other Hardware Types

- 5.1.2. Software

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Grocery

- 5.2.2. General Merchandise

- 5.2.3. Hospitality

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RapidPricer BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 First Data Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emarsys eMarketing Systems AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toshiba Global Commerce Solutions Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NCR Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujitsu Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zebra Technologies Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Diebold Nixdorf Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Datalogic SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Retail Automation Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Retail Automation Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Retail Automation Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Europe Retail Automation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Retail Automation Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Europe Retail Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Retail Automation Industry?

The projected CAGR is approximately 13.10%.

2. Which companies are prominent players in the Europe Retail Automation Industry?

Key companies in the market include Honeywell International Inc, RapidPricer BV, First Data Corporation, Emarsys eMarketing Systems AG, Toshiba Global Commerce Solutions Inc, NCR Corporation, Fujitsu Limited, Zebra Technologies Corp, Diebold Nixdorf Incorporated, Datalogic SpA.

3. What are the main segments of the Europe Retail Automation Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Quality and Fast Service; Automated Technologies Being More Widely Used in the Retail Business.

6. What are the notable trends driving market growth?

Grocery Retailers are Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Technical and Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2023 - Currys, the UK-based retailer, partnered with a digital display specialist UX Global (UXG), to trial KettyBot, the robot for customer assistance. China's Pudu Robotics develops KettyBot. The robot will significantly help customers who know what they want but need a little assistance finding it in the store. This way, customers will save time while enhancing their in-store experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Retail Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Retail Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Retail Automation Industry?

To stay informed about further developments, trends, and reports in the Europe Retail Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence