Key Insights

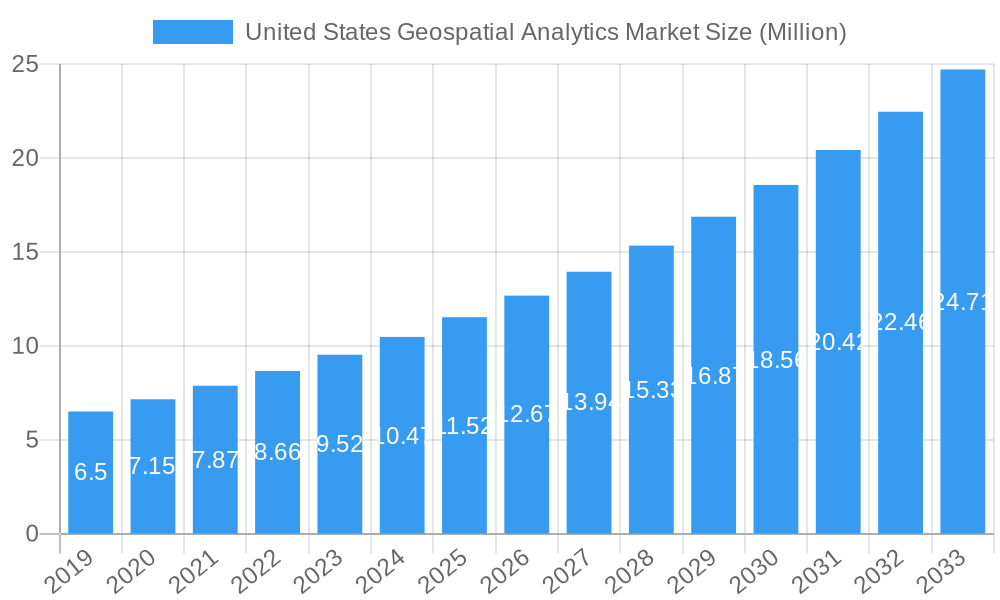

The United States Geospatial Analytics Market is poised for significant expansion, projected to reach $10.65 million by 2025, driven by a robust CAGR of 10.04%. This impressive growth is fueled by the increasing adoption of geospatial analytics across a diverse range of industries. Key drivers include the burgeoning demand for enhanced data-driven decision-making, the proliferation of location-aware devices and sensors, and the continuous advancements in analytical software and cloud-based platforms. The market is witnessing a transformative shift as businesses increasingly leverage spatial intelligence to optimize operations, understand complex patterns, and gain a competitive edge. For instance, the agriculture sector benefits from precision farming techniques, while utility and communication companies utilize it for network planning and maintenance. Furthermore, defense and intelligence agencies, government bodies, and the automotive and transportation sectors are all heavily investing in geospatial analytics for improved situational awareness, resource management, and infrastructure development.

United States Geospatial Analytics Market Market Size (In Million)

Emerging trends such as the integration of artificial intelligence and machine learning with geospatial data are further accelerating market adoption. This synergy enables more sophisticated predictive modeling, real-time insights, and automated analysis, unlocking new potential applications in areas like autonomous vehicles, smart cities, and advanced disaster response. While the market demonstrates strong upward momentum, potential restraints might include the initial investment costs for sophisticated software and skilled personnel, as well as data privacy and security concerns. However, the clear benefits in terms of efficiency gains, cost reductions, and enhanced strategic planning are expected to outweigh these challenges, ensuring continued robust growth. The market's segmented landscape, encompassing surface and network analysis, geovisualization, and a wide array of end-user verticals, highlights its pervasive applicability and the broad spectrum of opportunities available for stakeholders.

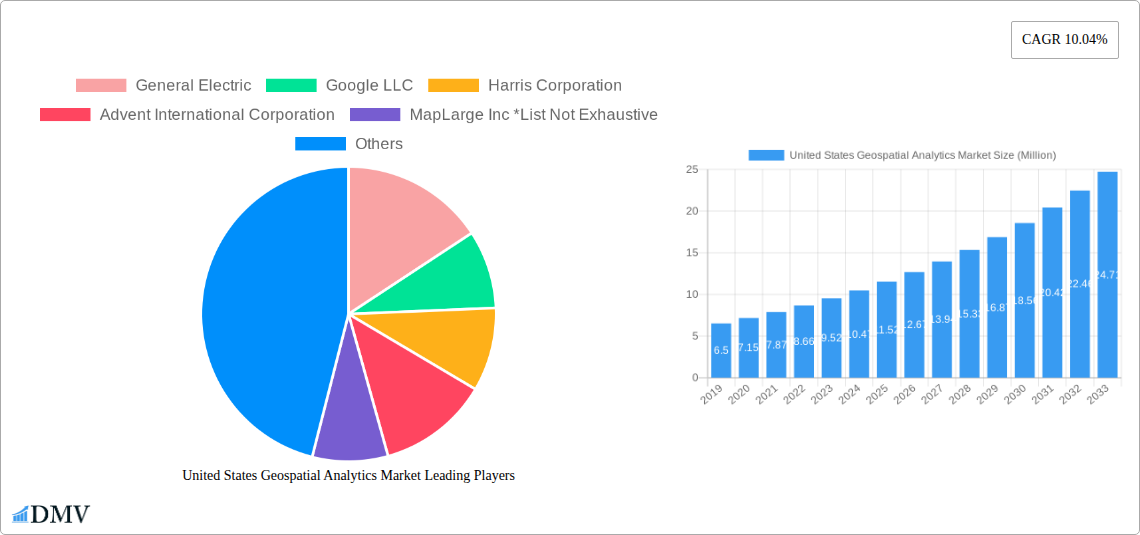

United States Geospatial Analytics Market Company Market Share

United States Geospatial Analytics Market: Comprehensive Industry Report (2019-2033)

Unlock the future of location intelligence with this in-depth analysis of the United States Geospatial Analytics Market. This report provides critical insights into market dynamics, growth trajectories, and strategic opportunities, covering the period from 2019 to 2033. We leverage advanced AI and satellite imagery analysis to deliver actionable intelligence for stakeholders across diverse industries. Explore the profound impact of geospatial intelligence, location-based services, AI-driven analytics, and big data visualization on the US economy. This research delves into market segmentation by Type (Surface Analysis, Network Analysis, Geovisualization) and End-user Vertical (Agriculture, Utility and Communication, Defense and Intelligence, Government, Mining and Natural Resources, Automotive and Transportation, Healthcare, Real Estate and Construction).

United States Geospatial Analytics Market Market Composition & Trends

The United States Geospatial Analytics Market exhibits a dynamic composition, characterized by a blend of established technology giants and innovative startups vying for market share. Market concentration is notably influenced by leading players like Google LLC, General Electric, and ESRI Inc., alongside significant private equity investments in specialized firms such as Advent International Corporation. Innovation is primarily driven by advancements in Artificial Intelligence (AI), machine learning, and cloud computing, enabling more sophisticated geospatial data analysis and predictive modeling. The regulatory landscape, particularly concerning data privacy and national security, plays a crucial role in shaping market access and development. Substitute products, while existing in traditional data analysis methods, are increasingly being superseded by the superior insights offered by geospatial solutions. End-user profiles are diverse, spanning from government agencies seeking enhanced public safety to private enterprises optimizing supply chains and resource management. Mergers and Acquisitions (M&A) activities, with deal values in the hundreds of millions of dollars, are a consistent feature, aimed at consolidating expertise and expanding service offerings. The market is poised for substantial growth, driven by the increasing demand for actionable insights derived from location-based data.

United States Geospatial Analytics Market Industry Evolution

The United States Geospatial Analytics Market has undergone a remarkable evolution, transforming from a niche technology to a foundational element across numerous sectors. The historical period (2019-2024) witnessed significant foundational growth, fueled by the increasing availability of high-resolution satellite imagery and advancements in remote sensing technologies. During this phase, the market saw an estimated annual growth rate of 15-20%, driven by early adoption in defense, intelligence, and critical infrastructure monitoring. The base year, 2025, marks a pivotal point, with the market valued at approximately $20,000 million, reflecting a maturing yet rapidly expanding industry.

Technological advancements have been the primary engine of this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) has revolutionized geospatial data analysis, moving beyond simple mapping to sophisticated pattern recognition, predictive modeling, and automated feature extraction. Cloud computing has democratized access to powerful geospatial tools and vast datasets, enabling smaller businesses and organizations to leverage these capabilities. Furthermore, the proliferation of Internet of Things (IoT) devices has created a continuous stream of real-time location data, further enhancing the value and applicability of geospatial analytics.

Shifting consumer and enterprise demands have also played a crucial role. Businesses are increasingly recognizing the strategic advantage of understanding the spatial context of their operations, customers, and markets. This has led to the adoption of geospatial analytics in areas such as site selection, logistics optimization, customer segmentation, risk assessment, and environmental monitoring. The government sector continues to be a major driver, utilizing geospatial intelligence for national security, urban planning, disaster management, and resource allocation. The forecast period (2025-2033) is projected to witness an accelerated growth trajectory, with an estimated Compound Annual Growth Rate (CAGR) of 18-22%, driven by emerging applications in autonomous vehicles, smart cities, precision agriculture, and personalized healthcare. The total market size is expected to reach over $100,000 million by 2033, underscoring the transformative impact of geospatial analytics on the US economy.

Leading Regions, Countries, or Segments in United States Geospatial Analytics Market

Within the United States Geospatial Analytics Market, the Defense and Intelligence end-user vertical stands out as a dominant segment, consistently driving significant investment and innovation. This dominance stems from the critical need for advanced situational awareness, threat assessment, and operational planning, where precise location-based intelligence is paramount. The sheer volume and complexity of data processed by these agencies necessitate sophisticated geospatial analysis tools.

- Defense and Intelligence: This segment benefits from substantial government funding, leading to the continuous development and deployment of cutting-edge geospatial technologies. Key drivers include national security imperatives, counter-terrorism efforts, and global reconnaissance. The demand for real-time intelligence, accurate mapping of complex terrains, and the ability to identify subtle changes from satellite and aerial imagery fuels its growth. Investment trends are characterized by long-term contracts and a focus on secure, high-performance solutions. Regulatory support is robust, often driven by national defense strategies.

Beyond Defense and Intelligence, the Government sector as a whole represents another significant driver. This encompasses federal, state, and local agencies utilizing geospatial analytics for a wide array of applications, including urban planning, emergency response, environmental management, and infrastructure development. The increasing adoption of smart city initiatives and the need for data-driven decision-making in public administration further bolster this segment's importance.

The Utility and Communication vertical is also experiencing robust growth, propelled by the need to manage vast networks, optimize service delivery, and respond effectively to outages. Geospatial analytics are crucial for infrastructure planning, maintenance, and disaster recovery in this sector. Similarly, the Automotive and Transportation sector is rapidly embracing geospatial analytics, especially with the advent of autonomous driving technology, intelligent traffic management systems, and the optimization of logistics and supply chains.

Among the 'Type' segments, Surface Analysis and Network Analysis are foundational, providing the bedrock for many applications. However, Geovisualization is gaining increasing prominence as it translates complex geospatial data into understandable and actionable insights for a broader audience, democratizing the use of geospatial intelligence.

United States Geospatial Analytics Market Product Innovations

Product innovation in the United States Geospatial Analytics Market is characterized by the seamless integration of AI, machine learning, and cloud-native architectures. Companies are developing advanced platforms that offer real-time processing of diverse data streams, from satellite imagery and aerial photography to drone feeds and IoT sensors. Unique selling propositions often lie in the ability to automate complex analytical tasks, such as object detection, change detection, and predictive modeling, significantly reducing manual effort and accelerating decision-making cycles. Technological advancements are focused on enhancing the accuracy, speed, and scalability of geospatial analysis, enabling applications in areas like precision agriculture, automated infrastructure inspection, and dynamic urban planning.

Propelling Factors for United States Geospatial Analytics Market Growth

Several key factors are propelling the growth of the United States Geospatial Analytics Market. Technologically, the exponential increase in the availability of high-resolution satellite and aerial imagery, coupled with the maturation of AI and machine learning algorithms, is a primary catalyst. Economically, the clear return on investment demonstrated by geospatial analytics in optimizing operations, reducing costs, and improving decision-making across various industries is driving widespread adoption. Regulatory influences, such as government mandates for data-driven environmental monitoring and infrastructure resilience, also contribute significantly. The increasing adoption of the Internet of Things (IoT) devices generates a constant influx of location-aware data, further fueling the need for sophisticated geospatial analysis.

Obstacles in the United States Geospatial Analytics Market Market

Despite its robust growth, the United States Geospatial Analytics Market faces certain obstacles. Regulatory challenges, particularly concerning data privacy and cybersecurity, can create complexities and require substantial investment in compliance. The high cost of advanced geospatial software and the need for specialized expertise can be a barrier for smaller organizations, limiting broader adoption. Supply chain disruptions, though less direct, can impact the availability of hardware components for data acquisition and processing. Furthermore, intense competitive pressures from both established players and agile startups necessitate continuous innovation and differentiation to maintain market share.

Future Opportunities in United States Geospatial Analytics Market

The United States Geospatial Analytics Market is ripe with future opportunities. The burgeoning fields of autonomous vehicles and smart cities present immense potential for advanced navigation, real-time traffic management, and urban planning applications. The growing emphasis on climate change mitigation and adaptation will drive demand for sophisticated environmental monitoring and resource management solutions. The expansion of precision agriculture promises to revolutionize food production through optimized crop management. Emerging markets in renewable energy siting and monitoring also offer significant growth avenues. Furthermore, advancements in edge computing will enable real-time geospatial analysis directly at the source of data collection.

Major Players in the United States Geospatial Analytics Market Ecosystem

- General Electric

- Google LLC

- Harris Corporation

- Advent International Corporation

- MapLarge Inc

- ESRI Inc

- Alteryx Inc

- Intermap Technologies Inc

- Trimble Inc

- Bentley Systems Inc

Key Developments in United States Geospatial Analytics Market Industry

- May 2023: CAPE Analytics, a player in AI-powered geospatial property intelligence, extended its partnership with The Hanover Insurance Group. This expansion focuses on integrating geospatial analytics and inspection and rating models into Hanover's underwriting procedures, aiming to improve workflows, underwriting outcomes, and pricing segmentation.

- March 2023: Carahsoft Technology Corp., a government IT solutions provider, partnered with Orbital Insight, a geospatial intelligence firm. Carahsoft will act as Orbital Insight's Master Government Aggregator, making their AI-powered geospatial data analytics accessible to the public sector through various government contracts.

Strategic United States Geospatial Analytics Market Market Forecast

The United States Geospatial Analytics Market is projected to experience sustained and accelerated growth in the coming years. Key growth catalysts include the increasing adoption of AI and machine learning for advanced predictive analytics, the continuous innovation in satellite and drone imaging technology, and the expanding application of geospatial intelligence in emerging sectors like autonomous mobility and smart city development. The rising demand for data-driven decision-making across government and commercial enterprises, coupled with a growing awareness of the strategic importance of location-based insights for operational efficiency and risk mitigation, will further fuel market expansion. The market potential is substantial, driven by the ongoing digital transformation and the inherent value of understanding spatial relationships in an increasingly complex world.

United States Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geovisualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

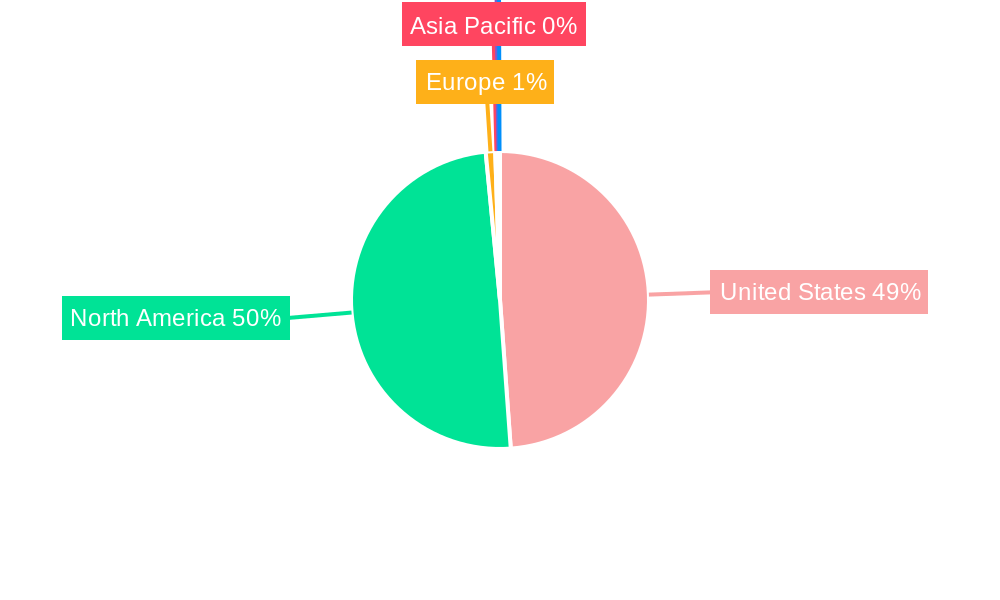

United States Geospatial Analytics Market Segmentation By Geography

- 1. United States

United States Geospatial Analytics Market Regional Market Share

Geographic Coverage of United States Geospatial Analytics Market

United States Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics

- 3.3. Market Restrains

- 3.3.1. High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data

- 3.4. Market Trends

- 3.4.1. Network Analysis is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geovisualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Electric

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Harris Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advent International Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MapLarge Inc *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ESRI Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alteryx Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intermap Technologies Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trimble Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bentley Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 General Electric

List of Figures

- Figure 1: United States Geospatial Analytics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Geospatial Analytics Market Share (%) by Company 2025

List of Tables

- Table 1: United States Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: United States Geospatial Analytics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: United States Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: United States Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Geospatial Analytics Market?

The projected CAGR is approximately 10.04%.

2. Which companies are prominent players in the United States Geospatial Analytics Market?

Key companies in the market include General Electric, Google LLC, Harris Corporation, Advent International Corporation, MapLarge Inc *List Not Exhaustive, ESRI Inc, Alteryx Inc, Intermap Technologies Inc, Trimble Inc, Bentley Systems Inc.

3. What are the main segments of the United States Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics.

6. What are the notable trends driving market growth?

Network Analysis is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data.

8. Can you provide examples of recent developments in the market?

May 2023 : CAPE Analytics, a player in AI-powered geospatial property intelligence, has extended its partnership with The Hanover Insurance Group, which provides independent agents with the best insurance coverage and prices. Integrating geospatial analytics and inspection and rating models into Hanover's underwriting procedure is the central component of the partnership expansion. The company's rating plans will benefit from this strategic move, which will improve workflows, new and renewal underwriting outcomes, and pricing segmentation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the United States Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence