Key Insights

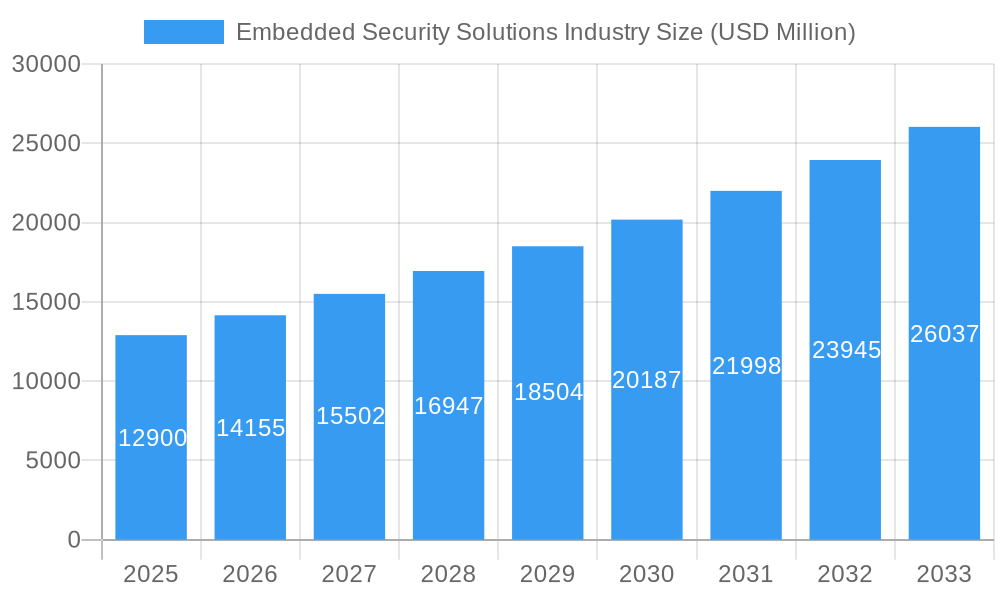

The Embedded Security Solutions Industry is poised for significant expansion, with a projected market size of $12.9 billion in 2025 and an impressive Compound Annual Growth Rate (CAGR) of 9.71% anticipated over the forecast period of 2025-2033. This robust growth is primarily fueled by an escalating demand for enhanced protection against sophisticated cyber threats across a multitude of connected devices. Key drivers include the proliferation of the Internet of Things (IoT), the increasing complexity of embedded systems, stringent regulatory compliance mandates for data protection, and the critical need to safeguard sensitive information in sectors like automotive, healthcare, and consumer electronics. The inherent vulnerabilities of interconnected devices necessitate robust security measures, pushing the adoption of advanced embedded security solutions. As more devices become interconnected, the attack surface expands, making embedded security an indispensable component of modern technology development and deployment.

Embedded Security Solutions Industry Market Size (In Billion)

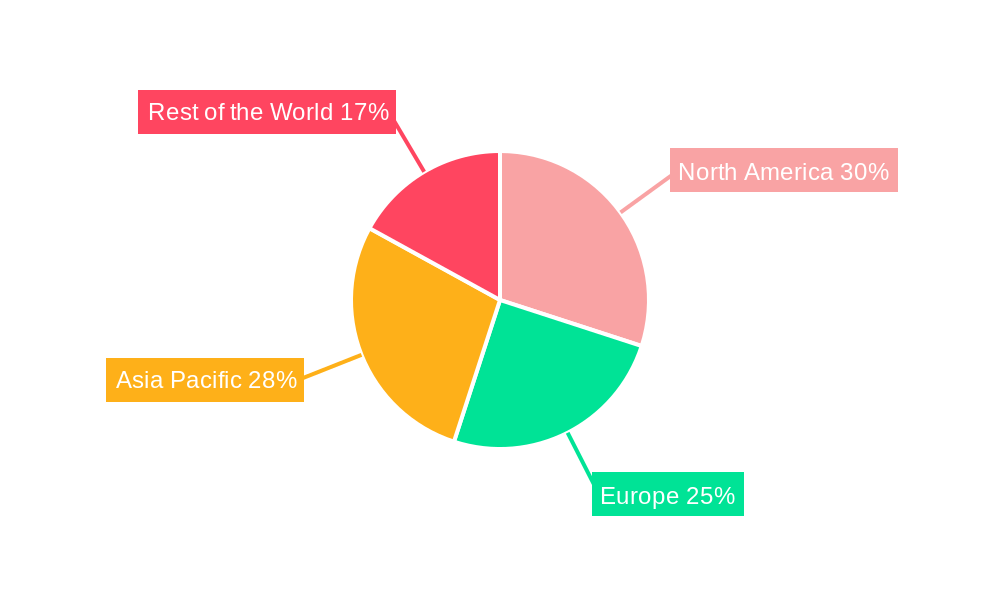

The market is segmented across component types, with hardware, software, and service offerings all playing crucial roles in delivering comprehensive security. Applications range from secure payment and authentication to robust content protection, with the automotive sector emerging as a dominant end-user segment due to the increasing digitization and connectivity of vehicles, followed closely by healthcare and consumer electronics. The ongoing advancements in hardware-based security, such as secure elements and trusted platform modules, coupled with sophisticated software solutions and specialized security services, are collectively addressing the evolving threat landscape. Geographically, North America and Asia Pacific are expected to lead market growth, driven by high adoption rates of connected technologies and significant investments in cybersecurity infrastructure, while Europe also presents a substantial market opportunity. Leading companies are continuously innovating to provide cutting-edge solutions that can withstand emerging cyber threats and ensure the integrity and confidentiality of data processed by embedded systems.

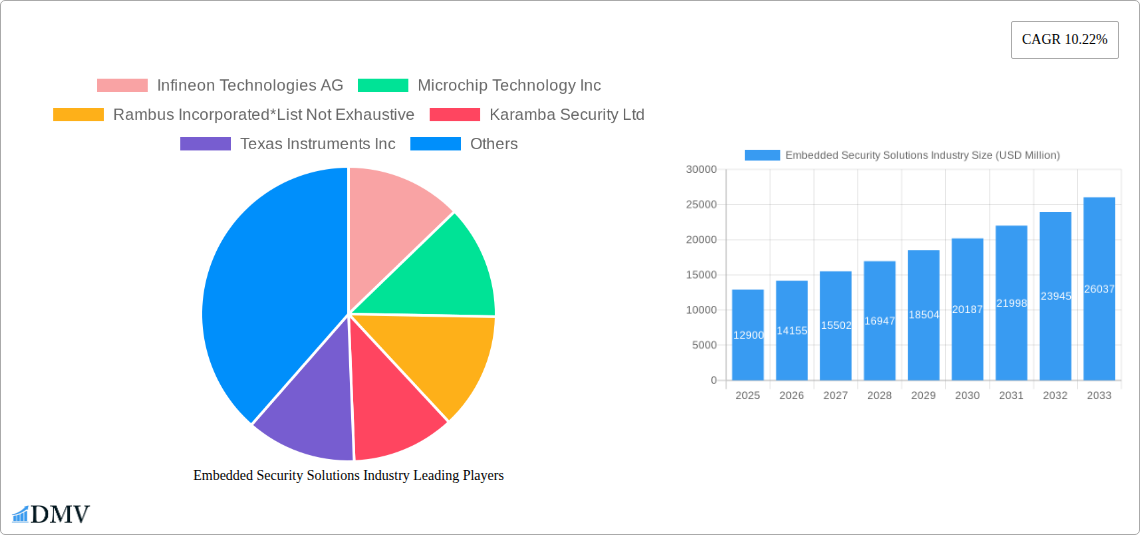

Embedded Security Solutions Industry Company Market Share

Gain unparalleled insights into the burgeoning embedded security solutions industry with this definitive report. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this analysis delves deep into the intricate market dynamics, technological advancements, and strategic opportunities shaping the future of securing connected devices. Our research provides a granular view of market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and emerging opportunities, all underpinned by robust data and expert analysis. Essential for stakeholders seeking to navigate and capitalize on the projected USD 100 billion market by 2033, this report empowers strategic decision-making in the critical domain of IoT security, hardware security modules (HSMs), secure element (SE), and trusted platform modules (TPMs).

Embedded Security Solutions Industry Market Composition & Trends

The embedded security solutions industry is characterized by a moderately concentrated market, with key players vying for dominance through continuous innovation and strategic acquisitions. The market's expansion is fueled by an escalating need for robust protection against sophisticated cyber threats targeting an ever-increasing volume of connected devices. Regulatory landscapes, such as GDPR and industry-specific mandates, are increasingly dictating stringent security requirements, acting as significant catalysts for adoption. While substitute products exist, their effectiveness in providing end-to-end security for embedded systems is often limited compared to specialized solutions. End-user profiles are diversifying rapidly, with critical sectors like automotive, healthcare, and industrial IoT demanding advanced embedded system security. Mergers and acquisitions (M&A) are a recurring theme, with significant deal values demonstrating consolidation and strategic integration. For instance, M&A activities are estimated to have reached over USD 5 billion in the last five years, reflecting the industry's dynamism.

- Market Share Distribution: Dominant players hold significant shares, with a few large corporations accounting for over 60% of the market revenue.

- Innovation Catalysts: Increasing attack vectors, growing IoT adoption, and evolving compliance standards are primary drivers of innovation.

- Regulatory Landscape: Strict data privacy laws and industry certifications (e.g., ISO 27001, FIPS 140-2) are shaping product development and market entry strategies.

- M&A Activities: High-value acquisitions and partnerships are prevalent as companies seek to expand their technology portfolios and market reach.

Embedded Security Solutions Industry Industry Evolution

The embedded security solutions industry has witnessed a dramatic evolution, transforming from basic protection mechanisms to sophisticated, multi-layered security architectures. Over the historical period (2019-2024), the market experienced a Compound Annual Growth Rate (CAGR) of approximately 15%, driven by the widespread adoption of the Internet of Things (IoT) and the subsequent surge in cyber threats. Technological advancements have been central to this evolution, with innovations in hardware-based security (like secure enclaves and hardware security modules) and advanced software security solutions (including encryption, authentication protocols, and secure boot mechanisms) becoming standard. Consumer demand has shifted significantly; early adopters were primarily concerned with basic data protection, but current demand centers on comprehensive security that ensures the integrity and privacy of sensitive information across the entire device lifecycle. The market's growth trajectory is projected to accelerate, with an anticipated CAGR of XX% during the forecast period (2025-2033). This growth is propelled by the increasing pervasiveness of connected devices in critical infrastructure, smart homes, and personal health monitoring, all of which require unwavering security. The adoption of secure-by-design principles is becoming paramount, with manufacturers embedding security features from the initial stages of product development. Furthermore, the rise of edge computing necessitates robust security at the device level, creating a substantial market for specialized embedded security solutions. The increasing complexity of attacks, including zero-day exploits and ransomware targeting embedded systems, further validates the need for advanced security measures. The market is also seeing a growing demand for post-quantum cryptography solutions, anticipating future threats from quantum computing. The integration of AI and machine learning in embedded security systems is another key trend, enabling proactive threat detection and automated response mechanisms. The cybersecurity skills gap, however, remains a challenge, influencing the pace of adoption and the demand for managed security services.

Leading Regions, Countries, or Segments in Embedded Security Solutions Industry

The embedded security solutions industry is witnessing a significant surge in demand across various segments and geographies, with North America and Europe currently leading the market. This dominance is primarily driven by stringent regulatory frameworks, high consumer awareness of cybersecurity threats, and significant investments in advanced technologies.

Component Type Dominance:

- Hardware Security: This segment is a cornerstone, accounting for an estimated XX% of the market share. Hardware-based solutions like TPMs, HSMs, and secure elements (SEs) offer unparalleled tamper resistance and are critical for device identity and secure key management. Key drivers include the increasing use of encryption and the need for secure boot processes in critical applications.

- Software Security: A rapidly growing segment, representing approximately XX% of the market, encompassing encryption algorithms, secure operating systems, access control, and secure update mechanisms. Its growth is fueled by the evolving threat landscape and the need for flexible, adaptable security layers.

- Service Security: This segment, comprising around XX% of the market, includes threat intelligence, managed security services, and security consulting. Its expansion is driven by the complexity of embedded security and the shortage of skilled cybersecurity professionals within organizations.

Application Dominance:

- Authentication: This application holds a substantial market share of approximately XX%, driven by the need for secure user and device authentication in connected environments, from simple access control to complex multi-factor authentication systems.

- Payment Security: A significant and growing segment, representing XX% of the market, fueled by the proliferation of secure payment terminals, mobile payments, and the demand for protecting financial transactions in embedded devices.

- Content Protection: This segment, accounting for XX%, is crucial for protecting digital rights management (DRM) in media devices and ensuring the integrity of proprietary content in various applications.

- Other Applications: This broad category, including industrial control systems, smart grids, and medical devices, accounts for the remaining XX%, showcasing the pervasive need for embedded security across diverse sectors.

End User Dominance:

- Automotive: The automotive sector is a leading consumer of embedded security, comprising an estimated XX% of the market. The increasing sophistication of connected cars, autonomous driving features, and in-car infotainment systems necessitates robust security to prevent hacking and ensure passenger safety. Investments in cybersecurity for vehicles are projected to reach USD XX billion by 2030.

- Consumer Electronics: This segment, representing XX%, is also a major driver, with smart homes, wearables, and connected appliances requiring security to protect user data and prevent unauthorized access.

- Telecommunications: With the rollout of 5G networks and the proliferation of network-connected devices, the telecommunications sector accounts for XX% of the market, requiring highly secure infrastructure and devices.

- Healthcare: The growing adoption of connected medical devices and the sensitivity of patient data make healthcare a critical and rapidly expanding end-user segment, accounting for XX% of the market.

Embedded Security Solutions Industry Product Innovations

Product innovations in the embedded security solutions industry are rapidly advancing to meet evolving threats. Key developments include the integration of hardware root-of-trust (RoT) architectures for enhanced device integrity, such as advanced TPMs and secure elements. Software innovations focus on lightweight, efficient encryption algorithms suitable for resource-constrained devices and AI-powered anomaly detection for real-time threat identification. The emergence of Post-Quantum Cryptography (PQC) solutions is a significant breakthrough, preparing embedded systems for the quantum computing era. These innovations offer enhanced security against future threats, improved performance, and reduced power consumption, driving greater adoption across diverse applications.

Propelling Factors for Embedded Security Solutions Industry Growth

The embedded security solutions industry is experiencing robust growth driven by several key factors. The relentless expansion of the IoT ecosystem, encompassing billions of connected devices, necessitates comprehensive security solutions to protect sensitive data and prevent network breaches. Evolving and increasingly stringent government regulations worldwide, such as data privacy laws and industry-specific compliance standards, mandate the implementation of robust embedded security. Furthermore, the escalating sophistication and frequency of cyberattacks targeting connected devices are compelling businesses and consumers alike to invest in advanced security measures. The growing demand for secure authentication and data protection in critical sectors like automotive, healthcare, and industrial automation also significantly propels market expansion.

Obstacles in the Embedded Security Solutions Industry Market

Despite its significant growth, the embedded security solutions industry faces several obstacles. The complexity and fragmentation of the embedded device landscape make it challenging to implement standardized security solutions. Furthermore, the high cost associated with advanced security implementations can be a barrier for smaller companies and less affluent markets. The persistent shortage of skilled cybersecurity professionals exacerbates implementation challenges and ongoing management. Additionally, supply chain disruptions, as witnessed in recent years, can impact the availability and cost of essential security hardware components. Evolving threat landscapes and the rapid pace of technological change also require continuous investment in security updates and new solutions, posing a challenge for long-term security planning.

Future Opportunities in Embedded Security Solutions Industry

The embedded security solutions industry is poised for significant future opportunities. The widespread adoption of 5G and the subsequent explosion of connected devices in smart cities and industrial IoT (IIoT) present a vast market for specialized security solutions. The increasing integration of AI and machine learning in embedded systems creates demand for AI-powered security features and secure AI model deployment. The burgeoning electric vehicle (EV) market and the push for autonomous driving present critical security needs for connected automotive systems. Furthermore, the global shift towards remote work and telehealth accelerates the demand for secure endpoint devices and data protection in these applications. The development and standardization of Post-Quantum Cryptography (PQC) will also unlock new opportunities for future-proofing embedded systems.

Major Players in the Embedded Security Solutions Industry Ecosystem

- Infineon Technologies AG

- Microchip Technology Inc

- Rambus Incorporated

- Karamba Security Ltd

- Texas Instruments Inc

- McAfee LLC

- Samsung Electronics Co

- STMicroelectronics N V

- Intellias Ltd

- Idemia Group

Key Developments in Embedded Security Solutions Industry Industry

- November 2022: Secure-IC and Unseenlabs announced their collaboration to retrofit existing BRO satellites with the ability to secure and authenticate data using Post-Quantum Cryptography, becoming the first firms worldwide to provide PQC authentication from satellite to cloud.

- November 2022: CACI International Inc joined the Red Hat Embedded Partner Program, aiming to create an enterprise scalable Commercial Solutions for Classified (CSfC) mobility solution based on CACI's Archon product line and Red Hat Enterprise Linux for secure remote access to classified settings.

Strategic Embedded Security Solutions Industry Market Forecast

The embedded security solutions industry is projected for substantial growth, driven by the continuous expansion of IoT devices, stringent regulatory demands, and the ever-present threat of sophisticated cyberattacks. The increasing integration of advanced technologies like AI and edge computing within embedded systems will create a strong demand for robust, intelligent security solutions. Strategic investments in hardware-based security, secure software development lifecycle practices, and managed security services will be crucial for market players. The future opportunities lie in addressing emerging threats, securing critical infrastructure, and enabling secure digital transformation across all sectors, positioning the market for sustained expansion and innovation.

Embedded Security Solutions Industry Segmentation

-

1. Component Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Service

-

2. Application

- 2.1. Payment

- 2.2. Authentication

- 2.3. Content Protection

- 2.4. Other Applications

-

3. End User

- 3.1. Automotive

- 3.2. Healthcare

- 3.3. Consumer Electronics

- 3.4. Telecommunications

- 3.5. Aerospace & Defence

- 3.6. Other End Users

Embedded Security Solutions Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Embedded Security Solutions Industry Regional Market Share

Geographic Coverage of Embedded Security Solutions Industry

Embedded Security Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing IoT Applications Increases the Need for IoT Security; Adoption of Wearable Devices in Healthcare

- 3.3. Market Restrains

- 3.3.1. Low Demand Due to Impact of COVID-; Non-Adherence to Government Regulations Due to Lack of Auditing

- 3.4. Market Trends

- 3.4.1. Adoption of Wearable Devices in Healthcare is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Embedded Security Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Payment

- 5.2.2. Authentication

- 5.2.3. Content Protection

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Automotive

- 5.3.2. Healthcare

- 5.3.3. Consumer Electronics

- 5.3.4. Telecommunications

- 5.3.5. Aerospace & Defence

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Embedded Security Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Service

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Payment

- 6.2.2. Authentication

- 6.2.3. Content Protection

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Automotive

- 6.3.2. Healthcare

- 6.3.3. Consumer Electronics

- 6.3.4. Telecommunications

- 6.3.5. Aerospace & Defence

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Embedded Security Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Service

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Payment

- 7.2.2. Authentication

- 7.2.3. Content Protection

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Automotive

- 7.3.2. Healthcare

- 7.3.3. Consumer Electronics

- 7.3.4. Telecommunications

- 7.3.5. Aerospace & Defence

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Embedded Security Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Service

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Payment

- 8.2.2. Authentication

- 8.2.3. Content Protection

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Automotive

- 8.3.2. Healthcare

- 8.3.3. Consumer Electronics

- 8.3.4. Telecommunications

- 8.3.5. Aerospace & Defence

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Rest of the World Embedded Security Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Service

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Payment

- 9.2.2. Authentication

- 9.2.3. Content Protection

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Automotive

- 9.3.2. Healthcare

- 9.3.3. Consumer Electronics

- 9.3.4. Telecommunications

- 9.3.5. Aerospace & Defence

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Microchip Technology Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rambus Incorporated*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Karamba Security Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Texas Instruments Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 McAfee LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Samsung Electronics Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 STMicroelectronics N V

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Intellias Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Idemia Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Embedded Security Solutions Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Embedded Security Solutions Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 3: North America Embedded Security Solutions Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Embedded Security Solutions Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Embedded Security Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Embedded Security Solutions Industry Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Embedded Security Solutions Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Embedded Security Solutions Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Embedded Security Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Embedded Security Solutions Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 11: Europe Embedded Security Solutions Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 12: Europe Embedded Security Solutions Industry Revenue (undefined), by Application 2025 & 2033

- Figure 13: Europe Embedded Security Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Embedded Security Solutions Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Embedded Security Solutions Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Embedded Security Solutions Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Embedded Security Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Embedded Security Solutions Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 19: Asia Pacific Embedded Security Solutions Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 20: Asia Pacific Embedded Security Solutions Industry Revenue (undefined), by Application 2025 & 2033

- Figure 21: Asia Pacific Embedded Security Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Embedded Security Solutions Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Embedded Security Solutions Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Embedded Security Solutions Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Embedded Security Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Embedded Security Solutions Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 27: Rest of the World Embedded Security Solutions Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 28: Rest of the World Embedded Security Solutions Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Rest of the World Embedded Security Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Embedded Security Solutions Industry Revenue (undefined), by End User 2025 & 2033

- Figure 31: Rest of the World Embedded Security Solutions Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Embedded Security Solutions Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Rest of the World Embedded Security Solutions Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 2: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Embedded Security Solutions Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 6: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Embedded Security Solutions Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 12: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Embedded Security Solutions Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: Germany Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 20: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global Embedded Security Solutions Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: India Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: China Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 28: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Embedded Security Solutions Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Embedded Security Solutions Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Latin America Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Middle East and Africa Embedded Security Solutions Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Embedded Security Solutions Industry?

The projected CAGR is approximately 9.71%.

2. Which companies are prominent players in the Embedded Security Solutions Industry?

Key companies in the market include Infineon Technologies AG, Microchip Technology Inc, Rambus Incorporated*List Not Exhaustive, Karamba Security Ltd, Texas Instruments Inc, McAfee LLC, Samsung Electronics Co, STMicroelectronics N V, Intellias Ltd, Idemia Group.

3. What are the main segments of the Embedded Security Solutions Industry?

The market segments include Component Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing IoT Applications Increases the Need for IoT Security; Adoption of Wearable Devices in Healthcare.

6. What are the notable trends driving market growth?

Adoption of Wearable Devices in Healthcare is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Low Demand Due to Impact of COVID-; Non-Adherence to Government Regulations Due to Lack of Auditing.

8. Can you provide examples of recent developments in the market?

November 2022: Secure-IC, a global provider of end-to-end cybersecurity solutions for embedded systems and connected objects, and Unseenlabs, a world leader in space-based RF detection for Maritime Domain Awareness, announced today at European Cyber Week 2022 their collaboration to retrofit existing BRO satellites with the ability to secure and authenticate data using Post-Quantum Cryptography. With this release, Secure-IC and Unseenlabs, based in Rennes, France, became the first firms worldwide to provide PQC authentication from satellite to cloud.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Embedded Security Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Embedded Security Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Embedded Security Solutions Industry?

To stay informed about further developments, trends, and reports in the Embedded Security Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence