Key Insights

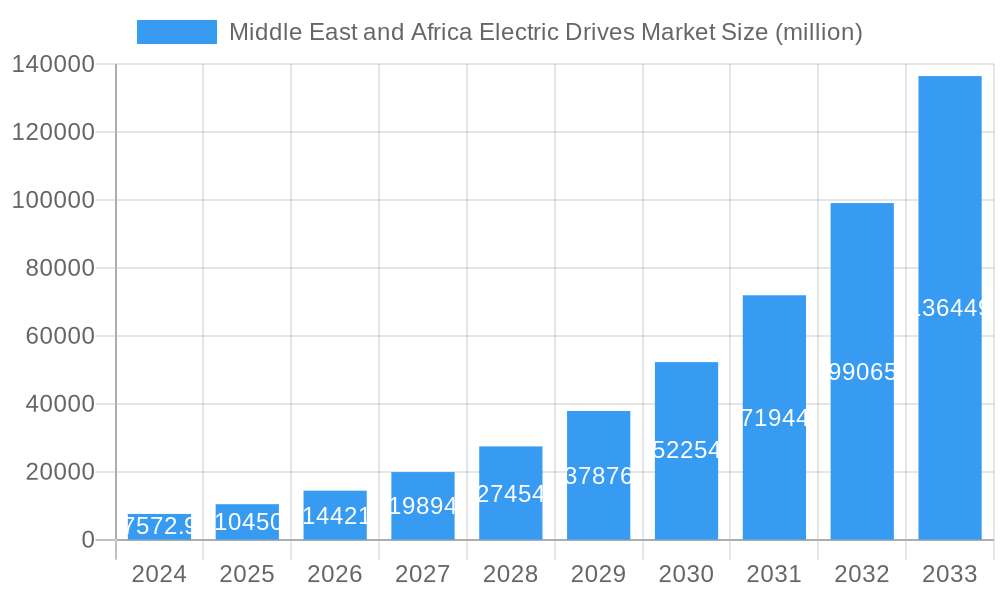

The Middle East and Africa (MEA) Electric Drives Market is poised for remarkable expansion, projecting a robust market size of USD 7572.9 million in 2024 and an impressive CAGR of 38%. This substantial growth is primarily fueled by the accelerating industrialization and infrastructure development across the region, particularly in sectors like Oil & Gas, Chemical & Petrochemical, and Power Generation. The increasing adoption of energy-efficient technologies to reduce operational costs and meet stringent environmental regulations is a significant driver. Furthermore, the burgeoning demand for automation in manufacturing processes, coupled with the growing focus on smart grid initiatives, is propelling the market forward. The widespread implementation of advanced AC drives, DC drives, and servo drives across various applications, from heavy machinery to sophisticated automation systems, underscores the market's dynamic nature.

Middle East and Africa Electric Drives Market Market Size (In Billion)

The MEA Electric Drives Market is characterized by several key trends, including the rising demand for variable speed drives (VSDs) for enhanced energy savings and process control. The increasing integration of IoT and AI-powered solutions is enabling predictive maintenance and optimized performance of electric drives, further contributing to market growth. While the market exhibits immense potential, certain restraints such as the high initial cost of advanced electric drives and the need for skilled personnel for installation and maintenance could pose challenges. However, ongoing technological advancements, coupled with supportive government initiatives promoting industrial automation and energy efficiency, are expected to mitigate these challenges, paving the way for sustained and accelerated growth in the forecast period of 2025-2033.

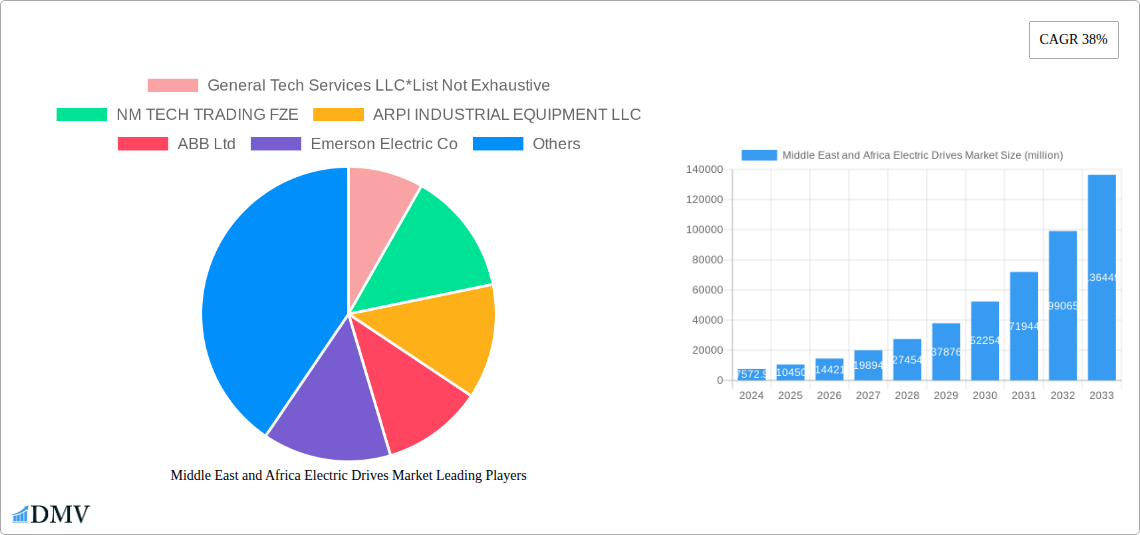

Middle East and Africa Electric Drives Market Company Market Share

This in-depth report provides an exhaustive analysis of the Middle East and Africa (MEA) Electric Drives Market. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this study delves into market dynamics, key players, technological advancements, and future opportunities. Discover critical insights for navigating the evolving landscape of industrial automation and energy efficiency in the MEA region.

Middle East and Africa Electric Drives Market Market Composition & Trends

The MEA electric drives market is characterized by a moderate level of concentration, with a few key players holding significant market share. Innovation is primarily driven by the increasing demand for energy-efficient solutions across various end-user industries. The regulatory landscape is gradually evolving, with governments in the region increasingly focusing on sustainability and industrial modernization, indirectly boosting the adoption of electric drives. Substitute products, such as mechanical drives, are losing traction as the benefits of variable speed drives (VSDs) in terms of energy savings and process control become more apparent.

Key trends shaping the market composition include:

- Growing demand for AC Drives: AC drives dominate the market due to their versatility and cost-effectiveness in a wide range of applications.

- Emerging importance of Servo Drives: Increasing automation in discrete manufacturing and packaging sectors is fueling the growth of servo drives.

- Focus on energy efficiency: Stringent environmental regulations and rising energy costs are compelling industries to invest in energy-efficient electric drives.

- Digitalization and IoT integration: The integration of smart technologies and IoT capabilities into electric drives is enhancing their performance and enabling predictive maintenance.

- Sectoral growth in Oil & Gas and Water & Wastewater: Significant investments in these sectors are driving the demand for robust and efficient electric drive solutions.

The market is poised for sustained growth, driven by ongoing industrial development and a strong emphasis on operational efficiency.

Middle East and Africa Electric Drives Market Industry Evolution

The Middle East and Africa Electric Drives Market has witnessed a significant evolutionary trajectory, marked by consistent growth and technological advancements throughout the study period (2019–2033). The historical period (2019–2024) laid the groundwork for this expansion, fueled by burgeoning industrial sectors and a growing awareness of energy efficiency. During this phase, AC drives established their dominance owing to their widespread applicability in pumps, fans, conveyors, and general machinery. The low voltage segment saw substantial adoption across Small and Medium Enterprises (SMEs) and various process industries.

The base year, 2025, stands as a pivotal point, reflecting a market that has matured in its understanding of the benefits offered by advanced electric drive technologies. This maturity is evident in the increasing demand for more sophisticated solutions like DC drives and servo drives, particularly within the Oil & Gas, Chemical & Petrochemical, and Discrete Industries. These sectors, critical to the MEA economy, are investing heavily in automation and process optimization to enhance productivity and reduce operational costs.

Looking ahead into the forecast period (2025–2033), the industry is anticipated to experience an accelerated growth rate. This surge will be propelled by several factors, including government initiatives promoting industrial diversification, increasing foreign direct investment in manufacturing and infrastructure, and the global push towards decarbonization. The adoption of medium voltage drives is expected to gain momentum as large-scale industrial projects, such as power plants and heavy manufacturing facilities, come online.

Consumer demand is shifting towards solutions that offer greater control, higher precision, and enhanced connectivity. This trend is evident in the rising interest in servo drives for applications requiring precise motion control, such as robotics, automated assembly lines, and advanced packaging machinery within the Food & Beverage and Discrete Industries. The Water & Wastewater sector, crucial for regional sustainability, will continue to be a significant demand driver, with a focus on energy-efficient pumps and treatment processes facilitated by variable speed drives.

Technological advancements are at the forefront of this evolution. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into electric drives is enabling smarter operations, predictive maintenance, and remote monitoring, thereby minimizing downtime and optimizing performance. Furthermore, the development of more compact, robust, and energy-efficient drive systems is making them accessible to a broader range of applications and industries. The MEA region, with its ambitious development goals, presents a fertile ground for the continued evolution and widespread adoption of electric drives, making it a key market for global manufacturers and technology providers. The market is projected to grow at a CAGR of approximately 6.5% to 7.8% during the forecast period.

Leading Regions, Countries, or Segments in Middle East and Africa Electric Drives Market

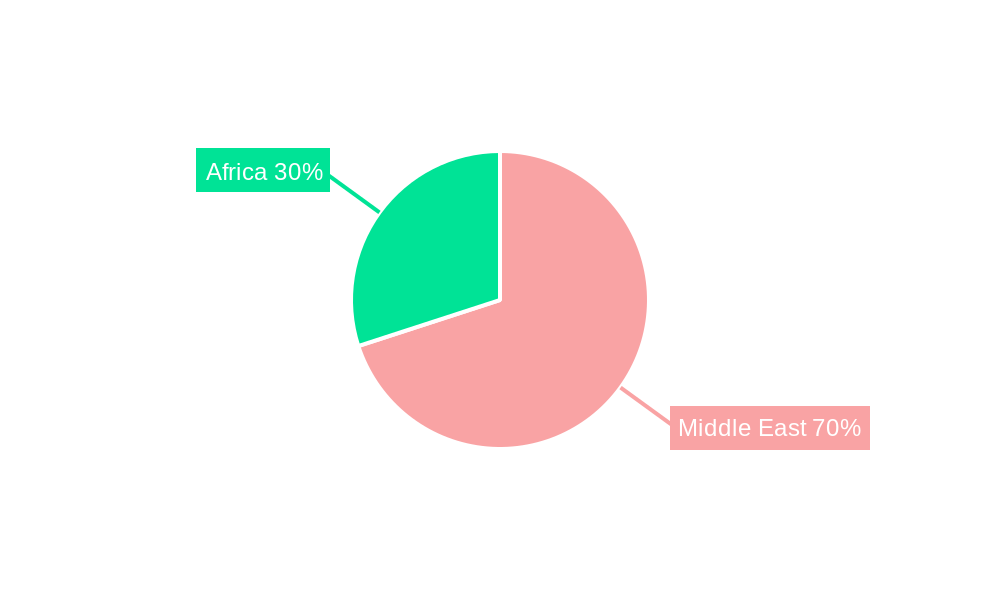

The Middle East and Africa Electric Drives Market is a diverse landscape, but when examining dominance factors, the United Arab Emirates (UAE) emerges as a leading country, driven by its robust industrial infrastructure, significant investments in sectors like Oil & Gas, and its strategic position as a regional hub for trade and manufacturing. Within the broader MEA region, the Middle East sub-region, spearheaded by the UAE and Saudi Arabia, significantly outpaces Africa in terms of current market size and adoption rates of electric drives, primarily due to higher industrialization levels and greater capital expenditure in key sectors.

The AC Drives segment consistently holds the largest market share. This is attributed to their versatility, cost-effectiveness, and extensive application across a multitude of industries, including Oil & Gas, Chemical & Petrochemical, Food & Beverage, Water & Wastewater, and HVAC systems.

Key Drivers for Dominance:

- Oil & Gas Sector Dominance: The Middle East, with its vast reserves, remains a primary driver. The need for efficient pumping, compression, and material handling in exploration, production, and refining operations fuels a substantial demand for low voltage and increasingly medium voltage AC drives. The ongoing infrastructure development and maintenance projects in this sector contribute significantly to market growth.

- Infrastructure Development: Government initiatives in countries like Saudi Arabia (Vision 2030) and the UAE are leading to massive investments in infrastructure, including power generation, water treatment, and transportation. This directly translates to increased demand for electric drives in associated projects.

- Growing Manufacturing Base: The UAE and Saudi Arabia are actively diversifying their economies by expanding their manufacturing capabilities. This includes the Discrete Industries, Food & Beverage, and Metal & Mining sectors, all of which rely heavily on automated processes powered by electric drives, particularly servo drives for precision applications and AC drives for general machinery.

- Energy Efficiency Imperatives: As energy costs rise and environmental concerns grow, industries are increasingly adopting energy-efficient technologies. Variable Speed Drives (VSDs) are crucial in reducing energy consumption in applications like pumps and fans, making Water & Wastewater and HVAC segments strong contributors to AC drive demand.

- Technological Adoption and Investment: Companies in the leading economies of the MEA region are more receptive to adopting advanced technologies. This includes the implementation of sophisticated control systems and automation, which inherently require high-performance electric drives.

While the Africa continent presents a significant future growth opportunity, its current market share is smaller due to varying levels of industrialization, infrastructure, and investment capacity across its diverse nations. However, with increasing FDI and development projects, countries in North Africa and select Sub-Saharan African nations are showing promising growth in sectors like mining and agriculture, which will contribute to the MEA electric drives market expansion in the long term. The low voltage segment is dominant across the region due to its widespread use in various industrial applications, but the adoption of medium voltage drives is anticipated to rise with the growth of large-scale industrial projects.

Middle East and Africa Electric Drives Market Product Innovations

Product innovations in the MEA electric drives market are increasingly focused on enhancing energy efficiency, improving operational intelligence, and facilitating seamless integration with Industry 4.0 frameworks. Manufacturers are developing compact and modular designs for AC drives and DC drives, simplifying installation and maintenance while optimizing space utilization in industrial facilities. The incorporation of advanced algorithms and AI capabilities is enabling predictive maintenance features, allowing for early detection of potential faults and minimizing downtime. Furthermore, the development of drives with enhanced connectivity options, such as integrated IoT modules, supports real-time data monitoring and remote control, crucial for optimizing performance in sectors like Oil & Gas and Water & Wastewater. The introduction of highly precise servo drives with improved torque control and dynamic response is catering to the growing demand for automation in the Discrete Industries and packaging sectors.

Propelling Factors for Middle East and Africa Electric Drives Market Growth

The MEA Electric Drives Market is propelled by a confluence of robust factors. Industrial diversification initiatives in countries like the UAE and Saudi Arabia are creating new manufacturing hubs, increasing demand for automation and electric drives. Significant infrastructure development projects, particularly in Power Generation and Water & Wastewater management, require a substantial number of efficient motor control solutions. The growing emphasis on energy efficiency and sustainability is a major catalyst, with industries actively seeking VSDs to reduce operational costs and meet environmental regulations. Furthermore, technological advancements, including the integration of IoT and AI into drives for smart manufacturing, are enhancing their appeal and driving adoption. Finally, the consistent demand from the Oil & Gas sector for reliable and high-performance drive systems continues to be a cornerstone of market growth.

Obstacles in the Middle East and Africa Electric Drives Market Market

Despite the positive growth trajectory, the MEA Electric Drives Market faces several obstacles. Limited skilled labor in some African nations can hinder the installation, operation, and maintenance of sophisticated electric drive systems. Fluctuating economic conditions and political instability in certain regions can impact investment decisions and project timelines. High initial costs associated with advanced drive technologies can be a deterrent for small and medium-sized enterprises with tighter budgets. Supply chain disruptions, particularly for specialized components, can lead to project delays and increased costs. Additionally, varying regulatory frameworks and standardization challenges across different countries within the MEA region can create complexities for market players.

Future Opportunities in Middle East and Africa Electric Drives Market

Emerging opportunities in the MEA Electric Drives Market are substantial and multifaceted. The renewable energy sector presents a significant avenue for growth, with the increasing deployment of solar and wind power plants requiring advanced control systems. The expansion of smart city initiatives across the region will drive demand for efficient electric drives in smart grids, intelligent transportation, and automated building management systems, particularly within the HVAC segment. Furthermore, the growing focus on food security and agricultural automation in Africa offers a new market for electric drives in irrigation systems and farm machinery. The continued adoption of Industry 4.0 technologies will also create demand for intelligent and connected drive solutions, opening doors for new applications and services. The growing adoption of electric vehicles (EVs) within the region, though still nascent, will create future opportunities in charging infrastructure and related industrial automation.

Major Players in the Middle East and Africa Electric Drives Market Ecosystem

- General Tech Services LLC

- NM TECH TRADING FZE

- ARPI INDUSTRIAL EQUIPMENT LLC

- ABB Ltd

- Emerson Electric Co

- Siemens AG

- Schneider Electric SE

- Severn Glocon Ltd

- STARDOM ENGINEERING SERVICES LLC

- Wintech Engineering

Key Developments in Middle East and Africa Electric Drives Market Industry

- July 2022: ABB, a global technology company, actively participated in the Dubai Expo 2020 as an official partner of the Swedish pavilion, showcasing its technology digitally and interactively in collaboration with over 100 companies and institutions. Under the pavilion's theme of "Co-creation for Innovation," ABB joined the country's actions to highlight the most creative solutions to help produce a smart society. The exhibition is the first to be held in the Middle East. Expo 2020 was a meeting place for businesses and governments from October 1 to March 31, 2022.

- July 2021: ABB announced a comprehensive range of dependable and high-efficiency motors and drives for all applications in the UAE. These are suitable for OEMs to incorporate into pumps and fans, gearboxes, conveyors, general machinery, and other applications.

Strategic Middle East and Africa Electric Drives Market Market Forecast

The strategic forecast for the MEA Electric Drives Market indicates robust and sustained growth, driven by a powerful combination of industrial expansion, technological innovation, and an unwavering focus on sustainability. The ongoing diversification of economies away from fossil fuels, particularly in the Gulf Cooperation Council (GCC) countries, is leading to significant investments in manufacturing, infrastructure, and renewable energy, all of which are core consumers of electric drives. The increasing adoption of Industry 4.0 principles, including automation, IoT, and AI, is not merely a trend but a fundamental shift that will necessitate more advanced and connected drive solutions. Furthermore, the growing awareness of energy conservation and the need to reduce carbon footprints will continue to fuel the demand for highly efficient variable speed drives across all sectors. The African continent, with its rapidly urbanizing populations and increasing FDI, presents a vast, untapped market with immense potential for growth in sectors like agriculture, mining, and water management, all of which are ripe for electrification and automation. The market's trajectory is set to benefit from a strong pipeline of infrastructure projects and a proactive stance by regional governments in promoting technological advancement and industrial development.

Middle East and Africa Electric Drives Market Segmentation

-

1. Type

- 1.1. AC Drives

- 1.2. DC Drives

- 1.3. Servo Drives

-

2. Voltage

- 2.1. Low

- 2.2. Medium

-

3. End-user Industry

- 3.1. Oil & Gas

- 3.2. Chemical & Petrochemical

- 3.3. Food & Beverage

- 3.4. Water & Wastewater

- 3.5. Power Generation

- 3.6. Metal & Mining

- 3.7. Pulp & Paper

- 3.8. HVAC

- 3.9. Discrete Industries

- 3.10. Other End-user Industries

Middle East and Africa Electric Drives Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Electric Drives Market Regional Market Share

Geographic Coverage of Middle East and Africa Electric Drives Market

Middle East and Africa Electric Drives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Industrialisation and Growing Demand for Energy Efficiency; Flourishing Automotive Sector

- 3.3. Market Restrains

- 3.3.1. High Costs and Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Oil & Gas is Expected a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Electric Drives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. AC Drives

- 5.1.2. DC Drives

- 5.1.3. Servo Drives

- 5.2. Market Analysis, Insights and Forecast - by Voltage

- 5.2.1. Low

- 5.2.2. Medium

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil & Gas

- 5.3.2. Chemical & Petrochemical

- 5.3.3. Food & Beverage

- 5.3.4. Water & Wastewater

- 5.3.5. Power Generation

- 5.3.6. Metal & Mining

- 5.3.7. Pulp & Paper

- 5.3.8. HVAC

- 5.3.9. Discrete Industries

- 5.3.10. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Tech Services LLC*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NM TECH TRADING FZE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ARPI INDUSTRIAL EQUIPMENT LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ABB Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emerson Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Severn Glocon Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 STARDOM ENGINEERING SERVICES LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wintech Engineering

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 General Tech Services LLC*List Not Exhaustive

List of Figures

- Figure 1: Middle East and Africa Electric Drives Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Electric Drives Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Electric Drives Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Electric Drives Market Revenue million Forecast, by Voltage 2020 & 2033

- Table 3: Middle East and Africa Electric Drives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Middle East and Africa Electric Drives Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Electric Drives Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa Electric Drives Market Revenue million Forecast, by Voltage 2020 & 2033

- Table 7: Middle East and Africa Electric Drives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Middle East and Africa Electric Drives Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Electric Drives Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Electric Drives Market?

The projected CAGR is approximately 38%.

2. Which companies are prominent players in the Middle East and Africa Electric Drives Market?

Key companies in the market include General Tech Services LLC*List Not Exhaustive, NM TECH TRADING FZE, ARPI INDUSTRIAL EQUIPMENT LLC, ABB Ltd, Emerson Electric Co, Siemens AG, Schneider Electric SE, Severn Glocon Ltd, STARDOM ENGINEERING SERVICES LLC, Wintech Engineering.

3. What are the main segments of the Middle East and Africa Electric Drives Market?

The market segments include Type, Voltage, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7572.9 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Industrialisation and Growing Demand for Energy Efficiency; Flourishing Automotive Sector.

6. What are the notable trends driving market growth?

Oil & Gas is Expected a Significant Growth.

7. Are there any restraints impacting market growth?

High Costs and Data Security Concerns.

8. Can you provide examples of recent developments in the market?

July 2022- ABB, a global technology company, actively participated in the Dubai Expo 2020 as an official partner of the Swedish pavilion, showcasing its technology digitally and interactively in collaboration with over 100 companies and institutions. Under the pavilion's theme of "Co-creation for Innovation," ABB joined the country's actions to highlight the most creative solutions to help produce a smart society. The exhibition is the first to be held in the Middle East. Expo 2020 was a meeting place for businesses and governments from October 1 to March 31, 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Electric Drives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Electric Drives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Electric Drives Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Electric Drives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence