Key Insights

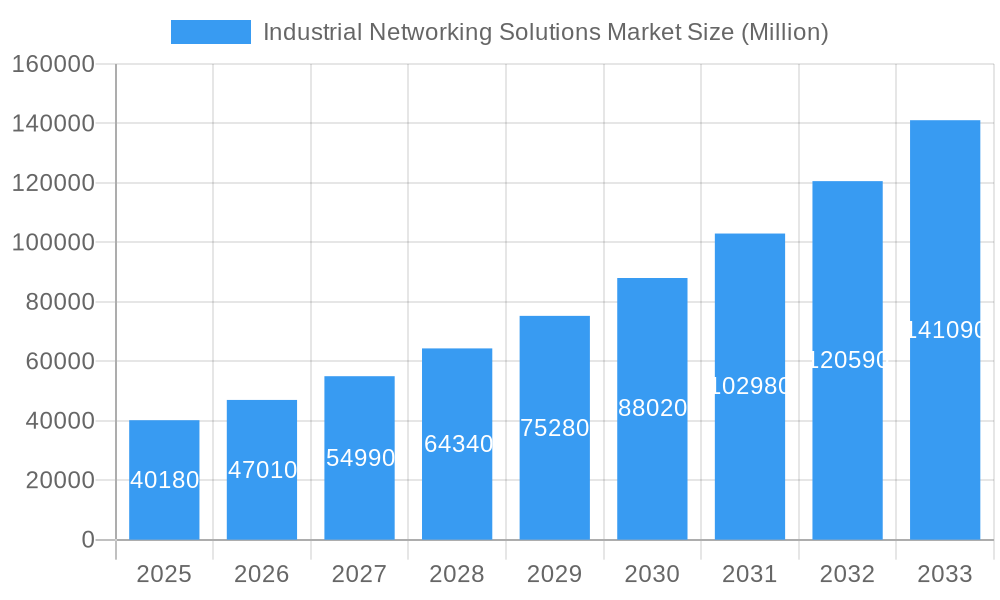

The Industrial Networking Solutions Market is poised for significant expansion, with an estimated market size of $40.18 billion in 2025, driven by a robust CAGR of 17%. This impressive growth is fueled by several key factors. The increasing adoption of Industry 4.0 technologies, the proliferation of the Industrial Internet of Things (IIoT), and the growing demand for real-time data analytics are major catalysts. Automation in manufacturing, smart grids in the energy sector, and the need for enhanced operational efficiency across diverse industries like automotive, financial services, and logistics are also contributing substantially. Furthermore, the continuous evolution of communication technologies, including 5G and edge computing, is enabling more sophisticated and reliable industrial networks. The market's dynamism is further highlighted by the prevalence of both wired and wireless connectivity solutions, catering to the diverse requirements of industrial environments, alongside a shift towards cloud-based deployment models for greater flexibility and scalability.

Industrial Networking Solutions Market Market Size (In Billion)

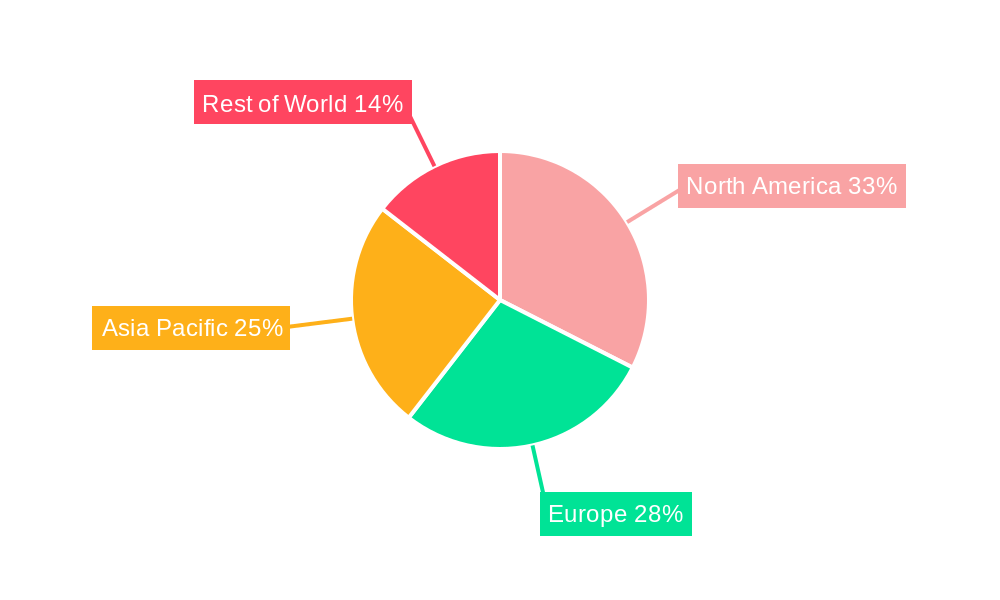

Despite the promising outlook, certain restraints could temper the market's full potential. These include the high initial investment costs associated with advanced networking infrastructure and cybersecurity concerns, which remain a critical challenge for industrial organizations. The complexity of integrating new networking solutions with legacy systems also presents a hurdle. However, the overwhelming benefits of enhanced productivity, improved safety, and predictive maintenance capabilities are expected to outweigh these challenges. The market is segmented across critical components like hardware, software, and services, with a broad range of end-user industries leveraging these solutions to optimize their operations. Major players like Cisco Systems, Siemens, and Huawei are actively innovating and expanding their portfolios to meet the evolving demands of this dynamic market. North America and Europe currently lead in adoption, but the Asia Pacific region is demonstrating rapid growth, driven by its expanding industrial base and smart manufacturing initiatives.

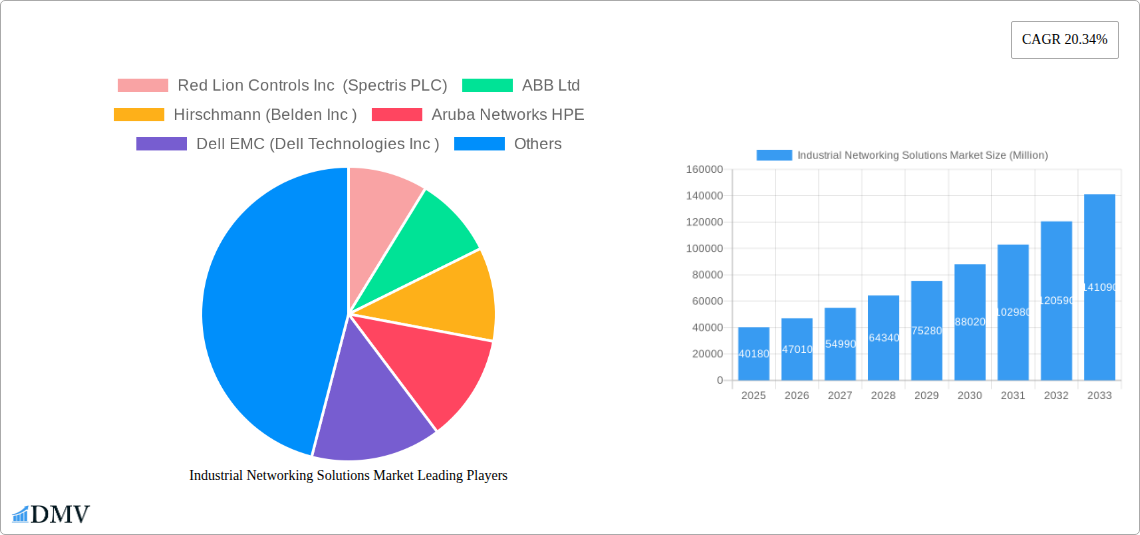

Industrial Networking Solutions Market Company Market Share

Industrial Networking Solutions Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth market research report provides a definitive analysis of the global Industrial Networking Solutions market, projecting its trajectory from 2019 to 2033. With a base year of 2025, the report leverages historical data from 2019-2024 and forecasts market dynamics through 2033. We delve into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. This report is essential for stakeholders seeking to understand the intricate workings and future potential of this critical technology sector.

Industrial Networking Solutions Market Market Composition & Trends

The Industrial Networking Solutions market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing demand for robust connectivity in industrial environments. Market concentration is moderately fragmented, with key players like Cisco Systems Inc., Rockwell Automation Inc., and Huawei Technologies Co Ltd. holding significant shares. The innovation landscape is driven by the continuous development of high-speed, secure, and reliable networking hardware, sophisticated software platforms for network management and analytics, and comprehensive service offerings including integration, maintenance, and cybersecurity. Substitute products, while emerging, currently struggle to match the specialized resilience and performance required in industrial settings. End-user profiles span a broad spectrum, from heavy manufacturing and automotive to logistics and telecommunications, each with unique connectivity needs. Merger and acquisition activities are strategically shaping the market, with significant deals valued in the billions, aiming to consolidate market presence and expand technological capabilities. For instance, recent M&A activity in the sector has reached approximately \$5.8 billion, reflecting a strategic push for market expansion and technological synergy.

- Market Share Distribution: The Hardware segment currently dominates the market, estimated at \$15.2 billion in 2025, owing to the foundational role of robust network infrastructure.

- M&A Deal Values: Recent significant acquisitions in the industrial networking space have collectively amounted to over \$5.8 billion, signaling consolidation and strategic growth.

- Innovation Catalysts: The drive for Industry 4.0, smart manufacturing, and the Industrial Internet of Things (IIoT) are primary catalysts for innovation.

- Regulatory Landscapes: Evolving cybersecurity mandates and industry-specific compliance standards are increasingly influencing product development and market entry.

Industrial Networking Solutions Market Industry Evolution

The Industrial Networking Solutions market has witnessed a profound evolution, transitioning from basic connectivity to sophisticated, intelligent networks driving operational efficiency and digital transformation across industries. This evolution is marked by a consistent upward trajectory in market growth, fueled by the escalating adoption of Industry 4.0 principles and the imperative for real-time data exchange and control. Technological advancements have been relentless, with a significant shift towards wireless technologies like 5G and Wi-Fi 6, offering greater flexibility and mobility on the factory floor and in remote industrial sites. The proliferation of edge computing solutions, enabling localized data processing and analysis, further enhances the performance and responsiveness of industrial networks. Concurrently, consumer demands have evolved, with industries now expecting highly resilient, secure, and scalable networking solutions that can seamlessly integrate with existing operational technology (OT) and information technology (IT) systems. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reaching an estimated market size of over \$45 billion. Adoption metrics for IIoT devices are surging, with an estimated 25 billion devices expected to be connected by 2027, underscoring the critical role of robust industrial networking. The integration of AI and machine learning within network management software is also a key trend, enabling predictive maintenance and automated troubleshooting, further optimizing operational uptime. The increasing complexity of industrial operations necessitates networks that can handle massive data volumes, support diverse communication protocols, and maintain stringent security postures against cyber threats.

Leading Regions, Countries, or Segments in Industrial Networking Solutions Market

The Manufacturing end-user industry stands as a dominant force within the global Industrial Networking Solutions market, driven by the widespread adoption of smart factory initiatives and the relentless pursuit of operational efficiency. This segment is expected to account for over 35% of the total market revenue in 2025, estimated at \$10.8 billion. The Automotive sector is a close contender, with significant investments in automated production lines and connected vehicle technologies, contributing an estimated \$6.5 billion. Furthermore, the Hardware component segment, projected at \$15.2 billion, remains the largest by value, reflecting the fundamental need for robust routers, switches, gateways, and industrial PCs that form the backbone of any industrial network. Within connectivity types, Wired solutions, particularly Ethernet-based technologies, continue to hold a substantial market share due to their inherent reliability and security in critical applications, estimated at \$12.5 billion. However, Wireless solutions, driven by 5G and Wi-Fi advancements, are experiencing rapid growth, especially in applications requiring mobility and flexible deployments, forecasted to reach \$10.3 billion. The On-premises deployment model still dominates, with industries prioritizing data security and control, valued at \$19.8 billion. Nevertheless, the Cloud deployment model is gaining traction, particularly for data analytics, remote monitoring, and software-as-a-service (SaaS) solutions.

- Key Drivers in Manufacturing:

- Industry 4.0 Adoption: Implementation of automation, AI, and IoT for enhanced productivity.

- Demand for Real-time Data: Need for immediate data acquisition and analysis for process optimization.

- Predictive Maintenance: Integration of sensors and networks to minimize downtime.

- Dominance Factors in Hardware:

- Ruggedization: Requirement for devices that can withstand harsh industrial environments (temperature, vibration, dust).

- High Bandwidth & Low Latency: Essential for real-time control and data-intensive applications.

- Security Features: Built-in security protocols to protect critical infrastructure.

- Growth in Wireless:

- Flexibility & Mobility: Enabling dynamic reconfigurations of production lines.

- Reduced Cabling Costs: Significant cost savings in large or complex facilities.

- Emergence of 5G: Offering high speed, low latency, and massive device connectivity.

Industrial Networking Solutions Market Product Innovations

Recent product innovations in the Industrial Networking Solutions market are significantly enhancing operational efficiency and security. Advancements in ruggedized industrial switches and routers now offer enhanced cybersecurity features, including intrusion detection and prevention systems, alongside support for emerging protocols like TSN (Time-Sensitive Networking) for deterministic communication. Software innovations are focused on AI-powered network management platforms that provide predictive analytics for maintenance, automated fault detection, and optimized traffic management, leading to reduced downtime and improved network performance. Furthermore, the integration of edge computing capabilities directly into networking hardware is enabling faster data processing at the source, reducing latency and bandwidth requirements for cloud transmission. Unique selling propositions lie in the ability of these solutions to seamlessly integrate with legacy industrial systems while providing the scalability and intelligence needed for future digital transformation initiatives. Performance metrics are demonstrably improving, with latency reduced by up to 40% in specific applications and network uptime exceeding 99.99%.

Propelling Factors for Industrial Networking Solutions Market Growth

The Industrial Networking Solutions market is propelled by a confluence of powerful factors driving its expansion. The relentless march of Industry 4.0 and the Industrial Internet of Things (IIoT) necessitates robust, high-speed, and secure networking infrastructure to connect vast numbers of sensors, actuators, and machinery for data collection and control. Economic imperatives, such as the pursuit of operational efficiency, reduced downtime, and optimized resource utilization, are compelling businesses to invest in advanced networking solutions. Regulatory pressures, particularly concerning cybersecurity and data privacy in critical infrastructure, are also driving the adoption of compliant and secure networking technologies. Technological advancements, including the advent of 5G, Wi-Fi 6, and edge computing, are creating new possibilities for more agile, responsive, and intelligent industrial operations, further stimulating market growth.

Obstacles in the Industrial Networking Solutions Market Market

Despite its robust growth, the Industrial Networking Solutions market faces several significant obstacles. High implementation costs, particularly for large-scale deployments and the integration of advanced hardware and software, can be a deterrent for smaller enterprises. The complex and evolving regulatory landscape, with varying cybersecurity standards across different regions and industries, presents challenges for global standardization and compliance. Supply chain disruptions, exacerbated by geopolitical factors and component shortages, can lead to delays and increased costs for critical networking hardware. Furthermore, the cybersecurity threat landscape is constantly evolving, demanding continuous investment in advanced security measures to protect sensitive industrial data and operations from sophisticated attacks. The integration of legacy operational technology (OT) with modern IT systems also presents significant interoperability challenges.

Future Opportunities in Industrial Networking Solutions Market

Emerging opportunities within the Industrial Networking Solutions market are ripe for exploitation by forward-thinking companies. The burgeoning demand for edge computing solutions, enabling localized data processing and real-time analytics within industrial environments, presents a significant growth avenue. The ongoing digital transformation across various sectors, including smart cities, intelligent transportation systems, and precision agriculture, will drive the need for scalable and secure industrial networking. The development and adoption of advanced wireless technologies, such as 5G and Wi-Fi 6E, will unlock new possibilities for highly mobile and flexible industrial operations. Furthermore, the increasing focus on sustainability and energy efficiency in industrial processes will spur demand for networking solutions that can monitor and optimize energy consumption. The growing emphasis on cybersecurity will also create opportunities for specialized security-focused industrial networking solutions.

Major Players in the Industrial Networking Solutions Market Ecosystem

- Red Lion Controls Inc (Spectris PLC)

- ABB Ltd

- Hirschmann (Belden Inc )

- Aruba Networks HPE

- Dell EMC (Dell Technologies Inc )

- Cisco Systems Inc

- Juniper Networks Inc

- Antaira Technologie

- Huawei Technologies Co Ltd

- Rockwell Automation Inc

- Nokia Corporation

- Sierra Wireless Inc

- Moxa Inc

- Eaton Corporation

Key Developments in Industrial Networking Solutions Market Industry

- 2023/07: Siemens AG announced a new series of industrial Ethernet switches designed for enhanced cybersecurity and TSN capabilities, aiming to bolster its position in the smart manufacturing segment.

- 2023/05: Cisco Systems Inc. launched a comprehensive suite of edge networking solutions tailored for industrial IoT applications, focusing on improved data aggregation and local processing.

- 2023/02: Nokia Corporation partnered with a major telecommunications provider to deploy private 5G networks in industrial facilities, showcasing the potential for next-generation wireless connectivity.

- 2022/11: Rockwell Automation Inc. expanded its IIoT platform with integrated networking solutions, emphasizing seamless connectivity and data visibility across the production floor.

- 2022/09: Belden Inc. (Hirschmann) introduced ruggedized wireless access points designed for harsh industrial environments, addressing the growing need for mobile connectivity in manufacturing and logistics.

- 2022/04: Dell EMC (Dell Technologies Inc.) unveiled new industrial computing solutions that integrate networking capabilities, facilitating edge data analytics and AI deployment.

Strategic Industrial Networking Solutions Market Market Forecast

The strategic outlook for the Industrial Networking Solutions market is exceptionally positive, driven by persistent demand for enhanced operational efficiency, robust security, and the seamless integration of digital technologies. The continued expansion of Industry 4.0 initiatives, coupled with the increasing adoption of AI, machine learning, and the Industrial Internet of Things, will serve as significant growth catalysts. Emerging technologies like 5G and edge computing are poised to revolutionize industrial operations, creating substantial market opportunities. Furthermore, the global push for resilient and secure critical infrastructure will ensure sustained investment in advanced networking solutions. The market is projected for robust growth, with an anticipated value exceeding \$45 billion by 2033, underscoring its strategic importance in the ongoing digital transformation of industries worldwide.

Industrial Networking Solutions Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software and Services

-

2. Type of Connectivity

- 2.1. Wired

- 2.2. Wireless

-

3. Deployment Type

- 3.1. On-premises

- 3.2. Cloud

-

4. End-User Industry

- 4.1. Automotive

- 4.2. Financial and Banking Industry

- 4.3. Manufacturing

- 4.4. Telecommunication

- 4.5. Logistics and Transportation

- 4.6. Other

Industrial Networking Solutions Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Industrial Networking Solutions Market Regional Market Share

Geographic Coverage of Industrial Networking Solutions Market

Industrial Networking Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in the usage of Wireless Networks across the Industry Operations; Rising Demand For Software Defined Wide Area Network

- 3.3. Market Restrains

- 3.3.1. ; Concerns Related to Data Privacy and Security

- 3.4. Market Trends

- 3.4.1. Manufacturing is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Networking Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software and Services

- 5.2. Market Analysis, Insights and Forecast - by Type of Connectivity

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Deployment Type

- 5.3.1. On-premises

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-User Industry

- 5.4.1. Automotive

- 5.4.2. Financial and Banking Industry

- 5.4.3. Manufacturing

- 5.4.4. Telecommunication

- 5.4.5. Logistics and Transportation

- 5.4.6. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Industrial Networking Solutions Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software and Services

- 6.2. Market Analysis, Insights and Forecast - by Type of Connectivity

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.3. Market Analysis, Insights and Forecast - by Deployment Type

- 6.3.1. On-premises

- 6.3.2. Cloud

- 6.4. Market Analysis, Insights and Forecast - by End-User Industry

- 6.4.1. Automotive

- 6.4.2. Financial and Banking Industry

- 6.4.3. Manufacturing

- 6.4.4. Telecommunication

- 6.4.5. Logistics and Transportation

- 6.4.6. Other

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Industrial Networking Solutions Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software and Services

- 7.2. Market Analysis, Insights and Forecast - by Type of Connectivity

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.3. Market Analysis, Insights and Forecast - by Deployment Type

- 7.3.1. On-premises

- 7.3.2. Cloud

- 7.4. Market Analysis, Insights and Forecast - by End-User Industry

- 7.4.1. Automotive

- 7.4.2. Financial and Banking Industry

- 7.4.3. Manufacturing

- 7.4.4. Telecommunication

- 7.4.5. Logistics and Transportation

- 7.4.6. Other

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Industrial Networking Solutions Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software and Services

- 8.2. Market Analysis, Insights and Forecast - by Type of Connectivity

- 8.2.1. Wired

- 8.2.2. Wireless

- 8.3. Market Analysis, Insights and Forecast - by Deployment Type

- 8.3.1. On-premises

- 8.3.2. Cloud

- 8.4. Market Analysis, Insights and Forecast - by End-User Industry

- 8.4.1. Automotive

- 8.4.2. Financial and Banking Industry

- 8.4.3. Manufacturing

- 8.4.4. Telecommunication

- 8.4.5. Logistics and Transportation

- 8.4.6. Other

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of World Industrial Networking Solutions Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software and Services

- 9.2. Market Analysis, Insights and Forecast - by Type of Connectivity

- 9.2.1. Wired

- 9.2.2. Wireless

- 9.3. Market Analysis, Insights and Forecast - by Deployment Type

- 9.3.1. On-premises

- 9.3.2. Cloud

- 9.4. Market Analysis, Insights and Forecast - by End-User Industry

- 9.4.1. Automotive

- 9.4.2. Financial and Banking Industry

- 9.4.3. Manufacturing

- 9.4.4. Telecommunication

- 9.4.5. Logistics and Transportation

- 9.4.6. Other

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Red Lion Controls Inc (Spectris PLC)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hirschmann (Belden Inc )

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aruba Networks HPE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dell EMC (Dell Technologies Inc )

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cisco Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Juniper Networks Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Antaira Technologie

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Huawei Technologies Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockwell Automation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Nokia Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Sierra Wireless Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Moxa Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Eaton Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Red Lion Controls Inc (Spectris PLC)

List of Figures

- Figure 1: Global Industrial Networking Solutions Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Industrial Networking Solutions Market Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Industrial Networking Solutions Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Industrial Networking Solutions Market Revenue (undefined), by Type of Connectivity 2025 & 2033

- Figure 5: North America Industrial Networking Solutions Market Revenue Share (%), by Type of Connectivity 2025 & 2033

- Figure 6: North America Industrial Networking Solutions Market Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 7: North America Industrial Networking Solutions Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 8: North America Industrial Networking Solutions Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 9: North America Industrial Networking Solutions Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 10: North America Industrial Networking Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Industrial Networking Solutions Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Industrial Networking Solutions Market Revenue (undefined), by Component 2025 & 2033

- Figure 13: Europe Industrial Networking Solutions Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Industrial Networking Solutions Market Revenue (undefined), by Type of Connectivity 2025 & 2033

- Figure 15: Europe Industrial Networking Solutions Market Revenue Share (%), by Type of Connectivity 2025 & 2033

- Figure 16: Europe Industrial Networking Solutions Market Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 17: Europe Industrial Networking Solutions Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 18: Europe Industrial Networking Solutions Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 19: Europe Industrial Networking Solutions Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 20: Europe Industrial Networking Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Europe Industrial Networking Solutions Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Industrial Networking Solutions Market Revenue (undefined), by Component 2025 & 2033

- Figure 23: Asia Pacific Industrial Networking Solutions Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Industrial Networking Solutions Market Revenue (undefined), by Type of Connectivity 2025 & 2033

- Figure 25: Asia Pacific Industrial Networking Solutions Market Revenue Share (%), by Type of Connectivity 2025 & 2033

- Figure 26: Asia Pacific Industrial Networking Solutions Market Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 27: Asia Pacific Industrial Networking Solutions Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 28: Asia Pacific Industrial Networking Solutions Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 29: Asia Pacific Industrial Networking Solutions Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Asia Pacific Industrial Networking Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Industrial Networking Solutions Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of World Industrial Networking Solutions Market Revenue (undefined), by Component 2025 & 2033

- Figure 33: Rest of World Industrial Networking Solutions Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Rest of World Industrial Networking Solutions Market Revenue (undefined), by Type of Connectivity 2025 & 2033

- Figure 35: Rest of World Industrial Networking Solutions Market Revenue Share (%), by Type of Connectivity 2025 & 2033

- Figure 36: Rest of World Industrial Networking Solutions Market Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 37: Rest of World Industrial Networking Solutions Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 38: Rest of World Industrial Networking Solutions Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 39: Rest of World Industrial Networking Solutions Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Rest of World Industrial Networking Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of World Industrial Networking Solutions Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Type of Connectivity 2020 & 2033

- Table 3: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 4: Global Industrial Networking Solutions Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 5: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 7: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Type of Connectivity 2020 & 2033

- Table 8: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 9: Global Industrial Networking Solutions Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 10: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 12: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Type of Connectivity 2020 & 2033

- Table 13: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 14: Global Industrial Networking Solutions Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 17: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Type of Connectivity 2020 & 2033

- Table 18: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 19: Global Industrial Networking Solutions Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 22: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Type of Connectivity 2020 & 2033

- Table 23: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 24: Global Industrial Networking Solutions Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 25: Global Industrial Networking Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Networking Solutions Market?

The projected CAGR is approximately 17%.

2. Which companies are prominent players in the Industrial Networking Solutions Market?

Key companies in the market include Red Lion Controls Inc (Spectris PLC), ABB Ltd, Hirschmann (Belden Inc ), Aruba Networks HPE, Dell EMC (Dell Technologies Inc ), Cisco Systems Inc, Juniper Networks Inc, Antaira Technologie, Huawei Technologies Co Ltd, Rockwell Automation Inc, Nokia Corporation, Sierra Wireless Inc, Moxa Inc, Eaton Corporation.

3. What are the main segments of the Industrial Networking Solutions Market?

The market segments include Component, Type of Connectivity, Deployment Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increase in the usage of Wireless Networks across the Industry Operations; Rising Demand For Software Defined Wide Area Network.

6. What are the notable trends driving market growth?

Manufacturing is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

; Concerns Related to Data Privacy and Security.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Networking Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Networking Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Networking Solutions Market?

To stay informed about further developments, trends, and reports in the Industrial Networking Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence