Key Insights

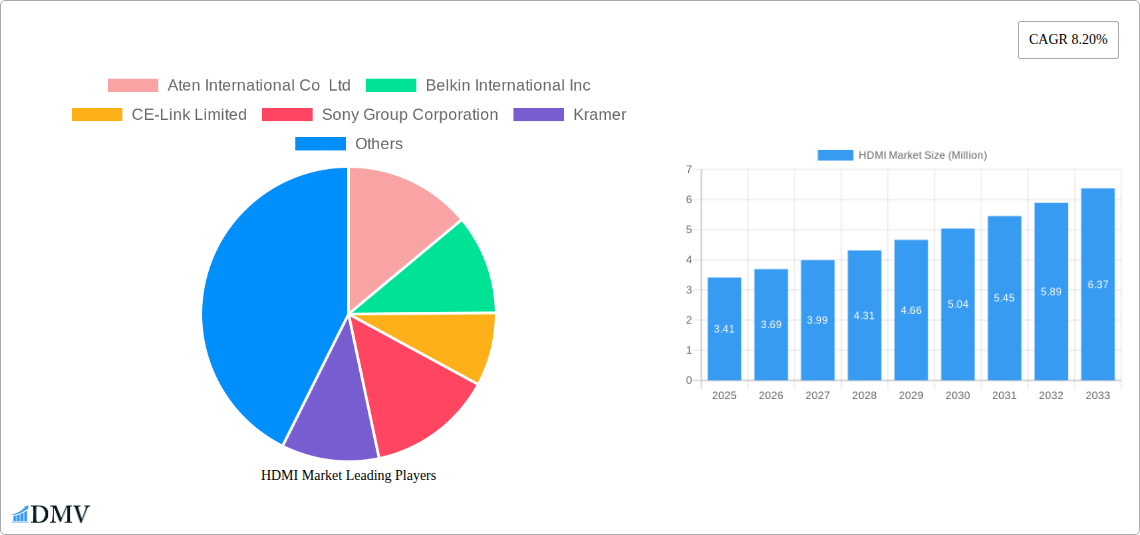

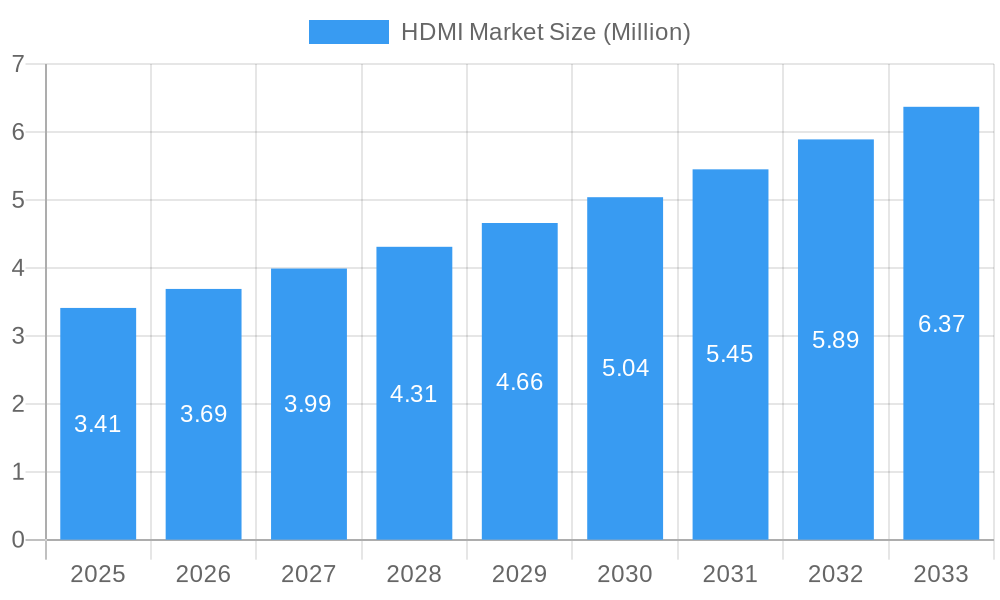

The global HDMI market is poised for substantial expansion, currently valued at approximately 3.15 Billion and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.20% through 2033. This impressive growth is fueled by the escalating demand for high-definition content and the ubiquitous integration of HDMI ports across a vast array of consumer electronics. Key drivers include the surging popularity of 4K and 8K televisions, advanced gaming consoles demanding higher bandwidth and lower latency, and the increasing adoption of HDMI in automotive infotainment systems. The proliferation of mobile devices, laptops, and tablets, all of which increasingly feature HDMI connectivity for seamless display mirroring and content streaming, further propels this market forward. Innovations in cable technology, such as the development of ultra-high-speed cables that support greater resolutions and refresh rates, alongside the evolving connector types like the versatile USB-C which can also carry HDMI signals, are critical to meeting the evolving needs of consumers and professional users alike.

HDMI Market Market Size (In Million)

The HDMI market's trajectory is further shaped by emerging trends, including the integration of HDMI into smart home ecosystems for enhanced audio-visual experiences and the growing use of high-speed HDMI cables in professional A/V installations for reliable signal transmission. While the market benefits from strong demand, certain restraints could influence its pace. These may include the increasing adoption of wireless display technologies for specific use cases, potential price sensitivities for premium cable segments in some consumer markets, and the ongoing development of alternative connectivity standards. However, the fundamental role of HDMI in delivering uncompressed digital audio and video signals ensures its continued relevance and dominance in the consumer electronics and professional A/V sectors. The market is segmented by cable type, connector type, and application, with widespread adoption across gaming consoles, TVs, mobile phones, automotive systems, and laptops, indicating a diversified and resilient market landscape.

HDMI Market Company Market Share

This in-depth report provides a granular analysis of the global HDMI market, forecasting significant growth from 2019 to 2033. Leveraging high-speed HDMI, ultra high-speed HDMI, and premium high-speed HDMI cable innovations, the market is poised for substantial expansion driven by the burgeoning demand for immersive entertainment experiences, advanced display technologies, and robust connectivity solutions. Our study encompasses the base year 2025, with detailed forecasts from 2025 to 2033, building upon historical data from 2019 to 2024. We delve into the intricate dynamics shaping the market, from evolving connector types like Type A, Type C, and Type D to the diverse applications spanning gaming consoles, TVs, laptops and tablets, and the rapidly expanding automotive systems sector. This report is essential for stakeholders seeking to understand market concentration, identify innovation catalysts, navigate regulatory landscapes, and capitalize on emerging opportunities in the dynamic HDMI ecosystem.

HDMI Market Market Composition & Trends

The HDMI market exhibits a moderately concentrated structure, with key players investing heavily in research and development to drive innovation. The increasing adoption of 8K televisions and next-generation gaming consoles fuels demand for ultra high-speed HDMI cables, pushing the boundaries of data transfer rates and visual fidelity. Regulatory landscapes, primarily governed by the HDMI Licensing Administrator, ensure interoperability and performance standards, fostering a competitive yet structured environment. Substitute products, while present, struggle to match the ubiquitous adoption and established ecosystem of HDMI. End-user profiles are diversifying, with significant growth in the automotive systems segment, integrating advanced infotainment and driver-assistance systems. Mergers and acquisitions (M&A) activity, while not widespread, is strategically focused on acquiring niche technologies or expanding market reach, with estimated deal values in the tens of millions. Market share distribution sees established manufacturers holding significant portions, but the emergence of specialized cable providers catering to specific applications, such as aerospace, is reshaping the competitive landscape. XXX

HDMI Market Industry Evolution

The evolution of the HDMI market is a testament to its adaptability and continuous innovation in response to technological advancements and shifting consumer demands. From its inception, HDMI (High-Definition Multimedia Interface) has been the cornerstone of digital audio-visual connectivity, progressively enhancing bandwidth capabilities and supporting higher resolutions and refresh rates. The introduction of successive HDMI versions, such as HDMI 1.4 supporting 4K resolution, HDMI 2.0 enabling 4K at 60Hz, and the latest HDMI 2.1 pushing towards 8K and 10K resolutions with features like Dynamic HDR and Variable Refresh Rate (VRR), has been instrumental in this evolution. The market growth trajectory has been significantly influenced by the proliferation of consumer electronics, particularly high-definition televisions, Blu-ray players, and gaming consoles. For instance, the adoption rate of 4K TVs, which began accelerating around 2015, directly fueled the demand for HDMI 2.0 compliant cables and devices. Similarly, the launch of PlayStation 5 and Xbox Series X/S in late 2020, supporting advanced gaming features like 4K@120Hz and VRR, created a surge in the demand for premium high-speed and ultra high-speed HDMI cables.

Technological advancements have not only focused on increasing bandwidth but also on enhancing user experience through features like the HDMI Ethernet Channel, which enables network connectivity over HDMI, and Audio Return Channel (ARC) and Enhanced Audio Return Channel (eARC), simplifying audio setups. The increasing integration of HDMI in automotive systems for infotainment and advanced driver-assistance systems (ADAS) presents a new and rapidly growing application segment. Consumer demand has shifted from basic HD to ultra-high definition content consumption, driving the need for higher performance HDMI solutions. Adoption metrics show a clear trend towards higher bandwidth HDMI versions, with HDMI 2.1-enabled devices and cables experiencing exponential growth in recent years. This continuous cycle of technological innovation, coupled with robust consumer adoption, solidifies HDMI's position as the de facto standard for digital audio-visual transmission.

Leading Regions, Countries, or Segments in HDMI Market

The HDMI market's dominance is a complex interplay of technological adoption, consumer electronics manufacturing hubs, and nascent application growth areas. Among the cable types, High-speed and Premium High-speed segments currently command significant market share due to their widespread adoption in existing consumer electronics. However, the Ultra High-speed segment is experiencing the most rapid growth, driven by the proliferation of 8K displays, advanced gaming consoles, and professional AV equipment.

In terms of connector types, Type A (Standard) remains the most prevalent due to its universal application in televisions, laptops, and gaming consoles. The increasing adoption of portable devices and compact electronics is fueling the growth of Type C (Mini) and Type D (Micro) connectors, particularly in mobile phones and tablets.

The Application segment reveals a clear leadership by TVs and Gaming Consoles, which have historically been major drivers of HDMI adoption. The burgeoning Automotive Systems segment is emerging as a significant growth frontier, with the integration of advanced infotainment systems and driver assistance technologies requiring high-bandwidth, reliable HDMI connectivity.

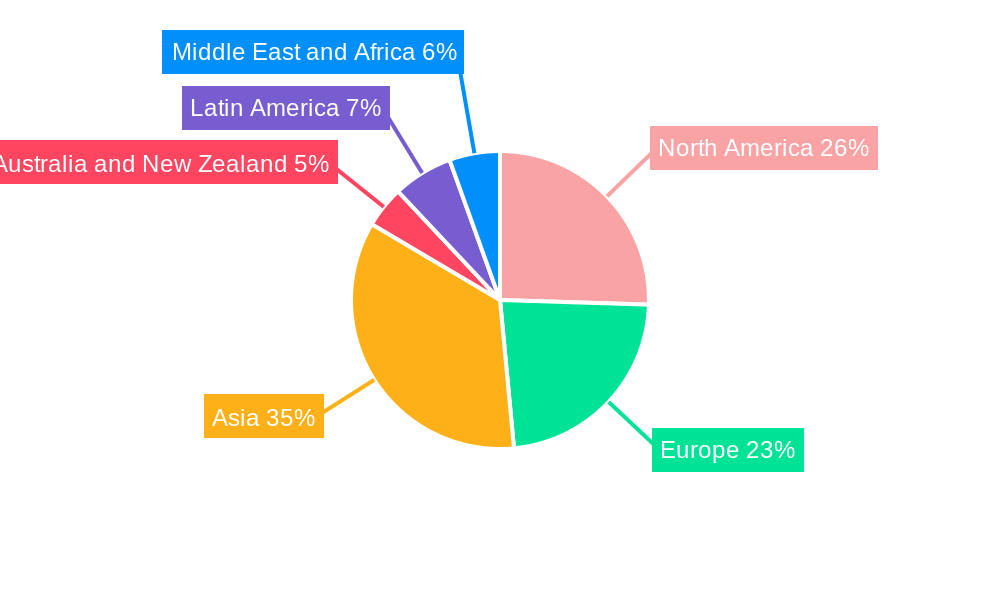

Geographically, North America and Europe have consistently been strong markets due to high disposable incomes and early adoption of premium entertainment technologies. Asia-Pacific, particularly China, plays a dual role as a massive consumer market and a global manufacturing hub for consumer electronics, driving both demand and supply for HDMI products. Key drivers in these leading regions include:

- High consumer spending on home entertainment systems: This fuels demand for high-resolution TVs and advanced AV equipment requiring robust HDMI connectivity.

- Dominance of gaming culture: The popularity of gaming consoles in regions like North America and Asia drives the demand for high-performance HDMI cables supporting advanced gaming features.

- Technological innovation and manufacturing prowess in Asia-Pacific: This region is home to many leading consumer electronics manufacturers, facilitating the widespread availability and adoption of HDMI-enabled devices.

- Increasing penetration of smart devices: The growing use of laptops, tablets, and mobile phones necessitates the use of various HDMI connector types for display output.

- Government initiatives and industry standards: Support for digital infrastructure and adherence to global connectivity standards promote HDMI adoption across diverse applications.

- Rapid advancements in automotive technology: The integration of sophisticated infotainment and connectivity features in vehicles is creating substantial demand for automotive-grade HDMI solutions.

HDMI Market Product Innovations

Product innovations in the HDMI market are largely centered on enhancing bandwidth, supporting higher resolutions and refresh rates, and integrating advanced features. The development of ultra high-speed HDMI cables capable of transmitting data at 48 Gbps is a prime example, enabling 8K video at 60Hz and 4K at 120Hz with features like Dynamic HDR and Variable Refresh Rate (VRR). These innovations are crucial for immersive gaming experiences and professional video production. Additionally, advancements in cable materials and shielding improve signal integrity and reduce interference over longer distances, catering to demanding applications like professional audio-visual installations and automotive systems. The unique selling proposition lies in delivering uncompromised audio-visual quality and seamless connectivity for the latest display and source devices.

Propelling Factors for HDMI Market Growth

The HDMI market's growth is propelled by several key factors. Technologically, the relentless pursuit of higher resolution content (4K, 8K), faster refresh rates, and immersive features like HDR and VRR is a primary driver. The increasing adoption of these technologies in consumer electronics, including high-definition TVs, gaming consoles like the PlayStation 5 and Xbox Series X, and advanced laptops, directly translates to a higher demand for compliant HDMI cables and connectors. Economically, rising disposable incomes globally contribute to increased spending on premium entertainment systems and devices. Furthermore, the expanding automotive sector's integration of sophisticated infotainment and driver-assistance systems necessitates robust HDMI connectivity. Regulatory support for digital broadcasting and content delivery standards also indirectly bolsters HDMI's position.

Obstacles in the HDMI Market Market

Despite its robust growth, the HDMI market faces certain obstacles. While HDMI Licensing Administrator sets standards, ensuring strict compliance across all manufacturers can be challenging, leading to potential compatibility issues and a fragmented user experience. Supply chain disruptions, particularly in raw materials and component sourcing, can impact production timelines and costs, as witnessed during global logistical challenges. Competitive pressures from alternative connectivity solutions, though less established in the mainstream AV space, can pose a threat in niche applications. Additionally, the cost associated with advanced HDMI certification can be a barrier for smaller manufacturers, potentially limiting innovation and product diversity. Piracy concerns related to high-bandwidth digital content protection (HDCP) can also influence product development and adoption rates.

Future Opportunities in HDMI Market

Emerging opportunities in the HDMI market are abundant, driven by evolving consumer trends and technological advancements. The continued expansion of the 8K television market, coupled with the increasing demand for high-fidelity audio and visual experiences in virtual reality (VR) and augmented reality (AR) applications, presents a significant avenue for growth. The automotive industry's push towards advanced connectivity for in-car entertainment, autonomous driving features, and enhanced diagnostics will create substantial demand for ruggedized and high-performance HDMI solutions. Furthermore, the growing adoption of high-resolution displays in commercial sectors like healthcare (medical imaging) and professional video production offers new market segments. The development of smaller, more integrated HDMI connectors for ultra-thin laptops and mobile devices, alongside advancements in fiber optic HDMI for extended reach and higher bandwidth, will unlock further potential.

Major Players in the HDMI Market Ecosystem

- Aten International Co Ltd

- Belkin International Inc

- CE-Link Limited

- Sony Group Corporation

- Kramer

- Nordost Cables

- Koninklijke Philips NV

- Eaton Corporation

- Extron

- Cheng Uei Precision Industry Co Ltd (FoxLink)

- Amphenol Corporation

- Foxconn Interconnect Technology

- Pure Fi Inc

- Shenzhen DNS Industries Co Ltd

- Honeywell Connection (Honeywell International Inc)

- The Chord Company Lt

Key Developments in HDMI Market Industry

- March 2024: PIC Wire and Cable unveiled the industry's first HDMI-certified cable explicitly tailored for the aerospace and defense sectors. This introduction marks a pivotal evolution in connectivity standards, delivering solutions meticulously aligned with the distinct requirements of aerospace settings. The H1926-HS cable, crafted and rigorously validated to comply with HDMI Cable standards, represents a significant advancement in aerospace and defense connectivity. This cable supports 4K video resolutions, outshining the conventional 1080p, and ensures remarkable detail and color fidelity over distances of up to 5 m (16.4 ft). Additionally, its compatibility with the HDMI Ethernet Channel enhances networking capabilities, providing a fluid connectivity experience without necessitating extra cables.

- January 2024: Katlax unveiled its latest product line, HDMI Connectors. HDMI was designed to ensure high-definition video and audio transmission across diverse products and is an established global connectivity standard. Its primary purpose is to elevate the quality of viewing and sound systems. HDMI connectors are also a staple in households, linking devices like digital TVs, DVD players, Blu-ray players, Xbox, PlayStation, and AppleTV to televisions.

Strategic HDMI Market Market Forecast

The strategic forecast for the HDMI market is exceptionally positive, driven by an unwavering demand for superior audio-visual experiences and seamless connectivity. The widespread adoption of 8K resolution, coupled with advancements in HDR, VRR, and high refresh rates, will continue to fuel the growth of the ultra high-speed HDMI segment. The automotive industry's integration of advanced infotainment systems and ADAS represents a significant new market frontier. Furthermore, the increasing prevalence of smart homes and the convergence of various electronic devices will necessitate robust HDMI solutions for inter-device communication. Investments in infrastructure for content creation and distribution of high-definition media will also indirectly bolster the market. The HDMI ecosystem's ability to adapt and incorporate emerging technologies ensures its sustained relevance and market potential.

HDMI Market Segmentation

-

1. Cable Type

- 1.1. Standard

- 1.2. High-speed

- 1.3. Premium High-speed

- 1.4. Ultra High-speed

-

2. Connector Type

- 2.1. Type A (Standard)

- 2.2. Type B (Dual-link)

- 2.3. Type C (Mini)

- 2.4. Type D (Micro)

- 2.5. Type E

-

3. Application

- 3.1. Gaming Consoles

- 3.2. TVs

- 3.3. Mobile Phones

- 3.4. Automotive Systems

- 3.5. Laptops and Tablets

- 3.6. Other Applications

HDMI Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

HDMI Market Regional Market Share

Geographic Coverage of HDMI Market

HDMI Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Adoption of Audio-video Devices; Rising Focus on the Gaming Industry Boosts the Adoption of Gaming Consoles

- 3.2.2 Fueling Market Expansion

- 3.3. Market Restrains

- 3.3.1 Rising Adoption of Audio-video Devices; Rising Focus on the Gaming Industry Boosts the Adoption of Gaming Consoles

- 3.3.2 Fueling Market Expansion

- 3.4. Market Trends

- 3.4.1. Applications in Gaming Consoles Are Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HDMI Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Standard

- 5.1.2. High-speed

- 5.1.3. Premium High-speed

- 5.1.4. Ultra High-speed

- 5.2. Market Analysis, Insights and Forecast - by Connector Type

- 5.2.1. Type A (Standard)

- 5.2.2. Type B (Dual-link)

- 5.2.3. Type C (Mini)

- 5.2.4. Type D (Micro)

- 5.2.5. Type E

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Gaming Consoles

- 5.3.2. TVs

- 5.3.3. Mobile Phones

- 5.3.4. Automotive Systems

- 5.3.5. Laptops and Tablets

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. North America HDMI Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 6.1.1. Standard

- 6.1.2. High-speed

- 6.1.3. Premium High-speed

- 6.1.4. Ultra High-speed

- 6.2. Market Analysis, Insights and Forecast - by Connector Type

- 6.2.1. Type A (Standard)

- 6.2.2. Type B (Dual-link)

- 6.2.3. Type C (Mini)

- 6.2.4. Type D (Micro)

- 6.2.5. Type E

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Gaming Consoles

- 6.3.2. TVs

- 6.3.3. Mobile Phones

- 6.3.4. Automotive Systems

- 6.3.5. Laptops and Tablets

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 7. Europe HDMI Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 7.1.1. Standard

- 7.1.2. High-speed

- 7.1.3. Premium High-speed

- 7.1.4. Ultra High-speed

- 7.2. Market Analysis, Insights and Forecast - by Connector Type

- 7.2.1. Type A (Standard)

- 7.2.2. Type B (Dual-link)

- 7.2.3. Type C (Mini)

- 7.2.4. Type D (Micro)

- 7.2.5. Type E

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Gaming Consoles

- 7.3.2. TVs

- 7.3.3. Mobile Phones

- 7.3.4. Automotive Systems

- 7.3.5. Laptops and Tablets

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 8. Asia HDMI Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 8.1.1. Standard

- 8.1.2. High-speed

- 8.1.3. Premium High-speed

- 8.1.4. Ultra High-speed

- 8.2. Market Analysis, Insights and Forecast - by Connector Type

- 8.2.1. Type A (Standard)

- 8.2.2. Type B (Dual-link)

- 8.2.3. Type C (Mini)

- 8.2.4. Type D (Micro)

- 8.2.5. Type E

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Gaming Consoles

- 8.3.2. TVs

- 8.3.3. Mobile Phones

- 8.3.4. Automotive Systems

- 8.3.5. Laptops and Tablets

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 9. Australia and New Zealand HDMI Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 9.1.1. Standard

- 9.1.2. High-speed

- 9.1.3. Premium High-speed

- 9.1.4. Ultra High-speed

- 9.2. Market Analysis, Insights and Forecast - by Connector Type

- 9.2.1. Type A (Standard)

- 9.2.2. Type B (Dual-link)

- 9.2.3. Type C (Mini)

- 9.2.4. Type D (Micro)

- 9.2.5. Type E

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Gaming Consoles

- 9.3.2. TVs

- 9.3.3. Mobile Phones

- 9.3.4. Automotive Systems

- 9.3.5. Laptops and Tablets

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 10. Latin America HDMI Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Cable Type

- 10.1.1. Standard

- 10.1.2. High-speed

- 10.1.3. Premium High-speed

- 10.1.4. Ultra High-speed

- 10.2. Market Analysis, Insights and Forecast - by Connector Type

- 10.2.1. Type A (Standard)

- 10.2.2. Type B (Dual-link)

- 10.2.3. Type C (Mini)

- 10.2.4. Type D (Micro)

- 10.2.5. Type E

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Gaming Consoles

- 10.3.2. TVs

- 10.3.3. Mobile Phones

- 10.3.4. Automotive Systems

- 10.3.5. Laptops and Tablets

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Cable Type

- 11. Middle East and Africa HDMI Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Cable Type

- 11.1.1. Standard

- 11.1.2. High-speed

- 11.1.3. Premium High-speed

- 11.1.4. Ultra High-speed

- 11.2. Market Analysis, Insights and Forecast - by Connector Type

- 11.2.1. Type A (Standard)

- 11.2.2. Type B (Dual-link)

- 11.2.3. Type C (Mini)

- 11.2.4. Type D (Micro)

- 11.2.5. Type E

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Gaming Consoles

- 11.3.2. TVs

- 11.3.3. Mobile Phones

- 11.3.4. Automotive Systems

- 11.3.5. Laptops and Tablets

- 11.3.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Cable Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Aten International Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Belkin International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 CE-Link Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sony Group Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kramer

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nordost Cables

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Koninklijke Philips NV

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Eaton Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Extron

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cheng Uei Precision Industry Co Ltd (FoxLink)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Amphenol Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Foxconn Interconnect Technology

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Pure Fi Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Shenzhen DNS Industries Co Ltd

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Honeywell Connection (Honeywell International Inc )

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 The Chord Company Lt

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.1 Aten International Co Ltd

List of Figures

- Figure 1: Global HDMI Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global HDMI Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America HDMI Market Revenue (Million), by Cable Type 2025 & 2033

- Figure 4: North America HDMI Market Volume (Billion), by Cable Type 2025 & 2033

- Figure 5: North America HDMI Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 6: North America HDMI Market Volume Share (%), by Cable Type 2025 & 2033

- Figure 7: North America HDMI Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 8: North America HDMI Market Volume (Billion), by Connector Type 2025 & 2033

- Figure 9: North America HDMI Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 10: North America HDMI Market Volume Share (%), by Connector Type 2025 & 2033

- Figure 11: North America HDMI Market Revenue (Million), by Application 2025 & 2033

- Figure 12: North America HDMI Market Volume (Billion), by Application 2025 & 2033

- Figure 13: North America HDMI Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America HDMI Market Volume Share (%), by Application 2025 & 2033

- Figure 15: North America HDMI Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America HDMI Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America HDMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America HDMI Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe HDMI Market Revenue (Million), by Cable Type 2025 & 2033

- Figure 20: Europe HDMI Market Volume (Billion), by Cable Type 2025 & 2033

- Figure 21: Europe HDMI Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 22: Europe HDMI Market Volume Share (%), by Cable Type 2025 & 2033

- Figure 23: Europe HDMI Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 24: Europe HDMI Market Volume (Billion), by Connector Type 2025 & 2033

- Figure 25: Europe HDMI Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 26: Europe HDMI Market Volume Share (%), by Connector Type 2025 & 2033

- Figure 27: Europe HDMI Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe HDMI Market Volume (Billion), by Application 2025 & 2033

- Figure 29: Europe HDMI Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe HDMI Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe HDMI Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe HDMI Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe HDMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe HDMI Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia HDMI Market Revenue (Million), by Cable Type 2025 & 2033

- Figure 36: Asia HDMI Market Volume (Billion), by Cable Type 2025 & 2033

- Figure 37: Asia HDMI Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 38: Asia HDMI Market Volume Share (%), by Cable Type 2025 & 2033

- Figure 39: Asia HDMI Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 40: Asia HDMI Market Volume (Billion), by Connector Type 2025 & 2033

- Figure 41: Asia HDMI Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 42: Asia HDMI Market Volume Share (%), by Connector Type 2025 & 2033

- Figure 43: Asia HDMI Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Asia HDMI Market Volume (Billion), by Application 2025 & 2033

- Figure 45: Asia HDMI Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia HDMI Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia HDMI Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia HDMI Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia HDMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia HDMI Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand HDMI Market Revenue (Million), by Cable Type 2025 & 2033

- Figure 52: Australia and New Zealand HDMI Market Volume (Billion), by Cable Type 2025 & 2033

- Figure 53: Australia and New Zealand HDMI Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 54: Australia and New Zealand HDMI Market Volume Share (%), by Cable Type 2025 & 2033

- Figure 55: Australia and New Zealand HDMI Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 56: Australia and New Zealand HDMI Market Volume (Billion), by Connector Type 2025 & 2033

- Figure 57: Australia and New Zealand HDMI Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 58: Australia and New Zealand HDMI Market Volume Share (%), by Connector Type 2025 & 2033

- Figure 59: Australia and New Zealand HDMI Market Revenue (Million), by Application 2025 & 2033

- Figure 60: Australia and New Zealand HDMI Market Volume (Billion), by Application 2025 & 2033

- Figure 61: Australia and New Zealand HDMI Market Revenue Share (%), by Application 2025 & 2033

- Figure 62: Australia and New Zealand HDMI Market Volume Share (%), by Application 2025 & 2033

- Figure 63: Australia and New Zealand HDMI Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand HDMI Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Australia and New Zealand HDMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand HDMI Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America HDMI Market Revenue (Million), by Cable Type 2025 & 2033

- Figure 68: Latin America HDMI Market Volume (Billion), by Cable Type 2025 & 2033

- Figure 69: Latin America HDMI Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 70: Latin America HDMI Market Volume Share (%), by Cable Type 2025 & 2033

- Figure 71: Latin America HDMI Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 72: Latin America HDMI Market Volume (Billion), by Connector Type 2025 & 2033

- Figure 73: Latin America HDMI Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 74: Latin America HDMI Market Volume Share (%), by Connector Type 2025 & 2033

- Figure 75: Latin America HDMI Market Revenue (Million), by Application 2025 & 2033

- Figure 76: Latin America HDMI Market Volume (Billion), by Application 2025 & 2033

- Figure 77: Latin America HDMI Market Revenue Share (%), by Application 2025 & 2033

- Figure 78: Latin America HDMI Market Volume Share (%), by Application 2025 & 2033

- Figure 79: Latin America HDMI Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America HDMI Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Latin America HDMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America HDMI Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa HDMI Market Revenue (Million), by Cable Type 2025 & 2033

- Figure 84: Middle East and Africa HDMI Market Volume (Billion), by Cable Type 2025 & 2033

- Figure 85: Middle East and Africa HDMI Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 86: Middle East and Africa HDMI Market Volume Share (%), by Cable Type 2025 & 2033

- Figure 87: Middle East and Africa HDMI Market Revenue (Million), by Connector Type 2025 & 2033

- Figure 88: Middle East and Africa HDMI Market Volume (Billion), by Connector Type 2025 & 2033

- Figure 89: Middle East and Africa HDMI Market Revenue Share (%), by Connector Type 2025 & 2033

- Figure 90: Middle East and Africa HDMI Market Volume Share (%), by Connector Type 2025 & 2033

- Figure 91: Middle East and Africa HDMI Market Revenue (Million), by Application 2025 & 2033

- Figure 92: Middle East and Africa HDMI Market Volume (Billion), by Application 2025 & 2033

- Figure 93: Middle East and Africa HDMI Market Revenue Share (%), by Application 2025 & 2033

- Figure 94: Middle East and Africa HDMI Market Volume Share (%), by Application 2025 & 2033

- Figure 95: Middle East and Africa HDMI Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa HDMI Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Middle East and Africa HDMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa HDMI Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global HDMI Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 2: Global HDMI Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 3: Global HDMI Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 4: Global HDMI Market Volume Billion Forecast, by Connector Type 2020 & 2033

- Table 5: Global HDMI Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global HDMI Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Global HDMI Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global HDMI Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global HDMI Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 10: Global HDMI Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 11: Global HDMI Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 12: Global HDMI Market Volume Billion Forecast, by Connector Type 2020 & 2033

- Table 13: Global HDMI Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global HDMI Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Global HDMI Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global HDMI Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global HDMI Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 18: Global HDMI Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 19: Global HDMI Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 20: Global HDMI Market Volume Billion Forecast, by Connector Type 2020 & 2033

- Table 21: Global HDMI Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global HDMI Market Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global HDMI Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global HDMI Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global HDMI Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 26: Global HDMI Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 27: Global HDMI Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 28: Global HDMI Market Volume Billion Forecast, by Connector Type 2020 & 2033

- Table 29: Global HDMI Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global HDMI Market Volume Billion Forecast, by Application 2020 & 2033

- Table 31: Global HDMI Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global HDMI Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global HDMI Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 34: Global HDMI Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 35: Global HDMI Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 36: Global HDMI Market Volume Billion Forecast, by Connector Type 2020 & 2033

- Table 37: Global HDMI Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global HDMI Market Volume Billion Forecast, by Application 2020 & 2033

- Table 39: Global HDMI Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global HDMI Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global HDMI Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 42: Global HDMI Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 43: Global HDMI Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 44: Global HDMI Market Volume Billion Forecast, by Connector Type 2020 & 2033

- Table 45: Global HDMI Market Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global HDMI Market Volume Billion Forecast, by Application 2020 & 2033

- Table 47: Global HDMI Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global HDMI Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global HDMI Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 50: Global HDMI Market Volume Billion Forecast, by Cable Type 2020 & 2033

- Table 51: Global HDMI Market Revenue Million Forecast, by Connector Type 2020 & 2033

- Table 52: Global HDMI Market Volume Billion Forecast, by Connector Type 2020 & 2033

- Table 53: Global HDMI Market Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global HDMI Market Volume Billion Forecast, by Application 2020 & 2033

- Table 55: Global HDMI Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global HDMI Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HDMI Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the HDMI Market?

Key companies in the market include Aten International Co Ltd, Belkin International Inc, CE-Link Limited, Sony Group Corporation, Kramer, Nordost Cables, Koninklijke Philips NV, Eaton Corporation, Extron, Cheng Uei Precision Industry Co Ltd (FoxLink), Amphenol Corporation, Foxconn Interconnect Technology, Pure Fi Inc, Shenzhen DNS Industries Co Ltd, Honeywell Connection (Honeywell International Inc ), The Chord Company Lt.

3. What are the main segments of the HDMI Market?

The market segments include Cable Type, Connector Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Audio-video Devices; Rising Focus on the Gaming Industry Boosts the Adoption of Gaming Consoles. Fueling Market Expansion.

6. What are the notable trends driving market growth?

Applications in Gaming Consoles Are Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Rising Adoption of Audio-video Devices; Rising Focus on the Gaming Industry Boosts the Adoption of Gaming Consoles. Fueling Market Expansion.

8. Can you provide examples of recent developments in the market?

March 2024: PIC Wire and Cable unveiled the industry's first HDMI-certified cable explicitly tailored for the aerospace and defense sectors. This introduction marks a pivotal evolution in connectivity standards, delivering solutions meticulously aligned with the distinct requirements of aerospace settings. The H1926-HS cable, crafted and rigorously validated to comply with HDMI Cable standards, represents a significant advancement in aerospace and defense connectivity. This cable supports 4K video resolutions, outshining the conventional 1080p, and ensures remarkable detail and color fidelity over distances of up to 5 m (16.4 ft). Additionally, its compatibility with the HDMI Ethernet Channel enhances networking capabilities, providing a fluid connectivity experience without necessitating extra cables.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HDMI Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HDMI Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HDMI Market?

To stay informed about further developments, trends, and reports in the HDMI Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence