Key Insights

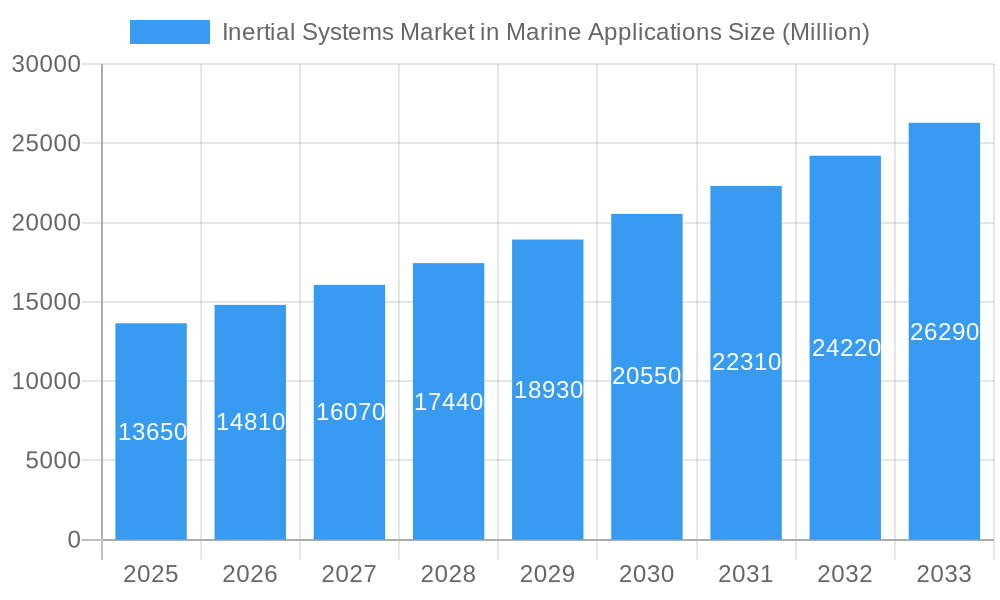

The global Inertial Systems Market in Marine Applications is poised for significant expansion, projected to reach an estimated $13.65 billion in 2025. This robust growth is driven by a compound annual growth rate (CAGR) of 8.6%, indicating a dynamic and expanding market. Key drivers fueling this surge include the increasing adoption of advanced navigation and positioning systems in commercial shipping for enhanced efficiency and safety, the escalating demand for autonomous vessels and unmanned underwater vehicles (UUVs) across various sectors like defense, research, and resource exploration, and the continuous technological advancements in inertial sensor technology, leading to more accurate, reliable, and cost-effective solutions. Furthermore, stringent regulations mandating enhanced safety and operational standards on maritime vessels are also a considerable catalyst for market penetration. The market is segmented by component, with Accelerometers, IMUs (Inertial Measurement Units), Gyroscopes, Magnetometers, and Attitude Heading Reference Systems (AHRS) all playing crucial roles in enabling precise navigation and control.

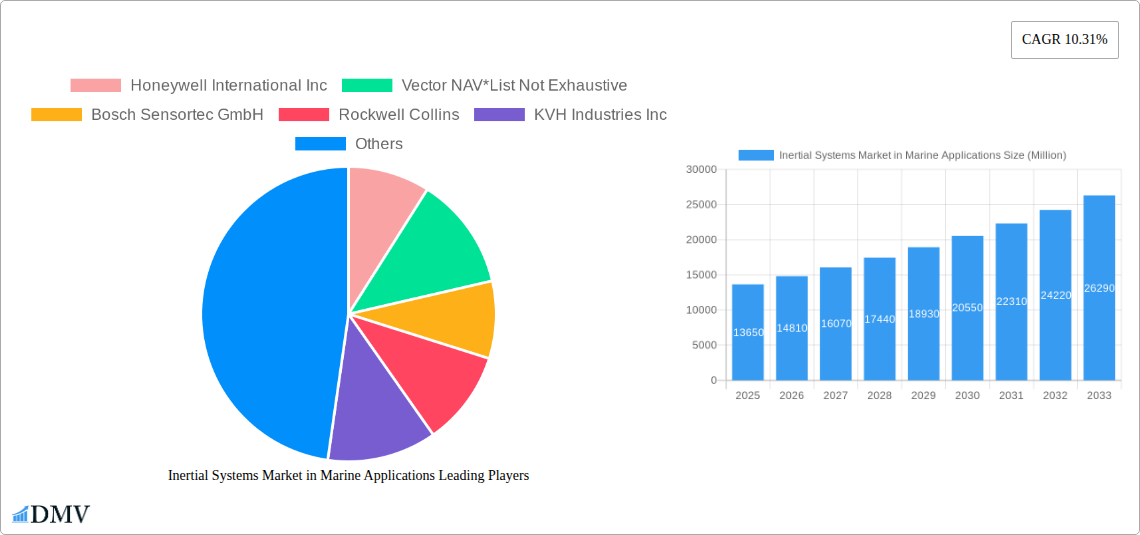

Inertial Systems Market in Marine Applications Market Size (In Billion)

Looking ahead, the market is expected to witness continued innovation and diversification. Trends such as the integration of inertial systems with other navigation technologies like GPS and sonar for improved redundancy and accuracy, the development of miniature and low-power inertial sensors for smaller maritime platforms, and the increasing use of artificial intelligence and machine learning for data processing and predictive maintenance are set to shape the future landscape. While the market benefits from strong demand, it is not without its challenges. Restraints such as the high initial investment costs associated with advanced inertial systems and the need for skilled personnel for installation, calibration, and maintenance can pose hurdles for widespread adoption, particularly for smaller operators. However, the inherent advantages of inertial systems in providing continuous, uncorrupted navigation data, even in GPS-denied environments, ensure their indispensable role in the maritime industry, driving sustained market expansion throughout the forecast period.

Inertial Systems Market in Marine Applications Company Market Share

This comprehensive report delves into the intricate Inertial Systems Market in Marine Applications, offering an in-depth analysis from 2019 to 2033, with a robust forecast period from 2025 to 2033. The study provides critical insights into the market's composition, trends, evolution, and future trajectory, making it an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this sector.

Inertial Systems Market in Marine Applications Market Composition & Trends

The inertial systems market in marine applications is characterized by a moderate degree of concentration, with key players like Honeywell International Inc., Vector NAV, Bosch Sensortec GmbH, Rockwell Collins, KVH Industries Inc., ST Microelectronics, Silicon Sensing Systems Ltd, Northrop Grumman Corporation, Raytheon Anschtz GmbH, Safran Group, and SBG Systems driving innovation and market share. The market is witnessing continuous innovation catalysts, fueled by the increasing demand for enhanced navigation accuracy, autonomous vessel capabilities, and advanced maritime surveillance. Regulatory landscapes, particularly concerning maritime safety and security, play a crucial role in shaping market dynamics, often mandating the adoption of high-performance inertial navigation systems. Substitute products, while present in the form of simpler navigational aids, are largely superseded by the superior precision and reliability offered by inertial systems in critical marine operations. End-user profiles range from commercial shipping and offshore exploration to naval operations and scientific research, each with unique performance and integration requirements. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to consolidate their market position and expand their technological portfolios. For instance, a hypothetical M&A deal valuing approximately USD 500 million could significantly alter the competitive landscape. Market share distribution is currently led by established players with robust R&D capabilities, however, emerging innovators are steadily gaining traction.

Inertial Systems Market in Marine Applications Industry Evolution

The inertial systems market in marine applications has undergone a significant evolution, driven by relentless technological advancements and the ever-increasing demands of the maritime industry. From rudimentary gyroscopic compasses to sophisticated Attitude Heading Reference Systems (AHRS) and high-precision Inertial Measurement Units (IMUs), the journey has been marked by a pursuit of greater accuracy, miniaturization, and cost-effectiveness. In the historical period (2019-2024), the market witnessed steady growth, propelled by the increasing complexity of maritime operations and the growing adoption of advanced navigation and positioning solutions. The base year, 2025, stands as a pivotal point, reflecting the current market maturity and the emerging trends that will define its future. The forecast period (2025-2033) is projected to witness accelerated growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 8.5%. This expansion is primarily attributed to the burgeoning demand for autonomous shipping, enhanced offshore exploration capabilities, and the modernization of naval fleets.

Technological advancements have been the cornerstone of this evolution. The integration of MEMS (Micro-Electro-Mechanical Systems) technology has led to the development of smaller, more robust, and more affordable inertial sensors, including accelerometers, gyroscopes, and magnetometers. These components are the building blocks of advanced inertial systems, enabling them to provide highly accurate data for position, velocity, and attitude determination. The development of tactical-grade and navigation-grade IMUs has been particularly impactful, catering to applications where resilience and precision are paramount, even in challenging environmental conditions.

Shifting consumer demands, driven by the push for greater operational efficiency, safety, and environmental compliance, have also played a crucial role. Shipowners and operators are increasingly investing in inertial systems to optimize voyage planning, reduce fuel consumption, and enhance situational awareness. The rise of smart shipping initiatives and the Internet of Things (IoT) in maritime further necessitates the integration of reliable and accurate inertial data for real-time decision-making and remote monitoring. The increasing complexity of naval operations, including mine countermeasures and unmanned underwater vehicles (UUVs), also fuels the demand for high-performance inertial navigation systems. Furthermore, the growing adoption of these systems in scientific research vessels for precise data acquisition in challenging oceanic environments is contributing to market expansion. The continuous improvement in sensor fusion algorithms, which combine inertial data with other navigation sources like GPS and sonar, has significantly enhanced the overall accuracy and reliability of maritime navigation systems. The market is poised for continued innovation, with ongoing research focused on improving sensor performance, developing novel algorithms, and integrating inertial systems into broader maritime automation frameworks.

Leading Regions, Countries, or Segments in Inertial Systems Market in Marine Applications

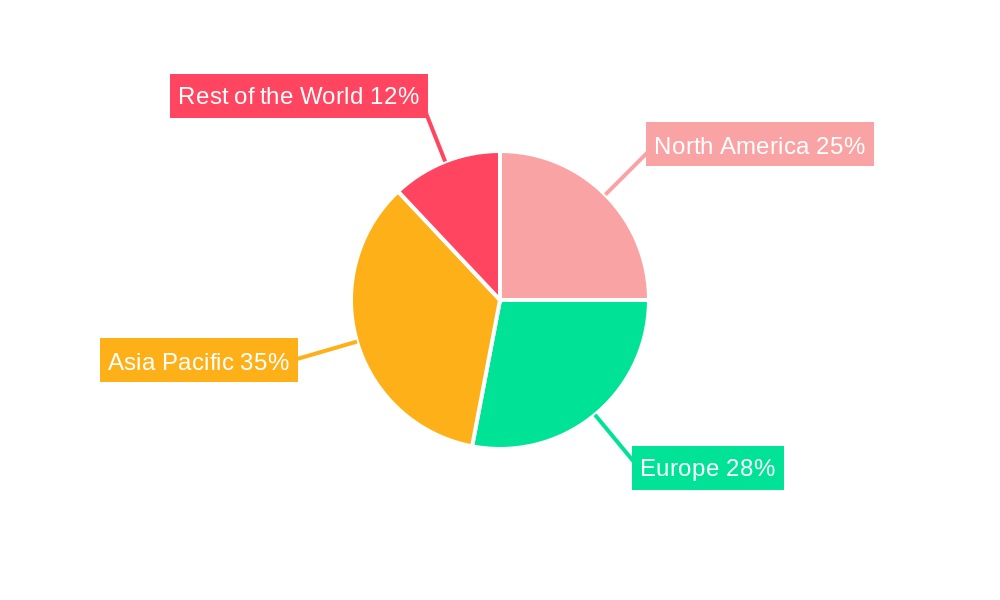

The inertial systems market in marine applications is experiencing dynamic shifts across regions and product segments, with Inertial Measurement Units (IMUs) emerging as the dominant segment. This dominance is attributed to their versatile functionality, encompassing the capabilities of accelerometers, gyroscopes, and magnetometers within a single, integrated package, making them ideal for a wide array of marine applications. The Asia Pacific region is projected to lead the market, driven by its extensive coastline, burgeoning maritime trade, and significant investments in naval modernization and offshore exploration. Countries like China, South Korea, Japan, and India are at the forefront of this growth, fueled by robust shipbuilding industries and increasing governmental focus on advanced maritime technologies.

Key drivers for the dominance of IMUs and the growth in the Asia Pacific region include:

- Technological Advancements and Miniaturization: The continuous development of MEMS-based IMUs has led to smaller, more power-efficient, and cost-effective solutions, making them accessible for a broader range of marine vessels, from small craft to large cargo ships and submarines.

- Increasing Demand for Autonomous and Semi-Autonomous Systems: The global push towards autonomous shipping and unmanned maritime systems (UMSs) requires highly accurate and reliable navigation and control systems, where IMUs play a critical role in providing precise motion data.

- Naval Modernization and Defense Spending: Significant investments by navies worldwide in upgrading their fleets with advanced navigation, surveillance, and weapon systems directly translate into a higher demand for sophisticated inertial systems, particularly high-grade IMUs.

- Growth in Offshore Exploration and Renewable Energy: The expanding offshore oil and gas sector, along with the growing renewable energy industry (e.g., offshore wind farms), necessitates precise positioning and navigation for exploration, construction, and maintenance vessels, boosting the demand for IMUs.

- Stringent Safety and Navigation Regulations: International maritime regulations and safety standards increasingly mandate the use of advanced navigation equipment, driving the adoption of IMUs for enhanced vessel safety and operational efficiency.

The Asia Pacific region's dominance is further bolstered by factors such as rapid economic development, a growing middle class demanding improved logistics, and a strategic geopolitical focus on maritime security. Government initiatives promoting smart port development and the adoption of digital technologies in the maritime sector also contribute significantly to this regional leadership. While North America and Europe remain important markets, driven by advanced naval programs and technological innovation, the sheer volume of maritime activity and ongoing infrastructure development in Asia Pacific positions it as the primary growth engine for the inertial systems market in marine applications. The segment of Attitude Heading Reference Systems (AHRS) also holds significant importance, often incorporating IMU technology, and is crucial for maintaining vessel orientation and stability.

Inertial Systems Market in Marine Applications Product Innovations

Product innovations in the inertial systems market in marine applications are consistently pushing the boundaries of precision, reliability, and size. Leading companies are developing new generations of Inertial Measurement Units (IMUs) and Attitude Heading Reference Systems (AHRS) that offer superior accuracy, even in the harshest marine environments. These innovations often involve advancements in sensor technology, such as high-stability gyroscopes and accelerometers, coupled with sophisticated sensor fusion algorithms. For instance, the development of tactical-grade IMUs, like the SBG Systems Pulse-40, addresses the critical need for resilience and accuracy in challenging conditions, enabling seamless navigation for vessels operating in dynamic and unpredictable seas. Furthermore, the miniaturization of these systems allows for integration into a wider array of platforms, from small survey boats to advanced unmanned vehicles, expanding their application scope and performance metrics.

Propelling Factors for Inertial Systems Market in Marine Applications Growth

Several key factors are propelling the growth of the inertial systems market in marine applications. The escalating demand for autonomous and semi-autonomous vessels in commercial shipping, offshore exploration, and defense sectors is a primary driver, as these systems are crucial for navigation and control. Technological advancements, particularly in MEMS sensor technology, have led to more compact, accurate, and cost-effective inertial solutions, making them accessible for a wider range of marine applications. Furthermore, the increasing focus on maritime safety and security, driven by stringent international regulations and the need to monitor vast ocean territories, necessitates the use of reliable navigation and positioning systems. Economic factors, such as the expansion of global trade and the continued investment in offshore resource extraction, also contribute to market expansion. The continuous modernization of naval fleets globally, with an emphasis on advanced capabilities, further fuels demand for high-performance inertial systems.

Obstacles in the Inertial Systems Market in Marine Applications Market

Despite robust growth, the inertial systems market in marine applications faces certain obstacles. Stringent certification processes and the need for long-term reliability in harsh marine environments can lead to extended development and adoption cycles for new technologies. Supply chain disruptions, as witnessed globally, can impact the availability and cost of critical components, affecting production timelines and pricing strategies. Intense competition among established players and emerging innovators can also put pressure on profit margins, requiring companies to constantly innovate and optimize their offerings. Furthermore, the high initial investment cost for advanced inertial systems can be a barrier for smaller maritime operators, limiting widespread adoption in certain segments. The need for specialized expertise in installation, calibration, and maintenance can also pose a challenge.

Future Opportunities in Inertial Systems Market in Marine Applications

The inertial systems market in marine applications is ripe with future opportunities. The burgeoning field of autonomous shipping presents a significant growth avenue, requiring increasingly sophisticated and reliable inertial navigation solutions for vessel autonomy. The expansion of offshore renewable energy projects, such as wind and tidal farms, will drive demand for precise positioning systems for installation, maintenance, and monitoring vessels. Advancements in sensor fusion techniques, integrating inertial data with other navigation sources, offer opportunities for enhanced accuracy and performance, catering to niche applications like deep-sea exploration and scientific research. The ongoing digitalization of the maritime industry and the development of smart ports will also create new avenues for inertial systems in logistics optimization and vessel traffic management. The increasing use of Unmanned Underwater Vehicles (UUVs) for various purposes, from environmental monitoring to defense, will further boost the demand for compact and high-performance inertial systems.

Major Players in the Inertial Systems Market in Marine Applications Ecosystem

- Honeywell International Inc.

- Vector NAV

- Bosch Sensortec GmbH

- Rockwell Collins

- KVH Industries Inc.

- ST Microelectronics

- Silicon Sensing Systems Ltd

- Northrop Grumman Corporation

- Raytheon Anschtz GmbH

- Safran Group

- SBG Systems

Key Developments in Inertial Systems Market in Marine Applications Industry

- March 2022: Silicon Sensing Systems' new DMU41 9 degrees of freedom (DoF) inertial measurement unit (IMU) received two significant production orders and several smaller orders totaling more than USD 1 million. The company also sent the unit out for testing in various industries, including marine navigation, rail track surveying, aircraft stabilization, and satellite low earth orbit. This development highlights the increasing demand for versatile and high-performance IMUs in critical maritime applications.

- February 2022: SBG Systems launched its new Pulse-40 Tactical grade IMU. The tactical-grade Inertial Measurement Unit Pulse-40 provides unparalleled performance in challenging environments in a small package for applications where accuracy and resilience are crucial under all circumstances. This launch addresses a key market need for robust inertial solutions capable of withstanding demanding maritime conditions, indicating a trend towards more resilient and compact inertial systems.

Strategic Inertial Systems Market in Marine Applications Market Forecast

The strategic outlook for the inertial systems market in marine applications is highly promising, driven by a confluence of technological innovation and evolving industry demands. The relentless pursuit of greater accuracy and reliability in maritime navigation, coupled with the accelerating adoption of autonomous and semi-autonomous vessel technologies, forms the bedrock of future growth. Advancements in MEMS technology are continuously enabling the development of smaller, more power-efficient, and cost-effective inertial solutions, broadening their applicability across the maritime spectrum, from small research craft to large commercial vessels and naval platforms. The increasing global emphasis on maritime safety and security, supported by evolving regulatory frameworks, further propels the demand for high-performance inertial navigation systems. Furthermore, the expansion of offshore energy exploration and the burgeoning renewable energy sector create significant opportunities for precise positioning and navigation solutions. Consequently, the market is poised for sustained expansion, fueled by these strategic catalysts and the ongoing commitment to enhancing maritime operational capabilities.

Inertial Systems Market in Marine Applications Segmentation

-

1. Component

- 1.1. Accelerometers

- 1.2. IMUs

- 1.3. Gyroscopes

- 1.4. Magnetometer

- 1.5. Attitude Heading

- 1.6. Reference Systems

Inertial Systems Market in Marine Applications Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Inertial Systems Market in Marine Applications Regional Market Share

Geographic Coverage of Inertial Systems Market in Marine Applications

Inertial Systems Market in Marine Applications REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of MEMS Technology; Increasing Applications Based on Motion Sensing

- 3.3. Market Restrains

- 3.3.1. Integration Drift Error

- 3.4. Market Trends

- 3.4.1. Evolving Need for High-Accuracy Inertial Systems Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inertial Systems Market in Marine Applications Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Accelerometers

- 5.1.2. IMUs

- 5.1.3. Gyroscopes

- 5.1.4. Magnetometer

- 5.1.5. Attitude Heading

- 5.1.6. Reference Systems

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Inertial Systems Market in Marine Applications Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Accelerometers

- 6.1.2. IMUs

- 6.1.3. Gyroscopes

- 6.1.4. Magnetometer

- 6.1.5. Attitude Heading

- 6.1.6. Reference Systems

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Inertial Systems Market in Marine Applications Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Accelerometers

- 7.1.2. IMUs

- 7.1.3. Gyroscopes

- 7.1.4. Magnetometer

- 7.1.5. Attitude Heading

- 7.1.6. Reference Systems

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Inertial Systems Market in Marine Applications Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Accelerometers

- 8.1.2. IMUs

- 8.1.3. Gyroscopes

- 8.1.4. Magnetometer

- 8.1.5. Attitude Heading

- 8.1.6. Reference Systems

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Inertial Systems Market in Marine Applications Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Accelerometers

- 9.1.2. IMUs

- 9.1.3. Gyroscopes

- 9.1.4. Magnetometer

- 9.1.5. Attitude Heading

- 9.1.6. Reference Systems

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vector NAV*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bosch Sensortec GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Rockwell Collins

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 KVH Industries Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ST Microelectronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Silicon Sensing Systems Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Northrop Grumman Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Raytheon Anschtz GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Safran Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SBG Systems

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Inertial Systems Market in Marine Applications Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Inertial Systems Market in Marine Applications Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Inertial Systems Market in Marine Applications Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Inertial Systems Market in Marine Applications Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Inertial Systems Market in Marine Applications Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Inertial Systems Market in Marine Applications Revenue (undefined), by Component 2025 & 2033

- Figure 7: Europe Inertial Systems Market in Marine Applications Revenue Share (%), by Component 2025 & 2033

- Figure 8: Europe Inertial Systems Market in Marine Applications Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Inertial Systems Market in Marine Applications Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Inertial Systems Market in Marine Applications Revenue (undefined), by Component 2025 & 2033

- Figure 11: Asia Pacific Inertial Systems Market in Marine Applications Revenue Share (%), by Component 2025 & 2033

- Figure 12: Asia Pacific Inertial Systems Market in Marine Applications Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Inertial Systems Market in Marine Applications Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Inertial Systems Market in Marine Applications Revenue (undefined), by Component 2025 & 2033

- Figure 15: Rest of the World Inertial Systems Market in Marine Applications Revenue Share (%), by Component 2025 & 2033

- Figure 16: Rest of the World Inertial Systems Market in Marine Applications Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Inertial Systems Market in Marine Applications Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Component 2020 & 2033

- Table 4: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Component 2020 & 2033

- Table 6: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Component 2020 & 2033

- Table 8: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Component 2020 & 2033

- Table 10: Global Inertial Systems Market in Marine Applications Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inertial Systems Market in Marine Applications?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Inertial Systems Market in Marine Applications?

Key companies in the market include Honeywell International Inc, Vector NAV*List Not Exhaustive, Bosch Sensortec GmbH, Rockwell Collins, KVH Industries Inc, ST Microelectronics, Silicon Sensing Systems Ltd, Northrop Grumman Corporation, Raytheon Anschtz GmbH, Safran Group, SBG Systems.

3. What are the main segments of the Inertial Systems Market in Marine Applications?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Emergence of MEMS Technology; Increasing Applications Based on Motion Sensing.

6. What are the notable trends driving market growth?

Evolving Need for High-Accuracy Inertial Systems Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Integration Drift Error.

8. Can you provide examples of recent developments in the market?

March 2022 - Silicon Sensing Systems' new DMU41 9 degrees of freedom (DoF) inertial measurement unit (IMU) received two significant production orders and several smaller orders totaling more than USD 1 million. The company also sent the unit out for testing in various industries, including marine navigation, rail track surveying, aircraft stabilization, and satellite low earth orbit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inertial Systems Market in Marine Applications," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inertial Systems Market in Marine Applications report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inertial Systems Market in Marine Applications?

To stay informed about further developments, trends, and reports in the Inertial Systems Market in Marine Applications, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence