Key Insights

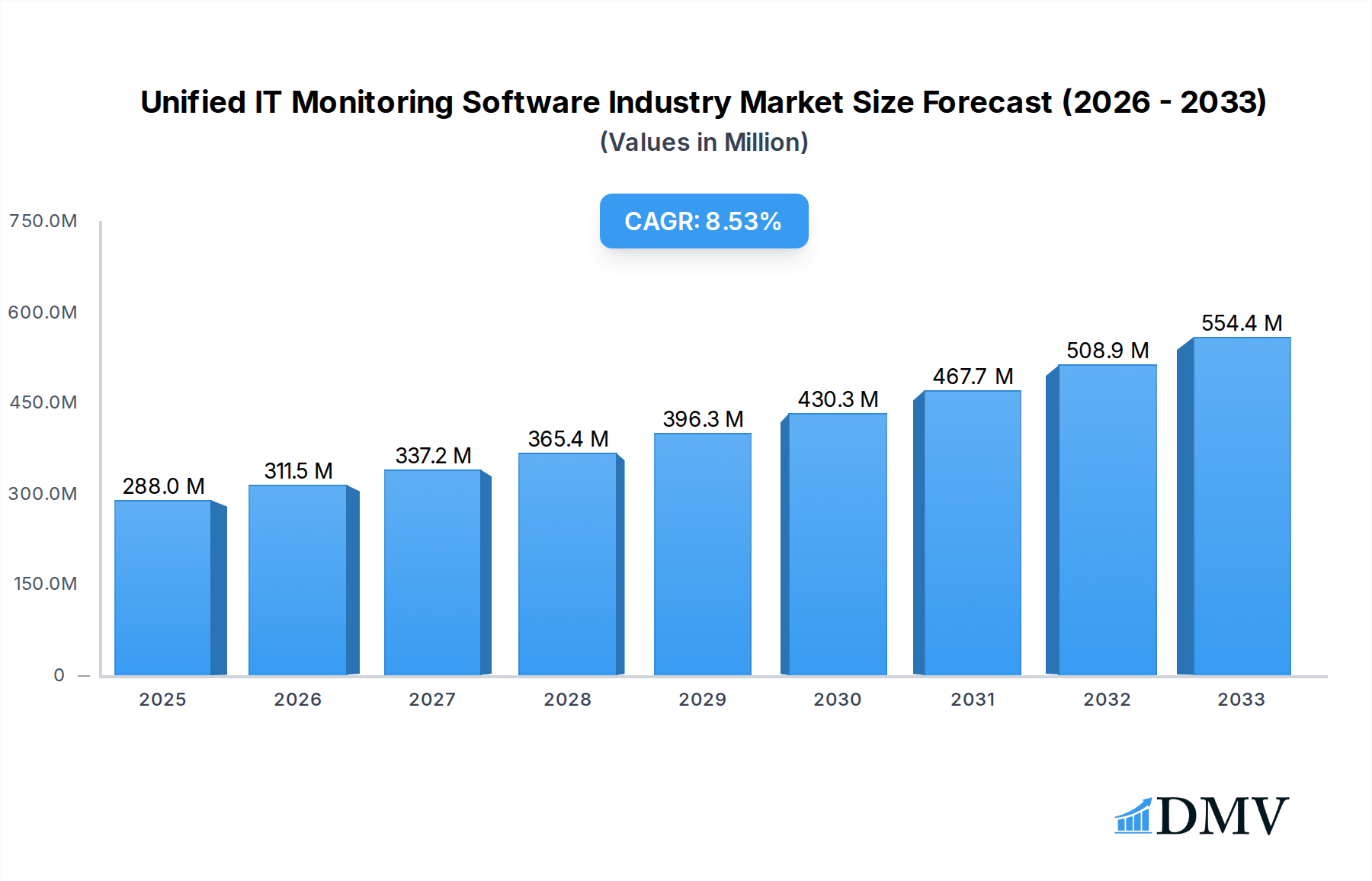

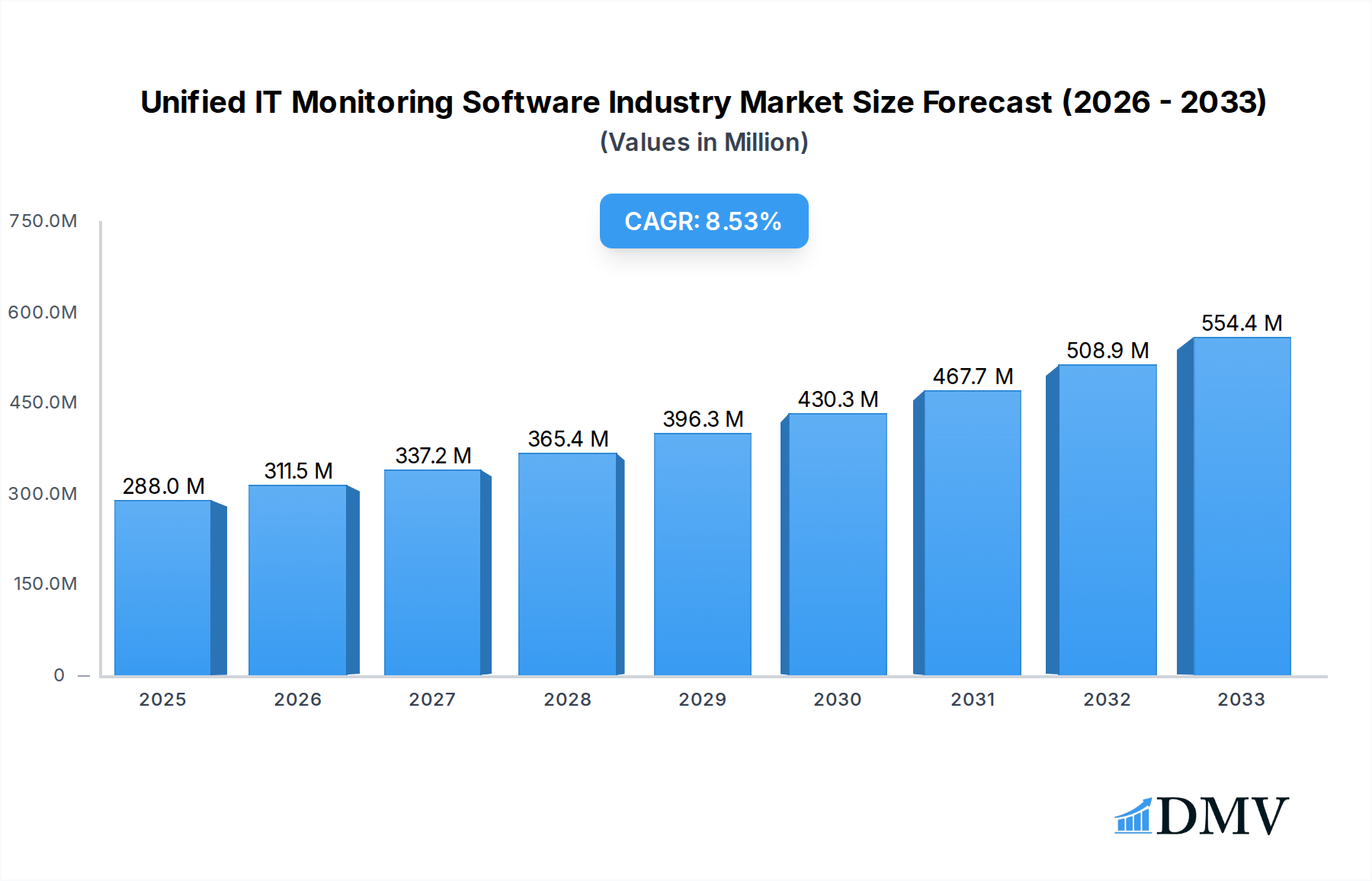

The Unified IT Monitoring Software market is poised for significant expansion, projected to reach a robust $288 million by 2025, driven by an impressive CAGR of 8.1% over the forecast period of 2025-2033. This growth is largely fueled by the increasing complexity of IT infrastructures, the escalating demand for seamless digital experiences, and the critical need for proactive issue resolution to minimize downtime. Key market drivers include the widespread adoption of cloud computing, the proliferation of hybrid and multi-cloud environments, and the surge in IoT devices, all of which necessitate comprehensive and integrated monitoring solutions. Businesses across all sectors are recognizing that effective IT monitoring is no longer a luxury but a fundamental requirement for operational efficiency, cybersecurity, and customer satisfaction. The evolving threat landscape and stringent regulatory compliance mandates further accentuate the importance of robust monitoring capabilities to detect and respond to anomalies swiftly.

Unified IT Monitoring Software Industry Market Size (In Million)

The market is segmenting effectively to cater to diverse needs, with solutions and services representing core offerings. Deployment models are increasingly favoring cloud-based solutions due to their scalability and flexibility, although on-premise deployments retain relevance for organizations with specific security or regulatory concerns. The demand for unified IT monitoring is particularly strong in sectors like BFSI, Healthcare and Life Sciences, and IT & Telecommunication, where operational continuity and data integrity are paramount. Emerging trends include the integration of AI and machine learning for predictive analytics and automated root cause analysis, as well as the growing emphasis on user experience monitoring (UEM). While the market exhibits strong growth potential, challenges such as the high initial investment costs for comprehensive solutions and the shortage of skilled IT professionals capable of managing complex monitoring systems could pose restraints to its unhindered advancement. Major players like Paessler AG, Verizon Enterprise Solutions, AppDynamics Inc., and Dynatrace LLC are actively innovating to address these demands and capitalize on the market's upward trajectory.

Unified IT Monitoring Software Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Unified IT Monitoring Software industry, providing critical insights for stakeholders from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study examines market dynamics, technological advancements, competitive landscapes, and future growth trajectories. Uncover market-shaping trends, leading players, and emerging opportunities within this vital sector that ensures optimal IT performance and business continuity across diverse verticals.

Unified IT Monitoring Software Industry Market Composition & Trends

The Unified IT Monitoring Software industry exhibits a moderately concentrated market structure, driven by continuous innovation and a growing demand for comprehensive IT oversight. Key innovation catalysts include the increasing complexity of hybrid and multi-cloud environments, the surge in remote workforces, and the imperative for enhanced cybersecurity posture. Regulatory landscapes, while not overly restrictive, are evolving to emphasize data privacy and resilience, indirectly influencing monitoring solution requirements. Substitute products, such as siloed monitoring tools, are steadily losing ground to integrated platforms offering holistic visibility. End-user profiles span across all major sectors, with BFSI, Healthcare and Life Sciences, Manufacturing, and IT & Telecommunication demonstrating the highest adoption rates due to their reliance on robust IT infrastructure. Merger and acquisition (M&A) activities are prevalent, with an estimated M&A deal value exceeding $2,000 million over the historical period, indicating a consolidation trend as larger players acquire specialized technologies and market share. The market share distribution is characterized by a few dominant vendors holding significant portions, while a robust ecosystem of mid-tier and niche players contributes to market dynamism.

- Market Concentration: Moderately concentrated with significant players and emerging innovators.

- Innovation Catalysts: Hybrid/multi-cloud complexity, remote work, cybersecurity needs, digital transformation initiatives.

- Regulatory Influence: Focus on data privacy (e.g., GDPR, CCPA) and operational resilience mandates.

- Substitute Products: Siloed monitoring tools, manual processes.

- End-user Verticals Driving Adoption: BFSI, Healthcare and Life Sciences, Manufacturing, IT & Telecommunication, Retail.

- M&A Activity: Indicative of market consolidation and strategic acquisitions, with estimated deal values over $2,000 million in the historical period.

Unified IT Monitoring Software Industry Industry Evolution

The Unified IT Monitoring Software industry has witnessed a transformative evolution, driven by rapid technological advancements and an ever-increasing reliance on digital infrastructure. From its nascent stages of basic network uptime monitoring, the industry has matured into sophisticated observability platforms capable of real-time performance analysis, anomaly detection, and predictive maintenance. The study period, 2019–2033, encapsulates significant shifts. The historical period (2019–2024) saw a substantial increase in cloud adoption, propelling the demand for cloud-native monitoring solutions. This era was marked by a growth rate averaging 15% annually, fueled by the digital transformation initiatives across industries. Businesses recognized the limitations of fragmented monitoring tools and began seeking integrated solutions that could provide a single pane of glass for their entire IT ecosystem, encompassing networks, applications, servers, and cloud infrastructure.

The base year, 2025, represents a pivotal point where the market solidifies its shift towards AI-powered analytics and automation. With an estimated market size of $15,000 million in 2025, the industry is poised for continued expansion. The forecast period (2025–2033) is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 18%. This accelerated growth is attributed to several factors. Firstly, the increasing adoption of complex technologies such as containerization, microservices, and edge computing necessitates advanced monitoring capabilities. Secondly, the pervasive threat of cyberattacks compels organizations to invest in solutions that can detect and respond to threats rapidly. Thirdly, the growing emphasis on customer experience, directly tied to application performance, is a significant driver. Adoption metrics indicate that over 70% of enterprises are actively evaluating or implementing unified IT monitoring solutions to gain deeper insights into their digital operations. Technological advancements like machine learning for predictive analytics, AIOps for automated incident resolution, and enhanced visualization tools are becoming standard features. The evolution continues towards more proactive, intelligent, and seamlessly integrated monitoring that supports the dynamic nature of modern IT environments, enabling organizations to optimize performance, reduce downtime, and enhance business agility.

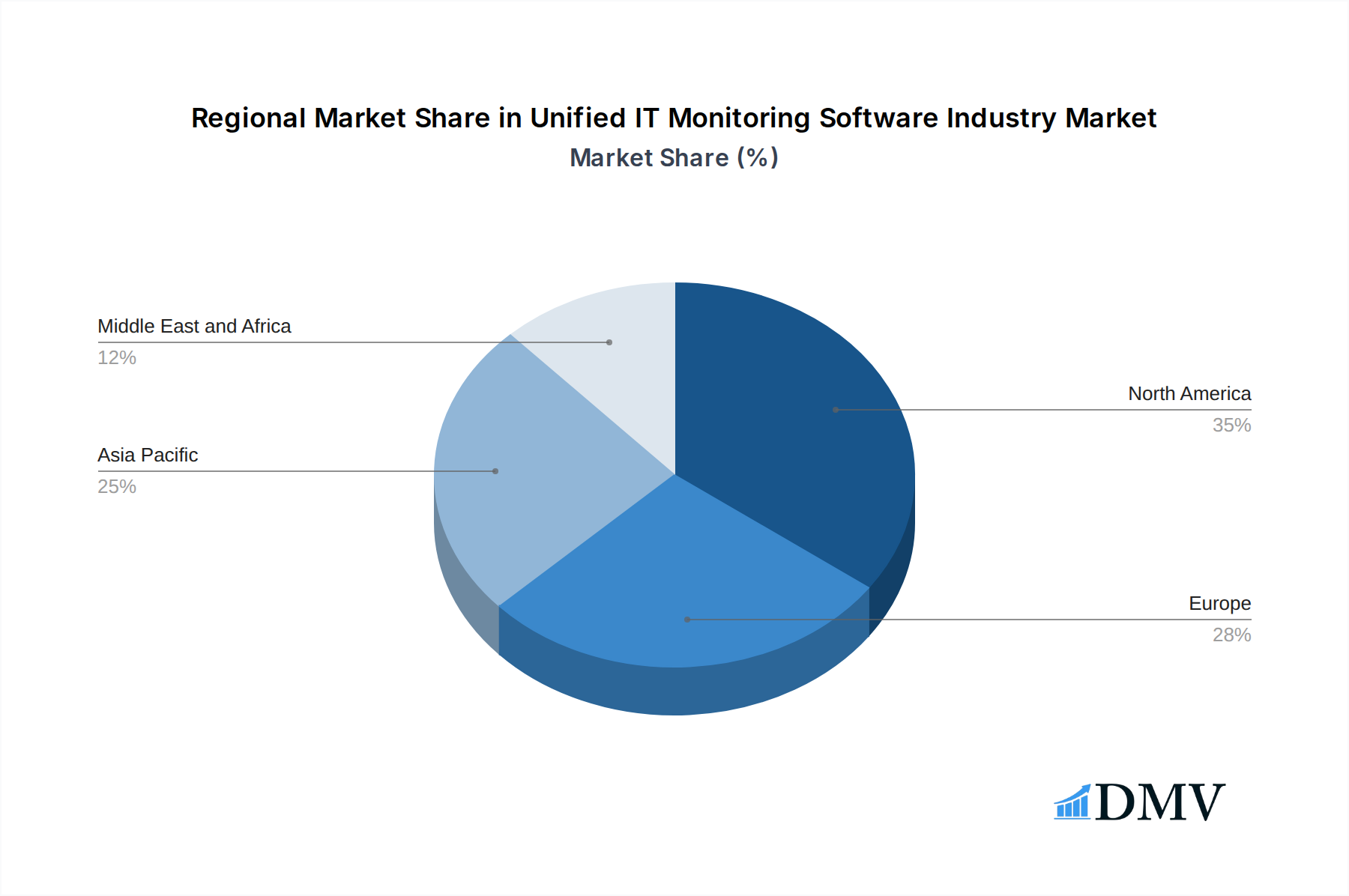

Leading Regions, Countries, or Segments in Unified IT Monitoring Software Industry

North America currently leads the Unified IT Monitoring Software industry, driven by its advanced technological infrastructure, high adoption rates of cloud computing, and a mature digital economy. The region's dominance is further bolstered by a strong presence of key industry players and a proactive approach to cybersecurity and IT operational efficiency. Significant investments in R&D and a continuous drive for digital transformation across its major end-user verticals, including BFSI, Healthcare and Life Sciences, and IT & Telecommunication, solidify its leading position.

- Dominant Region: North America.

- Key Drivers:

- High cloud adoption rates (over 75% of enterprises in the US and Canada).

- Significant investments in advanced IT infrastructure and cybersecurity measures.

- Presence of major technology hubs and a strong ecosystem of IT service providers.

- Stringent regulatory compliance demands in sectors like BFSI and healthcare.

- Early adoption of emerging technologies like AIOps and IoT monitoring.

- Key Drivers:

- Leading Component: Solutions segment is projected to capture over 65% of the market share by 2033.

- Analysis: The increasing complexity of IT environments necessitates integrated software solutions that provide comprehensive visibility and control. These solutions encompass network monitoring, application performance monitoring (APM), infrastructure monitoring, and log management, offering a unified platform for IT operations. The demand for advanced features like AI-driven analytics and automation within these solutions is a primary growth driver.

- Leading Deployment: Cloud deployment is experiencing the fastest growth, projected to account for over 70% of new deployments by 2033.

- Analysis: The agility, scalability, and cost-effectiveness of cloud-based solutions are highly attractive to businesses of all sizes. Cloud deployment allows for easier integration with other cloud services and simplifies management and maintenance. While on-premise solutions remain relevant for organizations with strict data sovereignty requirements or legacy infrastructure, the trend strongly favors cloud-native and SaaS-based unified monitoring platforms.

- Leading End-user Vertical: BFSI (Banking, Financial Services, and Insurance) sector is expected to maintain its position as the largest consumer, followed closely by IT & Telecommunication.

- Analysis: The BFSI sector relies heavily on the performance and availability of its IT systems for critical transactions and customer service. Downtime can result in significant financial losses and reputational damage, making robust IT monitoring a top priority. The IT & Telecommunication sector, as the backbone of digital infrastructure, also requires comprehensive monitoring to ensure service quality and network integrity.

Unified IT Monitoring Software Industry Product Innovations

Recent product innovations in the Unified IT Monitoring Software industry are focused on enhancing proactive problem-solving and providing deeper contextual insights. Solutions are increasingly incorporating AI and machine learning to automate anomaly detection, predict potential issues before they impact users, and accelerate root cause analysis. Advancements in agentless monitoring, exemplified by New Relic's launch for SAP® Solutions, allow for less intrusive data collection from critical business systems, simplifying deployment and minimizing performance overhead. Furthermore, the integration of cloud-native observability services, such as Riverbed's Alluvio IQ, is empowering IT teams with comprehensive visibility into complex cloud environments, enabling them to optimize performance and manage remote and hybrid workforces more effectively. These innovations are crucial for addressing the dynamic challenges of modern IT infrastructures.

Propelling Factors for Unified IT Monitoring Software Industry Growth

The Unified IT Monitoring Software industry is propelled by several key growth factors. The escalating complexity of IT infrastructures, driven by cloud adoption, microservices, and IoT, necessitates unified visibility. Digital transformation initiatives across all sectors demand robust performance monitoring to ensure seamless user experiences and business continuity. The increasing frequency and sophistication of cyber threats drive the need for integrated security and performance monitoring to detect and respond to anomalies effectively. Furthermore, the widespread adoption of remote and hybrid work models mandates enhanced network and application performance monitoring to support distributed workforces. The growing emphasis on data-driven decision-making and the need for operational efficiency also fuel demand.

Obstacles in the Unified IT Monitoring Software Industry Market

Despite robust growth, the Unified IT Monitoring Software industry faces several obstacles. The complexity of integrating disparate IT systems and legacy infrastructure can hinder seamless deployment and operationalization of unified solutions, leading to extended implementation cycles valued in months. The sheer volume of data generated by IT environments presents a challenge in terms of storage, processing, and actionable insight extraction, requiring significant investment in advanced analytics capabilities. Skills gaps within IT departments regarding the effective utilization of sophisticated monitoring tools also pose a restraint, impacting adoption rates. Additionally, the competitive landscape, while driving innovation, can also lead to price pressures, particularly for smaller vendors.

Future Opportunities in Unified IT Monitoring Software Industry

Emerging opportunities in the Unified IT Monitoring Software industry are abundant. The expanding edge computing landscape presents a significant new market for monitoring solutions that can manage distributed and often resource-constrained devices. The growing adoption of AI and machine learning in IT operations opens avenues for predictive and prescriptive analytics within monitoring platforms, moving beyond reactive issue resolution. The increasing demand for observability in DevOps workflows and the broader adoption of Site Reliability Engineering (SRE) practices create opportunities for tools that enhance collaboration and provide end-to-end visibility into the software delivery lifecycle. Furthermore, the burgeoning Internet of Things (IoT) ecosystem across various verticals like smart cities, industrial automation, and healthcare will require specialized unified monitoring capabilities, representing a multi-billion dollar opportunity.

Major Players in the Unified IT Monitoring Software Industry Ecosystem

- Paessler AG

- Verizon Enterprise Solutions LL

- AppDynamics Inc

- GroundWork Open Source Inc

- Opsview Limited

- Broadcom Inc

- Juniper Networks Inc

- Zenoss Inc

- Zoho Corporation

- Acronis International GmbH

- Dynatrace LLC

Key Developments in Unified IT Monitoring Software Industry Industry

- July 2022: New Relic Launches Agentless Monitoring for SAP® Solutions, the industry's first native observability solution delivered agentless for enterprises running critical business processes on SAP systems. The solution empowers IT teams to better support business operations by harnessing existing SAP data sources to access all necessary telemetry data. It also avoids installing intrusive monitoring agents in SAP production servers or relying on third-party connectors.

- September 2022: Riverbed Launches First Cloud Service As Part Of Unified Observability Push in Cloud-native SaaS service Alluvio IQ. It will inject more automation and visibility into the increasingly complex network, including remote and hybrid work environments, to help free up IT teams to work on more strategic IT initiatives when IT resources are being stretched thin.

Strategic Unified IT Monitoring Software Industry Market Forecast

The strategic forecast for the Unified IT Monitoring Software industry indicates sustained and accelerated growth, driven by the relentless digital transformation across global economies. The increasing adoption of cloud-native architectures, containerization, and edge computing will necessitate more sophisticated and integrated monitoring solutions, creating a market potential estimated to reach over $40,000 million by 2033. The ongoing advancements in AI and machine learning are expected to revolutionize how IT issues are detected, diagnosed, and resolved, making proactive and predictive monitoring a standard. Furthermore, the growing emphasis on customer experience and business resilience will continue to position unified IT monitoring as a critical component of enterprise IT strategy, fostering innovation and market expansion.

Unified IT Monitoring Software Industry Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Services

-

2. Deployment

- 2.1. On-Premise

- 2.2. Cloud

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Healthcare and Life Sciences

- 3.3. Manufacturing

- 3.4. IT & Telecommunication

- 3.5. Retail

- 3.6. Other End-user Vertical

Unified IT Monitoring Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

Unified IT Monitoring Software Industry Regional Market Share

Geographic Coverage of Unified IT Monitoring Software Industry

Unified IT Monitoring Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Adoption for Networking Solutions by Enterprises; Increasing Cyber Safety and Security Concerns Among Organisations

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. BFSI Sector Will Experience Significant Growth and Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Healthcare and Life Sciences

- 5.3.3. Manufacturing

- 5.3.4. IT & Telecommunication

- 5.3.5. Retail

- 5.3.6. Other End-user Vertical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-Premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Healthcare and Life Sciences

- 6.3.3. Manufacturing

- 6.3.4. IT & Telecommunication

- 6.3.5. Retail

- 6.3.6. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-Premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Healthcare and Life Sciences

- 7.3.3. Manufacturing

- 7.3.4. IT & Telecommunication

- 7.3.5. Retail

- 7.3.6. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-Premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Healthcare and Life Sciences

- 8.3.3. Manufacturing

- 8.3.4. IT & Telecommunication

- 8.3.5. Retail

- 8.3.6. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East and Africa Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-Premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Healthcare and Life Sciences

- 9.3.3. Manufacturing

- 9.3.4. IT & Telecommunication

- 9.3.5. Retail

- 9.3.6. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Paessler AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Verizon Enterprise Solutions LL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 AppDynamics Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GroundWork Open Source Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Opsview Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Broadcom Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Juniper Networks Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Zenoss Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zoho Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Acronis International GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dynatrace LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Paessler AG

List of Figures

- Figure 1: Global Unified IT Monitoring Software Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Unified IT Monitoring Software Industry Revenue (million), by Component 2025 & 2033

- Figure 3: North America Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Unified IT Monitoring Software Industry Revenue (million), by Deployment 2025 & 2033

- Figure 5: North America Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Unified IT Monitoring Software Industry Revenue (million), by End-user Vertical 2025 & 2033

- Figure 7: North America Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Unified IT Monitoring Software Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Unified IT Monitoring Software Industry Revenue (million), by Component 2025 & 2033

- Figure 11: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Unified IT Monitoring Software Industry Revenue (million), by Deployment 2025 & 2033

- Figure 13: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: Europe Unified IT Monitoring Software Industry Revenue (million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Unified IT Monitoring Software Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Unified IT Monitoring Software Industry Revenue (million), by Component 2025 & 2033

- Figure 19: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Unified IT Monitoring Software Industry Revenue (million), by Deployment 2025 & 2033

- Figure 21: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Asia Pacific Unified IT Monitoring Software Industry Revenue (million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Unified IT Monitoring Software Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Unified IT Monitoring Software Industry Revenue (million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Unified IT Monitoring Software Industry Revenue (million), by Deployment 2025 & 2033

- Figure 29: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Middle East and Africa Unified IT Monitoring Software Industry Revenue (million), by End-user Vertical 2025 & 2033

- Figure 31: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Middle East and Africa Unified IT Monitoring Software Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Component 2020 & 2033

- Table 2: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Deployment 2020 & 2033

- Table 3: Global Unified IT Monitoring Software Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Component 2020 & 2033

- Table 6: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Deployment 2020 & 2033

- Table 7: Global Unified IT Monitoring Software Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Component 2020 & 2033

- Table 10: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Deployment 2020 & 2033

- Table 11: Global Unified IT Monitoring Software Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Component 2020 & 2033

- Table 14: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Deployment 2020 & 2033

- Table 15: Global Unified IT Monitoring Software Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Component 2020 & 2033

- Table 18: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Deployment 2020 & 2033

- Table 19: Global Unified IT Monitoring Software Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Unified IT Monitoring Software Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unified IT Monitoring Software Industry?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Unified IT Monitoring Software Industry?

Key companies in the market include Paessler AG, Verizon Enterprise Solutions LL, AppDynamics Inc, GroundWork Open Source Inc, Opsview Limited, Broadcom Inc, Juniper Networks Inc, Zenoss Inc, Zoho Corporation, Acronis International GmbH, Dynatrace LLC.

3. What are the main segments of the Unified IT Monitoring Software Industry?

The market segments include Component, Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 288 million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption for Networking Solutions by Enterprises; Increasing Cyber Safety and Security Concerns Among Organisations.

6. What are the notable trends driving market growth?

BFSI Sector Will Experience Significant Growth and Drive the Market.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

July 2022 - New Relic Launches Agentless Monitoring for SAP® Solutions, the industry's first native observability solution delivered agentless for enterprises running critical business processes on SAP systems. The solution empowers IT teams to better support business operations by harnessing existing SAP data sources to access all necessary telemetry data. It also avoids installing intrusive monitoring agents in SAP production servers or relying on third-party connectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unified IT Monitoring Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unified IT Monitoring Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unified IT Monitoring Software Industry?

To stay informed about further developments, trends, and reports in the Unified IT Monitoring Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence