Key Insights

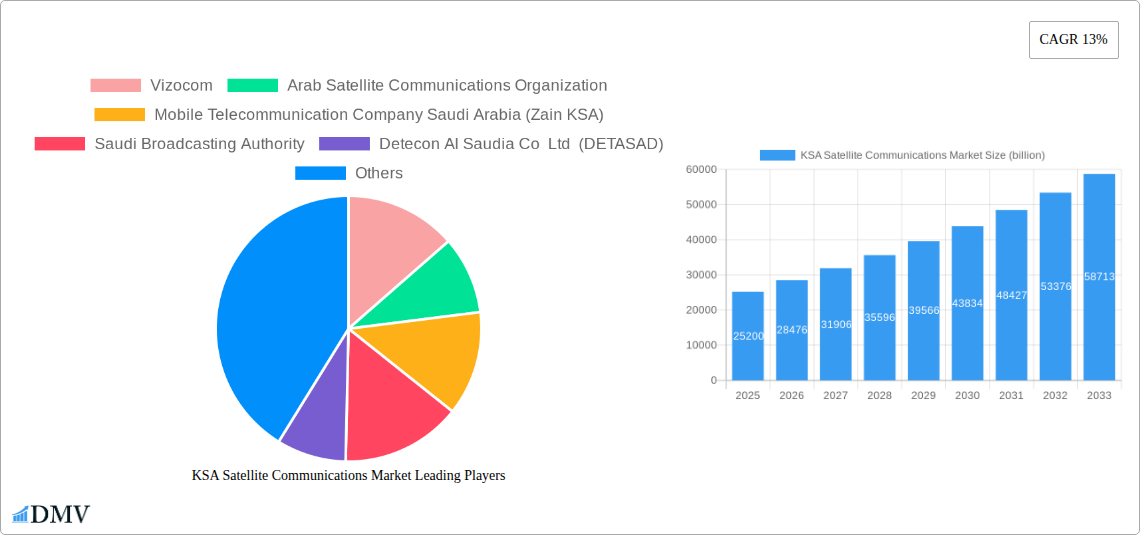

The Saudi Arabian satellite communications market is poised for significant expansion, projected to reach $25.2 billion in 2025, driven by robust government initiatives and the increasing demand for high-speed, reliable connectivity across various sectors. A compelling compound annual growth rate (CAGR) of 13% anticipated over the forecast period (2025-2033) underscores the dynamic nature of this market. Key growth drivers include the Kingdom's Vision 2030, which prioritizes digital transformation and infrastructure development, particularly in underserved regions. The burgeoning enterprise sector, coupled with the ongoing modernization of defense and government operations, is creating substantial demand for advanced satellite solutions. Furthermore, the expansion of media and entertainment services, which increasingly rely on satellite broadcasting and content delivery, also contributes significantly to market growth. The increasing adoption of portable and land-based satellite equipment, along with the ongoing development of maritime and airborne communication capabilities, are shaping the market landscape.

KSA Satellite Communications Market Market Size (In Billion)

The market's trajectory is further influenced by emerging trends such as the integration of 5G with satellite networks to achieve ubiquitous connectivity, the growing deployment of very small aperture terminals (VSATs) for remote area access, and the increasing use of satellite imagery and data analytics for commercial and governmental applications. While the market exhibits strong growth potential, certain restraints such as the high initial investment costs for satellite infrastructure and the evolving regulatory landscape could pose challenges. However, the consistent investment in technological advancements and the strategic partnerships among key players like STC, Zain KSA, and Arab Satellite Communications Organization (Arabsat) are expected to mitigate these hurdles. The diverse range of end-user verticals, from critical defense and government communications to the rapidly growing media and entertainment industry, ensures a broad base for sustained market expansion and innovation.

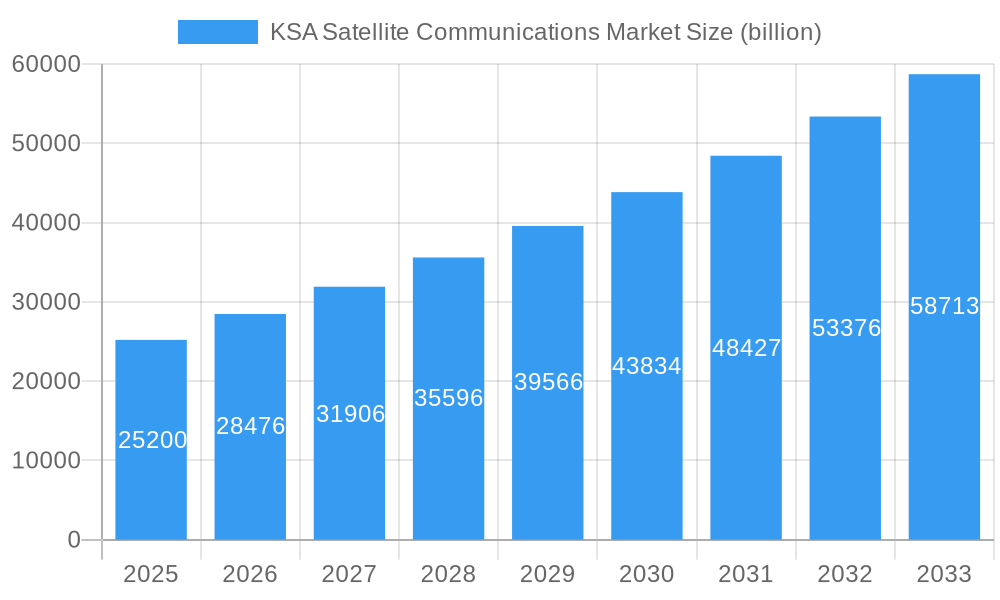

KSA Satellite Communications Market Company Market Share

This in-depth report provides a definitive analysis of the Kingdom of Saudi Arabia's (KSA) burgeoning satellite communications market. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. We offer critical insights into the evolving landscape of satellite communication technologies and services in KSA, driven by significant investments in digital transformation, defense modernization, and enterprise connectivity. The market, projected to reach hundreds of billions in value, is characterized by rapid technological adoption and strategic partnerships. This report is essential for stakeholders seeking to understand the current state and future trajectory of the KSA satellite communications sector, including key players like STC, Zain KSA, Arabsat, and Vizocom.

KSA Satellite Communications Market Market Composition & Trends

The KSA satellite communications market is a dynamic and increasingly consolidated sector, driven by robust demand across various end-user verticals. Innovation is a key catalyst, with companies consistently investing in advanced satellite technologies and service offerings to meet evolving connectivity needs. The regulatory landscape, while supportive of digital infrastructure development, presents ongoing considerations for market participants. Substitute products, primarily terrestrial networks, are being increasingly complemented by satellite solutions, especially in remote or underserved areas. End-user profiles are diverse, ranging from critical defense and government applications to expanding enterprise and media requirements. Mergers and acquisitions (M&A) are becoming more prevalent as larger entities seek to expand their portfolios and market reach, with significant M&A deal values projected to exceed tens of billions over the forecast period.

- Market Concentration: Moderate to high, with key players dominating specific segments.

- Innovation Catalysts: Government initiatives for digital transformation, defense modernization programs, and increasing demand for high-bandwidth connectivity.

- Regulatory Landscape: Supportive framework for infrastructure development, with ongoing adjustments to accommodate new technologies and services.

- Substitute Products: Terrestrial networks (fiber optics, 5G), increasingly integrated with satellite for hybrid solutions.

- End-User Profiles: Defense and Government (critical communications, surveillance), Enterprises (remote site connectivity, IoT), Maritime (vessel communication, tracking), Media and Entertainment (broadcasting, content delivery), and Other Verticals (telemedicine, education).

- M&A Activities: Increasing trend as companies seek strategic consolidation and market expansion.

KSA Satellite Communications Market Industry Evolution

The KSA satellite communications market has witnessed remarkable evolution, transitioning from a niche sector to a critical component of the nation's digital infrastructure. Over the historical period (2019-2024) and extending into the forecast period (2025-2033), market growth trajectories have been consistently upward. This expansion is fueled by significant investments in national digital transformation initiatives, such as Saudi Vision 2030, which prioritize ubiquitous connectivity. Technological advancements have been a relentless force, with the introduction of High Throughput Satellites (HTS), Low Earth Orbit (LEO) constellations, and advancements in ground equipment and services drastically improving capacity, speed, and cost-effectiveness. Shifting consumer and enterprise demands for seamless, reliable, and high-bandwidth connectivity, even in remote or mobile environments, have further propelled this evolution. The adoption of satellite services for previously underserved segments, like maritime and airborne platforms, has surged. For instance, the increasing deployment of Ka-band and Ku-band frequencies for HTS capacity has enabled data download speeds exceeding hundreds of Mbps, a significant leap from previous generations of satellite technology. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 15-20% during the forecast period, reaching a total market size in the range of hundreds of billions by 2033. The integration of satellite communications with terrestrial networks is also a key trend, creating hybrid solutions that offer unparalleled coverage and resilience, with adoption metrics for such integrated solutions showing a substantial increase year-on-year.

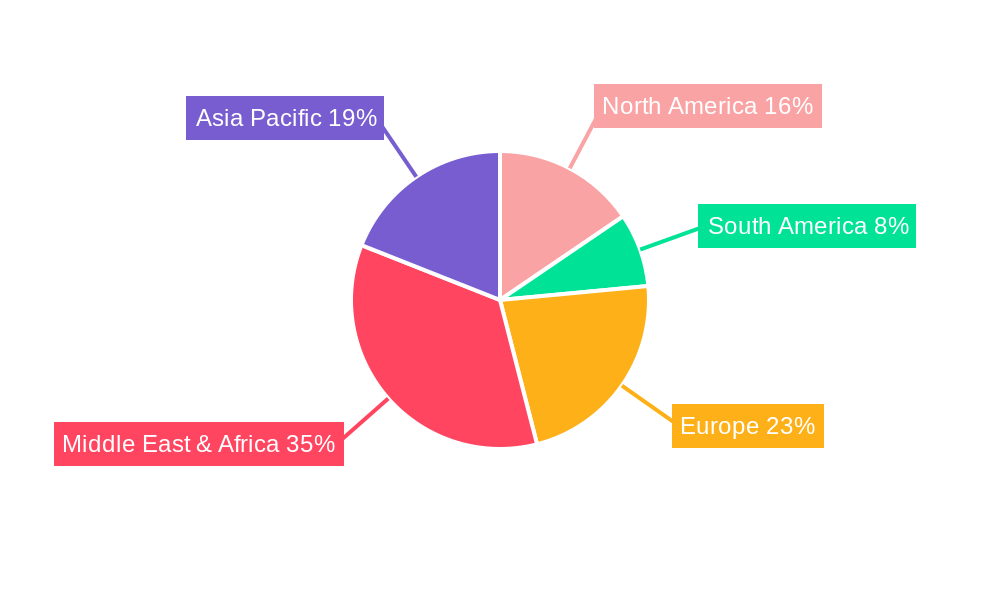

Leading Regions, Countries, or Segments in KSA Satellite Communications Market

Within the KSA satellite communications market, the Defense and Government end-user vertical stands out as a dominant force, driven by substantial strategic investments and the critical nature of its communication requirements. This dominance is underpinned by a confluence of factors, including national security imperatives, border surveillance needs, and the ongoing modernization of military and public service infrastructure. The Saudi government's commitment to enhancing national security and providing resilient communication networks for its extensive geographical reach necessitates advanced satellite solutions.

- Dominant Segment: Defense and Government End-user Vertical

- Key Drivers:

- National Security Investments: Significant budgetary allocations towards defense modernization and secure communication systems.

- Geopolitical Stability: The need for robust and reliable communication for defense operations and disaster management across a vast territory.

- Regulatory Support: Government policies that prioritize secure and advanced communication infrastructure for national entities.

- Technological Adoption: Early and widespread adoption of cutting-edge satellite technologies for intelligence, surveillance, reconnaissance (ISR), and tactical communications.

- Large-Scale Deployments: Requirement for extensive networks supporting diverse platforms including land-based units, naval vessels, and airborne assets.

The demand from the Defense and Government sector encompasses a wide array of satellite services, from secure voice and data transmission to high-bandwidth video streaming for real-time intelligence. This vertical also drives innovation in specialized ground equipment, including hardened terminals and portable satellite communication systems designed for harsh operational environments. The trend towards secure, encrypted, and resilient satellite links for critical command and control operations ensures that this segment will continue to lead market growth and investment throughout the forecast period, likely accounting for over 40% of the total market value.

The Services segment, encompassing managed services, data transmission, and connectivity solutions, also commands a significant share, intricately linked to the needs of dominant end-users like Defense and Government and Enterprises. Furthermore, the Land platform segment, which includes fixed and mobile ground terminals, is crucial due to the widespread deployment of terrestrial and expeditionary forces, as well as the expansion of enterprise operations in remote industrial areas.

KSA Satellite Communications Market Product Innovations

Product innovation in the KSA satellite communications market is rapidly advancing, with a focus on enhancing bandwidth, reducing latency, and improving the ruggedness and portability of solutions. The development of integrated satellite and terrestrial communication platforms, offering seamless connectivity across diverse environments, is a significant trend. Furthermore, advancements in antenna technology, including phased-array and electronically steered antennas, are enabling more efficient and agile satellite communication for mobile platforms. The introduction of satellite-enabled IoT solutions for industrial applications and the enhancement of real-time data transmission capabilities for media and entertainment are also key areas of innovation, promising increased efficiency and new service possibilities, with performance metrics like throughput often exceeding 1 Gbps for specialized enterprise and government applications.

Propelling Factors for KSA Satellite Communications Market Growth

The KSA satellite communications market is experiencing robust growth driven by several key factors. Foremost among these is the Saudi government's ambitious Vision 2030, which prioritizes digital transformation and the development of a connected economy, necessitating advanced communication infrastructure. Significant investments in defense modernization and national security further bolster demand for resilient and secure satellite solutions. The increasing adoption of High Throughput Satellites (HTS) and the emergence of Low Earth Orbit (LEO) constellations are expanding capacity and reducing costs, making satellite services more accessible. Furthermore, the growing need for connectivity in remote areas, for industries like oil and gas, mining, and for maritime and airborne applications, where terrestrial networks are impractical, is a significant growth driver. The market is projected to grow from an estimated tens of billions in the base year to hundreds of billions by 2033.

Obstacles in the KSA Satellite Communications Market Market

Despite the strong growth trajectory, the KSA satellite communications market faces certain obstacles. Regulatory complexities and the need for continuous adaptation to evolving international and national standards can pose challenges. High upfront costs associated with satellite infrastructure deployment and specialized ground equipment can be a barrier for smaller enterprises. Furthermore, while LEO constellations are reducing latency, it remains a consideration for highly time-sensitive applications compared to fiber optics. Supply chain disruptions, particularly for specialized components and skilled personnel, can impact project timelines and costs. The competitive pressure from rapidly advancing terrestrial technologies, such as 5G, also necessitates continuous innovation and strategic positioning for satellite service providers.

Future Opportunities in KSA Satellite Communications Market

The KSA satellite communications market is ripe with future opportunities. The expansion of 5G and future wireless technologies will likely involve hybrid satellite-terrestrial networks, creating new integration opportunities. The growing demand for high-speed broadband in underserved rural and remote areas presents a significant market. The burgeoning space economy and KSA's focus on becoming a regional space hub will foster further innovation and demand for satellite services. Emerging applications in areas like autonomous vehicles, advanced IoT deployments, and the metaverse will require the reliable and pervasive connectivity that satellite communications can provide. The ongoing expansion of Ka-band and Ku-band capacity and the development of more advanced LEO and MEO constellations will open new avenues for specialized services.

Major Players in the KSA Satellite Communications Market Ecosystem

- Vizocom

- Arab Satellite Communications Organization

- Mobile Telecommunication Company Saudi Arabia (Zain KSA)

- Saudi Broadcasting Authority

- Detecon Al Saudia Co Ltd (DETASAD)

- AXESS Networks Arabia Saudita

- Thuraya Telecommunications Company

- Saudi Telecom Company (STC)

- NOVAsat

- Salam (Integrated Telecom Company)

Key Developments in KSA Satellite Communications Market Industry

- May 2023: Arabsat launched Arabsat Badr-8, a seventh-generation satellite built on the Airbus Eurostar Neo electric orbit boosting platform, in partnership with Airbus and SpaceX. On May 26, the satellite was launched by a SpaceX Falcon 9 from Cape Canaveral Air Force Station in Florida. This development significantly enhances Arabsat's orbital capacity and service offerings, particularly for broadcasting and telecommunications across the MENA region.

- March 2023: Saudi Arabian origin The Helicopter Company (THC) will equip its Airbus and Leonardo helicopters with the Iridium Certus satellite communications system from Skytrac, a satcom company. The technology enables Wi-Fi connection, low-Earth orbit satellite communications, and 4G/LTE cellular communications possible. Skytrac will provide its SkyWeb automatic flight following service and mission monitoring, SAFR flight data monitoring, real-time HUMS alerts, Iridium push-to-talk communications, and voice and text messaging. This signifies a growing trend in equipping aviation fleets with advanced satcom solutions for enhanced operational efficiency and safety.

Strategic KSA Satellite Communications Market Market Forecast

The strategic forecast for the KSA satellite communications market is exceptionally promising, projecting sustained and accelerated growth driven by a confluence of technological advancements, economic diversification, and government impetus. The ongoing investment in robust national digital infrastructure, coupled with the increasing demand for reliable connectivity across enterprise, maritime, and airborne sectors, will continue to fuel market expansion. The strategic adoption of High Throughput Satellites (HTS) and the exploration of Low Earth Orbit (LEO) satellite constellations offer unprecedented opportunities for enhanced capacity, reduced latency, and cost-effectiveness. Furthermore, the Kingdom's commitment to becoming a regional leader in technology and innovation will spur the development and adoption of cutting-edge satellite communication solutions, positioning the market for substantial growth in the coming years, with projected market value reaching hundreds of billions.

KSA Satellite Communications Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

KSA Satellite Communications Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

KSA Satellite Communications Market Regional Market Share

Geographic Coverage of KSA Satellite Communications Market

KSA Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Connectivity; Government Initiatives and Investments

- 3.3. Market Restrains

- 3.3.1. Regulatory and Policy Challenges; Competition from Alternative Technologies

- 3.4. Market Trends

- 3.4.1. Increased Demand for Connectivity to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global KSA Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America KSA Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ground Equipment

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Portable

- 6.2.2. Land

- 6.2.3. Maritime

- 6.2.4. Airborne

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Maritime

- 6.3.2. Defense and Government

- 6.3.3. Enterprises

- 6.3.4. Media and Entertainment

- 6.3.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America KSA Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ground Equipment

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Portable

- 7.2.2. Land

- 7.2.3. Maritime

- 7.2.4. Airborne

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Maritime

- 7.3.2. Defense and Government

- 7.3.3. Enterprises

- 7.3.4. Media and Entertainment

- 7.3.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe KSA Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ground Equipment

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Portable

- 8.2.2. Land

- 8.2.3. Maritime

- 8.2.4. Airborne

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Maritime

- 8.3.2. Defense and Government

- 8.3.3. Enterprises

- 8.3.4. Media and Entertainment

- 8.3.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa KSA Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ground Equipment

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Portable

- 9.2.2. Land

- 9.2.3. Maritime

- 9.2.4. Airborne

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Maritime

- 9.3.2. Defense and Government

- 9.3.3. Enterprises

- 9.3.4. Media and Entertainment

- 9.3.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific KSA Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ground Equipment

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Portable

- 10.2.2. Land

- 10.2.3. Maritime

- 10.2.4. Airborne

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Maritime

- 10.3.2. Defense and Government

- 10.3.3. Enterprises

- 10.3.4. Media and Entertainment

- 10.3.5. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vizocom

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arab Satellite Communications Organization

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mobile Telecommunication Company Saudi Arabia (Zain KSA)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saudi Broadcasting Authority

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Detecon Al Saudia Co Ltd (DETASAD)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXESS Networks Arabia Saudita

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thuraya Telecommunications Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saudi Telecom Company (STC)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NOVAsat

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Salam (Integrated Telecom Company)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Vizocom

List of Figures

- Figure 1: Global KSA Satellite Communications Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global KSA Satellite Communications Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America KSA Satellite Communications Market Revenue (billion), by Type 2025 & 2033

- Figure 4: North America KSA Satellite Communications Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America KSA Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America KSA Satellite Communications Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America KSA Satellite Communications Market Revenue (billion), by Platform 2025 & 2033

- Figure 8: North America KSA Satellite Communications Market Volume (K Unit), by Platform 2025 & 2033

- Figure 9: North America KSA Satellite Communications Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: North America KSA Satellite Communications Market Volume Share (%), by Platform 2025 & 2033

- Figure 11: North America KSA Satellite Communications Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 12: North America KSA Satellite Communications Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 13: North America KSA Satellite Communications Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 14: North America KSA Satellite Communications Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 15: North America KSA Satellite Communications Market Revenue (billion), by Country 2025 & 2033

- Figure 16: North America KSA Satellite Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America KSA Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America KSA Satellite Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America KSA Satellite Communications Market Revenue (billion), by Type 2025 & 2033

- Figure 20: South America KSA Satellite Communications Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: South America KSA Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America KSA Satellite Communications Market Volume Share (%), by Type 2025 & 2033

- Figure 23: South America KSA Satellite Communications Market Revenue (billion), by Platform 2025 & 2033

- Figure 24: South America KSA Satellite Communications Market Volume (K Unit), by Platform 2025 & 2033

- Figure 25: South America KSA Satellite Communications Market Revenue Share (%), by Platform 2025 & 2033

- Figure 26: South America KSA Satellite Communications Market Volume Share (%), by Platform 2025 & 2033

- Figure 27: South America KSA Satellite Communications Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 28: South America KSA Satellite Communications Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 29: South America KSA Satellite Communications Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: South America KSA Satellite Communications Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 31: South America KSA Satellite Communications Market Revenue (billion), by Country 2025 & 2033

- Figure 32: South America KSA Satellite Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America KSA Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America KSA Satellite Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe KSA Satellite Communications Market Revenue (billion), by Type 2025 & 2033

- Figure 36: Europe KSA Satellite Communications Market Volume (K Unit), by Type 2025 & 2033

- Figure 37: Europe KSA Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe KSA Satellite Communications Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe KSA Satellite Communications Market Revenue (billion), by Platform 2025 & 2033

- Figure 40: Europe KSA Satellite Communications Market Volume (K Unit), by Platform 2025 & 2033

- Figure 41: Europe KSA Satellite Communications Market Revenue Share (%), by Platform 2025 & 2033

- Figure 42: Europe KSA Satellite Communications Market Volume Share (%), by Platform 2025 & 2033

- Figure 43: Europe KSA Satellite Communications Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 44: Europe KSA Satellite Communications Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 45: Europe KSA Satellite Communications Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 46: Europe KSA Satellite Communications Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 47: Europe KSA Satellite Communications Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe KSA Satellite Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe KSA Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe KSA Satellite Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa KSA Satellite Communications Market Revenue (billion), by Type 2025 & 2033

- Figure 52: Middle East & Africa KSA Satellite Communications Market Volume (K Unit), by Type 2025 & 2033

- Figure 53: Middle East & Africa KSA Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East & Africa KSA Satellite Communications Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East & Africa KSA Satellite Communications Market Revenue (billion), by Platform 2025 & 2033

- Figure 56: Middle East & Africa KSA Satellite Communications Market Volume (K Unit), by Platform 2025 & 2033

- Figure 57: Middle East & Africa KSA Satellite Communications Market Revenue Share (%), by Platform 2025 & 2033

- Figure 58: Middle East & Africa KSA Satellite Communications Market Volume Share (%), by Platform 2025 & 2033

- Figure 59: Middle East & Africa KSA Satellite Communications Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 60: Middle East & Africa KSA Satellite Communications Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 61: Middle East & Africa KSA Satellite Communications Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 62: Middle East & Africa KSA Satellite Communications Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 63: Middle East & Africa KSA Satellite Communications Market Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East & Africa KSA Satellite Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa KSA Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa KSA Satellite Communications Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific KSA Satellite Communications Market Revenue (billion), by Type 2025 & 2033

- Figure 68: Asia Pacific KSA Satellite Communications Market Volume (K Unit), by Type 2025 & 2033

- Figure 69: Asia Pacific KSA Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Asia Pacific KSA Satellite Communications Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Asia Pacific KSA Satellite Communications Market Revenue (billion), by Platform 2025 & 2033

- Figure 72: Asia Pacific KSA Satellite Communications Market Volume (K Unit), by Platform 2025 & 2033

- Figure 73: Asia Pacific KSA Satellite Communications Market Revenue Share (%), by Platform 2025 & 2033

- Figure 74: Asia Pacific KSA Satellite Communications Market Volume Share (%), by Platform 2025 & 2033

- Figure 75: Asia Pacific KSA Satellite Communications Market Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 76: Asia Pacific KSA Satellite Communications Market Volume (K Unit), by End-user Vertical 2025 & 2033

- Figure 77: Asia Pacific KSA Satellite Communications Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 78: Asia Pacific KSA Satellite Communications Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 79: Asia Pacific KSA Satellite Communications Market Revenue (billion), by Country 2025 & 2033

- Figure 80: Asia Pacific KSA Satellite Communications Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific KSA Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific KSA Satellite Communications Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global KSA Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global KSA Satellite Communications Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global KSA Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 4: Global KSA Satellite Communications Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 5: Global KSA Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global KSA Satellite Communications Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 7: Global KSA Satellite Communications Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global KSA Satellite Communications Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global KSA Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global KSA Satellite Communications Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global KSA Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 12: Global KSA Satellite Communications Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 13: Global KSA Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global KSA Satellite Communications Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global KSA Satellite Communications Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global KSA Satellite Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global KSA Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global KSA Satellite Communications Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 25: Global KSA Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 26: Global KSA Satellite Communications Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 27: Global KSA Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global KSA Satellite Communications Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global KSA Satellite Communications Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global KSA Satellite Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Argentina KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global KSA Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global KSA Satellite Communications Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 39: Global KSA Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 40: Global KSA Satellite Communications Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 41: Global KSA Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 42: Global KSA Satellite Communications Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 43: Global KSA Satellite Communications Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global KSA Satellite Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Germany KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: France KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Italy KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Spain KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Russia KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Benelux KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Nordics KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global KSA Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 64: Global KSA Satellite Communications Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Global KSA Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 66: Global KSA Satellite Communications Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 67: Global KSA Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 68: Global KSA Satellite Communications Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 69: Global KSA Satellite Communications Market Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global KSA Satellite Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Turkey KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Israel KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: GCC KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: North Africa KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: South Africa KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global KSA Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 84: Global KSA Satellite Communications Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 85: Global KSA Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 86: Global KSA Satellite Communications Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 87: Global KSA Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 88: Global KSA Satellite Communications Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 89: Global KSA Satellite Communications Market Revenue billion Forecast, by Country 2020 & 2033

- Table 90: Global KSA Satellite Communications Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: China KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: India KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 96: Japan KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 98: South Korea KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 100: ASEAN KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 102: Oceania KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific KSA Satellite Communications Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific KSA Satellite Communications Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the KSA Satellite Communications Market?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the KSA Satellite Communications Market?

Key companies in the market include Vizocom, Arab Satellite Communications Organization, Mobile Telecommunication Company Saudi Arabia (Zain KSA), Saudi Broadcasting Authority, Detecon Al Saudia Co Ltd (DETASAD), AXESS Networks Arabia Saudita, Thuraya Telecommunications Company, Saudi Telecom Company (STC), NOVAsat, Salam (Integrated Telecom Company).

3. What are the main segments of the KSA Satellite Communications Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Connectivity; Government Initiatives and Investments.

6. What are the notable trends driving market growth?

Increased Demand for Connectivity to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Regulatory and Policy Challenges; Competition from Alternative Technologies.

8. Can you provide examples of recent developments in the market?

May 2023: Arabsat launched Arabsat Badr-8, a seventh-generation satellite built on the Airbus Eurostar Neo electric orbit boosting platform, in partnership with Airbus and SpaceX. On May 26, the satellite was launched by a SpaceX Falcon 9 from Cape Canaveral Air Force Station in Florida.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "KSA Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the KSA Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the KSA Satellite Communications Market?

To stay informed about further developments, trends, and reports in the KSA Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence