Key Insights

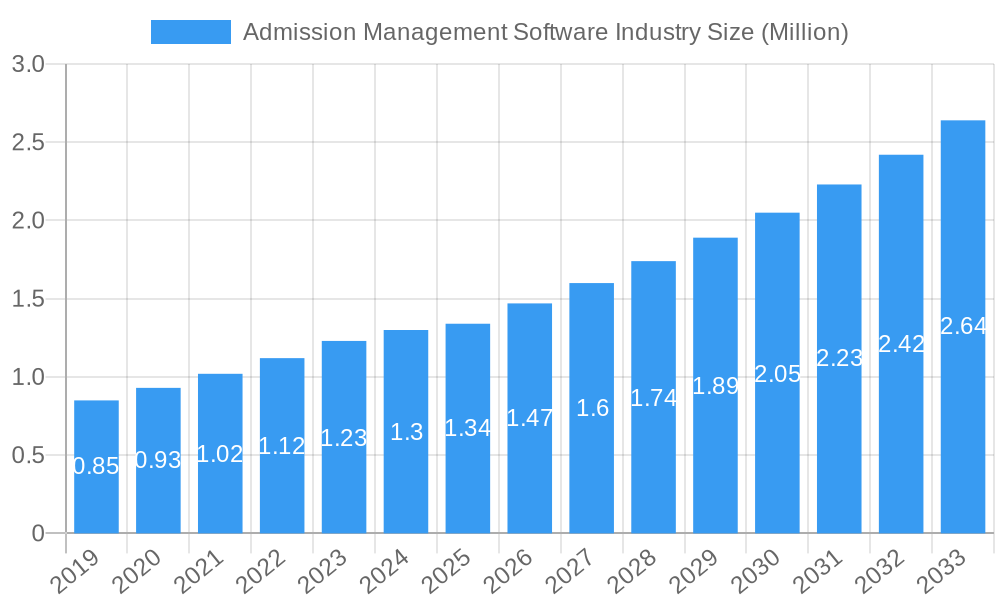

The Admission Management Software industry is poised for significant expansion, projected to reach 1.34 Billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.05% through 2033. This substantial growth is fueled by the increasing digitalization of educational institutions and the growing need for efficient, streamlined admission processes. Key drivers include the escalating demand for centralized data management, enhanced applicant experience, and improved operational efficiency in schools and universities worldwide. The software automates tasks such as application submission, document verification, candidate shortlisting, and communication, freeing up administrative staff to focus on more strategic initiatives. Furthermore, the rise of online learning and the need to manage a larger influx of diverse student applications, including international students, are significant catalysts. The shift towards cloud-based solutions is also a major trend, offering scalability, accessibility, and cost-effectiveness for educational providers of all sizes. This move also facilitates remote management and collaboration, crucial in today's evolving educational landscape.

Admission Management Software Industry Market Size (In Million)

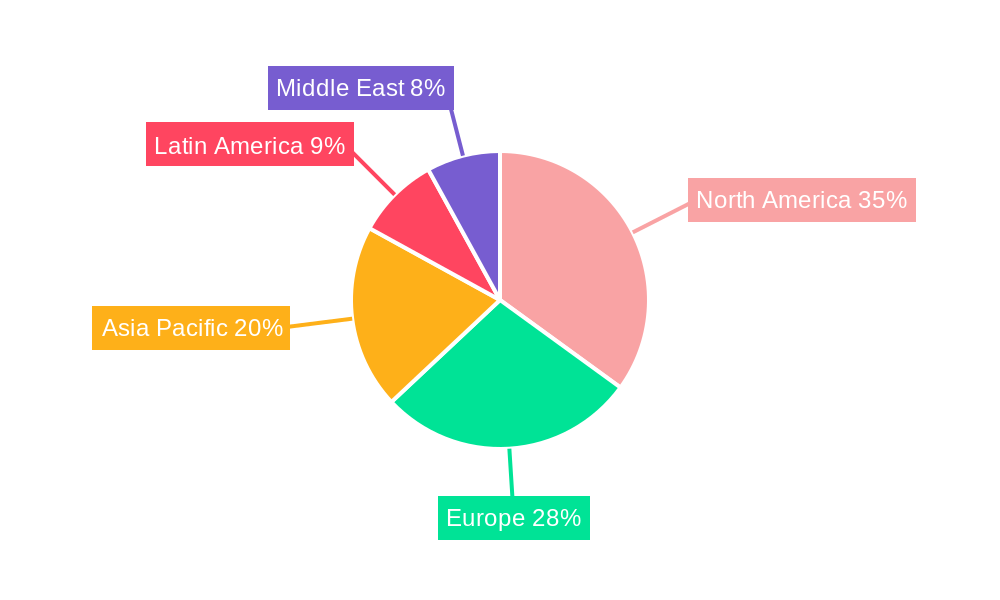

Despite the promising outlook, the market faces certain restraints, primarily related to the initial implementation costs and the need for ongoing technical expertise, which can be a barrier for smaller institutions. Data security concerns and the integration challenges with existing legacy systems also present hurdles. However, the overwhelming benefits of improved admission accuracy, reduced processing times, and enhanced data analytics are steadily overcoming these challenges. The market is segmented across various applications, including primary and secondary schools, universities, research institutes, and training institutions, each presenting unique adoption patterns and feature requirements. Geographically, North America and Europe currently lead the market due to early adoption and advanced technological infrastructure, but the Asia Pacific region is emerging as a high-growth market owing to rapid educational expansion and increasing investment in ed-tech solutions.

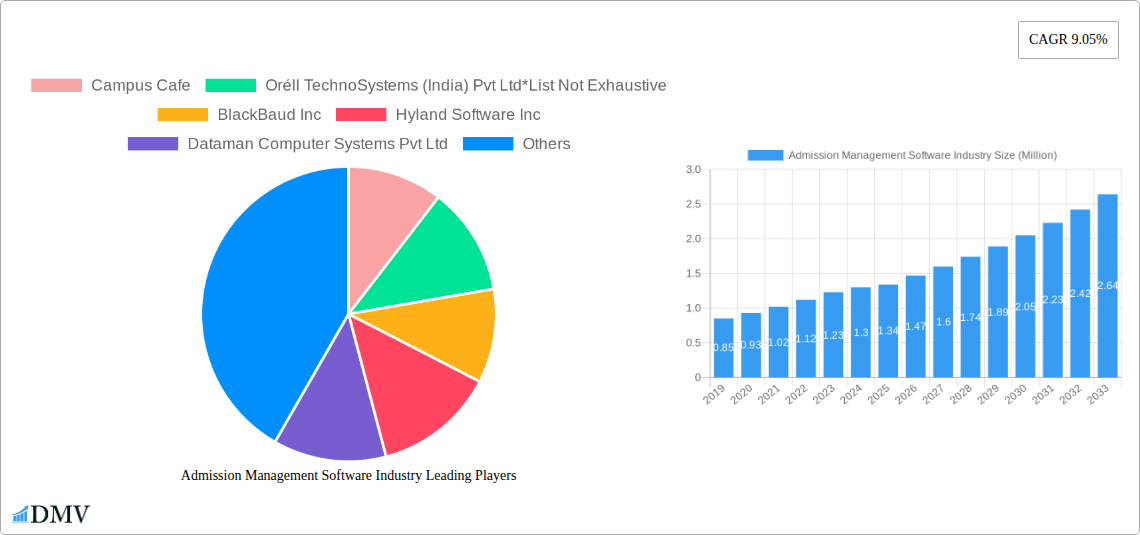

Admission Management Software Industry Company Market Share

Admission Management Software Industry Market Analysis Report: Unlocking Growth and Innovation

This comprehensive report dives deep into the dynamic Admission Management Software Industry, providing invaluable insights for stakeholders seeking to understand market composition, trends, evolution, and future potential. Spanning the historical period of 2019–2024 and projecting forward to 2033, with a base year of 2025, this analysis leverages expert research to equip you with the strategic knowledge needed to navigate this rapidly expanding sector.

Admission Management Software Industry Market Composition & Trends

The Admission Management Software Industry exhibits a moderately concentrated market structure, characterized by a blend of established enterprise solutions and emerging specialized providers. Innovation is predominantly driven by advancements in AI for predictive analytics, user experience enhancements, and seamless integration capabilities. The regulatory landscape, while not overly burdensome, focuses on data privacy and security compliance, particularly concerning student PII (Personally Identifiable Information). Substitute products, such as manual processes or fragmented CRM systems, are steadily losing ground to dedicated admission management solutions due to their inherent inefficiencies. End-user profiles are diverse, ranging from large universities with complex admission workflows to primary and secondary schools seeking streamlined application processes. Mergers and acquisitions (M&A) are a significant factor, with deal values estimated in the hundreds of millions of dollars, consolidating market share and fostering innovation. Key trends include a heightened demand for cloud-based solutions, personalized applicant experiences, and robust reporting for institutional decision-making. The market share distribution is anticipated to see a significant shift towards cloud deployments in the coming years.

Admission Management Software Industry Industry Evolution

The Admission Management Software Industry has undergone a remarkable evolution over the historical period of 2019–2024, fueled by an insatiable demand for efficiency, transparency, and enhanced applicant experiences within educational institutions worldwide. Initially, the market was dominated by on-premise solutions, often rigid and requiring significant IT infrastructure. However, the dawn of cloud computing and the increasing need for scalable, accessible, and cost-effective solutions have dramatically reshaped this landscape. Between 2019 and 2024, we've witnessed an accelerated adoption rate, with growth trajectories consistently exceeding expectations. Technological advancements have been a primary catalyst. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms has revolutionized aspects like applicant screening, predictive enrollment modeling, and personalized communication strategies. These technologies enable institutions to move beyond manual data entry and basic tracking to sophisticated data-driven decision-making.

Furthermore, the COVID-19 pandemic acted as an unexpected but powerful accelerant, forcing educational institutions to rapidly adopt digital solutions for remote operations, including admissions. This shift normalized the use of cloud-based admission management software and highlighted its critical role in maintaining operational continuity. Consumer demands have also evolved significantly. Prospective students now expect a seamless, digital-first application journey, akin to their experiences in e-commerce. They seek intuitive interfaces, clear communication channels, and personalized engagement throughout the admissions cycle. This pressure has compelled software providers to focus on user experience (UX) and user interface (UI) design, making their platforms more applicant-centric. The industry's growth rate, estimated to be a robust XX% annually during the historical period, reflects this confluence of technological progress and evolving user expectations. Adoption metrics for cloud-based solutions have surged, now accounting for over XX% of new implementations. The market is projected to continue its upward trajectory, driven by further innovation in AI, greater emphasis on data analytics, and the ongoing digital transformation of the education sector.

Leading Regions, Countries, or Segments in Admission Management Software Industry

The University segment stands out as the most dominant application within the Admission Management Software Industry, demonstrating unparalleled market penetration and growth potential. This dominance is intricately linked to the complex, high-volume, and multifaceted nature of university admissions. Universities globally grapple with an extensive array of applicants, diverse program offerings, stringent selection criteria, and the need for sophisticated applicant tracking and communication. The sheer scale of operations necessitates robust and feature-rich admission management solutions that can handle everything from initial application submission and document verification to interview scheduling, scholarship allocation, and enrollment management. The primary drivers for this dominance in the university segment include:

- High Investment Trends: Universities, especially in developed economies, often have substantial budgets allocated for technology to enhance their competitive edge and operational efficiency. This makes them prime targets for advanced admission management software.

- Regulatory Support & Compliance: The higher education sector is subject to extensive regulations regarding admissions, data privacy, and equal opportunity. Admission management software plays a crucial role in ensuring institutions remain compliant, leading to consistent demand for these solutions.

- Need for Advanced Features: Universities require sophisticated features such as AI-powered applicant scoring, plagiarism detection for essays, automated communication workflows, and detailed analytics to manage large applicant pools effectively.

- Global Reach and Competition: The increasing globalization of higher education means universities are competing for international students, requiring them to have sophisticated systems to manage diverse applicant profiles and navigate complex visa processes.

In terms of deployment, the Cloud segment has emerged as the clear leader, outpacing on-premise solutions significantly. This shift is driven by several compelling factors:

- Scalability and Flexibility: Cloud solutions offer unparalleled scalability, allowing institutions to easily adjust their software usage based on application volume fluctuations. This is particularly advantageous during peak admission seasons.

- Cost-Effectiveness: Cloud-based software often operates on a subscription model (SaaS), reducing upfront capital expenditure and offering predictable operational costs compared to the hefty investments required for on-premise infrastructure and maintenance.

- Accessibility and Collaboration: Cloud platforms enable authorized personnel to access admission data and manage processes from anywhere, fostering better collaboration among admissions teams, faculty, and administrative staff, regardless of their physical location.

- Automatic Updates and Maintenance: Software providers handle updates, security patches, and system maintenance for cloud solutions, freeing up internal IT resources and ensuring institutions are always using the latest, most secure version of the software.

While Primary and Secondary Schools, Research Institutes, and Training Institutions also represent significant markets, their adoption rates and feature requirements are generally less complex than those of universities. Consequently, the university segment, coupled with the overwhelming preference for cloud deployment, defines the current and future trajectory of the Admission Management Software Industry.

Admission Management Software Industry Product Innovations

Product innovation in Admission Management Software is rapidly evolving, focusing on enhancing the applicant journey and streamlining institutional processes. Key advancements include AI-powered predictive analytics for identifying high-potential candidates and optimizing recruitment strategies. Integration of chatbots and virtual assistants provides instant applicant support and automates routine queries. Furthermore, sophisticated data visualization dashboards offer real-time insights into application pipelines, diversity metrics, and enrollment forecasts. Unique selling propositions now lie in seamless integration with existing Student Information Systems (SIS) and Customer Relationship Management (CRM) platforms, robust cybersecurity measures, and customizable workflow automation that adapts to unique institutional needs. The performance metrics emphasize reduced application processing times, increased applicant conversion rates, and improved data accuracy.

Propelling Factors for Admission Management Software Industry Growth

Several key growth drivers are propelling the Admission Management Software Industry forward. Technologically, the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) enables predictive analytics, personalized applicant engagement, and automation of repetitive tasks, significantly boosting efficiency. Economically, the global push for higher education enrollment and the competitive landscape among institutions necessitate sophisticated tools to attract and manage students effectively. The rising adoption of cloud-based solutions (SaaS) reduces upfront costs and offers scalability, making advanced software accessible to a wider range of institutions. Regulatory trends, such as the need for data privacy compliance (e.g., GDPR, CCPA), also encourage the adoption of secure and robust admission management systems that can handle sensitive student information.

Obstacles in the Admission Management Software Industry Market

Despite robust growth, the Admission Management Software Industry faces several obstacles. High upfront implementation costs for comprehensive on-premise solutions and significant customization expenses can deter smaller institutions. Data security concerns and the need for strict compliance with evolving data privacy regulations (e.g., GDPR, CCPA) present ongoing challenges, requiring substantial investment in robust security measures. Integration complexities with legacy systems within educational institutions can be a significant hurdle, leading to lengthy and costly integration processes. Furthermore, resistance to change among administrative staff accustomed to manual processes, coupled with the need for extensive training, can slow down adoption rates. The market also experiences intense competitive pressure, leading to price wars and the need for continuous innovation to maintain market share.

Future Opportunities in Admission Management Software Industry

Emerging opportunities in the Admission Management Software Industry are abundant. The growing demand for personalized applicant experiences presents a significant avenue, with software providers focusing on AI-driven communication and tailored application pathways. The expansion into emerging markets, particularly in Asia and Africa, with rapidly growing student populations, offers substantial growth potential. Advancements in blockchain technology for secure and verifiable credential management in admissions is another promising area. The increasing focus on lifelong learning and upskilling creates opportunities for solutions tailored to continuing education programs and micro-credential admissions. Furthermore, the development of more advanced analytics and reporting tools that provide deeper insights into applicant behavior and enrollment trends will be a key differentiator.

Major Players in the Admission Management Software Industry Ecosystem

- Campus Cafe

- Oréll TechnoSystems (India) Pvt Ltd

- BlackBaud Inc

- Hyland Software Inc

- Dataman Computer Systems Pvt Ltd

- Edunext Technologies Pvt Ltd

- Embark Corporation

- Creatrix Campus

- Ellucian Company LP

- Advanta Innovations

Key Developments in Admission Management Software Industry Industry

- January 2023: Ellucian, a leading provider of higher education technology solutions, and Higher Digital, a key player in digital transformation management for higher education, announced a strategic partnership. This collaboration aims to accelerate and enhance the transition to cloud-based systems, modernize business processes, and improve system integration for colleges and universities. Under this arrangement, Ellucian will offer Higher Digital's change management services to its global customer base, complementing its existing implementation services and solution offerings. This development signifies a strong industry trend towards cloud adoption and strategic alliances to facilitate digital transformation within higher education.

Strategic Admission Management Software Industry Market Forecast

The Admission Management Software Industry is poised for significant and sustained growth, driven by the relentless pursuit of operational efficiency, enhanced applicant experiences, and data-driven decision-making within educational institutions globally. The forecast period (2025–2033) anticipates continued rapid expansion, fueled by advancements in AI for personalized engagement and predictive analytics, and the further consolidation of cloud-based (SaaS) solutions as the de facto standard. The increasing digitization of education, coupled with a growing global student population seeking higher education, creates a fertile ground for market expansion. Strategic partnerships, like the one between Ellucian and Higher Digital, will continue to shape the landscape, fostering innovation and accelerating digital transformation. The market potential remains immense, with a strong emphasis on seamless integration, robust data security, and intuitive user interfaces driving future adoption and success.

Admission Management Software Industry Segmentation

-

1. Application

- 1.1. Primary and Secondary Schools

- 1.2. University

- 1.3. Research Institute

- 1.4. Training Institution

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

Admission Management Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Admission Management Software Industry Regional Market Share

Geographic Coverage of Admission Management Software Industry

Admission Management Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Optimizing Operational Efficiency of Organizations; Increasing Demand for Scalability

- 3.3. Market Restrains

- 3.3.1. Potential Security Threats Regarding Consumer Information

- 3.4. Market Trends

- 3.4.1. School Segment Projected to Offer Significant Opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Admission Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Primary and Secondary Schools

- 5.1.2. University

- 5.1.3. Research Institute

- 5.1.4. Training Institution

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Admission Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Primary and Secondary Schools

- 6.1.2. University

- 6.1.3. Research Institute

- 6.1.4. Training Institution

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Admission Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Primary and Secondary Schools

- 7.1.2. University

- 7.1.3. Research Institute

- 7.1.4. Training Institution

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Admission Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Primary and Secondary Schools

- 8.1.2. University

- 8.1.3. Research Institute

- 8.1.4. Training Institution

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Admission Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Primary and Secondary Schools

- 9.1.2. University

- 9.1.3. Research Institute

- 9.1.4. Training Institution

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Admission Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Primary and Secondary Schools

- 10.1.2. University

- 10.1.3. Research Institute

- 10.1.4. Training Institution

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Campus Cafe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Oréll TechnoSystems (India) Pvt Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BlackBaud Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hyland Software Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dataman Computer Systems Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Edunext Technologies Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Embark Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Creatrix Campus

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ellucian Company LP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Advanta Innovations

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Campus Cafe

List of Figures

- Figure 1: Global Admission Management Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Admission Management Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Admission Management Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Admission Management Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Admission Management Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Admission Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Admission Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Admission Management Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Admission Management Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Admission Management Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Admission Management Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Admission Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Admission Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Admission Management Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Admission Management Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Admission Management Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 17: Asia Pacific Admission Management Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 18: Asia Pacific Admission Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Admission Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Admission Management Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Admission Management Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Admission Management Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 23: Latin America Admission Management Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: Latin America Admission Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Admission Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Admission Management Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East Admission Management Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East Admission Management Software Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Middle East Admission Management Software Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Middle East Admission Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Admission Management Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Admission Management Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Admission Management Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Admission Management Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Admission Management Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Admission Management Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Admission Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Admission Management Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Admission Management Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 9: Global Admission Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Admission Management Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Admission Management Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Admission Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Admission Management Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Admission Management Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 15: Global Admission Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Admission Management Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Admission Management Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Admission Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Admission Management Software Industry?

The projected CAGR is approximately 9.05%.

2. Which companies are prominent players in the Admission Management Software Industry?

Key companies in the market include Campus Cafe, Oréll TechnoSystems (India) Pvt Ltd*List Not Exhaustive, BlackBaud Inc, Hyland Software Inc, Dataman Computer Systems Pvt Ltd, Edunext Technologies Pvt Ltd, Embark Corporation, Creatrix Campus, Ellucian Company LP, Advanta Innovations.

3. What are the main segments of the Admission Management Software Industry?

The market segments include Application, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Optimizing Operational Efficiency of Organizations; Increasing Demand for Scalability.

6. What are the notable trends driving market growth?

School Segment Projected to Offer Significant Opportunities.

7. Are there any restraints impacting market growth?

Potential Security Threats Regarding Consumer Information.

8. Can you provide examples of recent developments in the market?

January 2023: Ellucian, the provider of higher education technology solutions, and Higher Digital, a player in digital transformation management for higher education, have announced a strategic partnership to accelerate and improve the move to the cloud, modernization of business processes, and system integration for colleges and universities. Ellucian will offer Higher Digital's change management services to customers worldwide to supplement its implementation services and solution offerings under this arrangement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Admission Management Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Admission Management Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Admission Management Software Industry?

To stay informed about further developments, trends, and reports in the Admission Management Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence