Key Insights

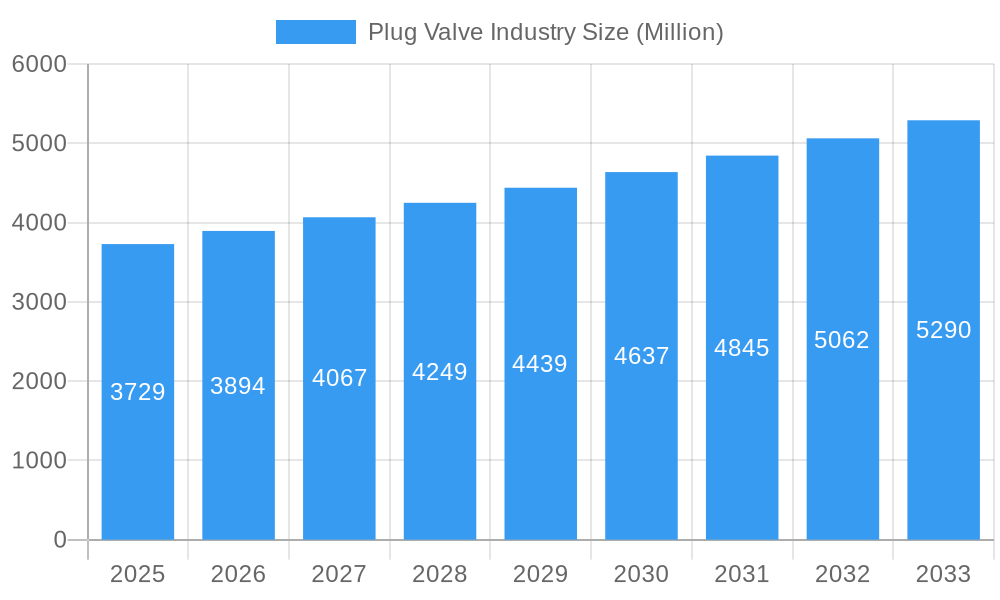

The global Plug Valve market is projected for robust growth, estimated to reach $3,729 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period of 2025-2033. This expansion is primarily driven by the escalating demand from critical industries such as Oil & Gas, Chemical & Petrochemical, and Water & Wastewater treatment. The increasing need for reliable fluid control solutions in these sectors, coupled with the growing investments in infrastructure development and industrial expansion worldwide, underpins this optimistic market outlook. Furthermore, technological advancements leading to the development of more efficient and specialized plug valve designs, including non-lubricated, eccentric, and expanding types, are catering to a broader range of applications and contributing to market buoyancy. The adoption of two-way and three-way plug valves is also on the rise, offering enhanced operational flexibility and process optimization for end-users.

Plug Valve Industry Market Size (In Billion)

The market landscape is characterized by several key trends, including a growing emphasis on valves with enhanced sealing capabilities and resistance to corrosive environments, particularly within the chemical and petrochemical sectors. The increasing adoption of smart valve technologies and automation solutions is also shaping the market, enabling better monitoring, control, and maintenance of plug valves. While the market is poised for growth, certain restraints may influence its trajectory. These could include fluctuating raw material prices, stringent regulatory compliance requirements in some regions, and the availability of alternative valve technologies in specific applications. However, the inherent advantages of plug valves, such as their robust design, high flow capacity, and suitability for abrasive media, are expected to maintain their competitive edge. Leading players like Flowserve Corporation, Emerson Electric Company, and Schlumberger Limited are actively engaged in innovation and strategic expansions to capture a larger market share.

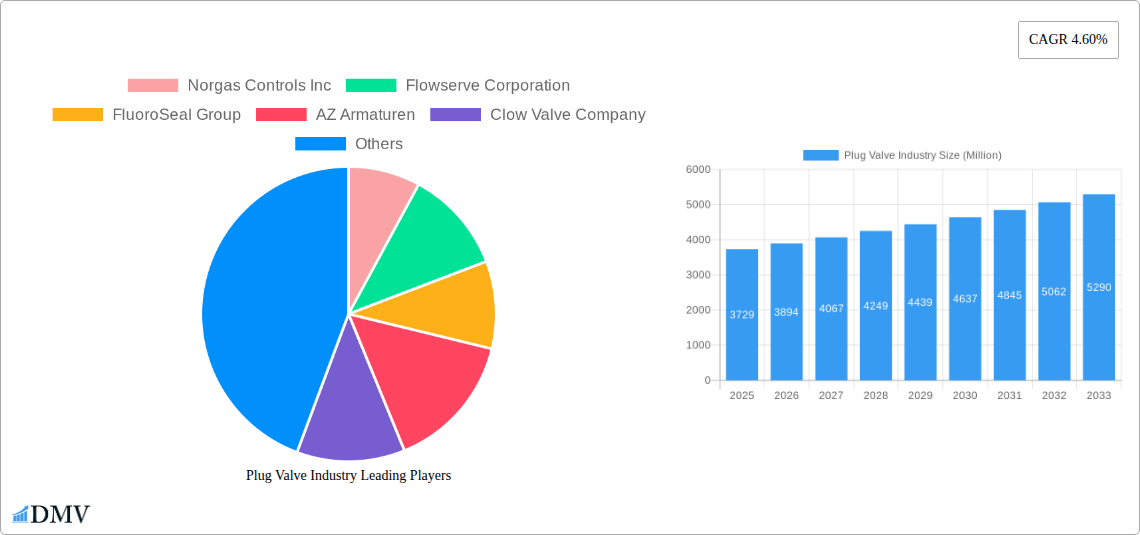

Plug Valve Industry Company Market Share

Plug Valve Industry Market Composition & Trends

The global Plug Valve Industry is characterized by a dynamic market composition influenced by continuous innovation and evolving end-user demands. Market concentration remains moderate, with several key players holding significant shares, yet leaving room for emerging entities to carve out niches. Innovation catalysts are primarily driven by the demand for enhanced operational efficiency, superior sealing capabilities, and compliance with stringent environmental regulations, particularly in the Oil & Gas and Chemical & Petrochemical sectors. The regulatory landscape is increasingly focused on fugitive emissions and safety standards, pushing manufacturers towards advanced, low-emission plug valve designs. Substitute products, such as ball valves and gate valves, present competitive pressure, but plug valves maintain their dominance in specific high-pressure and corrosive applications due to their robust design and reliability. End-user profiles span diverse industries, each with unique requirements for material compatibility, flow control, and pressure ratings. Mergers & Acquisition (M&A) activities are observed, indicating consolidation trends as larger entities seek to expand their product portfolios and market reach. For instance, the M&A deal value in the valve industry has seen significant activity, with an estimated XX million in the historical period. Key trends include the adoption of advanced materials for improved corrosion resistance and the development of smart, connected valves for remote monitoring and diagnostics.

- Market Concentration: Moderate, with a mix of established global leaders and specialized regional players.

- Innovation Drivers: Fugitive emissions reduction, material science advancements, energy efficiency, and smart valve technology.

- Regulatory Focus: ISO and API fugitive emissions standards (e.g., ISO 15848-1-BH-CO3, API 641 2016), material safety, and environmental protection.

- Substitute Products: Ball valves, gate valves, butterfly valves.

- End-User Diversification: Critical in Oil & Gas exploration and refining, chemical processing, water management, and energy generation.

- M&A Activity: Strategic acquisitions targeting expanded product lines, market access, and technological integration. Estimated M&A deal value in the historical period: XX million.

Plug Valve Industry Industry Evolution

The Plug Valve Industry has witnessed a remarkable evolution, driven by technological advancements and the persistent demand from core industrial sectors. Over the historical period from 2019–2024, the market has experienced a steady growth trajectory, with an average annual growth rate of approximately X.XX%. This growth is intrinsically linked to the expansion of the Oil & Gas industry, particularly in unconventional resource extraction and refining processes, and the burgeoning Chemical & Petrochemical sectors requiring robust fluid handling solutions. Technological advancements have been central to this evolution. Early plug valves, while effective, were often lubricated and prone to leakage. The introduction and widespread adoption of Non-Lubricated Plug Valves, Eccentric Plug Valves, and Expanding Plug Valves have revolutionized performance. Non-lubricated variants offer reduced maintenance and cleaner operation, crucial for environmental compliance. Eccentric plug valves provide excellent sealing and are ideal for slurries and viscous fluids. Expanding plug valves, with their unique inline repair capabilities, have addressed critical maintenance challenges, minimizing downtime.

The design evolution from simple Two-Way Plug Valves to more complex Three-Way Plug Valves has expanded their applicability in intricate piping systems for diverting or mixing flows. This innovation has been fueled by increasing automation and process control requirements in modern industrial facilities. Consumer demand has shifted towards valves that not only offer superior performance and longevity but also contribute to operational safety and environmental sustainability. Manufacturers are responding by investing heavily in R&D to develop valves with higher pressure ratings, improved temperature resistance, and enhanced chemical compatibility, particularly for aggressive media encountered in chemical processing. Adoption metrics for advanced plug valve technologies, such as those designed for low fugitive emissions, have seen a significant uptick, driven by stricter regulatory enforcement and corporate sustainability initiatives. The forecast period from 2025–2033 projects continued robust growth, with an estimated Compound Annual Growth Rate (CAGR) of X.XX%, as industries worldwide continue to invest in infrastructure and upgrade existing systems with more efficient and reliable valve technologies. The estimated market size in the base year 2025 is projected to reach XXX million, a testament to the enduring importance and innovation within the plug valve sector.

Leading Regions, Countries, or Segments in Plug Valve Industry

The global Plug Valve Industry's dominance is significantly influenced by regional industrial activity, regulatory frameworks, and specific segment preferences. Among the various segments, the Oil & Gas end-user industry consistently emerges as the primary driver of demand for plug valves, followed closely by the Chemical & Petrochemical sector. These industries necessitate highly reliable, robust, and chemically resistant valves for critical processes, including exploration, production, refining, and chemical synthesis. The Non-Lubricated Plug Valve segment also holds a leading position due to its inherent advantages in terms of reduced maintenance, environmental compliance, and suitability for a wide range of applications, from clean to abrasive fluids.

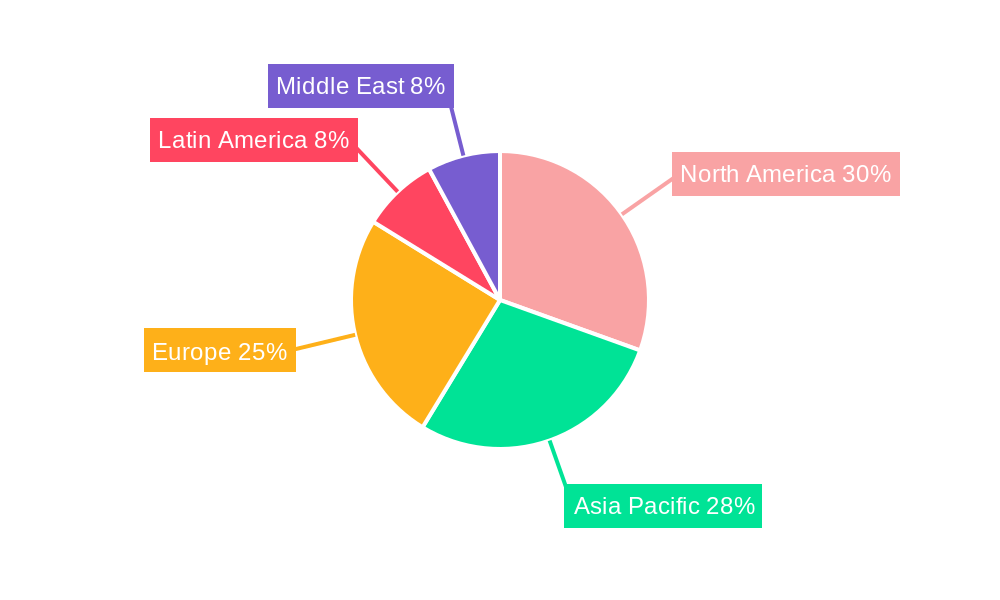

Geographically, North America and Asia-Pacific are recognized as the dominant regions. In North America, the sustained activity in the oil and gas sector, coupled with stringent environmental regulations demanding low-emission valves, fuels significant demand. The region's advanced manufacturing capabilities and focus on technological innovation further solidify its leading position. Asia-Pacific, driven by rapid industrialization, massive infrastructure development projects, and a growing chemical industry, presents a substantial and expanding market for plug valves. Countries like China and India are key contributors to this growth, both as major consumers and increasingly as manufacturing hubs.

The dominance of these regions and segments is attributable to several key drivers:

- Investment Trends: High capital expenditure in the exploration, production, and refining of oil and gas in North America and the Middle East, alongside significant investments in petrochemical plant expansions in Asia-Pacific, directly translate into substantial demand for plug valves. Global investment in water and wastewater infrastructure projects also contributes to market growth, albeit to a lesser extent than Oil & Gas.

- Regulatory Support: Stringent environmental regulations, particularly concerning fugitive emissions in the Oil & Gas and Chemical sectors, are a major impetus for the adoption of advanced plug valve technologies, such as low-emission and non-lubricated designs. Regions with robust environmental enforcement policies often exhibit higher demand for these sophisticated valve solutions.

- Industrial Growth & Modernization: The ongoing expansion of chemical manufacturing capabilities in Asia-Pacific and the continuous need to upgrade and maintain aging infrastructure in developed economies necessitate the replacement and installation of reliable plug valves. The increasing complexity of industrial processes also drives the demand for specialized valve types, such as three-way plug valves for intricate flow control.

- Technological Advancements: The development and widespread adoption of advanced plug valve designs, including those with enhanced material properties for extreme temperatures and corrosive environments, align with the evolving needs of high-demand industries. The ability of manufacturers to innovate and offer tailored solutions plays a crucial role in market leadership.

- Resource Availability & Demand: The concentration of oil and gas reserves and the significant demand for petrochemical products in regions like North America and the Middle East create a sustained need for the flow control equipment, including plug valves, essential for these operations.

The estimated market share for the Oil & Gas sector is approximately XX%, with the Chemical & Petrochemical sector following at around XX%. Within the product types, Non-Lubricated Plug Valves are estimated to capture XX% of the market share.

Plug Valve Industry Product Innovations

Product innovations in the Plug Valve Industry are sharply focused on enhancing performance, reliability, and environmental compliance. Recent advancements include the development of advanced non-lubricated plug valves utilizing novel sleeve materials for reduced friction and superior sealing, even in abrasive conditions. Eccentric plug valves are being engineered with specialized coatings to withstand highly corrosive media in chemical processing. A significant breakthrough is the advent of expanding plug valves with integrated smart diagnostics, allowing for real-time monitoring of valve condition and predictive maintenance, thus minimizing unexpected downtime. Furthermore, manufacturers are increasingly offering plug valves constructed from exotic alloys and specialized polymers to cater to the extreme temperature and chemical resistance requirements of niche applications in sectors like aerospace and pharmaceuticals. These innovations translate to longer service life, reduced maintenance costs, and improved operational safety, offering unique selling propositions in a competitive market.

Propelling Factors for Plug Valve Industry Growth

The Plug Valve Industry is propelled by several critical factors. Foremost is the sustained global demand from the Oil & Gas and Chemical & Petrochemical industries, which are core users of plug valves for their robust performance in high-pressure and corrosive environments. Technological advancements, particularly in material science and design engineering, are enabling the development of more efficient, durable, and environmentally compliant valves. The increasing stringency of environmental regulations, such as those targeting fugitive emissions, is a significant growth catalyst, pushing manufacturers to innovate and end-users to adopt advanced low-emission plug valve solutions. Furthermore, global investments in infrastructure development, including water and wastewater treatment facilities, contribute to market expansion. The ongoing need for industrial modernization and efficiency improvements across various sectors also drives demand for reliable flow control equipment.

- Sustained Industrial Demand: Continuous activity in Oil & Gas and Chemical/Petrochemical sectors.

- Technological Advancements: Innovations in materials, sealing, and smart valve technology.

- Stringent Environmental Regulations: Driving adoption of low-emission and environmentally friendly valve designs.

- Infrastructure Development: Investments in water, wastewater, and energy infrastructure.

- Industrial Modernization: Need for efficient and reliable flow control solutions.

Obstacles in the Plug Valve Industry Market

Despite robust growth, the Plug Valve Industry faces several significant obstacles. Intense competition from substitute valve types, such as ball valves and gate valves, which may offer lower initial costs for certain applications, presents a continuous challenge. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact manufacturing timelines and increase production costs. Complex regulatory environments in different regions can create compliance hurdles for manufacturers aiming for global market penetration. The high initial investment required for certain advanced plug valve technologies can be a barrier for smaller enterprises or in price-sensitive markets. Furthermore, the shortage of skilled labor in manufacturing and specialized maintenance can affect production efficiency and service delivery. The estimated impact of supply chain disruptions on market growth is projected to be around X% in the short term.

- Competitive Pressure: From alternative valve technologies.

- Supply Chain Volatility: Impacting material availability and cost.

- Regulatory Complexity: Varying standards across different geographies.

- High Initial Investment: For advanced and specialized valve solutions.

- Skilled Labor Shortage: Affecting manufacturing and maintenance capabilities.

Future Opportunities in Plug Valve Industry

The Plug Valve Industry is poised for significant future opportunities. The growing focus on sustainability and energy efficiency presents a substantial avenue for growth, with a rising demand for plug valves that minimize energy loss and environmental impact. The expansion of renewable energy sectors, such as geothermal and hydropower, will require specialized valve solutions, creating new market segments. The increasing adoption of Industry 4.0 technologies and the Internet of Things (IoT) opens doors for smart plug valves with advanced monitoring, diagnostic, and predictive maintenance capabilities, offering value-added services. Emerging markets in developing economies, with their rapid industrialization and infrastructure development, represent untapped potential. Furthermore, the continuous need for specialized valves for extreme environments, such as those found in advanced chemical processing and aerospace, will drive innovation and market growth.

- Sustainability & Energy Efficiency: Demand for low-emission and energy-saving valves.

- Renewable Energy Expansion: New applications in geothermal, hydropower, etc.

- Smart Valve Technology (IoT): Integration of digital capabilities for remote monitoring and diagnostics.

- Emerging Market Growth: Industrialization and infrastructure development in developing economies.

- Specialized Application Valves: For extreme environments in advanced industries.

Major Players in the Plug Valve Industry Ecosystem

- Norgas Controls Inc

- Flowserve Corporation

- FluoroSeal Group

- AZ Armaturen

- Clow Valve Company

- Crane ChemPharma & Energy

- Henry Pratt Company (Muller Co LLC)

- NTGD Valve (China) Co LTD

- ZheJiang YuanDong Valve Co Ltd

- Val-Matic Valve & Mfg Corporation

- 3Z Plug Valve

- Schlumberger Limited

- GA Industries

- Fujikin Incorporated

- Galli & Cassina Spa

- Emerson Electric Company

Key Developments in Plug Valve Industry Industry

- June 2021: Flowserve launched their new Durco G4XZ low-emission plug valve, engineered to meet stringent ISO and API fugitive emissions standards (ISO 15848-1-BH-CO3 and API 641 2016). This valve is suitable for challenging hydrofluoric acid (HF) alkylation industry processes including crude desalting, blending, gas plants, sulfur plants, isomerization, and light ends, enhancing safety and environmental compliance.

- June 2021: AZ Valves unveiled its CARTRIDGE-N valve type, a forged steel plug valve designed for fast service on welded plug valves, offering safe and easy inline repair with weld-ends and aligning pins for quick installation and maintenance. This development addresses critical downtime concerns in industrial operations.

Strategic Plug Valve Industry Market Forecast

The strategic forecast for the Plug Valve Industry indicates sustained and robust growth over the coming decade, driven by an intersection of critical industrial demands and technological advancements. The projected market size of XXX million in 2025 is set to expand significantly by 2033. Growth catalysts include the unrelenting need for reliable flow control in the expanding Oil & Gas and Chemical & Petrochemical sectors, coupled with a pronounced shift towards environmentally responsible operations necessitating low-emission and highly efficient valve solutions. Furthermore, substantial investments in global infrastructure, particularly in water and wastewater management, will continue to fuel demand. The increasing integration of smart technologies within valves, enabling predictive maintenance and remote monitoring, presents a key area for market expansion and value creation. Emerging markets will also play a crucial role, offering significant untapped potential for established and new players alike. The industry's ability to adapt to evolving regulatory landscapes and innovate in material science and design will be paramount to capitalizing on these extensive future opportunities.

Plug Valve Industry Segmentation

-

1. Type

- 1.1. Non-Lubricated Plug Valve

- 1.2. Eccentric Plug Valve

- 1.3. Expanding Plug Valve

-

2. Design

- 2.1. Two-Way Plug Valves

- 2.2. Three-Way Plug Valves

-

3. End-User Industry

- 3.1. Oil & Gas

- 3.2. Chemical & Petrochemical

- 3.3. Water & Wastewater

- 3.4. Energy

- 3.5. Other End-User Industries

Plug Valve Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Latin America

- 5. Middle East

Plug Valve Industry Regional Market Share

Geographic Coverage of Plug Valve Industry

Plug Valve Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Plug Valves in Water & Wastewater Industry; Increasing investment in Pipeline Infrastructures

- 3.3. Market Restrains

- 3.3.1 ; Lack of Common Platform for Zigbee

- 3.3.2 Profibus

- 3.3.3 and Ethernet

- 3.4. Market Trends

- 3.4.1. Oil & Gas Sector to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plug Valve Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Non-Lubricated Plug Valve

- 5.1.2. Eccentric Plug Valve

- 5.1.3. Expanding Plug Valve

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Two-Way Plug Valves

- 5.2.2. Three-Way Plug Valves

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil & Gas

- 5.3.2. Chemical & Petrochemical

- 5.3.3. Water & Wastewater

- 5.3.4. Energy

- 5.3.5. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Plug Valve Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Non-Lubricated Plug Valve

- 6.1.2. Eccentric Plug Valve

- 6.1.3. Expanding Plug Valve

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Two-Way Plug Valves

- 6.2.2. Three-Way Plug Valves

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Oil & Gas

- 6.3.2. Chemical & Petrochemical

- 6.3.3. Water & Wastewater

- 6.3.4. Energy

- 6.3.5. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Plug Valve Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Non-Lubricated Plug Valve

- 7.1.2. Eccentric Plug Valve

- 7.1.3. Expanding Plug Valve

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Two-Way Plug Valves

- 7.2.2. Three-Way Plug Valves

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Oil & Gas

- 7.3.2. Chemical & Petrochemical

- 7.3.3. Water & Wastewater

- 7.3.4. Energy

- 7.3.5. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Plug Valve Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Non-Lubricated Plug Valve

- 8.1.2. Eccentric Plug Valve

- 8.1.3. Expanding Plug Valve

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Two-Way Plug Valves

- 8.2.2. Three-Way Plug Valves

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Oil & Gas

- 8.3.2. Chemical & Petrochemical

- 8.3.3. Water & Wastewater

- 8.3.4. Energy

- 8.3.5. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Plug Valve Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Non-Lubricated Plug Valve

- 9.1.2. Eccentric Plug Valve

- 9.1.3. Expanding Plug Valve

- 9.2. Market Analysis, Insights and Forecast - by Design

- 9.2.1. Two-Way Plug Valves

- 9.2.2. Three-Way Plug Valves

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Oil & Gas

- 9.3.2. Chemical & Petrochemical

- 9.3.3. Water & Wastewater

- 9.3.4. Energy

- 9.3.5. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Plug Valve Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Non-Lubricated Plug Valve

- 10.1.2. Eccentric Plug Valve

- 10.1.3. Expanding Plug Valve

- 10.2. Market Analysis, Insights and Forecast - by Design

- 10.2.1. Two-Way Plug Valves

- 10.2.2. Three-Way Plug Valves

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Oil & Gas

- 10.3.2. Chemical & Petrochemical

- 10.3.3. Water & Wastewater

- 10.3.4. Energy

- 10.3.5. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Norgas Controls Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flowserve Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FluoroSeal Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AZ Armaturen

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clow Valve Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Crane ChemPharma & Energy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Henry Pratt Company (Muller Co LLC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NTGD Valve (China) Co LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ZheJiang YuanDong Valve Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Val-Matic Valve & Mfg Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 3Z Plug Valve

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Schlumberger Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GA Industries

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Fujikin Incorporated

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Galli & Cassina Spa

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Emerson Electric Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Norgas Controls Inc

List of Figures

- Figure 1: Global Plug Valve Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Plug Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Plug Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Plug Valve Industry Revenue (undefined), by Design 2025 & 2033

- Figure 5: North America Plug Valve Industry Revenue Share (%), by Design 2025 & 2033

- Figure 6: North America Plug Valve Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 7: North America Plug Valve Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Plug Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Plug Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Plug Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Plug Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Plug Valve Industry Revenue (undefined), by Design 2025 & 2033

- Figure 13: Asia Pacific Plug Valve Industry Revenue Share (%), by Design 2025 & 2033

- Figure 14: Asia Pacific Plug Valve Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 15: Asia Pacific Plug Valve Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Asia Pacific Plug Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Asia Pacific Plug Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Plug Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 19: Europe Plug Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Plug Valve Industry Revenue (undefined), by Design 2025 & 2033

- Figure 21: Europe Plug Valve Industry Revenue Share (%), by Design 2025 & 2033

- Figure 22: Europe Plug Valve Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 23: Europe Plug Valve Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Europe Plug Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Plug Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Plug Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Latin America Plug Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Plug Valve Industry Revenue (undefined), by Design 2025 & 2033

- Figure 29: Latin America Plug Valve Industry Revenue Share (%), by Design 2025 & 2033

- Figure 30: Latin America Plug Valve Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 31: Latin America Plug Valve Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Latin America Plug Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Plug Valve Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Plug Valve Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: Middle East Plug Valve Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Plug Valve Industry Revenue (undefined), by Design 2025 & 2033

- Figure 37: Middle East Plug Valve Industry Revenue Share (%), by Design 2025 & 2033

- Figure 38: Middle East Plug Valve Industry Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 39: Middle East Plug Valve Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East Plug Valve Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East Plug Valve Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plug Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Plug Valve Industry Revenue undefined Forecast, by Design 2020 & 2033

- Table 3: Global Plug Valve Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Plug Valve Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Plug Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Plug Valve Industry Revenue undefined Forecast, by Design 2020 & 2033

- Table 7: Global Plug Valve Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Plug Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Plug Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Plug Valve Industry Revenue undefined Forecast, by Design 2020 & 2033

- Table 11: Global Plug Valve Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Plug Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Plug Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Plug Valve Industry Revenue undefined Forecast, by Design 2020 & 2033

- Table 15: Global Plug Valve Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Plug Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Plug Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Plug Valve Industry Revenue undefined Forecast, by Design 2020 & 2033

- Table 19: Global Plug Valve Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Plug Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Plug Valve Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Plug Valve Industry Revenue undefined Forecast, by Design 2020 & 2033

- Table 23: Global Plug Valve Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Plug Valve Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plug Valve Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Plug Valve Industry?

Key companies in the market include Norgas Controls Inc, Flowserve Corporation, FluoroSeal Group, AZ Armaturen, Clow Valve Company, Crane ChemPharma & Energy, Henry Pratt Company (Muller Co LLC), NTGD Valve (China) Co LTD, ZheJiang YuanDong Valve Co Ltd, Val-Matic Valve & Mfg Corporation, 3Z Plug Valve, Schlumberger Limited, GA Industries, Fujikin Incorporated, Galli & Cassina Spa, Emerson Electric Company.

3. What are the main segments of the Plug Valve Industry?

The market segments include Type, Design, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plug Valves in Water & Wastewater Industry; Increasing investment in Pipeline Infrastructures.

6. What are the notable trends driving market growth?

Oil & Gas Sector to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Lack of Common Platform for Zigbee. Profibus. and Ethernet.

8. Can you provide examples of recent developments in the market?

June 2021 - Flowserve launched their new Durco G4XZ low-emission plug valve. According to the company, the valve was engineered to perform reliably and ensure compliance with the most stringent ISO and API fugitive emissions standards, including ISO 15848-1-BH-CO3 and API 641 2016. Furthermore, the new valve can be used in hydrofluoric acid (HF) alkylation industry processes, including crude desalting, blending, gas plants, sulfur plants, isomerization, and light ends.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plug Valve Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plug Valve Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plug Valve Industry?

To stay informed about further developments, trends, and reports in the Plug Valve Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence