Key Insights

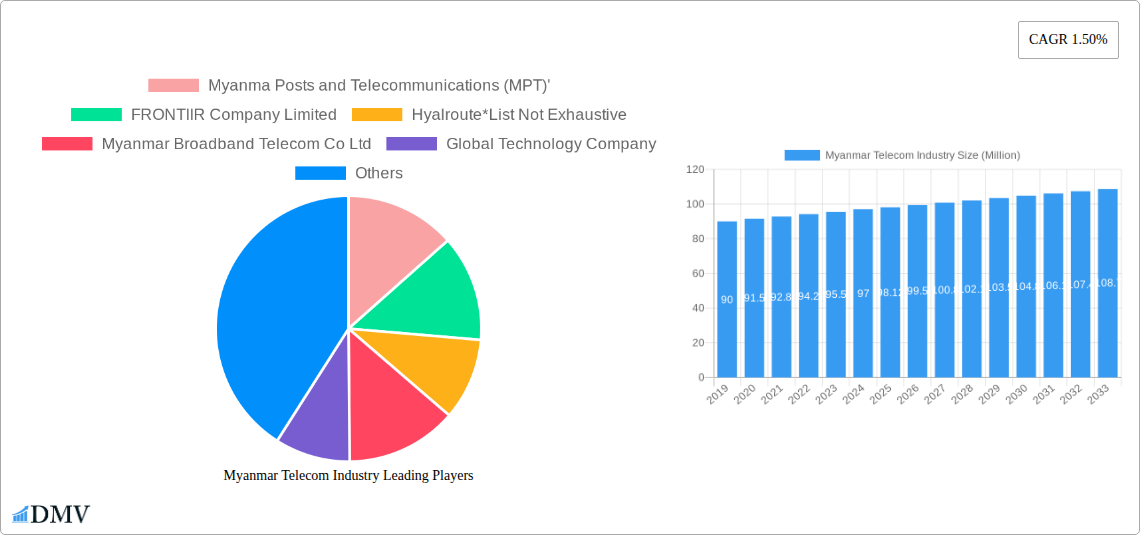

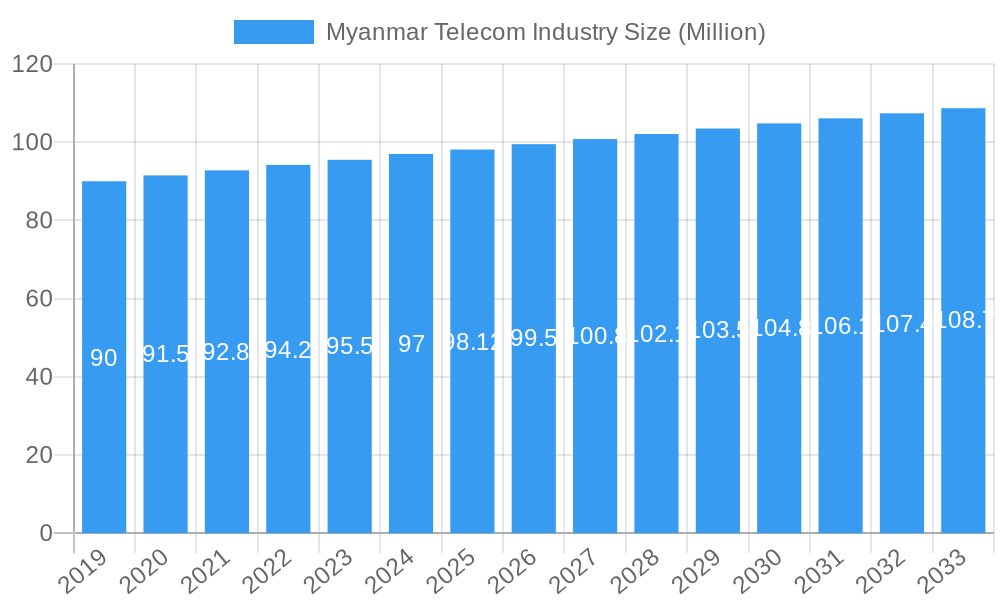

The Myanmar Telecom Industry is poised for steady expansion, projected to reach a market size of $98.12 million by 2025. This growth is driven by an anticipated CAGR of 1.6% over the forecast period from 2025 to 2033. While the CAGR appears modest, it signifies a maturing market with consistent, albeit gradual, increases in revenue. The primary drivers fueling this growth are the increasing penetration of mobile services, a growing demand for data connectivity, and the burgeoning adoption of Over-The-Top (OTT) and PayTV services. As Myanmar continues its digital transformation journey, the need for reliable and affordable telecommunication services is paramount, supporting this sustained market expansion. The competitive landscape is dynamic, featuring established players like Myanma Posts and Telecommunications (MPT) and Mytel SA, alongside newer entrants such as FRONTIIR Company Limited and Myanmar Broadband Telecom Co Ltd, all vying for market share.

Myanmar Telecom Industry Market Size (In Million)

The industry segmentation reveals a diversified market. Voice Services, encompassing both wired and wireless offerings, continue to form a foundational part of the revenue stream. However, the most significant growth is expected within Data and OTT/PayTV Services, reflecting global trends towards digital content consumption and increased internet usage. Potential restraints include infrastructure development challenges in remote areas, regulatory shifts, and the overall economic climate of the region. The market is almost exclusively focused on the Myanmar region, indicating a concentrated yet significant opportunity for service providers. Navigating these drivers and restraints, coupled with strategic investments in network expansion and service innovation, will be crucial for companies to capitalize on the evolving telecommunications landscape in Myanmar.

Myanmar Telecom Industry Company Market Share

This comprehensive report offers an unparalleled deep dive into the dynamic Myanmar telecom industry, providing critical insights for stakeholders, investors, and industry leaders. Analyzing market composition, trends, and evolution from 2019 to 2033, with a base year of 2025, this study unpacks the complexities of Myanmar's rapidly developing telecommunications market. We meticulously examine telecom services, including voice (wired and wireless), data, OTT, and PayTV, while highlighting telecom growth drivers and emerging telecom opportunities within this burgeoning Southeast Asian nation.

Myanmar Telecom Industry Market Composition & Trends

The Myanmar telecom industry exhibits a competitive yet evolving market composition, characterized by the presence of key players and a growing demand for digital services. Market concentration is influenced by infrastructure development and subscriber acquisition strategies. Innovation is increasingly driven by the adoption of new technologies and a focus on enhancing user experience. The regulatory landscape is a significant factor, shaping investment decisions and market entry. Substitute products, while present, are gradually being overshadowed by the superior connectivity and value offered by advanced Myanmar mobile services and broadband solutions. End-user profiles are diversifying, with a surge in digital-savvy youth and a growing enterprise segment seeking reliable Myanmar data services. Mergers and acquisitions (M&A) activities, though not exhaustive, play a crucial role in market consolidation and strategic expansion, with recent deal values indicating significant investment appetite. The market share distribution is dynamic, with major operators vying for dominance in lucrative segments.

- Market Concentration: Dominated by a few key mobile network operators, with ongoing competition in expanding subscriber base and service offerings.

- Innovation Catalysts: Driven by 5G readiness, mobile broadband expansion, and the increasing demand for digital entertainment and communication solutions.

- Regulatory Landscapes: Evolving regulations impacting spectrum allocation, foreign investment, and consumer protection.

- Substitute Products: Traditional communication methods are progressively being replaced by digital alternatives, particularly in data-centric applications.

- End-User Profiles: A rapidly growing youth demographic, increasing internet penetration, and a growing enterprise sector demanding robust connectivity.

- M&A Activities: Strategic partnerships and potential consolidations are key for market players seeking to enhance their competitive edge and expand their service portfolios.

Myanmar Telecom Industry Industry Evolution

The Myanmar telecom industry has undergone a remarkable transformation, evolving from a nascent market to a significant player in the digital economy. Over the historical period of 2019–2024, the industry witnessed substantial growth trajectories, fueled by increased mobile penetration and a growing appetite for data-intensive services. Technological advancements have been at the forefront of this evolution, with operators progressively upgrading their networks to support higher speeds and greater capacity. The shift from basic voice services to comprehensive Myanmar broadband services and digital solutions has been a defining characteristic of this period. Consumer demand has demonstrably shifted, with a pronounced preference for affordable and reliable Myanmar internet plans and value-added services. The adoption of smartphones has surged, creating a fertile ground for the expansion of mobile applications and over-the-top (OTT) content consumption. This continuous upward trend in adoption metrics, with estimated growth rates in the high single digits for data services, underscores the industry's robust expansion. The increasing accessibility and affordability of smartphones, coupled with a growing middle class, have been instrumental in driving this demand. Furthermore, government initiatives aimed at improving digital literacy and expanding internet access across rural areas have also played a pivotal role in accelerating the industry's evolution. The market has moved beyond basic connectivity to encompass a wider array of digital services, paving the way for more sophisticated offerings in the forecast period.

Leading Regions, Countries, or Segments in Myanmar Telecom Industry

Within the Myanmar telecom industry, the Data and segment is emerging as the most dominant and rapidly growing area, significantly outpacing other segments. This dominance is fueled by a confluence of factors including increasing smartphone penetration, a burgeoning young population with a high propensity for digital engagement, and the expanding needs of businesses for robust connectivity and cloud-based solutions. The rapid urbanization in key regions also contributes to this trend, creating concentrated demand for high-speed internet access.

Data and Segment Dominance: The primary driver of growth and revenue within the Myanmar telecom landscape.

- Increased Smartphone Penetration: Over 70% of the population is estimated to own a smartphone, driving data consumption for social media, entertainment, and productivity.

- Young and Digitally Savvy Population: A significant portion of Myanmar's population is under 30, actively seeking online content and digital services.

- Enterprise Demand: Businesses are increasingly relying on stable and fast data services for operations, e-commerce, and digital transformation initiatives.

- Mobile Broadband Expansion: Operators are heavily investing in expanding their 4G and preparing for 5G networks to cater to the escalating demand for mobile data.

- Affordable Data Plans: Competitive pricing strategies have made mobile data more accessible to a wider segment of the population, further accelerating adoption.

- Digital Services Ecosystem: The growth of e-commerce, online gaming, and digital payment platforms directly fuels the demand for data services.

Investment Trends: Significant capital expenditure is being directed towards enhancing data infrastructure, including fiber optic networks and mobile base stations, to support this burgeoning demand.

Regulatory Support: Government policies promoting digital inclusion and internet accessibility indirectly support the growth of the data segment by encouraging infrastructure development.

Shifting Consumer Preferences: Consumers are moving away from traditional voice calls to data-driven communication and entertainment platforms.

Myanmar Telecom Industry Product Innovations

Product innovations in the Myanmar telecom industry are increasingly focused on enhancing user experience and leveraging cutting-edge technology. ATOM's recent launch of "Toh Toh Sidecar," a 3D gamification feature offering substantial rewards, exemplifies this trend by integrating entertainment with mobile services, aiming to boost user engagement and loyalty. The ongoing preparations for 5G deployment by major players signal a significant technological leap, promising ultra-low latency and higher bandwidth, which will unlock new applications in areas like augmented reality, virtual reality, and advanced IoT solutions. These advancements are crucial for retaining and attracting customers in a competitive market.

Propelling Factors for Myanmar Telecom Industry Growth

The Myanmar telecom industry is propelled by a confluence of robust growth factors. Technological advancements, particularly the ongoing expansion of 4G networks and the anticipation of 5G, are fundamental. Economic growth, coupled with a rising middle class and increasing disposable income, fuels demand for data and digital services. Furthermore, government initiatives aimed at digital transformation and expanding internet accessibility, especially in underserved rural areas, create a supportive regulatory and policy environment. The youthful demographic's eagerness to adopt new technologies and digital solutions acts as a significant catalyst.

- Technological Advancements: Widespread 4G network expansion and impending 5G rollout.

- Economic Growth: Rising disposable incomes and a growing middle class.

- Government Support: Policies promoting digital inclusion and infrastructure development.

- Demographic Dividend: A large, tech-savvy youth population eager for digital services.

- Increasing Smartphone Penetration: Making mobile internet access ubiquitous.

Obstacles in the Myanmar Telecom Industry Market

Despite its growth potential, the Myanmar telecom industry faces several significant obstacles. Regulatory uncertainties and evolving legal frameworks can create challenges for long-term investment planning. Infrastructure development, particularly in remote and geographically challenging regions, remains capital-intensive and time-consuming. Supply chain disruptions, both for network equipment and consumer devices, can impact service availability and pricing. Intense competitive pressures among major operators can lead to price wars, affecting profitability. Furthermore, cybersecurity threats and data privacy concerns require continuous investment in robust security measures.

- Regulatory Complexities: Evolving policies and potential implementation challenges.

- Infrastructure Gaps: The cost and difficulty of extending coverage to rural and remote areas.

- Supply Chain Vulnerabilities: Reliance on international sourcing for equipment and components.

- Intense Competition: Pressure on pricing and margins due to multiple market players.

- Cybersecurity Risks: The need for continuous investment in data protection and network security.

Future Opportunities in Myanmar Telecom Industry

The Myanmar telecom industry is ripe with future opportunities. The nascent 5G market presents a significant avenue for innovation, enabling the development of advanced services like IoT, smart cities, and enhanced mobile gaming. The increasing adoption of cloud services by businesses offers opportunities for telcos to provide integrated solutions. Expansion into rural and underserved areas, by leveraging fixed wireless access and satellite broadband technologies, can unlock new subscriber bases. The growing demand for digital entertainment, including streaming services and e-sports, also presents lucrative prospects. Furthermore, partnerships for digital financial services and e-health initiatives can further diversify revenue streams.

- 5G Rollout & Applications: Enabling advanced services like IoT and AR/VR.

- Cloud Services Integration: Providing comprehensive digital solutions for enterprises.

- Rural Connectivity Expansion: Reaching unserved and underserved populations.

- Digital Entertainment Growth: Capitalizing on the demand for streaming and online gaming.

- Digital Financial & Health Services: Diversifying revenue through partnerships.

Major Players in the Myanmar Telecom Industry Ecosystem

- Myanma Posts and Telecommunications (MPT)

- FRONTIIR Company Limited

- Hyalroute

- Myanmar Broadband Telecom Co Ltd

- Global Technology Company

- Eager Communications Group Co Ltd

- Yatanarpon Teleport (YTP)

- Mytel S A

- ATOM Myanmar

Key Developments in Myanmar Telecom Industry Industry

- September 2022: ATOM launched "Toh Toh Sidecar," a 3D gamification feature offering rewards exceeding MMK 6 billion (USD 2.9 million) in a 90-day Mega Grand Draw campaign, enhancing user engagement.

- September 2022: ATOM, formerly Telenor, announced plans to invest hundreds of millions of dollars in Myanmar over the coming years to introduce the market's first 5G service, with a confident outlook for launch within the next few years.

Strategic Myanmar Telecom Industry Market Forecast

The Myanmar telecom industry is poised for significant growth, driven by ongoing network modernization and the anticipated rollout of 5G technology, projecting robust expansion in data and digital services. The increasing adoption of smartphones and the growing digital-native population represent a substantial market opportunity. Investments in expanding network coverage, particularly in rural areas, and the development of a sophisticated digital services ecosystem, including OTT platforms and e-commerce, will further bolster market potential. The strategic focus on innovation, coupled with a supportive regulatory environment, will ensure the industry's continued upward trajectory, making it an attractive market for both domestic and international stakeholders.

Myanmar Telecom Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Myanmar Telecom Industry Segmentation By Geography

- 1. Myanmar

Myanmar Telecom Industry Regional Market Share

Geographic Coverage of Myanmar Telecom Industry

Myanmar Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Mobile Penetration; Demand for Online Gaming

- 3.3. Market Restrains

- 3.3.1. ; High Initial Invetsment and Product Cost

- 3.4. Market Trends

- 3.4.1. Growing Mobile Penetration in Myanmar

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Myanma Posts and Telecommunications (MPT)'

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FRONTIIR Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyalroute*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Myanmar Broadband Telecom Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Global Technology Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eager Communications Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yatanarpon Teleport (YTP)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mytel S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ATOM Myanmar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Myanma Posts and Telecommunications (MPT)'

List of Figures

- Figure 1: Myanmar Telecom Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Myanmar Telecom Industry Share (%) by Company 2025

List of Tables

- Table 1: Myanmar Telecom Industry Revenue undefined Forecast, by Segmenta 2020 & 2033

- Table 2: Myanmar Telecom Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Myanmar Telecom Industry Revenue undefined Forecast, by Segmenta 2020 & 2033

- Table 4: Myanmar Telecom Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Telecom Industry?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Myanmar Telecom Industry?

Key companies in the market include Myanma Posts and Telecommunications (MPT)', FRONTIIR Company Limited, Hyalroute*List Not Exhaustive, Myanmar Broadband Telecom Co Ltd, Global Technology Company, Eager Communications Group Co Ltd, Yatanarpon Teleport (YTP), Mytel S A, ATOM Myanmar.

3. What are the main segments of the Myanmar Telecom Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Robust Mobile Penetration; Demand for Online Gaming.

6. What are the notable trends driving market growth?

Growing Mobile Penetration in Myanmar.

7. Are there any restraints impacting market growth?

; High Initial Invetsment and Product Cost.

8. Can you provide examples of recent developments in the market?

September 2022: ATOM, on the 100th day of its launch in Myanmar, launched the newest 3D gamification, Toh Toh Sidecar. It offers tempting draw rewards of over MMK 6 billion (USD 2.9 million) in a 90-day Mega Grand Draw campaign. Users may play the interactive game currently accessible on the ATOM Store app for a chance to win various grand prizes, including a brand-new BAIC car, money, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Telecom Industry?

To stay informed about further developments, trends, and reports in the Myanmar Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence