Key Insights

The Mexico Facility Management market is poised for significant expansion, projected to reach USD 36.32 billion in 2025, driven by an anticipated Compound Annual Growth Rate (CAGR) of 4.19% through 2033. This robust growth is fueled by increasing foreign investment in commercial and industrial sectors, demanding sophisticated facility management solutions to optimize operational efficiency and cost-effectiveness. The rising complexity of modern infrastructure, coupled with a growing awareness of sustainability and energy management, further propels the adoption of advanced FM services. Large enterprises, in particular, are increasingly turning to integrated facility management to streamline operations, reduce overheads, and enhance workplace productivity. The "Hard FM" segment, encompassing technical maintenance and building operations, is expected to lead the market, reflecting the critical need for reliable infrastructure management.

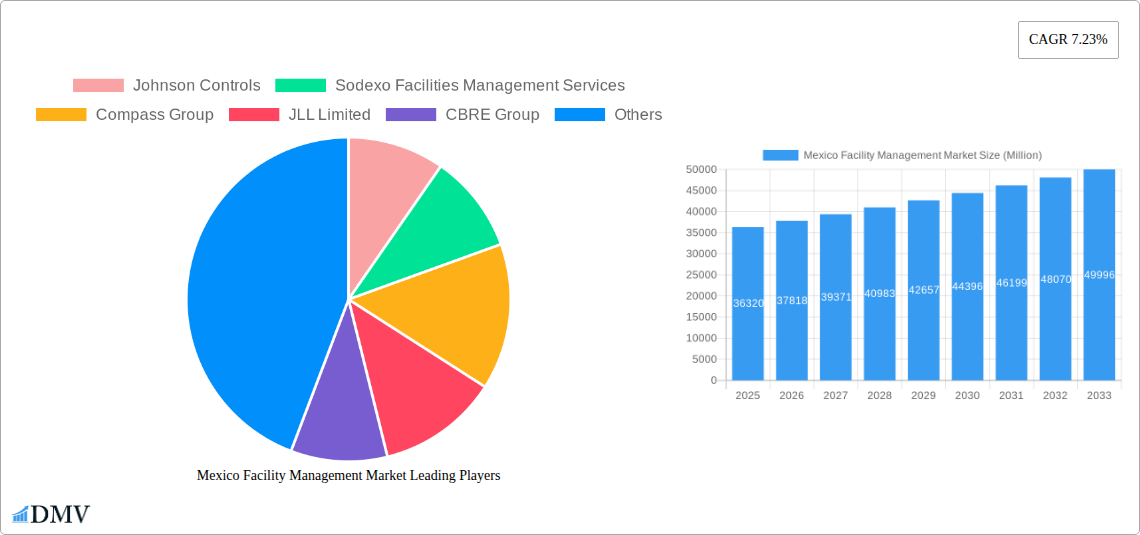

Mexico Facility Management Market Market Size (In Billion)

The market dynamics are further shaped by a growing preference for outsourced facility management, with bundled and integrated FM offerings gaining traction. Businesses are recognizing the benefits of leveraging specialized expertise for their facilities, allowing them to concentrate on core competencies. However, the market also faces challenges, including potential price sensitivity among smaller enterprises and the need for continuous upskilling of the workforce to keep pace with technological advancements. Nevertheless, the overarching trend points towards a maturing and professionalizing FM sector in Mexico, with a strong emphasis on service quality, technological integration, and customized solutions to cater to the diverse needs of commercial, institutional, and industrial end-users. The ongoing development of public and infrastructure projects also represents a substantial growth avenue for facility management providers.

Mexico Facility Management Market Company Market Share

This in-depth report provides a strategic analysis of the Mexico Facility Management Market, a rapidly evolving sector critical to operational efficiency across diverse industries. Our comprehensive study, spanning the historical period of 2019-2024 and extending to a forecast period of 2025-2033, with a base year of 2025, offers actionable insights for stakeholders navigating this dynamic landscape. We delve into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities, all while meticulously examining the strategies of key players. The report leverages high-ranking keywords such as "Mexico Facility Management," "Outsourced Facility Management," "Integrated Facility Management," "Hard FM," "Soft FM," and "Commercial Facility Management" to ensure maximum search visibility for decision-makers seeking to understand and capitalize on the Mexican market.

Mexico Facility Management Market Market Composition & Trends

The Mexico Facility Management Market exhibits a moderate to high degree of concentration, with a few dominant players holding significant market share. The market's evolution is catalyzed by relentless innovation, driven by the demand for cost-efficiency, sustainability, and advanced technology integration. Regulatory landscapes are becoming increasingly sophisticated, influencing service delivery standards and compliance requirements. The scarcity of readily available substitute products for comprehensive facility management services underscores the sector's unique value proposition. End-user profiles are diverse, ranging from expansive commercial complexes to critical institutional and public infrastructure, each with tailored FM needs. Merger and acquisition (M&A) activities are notable, with recent deals collectively valued in the billions, signaling a trend towards consolidation and strategic expansion. For instance, prominent M&A activities in the historical period are estimated to be valued at over $2.5 billion, reflecting a robust appetite for acquiring market share and technological capabilities. Key trends include the growing adoption of smart building technologies, the increasing demand for sustainability-focused FM solutions, and a surge in demand for integrated and bundled FM services that streamline operations and reduce overheads for businesses.

Mexico Facility Management Market Industry Evolution

The Mexico Facility Management Market has witnessed a remarkable growth trajectory, propelled by increasing urbanization, the expansion of the commercial and industrial sectors, and a growing awareness of the critical role of effective facility management in optimizing business operations and enhancing employee well-being. Over the study period (2019-2033), the market is projected to grow at a compound annual growth rate (CAGR) of approximately 7.8%, reaching an estimated value of over $25 billion by 2033. Technological advancements have been a significant catalyst, with the adoption of IoT sensors, AI-powered analytics, and integrated building management systems (BMS) transforming how facilities are managed. These technologies enable predictive maintenance, energy efficiency optimization, and enhanced security, thereby driving down operational costs and improving service delivery. Consumer demands have also shifted, with a greater emphasis on occupant comfort, health, and safety, particularly in the wake of global health events. This has led to an increased demand for specialized services such as enhanced cleaning protocols, air quality monitoring, and smart space management solutions. The shift from reactive to proactive and predictive facility management models is a defining characteristic of the industry's evolution. The base year 2025 is estimated to see market revenue exceeding $15 billion, with projected growth driven by these technological and consumer-led demands.

Leading Regions, Countries, or Segments in Mexico Facility Management Market

Within the Mexico Facility Management Market, Outsourced Facility Management commands the largest market share, projected to account for over 65% of the total market value by 2033. This dominance is further segmented, with Integrated FM emerging as the fastest-growing sub-segment, demonstrating a robust CAGR of approximately 9.2%. The Commercial end-user segment represents the most significant contributor to market revenue, driven by the proliferation of office buildings, retail spaces, and hospitality establishments.

- Dominance of Outsourced Facility Management: Businesses are increasingly recognizing the strategic advantage of outsourcing non-core FM functions to specialized providers, allowing them to focus on their primary operations. This trend is fueled by the desire for cost efficiencies, access to specialized expertise, and improved service quality.

- Rise of Integrated Facility Management: Integrated FM, which combines multiple FM services under a single contract, is witnessing exceptional growth. This model offers greater operational synergy, streamlined communication, and enhanced accountability, leading to significant cost savings and improved overall facility performance.

- Commercial Sector as a Key Driver: The robust growth of Mexico's commercial sector, including the construction of new office spaces, retail centers, and hotels, directly translates into increased demand for comprehensive facility management solutions. The need for efficient building operations, occupant comfort, and stringent safety standards in these high-traffic environments makes outsourced and integrated FM services highly sought after.

- Soft FM's Growing Importance: While Hard FM services remain crucial for building infrastructure, Soft FM services, encompassing cleaning, security, catering, and landscaping, are experiencing significant growth. This is driven by a greater focus on occupant well-being, employee productivity, and maintaining a positive brand image for businesses.

- Institutional and Public/Infrastructure Demand: The institutional sector, including healthcare and education, and the public/infrastructure segment (e.g., airports, transportation hubs) are also substantial contributors, driven by regulatory compliance, the need for critical infrastructure maintenance, and the demand for reliable operational services.

The estimated market share of Outsourced Facility Management is projected to be over $9.75 billion in 2025, with Integrated FM expected to reach over $4.5 billion within the same year.

Mexico Facility Management Market Product Innovations

The Mexico Facility Management Market is being reshaped by innovative solutions focused on sustainability, automation, and data-driven decision-making. Innovations include the deployment of AI-powered building management systems for predictive maintenance and energy optimization, resulting in an average energy cost reduction of 15-20%. Smart sensor technology is revolutionizing space utilization and occupant comfort, with new applications allowing for real-time environmental monitoring and automated adjustments to lighting and HVAC systems. Furthermore, advancements in robotic cleaning and automated security systems are enhancing efficiency and safety, particularly in high-traffic areas. The development of integrated digital platforms that consolidate all FM services onto a single interface is a key USP, offering clients unprecedented control and visibility.

Propelling Factors for Mexico Facility Management Market Growth

Several factors are propelling the growth of the Mexico Facility Management Market. Economically, increasing foreign direct investment and a growing manufacturing base are driving demand for efficient facility operations. Technologically, the rapid adoption of IoT, AI, and cloud computing is enabling more sophisticated and cost-effective FM solutions. Regulatory frameworks, while evolving, are increasingly emphasizing workplace safety and environmental sustainability, pushing businesses towards professional FM services. Furthermore, the growing trend of smart cities development in Mexico is creating new opportunities for integrated FM solutions in public infrastructure and commercial spaces. The increasing complexity of modern buildings and the rising cost of in-house management also contribute significantly.

Obstacles in the Mexico Facility Management Market Market

Despite robust growth, the Mexico Facility Management Market faces certain obstacles. A significant challenge remains the shortage of skilled labor, particularly for specialized technical roles in Hard FM services. Economic volatility and currency fluctuations can impact investment decisions and the pricing of imported technology. Regulatory complexities and varying enforcement standards across different regions can create compliance challenges for service providers. Furthermore, a degree of resistance to outsourcing among some established Mexican businesses, rooted in traditional operational models, can hinder market penetration. Supply chain disruptions, particularly for specialized equipment and technology, can also impact project timelines and costs.

Future Opportunities in Mexico Facility Management Market

The Mexico Facility Management Market is poised for significant future opportunities. The continued growth of the industrial and manufacturing sectors, particularly in the automotive and aerospace industries, will drive demand for specialized industrial facility management. The burgeoning e-commerce sector is also creating new warehousing and logistics facility management needs. The increasing focus on sustainability and green building certifications presents a significant opportunity for FM providers offering eco-friendly solutions and energy management services. Furthermore, the ongoing digitalization trend will lead to increased demand for integrated digital platforms and smart building technologies, creating a fertile ground for innovation and service expansion. The growing demand for healthcare and educational infrastructure will also create substantial opportunities in these institutional segments.

Major Players in the Mexico Facility Management Market Ecosystem

- Johnson Controls

- Sodexo Facilities Management Services

- Compass Group

- JLL Limited

- CBRE Group

- Cushman and Wakefield

- ISS Mexico

- Serco Facilities Management

Key Developments in Mexico Facility Management Market Industry

- 2023/Q4: Launch of advanced AI-driven predictive maintenance platforms by leading FM providers, improving operational efficiency by an estimated 18%.

- 2023/Q3: Significant increase in M&A activities, with major international FM firms acquiring local Mexican service providers to expand their footprint, totaling over $1.2 billion in disclosed deals.

- 2023/Q2: Growing adoption of integrated facility management (IFM) models, with key players reporting a 25% increase in IFM contracts from commercial and industrial clients.

- 2023/Q1: Enhanced focus on smart building technologies, including IoT sensor deployment for energy management and occupant comfort, with an estimated 30% of new contracts incorporating these features.

- 2022/Q4: Expansion of soft FM services, particularly in hygiene and security, driven by continued health and safety concerns across various end-user segments.

- 2022/Q3: Increased investment in sustainable FM practices, including waste management and renewable energy integration, by leading corporations in Mexico.

Strategic Mexico Facility Management Market Market Forecast

The Mexico Facility Management Market is on a robust growth trajectory, driven by an increasing reliance on professional outsourcing, technological advancements, and a growing emphasis on sustainability and operational efficiency. The strategic forecast indicates sustained expansion, fueled by ongoing infrastructure development, the digitalization of business operations, and the evolving needs of end-users across commercial, institutional, and industrial sectors. The market is expected to witness continued consolidation through M&A, alongside significant innovation in smart building technologies and integrated service delivery models, positioning Mexico as a key market in the global facility management landscape. The estimated market value is projected to exceed $30 billion by 2033, with a steady CAGR of approximately 7.8% over the forecast period.

Mexico Facility Management Market Segmentation

-

1. Fcaility Management

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End Users

Mexico Facility Management Market Segmentation By Geography

- 1. Mexico

Mexico Facility Management Market Regional Market Share

Geographic Coverage of Mexico Facility Management Market

Mexico Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Outsourcing of Non-core Operations; Steady Growth in Commercial Real Estate Sector; Strong Emphasis on Green Practices and Safety Awareness

- 3.3. Market Restrains

- 3.3.1. Regulatory & Legal Changes

- 3.4. Market Trends

- 3.4.1. Single Facility Management to have a significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fcaility Management

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Fcaility Management

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Johnson Controls

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sodexo Facilities Management Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Compass Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JLL Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CBRE Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cushmanand Wakefield

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ISS Mexico

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Serco Facilities management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls

List of Figures

- Figure 1: Mexico Facility Management Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Mexico Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Facility Management Market Revenue undefined Forecast, by Fcaility Management 2020 & 2033

- Table 2: Mexico Facility Management Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 3: Mexico Facility Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Mexico Facility Management Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Mexico Facility Management Market Revenue undefined Forecast, by Fcaility Management 2020 & 2033

- Table 6: Mexico Facility Management Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 7: Mexico Facility Management Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Mexico Facility Management Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Facility Management Market?

The projected CAGR is approximately 4.19%.

2. Which companies are prominent players in the Mexico Facility Management Market?

Key companies in the market include Johnson Controls, Sodexo Facilities Management Services, Compass Group, JLL Limited, CBRE Group, Cushmanand Wakefield, ISS Mexico, Serco Facilities management.

3. What are the main segments of the Mexico Facility Management Market?

The market segments include Fcaility Management, Offering, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Outsourcing of Non-core Operations; Steady Growth in Commercial Real Estate Sector; Strong Emphasis on Green Practices and Safety Awareness.

6. What are the notable trends driving market growth?

Single Facility Management to have a significant share.

7. Are there any restraints impacting market growth?

Regulatory & Legal Changes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Facility Management Market?

To stay informed about further developments, trends, and reports in the Mexico Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence