Key Insights

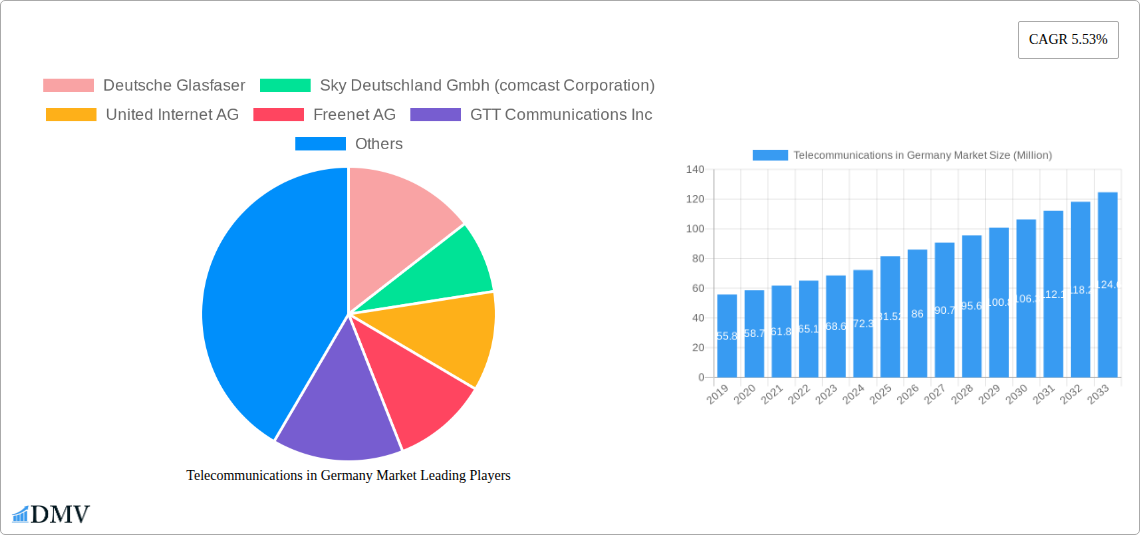

The German telecommunications market is poised for significant expansion, projected to reach €81.52 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.53% during the forecast period of 2025-2033. This sustained growth is being propelled by an increasing demand for high-speed data services, the widespread adoption of Over-The-Top (OTT) and PayTV platforms, and the ongoing digitalization across various sectors. The expansion of 5G networks and the continued investment in fiber optic infrastructure are critical drivers, enabling faster connectivity and supporting innovative applications. Businesses and consumers alike are demanding more bandwidth and lower latency, fueling the uptake of advanced telecommunications solutions. Furthermore, government initiatives promoting digital transformation and smart city development are contributing to a favorable market environment.

Telecommunications in Germany Market Market Size (In Million)

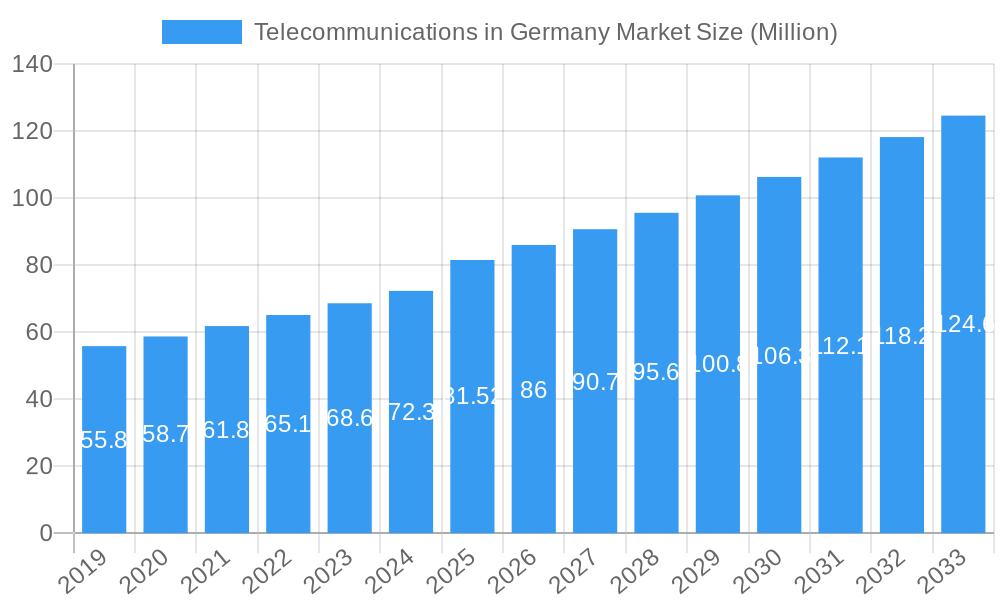

However, the market faces certain headwinds. Intense competition among established players and the emergence of new service providers can lead to price pressures and impact profitability. The substantial capital investment required for infrastructure upgrades, particularly in rolling out 5G and expanding fiber networks to underserved areas, presents a significant challenge. Regulatory complexities and the need for continuous innovation to keep pace with rapidly evolving technological landscapes also demand strategic agility from market participants. The market is segmented into Voice Services (including Wired and Wireless), Data and, OTT/PayTV Services. Key companies actively shaping this dynamic market include Deutsche Telekom AG, Vodafone GmbH, and Sky Deutschland GmbH (Comcast Corporation), among others, all vying for a larger share in this evolving digital ecosystem.

Telecommunications in Germany Market Company Market Share

Telecommunications in Germany Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides an unparalleled analysis of the Telecommunications in Germany Market, delving into its current landscape and projecting its trajectory through 2033. Covering a study period from 2019–2033, with 2025 as the base and estimated year, and a forecast period of 2025–2033, this research is essential for stakeholders seeking to understand market dynamics, German telecom growth drivers, 5G deployment Germany, and fiber optic expansion Germany. We meticulously examine market composition, industry evolution, leading segments, product innovations, growth catalysts, obstacles, and future opportunities within the German telecommunications sector. Gain critical insights into Deutsche Telekom market share, Vodafone Germany strategies, and the evolving role of OTT services Germany.

Telecommunications in Germany Market Market Composition & Trends

The Telecommunications in Germany Market exhibits a dynamic yet consolidated structure, with a few dominant players controlling a significant market share. Deutsche Telekom AG, Vodafone GmbH, and Telefonica Germany GmbH & Co OHG are key entities shaping the competitive landscape. Innovation is primarily driven by advancements in 5G network Germany and FTTH Germany infrastructure. Regulatory frameworks, while supportive of broadband expansion, also present complexities for new entrants. Substitute products, such as over-the-top (OTT) streaming services, are increasingly influencing traditional PayTV Germany offerings. End-user profiles are diversifying, with a growing demand for high-speed data services from both residential and enterprise segments. Merger and acquisition (M&A) activities, though present, are often strategic, focusing on network consolidation and service diversification. The market concentration is estimated to be high, with the top three players holding over 70% of the market share. M&A deal values are expected to remain significant, driven by the need for scale in infrastructure investment, potentially reaching multi-billion Euro figures in strategic consolidations.

Telecommunications in Germany Market Industry Evolution

The Telecommunications in Germany Market has undergone a profound transformation, evolving from traditional voice and basic data services to a complex ecosystem driven by high-speed connectivity and digital innovation. The historical period (2019–2024) witnessed a robust push towards broadband expansion Germany, particularly the rollout of fiber optic networks and the initial phases of 5G deployment. This evolution has been characterized by a continuous quest for faster speeds and more reliable internet access, significantly impacting consumer behavior and enterprise operations. The average download speeds have seen a substantial increase, with the proportion of households with access to speeds above 100 Mbps rising by an estimated 15% annually during the historical period. The adoption of VoIP Germany has largely replaced traditional wired voice services, reflecting a shift towards integrated communication solutions.

The forecast period (2025–2033) is poised for accelerated growth, propelled by the widespread implementation of 5G in Germany and the continued expansion of fiber to the home (FTTH) Germany. These technological advancements are not merely incremental upgrades; they are foundational to enabling new digital services and applications, including enhanced mobile broadband, low-latency IoT solutions, and immersive media experiences. The demand for data services is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8%, driven by the increasing consumption of video streaming, online gaming, and cloud-based services. Furthermore, the convergence of telecommunications with other sectors, such as automotive (for connected vehicles) and healthcare (for telemedicine), will unlock new revenue streams and further diversify the market. The strategic investments by key players like Deutsche Telekom AG and Vodafone GmbH in network infrastructure underscore the industry's commitment to future-proofing its services and meeting the ever-growing connectivity demands of the German economy and its citizens. The increasing adoption of OTT/PayTV services Germany is also a significant trend, directly impacting traditional broadcast revenue models and pushing telecom operators to offer bundled digital content solutions.

Leading Regions, Countries, or Segments in Telecommunications in Germany Market

Within the Telecommunications in Germany Market, the Data and OTT/PayTV Services segment is emerging as the most dominant and rapidly growing area. This dominance is fueled by a confluence of factors including burgeoning consumer demand for digital entertainment and essential business operations reliant on high-speed data transfer.

Data Services Dominance:

- High-Speed Broadband Expansion: Significant ongoing investments in fiber optic expansion Germany and 5G network Germany are providing the foundational infrastructure for increased data consumption. Regions with advanced fiber optic penetration, particularly in urban and economically developed areas like Bavaria and North Rhine-Westphalia, are leading this growth.

- Increased Bandwidth Demand: The proliferation of smart devices, cloud computing, remote work, and high-definition video streaming has created an insatiable appetite for robust and high-capacity data services. The average data consumption per user is projected to increase by over 20% annually.

- Enterprise Digitalization: German businesses are increasingly reliant on cloud services, IoT applications, and advanced networking solutions, driving substantial demand for enterprise-grade data connectivity.

OTT/PayTV Services Growth:

- Shifting Consumer Preferences: Consumers are migrating away from traditional cable and satellite TV subscriptions towards flexible, on-demand content offered by OTT platforms Germany. Services like Netflix, Amazon Prime Video, and Disney+ have witnessed exponential growth in subscriber numbers.

- Bundling Strategies: Telecom operators are actively integrating OTT/PayTV services Germany into their bundled offerings, such as the Sky Deutschland Gmbh (Comcast Corporation) partnerships and Freenet AG's content aggregation strategies. This bundling enhances customer value proposition and reduces churn.

- Technological Convergence: The seamless integration of high-speed internet with content delivery platforms makes this segment inherently tied to the telecommunications infrastructure. The availability of fast and stable internet is a prerequisite for a premium OTT viewing experience.

While Voice Services (Wired and Wireless) remain a foundational component of the telecommunications landscape, their growth is comparatively more mature. Wired voice services are experiencing a decline in subscriber numbers due to the shift towards VoIP and mobile. Wireless voice services, while essential, are increasingly subsumed within broader mobile data plans. Therefore, the dynamism and future revenue potential are overwhelmingly concentrated within the Data and OTT/PayTV Services segment, making it the pivotal focus for market players and investors in the Telecommunications in Germany Market.

Telecommunications in Germany Market Product Innovations

Recent product innovations in the Telecommunications in Germany Market are directly addressing the demand for enhanced speed, reliability, and integrated services. Deutsche Telekom AG's hybrid 5G offerings, combining fixed and mobile networks, provide download speeds up to 300 Mbit/s and upload speeds up to 50 Mbit/s, enhancing internet dependability for customers. Similarly, Freenet AG's introduction of #DSL internet packages, with LTE and DSL versions offering up to 100 Mbit/s for EUR 29.99 per month, showcases a commitment to versatile and accessible internet solutions tailored to different user needs and locations. These innovations emphasize seamless connectivity, faster data transfer, and flexible service plans, directly impacting user experience and driving adoption of advanced digital services.

Propelling Factors for Telecommunications in Germany Market Growth

The Telecommunications in Germany Market is propelled by a confluence of robust growth drivers. Technological advancements, particularly the widespread rollout of 5G network Germany and the continuous expansion of fiber optic expansion Germany, are foundational. Government initiatives and regulatory support for digital infrastructure development create a favorable investment climate. The increasing digitalization of industries, coupled with growing consumer demand for high-speed data, streaming services, and connected devices, further fuels market expansion. Economic stability within Germany also supports sustained investment in advanced telecommunications infrastructure. For instance, the €100 Million investment announced by Deutsche Telekom AG for fiber optic expansion in rural areas exemplifies this commitment to bridging the digital divide and fostering growth.

Obstacles in the Telecommunications in Germany Market Market

Despite strong growth, the Telecommunications in Germany Market faces several obstacles. The high cost of infrastructure deployment, especially for fiber optic expansion Germany in rural and sparsely populated areas, presents a significant financial challenge. Regulatory hurdles and complex permitting processes can slow down network build-outs. Intense competition among major players like Deutsche Telekom AG, Vodafone GmbH, and Telefonica Germany GmbH & Co OHG can lead to price wars, impacting profitability. Supply chain disruptions for critical components, exacerbated by global events, can also impede network upgrades and expansion. For example, a shortage of specialized fiber optic cables could delay rollouts by an estimated 3-6 months, impacting projected growth.

Future Opportunities in Telecommunications in Germany Market

The Telecommunications in Germany Market is ripe with emerging opportunities. The ongoing 5G deployment Germany presents immense potential for new revenue streams through enhanced mobile broadband, massive IoT, and ultra-reliable low-latency communications (URLLC) applications for industries such as manufacturing and logistics. The continued expansion of FTTH Germany will enable the proliferation of smart home technologies and advanced digital services. Furthermore, the growing demand for cloud-based solutions and cybersecurity services creates opportunities for telecom operators to diversify their offerings beyond basic connectivity. Strategic partnerships with technology providers and content creators will also be crucial for tapping into the evolving digital media landscape, particularly within the OTT/PayTV services Germany sector.

Major Players in the Telecommunications in Germany Market Ecosystem

- Deutsche Glasfaser

- Sky Deutschland GmbH (Comcast Corporation)

- United Internet AG

- Freenet AG

- GTT Communications Inc

- Deutsche Telekom AG

- Tele Columbus AG

- Vodafone GmbH

- BT Group PLC

- M-net Telekommunikations GmbH

- Telefonica Germany GmbH & Co OHG

Key Developments in Telecommunications in Germany Market Industry

- January 2023: Deutsche Telekom is integrating fixed and mobile networks with hybrid 5G to deliver quick, dependable internet. Customers may choose the Hybrid 5G add-on option or the MagentaZuhause Hybrid rate plan starting in February to take advantage of download speeds of up to 300 Mbit/s and upload rates of up to 50 Mbit/s across the mobile communications network.

- January 2023: Launching freenet Internet DSL is a crucial next step in providing Internet technology uniquely appropriate for each household and application. Freenet AG Freenet Internet currently offers the app-controlled #DSL internet package. Users may surf at up to 100 Mbit/s for EUR 29.99 per month. The new Internet service is already available on the mobile network as an LTE version, which is ideal for traveling and is now accessible as a DSL version for the consumer's own four walls.

Strategic Telecommunications in Germany Market Market Forecast

The Telecommunications in Germany Market is projected for sustained growth, driven by strategic investments in advanced infrastructure like 5G network Germany and fiber optic expansion Germany. The increasing adoption of OTT/PayTV services Germany and the continuous demand for high-speed data will create significant revenue opportunities. The market's future is characterized by innovation in service bundling, the integration of IoT solutions, and the expansion of connectivity into underserved areas. Continued technological advancements and supportive regulatory policies will ensure that Germany remains a leading European market for telecommunications services, with an estimated market value to reach over EUR 70 Billion by 2033.

Telecommunications in Germany Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT/PayTV Services

-

1.1. Voice Services

Telecommunications in Germany Market Segmentation By Geography

- 1. Germany

Telecommunications in Germany Market Regional Market Share

Geographic Coverage of Telecommunications in Germany Market

Telecommunications in Germany Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Deployments Bolster the Market Growth; High Regional Demand for Broadband

- 3.3. Market Restrains

- 3.3.1. Lack of awareness about serious games among end-users

- 3.4. Market Trends

- 3.4.1. 5G Deployments Bolster the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Telecommunications in Germany Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT/PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deutsche Glasfaser

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sky Deutschland Gmbh (comcast Corporation)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Internet AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Freenet AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GTT Communications Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Deutsche Telekom AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tele Columbus AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vodafone GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bt Group PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 M-net Telekommunikations GMBH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Telefonica Germany GmbH & Co OHG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Deutsche Glasfaser

List of Figures

- Figure 1: Telecommunications in Germany Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Telecommunications in Germany Market Share (%) by Company 2025

List of Tables

- Table 1: Telecommunications in Germany Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Telecommunications in Germany Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Telecommunications in Germany Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Telecommunications in Germany Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecommunications in Germany Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Telecommunications in Germany Market?

Key companies in the market include Deutsche Glasfaser, Sky Deutschland Gmbh (comcast Corporation), United Internet AG, Freenet AG, GTT Communications Inc, Deutsche Telekom AG, Tele Columbus AG, Vodafone GmbH, Bt Group PLC, M-net Telekommunikations GMBH, Telefonica Germany GmbH & Co OHG.

3. What are the main segments of the Telecommunications in Germany Market?

The market segments include Services .

4. Can you provide details about the market size?

The market size is estimated to be USD 81.52 Million as of 2022.

5. What are some drivers contributing to market growth?

5G Deployments Bolster the Market Growth; High Regional Demand for Broadband.

6. What are the notable trends driving market growth?

5G Deployments Bolster the Market Growth.

7. Are there any restraints impacting market growth?

Lack of awareness about serious games among end-users.

8. Can you provide examples of recent developments in the market?

January 2023: Deutsche Telekom is integrating fixed and mobile networks with hybrid 5G to deliver quick, dependable internet. Customers may choose the Hybrid 5G add-on option or the MagentaZuhause Hybrid rate plan starting in February to take advantage of download speeds of up to 300 Mbit/s and upload rates of up to 50 Mbit/s across the mobile communications network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecommunications in Germany Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecommunications in Germany Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecommunications in Germany Market?

To stay informed about further developments, trends, and reports in the Telecommunications in Germany Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence