Key Insights

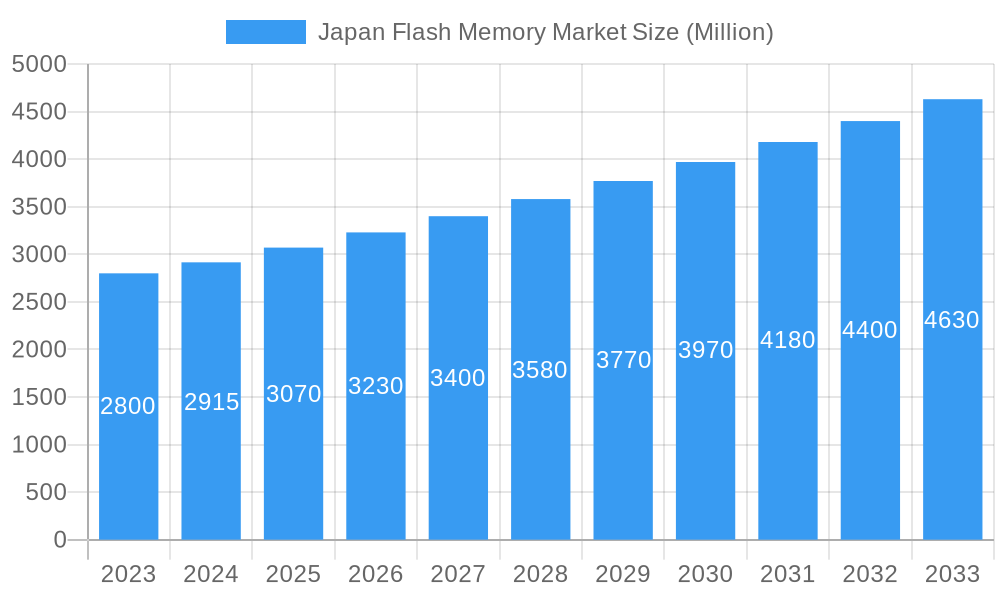

The Japan Flash Memory Market is poised for robust growth, projecting a market size of 3.07 million value units. This expansion is underpinned by a CAGR of 3.00%, indicating a steady and significant upward trajectory. The market's dynamism is driven by an insatiable demand for high-density storage solutions across various sectors. Key growth drivers include the burgeoning automotive industry, with increasing adoption of advanced driver-assistance systems (ADAS) and in-car infotainment, both requiring substantial flash memory. Furthermore, the persistent demand for mobile and tablet devices, coupled with the ongoing upgrades in client computing for PCs and SSDs, are significant contributors to market expansion. The data center segment, a critical hub for enterprise and server operations, also plays a pivotal role, necessitating advanced and reliable flash memory for efficient data processing and storage.

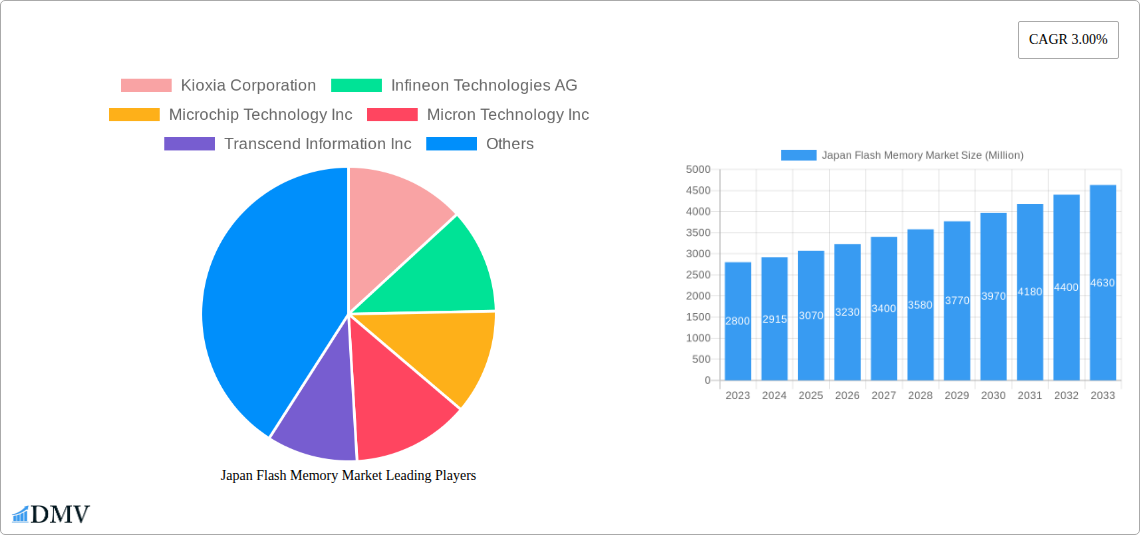

Japan Flash Memory Market Market Size (In Billion)

Emerging trends such as the increasing integration of AI and IoT devices are further fueling the need for specialized flash memory solutions offering enhanced performance and capacity. While the market benefits from these strong demand drivers, potential restraints could stem from supply chain volatilities and the ever-present pressure of price erosion due to intense competition among major players like Kioxia Corporation, Micron Technology Inc., and Western Digital Corporation. Nevertheless, the continuous innovation in NAND and NOR flash memory technologies, particularly in increasing densities and improving endurance, is expected to overcome these challenges, solidifying the market's growth trajectory throughout the forecast period. The strategic importance of Japan as a hub for semiconductor innovation and manufacturing also provides a conducive environment for sustained market development.

Japan Flash Memory Market Company Market Share

Japan Flash Memory Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a strategic analysis of the Japan flash memory market, covering intricate details from 2019 to 2033. With a base year of 2025, the report offers a granular forecast from 2025 to 2033, building upon historical data from 2019 to 2024. Dive deep into market dynamics, technological advancements, competitive landscapes, and emerging opportunities in Japan's rapidly evolving semiconductor industry, focusing on NAND flash memory and NOR flash memory solutions.

Japan Flash Memory Market Market Composition & Trends

The Japan flash memory market exhibits a dynamic composition characterized by intense innovation and strategic consolidation. Market concentration is influenced by the presence of global giants and specialized domestic players, driving a competitive environment for high-density flash memory and low-power NOR flash solutions. Key innovation catalysts include the relentless pursuit of higher storage capacities and faster data transfer speeds, essential for the burgeoning data center, automotive, and mobile & tablets sectors. Regulatory landscapes, while generally supportive of technological advancement, can introduce compliance considerations for manufacturers of embedded flash memory. Substitute products, such as DRAM and emerging non-volatile memory technologies, pose a constant challenge, necessitating continuous product development and cost optimization. End-user profiles are increasingly sophisticated, demanding tailored solutions for applications ranging from high-performance client SSDs to robust automotive-grade flash. Mergers and acquisitions (M&A) are pivotal in reshaping the market, with deals often focusing on acquiring advanced flash memory technology or expanding market reach. For instance, the September 2022 subsidy to Micron Technology Inc. for advanced memory chip development in Hiroshima underscores significant government investment and strategic alliances. The market share distribution is highly influenced by R&D investments and manufacturing capabilities, with leading companies striving to capture a larger portion of the Japan semiconductor market.

- Market Concentration Drivers: Advanced manufacturing capabilities, strong R&D pipelines, and strategic partnerships.

- Innovation Catalysts: Demand for increased storage in IoT devices, AI applications, and advanced driver-assistance systems (ADAS).

- Regulatory Landscape: Government initiatives to boost domestic semiconductor production and cybersecurity regulations influencing memory component choices.

- Substitute Products: Dynamic Random-Access Memory (DRAM), emerging Resistive RAM (ReRAM), and Magnetic RAM (MRAM).

- End-User Profiles: Diversified needs from high-performance computing to industrial automation and consumer electronics.

- M&A Activities: Strategic acquisitions aimed at technology integration and market expansion in the NAND flash market and NOR flash market.

Japan Flash Memory Market Industry Evolution

The Japan flash memory market has witnessed a remarkable industry evolution, driven by a confluence of technological breakthroughs, escalating demand from diverse end-user segments, and strategic government support. Over the historical period (2019-2024), the market has experienced consistent growth, fueled by the insatiable appetite for data storage and processing power across various applications. The base year 2025 is projected to see continued upward momentum, as the integration of advanced flash memory solutions becomes ubiquitous in modern technology. Market growth trajectories have been significantly shaped by the rapid advancements in NAND flash memory technology, particularly the transition to higher layer counts and the introduction of innovative architectures like 3D NAND, which have dramatically increased density and improved performance while reducing costs per bit. Similarly, NOR flash memory has seen evolution, focusing on enhanced reliability, higher densities for code storage, and lower power consumption, making it indispensable for embedded systems and automotive applications.

Shifting consumer demands have played a crucial role, with consumers expecting faster boot times, seamless multitasking, and ample storage for media and applications on their mobile devices and personal computers. This translates directly into increased demand for high-performance client SSDs and advanced mobile flash memory. The automotive sector is a particularly strong growth engine, with the increasing sophistication of in-vehicle infotainment systems, autonomous driving capabilities, and connectivity solutions requiring robust and high-capacity automotive-grade flash memory. The data center segment continues its expansion, driven by cloud computing, big data analytics, and the rise of AI, all of which rely heavily on high-speed and high-capacity enterprise flash storage. Technological advancements are not limited to density and speed; significant progress has been made in endurance, power efficiency, and data integrity, crucial for mission-critical applications. Adoption metrics show a clear trend towards solid-state solutions over traditional hard drives, especially in performance-sensitive applications. The forecast period (2025-2033) is expected to witness even more rapid growth, propelled by emerging technologies like AIoT (Artificial Intelligence of Things), advanced robotics, and the continued expansion of 5G infrastructure, all of which will require increasingly sophisticated flash memory solutions. The Japan semiconductor market is at the forefront of this evolution, with companies investing heavily in next-generation flash memory fabrication to meet future demands.

Leading Regions, Countries, or Segments in Japan Flash Memory Market

Within the Japan flash memory market, the dominance is multifaceted, with specific segments and end-user applications acting as significant growth engines. The NAND Flash Memory segment, particularly within higher density categories, is a major driver, propelled by the relentless demand for storage across consumer electronics and enterprise solutions. Specifically, the 2 GIGABIT & LESS (greater than 1GB) and 4 GIGABIT & LESS (greater than 2GB) densities of NAND flash are crucial for applications like Client (PC, Client SSD) and Data Center (Enterprise and Servers), which are experiencing robust expansion in Japan. The increasing adoption of high-performance computing, cloud services, and data analytics in Japanese enterprises necessitates substantial storage capacities, making these NAND flash memory segments pivotal.

The Automotive end-user segment is another critical area of dominance. Japan's strong automotive industry is a significant consumer of flash memory, particularly for advanced driver-assistance systems (ADAS), in-vehicle infotainment (IVI), and the increasing implementation of connected car technologies. This demand fuels the growth of both NAND flash memory for data logging and storage, and NOR flash memory for boot code and critical system functions within automotive ECUs. The reliability and longevity requirements of the automotive sector make high-quality automotive-grade flash memory a key differentiator.

In terms of NOR Flash Memory, the 32 MEGABIT & LESS (greater than 16MB) and 64 MEGABIT & LESS (greater than 32MB) categories are gaining prominence. These densities are essential for storing firmware and operating system code in a wide array of embedded systems, including industrial automation, consumer electronics, and increasingly sophisticated IoT devices. The ongoing development and adoption of smart appliances, industrial robots, and smart city infrastructure in Japan are significant contributors to the growth of these NOR flash memory segments.

The Client (PC, Client SSD) segment remains a foundational pillar, with Japanese consumers and businesses continually upgrading their personal computing devices for improved performance and productivity. The transition from traditional HDDs to faster and more reliable Client SSDs powered by NAND flash memory continues to be a strong growth driver.

Key drivers for the dominance of these segments include:

- Investment Trends: Significant investments in R&D and manufacturing infrastructure by leading Japanese and international semiconductor companies, such as Kioxia Corporation and Micron Technology Inc., to enhance flash memory production.

- Regulatory Support: Government initiatives aimed at bolstering the domestic semiconductor industry, including subsidies and tax incentives for advanced memory chip development and manufacturing, as exemplified by the September 2022 announcement regarding Micron Technology Inc.

- Technological Advancements: Continuous innovation in flash memory technology, leading to higher densities, faster speeds, improved endurance, and lower power consumption, catering to the evolving needs of demanding applications.

- Consumer Demand: A strong consumer base in Japan that readily adopts new technologies and demands high-performance devices, driving sales of SSDs, smartphones, and other consumer electronics that utilize advanced flash memory.

- Industry Specific Growth: The burgeoning IoT sector, the advanced automotive industry, and the continuous expansion of data centers in Japan are creating sustained demand for various types of flash memory.

The intricate interplay of these factors solidifies the leading position of high-density NAND flash and critical NOR flash segments, alongside the robust demand from the automotive and client computing sectors within the Japan flash memory market.

Japan Flash Memory Market Product Innovations

Product innovations in the Japan flash memory market are primarily focused on enhancing performance, increasing density, and improving power efficiency. Kioxia Corporation, a leader in NAND flash memory, consistently pushes the boundaries with advancements in 3D NAND technology, achieving record-breaking layer counts for greater storage capacity in smaller form factors. Infineon Technologies AG, with its launch of the SEMPER Nano NOR Flash memory in February 2023, has addressed the growing need for low-power, high-density solutions in battery-powered devices, highlighting its commitment to innovation in the embedded flash market. These innovations directly translate into faster data access, reduced latency, and more compact designs for devices across the mobile & tablets, automotive, and IoT sectors. Performance metrics are continuously improving, with sequential read/write speeds for NAND flash exceeding billions of bytes per second and NOR flash offering robust read performance critical for boot operations.

Propelling Factors for Japan Flash Memory Market Growth

Several key factors are propelling the growth of the Japan flash memory market. The relentless digital transformation across industries, including the expansion of data centers and the widespread adoption of cloud computing, creates an insatiable demand for high-capacity and high-performance NAND flash memory. Furthermore, the rapid advancements in the automotive sector, with the proliferation of autonomous driving technologies, electric vehicles, and sophisticated infotainment systems, are significant growth catalysts for automotive-grade flash memory. The Japanese government's strategic focus on bolstering its domestic semiconductor industry, including initiatives like the USD 320 million subsidy announced for Micron Technology Inc., plays a crucial role in fostering innovation and manufacturing capabilities. Technological advancements, such as the development of higher-density 3D NAND and more efficient NOR flash solutions, also contribute significantly to market expansion by meeting evolving end-user requirements.

Obstacles in the Japan Flash Memory Market Market

Despite strong growth potential, the Japan flash memory market faces several obstacles. Intense global competition from established players and emerging manufacturers can exert pressure on pricing and profit margins. Supply chain disruptions, exacerbated by geopolitical tensions and the reliance on global raw material sourcing, can lead to production delays and increased costs. The high capital expenditure required for advanced flash memory fabrication facilities presents a significant barrier to entry for new players. Furthermore, the rapid pace of technological evolution necessitates continuous and substantial R&D investment to stay competitive, posing a financial challenge for smaller companies. Evolving environmental regulations and the drive for sustainable manufacturing practices can also introduce additional compliance costs and operational complexities.

Future Opportunities in Japan Flash Memory Market

The future of the Japan flash memory market is rife with opportunities. The burgeoning Internet of Things (IoT) ecosystem, encompassing smart homes, industrial automation, and smart cities, will demand a significant increase in embedded flash memory solutions, particularly NOR flash for firmware and NAND flash for data logging. The continued advancements in Artificial Intelligence (AI) and Machine Learning (ML) applications will drive the need for higher density, faster NAND flash memory for training and inference workloads in data centers and edge devices. The growing demand for advanced driver-assistance systems (ADAS) and autonomous driving features in the automotive sector presents a substantial opportunity for high-reliability and high-performance automotive-grade flash memory. Furthermore, the ongoing government support for the domestic semiconductor industry, coupled with Japan's strong technological base, provides fertile ground for innovation in next-generation flash memory technologies.

Major Players in the Japan Flash Memory Market Ecosystem

- Kioxia Corporation

- Infineon Technologies AG

- Microchip Technology Inc

- Micron Technology Inc

- Transcend Information Inc

- Western Digital Corporation

- Renesas Electronics Corporation

- Gigadevice Semiconductor Inc

- Winbond Electronics Corporation

Key Developments in Japan Flash Memory Market Industry

- February 2023: Infineon Technologies AG launched the SEMPER Nano NOR Flash memory for small-form-factor, battery-powered electronic devices. With the increasing demand for more memory, the company introduced new flash memory to deliver a solution comprising both high density and low power, design support, and robust engineering, impacting the embedded systems and IoT segments.

- September 2022: Japan government announced a subsidy of USD 320 million to Micron Technology Inc. to develop advanced memory chips at their manufacturing plant based in Hiroshima, Japan. The subsidy aims to increase cooperation between the United States and Japan amid geopolitical tensions and technology conflict with China, signaling a strategic investment in advanced memory chip production and strengthening bilateral ties.

Strategic Japan Flash Memory Market Market Forecast

The Japan flash memory market is poised for significant growth, driven by the accelerating digital transformation across its key industries. The increasing demand for high-density NAND flash memory in data centers and client computing segments, coupled with the critical role of NOR flash memory in the expanding automotive and IoT sectors, forms the bedrock of this expansion. Strategic investments, such as the substantial government subsidy for Micron Technology Inc., underscore the nation's commitment to advancing its semiconductor manufacturing capabilities. The continuous pursuit of technological innovation, focusing on improved performance, energy efficiency, and reliability, will be crucial for market players to capitalize on emerging opportunities in areas like AI and advanced connectivity. The forecast period (2025–2033) is expected to witness sustained market development, solidifying Japan's position in the global flash memory landscape.

Japan Flash Memory Market Segmentation

-

1. Type

-

1.1. NAND Flash Memory

-

1.1.1. By Density

- 1.1.1.1. 128 MB & LESS

- 1.1.1.2. 512 MB & LESS

- 1.1.1.3. 2 GIGABIT & LESS (greater than 1GB)

- 1.1.1.4. 256 MB & LESS

- 1.1.1.5. 1 GIGABIT & LESS

- 1.1.1.6. 4 GIGABIT & LESS (greater than 2GB)

-

1.1.1. By Density

-

1.2. NOR Flash Memory

- 1.2.1. 2 MEGABIT & LESS

- 1.2.2. 4 MEGABIT & LESS (greater than 2MB)

- 1.2.3. 8 MEGABIT & LESS (greater than 4MB)

- 1.2.4. 16 MEGABIT & LESS (greater than 8MB)

- 1.2.5. 32 MEGABIT & LESS (greater than 16MB)

- 1.2.6. 64 MEGABIT & LESS (greater than 32MB)

-

1.1. NAND Flash Memory

-

2. End User

- 2.1. Data Center (Enterprise and Servers)

- 2.2. Automotive

- 2.3. Mobile & Tablets

- 2.4. Client (PC, Client SSD)

- 2.5. Other End-user Applications

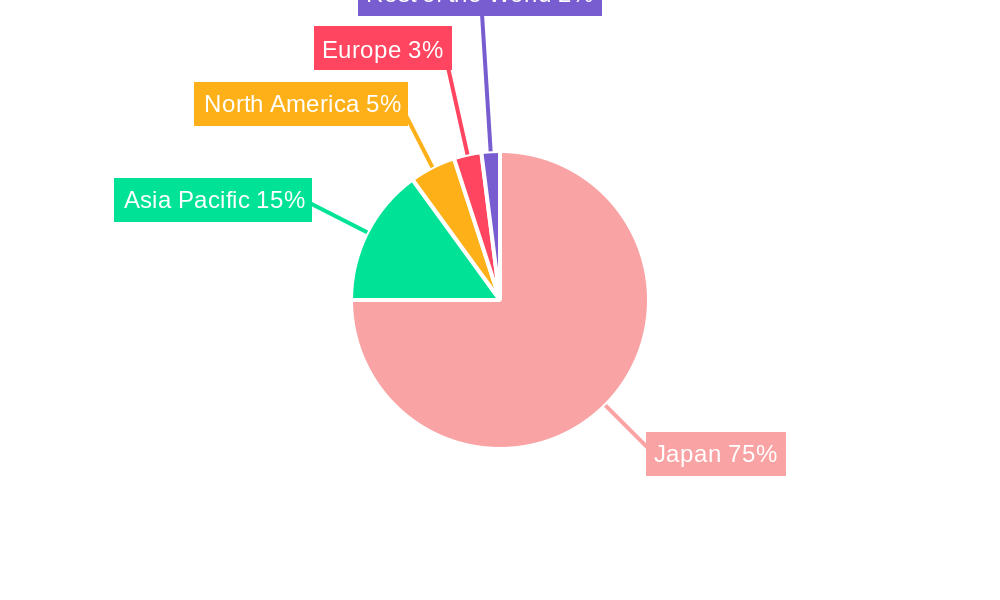

Japan Flash Memory Market Segmentation By Geography

- 1. Japan

Japan Flash Memory Market Regional Market Share

Geographic Coverage of Japan Flash Memory Market

Japan Flash Memory Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Electric Vehicles and Smartphones; Growing Applications of IoT

- 3.3. Market Restrains

- 3.3.1. Reliability Issues

- 3.4. Market Trends

- 3.4.1. Automotive to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Flash Memory Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. NAND Flash Memory

- 5.1.1.1. By Density

- 5.1.1.1.1. 128 MB & LESS

- 5.1.1.1.2. 512 MB & LESS

- 5.1.1.1.3. 2 GIGABIT & LESS (greater than 1GB)

- 5.1.1.1.4. 256 MB & LESS

- 5.1.1.1.5. 1 GIGABIT & LESS

- 5.1.1.1.6. 4 GIGABIT & LESS (greater than 2GB)

- 5.1.1.1. By Density

- 5.1.2. NOR Flash Memory

- 5.1.2.1. 2 MEGABIT & LESS

- 5.1.2.2. 4 MEGABIT & LESS (greater than 2MB)

- 5.1.2.3. 8 MEGABIT & LESS (greater than 4MB)

- 5.1.2.4. 16 MEGABIT & LESS (greater than 8MB)

- 5.1.2.5. 32 MEGABIT & LESS (greater than 16MB)

- 5.1.2.6. 64 MEGABIT & LESS (greater than 32MB)

- 5.1.1. NAND Flash Memory

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Data Center (Enterprise and Servers)

- 5.2.2. Automotive

- 5.2.3. Mobile & Tablets

- 5.2.4. Client (PC, Client SSD)

- 5.2.5. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kioxia Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microchip Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Micron Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transcend Information Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Western Digital Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renesas Electronics Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gigadevice Semiconductor Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Winbond Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kioxia Corporation

List of Figures

- Figure 1: Japan Flash Memory Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Flash Memory Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Flash Memory Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Flash Memory Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Japan Flash Memory Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Flash Memory Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Japan Flash Memory Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Japan Flash Memory Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Flash Memory Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Japan Flash Memory Market?

Key companies in the market include Kioxia Corporation, Infineon Technologies AG, Microchip Technology Inc, Micron Technology Inc, Transcend Information Inc, Western Digital Corporation, Renesas Electronics Corporation, Gigadevice Semiconductor Inc, Winbond Electronics Corporation.

3. What are the main segments of the Japan Flash Memory Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Electric Vehicles and Smartphones; Growing Applications of IoT.

6. What are the notable trends driving market growth?

Automotive to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Reliability Issues.

8. Can you provide examples of recent developments in the market?

February 2023: Infineon Technologies AG launched the SEMPER Nano NOR Flash memory for small-form-factor, battery-powered electronic devices. With the increasing demand for more memory, the company introduced new flash memory to deliver a solution comprising both high density and low power, design support, and robust engineering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Flash Memory Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Flash Memory Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Flash Memory Market?

To stay informed about further developments, trends, and reports in the Japan Flash Memory Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence