Key Insights

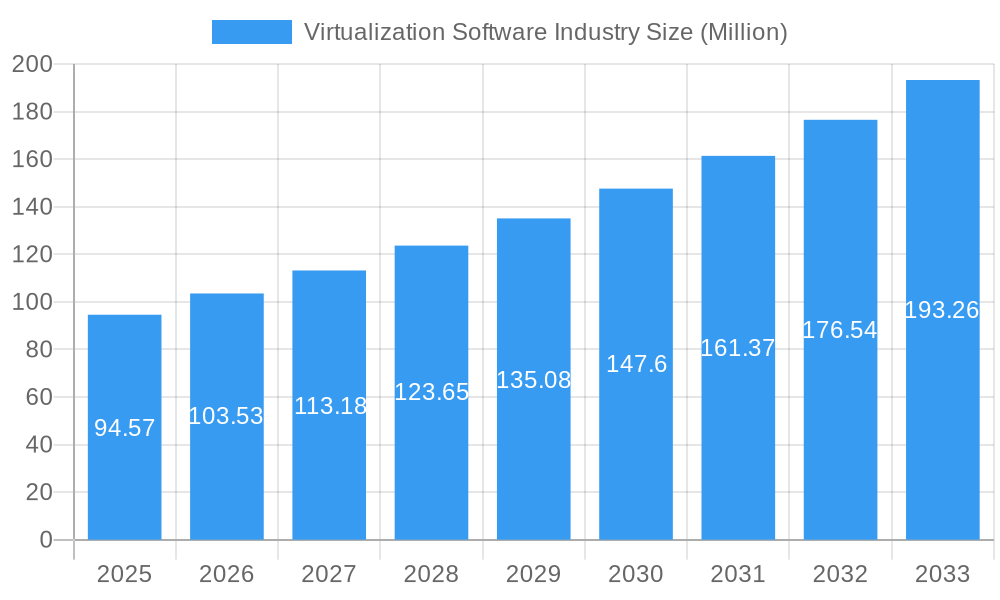

The Virtualization Software Industry is poised for substantial growth, with a current market size estimated at 94.57 Million and a projected Compound Annual Growth Rate (CAGR) of 9.47% over the forecast period of 2025-2033. This robust expansion is driven by a confluence of factors, including the escalating demand for enhanced IT infrastructure flexibility, cost optimization through resource consolidation, and the increasing adoption of cloud computing services. Businesses are increasingly leveraging virtualization to improve scalability, agility, and disaster recovery capabilities, thereby reducing operational expenses and boosting overall efficiency. The continuous evolution of hardware and software technologies further fuels this growth, enabling more sophisticated virtualization solutions that cater to diverse enterprise needs. Key players like VMware, Microsoft, Oracle, and Citrix Systems are at the forefront, investing heavily in research and development to introduce innovative platforms and features that address emerging market demands. The industry is witnessing a strong emphasis on improving application performance, security, and management across various virtualized environments.

Virtualization Software Industry Market Size (In Million)

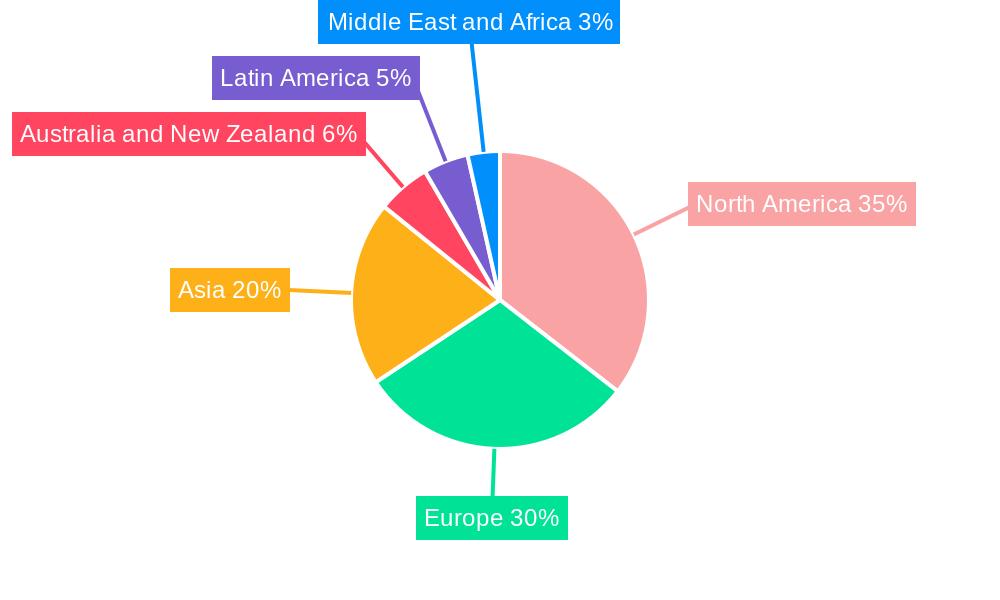

The market is segmented across different platform types, including PC Virtualization, Mobile Virtualization, and specialized solutions like Application Virtualization, Network Virtualization, and Hardware Virtualization. These segments cater to a wide array of use cases, from desktop deployments and mobile device management to complex server and data center architectures. While the widespread adoption of virtualization brings immense benefits, certain restraints, such as the complexity of implementation and management in large-scale environments, as well as initial investment costs, could pose challenges. However, ongoing advancements in management tools and increasing accessibility are mitigating these concerns. The geographical landscape indicates a strong presence in North America and Europe, with Asia expected to exhibit significant growth due to rapid digital transformation initiatives and the burgeoning IT sector. The competitive landscape is characterized by intense innovation and strategic collaborations among major companies, all vying to capture a larger share of this dynamic and rapidly expanding market.

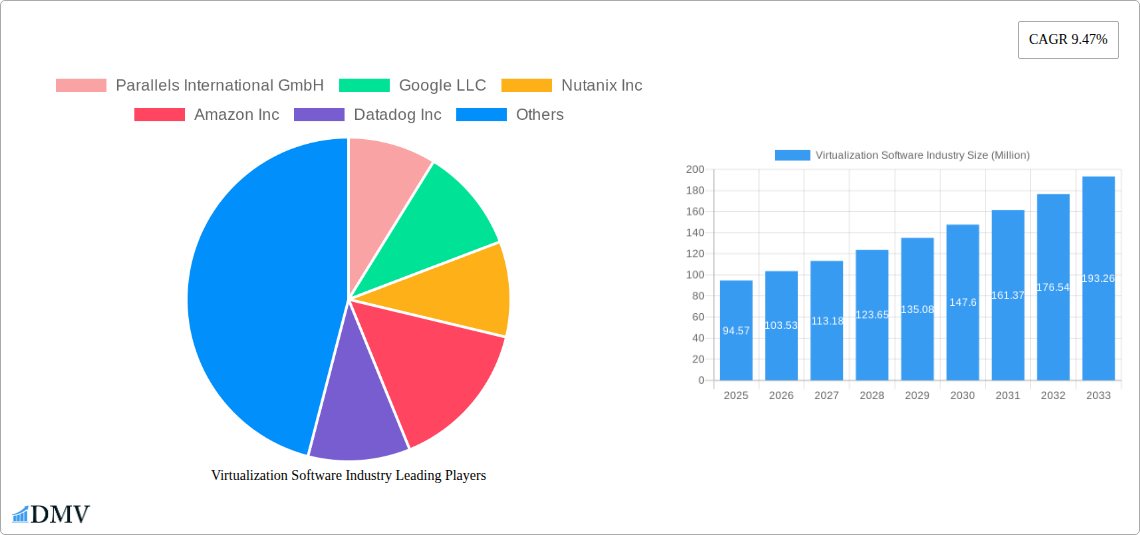

Virtualization Software Industry Company Market Share

Unlock comprehensive insights into the dynamic Virtualization Software Industry. This in-depth report provides a granular analysis of market composition, trends, evolution, and future trajectory from 2019 to 2033, with a base year of 2025. We explore critical segments like PC Virtualization, Mobile Virtualization, Application Virtualization, Network Virtualization, and Hardware Virtualization, empowering stakeholders with actionable intelligence for strategic decision-making. Our research encompasses key industry players and pivotal developments shaping the global virtualization landscape.

Virtualization Software Industry Market Composition & Trends

The global virtualization software market exhibits a dynamic yet moderately concentrated landscape, driven by relentless innovation and strategic mergers and acquisitions. Market share distribution is influenced by leading providers offering comprehensive solutions across diverse platforms. Key innovation catalysts include the increasing demand for cloud computing, edge computing, and the burgeoning Internet of Things (IoT) ecosystem, which necessitate efficient resource management and deployment flexibility. The regulatory landscape, while generally supportive of technological advancement, presents evolving compliance requirements for data security and privacy across different regions. Substitute products, such as bare-metal provisioning for specific high-performance computing needs, exist but offer limited versatility compared to virtualization solutions. End-user profiles span from small and medium-sized enterprises (SMEs) seeking cost-effective IT infrastructure to large enterprises demanding robust scalability and disaster recovery capabilities. M&A activities are significant, with deal values often in the multi-million dollar range, as companies consolidate to enhance their portfolios and expand market reach. For instance, recent consolidations aim to integrate AI-driven automation and advanced security features into existing virtualization platforms, increasing market share for acquiring entities.

- Market Share Distribution: Fragmented with key players holding substantial portions, driven by comprehensive cloud and enterprise solutions.

- M&A Deal Values: Expected to exceed XXX Million USD annually, reflecting strategic consolidation and technology integration.

- Innovation Catalysts: Cloud adoption, edge computing expansion, IoT proliferation, AI integration, and enhanced cybersecurity demands.

- Substitute Products: Bare-metal provisioning for niche high-performance applications.

- End-User Profiles: SMEs for cost savings and scalability, Enterprises for agility, disaster recovery, and robust infrastructure.

Virtualization Software Industry Industry Evolution

The Virtualization Software Industry has undergone a profound evolution, driven by continuous technological advancements and shifting consumer and enterprise demands. From its inception, virtualization has been a cornerstone of modern IT infrastructure, enabling unprecedented flexibility, efficiency, and cost savings. Initially focused on server consolidation and desktop virtualization to reduce hardware costs and simplify management, the industry has since expanded dramatically. The study period, 2019–2033, showcases this rapid growth. In the historical period (2019–2024), we observed a significant surge in cloud-native virtualization, with platforms like VMware and Red Hat leading the charge in containerization and Kubernetes orchestration. This shift was propelled by the growing need for agile application development and deployment, enabling businesses to scale resources dynamically based on demand. The estimated year (2025) signifies a mature market where hybrid and multi-cloud strategies are standard, with a strong emphasis on software-defined everything (SDE) architectures. For example, the adoption rate of Network Virtualization, particularly Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), has seen a compound annual growth rate (CAGR) of approximately 15-18% in the preceding years, driven by the need for more agile and programmable network infrastructures. Application virtualization has also matured, moving beyond simple application streaming to more complex containerization models powered by technologies like Docker and Kubernetes, which boast adoption rates exceeding 60% in enterprise environments for modern application deployment. Hardware virtualization remains foundational, powering hypervisors that underpin most cloud and enterprise data centers, with over 90% of enterprise servers now virtualized. Mobile virtualization, while a smaller segment, is gaining traction with the rise of mobile device management (MDM) and the need to run applications across various mobile operating systems and form factors, showing a CAGR of approximately 10-12%. The forecast period (2025–2033) anticipates further integration of AI and machine learning into virtualization management for predictive maintenance, automated resource optimization, and enhanced security. Edge virtualization will emerge as a significant growth area, driven by the proliferation of IoT devices and the demand for localized processing and real-time data analysis. This evolution from basic server consolidation to sophisticated, AI-driven, and distributed virtualization architectures underscores the industry's dynamic nature and its indispensable role in enabling digital transformation across all sectors.

Leading Regions, Countries, or Segments in Virtualization Software Industry

North America currently stands as the dominant region in the Virtualization Software Industry, driven by its robust technological infrastructure, high adoption rates of advanced IT solutions, and significant presence of major technology players. The United States, in particular, is a powerhouse, fueled by substantial investments in cloud computing, enterprise software development, and cutting-edge research and development.

- Platform Dominance - PC Virtualization: North America leads in PC virtualization due to the widespread adoption of Virtual Desktop Infrastructure (VDI) solutions in enterprises for enhanced security, remote work enablement, and simplified IT management. Major companies like Microsoft and Citrix have a strong foothold in this segment, offering comprehensive VDI solutions that cater to diverse business needs.

- Segment Dominance - Application Virtualization: Application virtualization, particularly containerization technologies like Docker and Kubernetes, is experiencing explosive growth globally, but North America is at the forefront. The region's vibrant startup ecosystem and its concentration of large technology firms have accelerated the adoption of microservices architectures and cloud-native application development, where application virtualization is a critical enabler. Red Hat's OpenShift platform, for instance, sees significant traction here.

- Key Drivers in North America:

- High Cloud Adoption: Extensive use of public, private, and hybrid cloud environments necessitating advanced virtualization.

- Enterprise Investment: Significant IT spending by large enterprises on digital transformation initiatives.

- Innovation Hubs: Presence of major technology companies and research institutions fostering rapid innovation.

- Skilled Workforce: Availability of a highly skilled workforce in cloud computing and virtualization technologies.

- Regulatory Support: Generally supportive regulatory environment for technology development and data management.

Europe follows closely, with Western European countries like Germany, the UK, and France showing strong demand for virtualization solutions, particularly in sectors like finance and manufacturing. Asia Pacific is an emerging market with rapid growth driven by countries like China and India, where digital transformation initiatives are accelerating, and the adoption of cloud services is on an upward trajectory. The demand for Network Virtualization and Hardware Virtualization is consistent across all leading regions, as these form the fundamental layers of modern IT infrastructure. However, the rate of adoption and the specific focus on different types of virtualization, such as Mobile Virtualization versus PC Virtualization, can vary based on regional economic development, mobile penetration rates, and specific industry needs.

Virtualization Software Industry Product Innovations

Product innovations in the Virtualization Software Industry are relentlessly pushing the boundaries of efficiency, security, and scalability. Key advancements include the integration of AI and machine learning for automated resource management, predictive analytics, and self-healing capabilities within virtualized environments. Enhanced security features, such as granular access controls, immutable infrastructure, and advanced threat detection, are becoming standard offerings, addressing growing cybersecurity concerns. Furthermore, the development of lightweight, cloud-native virtualization solutions, including advanced containerization platforms and serverless computing architectures, enables faster application deployment and greater resource optimization. Performance metrics like reduced latency, improved throughput, and increased virtual machine density are continuously being optimized. For example, newer hypervisors demonstrate up to 15% improvement in I/O performance compared to previous generations, and advanced application delivery controllers offer sub-millisecond response times. The focus is on delivering seamless, secure, and high-performance virtualized experiences across diverse environments, from on-premises data centers to the edge.

Propelling Factors for Virtualization Software Industry Growth

The Virtualization Software Industry is experiencing robust growth fueled by several key factors. The pervasive adoption of cloud computing is a primary driver, as virtualization forms the bedrock of public, private, and hybrid cloud infrastructures, enabling scalability and cost efficiency. The increasing demand for remote work and distributed workforce models necessitates virtual desktop infrastructure (VDI) and application virtualization for secure and seamless access to resources. Furthermore, the burgeoning Internet of Things (IoT) ecosystem requires efficient edge computing solutions, which heavily rely on lightweight virtualization technologies. The ongoing digital transformation initiatives across various industries, coupled with the need for enhanced data security and disaster recovery capabilities, also significantly propel market expansion. Lastly, the continuous innovation in hardware and software, leading to improved performance and reduced costs, makes virtualization an increasingly attractive proposition for businesses of all sizes.

- Cloud Computing Adoption: Essential for scalability, agility, and cost-effectiveness in cloud environments.

- Remote Work Trends: Drives demand for VDI and application virtualization solutions.

- IoT and Edge Computing: Requires efficient resource management at the edge.

- Digital Transformation: Enables modernization of IT infrastructure and business processes.

- Enhanced Security & DR: Provides robust solutions for data protection and business continuity.

Obstacles in the Virtualization Software Industry Market

Despite its immense growth, the Virtualization Software Industry faces several obstacles. Security concerns, particularly regarding data breaches within virtualized environments and the complexity of securing multi-cloud deployments, remain a significant hurdle. Integration complexity with legacy systems and ensuring seamless interoperability between different virtualization platforms can also be challenging for organizations. High initial investment costs for robust virtualization solutions, including hardware upgrades and skilled personnel, can be prohibitive for smaller businesses. Vendor lock-in is another concern, as organizations may become dependent on specific vendor ecosystems, limiting flexibility and potentially increasing long-term costs. Furthermore, performance overhead associated with hypervisors, although continuously minimized, can still be a consideration for highly resource-intensive applications. The shortage of skilled professionals in virtualization management and cloud technologies also presents a challenge for widespread adoption and effective implementation.

- Security Vulnerabilities: Evolving threats and complexities in securing virtualized environments.

- Integration Challenges: Difficulty in seamlessly integrating with existing legacy IT infrastructure.

- Initial Investment Costs: Substantial upfront expenditure for hardware, software, and expertise.

- Vendor Lock-in: Dependency on specific vendor solutions, limiting future flexibility.

- Performance Overhead: Resource consumption by hypervisors for certain demanding applications.

- Talent Shortage: Limited availability of skilled professionals for virtualization management.

Future Opportunities in Virtualization Software Industry

The Virtualization Software Industry is poised for significant future opportunities. The exponential growth of edge computing, driven by the Internet of Things (IoT) and the demand for real-time data processing, will necessitate innovative edge virtualization solutions. AI-powered automation in virtualization management, including self-optimizing resources and predictive maintenance, will unlock new levels of efficiency and cost savings. The expansion of containerization and Kubernetes orchestration for cloud-native applications presents a vast market for advanced platforms and services. Furthermore, the increasing adoption of augmented reality (AR) and virtual reality (VR) technologies for immersive work and entertainment experiences will create new avenues for specialized virtualization solutions, particularly in mobile and PC virtualization. The growing emphasis on sustainability and energy efficiency in data centers will also drive demand for virtualization solutions that optimize power consumption.

- Edge Computing Expansion: Demand for lightweight and efficient edge virtualization.

- AI-Driven Automation: Opportunities for intelligent resource management and self-healing.

- Container Orchestration: Growth in platforms and services for containerized applications.

- AR/VR Integration: Development of specialized virtualization for immersive experiences.

- Sustainability Focus: Solutions that enhance energy efficiency in data centers.

Major Players in the Virtualization Software Industry Ecosystem

- Parallels International GmbH

- Google LLC

- Nutanix Inc

- Amazon Inc

- Datadog Inc

- Microsoft Corporation

- TenAsys Corporation

- NComupting Co Ltd

- Red Hat Inc (IBM Corporation)

- Lynx Software Technologies

- Huawei Technologies Co Ltd

- Oracle Corporation

- VMware Inc

- Citrix Systems Inc

Key Developments in Virtualization Software Industry Industry

- October 2022: Microsoft and Meta collaborated to create immersive experiences for the future of work and play. As announced during Meta Connect 2022, the collaboration enabled to bring Mesh for Microsoft Teams to Meta Quest devices. It will help people gather virtually where work happens on any device such as smartphones, laptops, and mixed-reality headsets. Mesh for Teams with Meta Quest Pro and Meta Quest 2 devices will enable people to connect and collaborate as if they are together in person.

- August 2022: NetApp and VMware Strengthen Global Partnership to assist customers in multicloud modernization. VMware Cloud Foundation with Tanzu enables IT to manage virtual machines (VMs) and container orchestration from a single unified platform. VMware Tanzu and VMware Cloud Foundation enable the utilization of NetApp ONTAP-based storage arrays, allowing users to build up a flexible data fabric for classic VMs and modern, containerized applications.

Strategic Virtualization Software Industry Market Forecast

The Virtualization Software Industry is projected for sustained and robust growth, driven by its indispensable role in enabling digital transformation and modern IT infrastructure. Key growth catalysts include the ongoing expansion of cloud computing, the increasing prevalence of remote work, and the proliferation of IoT devices demanding edge computing capabilities. Advancements in AI and machine learning are expected to further enhance the efficiency and automation of virtualized environments. The industry's ability to deliver cost savings, scalability, and enhanced security will continue to make it a strategic imperative for businesses worldwide. Future market potential lies in the development of specialized solutions for emerging technologies like AR/VR and the increasing focus on energy-efficient data center operations. This strategic positioning ensures a dynamic and promising future for the virtualization software market.

Virtualization Software Industry Segmentation

-

1. Platform

- 1.1. PC Virtualization

- 1.2. Mobile Virtualization

-

2. Type

- 2.1. Application Virtualization

- 2.2. Network Virtualization

- 2.3. Hardware Virtualization

- 2.4. Other Types

Virtualization Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Virtualization Software Industry Regional Market Share

Geographic Coverage of Virtualization Software Industry

Virtualization Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Reductions due to Reduced Hardware Spending; Improved IT Efficiency due to Virtualization

- 3.3. Market Restrains

- 3.3.1. High Initial Investment During the Deployment in the Infrastructure

- 3.4. Market Trends

- 3.4.1. PC/ Desktop Virtualization is expected to hold Major Market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtualization Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. PC Virtualization

- 5.1.2. Mobile Virtualization

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Application Virtualization

- 5.2.2. Network Virtualization

- 5.2.3. Hardware Virtualization

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Virtualization Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. PC Virtualization

- 6.1.2. Mobile Virtualization

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Application Virtualization

- 6.2.2. Network Virtualization

- 6.2.3. Hardware Virtualization

- 6.2.4. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe Virtualization Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. PC Virtualization

- 7.1.2. Mobile Virtualization

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Application Virtualization

- 7.2.2. Network Virtualization

- 7.2.3. Hardware Virtualization

- 7.2.4. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Virtualization Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. PC Virtualization

- 8.1.2. Mobile Virtualization

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Application Virtualization

- 8.2.2. Network Virtualization

- 8.2.3. Hardware Virtualization

- 8.2.4. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Australia and New Zealand Virtualization Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. PC Virtualization

- 9.1.2. Mobile Virtualization

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Application Virtualization

- 9.2.2. Network Virtualization

- 9.2.3. Hardware Virtualization

- 9.2.4. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Latin America Virtualization Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. PC Virtualization

- 10.1.2. Mobile Virtualization

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Application Virtualization

- 10.2.2. Network Virtualization

- 10.2.3. Hardware Virtualization

- 10.2.4. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Middle East and Africa Virtualization Software Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 11.1.1. PC Virtualization

- 11.1.2. Mobile Virtualization

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Application Virtualization

- 11.2.2. Network Virtualization

- 11.2.3. Hardware Virtualization

- 11.2.4. Other Types

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Parallels International GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Google LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Nutanix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Amazon Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Datadog Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 TenAsys Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NComupting Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Red Hat Inc (IBM Corporation)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Lynx Software Technologies*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Huawei Technologies Co Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Oracle Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 VMware Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Citrix Systems Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Parallels International GmbH

List of Figures

- Figure 1: Global Virtualization Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Virtualization Software Industry Revenue (Million), by Platform 2025 & 2033

- Figure 3: North America Virtualization Software Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Virtualization Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Virtualization Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Virtualization Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Virtualization Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Virtualization Software Industry Revenue (Million), by Platform 2025 & 2033

- Figure 9: Europe Virtualization Software Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 10: Europe Virtualization Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Virtualization Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Virtualization Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Virtualization Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Virtualization Software Industry Revenue (Million), by Platform 2025 & 2033

- Figure 15: Asia Virtualization Software Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Asia Virtualization Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Virtualization Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Virtualization Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Virtualization Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Virtualization Software Industry Revenue (Million), by Platform 2025 & 2033

- Figure 21: Australia and New Zealand Virtualization Software Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Australia and New Zealand Virtualization Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: Australia and New Zealand Virtualization Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Australia and New Zealand Virtualization Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Virtualization Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Virtualization Software Industry Revenue (Million), by Platform 2025 & 2033

- Figure 27: Latin America Virtualization Software Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 28: Latin America Virtualization Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Virtualization Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Virtualization Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Virtualization Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Virtualization Software Industry Revenue (Million), by Platform 2025 & 2033

- Figure 33: Middle East and Africa Virtualization Software Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 34: Middle East and Africa Virtualization Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Virtualization Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Virtualization Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Virtualization Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Virtualization Software Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Global Virtualization Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Virtualization Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Virtualization Software Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: Global Virtualization Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Virtualization Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Virtualization Software Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Global Virtualization Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Virtualization Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Virtualization Software Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 11: Global Virtualization Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Virtualization Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Virtualization Software Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 14: Global Virtualization Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Virtualization Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Virtualization Software Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 17: Global Virtualization Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Virtualization Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Virtualization Software Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 20: Global Virtualization Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Virtualization Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtualization Software Industry?

The projected CAGR is approximately 9.47%.

2. Which companies are prominent players in the Virtualization Software Industry?

Key companies in the market include Parallels International GmbH, Google LLC, Nutanix Inc, Amazon Inc, Datadog Inc, Microsoft Corporation, TenAsys Corporation, NComupting Co Ltd, Red Hat Inc (IBM Corporation), Lynx Software Technologies*List Not Exhaustive, Huawei Technologies Co Ltd, Oracle Corporation, VMware Inc, Citrix Systems Inc.

3. What are the main segments of the Virtualization Software Industry?

The market segments include Platform, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 94.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Reductions due to Reduced Hardware Spending; Improved IT Efficiency due to Virtualization.

6. What are the notable trends driving market growth?

PC/ Desktop Virtualization is expected to hold Major Market share.

7. Are there any restraints impacting market growth?

High Initial Investment During the Deployment in the Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2022: Microsoft and Meta collaborated to create immersive experiences for the future of work and play. As announced during Meta Connect 2022, the collaboration enabled to bring Mesh for Microsoft Teams to Meta Quest devices. It will help people gather virtually where work happens on any device such as smartphones, laptops, and mixed-reality headsets. Mesh for Teams with Meta Quest Pro and Meta Quest 2 devices will enable people to connect and collaborate as if they are together in person.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtualization Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtualization Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtualization Software Industry?

To stay informed about further developments, trends, and reports in the Virtualization Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence