Key Insights

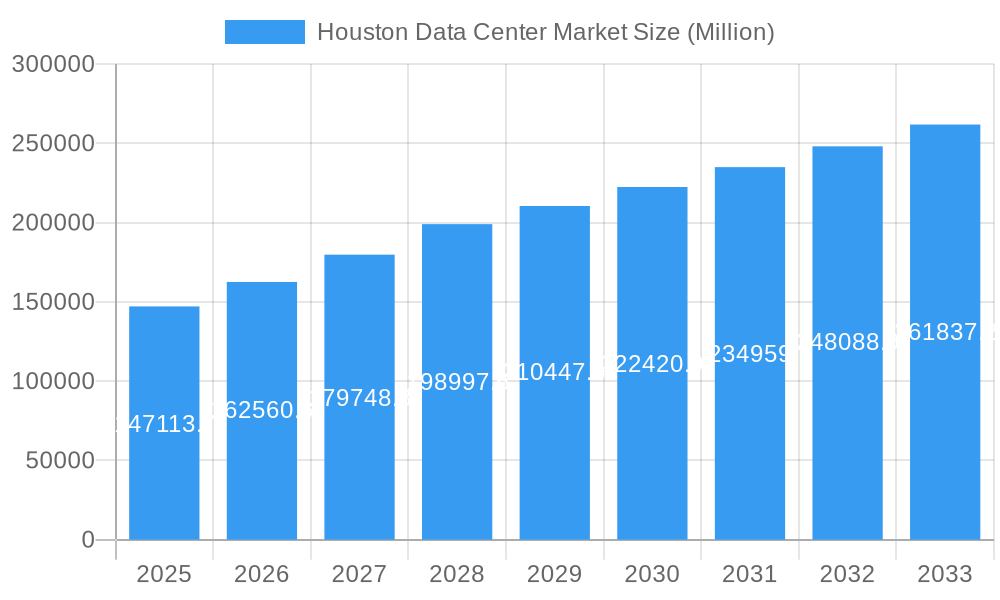

The Houston Data Center Market is poised for substantial expansion, projected to reach an impressive $147,113.7 million in 2025. This robust growth is fueled by a compelling 10.5% CAGR, indicating a dynamic and rapidly evolving landscape. The market's expansion is primarily driven by the escalating demand for digital infrastructure to support cloud computing adoption, the burgeoning telecom sector, and the increasing digitalization across industries like BFSI, manufacturing, and e-commerce. The proliferation of edge computing and the strategic importance of Houston as a major energy and technology hub further bolster these growth drivers. As businesses increasingly rely on robust and scalable data storage and processing capabilities, the demand for advanced data center solutions, including hyperscale, retail colocation, and wholesale deployments, will continue to surge. This sustained demand is creating significant opportunities for market players and fostering innovation in data center design, efficiency, and connectivity.

Houston Data Center Market Market Size (In Billion)

The Houston Data Center Market is characterized by a diverse range of segments, catering to varying needs from small deployments to massive hyperscale facilities. The absorption of capacity is particularly strong in utilized segments, with retail and wholesale colocation types seeing significant uptake from cloud providers, telecom operators, and enterprises across key sectors such as media & entertainment, government, and BFSI. While non-utilized capacity exists, the strong 10.5% CAGR suggests a healthy absorption rate and a continuous need for new capacity. Key players like Equinix Inc., Digital Realty Trust Inc., and EdgeConneX Inc. are actively investing and expanding their presence, recognizing Houston's strategic significance. Emerging trends like sustainability, advanced cooling technologies, and increased focus on data security are shaping the market, while potential restraints such as rising construction costs and skilled labor shortages need to be proactively managed to ensure continued market health.

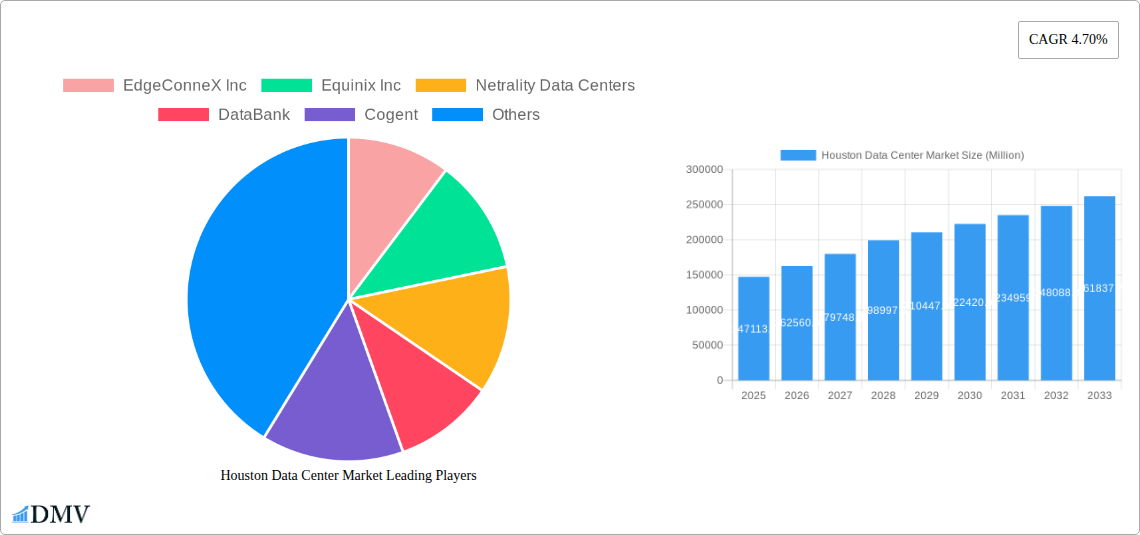

Houston Data Center Market Company Market Share

This in-depth report provides a definitive analysis of the Houston Data Center Market, exploring its current composition, historical trajectory, and future projections through 2033. Leveraging a wealth of data, this report dissects key market dynamics, including infrastructure development, colocation trends, end-user absorption, and the strategic initiatives of leading industry players like EdgeConneX Inc, Equinix Inc, Netrality Data Centers, DataBank, Cogent, Digital Realty Trust Inc, and Stream Data Centers. Understand the intricate interplay of market forces, technological advancements, and investment landscapes shaping the future of data center capacity in Houston.

Houston Data Center Market Market Composition & Trends

The Houston Data Center Market is characterized by a dynamic blend of established players and emerging providers, driving innovation and catering to a diverse range of end-user demands. Market concentration is steadily increasing as major operators expand their footprint to meet the burgeoning need for digital infrastructure. Innovation catalysts are primarily driven by the demand for higher power densities, advanced cooling solutions, and enhanced security protocols, particularly from hyperscale and enterprise clients. The regulatory landscape, while generally supportive of infrastructure development, requires adherence to environmental and utility regulations. Substitute products primarily revolve around on-premises infrastructure, though the scalability and cost-effectiveness of colocation are increasingly favored. End-user profiles are highly varied, spanning Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, and E-Commerce sectors. Mergers and acquisitions (M&A) activities are a significant trend, with deal values projected to see substantial growth as companies consolidate to achieve economies of scale and expand market reach. The market share distribution is influenced by the deployment of large-scale hyperscale facilities alongside a growing demand for retail and wholesale colocation services. This evolving composition signifies a maturing market poised for significant expansion.

Houston Data Center Market Industry Evolution

The Houston Data Center Market has undergone a significant transformation, evolving from a nascent colocation hub to a critical node in the digital economy. The Historical Period (2019–2024) witnessed consistent growth, fueled by increasing enterprise adoption of cloud computing and the expansion of the digital media landscape. Average growth rates during this period hovered around 8-10% annually, driven by investments in new builds and expansions to accommodate rising data storage and processing needs. Technological advancements have been a constant driver, with the introduction of more efficient cooling systems, higher density rack capabilities, and enhanced network interconnectivity. The shift towards hybrid and multi-cloud strategies among enterprises has further amplified demand for flexible and scalable data center solutions.

The Base Year (2025) marks a pivotal point, with a projected market valuation of approximately $5,000 million. The Forecast Period (2025–2033) is anticipated to see accelerated growth, with an estimated compound annual growth rate (CAGR) of 12-15%. This surge is attributed to several key factors: the burgeoning demand from AI and machine learning workloads, the continued expansion of 5G networks requiring edge computing solutions, and the increasing digitization of traditional industries like manufacturing and healthcare. Furthermore, the growing importance of data sovereignty and localized data processing will necessitate further investment in Houston’s resilient infrastructure. Adoption metrics for hyperscale colocation are expected to rise sharply, surpassing retail and wholesale segments in terms of capacity deployment. The market's evolution is intrinsically linked to its ability to attract significant capital investment, foster technological innovation, and adapt to the ever-changing demands of the digital-first economy, with Estimated Year (2025) figures reflecting this robust upward trajectory.

Leading Regions, Countries, or Segments in Houston Data Center Market

Within the expansive Houston Data Center Market, the Massive and Mega DC Size segments are emerging as dominant forces, driven by the insatiable demand from hyperscale cloud providers and large enterprises. These colossal facilities, often exceeding 500,000 square feet, are at the forefront of accommodating the massive data processing and storage requirements of modern digital operations.

DC Size Dominance:

- Massive & Mega: These segments are experiencing the highest growth rates due to the concentration of hyperscale cloud providers and large-scale enterprise deployments. Their ability to offer vast power and cooling infrastructure is crucial.

- Large: Continues to be a significant segment, catering to medium-to-large enterprises seeking substantial dedicated space and customized solutions.

Tier Type Dominance:

- Tier 3: This is the most prevalent and sought-after tier type, offering a balance of reliability, redundancy, and availability essential for most business-critical applications. The ongoing expansion by Element Critical, featuring a Tier III data center with advanced power redundancy, exemplifies this trend.

- Tier 4: While representing a smaller portion of the current market, Tier 4 facilities are gaining traction for highly critical operations requiring the utmost uptime and fault tolerance, particularly within the government and BFSI sectors.

Absorption by Colocation Type:

- Hyperscale: This segment is the primary driver of new capacity absorption, with major cloud providers leasing vast footprints to support their global infrastructure.

- Wholesale: Continues to be robust, serving enterprises that require dedicated space but not the full commitment of a hyperscale build-out.

- Retail: While experiencing steady demand, it plays a secondary role compared to wholesale and hyperscale in terms of overall capacity absorption.

Absorption by End User:

- Cloud & IT: This remains the largest and fastest-growing end-user segment, directly benefiting from the expansion of cloud infrastructure and services.

- Telecom: With the rollout of 5G and increased network density, telecom companies are significant consumers of data center space for edge deployments and core network infrastructure.

- E-Commerce & Media & Entertainment: These sectors are experiencing exponential growth in data generation and consumption, necessitating increased data center capacity for content delivery, streaming, and online retail operations.

- BFSI & Government: These sectors are increasingly migrating critical workloads to secure, reliable data centers, driving demand for high-availability and compliant facilities.

The dominance of Massive and Mega DC sizes, coupled with the prevalence of Tier 3 facilities and the overwhelming absorption by hyperscale and Cloud & IT end-users, paints a clear picture of the Houston market's current trajectory. Investment trends are heavily skewed towards large-scale developments, supported by a stable regulatory environment and strategic utility partnerships.

Houston Data Center Market Product Innovations

The Houston Data Center Market is witnessing rapid product innovations focused on enhancing efficiency, sustainability, and performance. Liquid cooling technologies are gaining traction to manage the increasing power densities of modern IT equipment, offering superior heat dissipation compared to traditional air cooling. AI-driven infrastructure management solutions are being deployed to optimize power usage, predict maintenance needs, and enhance security. Furthermore, advancements in modular data center designs are enabling faster deployment and greater scalability. The integration of renewable energy sources and advanced energy storage systems are key innovation areas aimed at reducing the environmental footprint and ensuring reliable power supply, thereby improving performance metrics for uptime and operational efficiency.

Propelling Factors for Houston Data Center Market Growth

Several key factors are propelling the growth of the Houston Data Center Market. Technological advancements in AI, IoT, and 5G are generating unprecedented data volumes, requiring robust processing and storage capabilities. The economic imperative to support digital transformation across industries, from manufacturing to healthcare, is a significant driver. Houston's strategic location as a major energy hub provides access to abundant and relatively stable power, a critical component for data center operations. Favorable regulatory environments and government incentives for infrastructure development further bolster investment. The increasing demand for edge computing solutions to reduce latency for real-time applications also fuels localized data center expansion.

Obstacles in the Houston Data Center Market Market

Despite its robust growth, the Houston Data Center Market faces several obstacles. Supply chain disruptions for critical hardware and construction materials can lead to project delays and cost overruns. Rising energy costs, though historically manageable due to Houston's energy sector, present a persistent challenge for operational expenditure. Intense competition among established and new market entrants can pressure pricing and profit margins. Talent acquisition for specialized data center operations and maintenance roles is becoming increasingly difficult. Furthermore, evolving environmental regulations and the pressure to adopt more sustainable practices require continuous investment in greener technologies and infrastructure.

Future Opportunities in Houston Data Center Market

The Houston Data Center Market is ripe with future opportunities. The burgeoning demand for AI and machine learning infrastructure will drive the need for high-density, high-performance data centers. The continued expansion of the 5G network will spur the development of edge data centers for localized processing. Sustainability initiatives present a significant opportunity for providers offering green data center solutions and renewable energy integration. The growing healthcare and life sciences sectors in Houston require specialized, secure data storage and processing capabilities. Furthermore, the ongoing digital transformation of traditional industries creates opportunities for tailored colocation and managed services.

Major Players in the Houston Data Center Market Ecosystem

- EdgeConneX Inc

- Equinix Inc

- Netrality Data Centers

- DataBank

- Cogent

- Digital Realty Trust Inc

- Stream Data Centers

Key Developments in Houston Data Center Market Industry

- May 2022: Element Critical Completes Houston One Data Centre expansion to meet increasing demand for Texas Customizable Data Centre Space. The Tier III data center is next to a 300 MW loop-fed substation, offering a premium rollover service that automatically transfers power from two redundant substation transformers for optimal reliability. This development significantly bolsters the availability of high-quality, resilient data center capacity in the region, particularly for businesses requiring robust power infrastructure.

Strategic Houston Data Center Market Market Forecast

The strategic forecast for the Houston Data Center Market indicates sustained and accelerated growth through 2033. Driven by the relentless demand for digital infrastructure fueled by AI, 5G, and enterprise digital transformation, the market is poised for significant expansion. Investment will continue to flow into large-scale hyperscale facilities and strategically located edge data centers. The emphasis on sustainability and power efficiency will shape future development, presenting opportunities for innovative solutions. Houston’s established position as a critical data hub, coupled with its resilient energy infrastructure, positions it for continued leadership in the data center landscape.

Houston Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Houston Data Center Market Segmentation By Geography

- 1. Houston

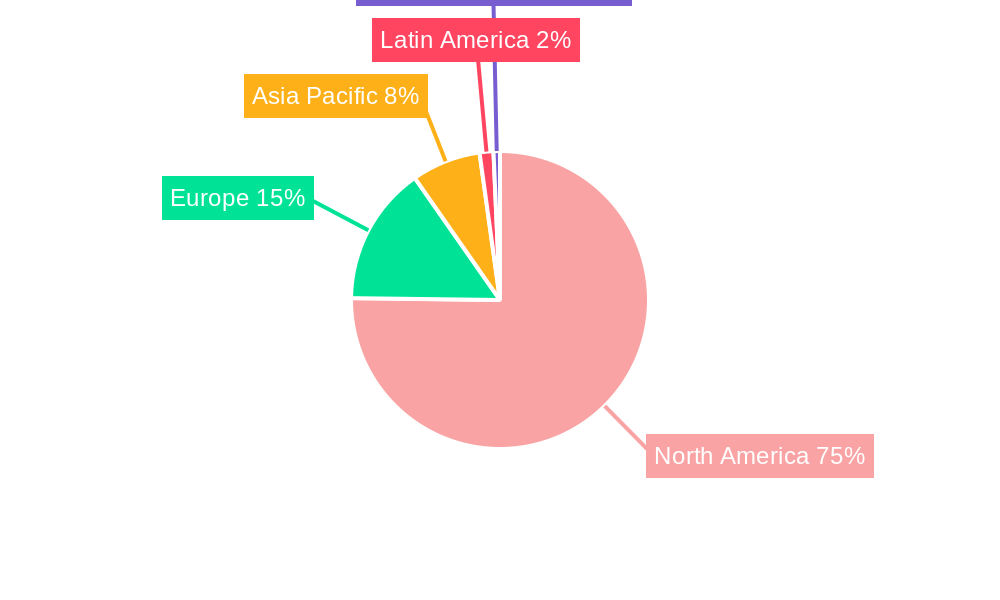

Houston Data Center Market Regional Market Share

Geographic Coverage of Houston Data Center Market

Houston Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. High Adoption Of Hyperscale Data Center

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Houston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Houston

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EdgeConneX Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equinix Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Netrality Data Centers

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DataBank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cogent

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Digital Realty Trust Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stream Data Centers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 EdgeConneX Inc

List of Figures

- Figure 1: Houston Data Center Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Houston Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Houston Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 2: Houston Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 3: Houston Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 4: Houston Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Houston Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 6: Houston Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 7: Houston Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Houston Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Houston Data Center Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the Houston Data Center Market?

Key companies in the market include EdgeConneX Inc, Equinix Inc, Netrality Data Centers, DataBank, Cogent, Digital Realty Trust Inc, Stream Data Centers.

3. What are the main segments of the Houston Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

High Adoption Of Hyperscale Data Center.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

May 2022: Element Critical Completes Houston One Data Centre expansion to meet increasing demand for Texas Customizable Data Centre Space. The Tier III data center is next to a 300 MW loop-fed substation. It offers a premium rollover service that automatically transfers power from two redundant substation transformers for optimal reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Houston Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Houston Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Houston Data Center Market?

To stay informed about further developments, trends, and reports in the Houston Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence