Key Insights

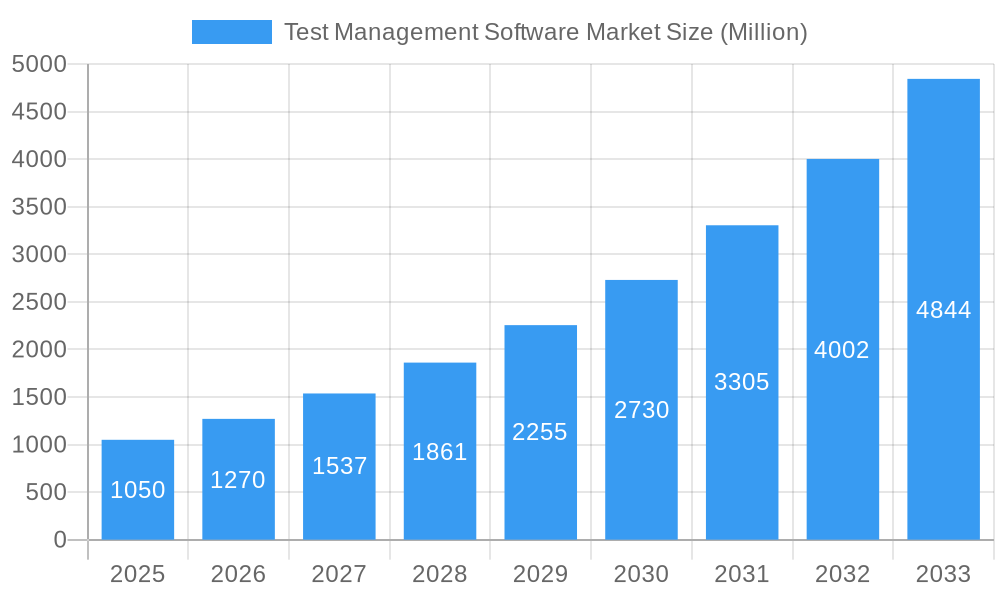

The global Test Management Software market is poised for significant expansion, with an estimated market size of 1.05 Billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 20.80% through 2033. This dynamic growth is fueled by an increasing emphasis on software quality and reliability across diverse industries. Key drivers include the rising complexity of software applications, the growing adoption of agile and DevOps methodologies, and the escalating demand for efficient defect management and test execution. The Software segment is expected to lead the market, supported by continuous innovation in features and functionalities. Services, including consulting and implementation, will also play a crucial role in facilitating widespread adoption and maximizing the value of these solutions.

Test Management Software Market Market Size (In Billion)

The market is segmented by organization size into Small & Medium Enterprises (SMEs) and Large Enterprises, both of which are demonstrating strong adoption. Cloud-based deployment models are gaining considerable traction due to their scalability, cost-effectiveness, and accessibility, while On-Premise solutions continue to be relevant for organizations with stringent data security requirements. The BFSI, IT and Telecommunication, and Retail sectors are identified as key end-user industries, driven by the critical need for flawless software in their operations. Emerging trends such as the integration of AI and machine learning for test automation and predictive analytics are further shaping the market landscape. Restraints, such as the initial cost of implementation and the need for skilled personnel, are being addressed through evolving service models and vendor support. Major players like Atlassian Corporation Inc., Microsoft Corporation, and Asana Inc. are actively innovating and expanding their offerings to capture this burgeoning market.

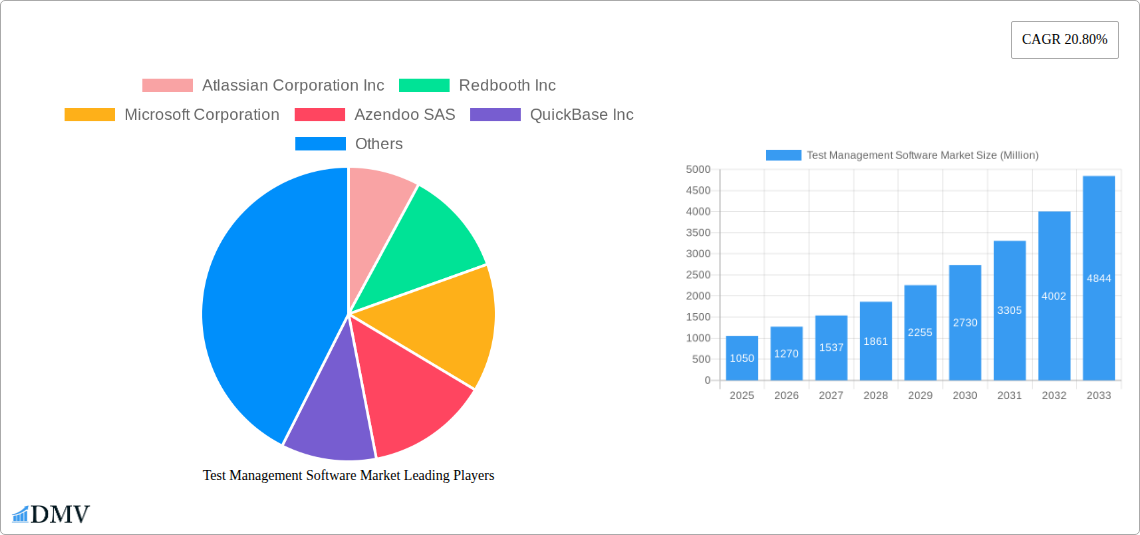

Test Management Software Market Company Market Share

This in-depth report provides an unparalleled analysis of the Test Management Software market, meticulously examining its evolution, key drivers, emerging trends, and future trajectory. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period extending to 2033, this report equips stakeholders with critical insights for strategic decision-making. We delve into the intricate dynamics of this rapidly expanding sector, offering granular segmentation by Components (Software, Services), Organization Size (Small & Medium Enterprises, Large Enterprises), Deployment Mode (Cloud, On-Premise), and End-User Industry (BFSI, IT and Telecommunication, Retail, Manufacturing, Travel and Tourism, Other End-user Industries). Discover how leading players like Atlassian Corporation Inc, Microsoft Corporation, and Asana Inc are shaping the landscape of test management solutions, quality assurance software, and application lifecycle management.

Test Management Software Market Market Composition & Trends

The Test Management Software market is characterized by a dynamic composition and evolving trends, driven by the imperative for enhanced software quality and accelerated development cycles. Market concentration is influenced by the presence of established global technology giants and a growing cohort of specialized vendors, each vying for market share through innovation and strategic partnerships. Key innovation catalysts include the rise of Agile and DevOps methodologies, demanding more integrated and automated testing processes. The regulatory landscape, particularly within the BFSI and Healthcare sectors, mandates stringent quality standards, further propelling the adoption of robust test management tools. Substitute products, while present in the form of manual testing or rudimentary spreadsheets, are increasingly becoming obsolete due to their inability to scale with modern software development complexities. End-user profiles range from agile startups to large enterprises, each with unique requirements for test planning, test execution, and defect tracking. Mergers and acquisitions (M&A) activities are significant, with notable deal values shaping market consolidation. For instance, M&A activities in the quality management software space are projected to reach an estimated USD 15,000 Million by 2025, indicating strong strategic interest. Understanding the market share distribution, currently estimated to be around 25% for the top 5 players, is crucial for competitive analysis.

Test Management Software Market Industry Evolution

The Test Management Software market has undergone a transformative evolution, mirroring the broader shifts in the software development lifecycle. From its nascent stages of basic test case management, the industry has progressively embraced sophisticated solutions offering end-to-end quality assurance management. The study period 2019–2024 witnessed a steady upward trajectory in market adoption, fueled by an increasing awareness of the critical role of quality in delivering successful software products. Technological advancements have been the bedrock of this evolution. The advent of cloud computing has democratized access to powerful test management platforms, enabling Small & Medium Enterprises (SMEs) to leverage enterprise-grade solutions at reduced costs. This has led to an estimated 18% compound annual growth rate (CAGR) in cloud-based test management solutions during the historical period. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is now revolutionizing the market, enabling predictive defect analysis, automated test script generation, and intelligent test optimization. Adoption metrics for AI-powered testing tools are projected to reach 40% by 2027, indicating a significant shift towards intelligent automation. Shifting consumer demands, driven by the need for faster time-to-market and superior user experiences, have further amplified the importance of efficient test management. The demand for seamless integration with CI/CD pipelines has become a standard requirement, pushing vendors to offer comprehensive application lifecycle management (ALM) capabilities. This has resulted in an estimated market growth from USD 3,000 Million in 2019 to USD 6,500 Million by 2024, showcasing robust expansion. The market is expected to continue its impressive growth, with an estimated CAGR of 15% projected for the forecast period.

Leading Regions, Countries, or Segments in Test Management Software Market

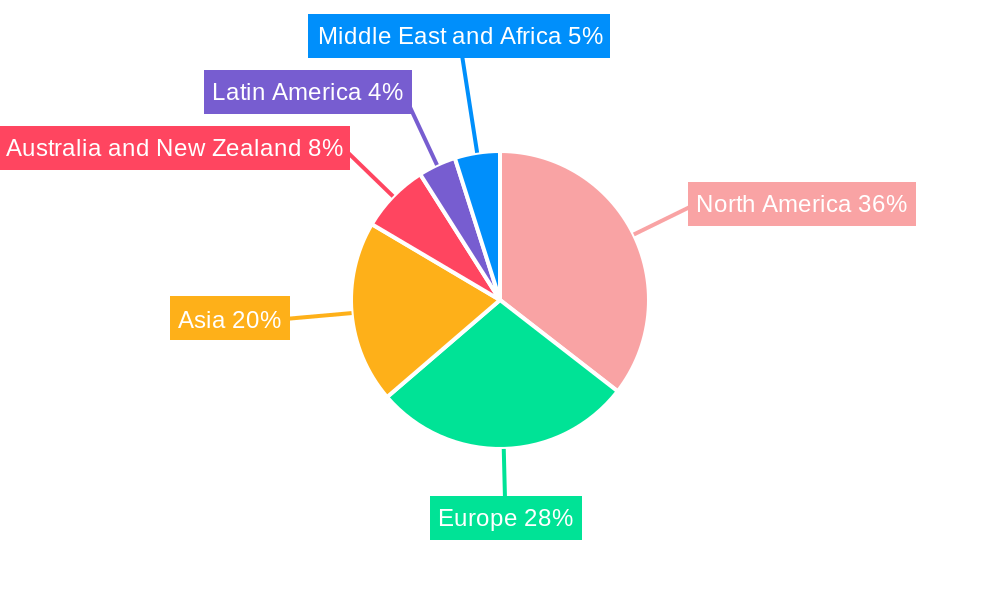

The Test Management Software market exhibits distinct regional dominance and segment preferences, driven by varying levels of technological adoption, economic development, and regulatory frameworks.

Dominant Segment: IT and Telecommunication Industry This sector consistently emerges as the leading end-user industry, accounting for an estimated 35% of the global test management software market share. The rapid pace of innovation, constant software updates, and the critical nature of their services necessitate rigorous quality assurance and efficient test management. The increasing complexity of telecommunication networks and the widespread adoption of cloud-based services further amplify the demand for sophisticated test management solutions.

Dominant Deployment Mode: Cloud The Cloud deployment mode has witnessed remarkable growth and currently holds the largest market share, projected to reach 65% by 2025. This dominance is attributed to its inherent scalability, cost-effectiveness, and ease of implementation, making it an attractive option for both Small & Medium Enterprises and large organizations. Cloud-based test management platforms offer seamless access and collaboration, crucial for distributed teams.

Dominant Region: North America North America, particularly the United States, leads the global Test Management Software market, driven by a strong presence of technology giants, a mature IT infrastructure, and a significant investment in research and development. The region's early adoption of Agile and DevOps practices, coupled with a robust regulatory environment demanding high software quality, further solidifies its leadership. The market in this region is estimated to be worth USD 2,500 Million in 2025.

Key Drivers within Segments:

- IT and Telecommunication: Escalating demand for network reliability, rapid development cycles for new applications and services, and the proliferation of IoT devices.

- Cloud Deployment: Reduced infrastructure costs, enhanced accessibility, automatic updates, and improved collaboration for geographically dispersed teams.

- North America: Proactive adoption of cutting-edge technologies, significant R&D investments by major tech players, and stringent quality mandates in regulated industries.

- Software Component: The core functionality of test case creation, execution, defect tracking, and reporting remains the primary driver for software component adoption.

- Large Enterprises: The need for scalable, comprehensive solutions to manage complex projects and a large number of testers.

Test Management Software Market Product Innovations

Product innovations in the Test Management Software market are revolutionizing how software quality is assured. Vendors are increasingly integrating AI and ML capabilities to automate repetitive tasks, predict defects, and optimize test coverage, leading to more efficient and effective testing cycles. Unique selling propositions now include advanced analytics dashboards, real-time reporting, and seamless integration with development tools like JIRA and Azure DevOps. For instance, the introduction of AI-driven test case generation is reducing manual effort by an estimated 30%, while predictive analytics are improving defect detection rates by 20%. Performance metrics are being redefined by faster execution times and reduced bug leakage into production environments, with some platforms achieving an 80% reduction in critical bugs.

Propelling Factors for Test Management Software Market Growth

Several key factors are propelling the growth of the Test Management Software market. The increasing complexity of software applications, driven by the proliferation of mobile, web, and IoT technologies, necessitates robust quality assurance processes. The widespread adoption of Agile and DevOps methodologies, emphasizing continuous integration and continuous delivery (CI/CD), has created a strong demand for integrated test management tools that can streamline workflows and accelerate release cycles. Furthermore, stringent regulatory compliance requirements across various industries, particularly BFSI and healthcare, mandate high levels of software reliability and security, driving the adoption of comprehensive test management solutions. The growing awareness of the cost implications of software defects, both in terms of remediation and reputational damage, is also a significant growth catalyst.

Obstacles in the Test Management Software Market Market

Despite its robust growth, the Test Management Software market faces several obstacles. The high initial investment required for comprehensive test management suites, particularly for advanced features like AI integration, can be a deterrent for Small & Medium Enterprises. A significant barrier is the shortage of skilled testing professionals capable of effectively utilizing and managing these sophisticated tools. Furthermore, the complexity of integrating new test management solutions with existing legacy systems can pose significant challenges for organizations, leading to implementation delays and increased costs. Intense competition among vendors also puts pressure on pricing, potentially impacting profitability for some players.

Future Opportunities in Test Management Software Market

The Test Management Software market is poised for significant future opportunities. The continued rise of AI and ML presents a vast opportunity for developing even smarter testing solutions, including predictive quality analysis and automated test script optimization. The growing adoption of low-code/no-code development platforms will create a demand for user-friendly test management tools that can be easily utilized by citizen developers. Expansion into emerging markets, particularly in Asia-Pacific and Latin America, where digital transformation is accelerating, offers substantial growth potential. The increasing focus on security testing and performance testing as integral parts of the overall testing process also presents opportunities for specialized and integrated solutions.

Major Players in the Test Management Software Market Ecosystem

- Atlassian Corporation Inc

- Redbooth Inc

- Microsoft Corporation

- Azendoo SAS

- QuickBase Inc

- Workfront Inc

- RingCentral Inc

- Asana Inc

- Pivotal Software Inc

- Upland Software Inc

Key Developments in Test Management Software Market Industry

- May 2023: Project management software provider Monday.com Ltd. announced the release of a new product that centralizes software development tracking in one location for easier collaboration between developers, engineers, and administrators. A work operating system or Work OS, offered by Monday.com, enables businesses to immediately start developing their work management and collaboration solutions. Using standard workflow and communication tools, it enables them to facilitate project management among various employees and teams.

- June 2022: Lytho, the brand and creative operations platform, launched its Creative Workflow Software in Europe. Creative Workflows assist creatives in bringing order and efficiency to the creative life cycle, from project management to the approval and creative briefs process and reporting of creative activities.

Strategic Test Management Software Market Market Forecast

The Test Management Software market is set for sustained, robust growth in the coming years. The strategic forecast indicates a significant expansion driven by the increasing adoption of AI and ML for intelligent automation in testing. The ongoing digital transformation across industries and the persistent demand for high-quality, secure software applications will continue to fuel the need for comprehensive test management solutions. Furthermore, the shift towards cloud-based platforms and the growing embrace of Agile and DevOps practices will further accelerate market penetration. Emerging markets represent a significant untapped potential, promising substantial revenue growth. The market is projected to reach an estimated USD 15,000 Million by 2033, with a compound annual growth rate (CAGR) of approximately 15% during the forecast period.

Test Management Software Market Segmentation

-

1. Components

- 1.1. Software

- 1.2. Services

-

2. Organization Size

- 2.1. Small & Medium Enterprises

- 2.2. Large Enterprises

-

3. Deployment Mode

- 3.1. Cloud

- 3.2. On-Premise

-

4. End-User Industry

- 4.1. BFSI

- 4.2. IT and Telecommunication

- 4.3. Retail

- 4.4. Manufacturing

- 4.5. Travel and Tourism

- 4.6. Other End-user Industries

Test Management Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Test Management Software Market Regional Market Share

Geographic Coverage of Test Management Software Market

Test Management Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Adoption of Cloud-Based Solution for Task Management by SMEs; Increasing Integration of Task Management Software with Third-Party Tools and Technological Adavncement in Areas of AI and ML

- 3.3. Market Restrains

- 3.3.1. Increasing Security and Privacy Concerns Among Enterprises

- 3.4. Market Trends

- 3.4.1. Rise in the Travel and Transportation are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Test Management Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Components

- 5.1.1. Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small & Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.3.1. Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by End-User Industry

- 5.4.1. BFSI

- 5.4.2. IT and Telecommunication

- 5.4.3. Retail

- 5.4.4. Manufacturing

- 5.4.5. Travel and Tourism

- 5.4.6. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Components

- 6. North America Test Management Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Components

- 6.1.1. Software

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small & Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.3.1. Cloud

- 6.3.2. On-Premise

- 6.4. Market Analysis, Insights and Forecast - by End-User Industry

- 6.4.1. BFSI

- 6.4.2. IT and Telecommunication

- 6.4.3. Retail

- 6.4.4. Manufacturing

- 6.4.5. Travel and Tourism

- 6.4.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Components

- 7. Europe Test Management Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Components

- 7.1.1. Software

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small & Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.3.1. Cloud

- 7.3.2. On-Premise

- 7.4. Market Analysis, Insights and Forecast - by End-User Industry

- 7.4.1. BFSI

- 7.4.2. IT and Telecommunication

- 7.4.3. Retail

- 7.4.4. Manufacturing

- 7.4.5. Travel and Tourism

- 7.4.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Components

- 8. Asia Test Management Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Components

- 8.1.1. Software

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small & Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.3.1. Cloud

- 8.3.2. On-Premise

- 8.4. Market Analysis, Insights and Forecast - by End-User Industry

- 8.4.1. BFSI

- 8.4.2. IT and Telecommunication

- 8.4.3. Retail

- 8.4.4. Manufacturing

- 8.4.5. Travel and Tourism

- 8.4.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Components

- 9. Australia and New Zealand Test Management Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Components

- 9.1.1. Software

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small & Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.3.1. Cloud

- 9.3.2. On-Premise

- 9.4. Market Analysis, Insights and Forecast - by End-User Industry

- 9.4.1. BFSI

- 9.4.2. IT and Telecommunication

- 9.4.3. Retail

- 9.4.4. Manufacturing

- 9.4.5. Travel and Tourism

- 9.4.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Components

- 10. Latin America Test Management Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Components

- 10.1.1. Software

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Small & Medium Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.3.1. Cloud

- 10.3.2. On-Premise

- 10.4. Market Analysis, Insights and Forecast - by End-User Industry

- 10.4.1. BFSI

- 10.4.2. IT and Telecommunication

- 10.4.3. Retail

- 10.4.4. Manufacturing

- 10.4.5. Travel and Tourism

- 10.4.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Components

- 11. Middle East and Africa Test Management Software Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Components

- 11.1.1. Software

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Organization Size

- 11.2.1. Small & Medium Enterprises

- 11.2.2. Large Enterprises

- 11.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 11.3.1. Cloud

- 11.3.2. On-Premise

- 11.4. Market Analysis, Insights and Forecast - by End-User Industry

- 11.4.1. BFSI

- 11.4.2. IT and Telecommunication

- 11.4.3. Retail

- 11.4.4. Manufacturing

- 11.4.5. Travel and Tourism

- 11.4.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Components

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Atlassian Corporation Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Redbooth Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Microsoft Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Azendoo SAS

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 QuickBase Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Workfront Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 RingCentral Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Asana Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Pivotal Software Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Upland Software Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Atlassian Corporation Inc

List of Figures

- Figure 1: Global Test Management Software Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Test Management Software Market Revenue (Million), by Components 2025 & 2033

- Figure 3: North America Test Management Software Market Revenue Share (%), by Components 2025 & 2033

- Figure 4: North America Test Management Software Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America Test Management Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Test Management Software Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 7: North America Test Management Software Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 8: North America Test Management Software Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 9: North America Test Management Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 10: North America Test Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Test Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Test Management Software Market Revenue (Million), by Components 2025 & 2033

- Figure 13: Europe Test Management Software Market Revenue Share (%), by Components 2025 & 2033

- Figure 14: Europe Test Management Software Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 15: Europe Test Management Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 16: Europe Test Management Software Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 17: Europe Test Management Software Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 18: Europe Test Management Software Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 19: Europe Test Management Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 20: Europe Test Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Test Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Test Management Software Market Revenue (Million), by Components 2025 & 2033

- Figure 23: Asia Test Management Software Market Revenue Share (%), by Components 2025 & 2033

- Figure 24: Asia Test Management Software Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 25: Asia Test Management Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 26: Asia Test Management Software Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 27: Asia Test Management Software Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 28: Asia Test Management Software Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Asia Test Management Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Asia Test Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Test Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Test Management Software Market Revenue (Million), by Components 2025 & 2033

- Figure 33: Australia and New Zealand Test Management Software Market Revenue Share (%), by Components 2025 & 2033

- Figure 34: Australia and New Zealand Test Management Software Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 35: Australia and New Zealand Test Management Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 36: Australia and New Zealand Test Management Software Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 37: Australia and New Zealand Test Management Software Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 38: Australia and New Zealand Test Management Software Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Australia and New Zealand Test Management Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Australia and New Zealand Test Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Australia and New Zealand Test Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Test Management Software Market Revenue (Million), by Components 2025 & 2033

- Figure 43: Latin America Test Management Software Market Revenue Share (%), by Components 2025 & 2033

- Figure 44: Latin America Test Management Software Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 45: Latin America Test Management Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 46: Latin America Test Management Software Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 47: Latin America Test Management Software Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 48: Latin America Test Management Software Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 49: Latin America Test Management Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 50: Latin America Test Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Latin America Test Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Middle East and Africa Test Management Software Market Revenue (Million), by Components 2025 & 2033

- Figure 53: Middle East and Africa Test Management Software Market Revenue Share (%), by Components 2025 & 2033

- Figure 54: Middle East and Africa Test Management Software Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 55: Middle East and Africa Test Management Software Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 56: Middle East and Africa Test Management Software Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 57: Middle East and Africa Test Management Software Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 58: Middle East and Africa Test Management Software Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 59: Middle East and Africa Test Management Software Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 60: Middle East and Africa Test Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Test Management Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Test Management Software Market Revenue Million Forecast, by Components 2020 & 2033

- Table 2: Global Test Management Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global Test Management Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 4: Global Test Management Software Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 5: Global Test Management Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Test Management Software Market Revenue Million Forecast, by Components 2020 & 2033

- Table 7: Global Test Management Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 8: Global Test Management Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 9: Global Test Management Software Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Global Test Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Test Management Software Market Revenue Million Forecast, by Components 2020 & 2033

- Table 12: Global Test Management Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 13: Global Test Management Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 14: Global Test Management Software Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Test Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Test Management Software Market Revenue Million Forecast, by Components 2020 & 2033

- Table 17: Global Test Management Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 18: Global Test Management Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 19: Global Test Management Software Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Test Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Test Management Software Market Revenue Million Forecast, by Components 2020 & 2033

- Table 22: Global Test Management Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 23: Global Test Management Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 24: Global Test Management Software Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 25: Global Test Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Test Management Software Market Revenue Million Forecast, by Components 2020 & 2033

- Table 27: Global Test Management Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 28: Global Test Management Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 29: Global Test Management Software Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 30: Global Test Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Test Management Software Market Revenue Million Forecast, by Components 2020 & 2033

- Table 32: Global Test Management Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 33: Global Test Management Software Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 34: Global Test Management Software Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 35: Global Test Management Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Test Management Software Market?

The projected CAGR is approximately 20.80%.

2. Which companies are prominent players in the Test Management Software Market?

Key companies in the market include Atlassian Corporation Inc, Redbooth Inc, Microsoft Corporation, Azendoo SAS, QuickBase Inc, Workfront Inc, RingCentral Inc, Asana Inc, Pivotal Software Inc, Upland Software Inc.

3. What are the main segments of the Test Management Software Market?

The market segments include Components, Organization Size, Deployment Mode, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption of Cloud-Based Solution for Task Management by SMEs; Increasing Integration of Task Management Software with Third-Party Tools and Technological Adavncement in Areas of AI and ML.

6. What are the notable trends driving market growth?

Rise in the Travel and Transportation are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Security and Privacy Concerns Among Enterprises.

8. Can you provide examples of recent developments in the market?

May 2023 - Project management software provider Monday.com Ltd. announced the release of a new product that centralizes software development tracking in one location for easier collaboration between developers, engineer's and administrators. A work operating system or Work OS, is offered by Monday.com and enables businesses to immediately start developing their work management and collaboration solutions. Using standard workflow and communication tools, it enbales them to facillitate project mangement among various employees and teams.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Test Management Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Test Management Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Test Management Software Market?

To stay informed about further developments, trends, and reports in the Test Management Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence