Key Insights

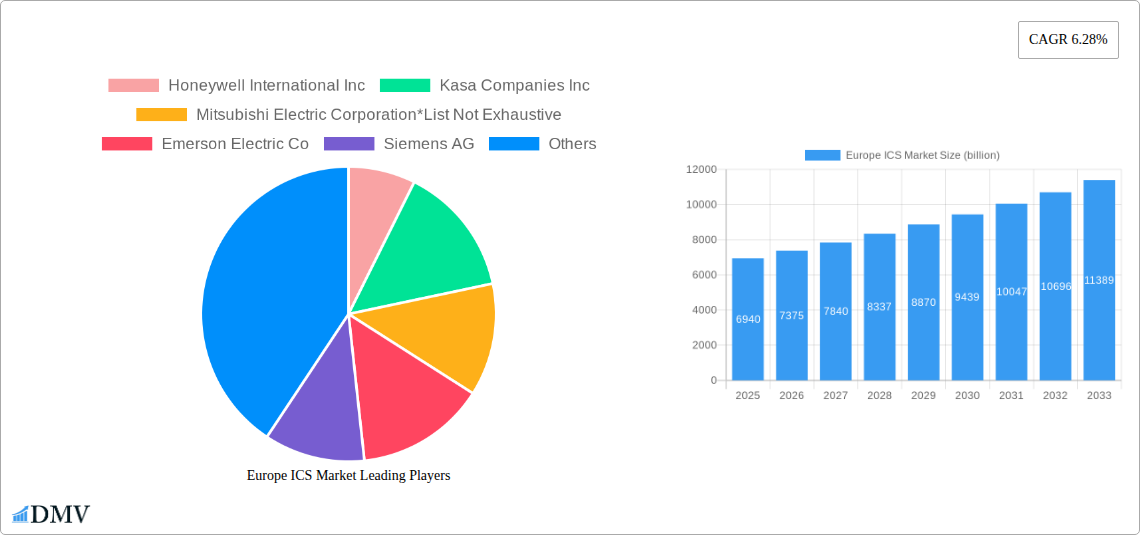

The European Industrial Control Systems (ICS) market is poised for significant expansion, projected to reach an estimated $6.94 billion in 2025. This growth is driven by a confluence of factors, including the escalating need for enhanced operational efficiency, stringent regulatory compliance, and the pervasive adoption of Industry 4.0 technologies across critical sectors. The compound annual growth rate (CAGR) for the forecast period is robust at 6.28%, indicating a steady and sustained upward trajectory. Key growth drivers include the increasing demand for advanced automation solutions in the Power and Utilities sector to manage complex grids, the digital transformation initiatives within the Oil and Gas and Chemical industries to optimize production processes and ensure safety, and the growing integration of sophisticated control systems in the Food and Beverages sector for quality control and traceability. The shift towards smart manufacturing and the Internet of Things (IoT) further fuels this expansion, necessitating more intelligent and interconnected ICS solutions.

Europe ICS Market Market Size (In Billion)

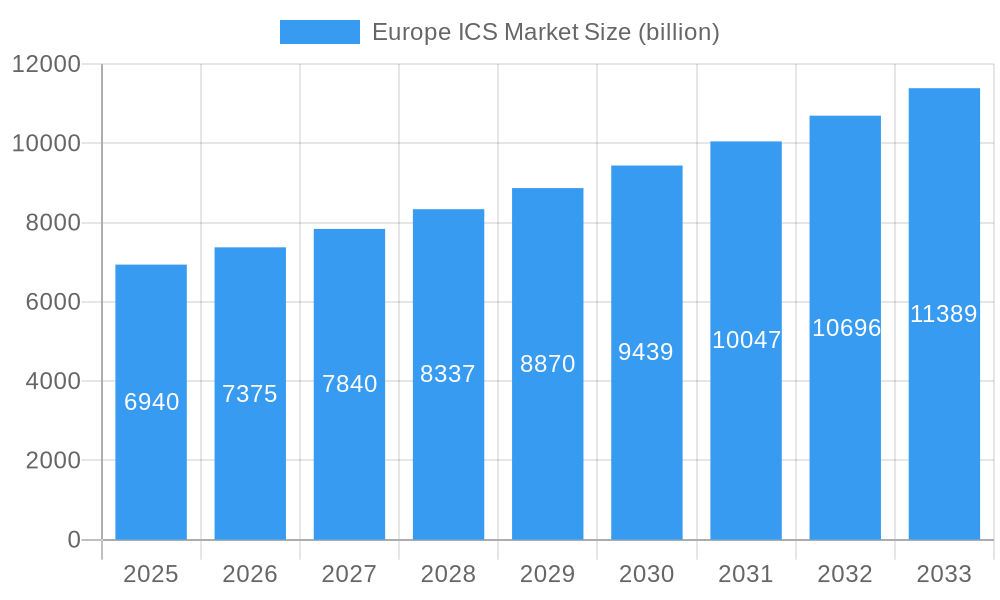

The market's segmentation reveals diverse application areas, with Operational Technology (OT) components like SCADA, DCS, and PLCs forming the backbone of industrial operations, while software solutions such as APM, MES, and ERP are critical for overarching management and optimization. The widespread adoption across end-user industries such as Oil and Gas, Chemical and Petrochemical, Power and Utilities, and Automotive and Transportation underscores the pervasive nature of ICS. Leading players like Siemens AG, Honeywell International Inc., and ABB are at the forefront of innovation, introducing cutting-edge solutions that address cybersecurity concerns, improve system reliability, and facilitate seamless integration of legacy and new technologies. Emerging trends like edge computing, AI-driven analytics within ICS, and the increasing focus on cybersecurity resilience are shaping the market landscape, offering new avenues for growth and differentiation.

Europe ICS Market Company Market Share

Europe Industrial Control Systems (ICS) Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a panoramic view of the Europe Industrial Control Systems (ICS) Market, meticulously analyzing its current composition, intricate trends, and dynamic evolution. Spanning the study period of 2019 to 2033, with a base year of 2025, this report offers critical insights for stakeholders seeking to understand the competitive landscape, technological advancements, and growth opportunities within this vital sector. We delve into key segments like Supervisory Control and Data Acquisition (SCADA), Distributed Control System (DCS), Programmable Logic Controller (PLC), and Manufacturing Execution System (MES), examining their impact across diverse end-user industries such as Oil and Gas, Power and Utilities, and Automotive and Transportation. With market values projected in the billions, this analysis equips businesses with the strategic intelligence needed to navigate and capitalize on the evolving European ICS market.

Europe ICS Market Market Composition & Trends

The Europe Industrial Control Systems (ICS) Market is characterized by a moderate level of concentration, with key players like Siemens AG, Honeywell International Inc., Schneider Electric, and ABB holding significant market share. Innovation is largely driven by the increasing demand for operational efficiency, cybersecurity resilience, and digital transformation initiatives across various industrial sectors. Regulatory landscapes, including the NIS Directive and evolving cybersecurity standards, are increasingly shaping market dynamics by mandating robust security measures for critical infrastructure. The threat of substitute products is relatively low in core ICS functionalities due to the specialized nature and critical reliability requirements of these systems, though advancements in IT integration are blurring traditional OT/IT lines. End-user profiles are diverse, ranging from large-scale petrochemical plants requiring sophisticated DCS and SCADA solutions to smaller manufacturing facilities leveraging PLCs and MES for automation. Mergers and acquisitions (M&A) activities are expected to remain a significant trend, with estimated deal values potentially reaching billions as companies aim to consolidate their portfolios, acquire new technologies, and expand their geographical reach. The market share distribution is dynamic, with leading vendors continuously vying for dominance through product innovation and strategic partnerships. The integration of AI and machine learning into ICS is a key catalyst for future growth, enabling predictive maintenance and enhanced process optimization.

- Market Concentration: Moderate to High

- Innovation Catalysts: Digital Transformation, Cybersecurity Demands, Industry 4.0 Adoption

- Regulatory Influences: NIS Directive, IEC 62443 Standards, GDPR

- Substitute Product Landscape: Limited in core functions, evolving with IT integration

- End-User Profiles: Diverse, from large-scale infrastructure to specialized manufacturing

- M&A Activity: Ongoing, with significant deal values in billions

Europe ICS Market Industry Evolution

The Europe Industrial Control Systems (ICS) Market has witnessed a significant evolution, driven by the relentless march of digital transformation and the imperative for enhanced operational efficiency and security. Over the historical period (2019-2024), the market demonstrated a steady growth trajectory, fueled by investments in modernizing aging industrial infrastructure and the increasing adoption of automation. The base year of 2025 marks a pivotal point, with the market poised for accelerated expansion due to the widespread implementation of Industry 4.0 principles. This evolution is intrinsically linked to technological advancements, particularly in areas like the Industrial Internet of Things (IIoT), cloud computing, and advanced analytics, which are transforming how industrial processes are monitored, controlled, and optimized. The adoption of SCADA and DCS systems has become paramount for managing complex operations in sectors such as Power and Utilities and Oil and Gas, with investments projected to reach billions. Furthermore, the growing emphasis on cybersecurity has spurred the development and adoption of specialized ICS security solutions, including those offered by companies like Tofino Security and Sourcefire Inc., recognizing the vulnerabilities inherent in interconnected industrial networks. Shifting consumer demands for faster production cycles, higher quality products, and greater sustainability are also indirectly influencing the ICS market by pushing manufacturers to adopt more agile and efficient production methods. The forecast period (2025-2033) is expected to see unprecedented growth, with an estimated compound annual growth rate (CAGR) of XX%, reaching a market valuation of hundreds of billions by 2033. This growth will be underpinned by the continued integration of AI and machine learning for predictive maintenance and process optimization, the expansion of IIoT connectivity, and the increasing demand for integrated software solutions like Asset Performance Management (APM) and Manufacturing Execution System (MES). The market's maturity is also reflected in the increasing focus on lifecycle management and the development of smart, connected industrial environments.

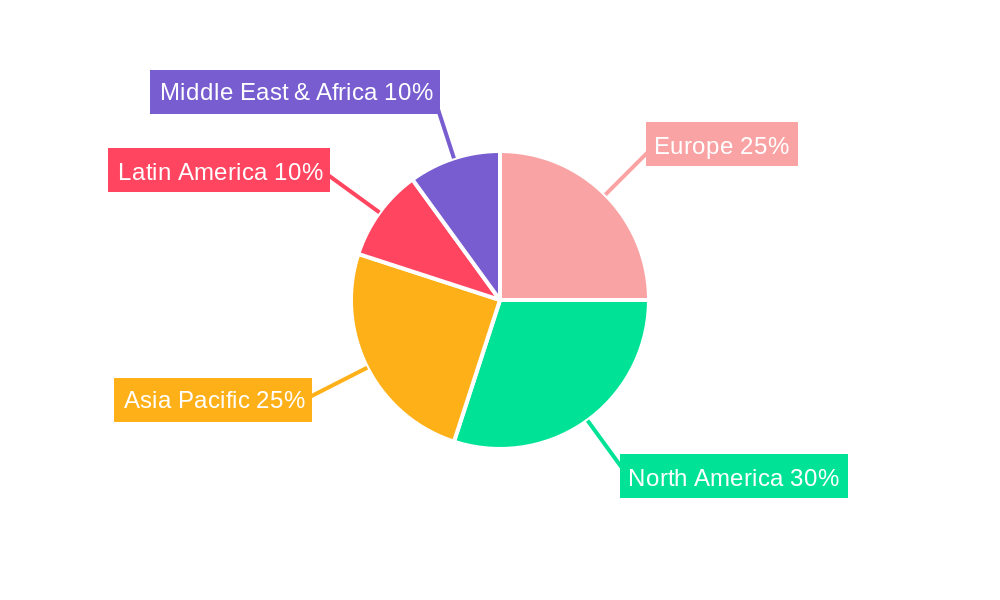

Leading Regions, Countries, or Segments in Europe ICS Market

The Europe Industrial Control Systems (ICS) Market exhibits distinct regional leadership and segment dominance, primarily driven by established industrial bases, forward-thinking regulatory frameworks, and significant investment trends.

Dominant Region/Country: Germany consistently emerges as a leading region within the European ICS market, often accounting for a substantial portion of the market share, projected to be in the tens of billions. This dominance is attributed to its robust manufacturing sector, particularly in automotive and machinery, which heavily relies on sophisticated DCS and PLC systems. Furthermore, Germany's commitment to Industry 4.0 initiatives and its proactive approach to cybersecurity standards create a fertile ground for ICS adoption. Other significant contributors include the UK and France, with their substantial Oil and Gas and Power and Utilities sectors driving demand for advanced SCADA and control solutions.

Dominant Segments within Operational Technology:

- Supervisory Control and Data Acquisition (SCADA): SCADA systems are a cornerstone of the European ICS market, particularly in the Power and Utilities and Water and Wastewater industries. Their ability to provide centralized monitoring and control over geographically dispersed assets makes them indispensable. Investment trends in grid modernization and smart metering are further boosting SCADA adoption, with the segment alone estimated to be worth billions.

- Distributed Control System (DCS): DCS solutions hold a commanding presence in continuous process industries like Chemical and Petrochemical and Life Sciences. Their inherent redundancy and ability to manage complex, multi-loop control processes ensure high reliability and precise operation. The demand for advanced process automation and compliance with stringent quality standards propels DCS market growth, contributing billions to the overall market value.

- Programmable Logic Controller (PLC): PLCs remain the workhorse of discrete manufacturing and automation across industries such as Automotive and Transportation and Food and Beverages. Their flexibility, cost-effectiveness, and increasing connectivity capabilities, especially with IIoT integration, ensure their continued relevance and substantial market share, estimated in the billions.

Dominant Segments within Software:

- Manufacturing Execution System (MES): MES solutions are gaining significant traction as they bridge the gap between enterprise-level planning and shop floor execution. Their ability to enhance production efficiency, track work-in-progress, and improve quality control is crucial for industries seeking to optimize their operations. The growing adoption of smart manufacturing strategies is a key driver for MES market growth, with projections in the billions.

- Asset Performance Management (APM): APM software, leveraging predictive analytics and AI, is becoming increasingly vital for optimizing the lifecycle management of industrial assets. Its ability to reduce downtime, predict failures, and extend asset lifespan is highly valued across all end-user industries, contributing billions to the software segment.

Key Drivers of Dominance:

- Investment Trends: Significant government and private sector investments in industrial modernization and digital transformation initiatives.

- Regulatory Support: Stringent cybersecurity mandates and environmental regulations that necessitate advanced control and monitoring systems.

- Industrial Infrastructure: The presence of large, established industrial sectors that require sophisticated automation and control solutions.

- Technological Adoption: High propensity to adopt cutting-edge technologies like IIoT, AI, and cloud computing in industrial processes.

Europe ICS Market Product Innovations

Product innovations in the Europe Industrial Control Systems (ICS) Market are rapidly advancing, focusing on enhanced cybersecurity, edge computing capabilities, and seamless integration with IT environments. Companies are developing next-generation SCADA and DCS platforms with embedded security features, offering real-time threat detection and mitigation. The emergence of intelligent PLCs with built-in AI algorithms for predictive maintenance is revolutionizing operational efficiency. Furthermore, the integration of Human Machine Interface (HMI) solutions with augmented reality (AR) capabilities is transforming operator interaction and troubleshooting. Performance metrics are consistently improving, with faster processing speeds, lower latency, and increased data handling capacity. Unique selling propositions now revolve around providing holistic, secure, and intelligent automation solutions that cater to the complex needs of Industry 4.0.

Propelling Factors for Europe ICS Market Growth

The Europe Industrial Control Systems (ICS) Market is propelled by several key factors. The relentless push towards Industry 4.0 and digital transformation is a primary driver, demanding more sophisticated automation and data analytics. Increasing investments in energy efficiency and sustainability across sectors like Power and Utilities and Manufacturing necessitate advanced control systems. Stringent government regulations, such as the NIS Directive, mandating enhanced cybersecurity for critical infrastructure, are spurring the adoption of secure ICS solutions. Furthermore, the growing demand for predictive maintenance and operational optimization to reduce downtime and costs is fueling the growth of APM and MES software. The continuous development of IIoT technologies is also expanding the scope and capabilities of ICS, enabling greater connectivity and data utilization.

Obstacles in the Europe ICS Market Market

Despite robust growth, the Europe Industrial Control Systems (ICS) Market faces several obstacles. The escalating sophistication of cyber threats poses a significant challenge, demanding constant investment in robust security measures and skilled personnel to protect critical infrastructure. Legacy systems within established industries can be difficult and costly to upgrade or integrate with newer technologies, creating compatibility issues and hindering rapid adoption. Supply chain disruptions, exacerbated by geopolitical events, can impact the availability and cost of critical components, affecting project timelines and budgets. The shortage of skilled cybersecurity professionals and OT engineers capable of managing and securing these complex systems presents a persistent barrier. Furthermore, the fragmented regulatory landscape across different European countries, while aiming for harmonization, can still create complexities for multinational companies.

Future Opportunities in Europe ICS Market

The Europe Industrial Control Systems (ICS) Market presents numerous future opportunities. The burgeoning demand for smart grids and renewable energy integration in the Power and Utilities sector will drive significant ICS investment. The expansion of autonomous systems and electrification in the Automotive and Transportation industry offers a vast new market for advanced control solutions. The increasing focus on personalized medicine and biotechnology will fuel growth in the Life Sciences sector, requiring highly precise and compliant ICS. Furthermore, the ongoing trend of digitizing manufacturing processes across all industries presents a continuous opportunity for MES, APM, and IIoT-enabled solutions. The development of AI-powered ICS for enhanced decision-making and autonomous operations also represents a substantial growth avenue.

Major Players in the Europe ICS Market Ecosystem

- Honeywell International Inc.

- Kasa Companies Inc.

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Siemens AG

- Juniper Networks Inc.

- Tofino Security

- Schneider Electric

- Sourcefire Inc.

- IBM

- ABB

Key Developments in Europe ICS Market Industry

- January 2024: Siemens AG announced a strategic partnership with Microsoft to accelerate digital transformation in manufacturing, integrating Siemens' Mindsphere IoT platform with Azure cloud services.

- December 2023: Honeywell International Inc. launched a new suite of cybersecurity solutions designed specifically for industrial control systems, enhancing protection against evolving threats.

- November 2023: Schneider Electric acquired a majority stake in Aveva, a global leader in industrial software, to strengthen its digital offerings and expand its market reach in the ICS sector.

- October 2023: Emerson Electric Co. introduced an advanced predictive analytics solution for its DeltaV DCS platform, enabling proactive identification of potential equipment failures.

- September 2023: ABB launched a new generation of intelligent motor control centers, incorporating advanced connectivity and diagnostics for improved operational efficiency in industrial plants.

- August 2023: Juniper Networks Inc. expanded its industrial security portfolio with enhanced threat intelligence capabilities for protecting critical infrastructure.

- July 2023: Tofino Security released an updated version of its Industrial Security Appliance, offering advanced threat detection and prevention for OT networks.

- June 2023: IBM announced new AI-driven capabilities for its cognitive industrial solutions, aimed at optimizing operational performance and reducing downtime in manufacturing.

- May 2023: Mitsubishi Electric Corporation unveiled its next-generation PLC series, featuring enhanced processing power and integrated communication capabilities for smart factory applications.

- April 2023: Sourcefire Inc. (part of Cisco) announced expanded threat intelligence sharing programs for industrial cybersecurity, fostering a more secure ICS ecosystem.

Strategic Europe ICS Market Market Forecast

The strategic Europe Industrial Control Systems (ICS) Market forecast indicates sustained and robust growth, driven by the accelerating adoption of digital technologies and the imperative for operational resilience. The convergence of Information Technology (IT) and Operational Technology (OT) will continue to unlock new possibilities, enabling greater data-driven decision-making and automation. Investments in cybersecurity will remain paramount, shaping product development and market strategies. The increasing demand for sustainable industrial practices will further propel the adoption of energy-efficient ICS solutions. Emerging markets and niche applications within sectors like Life Sciences and advanced manufacturing will offer significant growth potential. The forecast anticipates a market valuation in the hundreds of billions by 2033, underscoring the critical role of ICS in Europe's industrial future.

Europe ICS Market Segmentation

-

1. Operational Technology

- 1.1. Supervisory Control and Data Acquisition (SCADA)

- 1.2. Distributed Control System (DCS)

- 1.3. Programmable Logic Controller (PLC)

- 1.4. Intelligent Electronic Devices (IED)

- 1.5. Human Machine Interface (HMI)

- 1.6. Other Systems

-

2. Software

- 2.1. Asset Performance Management (APM)

- 2.2. Product Lifecycle Management (PLM)

- 2.3. Manufacturing Execution System (MES)

- 2.4. Enterprise Resource Planning (ERP)

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Chemical and Petrochemical

- 3.3. Power and Utilities

- 3.4. Food and Beverages

- 3.5. Automotive and Transportation

- 3.6. Life Sciences

- 3.7. Water and Wastewater

- 3.8. Metal and Mining

- 3.9. Pulp and Paper

- 3.10. Electronics/Semiconductor

- 3.11. Other End-user Industries

Europe ICS Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe ICS Market Regional Market Share

Geographic Coverage of Europe ICS Market

Europe ICS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Cyberattacks; Convergence of IT and OT Networks

- 3.3. Market Restrains

- 3.3.1. Complexity in Implementing the Security Systems

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe ICS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology

- 5.1.1. Supervisory Control and Data Acquisition (SCADA)

- 5.1.2. Distributed Control System (DCS)

- 5.1.3. Programmable Logic Controller (PLC)

- 5.1.4. Intelligent Electronic Devices (IED)

- 5.1.5. Human Machine Interface (HMI)

- 5.1.6. Other Systems

- 5.2. Market Analysis, Insights and Forecast - by Software

- 5.2.1. Asset Performance Management (APM)

- 5.2.2. Product Lifecycle Management (PLM)

- 5.2.3. Manufacturing Execution System (MES)

- 5.2.4. Enterprise Resource Planning (ERP)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Chemical and Petrochemical

- 5.3.3. Power and Utilities

- 5.3.4. Food and Beverages

- 5.3.5. Automotive and Transportation

- 5.3.6. Life Sciences

- 5.3.7. Water and Wastewater

- 5.3.8. Metal and Mining

- 5.3.9. Pulp and Paper

- 5.3.10. Electronics/Semiconductor

- 5.3.11. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kasa Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Electric Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emerson Electric Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tofino Security

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sourcefire Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IBM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ABB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe ICS Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe ICS Market Share (%) by Company 2025

List of Tables

- Table 1: Europe ICS Market Revenue billion Forecast, by Operational Technology 2020 & 2033

- Table 2: Europe ICS Market Revenue billion Forecast, by Software 2020 & 2033

- Table 3: Europe ICS Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe ICS Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe ICS Market Revenue billion Forecast, by Operational Technology 2020 & 2033

- Table 6: Europe ICS Market Revenue billion Forecast, by Software 2020 & 2033

- Table 7: Europe ICS Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe ICS Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe ICS Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe ICS Market?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the Europe ICS Market?

Key companies in the market include Honeywell International Inc, Kasa Companies Inc, Mitsubishi Electric Corporation*List Not Exhaustive, Emerson Electric Co, Siemens AG, Juniper Networks Inc, Tofino Security, Schneider Electric, Sourcefire Inc, IBM, ABB.

3. What are the main segments of the Europe ICS Market?

The market segments include Operational Technology, Software, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.94 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Cyberattacks; Convergence of IT and OT Networks.

6. What are the notable trends driving market growth?

Automotive Sector to Drive Market Growth.

7. Are there any restraints impacting market growth?

Complexity in Implementing the Security Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe ICS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe ICS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe ICS Market?

To stay informed about further developments, trends, and reports in the Europe ICS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence