Key Insights

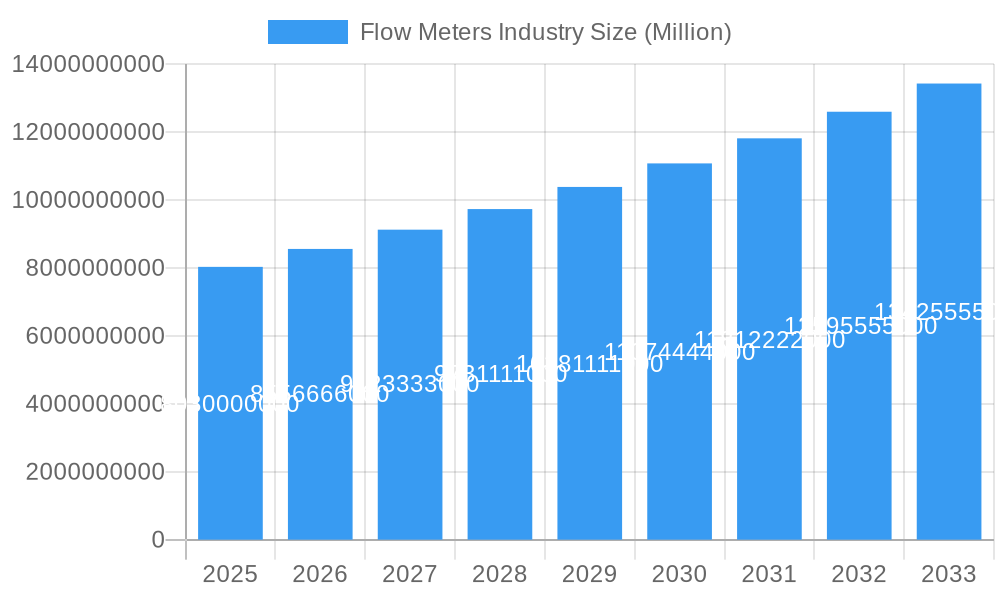

The global Flow Meters market is poised for significant expansion, projected to reach $8.03 billion by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 6.47% throughout the forecast period of 2025-2033. This growth is underpinned by a confluence of escalating demand from core industrial sectors and advancements in flow measurement technology. The Oil and Gas sector, a traditional powerhouse, continues to drive demand for accurate and reliable flow meters for exploration, production, and transportation. Simultaneously, the burgeoning Water and Wastewater industry is increasingly investing in intelligent flow metering solutions for efficient resource management, leak detection, and compliance with stringent environmental regulations. The Chemical and Petrochemical industries also present substantial opportunities, requiring precise measurement for process optimization and safety. Furthermore, the Food & Beverage and Pulp & Paper sectors are adopting advanced flow meters to ensure product quality, streamline production processes, and minimize waste.

Flow Meters Industry Market Size (In Billion)

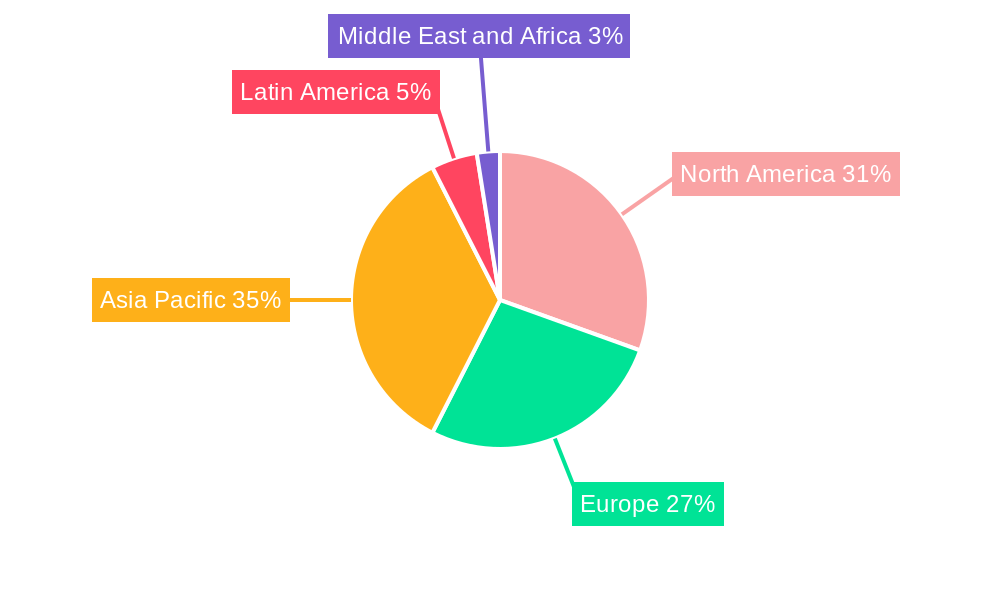

Technological innovation is a pivotal driver of market evolution. The Coriolis and Electromagnetic flow meters are expected to maintain strong market positions due to their accuracy, reliability, and suitability for a wide range of fluid types. The increasing adoption of clamp-on Ultrasonic flow meters, offering non-intrusive measurement capabilities, is a key trend, particularly in industries where process interruption is costly. The market also faces certain restraints, including the high initial cost of some advanced flow meter technologies and the need for skilled personnel for installation and maintenance. However, the growing focus on operational efficiency, regulatory compliance, and the Industrial Internet of Things (IIoT) integration is expected to overcome these challenges, fostering widespread adoption of smart and connected flow measurement solutions. Asia Pacific is anticipated to emerge as a dominant region due to rapid industrialization and infrastructure development, while North America and Europe will continue to be significant markets with a focus on upgrading existing infrastructure and adopting advanced technologies.

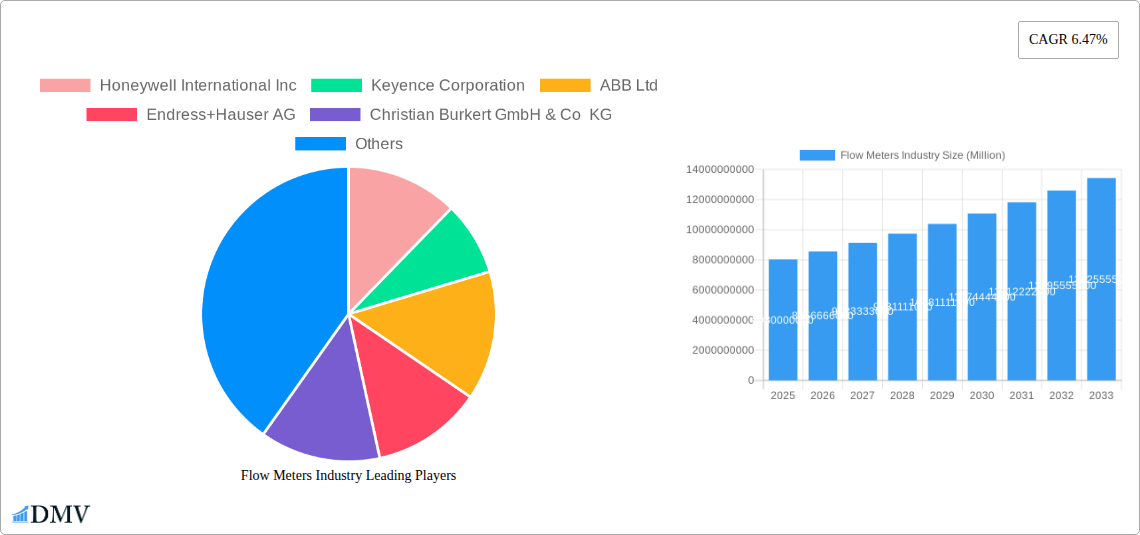

Flow Meters Industry Company Market Share

Flow Meters Industry Market Composition & Trends

The global flow meters market is characterized by a dynamic and evolving landscape, driven by increasing industrial automation, stringent process control demands, and the continuous pursuit of efficiency across diverse end-user industries. Market concentration is moderate, with a blend of large multinational corporations and specialized niche players. Innovation catalysts are primarily centered around enhanced accuracy, miniaturization, wireless flow meter technology, and the integration of IoT capabilities for real-time data analytics and predictive maintenance. Regulatory landscapes, particularly concerning environmental compliance and safety standards in sectors like oil and gas flow meters and water wastewater flow meters, significantly influence product development and adoption. Substitute products, while present in certain low-precision applications, often fall short in meeting the exacting requirements of modern industrial processes. End-user profiles are increasingly sophisticated, demanding customized solutions that address specific operational challenges. Mergers and acquisitions (M&A) activities are strategic, aimed at expanding product portfolios, gaining market share in high-growth segments like biopharmaceutical flow meters, and acquiring innovative technologies. Projected M&A deal values are estimated to reach several hundred million dollars, reflecting the strategic importance of consolidating expertise and market reach. Market share distribution is influenced by technological leadership, global presence, and the ability to cater to the evolving needs of industries such as chemical flow meters and food beverage flow meters.

Flow Meters Industry Industry Evolution

The flow meters industry has witnessed a remarkable evolutionary journey, marked by consistent market growth and transformative technological advancements. From its inception, the industry has been driven by the fundamental need for accurate measurement and control of fluid flow, a critical element in virtually every industrial process. Over the historical period (2019-2024), the market experienced steady growth, fueled by increasing industrialization and a growing emphasis on process optimization. The base year (2025) signifies a mature yet dynamic market, poised for accelerated expansion in the coming years. The study period (2019-2033) encapsulates this significant growth trajectory, with the forecast period (2025-2033) expected to see robust compound annual growth rates (CAGRs) of approximately 6.5% to 8.0%. This growth is directly attributable to the escalating adoption of advanced flow meter technologies.

Technological advancements have been a primary engine of evolution. The shift from purely mechanical to digital and smart flow meters has revolutionized accuracy, reliability, and data management. Key technologies like Coriolis flow meters, known for their mass flow measurement capabilities, have seen significant adoption in demanding applications such as chemical processing and oil and gas flow meters. Similarly, electromagnetic flow meters, particularly in-line magnetic flowmeters and low flow magnetic flowmeters, have become indispensable in conductive fluid applications, including water treatment and food & beverage production. Ultrasonic flow meters, especially the clamp-on ultrasonic flowmeters, offer non-invasive measurement solutions, gaining traction for their ease of installation and maintenance.

Shifting consumer demands have also played a pivotal role. Industries are no longer satisfied with basic flow readings; they now require integrated solutions that offer real-time data streaming, remote monitoring, predictive analytics, and seamless integration with SCADA and DCS systems. The rise of the Industrial Internet of Things (IIoT) has created a demand for smart flow meters capable of communicating wirelessly and contributing to a more connected and intelligent manufacturing environment. This has spurred innovation in areas like sensor technology, data processing algorithms, and communication protocols. Furthermore, the increasing focus on environmental regulations and resource management has heightened the demand for accurate and efficient flow measurement in water and wastewater management, and in optimizing energy consumption across various industries. The evolution of the flow meters industry is a testament to its adaptability and its crucial role in enabling industrial progress and sustainability.

Leading Regions, Countries, or Segments in Flow Meters Industry

The global flow meters market exhibits distinct regional dominance and segment leadership, driven by a confluence of industrial infrastructure, technological adoption rates, and regulatory frameworks. North America, particularly the United States, and Europe, led by Germany, are consistently at the forefront, driven by their advanced industrial ecosystems and stringent quality standards. Asia Pacific, with its rapidly expanding manufacturing base in countries like China and India, is emerging as a high-growth region.

Within the Technology segment, Coriolis flow meters continue to command a significant market share due to their unparalleled accuracy in measuring mass flow, making them indispensable for critical applications in the chemical and petrochemical industry and the oil and gas sector. Their ability to provide density and temperature readings simultaneously further enhances their value proposition. Electromagnetic flow meters are also dominant, especially in industries handling conductive liquids. The sub-segments of In-line Magnetic Flowmeters are widely adopted for their robustness and accuracy in large-scale applications, while Low Flow Magnetic Flowmeters are crucial for precise measurement in laboratory and pilot plant settings. Insertion Electromagnetic Flowmeters offer cost-effective solutions for large pipe diameters.

The End-user Industry landscape is similarly segmented. The Oil and Gas sector remains a cornerstone of the flow meters market, demanding high-performance, durable meters for exploration, production, refining, and transportation. The Water and Wastewater industry represents another substantial segment, driven by the global need for efficient water management, leakage detection, and compliance with environmental discharge regulations. The Chemical and Petrochemical industry relies heavily on accurate flow measurement for process control, safety, and product quality. The Food & Beverage industry is a rapidly growing segment, prioritizing hygienic designs, sanitary approvals, and precise batching for production efficiency. The Pulp and Paper industry also represents a steady demand for reliable flow measurement solutions.

Key drivers for regional and segment dominance include:

- Investment Trends: Significant capital expenditure in infrastructure development, particularly in emerging economies, fuels the demand for industrial flow meters.

- Regulatory Support: Stringent environmental regulations and safety mandates, especially in North America and Europe, necessitate the adoption of advanced flow measurement devices for compliance and process integrity.

- Technological Adoption: Regions with a strong R&D focus and a high propensity for adopting automation and digital technologies lead in the uptake of smart flow meters and IoT-enabled flow meters.

- Industry Concentration: The presence of major players in specific industries, such as petrochemical hubs or biopharmaceutical clusters, directly influences the demand for specialized flow meter solutions.

- Skilled Workforce: Availability of a skilled workforce adept at installing, maintaining, and interpreting data from sophisticated flow meters is crucial for market growth.

The continuous innovation in Ultrasonic flow meters, particularly Clamp-on Ultrasonic Flowmeters, for their non-intrusive nature and ease of retrofitting, is expanding their applicability across various end-user industries. The market is also witnessing increased demand for Other Technologies such as thermal mass flow meters and vortex flow meters, catering to specific niche applications.

Flow Meters Industry Product Innovations

The flow meters industry is continuously propelled by groundbreaking product innovations that enhance accuracy, versatility, and connectivity. Companies are focusing on developing smart flow meters with integrated IoT capabilities, enabling remote monitoring and real-time data analysis for predictive maintenance and process optimization. Advancements in sensor technology are leading to miniaturized and highly accurate devices, such as the improved SONOTEC SONOFLOW CO.55 V3.0 non-contact flow meter, offering exceptional measurement accuracy and repeatability crucial for biotechnology applications. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) algorithms into flow meter software is enabling more sophisticated diagnostics and operational insights. The introduction of wireless flow meters is simplifying installation and reducing cabling costs, making advanced flow measurement accessible in more challenging environments. These innovations directly address the growing demand for enhanced process control, operational efficiency, and data-driven decision-making across all major end-user sectors.

Propelling Factors for Flow Meters Industry Growth

The flow meters industry is experiencing robust growth driven by several pivotal factors. Increasing industrial automation and the push for Industry 4.0 initiatives are demanding more precise and integrated flow measurement solutions. The growing global focus on water resource management and wastewater treatment is significantly boosting the demand for water wastewater flow meters. Stringent environmental regulations across sectors like oil and gas and chemical and petrochemical necessitate accurate monitoring and control of fluid flows, driving the adoption of advanced flow meters. Technological advancements, including the development of smart flow meters, wireless connectivity, and enhanced sensor accuracy in technologies like Coriolis and ultrasonic flow meters, are creating new market opportunities. Furthermore, the expansion of end-user industries, particularly in emerging economies, coupled with the need for improved operational efficiency and reduced waste, are substantial growth catalysts for the flow meters market.

Obstacles in the Flow Meters Industry Market

Despite its promising growth, the flow meters industry faces several obstacles. The high initial cost of advanced flow meters, particularly for technologies like Coriolis and sophisticated ultrasonic systems, can be a barrier for smaller enterprises or in cost-sensitive applications. Intense competition among a large number of players, including established giants and emerging innovators, can lead to price pressures. Supply chain disruptions, as witnessed in recent years, can impact the availability of raw materials and electronic components, affecting production timelines and costs. Evolving regulatory landscapes can sometimes create compliance challenges, requiring continuous adaptation of product designs and functionalities. Furthermore, the need for skilled personnel to install, calibrate, and maintain complex flow meter systems can limit adoption in regions with a shortage of technical expertise.

Future Opportunities in Flow Meters Industry

The flow meters industry is ripe with future opportunities, primarily driven by emerging trends and unmet market needs. The burgeoning demand for smart flow meters integrated with IoT platforms for predictive maintenance and remote monitoring presents a significant avenue for growth. The increasing focus on sustainable practices and resource efficiency will continue to fuel demand in sectors like water management and the renewable energy sector. The expansion of the biopharmaceutical industry and its stringent requirements for precise fluid control offers substantial potential for specialized hygienic flow meters. Furthermore, the development of new applications for non-contact ultrasonic flow meters and advancements in miniaturization for low-flow applications in microfluidics and laboratory settings represent promising areas for innovation and market penetration. The growing adoption of digitalization across all industrial sectors will further accelerate the demand for data-rich and connected flow measurement solutions.

Major Players in the Flow Meters Industry Ecosystem

- Honeywell International Inc

- Keyence Corporation

- ABB Ltd

- Endress+Hauser AG

- Christian Burkert GmbH & Co KG

- Emerson Electric Co

- SICK AG

- Siemens AG

- Sensirion AG

- TSI incorporated

- OMEGA Engineering

- Krohne Messtechnik GmbH

- Azbil Corporation

- Yokogawa Electric Corporation

- Bronkhorst High-Tech BV

Key Developments in Flow Meters Industry Industry

- October 2022: Watson-Marlow Fluid Technology Solutions (WMFTS) announced the availability of the KROHNE FLEXMAG 4050 C electromagnetic flowmeter to biopharmaceutical clients. This development strengthens WMFTS's position as a provider of total-solution packages for customers adopting fluid path processes, offering an exact and dependable flow measurement device that smoothly connects with other WMFTS products.

- May 2022: SONOTEC improved its SONOFLOW CO.55 non-contact flow meter to enhance efficiency in PAT-related upstream and downstream biotechnology activities. The new SONOFLOW CO.55 V3.0 sensor offers exceptional measurement accuracy and superior clamp-to-clamp repeatability.

Strategic Flow Meters Industry Market Forecast

The flow meters industry is projected for substantial growth, driven by an insatiable demand for precision, automation, and data integration across global industrial sectors. The increasing adoption of smart flow meters with IoT connectivity will revolutionize process control, enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency. The ongoing emphasis on sustainable resource management, particularly in water and wastewater treatment, will continue to be a significant growth catalyst. Furthermore, the rapid expansion of industries like biopharmaceuticals and advanced manufacturing will necessitate increasingly sophisticated flow measurement solutions. Emerging technologies and new market applications, coupled with strategic investments and a focus on developing tailored solutions for specific industry needs, are expected to propel the flow meters market to new heights in the coming years, solidifying its role as an indispensable component of modern industrial operations.

Flow Meters Industry Segmentation

-

1. Technology

- 1.1. Coriolis

-

1.2. Electromagnetic

- 1.2.1. In-line Magnetic Flowmeters

- 1.2.2. Low Flow Magnetic Flowmeters

- 1.2.3. Insertion

- 1.3. Differential Pressure

-

1.4. Ultrasonic

- 1.4.1. Clamp-on

- 1.5. Other Technologies

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Water and Wastewater

- 2.3. Chemical and Petrochemical

- 2.4. Food & Beverage

- 2.5. Pulp and Paper

- 2.6. Other End-user Industries

Flow Meters Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Flow Meters Industry Regional Market Share

Geographic Coverage of Flow Meters Industry

Flow Meters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Penetration of IoT and Automation in Flow Rate Measurement Applications; Growing Industrial Demand regarding Safety and Efficiency Concerns

- 3.3. Market Restrains

- 3.3.1. High Capital Investments; Fluctuating Commodity Prices and Volatile Economic Scenario

- 3.4. Market Trends

- 3.4.1. Electromagnetic Flow Meter Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flow Meters Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Coriolis

- 5.1.2. Electromagnetic

- 5.1.2.1. In-line Magnetic Flowmeters

- 5.1.2.2. Low Flow Magnetic Flowmeters

- 5.1.2.3. Insertion

- 5.1.3. Differential Pressure

- 5.1.4. Ultrasonic

- 5.1.4.1. Clamp-on

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water and Wastewater

- 5.2.3. Chemical and Petrochemical

- 5.2.4. Food & Beverage

- 5.2.5. Pulp and Paper

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Flow Meters Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Coriolis

- 6.1.2. Electromagnetic

- 6.1.2.1. In-line Magnetic Flowmeters

- 6.1.2.2. Low Flow Magnetic Flowmeters

- 6.1.2.3. Insertion

- 6.1.3. Differential Pressure

- 6.1.4. Ultrasonic

- 6.1.4.1. Clamp-on

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Water and Wastewater

- 6.2.3. Chemical and Petrochemical

- 6.2.4. Food & Beverage

- 6.2.5. Pulp and Paper

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Flow Meters Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Coriolis

- 7.1.2. Electromagnetic

- 7.1.2.1. In-line Magnetic Flowmeters

- 7.1.2.2. Low Flow Magnetic Flowmeters

- 7.1.2.3. Insertion

- 7.1.3. Differential Pressure

- 7.1.4. Ultrasonic

- 7.1.4.1. Clamp-on

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Water and Wastewater

- 7.2.3. Chemical and Petrochemical

- 7.2.4. Food & Beverage

- 7.2.5. Pulp and Paper

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Flow Meters Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Coriolis

- 8.1.2. Electromagnetic

- 8.1.2.1. In-line Magnetic Flowmeters

- 8.1.2.2. Low Flow Magnetic Flowmeters

- 8.1.2.3. Insertion

- 8.1.3. Differential Pressure

- 8.1.4. Ultrasonic

- 8.1.4.1. Clamp-on

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Water and Wastewater

- 8.2.3. Chemical and Petrochemical

- 8.2.4. Food & Beverage

- 8.2.5. Pulp and Paper

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Flow Meters Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Coriolis

- 9.1.2. Electromagnetic

- 9.1.2.1. In-line Magnetic Flowmeters

- 9.1.2.2. Low Flow Magnetic Flowmeters

- 9.1.2.3. Insertion

- 9.1.3. Differential Pressure

- 9.1.4. Ultrasonic

- 9.1.4.1. Clamp-on

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Water and Wastewater

- 9.2.3. Chemical and Petrochemical

- 9.2.4. Food & Beverage

- 9.2.5. Pulp and Paper

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Flow Meters Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Coriolis

- 10.1.2. Electromagnetic

- 10.1.2.1. In-line Magnetic Flowmeters

- 10.1.2.2. Low Flow Magnetic Flowmeters

- 10.1.2.3. Insertion

- 10.1.3. Differential Pressure

- 10.1.4. Ultrasonic

- 10.1.4.1. Clamp-on

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Water and Wastewater

- 10.2.3. Chemical and Petrochemical

- 10.2.4. Food & Beverage

- 10.2.5. Pulp and Paper

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Keyence Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Endress+Hauser AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Christian Burkert GmbH & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emerson Electric Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SICK AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sensirion AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TSI incorporated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OMEGA Engineering

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Krohne Messtechnik GmbH*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Azbil Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yokogawa Electric Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bronkhorst High-Tech BV

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Flow Meters Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Flow Meters Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Flow Meters Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Flow Meters Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Flow Meters Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Flow Meters Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Flow Meters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Flow Meters Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Flow Meters Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Flow Meters Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Flow Meters Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Flow Meters Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Flow Meters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Flow Meters Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Flow Meters Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Flow Meters Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Flow Meters Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Flow Meters Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Flow Meters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Flow Meters Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Latin America Flow Meters Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Flow Meters Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Flow Meters Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Flow Meters Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Flow Meters Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Flow Meters Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Flow Meters Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Flow Meters Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Flow Meters Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Flow Meters Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Flow Meters Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flow Meters Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Flow Meters Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Flow Meters Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Flow Meters Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Flow Meters Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Flow Meters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Flow Meters Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Flow Meters Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Flow Meters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Flow Meters Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global Flow Meters Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Flow Meters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Flow Meters Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Flow Meters Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Flow Meters Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Flow Meters Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Flow Meters Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 27: Global Flow Meters Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Flow Meters Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flow Meters Industry?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the Flow Meters Industry?

Key companies in the market include Honeywell International Inc, Keyence Corporation, ABB Ltd, Endress+Hauser AG, Christian Burkert GmbH & Co KG, Emerson Electric Co, SICK AG, Siemens AG, Sensirion AG, TSI incorporated, OMEGA Engineering, Krohne Messtechnik GmbH*List Not Exhaustive, Azbil Corporation, Yokogawa Electric Corporation, Bronkhorst High-Tech BV.

3. What are the main segments of the Flow Meters Industry?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Penetration of IoT and Automation in Flow Rate Measurement Applications; Growing Industrial Demand regarding Safety and Efficiency Concerns.

6. What are the notable trends driving market growth?

Electromagnetic Flow Meter Holds Significant Market Share.

7. Are there any restraints impacting market growth?

High Capital Investments; Fluctuating Commodity Prices and Volatile Economic Scenario.

8. Can you provide examples of recent developments in the market?

October 2022: Watson-Marlow Fluid Technology Solutions (WMFTS) announced that the KROHNE FLEXMAG 4050 C electromagnetic flowmeter is available to biopharmaceutical clients. It strengthens the company's position as a provider of total-solution packages for customers adopting fluid path processes by being an exact and dependable flow measurement device that smoothly connects with other WMFTS products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flow Meters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flow Meters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flow Meters Industry?

To stay informed about further developments, trends, and reports in the Flow Meters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence