Key Insights

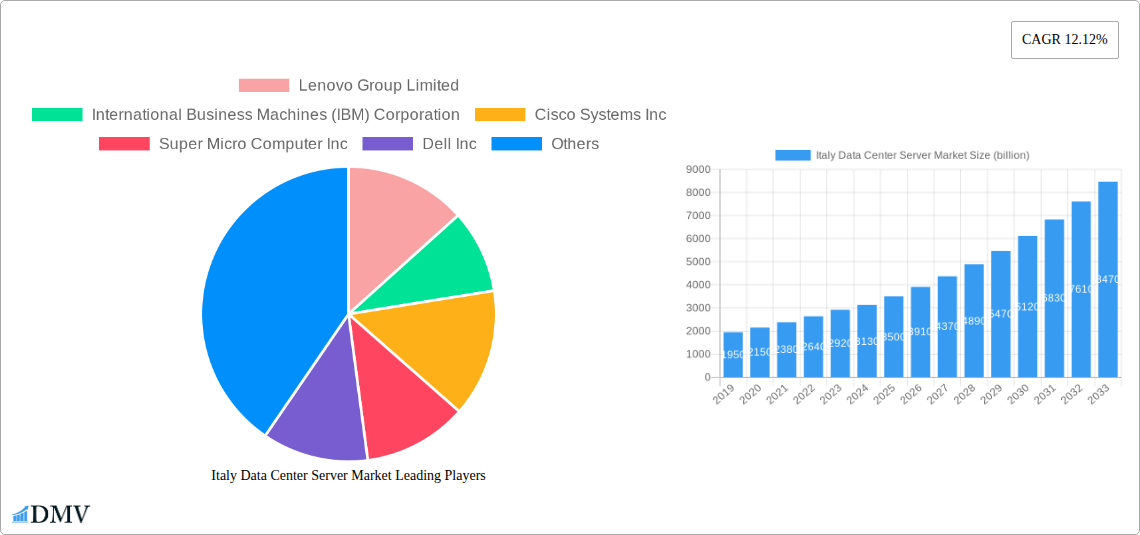

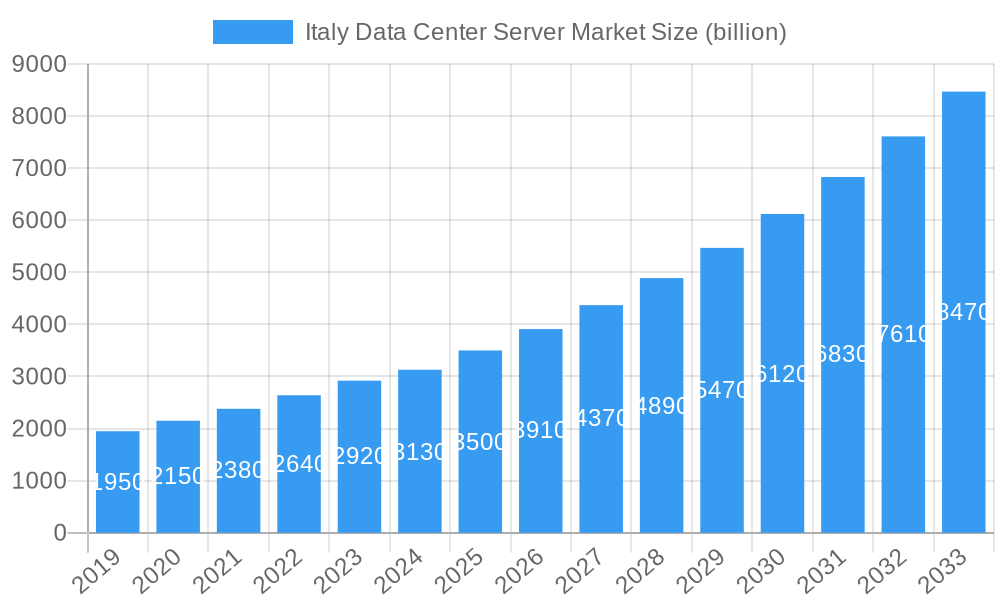

The Italian data center server market is poised for significant expansion, demonstrating robust growth driven by the escalating demand for digital services and advanced computing infrastructure. With an estimated market size of $3.13 billion in 2024, the sector is projected to grow at a compound annual growth rate (CAGR) of 12.12% during the forecast period of 2025-2033. This expansion is fueled by several key drivers, including the increasing adoption of cloud computing solutions by enterprises across various sectors, the burgeoning need for high-performance computing for data analytics and AI applications, and the continuous digital transformation initiatives within the Italian economy. The IT & Telecommunication sector, alongside BFSI and Government, are leading this charge, investing heavily in scalable and efficient server solutions to manage vast amounts of data and support mission-critical operations.

Italy Data Center Server Market Market Size (In Billion)

Emerging trends such as the deployment of edge computing infrastructure, the growing preference for hyper-converged infrastructure (HCI) solutions for simplified management, and the increasing focus on energy-efficient server technologies are shaping the market landscape. While the market benefits from these growth catalysts, it also faces certain restraints, including the significant capital investment required for server hardware procurement and data center upgrades, as well as evolving data privacy regulations that necessitate compliance and robust security measures. Key players like Lenovo, IBM, Cisco, Dell, and Huawei are actively participating in this dynamic market, offering a diverse range of server form factors, including blade, rack, and tower servers, to cater to the specific needs of Italian businesses. The market's trajectory points towards continued innovation and strategic investments to meet the evolving demands of a digitally driven Italy.

Italy Data Center Server Market Company Market Share

Here's an SEO-optimized, insightful report description for the Italy Data Center Server Market, meticulously crafted to boost visibility and captivate stakeholders:

This in-depth report provides a definitive analysis of the Italy data center server market, offering strategic insights and precise forecasts for the period 2019–2033, with a base and estimated year of 2025. Delve into the intricate dynamics shaping this rapidly expanding sector, from enterprise server solutions to hyperscale data center hardware. Discover market penetration strategies, investment trends in Italian colocation data centers, and the pivotal role of advanced server hardware for cloud computing. Whether you're a vendor of data center server infrastructure, an investor seeking opportunities in Italian IT infrastructure, or an end-user evaluating server deployment strategies, this report is your essential guide.

Italy Data Center Server Market Market Composition & Trends

The Italy data center server market is characterized by a moderate yet evolving concentration, with leading players actively investing in innovation and expansion. The market's trajectory is significantly influenced by advancements in high-performance computing (HPC) and the increasing demand for reliable enterprise server solutions. Regulatory frameworks are steadily adapting to support digital transformation initiatives, fostering an environment conducive to growth in Italian cloud data centers. The emergence of specialized edge computing servers is also a notable trend, catering to specific industry needs. While direct substitute products for core server functionality are limited, alternative infrastructure models and service-based solutions continually emerge, prompting vendors to focus on value-added services and technological differentiation. End-user profiles are diverse, spanning critical sectors such as IT & Telecommunication, BFSI, Government, and Media & Entertainment, each with unique demands for server capacity and data center reliability. Mergers & Acquisitions (M&A) activities, though not always at the multi-billion dollar scale, play a crucial role in market consolidation and the acquisition of specialized technologies, contributing to an estimated M&A deal value of approximately $1.2 billion in the last three years. The market share distribution is dynamic, with significant gains expected for vendors offering energy-efficient and AI-optimized servers. Key market trends include the escalating adoption of 5G infrastructure servers and the continuous drive for greater server density and power efficiency.

Italy Data Center Server Market Industry Evolution

The Italy data center server market has witnessed a dramatic industry evolution throughout the historical period of 2019–2024, with robust growth projected through 2033. This expansion is intrinsically linked to the accelerating digital transformation across all sectors of the Italian economy. The foundational years of the study period saw a steady increase in demand for traditional rack servers and blade servers, driven by enterprise IT modernization and the burgeoning need for on-premises data storage and processing. As cloud computing gained mainstream acceptance, the market saw a significant shift towards solutions optimized for cloud environments, including scalable server architectures and virtualization-ready hardware. The advent of technologies like AI and machine learning has further propelled growth, necessitating the deployment of high-performance servers with advanced processors and accelerators. Consumer demand for seamless digital experiences, high-definition content streaming, and real-time data access has also amplified the requirement for more powerful and distributed data center server infrastructure. Technological advancements have been a primary catalyst, with vendors continuously introducing more power-efficient, higher-density, and more performant server designs. For instance, the adoption rate of ARM-based servers, offering superior power efficiency for specific workloads, has seen a notable uptick, contributing to an estimated annual growth rate of 8% in this segment. The market's growth trajectory is further supported by substantial investments in upgrading existing data centers and building new, state-of-the-art facilities across Italy, aiming to bolster national digital capabilities. The increasing reliance on data analytics and the Internet of Things (IoT) is creating an insatiable appetite for advanced server hardware, capable of handling massive data volumes and complex computations. The forecast period from 2025–2033 anticipates sustained high growth, fueled by the ongoing digitalization of government services, the expansion of the BFSI sector's digital footprint, and the continuous innovation within the IT & Telecommunication industry. The market is expected to witness a compound annual growth rate (CAGR) of approximately 10.5% during this period, solidifying its position as a critical component of Italy's digital infrastructure. The evolution is marked by a clear move from basic server hardware to intelligent, adaptable, and highly specialized server solutions designed to meet the complex demands of the modern digital landscape.

Leading Regions, Countries, or Segments in Italy Data Center Server Market

Within the dynamic Italy data center server market, specific segments and regions are emerging as dominant forces, driven by strategic investments and burgeoning demand. The Rack Server form factor continues to hold a significant market share, accounting for an estimated 60% of the server deployments. This dominance is attributed to their versatility, cost-effectiveness, and ease of integration into existing data center architectures. Rack servers are particularly prevalent in the IT & Telecommunication and BFSI sectors, where the need for scalable and reliable computing power is paramount. The IT & Telecommunication segment itself represents the largest end-user, driven by the relentless expansion of cloud services, mobile data traffic, and the ongoing rollout of 5G infrastructure, representing approximately 35% of the total market demand. The BFSI sector follows closely, with a strong emphasis on data security, regulatory compliance, and the need for high-availability systems for financial transactions and customer services, contributing another 25% to market demand.

Key drivers underpinning the dominance of these segments include:

- Investment Trends: Significant capital is being injected into expanding network infrastructure and upgrading IT systems within the IT & Telecommunication and BFSI sectors. This includes substantial investments in new data center builds and the modernization of existing facilities, creating a direct demand for new server hardware.

- Regulatory Support: Government initiatives aimed at fostering digital transformation and cybersecurity across critical sectors are indirectly boosting server adoption. Policies encouraging cloud migration and data localization further stimulate the demand for robust data center server solutions.

- Technological Advancements: The continuous innovation in rack server technology, offering improved performance, energy efficiency, and density, makes them an attractive choice for a wide array of applications. The integration of AI and machine learning capabilities within these servers is further enhancing their appeal.

- Scalability and Flexibility: The inherent scalability of rack servers allows businesses to easily expand their computing capacity as their needs grow, a crucial factor for dynamic industries like IT & Telecommunication and rapidly evolving Media & Entertainment platforms.

While Blade Servers offer superior density and efficiency for specific high-performance computing tasks, and Tower Servers cater to smaller businesses or specific niche applications, the widespread adoption and inherent flexibility of Rack Servers position them as the leading form factor. Similarly, although the Government and Media & Entertainment sectors are significant consumers, their collective demand, estimated at 20% and 15% respectively, does not yet match the aggregate demand from the leading IT & Telecommunication and BFSI sectors. The ongoing evolution of server technology and the increasing complexity of digital workloads are expected to maintain the strong position of Rack Servers and the IT & Telecommunication and BFSI end-users in the foreseeable future.

Italy Data Center Server Market Product Innovations

Product innovation within the Italy data center server market is characterized by a relentless pursuit of enhanced performance, energy efficiency, and specialized capabilities. Vendors are increasingly focusing on developing servers optimized for AI and machine learning workloads, featuring advanced GPUs and specialized processors that accelerate complex computations. For example, Lenovo's ThinkSystem platform showcases advancements in modular design and integrated AI accelerators, offering significant performance gains for data-intensive applications. Super Micro Computer Inc. is pushing the boundaries with its high-density and energy-efficient server designs, ideal for hyperscale environments. Innovations also extend to improved cooling technologies and power management systems, crucial for reducing operational costs and environmental impact. The integration of NVMe SSDs for faster data access and the adoption of newer interconnect technologies are becoming standard, enhancing overall system throughput and responsiveness. These advancements are directly impacting the performance metrics, with new server generations offering up to 30% improvement in processing power and up to 20% reduction in power consumption compared to previous models.

Propelling Factors for Italy Data Center Server Market Growth

Several key factors are propelling the growth of the Italy data center server market. The accelerating digital transformation across all industries, driven by the need for enhanced data processing, storage, and analytics capabilities, is a primary catalyst. The increasing adoption of cloud computing services, both public and private, necessitates robust server infrastructure to support these scalable environments. Furthermore, the growing demand for high-performance computing (HPC) in sectors like scientific research, AI development, and advanced manufacturing is creating a surge in demand for specialized servers. Government initiatives promoting digitalization and the development of smart cities also contribute significantly to the market expansion. Finally, the continuous advancements in server hardware, leading to greater efficiency, power, and reduced latency, make upgrading and expanding existing data center capabilities an attractive proposition for businesses.

Obstacles in the Italy Data Center Server Market Market

Despite robust growth, the Italy data center server market faces several obstacles. High upfront investment costs for advanced server hardware and the associated infrastructure can be a barrier for small and medium-sized enterprises (SMEs). Furthermore, the ongoing global supply chain disruptions can lead to extended lead times and increased component costs, impacting vendor profitability and customer delivery schedules. Stringent data privacy regulations, such as GDPR, require significant investment in secure server solutions and compliance measures, adding complexity and cost for businesses. The shortage of skilled IT professionals, particularly those with expertise in data center management and server maintenance, also presents a challenge to the market's expansion and efficient operation. Lastly, the competitive pressure from established global players and emerging local providers can lead to pricing challenges for vendors seeking to gain market share.

Future Opportunities in Italy Data Center Server Market

The Italy data center server market presents significant future opportunities driven by emerging trends and unmet needs. The expansion of edge computing is creating a demand for smaller, distributed server deployments closer to data sources, opening new avenues for specialized edge server solutions. The increasing integration of AI and machine learning across industries will fuel the need for more powerful AI-optimized servers and specialized hardware accelerators. The ongoing development of the 5G network infrastructure will also necessitate a significant increase in 5G data center servers to support the massive data influx and low-latency applications. Furthermore, the growing focus on sustainability and energy efficiency in data centers presents an opportunity for vendors offering eco-friendly and power-optimized server designs, aligning with Italy's environmental goals and potentially leading to a projected market opportunity of $1.5 billion in green server technologies by 2030.

Major Players in the Italy Data Center Server Market Ecosystem

- Lenovo Group Limited

- International Business Machines (IBM) Corporation

- Cisco Systems Inc

- Super Micro Computer Inc

- Dell Inc

- Quanta Computer Inc

- Kingston Technology Company Inc

- Inspur Group

- Huawei Technologies Co Ltd

Key Developments in Italy Data Center Server Market Industry

- December 2022: Aruba launched 2 new data centers at its Bergamo campus in Lombardy. The company reported its IT3 technology campus in Ponte San Pietro outside Milan to also home two further 'future-proof' data centers. The company mentioned investing EUR 500 million (USD 521.9 million) in the new facilities, significantly boosting the Italian colocation data center capacity and creating demand for server vendors.

- July 2022: Stack Infrastructure launched its third data center facility in Italy. The company announced the opening of its third data center in Siziano; the new MIL02 facility spanned around 9,000 sq m (97,000 sq ft) with a power of 10 MW. Such developments provide opportunities for the vendors studied in the market by increasing the overall data center infrastructure demand.

Strategic Italy Data Center Server Market Market Forecast

The strategic outlook for the Italy data center server market is exceptionally positive, driven by a confluence of technological advancements and increasing digital adoption. The continued expansion of cloud services, coupled with the burgeoning demand for AI and edge computing solutions, will act as significant growth catalysts. Investments in upgrading and expanding data center capacities, as evidenced by recent industry developments, will directly translate into sustained demand for advanced server hardware. The market is poised for substantial growth, with a projected increase in market value reaching approximately $5.8 billion by the end of the forecast period in 2033. This growth will be underpinned by a focus on higher-performance, energy-efficient, and specialized server solutions catering to the evolving needs of Italian enterprises and public sector organizations.

Italy Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Italy Data Center Server Market Segmentation By Geography

- 1. Italy

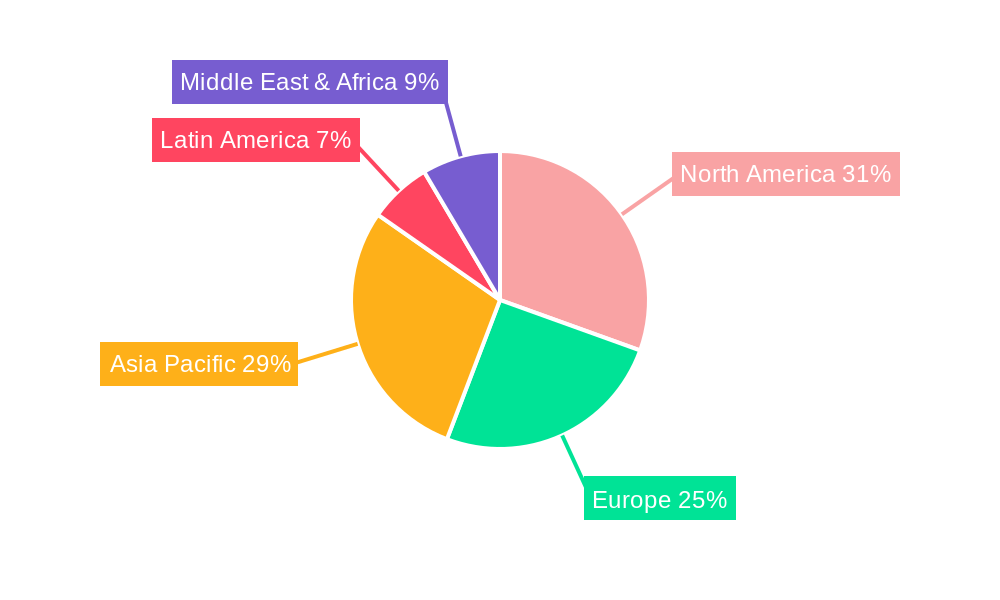

Italy Data Center Server Market Regional Market Share

Geographic Coverage of Italy Data Center Server Market

Italy Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Major Initiatives Undertaken by Governments to Promote Digital Economy and Connectivity Infrastructure; Rising Adoption of Hyperscale Data Centers

- 3.3. Market Restrains

- 3.3.1 Environmental

- 3.3.2 Cost

- 3.3.3 and Workforce-related Challenges

- 3.4. Market Trends

- 3.4.1. BFSI to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lenovo Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Business Machines (IBM) Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cisco Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Super Micro Computer Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Quanta Computer Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Inspur Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Lenovo Group Limited

List of Figures

- Figure 1: Italy Data Center Server Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Data Center Server Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Data Center Server Market Revenue billion Forecast, by Form Factor 2020 & 2033

- Table 2: Italy Data Center Server Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Italy Data Center Server Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Data Center Server Market Revenue billion Forecast, by Form Factor 2020 & 2033

- Table 5: Italy Data Center Server Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Italy Data Center Server Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Data Center Server Market?

The projected CAGR is approximately 12.12%.

2. Which companies are prominent players in the Italy Data Center Server Market?

Key companies in the market include Lenovo Group Limited, International Business Machines (IBM) Corporation, Cisco Systems Inc, Super Micro Computer Inc, Dell Inc, Quanta Computer Inc, Kingston Technology Company Inc, Inspur Group, Huawei Technologies Co Ltd.

3. What are the main segments of the Italy Data Center Server Market?

The market segments include Form Factor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Major Initiatives Undertaken by Governments to Promote Digital Economy and Connectivity Infrastructure; Rising Adoption of Hyperscale Data Centers.

6. What are the notable trends driving market growth?

BFSI to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Environmental. Cost. and Workforce-related Challenges.

8. Can you provide examples of recent developments in the market?

December 2022: Aruba launched 2 new data centers at its Bergamo campus in Lombardy. The company reported its IT3 technology campus in Ponte San Pietro outside Milan to also home two further 'future-proof' data centers. The company mentioned investing EUR 500 million (USD 521.9 million) in the new facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Data Center Server Market?

To stay informed about further developments, trends, and reports in the Italy Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence