Key Insights

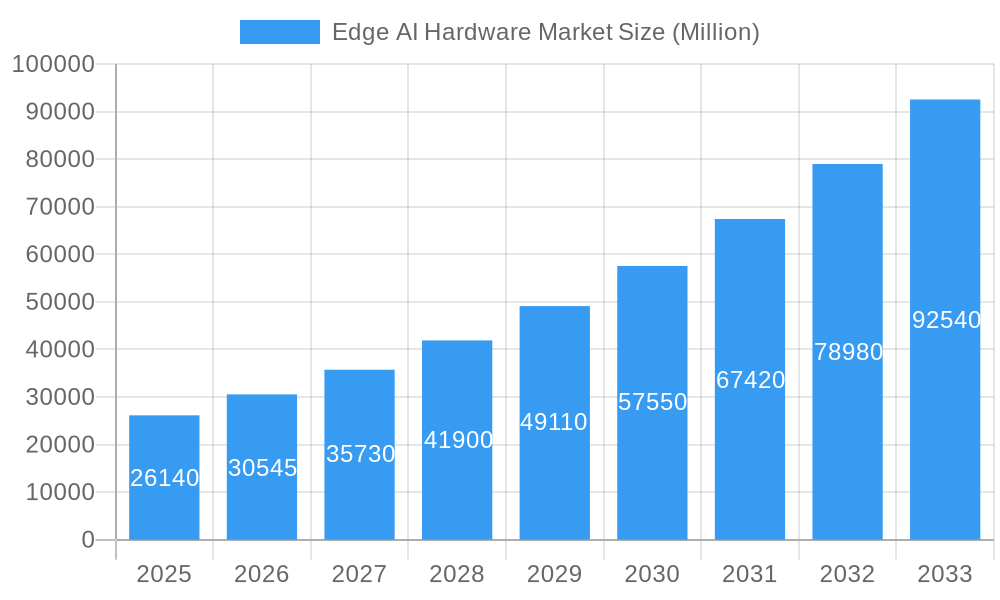

The Edge AI Hardware Market is poised for remarkable expansion, projected to reach a substantial $26.14 billion in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 17.6% throughout the forecast period. This robust growth is fueled by the increasing demand for real-time data processing and decision-making directly at the source, reducing latency and enhancing efficiency across a multitude of applications. Key drivers include the burgeoning adoption of IoT devices, the need for enhanced privacy and security in data handling, and the declining costs of AI processing capabilities. The market's dynamism is further underscored by its segmentation across diverse processor types such as CPUs, GPUs, FPGAs, and ASICs, each catering to specific computational needs. Devices like smartphones, cameras, robots, wearables, and smart speakers are becoming increasingly intelligent, integrating sophisticated edge AI hardware to deliver enhanced user experiences and unlock new functionalities.

Edge AI Hardware Market Market Size (In Billion)

The pervasive integration of AI at the edge is transforming various end-user industries, with significant implications for government, real estate, consumer electronics, automotive, transportation, healthcare, and manufacturing sectors. Innovations in AI algorithms and specialized hardware are enabling more powerful and efficient edge computing solutions, contributing to the market's upward trajectory. While the market exhibits immense potential, certain restraints, such as the complexity of deployment and integration, and the need for skilled personnel, need to be addressed. Nevertheless, the strong momentum in AI innovation and the continuous development of more power-efficient and cost-effective edge AI hardware are expected to overcome these challenges, propelling the market towards sustained and significant growth in the coming years. Leading companies in this space, including Baidu Inc., Samsung Group, Alphabet Inc., Qualcomm Incorporated, and Nvidia Corporation, are heavily investing in research and development to maintain a competitive edge.

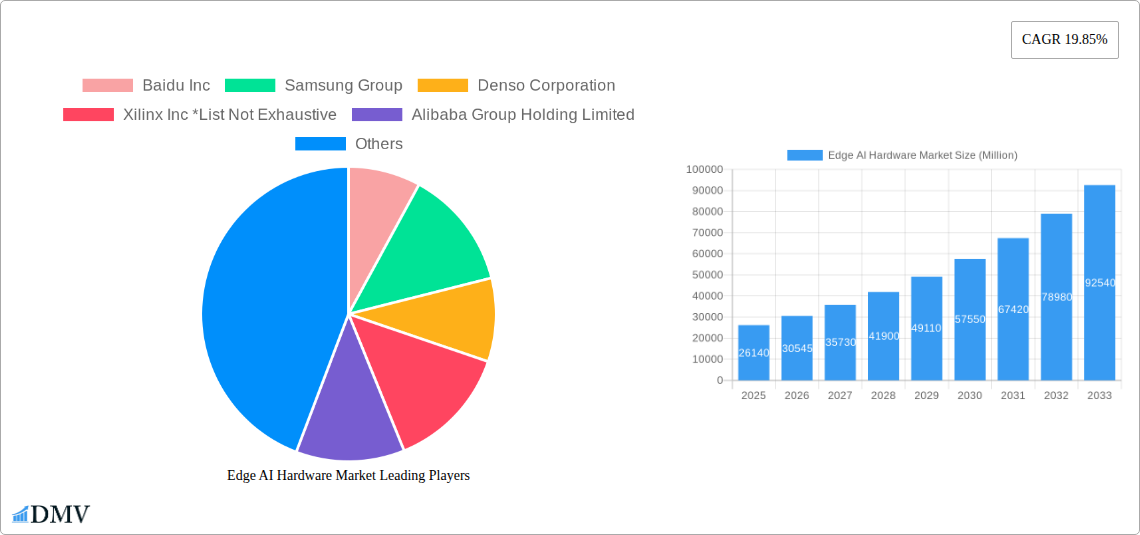

Edge AI Hardware Market Company Market Share

This in-depth report on the Edge AI Hardware Market provides a panoramic view of the burgeoning landscape of intelligent processing at the edge. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis delves into the intricate composition, evolutionary trajectory, and pivotal growth drivers shaping this transformative sector. We meticulously dissect market trends, technological advancements, competitive strategies, and regional dynamics, offering actionable insights for stakeholders seeking to capitalize on the exponential growth of AI at the edge.

Edge AI Hardware Market Market Composition & Trends

The Edge AI Hardware Market is characterized by a dynamic interplay of innovation and strategic consolidation. Market concentration is steadily evolving as established technology giants and agile startups vie for dominance in critical segments. Innovation catalysts are abundant, driven by the relentless demand for low-latency processing, enhanced data privacy, and reduced reliance on cloud infrastructure. Regulatory landscapes are emerging, focusing on data sovereignty and ethical AI deployment, influencing hardware design and market entry strategies. Substitute products, primarily cloud-based AI solutions, are facing increasing competition from the cost-effectiveness and real-time capabilities of edge AI hardware. End-user profiles are diversifying rapidly, with the automotive, consumer electronics, and manufacturing industries emerging as key adopters. Mergers and acquisitions (M&A) activities are on the rise, with significant M&A deal values indicating strategic plays for market share and technological integration. The market share distribution is becoming increasingly fragmented yet concentrated among leading players, with estimated M&A deal values in the billions.

- Market Concentration Drivers: Increasing R&D investments, strategic partnerships, and the pursuit of specialized chip architectures.

- Innovation Catalysts: Demand for real-time analytics, IoT expansion, and advancements in AI algorithms requiring localized processing.

- Regulatory Influence: Growing emphasis on data privacy regulations (e.g., GDPR, CCPA) driving on-device processing solutions.

- End-User Diversification: Expansion beyond traditional markets into sectors like healthcare and smart cities.

- M&A Activity: Consolidation to acquire intellectual property, expand product portfolios, and gain market access.

Edge AI Hardware Market Industry Evolution

The Edge AI Hardware Market has witnessed a remarkable evolutionary arc, transitioning from nascent concepts to a critical component of modern technological infrastructure. This evolution is fundamentally driven by the exponential growth of connected devices and the ever-increasing volume of data generated at the network's edge. Over the historical period of 2019–2024, we observed a nascent but rapidly expanding market, characterized by early experimentation and foundational technology development. The base year of 2025 marks a significant inflection point, with widespread adoption and commercialization taking hold across diverse industries. Projections indicate a compound annual growth rate (CAGR) of over 25% in the forecast period, pushing the market valuation into hundreds of billions. This robust growth trajectory is fueled by several key factors: the proliferation of the Internet of Things (IoT), the demand for real-time decision-making in applications like autonomous vehicles and industrial automation, and the imperative to enhance data security and privacy by processing sensitive information locally.

Technological advancements have been paramount in this evolution. The development of specialized processors such as GPUs, FPGAs, and ASICs tailored for AI inference at the edge has significantly improved performance and energy efficiency. For instance, the integration of dedicated AI accelerators within CPUs and the emergence of custom AI chips designed for specific edge applications have been game-changers. Shifting consumer demands, particularly the expectation of seamless and responsive digital experiences, have also played a crucial role. Smart devices, wearables, and connected appliances are increasingly incorporating on-device AI capabilities to offer personalized and intelligent functionalities without constant cloud connectivity. The adoption of edge AI hardware is no longer confined to niche applications; it is becoming a mainstream requirement for any device or system aiming to leverage the power of artificial intelligence in real-time. The market is witnessing a paradigm shift from cloud-centric AI to a hybrid edge-cloud approach, with edge AI hardware forming the bedrock of this decentralized intelligence.

Leading Regions, Countries, or Segments in Edge AI Hardware Market

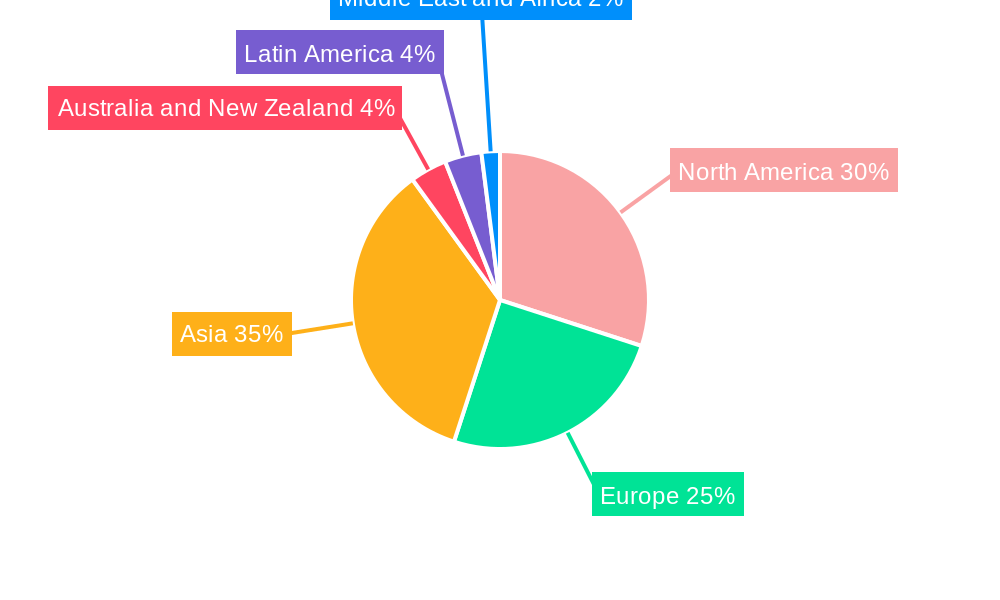

The Edge AI Hardware Market is witnessing a significant concentration of activity and growth in specific regions, countries, and segments, underscoring the uneven yet strategic development of this industry.

Dominant Segments:

Processor:

- ASICs (Application-Specific Integrated Circuits): Expected to exhibit the highest growth rate due to their tailored performance and power efficiency for specific AI tasks at the edge. Their development is crucial for optimizing AI inference in mass-produced devices. The market for ASICs in edge AI is projected to reach tens of billions by 2033.

- GPUs (Graphics Processing Units): Continue to hold a significant market share, especially in applications requiring complex parallel processing and model training at the edge, such as advanced robotics and autonomous driving systems. Their versatility makes them a strong contender.

- FPGAs (Field-Programmable Gate Arrays): Offer flexibility and reconfigurability, making them ideal for applications with evolving AI algorithms or specialized processing needs. Their adoption is growing in industrial automation and surveillance.

- CPUs (Central Processing Units): Remain foundational, often integrated with AI accelerators, but their standalone AI processing capabilities are being increasingly surpassed by specialized hardware.

Device:

- Smartphones: Represent a massive market for edge AI hardware, with an increasing number of AI-powered features like image recognition, natural language processing, and personalized recommendations being processed directly on the device. The sheer volume of smartphone users drives significant demand.

- Cameras (Smart Cameras & Surveillance): AI-enabled cameras are transforming security, retail analytics, and industrial monitoring, requiring powerful edge processors for real-time object detection, facial recognition, and anomaly detection. This segment is growing at a rapid pace, projected to be in the tens of billions.

- Automotive: The automotive sector is a primary driver for edge AI hardware, powering Advanced Driver-Assistance Systems (ADAS), in-car infotainment, and eventually fully autonomous driving. Investments in this sector are in the hundreds of billions.

End-User Industry:

- Automotive & Transportation: Leading the charge with significant investments in ADAS, predictive maintenance, and in-vehicle AI. The safety and efficiency demands of this sector make edge AI indispensable.

- Consumer Electronics: Driven by the proliferation of smart home devices, wearables, and personal computing devices, all seeking enhanced AI capabilities for user experience.

- Manufacturing: Industrial IoT (IIoT) applications are leveraging edge AI for predictive maintenance, quality control, robotic automation, and supply chain optimization.

Leading Region:

- North America & Asia Pacific: These regions are at the forefront of edge AI hardware adoption and innovation.

- Key Drivers in North America: Strong R&D infrastructure, significant venture capital funding, and a high concentration of leading tech companies (e.g., Alphabet, Apple, Amazon). The demand for advanced AI in sectors like automotive and healthcare is a major catalyst.

- Key Drivers in Asia Pacific: Rapid industrialization, massive manufacturing capabilities, a burgeoning consumer electronics market, and government initiatives supporting AI development (e.g., China's AI strategy). Countries like China, South Korea, and Japan are major players in both hardware production and adoption. The automotive and smart city initiatives are particularly strong drivers in this region.

Edge AI Hardware Market Product Innovations

Product innovations in the Edge AI Hardware Market are centered around enhancing processing power, reducing energy consumption, and miniaturizing form factors. Companies are developing highly specialized ASICs and NPUs (Neural Processing Units) designed for efficient AI inference on-device, enabling features like real-time object detection, natural language understanding, and predictive analytics directly within smartphones, smart cameras, robots, and wearables. Innovations in neuromorphic computing and in-memory computing are paving the way for even more energy-efficient and powerful edge AI solutions, pushing performance metrics beyond traditional benchmarks. For instance, novel AI chips are emerging that can perform complex computations with significantly lower power budgets, making them ideal for battery-operated edge devices.

Propelling Factors for Edge AI Hardware Market Growth

The Edge AI Hardware Market is propelled by a confluence of powerful factors. The exponential growth of the Internet of Things (IoT) ecosystem necessitates localized data processing to manage the vast influx of data generated by connected devices, demanding low-latency and real-time analytics. Furthermore, increasing concerns around data privacy and security are driving the adoption of edge AI solutions that process sensitive information on-device, reducing the need for data transmission to the cloud. Economic drivers include the pursuit of operational efficiency and cost reduction in industries like manufacturing and logistics through AI-powered automation and predictive maintenance. Regulatory support, including government initiatives promoting AI adoption and national AI strategies, is also a significant catalyst, encouraging investment and innovation. The development of more sophisticated AI algorithms requiring specialized hardware further fuels this growth.

Obstacles in the Edge AI Hardware Market Market

Despite its promising trajectory, the Edge AI Hardware Market faces several significant obstacles. The high cost of developing and manufacturing specialized AI chips, particularly ASICs, can be a barrier to entry for smaller companies and may limit adoption in cost-sensitive applications. Supply chain disruptions, as witnessed in recent years, can impact the availability and pricing of essential components, leading to production delays and increased costs. Standardization challenges across different hardware architectures and software frameworks can hinder interoperability and create fragmentation in the market. Furthermore, technical limitations such as power consumption constraints for battery-operated devices and the need for robust thermal management in some edge environments remain ongoing challenges. The competitive pressure from established cloud AI providers also necessitates continuous innovation and differentiation for edge hardware solutions.

Future Opportunities in Edge AI Hardware Market

The Edge AI Hardware Market is ripe with emerging opportunities. The expansion of 5G networks is set to unlock new possibilities for low-latency, high-bandwidth edge AI applications, particularly in areas like augmented reality, virtual reality, and real-time video analytics. The growing demand for sustainability and energy efficiency in computing presents an opportunity for hardware solutions that minimize power consumption at the edge. The increasing adoption of AI in healthcare, from diagnostic imaging to remote patient monitoring, will require specialized edge AI hardware for secure and immediate data analysis. Furthermore, the development of edge AI platforms that offer end-to-end solutions, from hardware to software and analytics, is a significant growth area. The continued integration of AI into industrial automation and the burgeoning smart city initiatives worldwide will also create substantial demand for advanced edge AI hardware.

Major Players in the Edge AI Hardware Market Ecosystem

- Baidu Inc

- Samsung Group

- Denso Corporation

- Xilinx Inc

- Alibaba Group Holding Limited

- Alphabet Inc

- Continental AG

- Qualcomm Incorporated

- Advanced Micro Devices Inc

- Amazon com Inc

- Robert Bosch GmbH

- KALRAY Corporation

- Huawei Technologies Co Ltd

- MediaTek Inc

- Nvidia Corporation

- Apple Inc

- Intel Corporation

Key Developments in Edge AI Hardware Market Industry

- November 2022: Network solutions provider Lumen Technologies began expanding its portfolio of Edge Computing Solutions into the Asia-Pacific Region, including its Edge Bare Metal pay-as-you-go hardware solution for servers, taking advantage of sites in Singapore and Japan. This expansion signifies the growing global demand for robust edge infrastructure.

- October 2022: Kneron bagged USD 50 million in funding for next-gen AI hardware solutions. The company plans to use the funds to accelerate its research and development to produce next-gen AI inference modules. Kneron anticipates increased adoption of on-device edge AI technology in the future, emphasizing the trend of pushing AI processing closer to the data source.

- August 2022: Stanford University engineers created a more efficient and flexible AI chip suited to power AI in tiny edge devices. The engineers' chip, called NeuRRAM, is a novel resistive random-access memory (RRAM) chip that innovates how current chips process and store data, showcasing advancements in fundamental chip design for edge AI.

Strategic Edge AI Hardware Market Market Forecast

The strategic forecast for the Edge AI Hardware Market is exceptionally robust, driven by an unyielding demand for localized intelligence across a multitude of applications. The continuous expansion of the IoT, coupled with stringent data privacy regulations and the need for real-time decision-making, forms the bedrock of this growth. Investments are projected to soar into the hundreds of billions, fueled by breakthroughs in AI algorithms and the development of specialized hardware like ASICs and NPUs. The automotive sector, consumer electronics, and manufacturing industries will remain primary growth catalysts, with significant potential emerging in healthcare and smart cities. The evolution towards more power-efficient, compact, and high-performance edge AI solutions will define the market landscape, presenting substantial opportunities for both established players and innovative newcomers to capture a significant share of this transformative technology market.

Edge AI Hardware Market Segmentation

-

1. Processor

- 1.1. CPU

- 1.2. GPU

- 1.3. FPGA

- 1.4. ASICs

-

2. Device

- 2.1. Smartphones

- 2.2. Cameras

- 2.3. Robots

- 2.4. Wearables

- 2.5. Smart Speaker

- 2.6. Other Devices

-

3. End-User Industry

- 3.1. Government

- 3.2. Real Estate

- 3.3. Consumer Electronics

- 3.4. Automotive

- 3.5. Transportation

- 3.6. Healthcare

- 3.7. Manufacturing

- 3.8. Others

Edge AI Hardware Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Edge AI Hardware Market Regional Market Share

Geographic Coverage of Edge AI Hardware Market

Edge AI Hardware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of AI in Edge Devices; Increasing Demand for Smart Homes and Smart Cities

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to Edge AI Devices

- 3.4. Market Trends

- 3.4.1. Increase Demand for Smart Homes and Smart Cities is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Processor

- 5.1.1. CPU

- 5.1.2. GPU

- 5.1.3. FPGA

- 5.1.4. ASICs

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Smartphones

- 5.2.2. Cameras

- 5.2.3. Robots

- 5.2.4. Wearables

- 5.2.5. Smart Speaker

- 5.2.6. Other Devices

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Government

- 5.3.2. Real Estate

- 5.3.3. Consumer Electronics

- 5.3.4. Automotive

- 5.3.5. Transportation

- 5.3.6. Healthcare

- 5.3.7. Manufacturing

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Processor

- 6. North America Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Processor

- 6.1.1. CPU

- 6.1.2. GPU

- 6.1.3. FPGA

- 6.1.4. ASICs

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Smartphones

- 6.2.2. Cameras

- 6.2.3. Robots

- 6.2.4. Wearables

- 6.2.5. Smart Speaker

- 6.2.6. Other Devices

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Government

- 6.3.2. Real Estate

- 6.3.3. Consumer Electronics

- 6.3.4. Automotive

- 6.3.5. Transportation

- 6.3.6. Healthcare

- 6.3.7. Manufacturing

- 6.3.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Processor

- 7. Europe Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Processor

- 7.1.1. CPU

- 7.1.2. GPU

- 7.1.3. FPGA

- 7.1.4. ASICs

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Smartphones

- 7.2.2. Cameras

- 7.2.3. Robots

- 7.2.4. Wearables

- 7.2.5. Smart Speaker

- 7.2.6. Other Devices

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Government

- 7.3.2. Real Estate

- 7.3.3. Consumer Electronics

- 7.3.4. Automotive

- 7.3.5. Transportation

- 7.3.6. Healthcare

- 7.3.7. Manufacturing

- 7.3.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Processor

- 8. Asia Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Processor

- 8.1.1. CPU

- 8.1.2. GPU

- 8.1.3. FPGA

- 8.1.4. ASICs

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Smartphones

- 8.2.2. Cameras

- 8.2.3. Robots

- 8.2.4. Wearables

- 8.2.5. Smart Speaker

- 8.2.6. Other Devices

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Government

- 8.3.2. Real Estate

- 8.3.3. Consumer Electronics

- 8.3.4. Automotive

- 8.3.5. Transportation

- 8.3.6. Healthcare

- 8.3.7. Manufacturing

- 8.3.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Processor

- 9. Australia and New Zealand Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Processor

- 9.1.1. CPU

- 9.1.2. GPU

- 9.1.3. FPGA

- 9.1.4. ASICs

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Smartphones

- 9.2.2. Cameras

- 9.2.3. Robots

- 9.2.4. Wearables

- 9.2.5. Smart Speaker

- 9.2.6. Other Devices

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Government

- 9.3.2. Real Estate

- 9.3.3. Consumer Electronics

- 9.3.4. Automotive

- 9.3.5. Transportation

- 9.3.6. Healthcare

- 9.3.7. Manufacturing

- 9.3.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Processor

- 10. Latin America Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Processor

- 10.1.1. CPU

- 10.1.2. GPU

- 10.1.3. FPGA

- 10.1.4. ASICs

- 10.2. Market Analysis, Insights and Forecast - by Device

- 10.2.1. Smartphones

- 10.2.2. Cameras

- 10.2.3. Robots

- 10.2.4. Wearables

- 10.2.5. Smart Speaker

- 10.2.6. Other Devices

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Government

- 10.3.2. Real Estate

- 10.3.3. Consumer Electronics

- 10.3.4. Automotive

- 10.3.5. Transportation

- 10.3.6. Healthcare

- 10.3.7. Manufacturing

- 10.3.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Processor

- 11. Middle East and Africa Edge AI Hardware Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Processor

- 11.1.1. CPU

- 11.1.2. GPU

- 11.1.3. FPGA

- 11.1.4. ASICs

- 11.2. Market Analysis, Insights and Forecast - by Device

- 11.2.1. Smartphones

- 11.2.2. Cameras

- 11.2.3. Robots

- 11.2.4. Wearables

- 11.2.5. Smart Speaker

- 11.2.6. Other Devices

- 11.3. Market Analysis, Insights and Forecast - by End-User Industry

- 11.3.1. Government

- 11.3.2. Real Estate

- 11.3.3. Consumer Electronics

- 11.3.4. Automotive

- 11.3.5. Transportation

- 11.3.6. Healthcare

- 11.3.7. Manufacturing

- 11.3.8. Others

- 11.1. Market Analysis, Insights and Forecast - by Processor

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Baidu Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Samsung Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Denso Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Xilinx Inc *List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Alibaba Group Holding Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alphabet Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Continental AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Qualcomm Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Advanced Micro Devices Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Amazon com Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Robert Bosch GmbH

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 KALRAY Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Huawei Technologies Co Ltd

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 MediaTek Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Nvidia Corporation

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Apple Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Intel Corporation

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.1 Baidu Inc

List of Figures

- Figure 1: Global Edge AI Hardware Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 3: North America Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 4: North America Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 5: North America Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 6: North America Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 7: North America Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 11: Europe Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 12: Europe Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 13: Europe Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 14: Europe Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 15: Europe Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 19: Asia Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 20: Asia Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 21: Asia Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 22: Asia Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 23: Asia Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 27: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 28: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 29: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 30: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 31: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Australia and New Zealand Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 35: Latin America Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 36: Latin America Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 37: Latin America Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 38: Latin America Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 39: Latin America Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Latin America Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Latin America Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by Processor 2025 & 2033

- Figure 43: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by Processor 2025 & 2033

- Figure 44: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by Device 2025 & 2033

- Figure 45: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by Device 2025 & 2033

- Figure 46: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by End-User Industry 2025 & 2033

- Figure 47: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 48: Middle East and Africa Edge AI Hardware Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East and Africa Edge AI Hardware Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 2: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 3: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Edge AI Hardware Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 6: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 7: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 10: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 11: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 14: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 15: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 18: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 19: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 22: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 23: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Edge AI Hardware Market Revenue undefined Forecast, by Processor 2020 & 2033

- Table 26: Global Edge AI Hardware Market Revenue undefined Forecast, by Device 2020 & 2033

- Table 27: Global Edge AI Hardware Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 28: Global Edge AI Hardware Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Edge AI Hardware Market?

The projected CAGR is approximately 21.7%.

2. Which companies are prominent players in the Edge AI Hardware Market?

Key companies in the market include Baidu Inc, Samsung Group, Denso Corporation, Xilinx Inc *List Not Exhaustive, Alibaba Group Holding Limited, Alphabet Inc, Continental AG, Qualcomm Incorporated, Advanced Micro Devices Inc, Amazon com Inc, Robert Bosch GmbH, KALRAY Corporation, Huawei Technologies Co Ltd, MediaTek Inc, Nvidia Corporation, Apple Inc, Intel Corporation.

3. What are the main segments of the Edge AI Hardware Market?

The market segments include Processor, Device, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of AI in Edge Devices; Increasing Demand for Smart Homes and Smart Cities.

6. What are the notable trends driving market growth?

Increase Demand for Smart Homes and Smart Cities is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Security Concerns Related to Edge AI Devices.

8. Can you provide examples of recent developments in the market?

November 2022 - Network solutions provider Lumen Technologies began expanding its portfolio of Edge Computing Solutions into the Asia-Pacific Region, including its Edge Bare Metal pay-as-you-go hardware solution for servers, taking advantage of sites in Singapore and Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Edge AI Hardware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Edge AI Hardware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Edge AI Hardware Market?

To stay informed about further developments, trends, and reports in the Edge AI Hardware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence