Key Insights

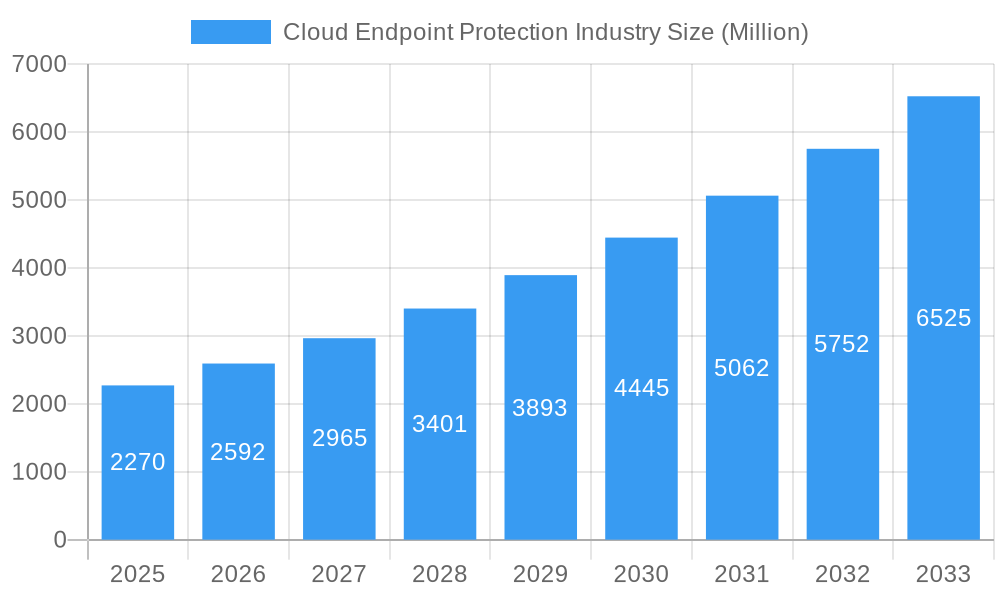

The Cloud Endpoint Protection market is poised for substantial growth, projected to reach USD 2.27 billion in 2025, driven by an impressive CAGR of 14.26% throughout the forecast period. This robust expansion is fueled by several critical factors, including the escalating sophistication and frequency of cyber threats targeting endpoints, the increasing adoption of cloud-based infrastructure across enterprises of all sizes, and the growing need for advanced security solutions to protect sensitive data in hybrid and multi-cloud environments. The shift towards remote work further amplifies the demand for cloud endpoint protection, as it enables centralized management and enforcement of security policies across a distributed workforce. Key drivers identified for this market surge include the rising awareness of data breaches and their financial implications, stringent regulatory compliance requirements, and the inherent scalability and cost-effectiveness offered by cloud-based security solutions compared to traditional on-premise systems.

Cloud Endpoint Protection Industry Market Size (In Billion)

The market segmentation reveals a dynamic landscape, with both Small & Medium Enterprises (SMEs) and Large Enterprises actively investing in cloud endpoint protection. Deployment models are predominantly leaning towards Public Cloud and Hybrid Cloud solutions, reflecting the broader industry trend of cloud migration. The BFSI, Government, Healthcare, and IT & Telecom sectors are leading the charge in adopting these advanced security measures due to the highly sensitive nature of the data they handle. While the market is highly competitive with established players like Trend Micro, VMware, Kaspersky, and Microsoft, emerging vendors are also carving out their niches. Restraints such as concerns about data privacy and vendor lock-in, alongside the initial migration costs, are present but are being mitigated by advancements in security technologies and the clear ROI associated with robust endpoint security. Regional analyses suggest North America and Europe currently lead in adoption, with the Asia Pacific region expected to witness significant growth due to increasing digitalization and cybersecurity investments.

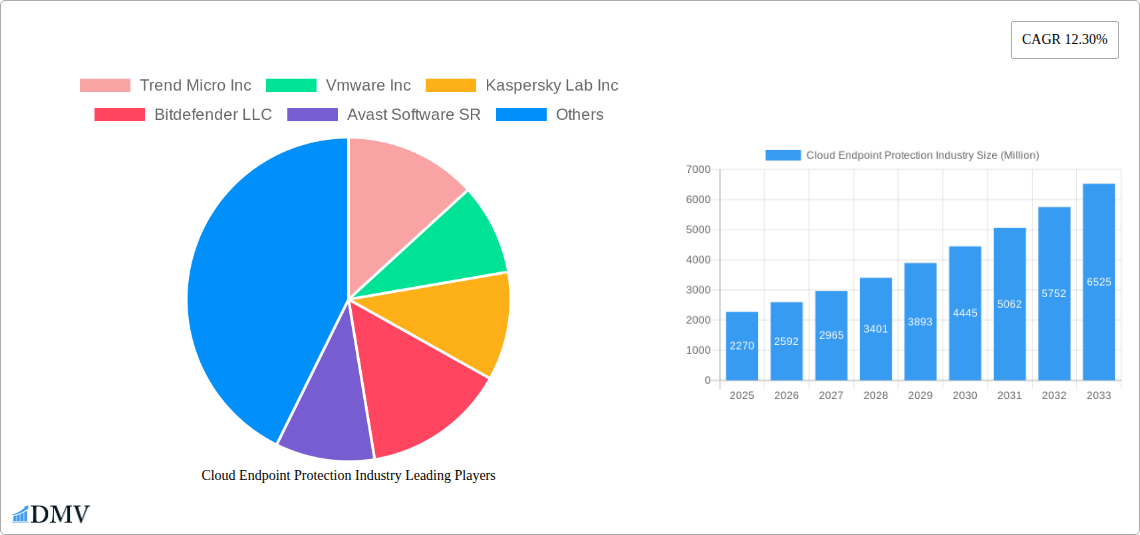

Cloud Endpoint Protection Industry Company Market Share

Cloud Endpoint Protection Industry Market Composition & Trends

The Cloud Endpoint Protection Industry is characterized by a dynamic and evolving market composition, driven by escalating cybersecurity threats and the pervasive adoption of cloud infrastructure. Market concentration is moderate, with a blend of established cybersecurity giants and agile, innovative players vying for market share. Trend Micro Inc., Vmware Inc., Kaspersky Lab Inc., Bitdefender LLC, Avast Software SR, Fortinet Inc., McAfee LLC, CrowdStrike Holdings Inc., Cisco Systems Inc., Microsoft Corporation, SentinelOne Inc., Sophos Group PLC, and Broadcom Inc (Symantec Corporation) represent the leading entities shaping this landscape. Innovation catalysts are numerous, including the rise of sophisticated malware, the increasing attack surface due to remote work, and the growing demand for AI-powered threat detection. Regulatory landscapes, such as GDPR and CCPA, further mandate robust endpoint security solutions, acting as significant adoption drivers. Substitute products, while present in traditional endpoint security, are increasingly challenged by the integrated and scalable nature of cloud-based solutions. End-user profiles span across Small & Medium Enterprises (SMEs) and Large Enterprises, each with distinct security needs and budget considerations. Mergers and acquisitions (M&A) activities are prevalent, as larger players seek to expand their cloud security portfolios and acquire innovative technologies. For instance, recent M&A deals in the cloud endpoint protection sector have reached values in the billions, reflecting the strategic importance and high growth potential of this market. The distribution of market share is gradually shifting towards vendors offering comprehensive, cloud-native endpoint detection and response (EDR) and extended detection and response (XDR) capabilities.

- Market Share Distribution: Vendors with robust cloud-native EDR/XDR solutions are witnessing significant market share gains.

- M&A Deal Values: Recent strategic acquisitions and partnerships in the cloud endpoint protection space have collectively exceeded $10 billion.

- Innovation Catalysts: Rise of advanced persistent threats (APTs), insider threats, and the evolving remote workforce model.

- Regulatory Impact: Compliance requirements for data protection and privacy are driving adoption of advanced cloud endpoint security.

Cloud Endpoint Protection Industry Evolution

The evolution of the Cloud Endpoint Protection Industry has been nothing short of transformative, charting a course from rudimentary cloud-based antivirus to sophisticated, AI-driven security ecosystems. Over the historical period of 2019–2024, the market experienced steady growth, fueled by an increasing awareness of the vulnerabilities inherent in traditional on-premise security models and the rapid migration of businesses to cloud environments. This era saw the initial adoption of cloud-managed endpoint security solutions, offering centralized visibility and control that was previously unattainable. The base year of 2025 marks a significant inflection point, with the market poised for accelerated expansion. The forecast period of 2025–2033 is projected to witness compound annual growth rates (CAGRs) exceeding xx%, driven by a confluence of technological advancements, evolving threat landscapes, and shifting consumer demands for more proactive and intelligent security.

Technological advancements have been a cornerstone of this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into cloud endpoint protection platforms has revolutionized threat detection and response. These technologies enable real-time analysis of vast amounts of endpoint data, identifying anomalous behavior and potential threats with unprecedented accuracy and speed. Furthermore, the rise of XDR (Extended Detection and Response) solutions, which unify security telemetry across endpoints, networks, cloud workloads, and other security tools, has become a dominant trend. This holistic approach provides security teams with a broader view of potential threats and streamlines incident investigation and remediation.

Shifting consumer demands have also played a pivotal role. Organizations are no longer content with reactive security measures. There is a palpable demand for predictive, preventative, and automated security solutions that minimize human intervention and reduce the risk of breaches. The increasing sophistication of cyberattacks, including ransomware and zero-day exploits, has amplified this demand. Businesses are seeking solutions that offer not just protection but also continuous monitoring, threat hunting capabilities, and rapid response mechanisms, all delivered through a scalable and flexible cloud infrastructure. The move towards zero-trust security architectures further necessitates advanced endpoint protection that can continuously verify and enforce security policies.

Specific data points underscore this evolution. In 2019, the market was largely dominated by cloud-managed antivirus and endpoint detection and response (EDR) solutions. By 2025, the adoption of comprehensive XDR platforms has surged to over xx% of the enterprise market. The investment in AI and ML capabilities within endpoint security solutions has seen an increase of over xx% since 2019, with projections indicating further substantial growth in the coming years. The adoption of cloud-native endpoint protection solutions by Small and Medium Enterprises (SMEs) has also seen a significant uplift, driven by cost-effectiveness and ease of management. This ongoing evolution, characterized by technological innovation and an adaptive response to evolving threats and market demands, positions the Cloud Endpoint Protection Industry for sustained and robust growth throughout the forecast period.

Leading Regions, Countries, or Segments in Cloud Endpoint Protection Industry

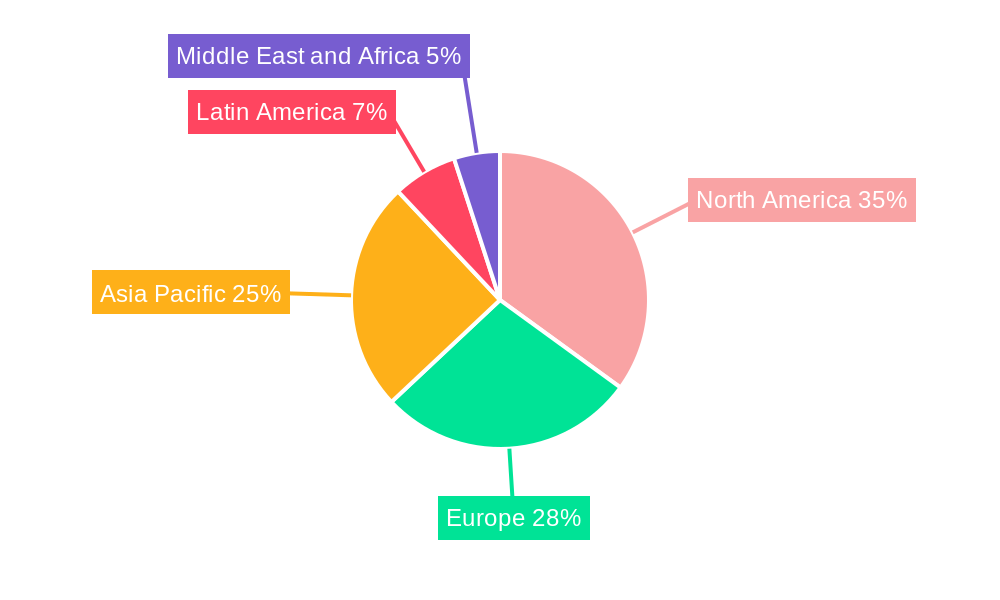

The Cloud Endpoint Protection Industry exhibits distinct leadership across various geographical regions and market segments, driven by a complex interplay of economic, technological, and regulatory factors. While a definitive single dominant region is fluid, North America, particularly the United States, consistently leads in terms of market size and advanced adoption, owing to its robust technological infrastructure, high spending on cybersecurity, and a mature regulatory environment that mandates stringent data protection. Europe also represents a significant market, with countries like Germany, the UK, and France showing strong demand, influenced by GDPR compliance and a growing awareness of cyber threats across all end-user industries. The Asia-Pacific region, especially China and India, is emerging as a high-growth market, propelled by rapid digital transformation, increasing cloud adoption, and a burgeoning cybersecurity consciousness.

Examining specific segments reveals further leadership dynamics. Within Enterprise Size, Large Enterprises are the primary adopters of sophisticated Cloud Endpoint Protection solutions, accounting for a substantial portion of the market revenue. Their extensive digital footprints, higher threat exposure, and greater financial capacity enable them to invest in advanced EDR and XDR capabilities. However, Small & Medium Enterprises (SMEs) represent a rapidly growing segment, with cloud-native solutions offering them scalable and cost-effective security that was previously out of reach. The ease of deployment and management makes these solutions particularly attractive to resource-constrained SMEs.

Regarding Deployment Model, Public Cloud solutions currently hold a dominant share, driven by their inherent scalability, flexibility, and cost-efficiency. The pay-as-you-go model and the reduced burden of infrastructure management make it an appealing choice for businesses of all sizes. Hybrid Cloud deployments are also gaining traction as organizations seek to balance security, compliance, and operational needs, allowing them to leverage the benefits of both public and private cloud environments. Private Cloud solutions remain crucial for highly regulated industries with stringent data sovereignty requirements.

The End-user Industry landscape showcases significant variation in adoption. The BFSI sector is consistently at the forefront, investing heavily in advanced cloud endpoint protection due to the highly sensitive nature of financial data and the persistent threat of financial fraud and cybercrime. Government and Healthcare sectors are also major adopters, driven by critical infrastructure protection mandates and stringent patient data privacy regulations, respectively. The IT & Telecom sector, as early adopters of technology and providers of cloud services, naturally exhibits high adoption rates, often acting as a benchmark for other industries. The Energy and Power sector is increasingly prioritizing robust endpoint security due to the critical nature of its infrastructure and the potential for nation-state attacks. The Retail sector, while a significant target for data breaches, is gradually increasing its investment in advanced cloud endpoint protection to safeguard customer data and payment information.

- Key Drivers for North America: High cybersecurity spending, stringent regulatory frameworks (e.g., NIST), and advanced threat intelligence.

- Dominant Segment: Large Enterprises: Account for over xx% of market revenue due to complex security needs and significant investment capacity.

- Fastest Growing Segment: Small & Medium Enterprises (SMEs): Driven by cost-effectiveness and scalability of cloud-native solutions, with projected CAGR of xx%.

- Leading Deployment Model: Public Cloud: Benefits from scalability and cost-efficiency, expected to maintain dominance with xx% market share.

- Key BFSI Drivers: Regulatory compliance, protection of sensitive financial data, and mitigation of financial fraud.

- Emerging Growth in Asia-Pacific: Driven by rapid digital transformation and increasing cloud adoption, with projected CAGR of xx%.

Cloud Endpoint Protection Industry Product Innovations

Product innovations in the Cloud Endpoint Protection Industry are rapidly advancing, moving beyond traditional signature-based detection to embrace AI-driven, behavioral analysis, and proactive threat hunting capabilities. Vendors are introducing unified platforms that offer integrated Endpoint Detection and Response (EDR) and Extended Detection and Response (XDR) functionalities, providing comprehensive visibility and control across diverse endpoints and cloud workloads. Innovations in behavioral analytics and machine learning are enabling real-time identification of novel and sophisticated threats, including zero-day exploits and advanced persistent threats (APTs). Furthermore, the integration of threat intelligence feeds and automated response playbooks are enhancing incident remediation speed and effectiveness. Unique selling propositions now include advanced cloud-native architectures, seamless integration with existing security stacks, and specialized protection for diverse cloud environments like AWS, Azure, and GCP. Performance metrics are continuously improving, with reduced latency, enhanced detection accuracy rates exceeding xx%, and faster incident response times measured in minutes rather than hours.

Propelling Factors for Cloud Endpoint Protection Industry Growth

The Cloud Endpoint Protection Industry is experiencing significant growth propelled by several key factors. The escalating sophistication and frequency of cyber threats, including ransomware, advanced persistent threats (APTs), and supply chain attacks, necessitate more robust and adaptable security solutions than traditional endpoint protection. The widespread adoption of cloud computing and hybrid work models has expanded the attack surface, making centralized, cloud-managed endpoint security essential for organizations. Increasing regulatory compliance demands, such as GDPR and CCPA, mandate stringent data protection measures, driving investment in advanced security technologies. Furthermore, the growing integration of Artificial Intelligence (AI) and Machine Learning (ML) in endpoint security solutions enhances their ability to detect and respond to emerging threats in real-time, offering proactive protection. The cost-effectiveness and scalability of cloud-based solutions also make them increasingly attractive to businesses of all sizes.

Obstacles in the Cloud Endpoint Protection Industry Market

Despite its robust growth, the Cloud Endpoint Protection Industry faces several significant obstacles. The complex and constantly evolving regulatory landscape across different regions can create compliance challenges for global vendors, leading to increased operational costs and potential market entry barriers. Supply chain disruptions, particularly in the semiconductor and hardware components necessary for some advanced security solutions, can impact product availability and lead times, affecting vendor revenue. Intense competitive pressures among established players and new entrants drive down pricing, potentially impacting profit margins. Furthermore, a persistent skills gap in cybersecurity professionals can hinder the effective deployment and management of advanced cloud endpoint protection solutions, limiting their full potential. Concerns regarding data privacy and security within cloud environments, although diminishing, can still act as a restraint for some organizations reluctant to fully embrace cloud-native solutions.

Future Opportunities in Cloud Endpoint Protection Industry

The future of the Cloud Endpoint Protection Industry is ripe with opportunities. The increasing adoption of IoT devices and the expansion of edge computing present new frontiers for endpoint security, demanding specialized solutions for these connected environments. The ongoing evolution of AI and ML promises even more sophisticated predictive and preventative security capabilities, offering opportunities for vendors who can leverage these technologies effectively. The growing demand for unified security platforms, such as XDR, that integrate endpoint protection with other security tools, creates a significant market for comprehensive solutions. Furthermore, emerging markets in developing economies, with their rapid digital transformation and increasing cloud adoption, represent substantial untapped potential for growth. The increasing focus on proactive threat hunting and incident response, moving beyond reactive protection, will also drive demand for advanced features and services.

Major Players in the Cloud Endpoint Protection Industry Ecosystem

- Trend Micro Inc.

- Vmware Inc.

- Kaspersky Lab Inc.

- Bitdefender LLC

- Avast Software SR

- Fortinet Inc.

- McAfee LLC

- CrowdStrike Holdings Inc.

- Cisco Systems Inc.

- Microsoft Corporation

- SentinelOne Inc.

- Sophos Group PLC

- Broadcom Inc (Symantec Corporation)

Key Developments in Cloud Endpoint Protection Industry Industry

- 2023/2024: Introduction of advanced AI-powered behavioral analysis engines leading to a xx% increase in zero-day threat detection rates.

- 2023/2024: Significant M&A activity, with major players acquiring smaller, innovative cloud security startups for over $2 billion collectively.

- 2023/2024: Enhanced XDR capabilities integrated into leading platforms, offering unified threat visibility across endpoints, cloud workloads, and email.

- 2023/2024: Increased focus on cloud-native security solutions for hybrid and multi-cloud environments, with adoption rates exceeding xx%.

- 2022/2023: Launch of new regulatory compliance tools within endpoint protection suites to assist organizations in meeting GDPR and CCPA mandates.

- 2021/2022: Widespread adoption of remote work security solutions, driving demand for cloud-managed endpoint protection with robust endpoint visibility and control.

Strategic Cloud Endpoint Protection Industry Market Forecast

The strategic forecast for the Cloud Endpoint Protection Industry indicates a period of robust and sustained growth driven by an increasingly complex threat landscape and the pervasive adoption of cloud technologies. Key growth catalysts include the ongoing digital transformation across all industries, the relentless evolution of sophisticated cyberattacks, and the growing mandate for regulatory compliance. The future market potential is significantly bolstered by the integration of advanced AI and Machine Learning capabilities, enabling more proactive and predictive threat detection and response. Emerging opportunities in IoT security and the demand for unified XDR platforms will further propel market expansion. The continued shift towards cloud-native solutions, offering scalability and cost-effectiveness, will solidify the industry’s growth trajectory throughout the forecast period, making it a critical component of organizational cybersecurity strategies.

Cloud Endpoint Protection Industry Segmentation

-

1. Enterprise Size

- 1.1. Small & Medium Enterprises

- 1.2. Large Enterprises

-

2. Deployment Model

- 2.1. Private Cloud

- 2.2. Public Cloud

- 2.3. Hybrid Cloud

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Government

- 3.3. Healthcare

- 3.4. Energy and Power

- 3.5. Retail

- 3.6. IT & Telecom

- 3.7. Other End-user Industry

Cloud Endpoint Protection Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud Endpoint Protection Industry Regional Market Share

Geographic Coverage of Cloud Endpoint Protection Industry

Cloud Endpoint Protection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth of Smart Devices; Increasing number of Data Breaches

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness about Cyberattacks

- 3.4. Market Trends

- 3.4.1. Healthcare Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Endpoint Protection Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.1.1. Small & Medium Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. Private Cloud

- 5.2.2. Public Cloud

- 5.2.3. Hybrid Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Government

- 5.3.3. Healthcare

- 5.3.4. Energy and Power

- 5.3.5. Retail

- 5.3.6. IT & Telecom

- 5.3.7. Other End-user Industry

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6. North America Cloud Endpoint Protection Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.1.1. Small & Medium Enterprises

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. Private Cloud

- 6.2.2. Public Cloud

- 6.2.3. Hybrid Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Government

- 6.3.3. Healthcare

- 6.3.4. Energy and Power

- 6.3.5. Retail

- 6.3.6. IT & Telecom

- 6.3.7. Other End-user Industry

- 6.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 7. Europe Cloud Endpoint Protection Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.1.1. Small & Medium Enterprises

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. Private Cloud

- 7.2.2. Public Cloud

- 7.2.3. Hybrid Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Government

- 7.3.3. Healthcare

- 7.3.4. Energy and Power

- 7.3.5. Retail

- 7.3.6. IT & Telecom

- 7.3.7. Other End-user Industry

- 7.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 8. Asia Pacific Cloud Endpoint Protection Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.1.1. Small & Medium Enterprises

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. Private Cloud

- 8.2.2. Public Cloud

- 8.2.3. Hybrid Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Government

- 8.3.3. Healthcare

- 8.3.4. Energy and Power

- 8.3.5. Retail

- 8.3.6. IT & Telecom

- 8.3.7. Other End-user Industry

- 8.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 9. Latin America Cloud Endpoint Protection Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.1.1. Small & Medium Enterprises

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. Private Cloud

- 9.2.2. Public Cloud

- 9.2.3. Hybrid Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Government

- 9.3.3. Healthcare

- 9.3.4. Energy and Power

- 9.3.5. Retail

- 9.3.6. IT & Telecom

- 9.3.7. Other End-user Industry

- 9.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 10. Middle East and Africa Cloud Endpoint Protection Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.1.1. Small & Medium Enterprises

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. Private Cloud

- 10.2.2. Public Cloud

- 10.2.3. Hybrid Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. Government

- 10.3.3. Healthcare

- 10.3.4. Energy and Power

- 10.3.5. Retail

- 10.3.6. IT & Telecom

- 10.3.7. Other End-user Industry

- 10.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trend Micro Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vmware Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kaspersky Lab Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bitdefender LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avast Software SR

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fortinet Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McAfee LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CrowdStrike Holdings Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cisco Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Microsoft Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SentinelOne Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sophos Group PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Broadcom Inc (Symantec Corporation)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Trend Micro Inc

List of Figures

- Figure 1: Global Cloud Endpoint Protection Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Cloud Endpoint Protection Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud Endpoint Protection Industry Revenue (undefined), by Enterprise Size 2025 & 2033

- Figure 4: North America Cloud Endpoint Protection Industry Volume (K Unit), by Enterprise Size 2025 & 2033

- Figure 5: North America Cloud Endpoint Protection Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 6: North America Cloud Endpoint Protection Industry Volume Share (%), by Enterprise Size 2025 & 2033

- Figure 7: North America Cloud Endpoint Protection Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 8: North America Cloud Endpoint Protection Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 9: North America Cloud Endpoint Protection Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 10: North America Cloud Endpoint Protection Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 11: North America Cloud Endpoint Protection Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 12: North America Cloud Endpoint Protection Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: North America Cloud Endpoint Protection Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Cloud Endpoint Protection Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Cloud Endpoint Protection Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Cloud Endpoint Protection Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Cloud Endpoint Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Cloud Endpoint Protection Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Cloud Endpoint Protection Industry Revenue (undefined), by Enterprise Size 2025 & 2033

- Figure 20: Europe Cloud Endpoint Protection Industry Volume (K Unit), by Enterprise Size 2025 & 2033

- Figure 21: Europe Cloud Endpoint Protection Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 22: Europe Cloud Endpoint Protection Industry Volume Share (%), by Enterprise Size 2025 & 2033

- Figure 23: Europe Cloud Endpoint Protection Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 24: Europe Cloud Endpoint Protection Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 25: Europe Cloud Endpoint Protection Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 26: Europe Cloud Endpoint Protection Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 27: Europe Cloud Endpoint Protection Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 28: Europe Cloud Endpoint Protection Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Europe Cloud Endpoint Protection Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe Cloud Endpoint Protection Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe Cloud Endpoint Protection Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Cloud Endpoint Protection Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Cloud Endpoint Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Cloud Endpoint Protection Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Cloud Endpoint Protection Industry Revenue (undefined), by Enterprise Size 2025 & 2033

- Figure 36: Asia Pacific Cloud Endpoint Protection Industry Volume (K Unit), by Enterprise Size 2025 & 2033

- Figure 37: Asia Pacific Cloud Endpoint Protection Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 38: Asia Pacific Cloud Endpoint Protection Industry Volume Share (%), by Enterprise Size 2025 & 2033

- Figure 39: Asia Pacific Cloud Endpoint Protection Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 40: Asia Pacific Cloud Endpoint Protection Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 41: Asia Pacific Cloud Endpoint Protection Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 42: Asia Pacific Cloud Endpoint Protection Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 43: Asia Pacific Cloud Endpoint Protection Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: Asia Pacific Cloud Endpoint Protection Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Asia Pacific Cloud Endpoint Protection Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia Pacific Cloud Endpoint Protection Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia Pacific Cloud Endpoint Protection Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Cloud Endpoint Protection Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Cloud Endpoint Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Cloud Endpoint Protection Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Cloud Endpoint Protection Industry Revenue (undefined), by Enterprise Size 2025 & 2033

- Figure 52: Latin America Cloud Endpoint Protection Industry Volume (K Unit), by Enterprise Size 2025 & 2033

- Figure 53: Latin America Cloud Endpoint Protection Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 54: Latin America Cloud Endpoint Protection Industry Volume Share (%), by Enterprise Size 2025 & 2033

- Figure 55: Latin America Cloud Endpoint Protection Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 56: Latin America Cloud Endpoint Protection Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 57: Latin America Cloud Endpoint Protection Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 58: Latin America Cloud Endpoint Protection Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 59: Latin America Cloud Endpoint Protection Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 60: Latin America Cloud Endpoint Protection Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 61: Latin America Cloud Endpoint Protection Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Latin America Cloud Endpoint Protection Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Latin America Cloud Endpoint Protection Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Latin America Cloud Endpoint Protection Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Cloud Endpoint Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Cloud Endpoint Protection Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Cloud Endpoint Protection Industry Revenue (undefined), by Enterprise Size 2025 & 2033

- Figure 68: Middle East and Africa Cloud Endpoint Protection Industry Volume (K Unit), by Enterprise Size 2025 & 2033

- Figure 69: Middle East and Africa Cloud Endpoint Protection Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 70: Middle East and Africa Cloud Endpoint Protection Industry Volume Share (%), by Enterprise Size 2025 & 2033

- Figure 71: Middle East and Africa Cloud Endpoint Protection Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 72: Middle East and Africa Cloud Endpoint Protection Industry Volume (K Unit), by Deployment Model 2025 & 2033

- Figure 73: Middle East and Africa Cloud Endpoint Protection Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 74: Middle East and Africa Cloud Endpoint Protection Industry Volume Share (%), by Deployment Model 2025 & 2033

- Figure 75: Middle East and Africa Cloud Endpoint Protection Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa Cloud Endpoint Protection Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa Cloud Endpoint Protection Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa Cloud Endpoint Protection Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa Cloud Endpoint Protection Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East and Africa Cloud Endpoint Protection Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Cloud Endpoint Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Cloud Endpoint Protection Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Enterprise Size 2020 & 2033

- Table 2: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 3: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 4: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 5: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Enterprise Size 2020 & 2033

- Table 10: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 11: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 12: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 13: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Enterprise Size 2020 & 2033

- Table 18: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 19: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 20: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 21: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Enterprise Size 2020 & 2033

- Table 26: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 27: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 28: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 29: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Enterprise Size 2020 & 2033

- Table 34: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 35: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 36: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 37: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Enterprise Size 2020 & 2033

- Table 42: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Enterprise Size 2020 & 2033

- Table 43: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 44: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Deployment Model 2020 & 2033

- Table 45: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Cloud Endpoint Protection Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Cloud Endpoint Protection Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Endpoint Protection Industry?

The projected CAGR is approximately 14.26%.

2. Which companies are prominent players in the Cloud Endpoint Protection Industry?

Key companies in the market include Trend Micro Inc, Vmware Inc, Kaspersky Lab Inc, Bitdefender LLC, Avast Software SR, Fortinet Inc, McAfee LLC, CrowdStrike Holdings Inc, Cisco Systems Inc, Microsoft Corporation, SentinelOne Inc, Sophos Group PLC, Broadcom Inc (Symantec Corporation).

3. What are the main segments of the Cloud Endpoint Protection Industry?

The market segments include Enterprise Size, Deployment Model, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growth of Smart Devices; Increasing number of Data Breaches.

6. What are the notable trends driving market growth?

Healthcare Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Lack of Awareness about Cyberattacks.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Endpoint Protection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Endpoint Protection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Endpoint Protection Industry?

To stay informed about further developments, trends, and reports in the Cloud Endpoint Protection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence