Key Insights

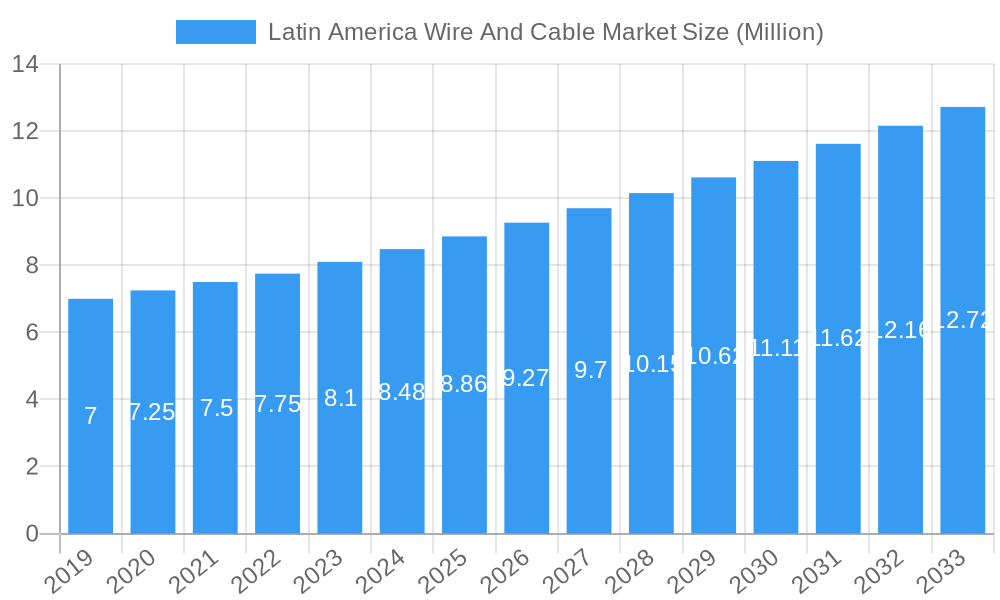

The Latin America Wire and Cable Market is poised for substantial growth, projected to reach a market size of $8.86 Million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.50% through 2033. This robust expansion is primarily fueled by the burgeoning construction sector, encompassing both residential and commercial developments across key economies like Brazil, Mexico, and Colombia. The increasing demand for advanced infrastructure, coupled with ongoing smart city initiatives and the expansion of telecommunications networks, are significant drivers. Furthermore, the growing need for reliable power transmission and distribution solutions, particularly in underserved areas, is contributing to market momentum. The market is expected to witness a strong demand for Fiber Optic Cables due to the rapid adoption of high-speed internet and advancements in data communication technologies. Signal and Control Cables are also anticipated to experience a steady rise, driven by the increasing automation in industrial and commercial applications.

Latin America Wire And Cable Market Market Size (In Million)

The market's trajectory is supported by substantial investments in renewable energy projects and the modernization of existing power grids. This necessitates the deployment of high-quality Power Cables. While the market benefits from these growth drivers, certain restraints such as fluctuating raw material prices, particularly for copper and aluminum, and the presence of a fragmented market with numerous small and medium-sized players could pose challenges. However, the overall outlook remains positive, with major industry players like Prysmian Group, Nexans, and ZTT Group actively expanding their presence and product portfolios within the region. Innovations in cable manufacturing, focusing on enhanced durability, efficiency, and sustainability, are expected to further shape the market landscape. The forecast period anticipates continued innovation and strategic collaborations to address infrastructure needs and capitalize on emerging opportunities.

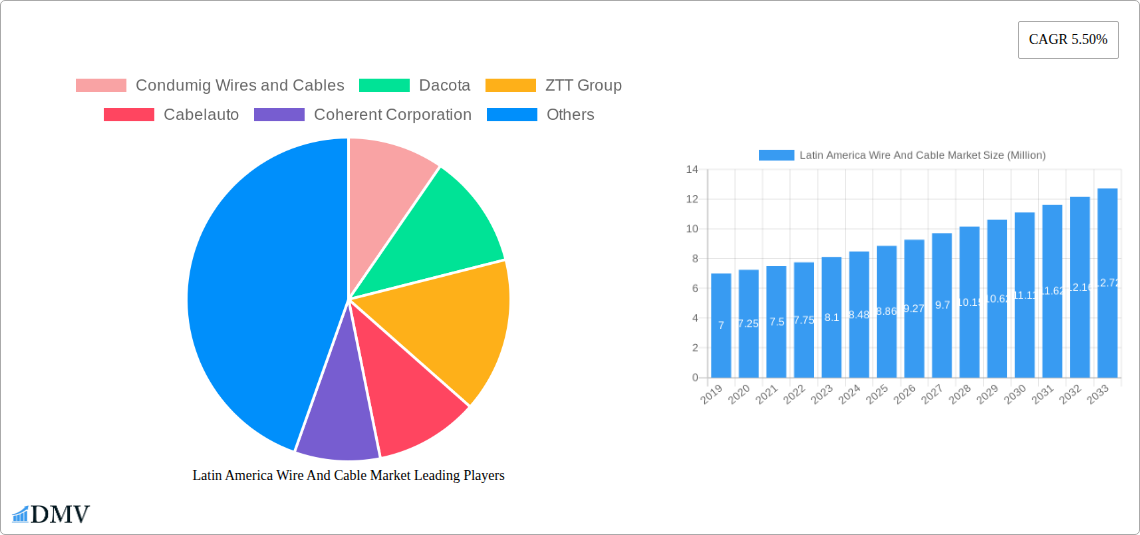

Latin America Wire And Cable Market Company Market Share

This comprehensive Latin America Wire and Cable Market report delivers an in-depth analysis of market dynamics, growth drivers, and future opportunities. Spanning the historical period of 2019–2024, with a base year of 2025 and a forecast period extending to 2033, this report is essential for stakeholders seeking to navigate the evolving wire and cable industry landscape in Latin America. We provide granular insights into power cables, fiber optic cables, signal and control cables, and the burgeoning construction, telecommunications (IT & Telecom), and power infrastructure sectors.

Latin America Wire And Cable Market Market Composition & Trends

The Latin America Wire and Cable Market exhibits a dynamic composition, characterized by a moderate market concentration with key players like Prysmian Group, Nexans, and Condumig Wires and Cables holding significant sway. Innovation is primarily driven by advancements in fiber optic cable technology and the demand for high-performance power cables to support expanding energy grids. Regulatory landscapes vary across countries, influencing adoption rates for advanced cabling solutions. Substitute products, while present, are increasingly outpaced by the superior performance and bandwidth offered by modern wire and cable solutions, especially within the telecommunications and construction sectors. End-user profiles are diverse, ranging from large-scale infrastructure projects to residential and commercial building developments, each with distinct cabling requirements. Mergers and acquisitions (M&A) activities are a notable trend, with strategic acquisitions aimed at expanding market reach and product portfolios. For instance, the Southwire Company LLC acquisition of Genesis Wire & Cable Business in October 2023 highlights this trend, potentially impacting the low-voltage cable segment. The overall M&A deal value in the Latin American region is estimated to be in the range of several hundred million USD, reflecting the strategic importance of this market.

- Market Share Distribution: Dominated by a few key global and regional players, with increasing fragmentation in niche segments.

- M&A Deal Values: Significant investments in strategic acquisitions, contributing to market consolidation and expansion.

- Innovation Catalysts: Demand for faster data transmission (fiber optics), increased energy efficiency (power cables), and smart building technologies.

- Regulatory Landscapes: Varying standards and government incentives impacting infrastructure development and product adoption.

- Substitute Products: Limited impact due to superior performance and longevity of advanced wire and cable solutions.

Latin America Wire And Cable Market Industry Evolution

The Latin America Wire and Cable Market has undergone a significant evolutionary trajectory, driven by a confluence of robust economic development, increasing urbanization, and a strong push towards digital transformation. Over the historical period of 2019–2024, the market experienced steady growth, fueled by substantial investments in infrastructure projects, including renewable energy installations, smart grid development, and the expansion of broadband networks. The adoption of fiber optic cable technology has been particularly transformative, witnessing a compound annual growth rate (CAGR) of approximately 8-10% during this period, as countries across the region prioritize high-speed internet access for both commercial and residential consumers. This surge in demand for faster data transmission is directly linked to the growth of the Telecommunications (IT & Telecom) end-user vertical, which accounts for a substantial portion of the market share.

Technological advancements have played a pivotal role in shaping the industry. The development of advanced insulation materials, enhanced fire-retardant properties, and greater energy efficiency in power cables has allowed manufacturers to cater to more stringent safety and performance standards. Furthermore, the proliferation of smart city initiatives and the Internet of Things (IoT) has created new avenues for signal and control cables, driving innovation in miniaturization and increased data carrying capacity. Consumer demands are increasingly shifting towards sustainable and environmentally friendly products, prompting manufacturers to invest in eco-conscious production processes and materials. This is reflected in the growing interest in cables with lower environmental impact and extended lifespans. The construction sector, encompassing both residential and commercial applications, remains a cornerstone of the market, with an estimated CAGR of 6-8%, driven by ongoing urbanization and the need for modern electrical infrastructure. The Power In segment, crucial for energy transmission and distribution, is also experiencing consistent growth, projected at a CAGR of 5-7%, as governments invest in modernizing their power grids to ensure reliable and efficient energy supply. The market has demonstrated resilience and adaptability, consistently evolving to meet the demands of a rapidly modernizing Latin American economy.

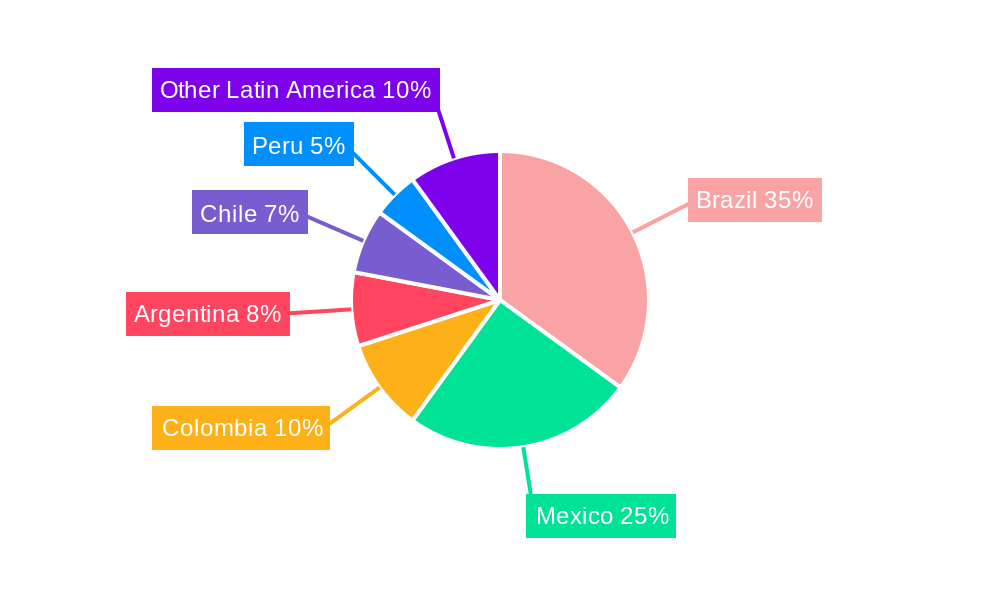

Leading Regions, Countries, or Segments in Latin America Wire And Cable Market

Within the expansive Latin America Wire and Cable Market, Brazil consistently emerges as the dominant region, driven by its large economy, extensive industrial base, and significant investments in infrastructure development. Its dominance is particularly pronounced in the Power Cable segment, which is essential for the nation's vast energy generation and distribution networks, including hydroelectric, wind, and solar power projects. The construction sector, encompassing both residential and commercial applications, is another significant driver of demand for various wire and cable types in Brazil. The country's robust manufacturing capabilities and the presence of major wire and cable manufacturers contribute to its leading position.

The Telecommunications (IT & Telecom) segment is also experiencing substantial growth in Brazil, propelled by government initiatives to expand broadband internet access and the increasing adoption of 5G technology. This surge in demand for high-speed connectivity fuels the market for Fiber Optic Cable. Countries like Mexico and Colombia also represent significant markets within Latin America, each with unique growth drivers. Mexico benefits from its strong manufacturing sector, particularly in automotive and electronics, leading to a steady demand for Signal and Control Cable and specialized Power Cables. Colombia, with its increasing focus on renewable energy and infrastructure modernization, is also a key market for Power Cables and Fiber Optic Cables.

- Dominant Region: Brazil leads due to its economic size, infrastructure investments, and manufacturing prowess.

- Key Drivers in Brazil:

- Significant government and private sector investment in power infrastructure, including renewable energy projects.

- Ongoing urbanization and a booming construction (Residential and Commercial) sector demanding extensive electrical cabling.

- Government push for digital transformation, accelerating the adoption of Fiber Optic Cable for Telecommunications (IT & Telecom).

- Established manufacturing base for wire and cable production.

- Key Drivers in Brazil:

- Leading Cable Type: Power Cable holds the largest market share due to widespread application in energy transmission, distribution, and industrial use.

- Dominance Factors:

- Essential for grid modernization and expansion across all Latin American economies.

- Critical for industrial operations and manufacturing facilities.

- Growing demand for specialized power cables for renewable energy sources.

- Dominance Factors:

- Leading End-user Vertical: Construction (Residential and Commercial) is a primary consumer, followed closely by Telecommunications (IT & Telecom).

- Dominance Factors in Construction:

- Continuous urbanization and housing development across the region.

- Increasing demand for smart building technologies and advanced electrical systems.

- Retrofitting and renovation of existing structures.

- Dominance Factors in Telecommunications:

- Rapid rollout of high-speed internet and broadband services.

- Deployment of 5G networks and data centers.

- Growing demand for reliable and high-capacity data transmission.

- Dominance Factors in Construction:

Latin America Wire And Cable Market Product Innovations

Product innovation in the Latin America Wire and Cable Market is driven by the pursuit of enhanced performance, reliability, and sustainability. Manufacturers are increasingly focusing on developing fiber optic cables with higher bandwidth and increased durability for telecommunications and data transmission, exemplified by advancements like Belden's OptiTuff Mini Fiber Cables, designed for space-saving installations. In the power cable segment, innovations center on improved insulation materials for higher voltage ratings, enhanced thermal performance, and increased fire safety, catering to stringent industry standards. The development of specialized signal and control cables with greater resistance to electromagnetic interference (EMI) and improved flexibility for automation and industrial applications is also a key trend. For instance, Coherent Corporation is at the forefront of developing advanced materials that enhance optical performance, which directly impacts fiber optic cable capabilities.

Propelling Factors for Latin America Wire And Cable Market Growth

Several key factors are propelling the growth of the Latin America Wire and Cable Market. Government initiatives aimed at expanding and modernizing power infrastructure, including significant investments in renewable energy sources like solar and wind, are driving demand for high-capacity power cables. The rapid digitalization across the region, particularly the expansion of broadband internet and the rollout of 5G networks, is a major catalyst for the fiber optic cable segment within Telecommunications (IT & Telecom). Furthermore, ongoing urbanization and a burgeoning construction sector, both residential and commercial, necessitate continuous investment in electrical wiring and cabling solutions. Economic recovery and foreign direct investment in manufacturing and industrial sectors also contribute significantly to the demand for various wire and cable products.

Obstacles in the Latin America Wire And Cable Market Market

Despite robust growth, the Latin America Wire and Cable Market faces several obstacles. Fluctuating raw material prices, particularly copper and aluminum, can impact profitability and market stability. Intense price competition among manufacturers, especially in commodity cable segments, can squeeze profit margins. Regulatory inconsistencies and complexities across different Latin American countries can create challenges for market entry and compliance. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to production delays and increased costs. Moreover, the slow adoption of advanced technologies in some segments and the reliance on traditional infrastructure in certain regions can hinder the uptake of higher-value wire and cable solutions.

Future Opportunities in Latin America Wire And Cable Market

Emerging opportunities within the Latin America Wire and Cable Market are abundant. The ongoing transition to renewable energy sources presents a significant opportunity for specialized power cables and associated infrastructure. The continuous expansion of digital networks and the growing demand for data services will further fuel the market for fiber optic cables. Smart city initiatives and the increasing adoption of IoT devices create demand for advanced signal and control cables and interconnected solutions. Furthermore, the growing middle class and continued urbanization will drive demand for residential and commercial construction, boosting the market for all types of electrical wire and cable. Investments in electric vehicle (EV) charging infrastructure also represent a nascent but promising opportunity.

Major Players in the Latin America Wire And Cable Market Ecosystem

- Condumig Wires and Cables

- Dacota

- ZTT Group

- Cabelauto

- Coherent Corporation

- Cofibam

- Acome

- Southwire Company LLC

- Belden Incorporated

- American Wire Group

- Alubar

- Tramar Condutores Especiais

- Cobrecom

- Induscabos Electric Conductors

- Tfkable

- Prysmian Group

- Lamesa Cabos Elétricos

- Encore Wire

- Nexans

- Cabletech Cabos

- Cablena

- Condumax

- Pan Electric

- Dacon Systems Inc

- Italcabos

- Condex

- Cobreflex

- Fujikura Ltd

- Yangtze Optical Fiber and Cable Joint Stock Limited Company

- Copperfio

- AF Datalink

- Te Connectivity

- Conduspar

- Brascopper

Key Developments in Latin America Wire And Cable Market Industry

- October 2023 - Southwire Company LLC announced the acquisition of Genesis Wire & Cable Business. Genesis Wire & Cable is a leading U.S. low-voltage cable manufacturer, providing a critical connection for various residential and commercial applications, including comfort, security, network and communications, entertainment, and fire and safety. This acquisition aims to expand Southwire's product portfolio and market reach within the low-voltage segment.

- August 2023 - Belden announced the offer of field-termination connectivity for its OptiTuff Mini Fiber Cables. This advancement continues the revolutionary breakthrough that OptiTuff Mini Fiber Cables provide for fiber installations, enabling installers to use space-saving OptiTuff systems in more fiber applications. This innovation directly addresses the growing demand for efficient and compact fiber optic solutions.

Strategic Latin America Wire And Cable Market Market Forecast

The strategic forecast for the Latin America Wire and Cable Market from 2025–2033 indicates continued robust growth, driven by sustained investments in critical infrastructure, digital transformation, and urbanization. The increasing focus on renewable energy integration will significantly boost demand for advanced power cables. The relentless expansion of high-speed internet and 5G services will continue to propel the fiber optic cable market, particularly within the Telecommunications (IT & Telecom) sector. Furthermore, the thriving construction industry, encompassing both residential and commercial projects, will remain a cornerstone of demand. Opportunities arising from smart city initiatives and the adoption of IoT technologies will also contribute to market expansion, making the Latin America Wire and Cable Market a highly attractive investment landscape for stakeholders.

Latin America Wire And Cable Market Segmentation

-

1. Cable Type

- 1.1. Fiber Optic Cable

- 1.2. Signal and Control Cable

- 1.3. Power Cable

- 1.4. Others

-

2. End-user Vertical

- 2.1. Construction (Residential and Commercial)

- 2.2. Telecommunications (IT & Telecom)

- 2.3. Power In

- 2.4. Others End-user Verticals

Latin America Wire And Cable Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Wire And Cable Market Regional Market Share

Geographic Coverage of Latin America Wire And Cable Market

Latin America Wire And Cable Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Infrastructure Development and Continuing Smart City Projects; Continuous Expansion in the Telecommunications Industry

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Associated Complexities

- 3.4. Market Trends

- 3.4.1. Fiber Optic Cable is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Wire And Cable Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Fiber Optic Cable

- 5.1.2. Signal and Control Cable

- 5.1.3. Power Cable

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Construction (Residential and Commercial)

- 5.2.2. Telecommunications (IT & Telecom)

- 5.2.3. Power In

- 5.2.4. Others End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Condumig Wires and Cables

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dacota

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZTT Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cabelauto

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coherent Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cofibam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Acome

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Southwire Company LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belden Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 American Wire Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alubar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tramar Condutores Especiais

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cobrecom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Induscabos Electric Conductors

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tfkable

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Prysmian Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Lamesa Cabos Elétricos

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Encore Wire

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Nexans

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Cabletech Cabos

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Cablena

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Condumax

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Pan Electric

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Dacon Systems Inc

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Italcabos

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Condex

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 Cobreflex

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 Fujikura Ltd

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.29 Yangtze Optical Fiber and Cable Joint Stock Limited Company

- 6.2.29.1. Overview

- 6.2.29.2. Products

- 6.2.29.3. SWOT Analysis

- 6.2.29.4. Recent Developments

- 6.2.29.5. Financials (Based on Availability)

- 6.2.30 Copperfio

- 6.2.30.1. Overview

- 6.2.30.2. Products

- 6.2.30.3. SWOT Analysis

- 6.2.30.4. Recent Developments

- 6.2.30.5. Financials (Based on Availability)

- 6.2.31 AF Datalink

- 6.2.31.1. Overview

- 6.2.31.2. Products

- 6.2.31.3. SWOT Analysis

- 6.2.31.4. Recent Developments

- 6.2.31.5. Financials (Based on Availability)

- 6.2.32 Te Connectivity

- 6.2.32.1. Overview

- 6.2.32.2. Products

- 6.2.32.3. SWOT Analysis

- 6.2.32.4. Recent Developments

- 6.2.32.5. Financials (Based on Availability)

- 6.2.33 Conduspar

- 6.2.33.1. Overview

- 6.2.33.2. Products

- 6.2.33.3. SWOT Analysis

- 6.2.33.4. Recent Developments

- 6.2.33.5. Financials (Based on Availability)

- 6.2.34 Brascopper

- 6.2.34.1. Overview

- 6.2.34.2. Products

- 6.2.34.3. SWOT Analysis

- 6.2.34.4. Recent Developments

- 6.2.34.5. Financials (Based on Availability)

- 6.2.1 Condumig Wires and Cables

List of Figures

- Figure 1: Latin America Wire And Cable Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Wire And Cable Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Wire And Cable Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 2: Latin America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2020 & 2033

- Table 3: Latin America Wire And Cable Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Latin America Wire And Cable Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 5: Latin America Wire And Cable Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Wire And Cable Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Latin America Wire And Cable Market Revenue Million Forecast, by Cable Type 2020 & 2033

- Table 8: Latin America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2020 & 2033

- Table 9: Latin America Wire And Cable Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Latin America Wire And Cable Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 11: Latin America Wire And Cable Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Wire And Cable Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Brazil Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Argentina Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Chile Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Colombia Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Peru Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Peru Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Venezuela Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Venezuela Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Ecuador Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Ecuador Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Bolivia Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Bolivia Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Paraguay Latin America Wire And Cable Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Paraguay Latin America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Wire And Cable Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Latin America Wire And Cable Market?

Key companies in the market include Condumig Wires and Cables, Dacota, ZTT Group, Cabelauto, Coherent Corporation, Cofibam, Acome, Southwire Company LLC, Belden Incorporated, American Wire Group, Alubar, Tramar Condutores Especiais, Cobrecom, Induscabos Electric Conductors, Tfkable, Prysmian Group, Lamesa Cabos Elétricos, Encore Wire, Nexans, Cabletech Cabos, Cablena, Condumax, Pan Electric, Dacon Systems Inc, Italcabos, Condex, Cobreflex, Fujikura Ltd, Yangtze Optical Fiber and Cable Joint Stock Limited Company, Copperfio, AF Datalink, Te Connectivity, Conduspar, Brascopper.

3. What are the main segments of the Latin America Wire And Cable Market?

The market segments include Cable Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Infrastructure Development and Continuing Smart City Projects; Continuous Expansion in the Telecommunications Industry.

6. What are the notable trends driving market growth?

Fiber Optic Cable is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Installation and Associated Complexities.

8. Can you provide examples of recent developments in the market?

October 2023 - Southwire Company LLC announced the acquisition of Genesis Wire & Cable Business. Genesis Wire & Cable is a leading U.S. low-voltage cable manufacturer, providing a critical connection for various residential and commercial applications, including comfort, security, network and communications, entertainment, and fire and safety.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Wire And Cable Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Wire And Cable Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Wire And Cable Market?

To stay informed about further developments, trends, and reports in the Latin America Wire And Cable Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence