Key Insights

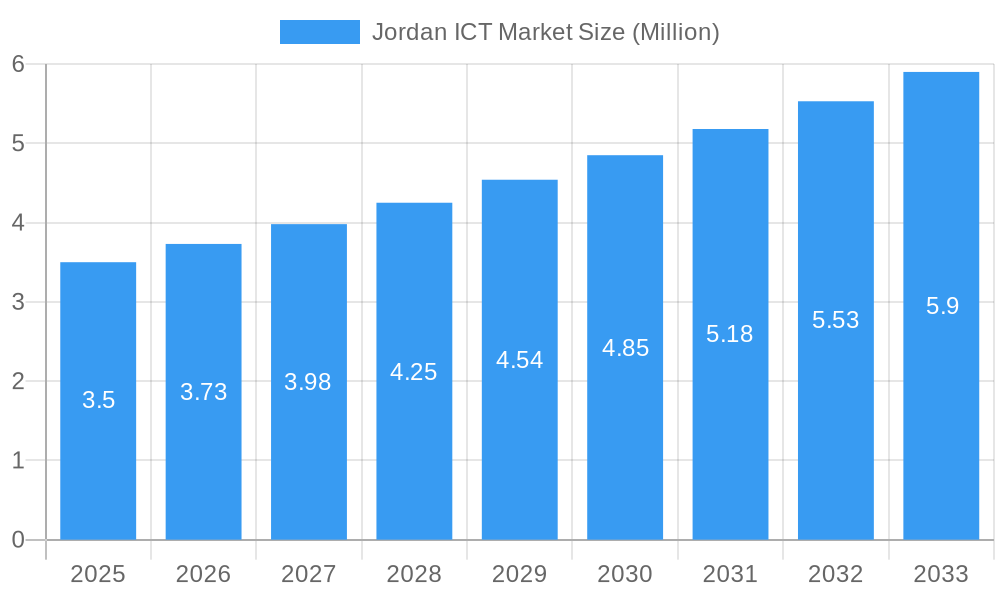

The Information and Communication Technology (ICT) market in Jordan is poised for significant expansion, projected to reach $3.5 million by 2025. This robust growth is underpinned by a Compound Annual Growth Rate (CAGR) of 6.47% over the forecast period of 2025-2033. This upward trajectory is largely driven by the increasing adoption of digital transformation initiatives across various industries, including BFSI, IT and Telecom, Government, and Retail. Furthermore, substantial investments in cloud computing, artificial intelligence, and cybersecurity solutions are acting as key catalysts for market expansion. The Jordanian government's commitment to fostering a digital economy, coupled with a growing pool of skilled IT professionals, further bolsters this positive outlook. The increasing penetration of smartphones and high-speed internet services is also facilitating greater access to digital services, thereby stimulating demand across hardware, software, and IT services segments.

Jordan ICT Market Market Size (In Million)

The market's segmentation reveals a balanced demand across enterprise sizes, with both Small and Medium Enterprises (SMEs) and Large Enterprises actively investing in advanced ICT solutions to enhance operational efficiency and competitiveness. Telecommunication services, essential for connectivity, represent a vital component of the market. While the market benefits from strong growth drivers, it also faces certain restraints. These may include initial implementation costs for advanced technologies, potential challenges in cybersecurity threat management, and the need for continuous upskilling of the workforce to keep pace with rapid technological advancements. Despite these challenges, the overarching trends of digital acceleration, cloud migration, and the demand for data analytics solutions are expected to propel the Jordan ICT market to new heights, making it an attractive landscape for both local and international technology providers.

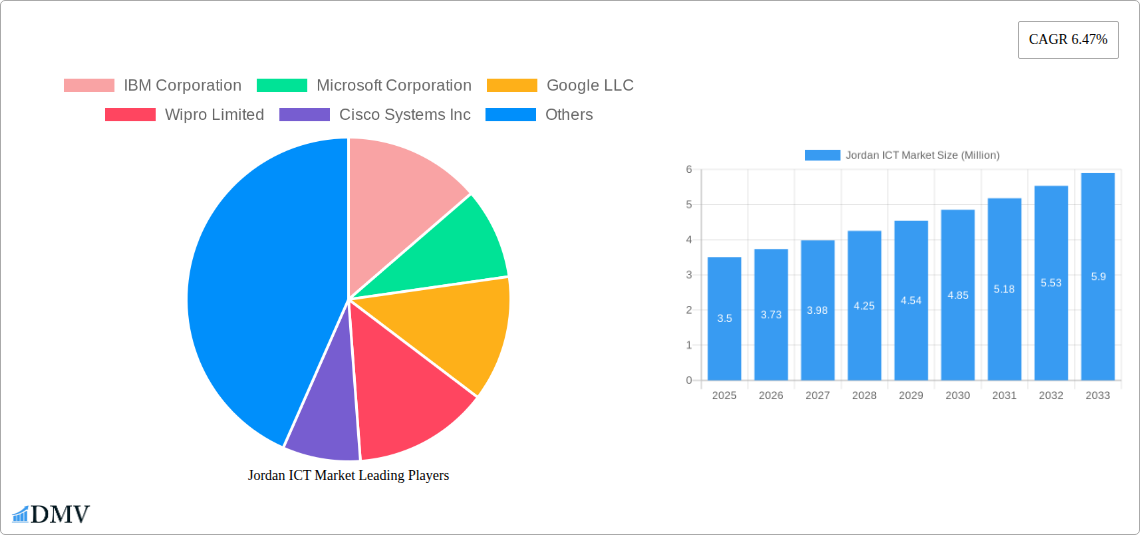

Jordan ICT Market Company Market Share

Jordan ICT Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the Jordan ICT market, offering critical insights into its current landscape, evolutionary trajectory, and promising future. Covering the historical period from 2019 to 2024, with a base year of 2025 and a robust forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the dynamic digital transformation within Jordan. Our comprehensive coverage delves into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities, all underpinned by rigorous data and expert analysis.

Jordan ICT Market Market Composition & Trends

The Jordan ICT market is characterized by a moderate concentration of key players, with innovation catalyzed by increasing digital adoption across various sectors. Regulatory frameworks are evolving to support digital growth, though the presence of substitute products in certain segments poses a competitive challenge. End-user profiles are diversifying, with a significant surge in demand from Small and Medium Enterprises (SMEs) alongside established large enterprises. Mergers and acquisitions (M&A) activity, while not yet at peak levels, is anticipated to increase as companies seek to expand their market reach and technological capabilities. The ICT market share distribution is projected to see dynamic shifts, with significant investments in IT services and telecommunication services driving growth. M&A deal values are expected to climb as strategic partnerships and consolidations become more prevalent. Understanding these intricate market dynamics is crucial for navigating the Jordanian digital landscape.

- Market Concentration: Moderate, with key players consolidating influence.

- Innovation Catalysts: Growing demand for digital solutions, government digital transformation initiatives.

- Regulatory Landscape: Supportive of digital infrastructure development and data security.

- Substitute Products: Emerging competition from cloud-based solutions and open-source alternatives.

- End-User Profiles: Growing adoption by SMEs, sustained demand from large enterprises and government sectors.

- M&A Activities: Increasing strategic acquisitions and partnerships to enhance market presence.

Jordan ICT Market Industry Evolution

The Jordan ICT market has witnessed a remarkable evolutionary journey, marked by consistent market growth trajectories and rapid technological advancements. The historical period from 2019-2024 has laid a strong foundation, with the base year of 2025 setting the stage for accelerated expansion. Shifting consumer demands, influenced by global digital trends and increasing internet penetration, have propelled the adoption of innovative solutions across all segments. The Jordan digital economy is expanding, fueled by investments in cloud computing, cybersecurity, and artificial intelligence. Growth rates in software solutions and IT services have been particularly impressive, reflecting the increasing reliance of businesses on digital infrastructure. Furthermore, the expansion of 5G networks and enhanced broadband connectivity are critical adoption metrics that signify a maturing market. The forecast period (2025-2033) promises further unprecedented growth, driven by smart city initiatives, digital government programs, and the burgeoning startup ecosystem.

Leading Regions, Countries, or Segments in Jordan ICT Market

Within the Jordan ICT market, IT Services and Telecommunication Services stand out as the dominant segments, driven by substantial investments and a growing need for robust digital infrastructure. The BFSI (Banking, Financial Services, and Insurance) and Government industry verticals are leading the charge in digital transformation, recognizing the imperative of efficient and secure digital operations. Large Enterprises, accustomed to complex IT demands, continue to be significant consumers, but the rapid growth and increasing digital maturity of Small and Medium Enterprises (SMEs) present a compelling expansion frontier.

Key drivers for the dominance of these segments include:

- Investment Trends: Significant capital expenditure in telecommunications infrastructure, including recent infrastructure investments by major operators.

- Regulatory Support: Government initiatives promoting digital transformation and cybersecurity standards, fostering trust and adoption.

- Technological Adoption: Increasing demand for cloud services, data analytics, and digital security solutions to enhance operational efficiency and customer engagement.

- Digitalization Mandates: Government and industry-specific mandates pushing for digital service delivery and paperless operations.

The dominance of IT Services is further amplified by the increasing need for specialized skills in areas such as cloud migration, cybersecurity implementation, and data management. Similarly, the telecommunications sector is undergoing a significant upgrade with the rollout of advanced network technologies, enabling new services and applications. The penetration of digital services within the BFSI sector, crucial for financial inclusion and customer convenience, along with the government's push for e-governance, solidifies the leading position of these segments.

Jordan ICT Market Product Innovations

The Jordan ICT market is experiencing a wave of innovative product developments, primarily focused on enhancing efficiency, security, and user experience. Cloud-based solutions are gaining traction, offering scalable and cost-effective alternatives to traditional on-premise systems. Advancements in cybersecurity tools are crucial, addressing the growing threat landscape and bolstering data protection for businesses and individuals. The development of specialized software for various industry verticals, such as fintech solutions for BFSI and smart city platforms for government, exemplifies tailored innovation. Performance metrics often highlight improved processing speeds, enhanced data analytics capabilities, and seamless integration with existing IT ecosystems, making these innovations highly attractive to the Jordanian market.

Propelling Factors for Jordan ICT Market Growth

The Jordan ICT market's growth is propelled by a confluence of technological, economic, and regulatory factors. Significant technological advancements, including the expansion of 5G networks and increased cloud adoption, are foundational. Economically, the government's commitment to fostering a digital economy and attracting foreign investment plays a crucial role. Regulatory initiatives aimed at promoting innovation, cybersecurity, and data privacy create a favorable business environment. For instance, government programs supporting digital transformation in SMEs and the development of tech hubs are directly contributing to market expansion.

Obstacles in the Jordan ICT Market Market

Despite its growth potential, the Jordan ICT market faces several obstacles. Regulatory challenges, though improving, can sometimes present complexities for new market entrants. Supply chain disruptions, particularly for hardware components, can impact project timelines and costs. Furthermore, intense competitive pressures from both local and international players necessitate continuous innovation and cost-efficiency. The digital skills gap also remains a concern, as a shortage of highly skilled IT professionals can hinder the adoption and implementation of advanced technologies.

Future Opportunities in Jordan ICT Market

Emerging opportunities in the Jordan ICT market are abundant, driven by the ongoing digital transformation across various sectors. The expansion of e-commerce, fueled by changing consumer behavior, presents a significant opportunity for digital platforms and logistics solutions. The burgeoning fintech sector offers avenues for innovation in digital payments, banking, and investment services. Furthermore, the government's focus on smart city initiatives and digital governance creates demand for IoT solutions, data analytics, and cybersecurity services. The growing startup ecosystem also fosters innovation and the development of niche ICT solutions.

Major Players in the Jordan ICT Market Ecosystem

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Wipro Limited

- Cisco Systems Inc

- Expedia Group Inc

- Oracle Corporation

- Telefonaktiebolaget LM Ericsson

- Devoteam

- Datos Solution LLC

Key Developments in Jordan ICT Market Industry

- March 2024: Zain Group disclosed a significant infrastructure investment, with its capital expenditure (Capex) hitting USD 994 million. The company's strategic moves, like selling towers and engaging in leaseback agreements in pivotal markets like Saudi Arabia, Kuwait, Jordan, and Iraq, bolstered operational efficiencies, leading to a surge in net profits.

- October 2023: Aqaba Digital Hub launched a data center in Jordan. The new data center, with a capacity of 6 megawatts, integrates a neutral internet exchange point, enabling seamless data exchange with local telecommunications companies, internet service providers, and digital content providers. This integration significantly reduces access times and minimizes data-sharing costs.

Strategic Jordan ICT Market Market Forecast

The strategic forecast for the Jordan ICT market anticipates sustained and accelerated growth, driven by ongoing digitalization initiatives and increasing digital adoption across all industry verticals. Key growth catalysts include further investments in telecommunications infrastructure, the expansion of cloud computing services, and a heightened focus on cybersecurity solutions. The forecast period (2025-2033) is expected to witness significant market potential as the government continues to champion digital transformation and private sector investment in technology rises. Emerging trends like AI-driven solutions and IoT integration will further shape the market, creating ample opportunities for innovation and economic development within the Kingdom.

Jordan ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprises

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Jordan ICT Market Segmentation By Geography

- 1. Jordan

Jordan ICT Market Regional Market Share

Geographic Coverage of Jordan ICT Market

Jordan ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation

- 3.3. Market Restrains

- 3.3.1. Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation

- 3.4. Market Trends

- 3.4.1. Consistent Digital Transformation Initiatives are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Jordan ICT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprises

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Jordan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wipro Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Expedia Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oracle Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telefonaktiebolaget LM Ericsson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Devoteam

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Datos Solution LLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Jordan ICT Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Jordan ICT Market Share (%) by Company 2025

List of Tables

- Table 1: Jordan ICT Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Jordan ICT Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Jordan ICT Market Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 4: Jordan ICT Market Volume Billion Forecast, by Size of Enterprises 2020 & 2033

- Table 5: Jordan ICT Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 6: Jordan ICT Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 7: Jordan ICT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Jordan ICT Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Jordan ICT Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Jordan ICT Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Jordan ICT Market Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 12: Jordan ICT Market Volume Billion Forecast, by Size of Enterprises 2020 & 2033

- Table 13: Jordan ICT Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 14: Jordan ICT Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: Jordan ICT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Jordan ICT Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Jordan ICT Market?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the Jordan ICT Market?

Key companies in the market include IBM Corporation, Microsoft Corporation, Google LLC, Wipro Limited, Cisco Systems Inc, Expedia Group Inc, Oracle Corporation, Telefonaktiebolaget LM Ericsson, Devoteam, Datos Solution LLC*List Not Exhaustive.

3. What are the main segments of the Jordan ICT Market?

The market segments include Type, Size of Enterprises, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation.

6. What are the notable trends driving market growth?

Consistent Digital Transformation Initiatives are Driving the Market.

7. Are there any restraints impacting market growth?

Rising Digital Transformation in Industries; Rapid Development of 5G Network Across the Nation.

8. Can you provide examples of recent developments in the market?

March 2024: Zain Group, a prominent telecommunications operator in the Middle East and North Africa, disclosed a significant infrastructure investment, with its capital expenditure (Capex) hitting USD 994 million. The company's strategic moves, like selling towers and engaging in leaseback agreements in pivotal markets like Saudi Arabia, Kuwait, Jordan, and Iraq, bolstered operational efficiencies, leading to a surge in net profits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Jordan ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Jordan ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Jordan ICT Market?

To stay informed about further developments, trends, and reports in the Jordan ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence