Key Insights

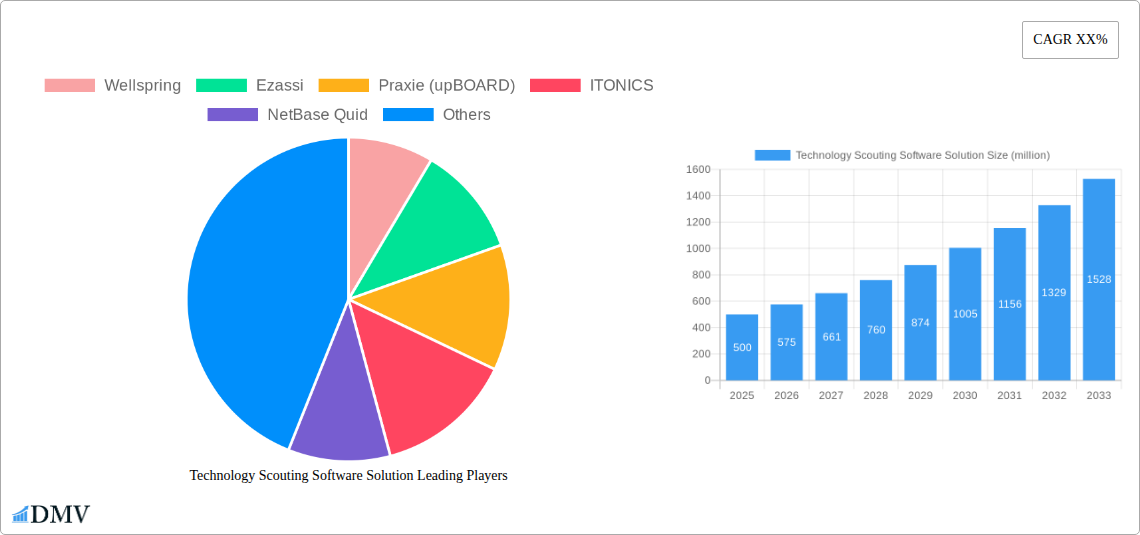

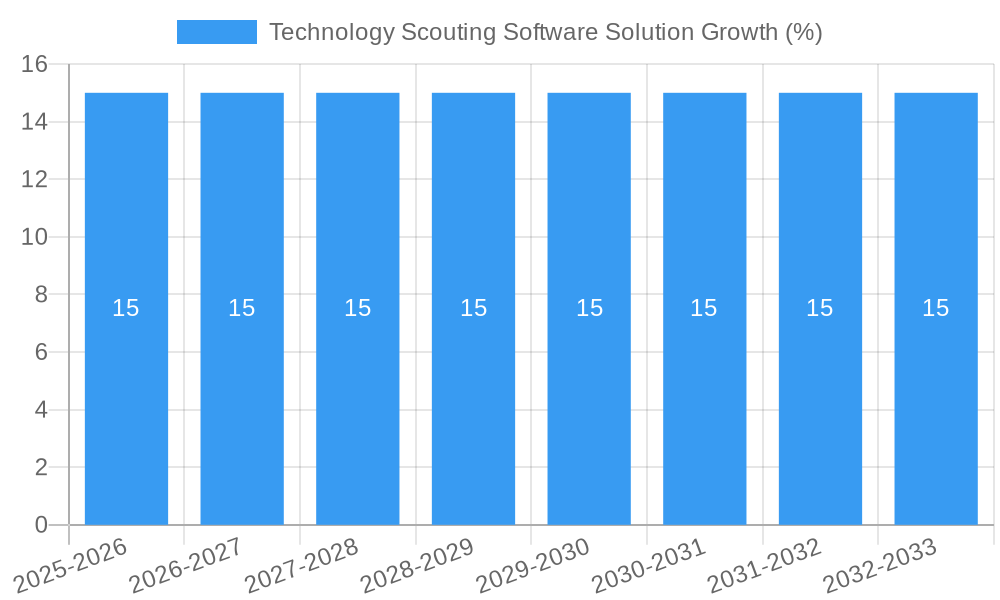

The global Technology Scouting Software Solution market is poised for significant expansion, with an estimated market size of approximately $500 million in 2025. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of around 15% through 2033, indicating a dynamic and evolving landscape. The primary drivers fueling this surge include the increasing need for organizations to stay ahead of disruptive technologies, gain a competitive edge through innovation, and optimize their R&D investments. Companies are recognizing the critical importance of systematically identifying emerging trends, potential partnerships, and acquisition targets to foster a culture of continuous innovation and maintain market leadership.

Several key trends are shaping the technology scouting software market. The widespread adoption of cloud-based solutions is enabling greater accessibility, scalability, and collaboration for businesses of all sizes, from large enterprises seeking comprehensive innovation intelligence to Small and Medium-sized Enterprises (SMEs) looking for cost-effective scouting tools. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of these platforms, allowing for more sophisticated analysis of vast datasets, predictive insights, and automated identification of relevant technologies and intellectual property. While the market is experiencing strong tailwinds, potential restraints include data privacy concerns, the integration challenges with existing enterprise systems, and the initial cost of implementation for some advanced solutions. Nevertheless, the overwhelming benefits of proactive technology scouting are driving market adoption across diverse industries.

Technology Scouting Software Solution Market Composition & Trends

This comprehensive report delves into the dynamic Technology Scouting Software Solution market, projecting a significant market size of approximately 25,000 million by 2033. The market exhibits a moderately concentrated structure, with key players like Wellspring, Ezassi, Praxie (upBOARD), ITONICS, NetBase Quid, Questel (Orbit Intelligence), Qmarkets (Q-scout), CPA Global, IP.com (InnovationQ), Lens, ResoluteAI, and PatSnap Discovery collectively holding a substantial market share. Innovation is primarily driven by advancements in AI, machine learning, and natural language processing, enabling more sophisticated and predictive scouting capabilities. Regulatory landscapes, while generally supportive of innovation, are evolving, particularly concerning data privacy and intellectual property management, which are critical considerations for technology scouting platforms. Substitute products, such as manual research methods and generic market intelligence tools, are steadily losing ground as the specialized features and efficiency gains offered by dedicated technology scouting solutions become apparent. End-user profiles span both Large Enterprises seeking to identify disruptive technologies and stay ahead of competitors, and SMEs aiming to leverage external innovation to accelerate growth. Mergers and acquisitions (M&A) are a key trend, with an estimated M&A deal value of 3,500 million during the historical period (2019-2024), indicating strategic consolidation and the acquisition of innovative technologies and customer bases.

Technology Scouting Software Solution Industry Evolution

The Technology Scouting Software Solution industry has witnessed a remarkable evolution, driven by an insatiable demand for proactive innovation management and competitive intelligence. Throughout the Study Period (2019–2033), the market has transitioned from niche solutions to indispensable tools for strategic foresight. The Base Year (2025) serves as a critical juncture, with the market value estimated to reach 15,000 million and poised for substantial expansion. The Forecast Period (2025–2033) anticipates a Compound Annual Growth Rate (CAGR) of approximately 15.5%, fueled by the increasing complexity of global innovation ecosystems and the need for efficient identification of emerging technologies, startups, and research breakthroughs. Technological advancements have been central to this evolution. Early solutions often relied on keyword-based searches and manual curation. However, the integration of advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms has revolutionized capabilities. These sophisticated technologies now enable semantic understanding, predictive analysis, and automated trend identification, allowing businesses to discover nascent technologies and potential disruptions far earlier in their lifecycle. For instance, the adoption of AI-powered patent analysis has surged, offering deeper insights into patent landscapes and competitive R&D activities. Shifting consumer demands, particularly the drive for sustainability, digital transformation, and personalized experiences, have further accelerated the need for effective technology scouting. Companies are increasingly looking to external innovation to meet these evolving market expectations, making robust technology scouting software essential for staying relevant and competitive. The market's growth trajectory is a testament to its increasing importance in a business environment characterized by rapid technological change and intense global competition.

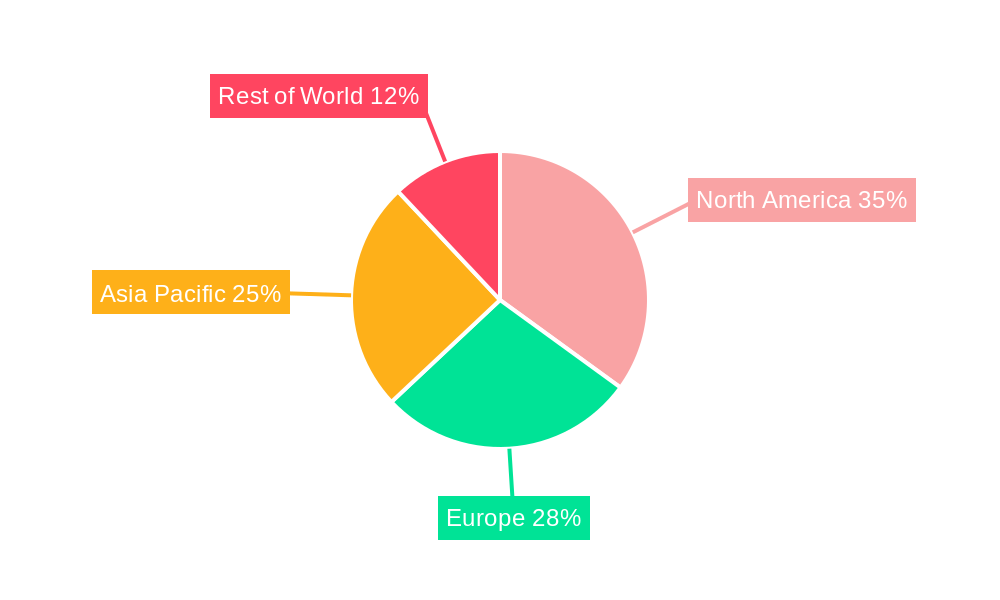

Leading Regions, Countries, or Segments in Technology Scouting Software Solution

North America currently dominates the Technology Scouting Software Solution market, driven by a robust ecosystem of innovation, significant venture capital investments, and a high concentration of large enterprises actively engaged in R&D and strategic partnerships. The United States, in particular, leads with substantial investments in emerging technologies and a mature market for advanced software solutions. The Application segment of Large Enterprises is the primary driver of this dominance, as these organizations possess the resources and strategic imperative to invest in sophisticated technology scouting platforms for competitive advantage and portfolio management. Their need to identify disruptive technologies, potential acquisition targets, and emerging market trends fuels significant demand.

- North America's Dominance Factors:

- High R&D Expenditure: Significant investment in research and development by leading corporations.

- Venture Capital Activity: A thriving venture capital landscape that fuels startup innovation and acquisition interest.

- Technological Adoption: Early and widespread adoption of advanced digital solutions, including AI and ML.

- Regulatory Environment: A generally supportive environment for innovation and intellectual property protection.

The Types segment of Web-Based and Cloud-Based solutions are equally prominent across all regions, offering scalability, accessibility, and cost-effectiveness that appeal to both Large Enterprises and SMEs. Cloud-based solutions, in particular, have seen exponential growth due to their inherent flexibility, ease of deployment, and reduced IT infrastructure overhead. This allows companies of all sizes to access powerful technology scouting capabilities without significant upfront investment.

- Key Drivers for Web-Based & Cloud-Based Solutions:

- Scalability & Flexibility: Ability to adapt to changing organizational needs and data volumes.

- Accessibility: Remote access from any location, facilitating global collaboration.

- Cost-Effectiveness: Reduced capital expenditure and predictable operational costs.

- Faster Deployment: Quick implementation and integration with existing systems.

While North America leads, Europe and Asia-Pacific are rapidly growing markets. Europe benefits from strong industrial sectors and increasing government initiatives to foster innovation. The Asia-Pacific region, particularly China and South Korea, is experiencing rapid technological advancement and a surge in corporate investment in R&D and intellectual property, making it a crucial growth frontier for technology scouting software.

Technology Scouting Software Solution Product Innovations

Product innovations in technology scouting software are largely centered on enhancing the precision, speed, and actionable insights delivered to users. Advanced AI and ML algorithms are now capable of performing deep semantic analysis of scientific literature, patent databases, and emerging tech trends, leading to the identification of previously overlooked innovation opportunities. Features like predictive trend analysis, automated anomaly detection in patent filings, and sophisticated competitor monitoring provide users with a significant edge. Performance metrics are increasingly focused on the accuracy of identified innovations, the reduction in time-to-insight, and the ROI generated from scouting activities. Unique selling propositions often revolve around intuitive user interfaces, seamless integration with internal innovation pipelines, and the ability to generate customized intelligence reports tailored to specific strategic objectives. The integration of blockchain for IP verification and tracking is an emerging innovation, further solidifying the value proposition of these advanced solutions.

Propelling Factors for Technology Scouting Software Solution Growth

The growth of the Technology Scouting Software Solution market is propelled by several critical factors. The accelerating pace of technological change across industries necessitates constant vigilance and proactive discovery of emerging innovations. This is compounded by the increasing global competition, forcing companies to seek external R&D and novel solutions to maintain a competitive edge. Furthermore, the rise of the Open Innovation paradigm, encouraging collaboration and the leveraging of external knowledge, directly fuels the demand for tools that facilitate such processes. Regulatory shifts, particularly those promoting intellectual property protection and technology transfer, also play a role. Economic factors, such as increased R&D budgets and a focus on digital transformation initiatives, further bolster the market's upward trajectory.

Obstacles in the Technology Scouting Software Solution Market

Despite its strong growth potential, the Technology Scouting Software Solution market faces several obstacles. The inherent complexity of accurately identifying and validating truly disruptive technologies can be a significant challenge, leading to potential false positives or missed opportunities. The high cost of implementing and maintaining advanced AI-driven platforms can be a barrier, especially for smaller organizations. Data privacy concerns and the need for robust security protocols are paramount, requiring significant investment in compliance and cybersecurity measures. Furthermore, the rapid evolution of the technology itself means that continuous updates and training are necessary, potentially leading to user adoption hurdles and resistance to change within organizations. Overcoming these barriers requires a focus on user-friendly design, clear ROI demonstration, and robust data governance frameworks.

Future Opportunities in Technology Scouting Software Solution

Emerging opportunities in the Technology Scouting Software Solution market are abundant and diverse. The growing focus on sustainable technologies and the circular economy presents a significant new area for scouting. As industries increasingly adopt AI and automation, specialized scouting solutions for these fields will gain prominence. The burgeoning market for personalized medicine and advanced biotechnology also offers substantial potential for tailored scouting platforms. Furthermore, the expansion of IoT devices and the associated data streams create a need for solutions that can effectively scout innovations within this interconnected landscape. The development of more predictive analytics and foresight capabilities within these platforms will also unlock new opportunities for strategic decision-making.

Major Players in the Technology Scouting Software Solution Ecosystem

- Wellspring

- Ezassi

- Praxie (upBOARD)

- ITONICS

- NetBase Quid

- Questel (Orbit Intelligence)

- Qmarkets (Q-scout)

- CPA Global

- IP.com (InnovationQ)

- Lens

- ResoluteAI

- PatSnap Discovery

Key Developments in Technology Scouting Software Solution Industry

- 2023/11: Integration of advanced generative AI for enhanced patent analysis and white space identification.

- 2023/09: Launch of a new cloud-based platform focusing on sustainability-related technology scouting.

- 2023/07: Acquisition of a startup specializing in AI-driven scientific literature analysis by a major player.

- 2023/05: Release of enhanced natural language processing (NLP) capabilities for deeper trend forecasting.

- 2023/03: Partnership formed to integrate real-time market sentiment analysis into scouting dashboards.

- 2022/12: Introduction of blockchain-based IP verification features for enhanced security and transparency.

- 2022/10: Significant investment round for a company focusing on predictive technology trend analysis.

- 2022/08: Expansion of platform capabilities to include scouting for open-source innovations.

Strategic Technology Scouting Software Solution Market Forecast

The strategic Technology Scouting Software Solution market forecast indicates robust growth driven by the relentless pursuit of innovation and competitive advantage. Future opportunities lie in leveraging advanced AI for predictive analytics, exploring emerging sectors like sustainable technologies and biotechnology, and expanding cloud-based offerings to a broader market. The increasing need for efficient R&D, proactive threat identification, and strategic partnership development will continue to fuel demand. With a projected market size of 25,000 million by 2033, the market is poised for significant expansion, making it a crucial area for businesses seeking to navigate the complexities of the modern innovation landscape.

Technology Scouting Software Solution Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Types

- 2.1. Web-Based

- 2.2. Cloud-Based

Technology Scouting Software Solution Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Technology Scouting Software Solution REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Technology Scouting Software Solution Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Web-Based

- 5.2.2. Cloud-Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Technology Scouting Software Solution Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Web-Based

- 6.2.2. Cloud-Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Technology Scouting Software Solution Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Web-Based

- 7.2.2. Cloud-Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Technology Scouting Software Solution Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Web-Based

- 8.2.2. Cloud-Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Technology Scouting Software Solution Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Web-Based

- 9.2.2. Cloud-Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Technology Scouting Software Solution Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Web-Based

- 10.2.2. Cloud-Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Wellspring

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ezassi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Praxie (upBOARD)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ITONICS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NetBase Quid

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Questel (Orbit Intelligence)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qmarkets (Q-scout)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CPA Global

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IP.com (InnovationQ)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lens

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ResoluteAI

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PatSnap Discovery

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Wellspring

List of Figures

- Figure 1: Global Technology Scouting Software Solution Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Technology Scouting Software Solution Revenue (million), by Application 2024 & 2032

- Figure 3: North America Technology Scouting Software Solution Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Technology Scouting Software Solution Revenue (million), by Types 2024 & 2032

- Figure 5: North America Technology Scouting Software Solution Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Technology Scouting Software Solution Revenue (million), by Country 2024 & 2032

- Figure 7: North America Technology Scouting Software Solution Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Technology Scouting Software Solution Revenue (million), by Application 2024 & 2032

- Figure 9: South America Technology Scouting Software Solution Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Technology Scouting Software Solution Revenue (million), by Types 2024 & 2032

- Figure 11: South America Technology Scouting Software Solution Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Technology Scouting Software Solution Revenue (million), by Country 2024 & 2032

- Figure 13: South America Technology Scouting Software Solution Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Technology Scouting Software Solution Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Technology Scouting Software Solution Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Technology Scouting Software Solution Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Technology Scouting Software Solution Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Technology Scouting Software Solution Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Technology Scouting Software Solution Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Technology Scouting Software Solution Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Technology Scouting Software Solution Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Technology Scouting Software Solution Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Technology Scouting Software Solution Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Technology Scouting Software Solution Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Technology Scouting Software Solution Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Technology Scouting Software Solution Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Technology Scouting Software Solution Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Technology Scouting Software Solution Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Technology Scouting Software Solution Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Technology Scouting Software Solution Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Technology Scouting Software Solution Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Technology Scouting Software Solution Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Technology Scouting Software Solution Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Technology Scouting Software Solution Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Technology Scouting Software Solution Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Technology Scouting Software Solution Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Technology Scouting Software Solution Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Technology Scouting Software Solution Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Technology Scouting Software Solution Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Technology Scouting Software Solution Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Technology Scouting Software Solution Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Technology Scouting Software Solution Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Technology Scouting Software Solution Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Technology Scouting Software Solution Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Technology Scouting Software Solution Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Technology Scouting Software Solution Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Technology Scouting Software Solution Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Technology Scouting Software Solution Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Technology Scouting Software Solution Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Technology Scouting Software Solution Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Technology Scouting Software Solution Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Technology Scouting Software Solution?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Technology Scouting Software Solution?

Key companies in the market include Wellspring, Ezassi, Praxie (upBOARD), ITONICS, NetBase Quid, Questel (Orbit Intelligence), Qmarkets (Q-scout), CPA Global, IP.com (InnovationQ), Lens, ResoluteAI, PatSnap Discovery.

3. What are the main segments of the Technology Scouting Software Solution?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Technology Scouting Software Solution," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Technology Scouting Software Solution report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Technology Scouting Software Solution?

To stay informed about further developments, trends, and reports in the Technology Scouting Software Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence