Key Insights

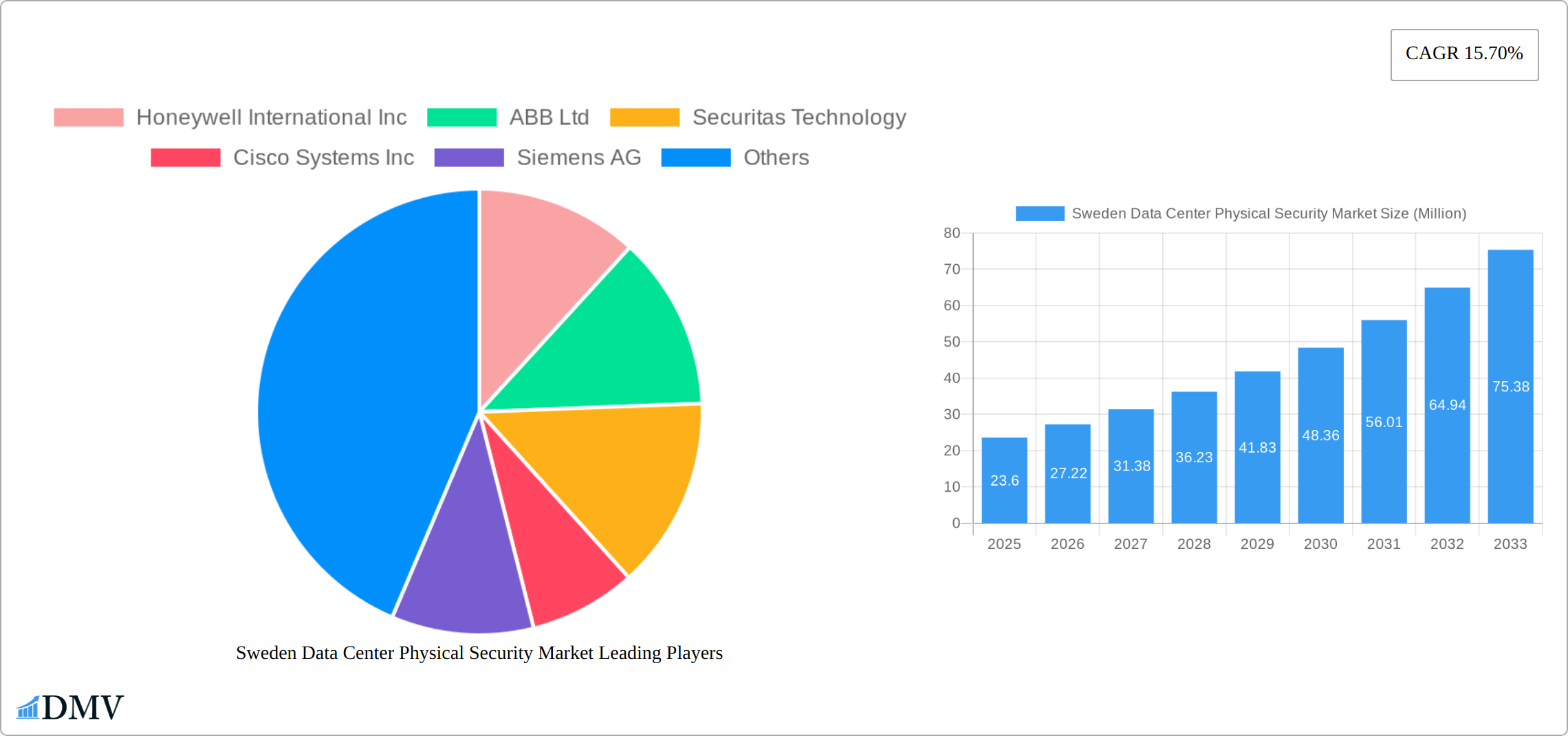

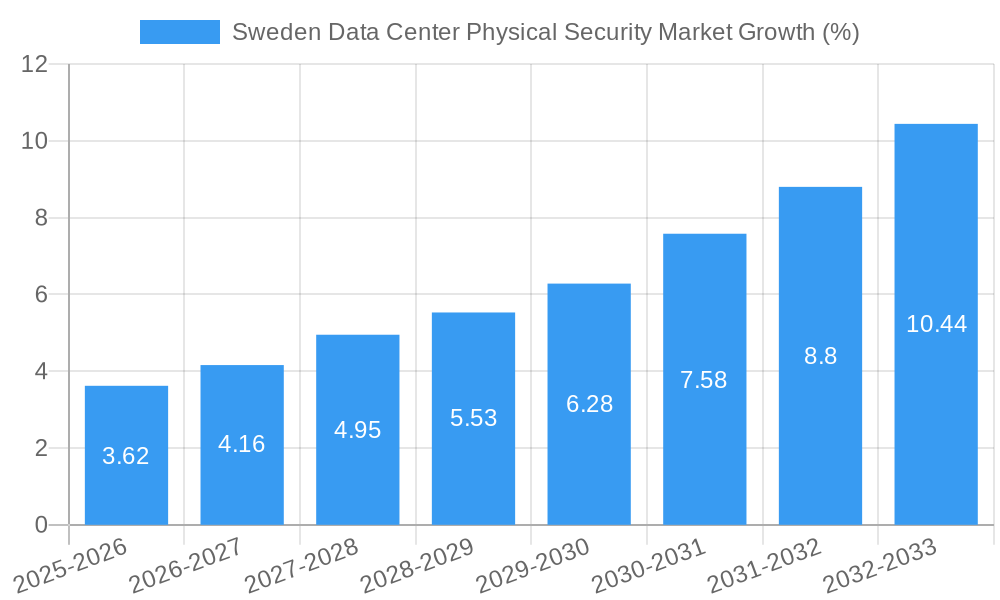

The Sweden Data Center Physical Security Market is experiencing robust growth, projected to reach a market size of approximately €23.60 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 15.70% from 2019 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and the surge in data center construction necessitate enhanced security measures to protect sensitive information and infrastructure from physical threats. Furthermore, stringent government regulations regarding data privacy and security are compelling data center operators to invest heavily in sophisticated physical security systems. Growing concerns about cyber threats and the rising incidence of data breaches further contribute to market growth. The market is segmented by service type (consulting, professional, and system integration), end-user (IT & telecommunications, BFSI, government, healthcare, and others), and solution type (video surveillance, access control, and other solutions like mantraps and fences). Major players like Honeywell, ABB, Securitas Technology, and Cisco are actively competing in this dynamic market, offering a range of advanced security solutions. Market trends indicate a shift towards integrated security systems, leveraging technologies like AI and analytics for improved threat detection and response.

While the market enjoys significant growth, certain restraints exist. The high initial investment cost of implementing comprehensive physical security systems can be a barrier for smaller data center operators. Furthermore, the complexity of integrating various security solutions and the need for skilled personnel to manage these systems present challenges. However, the long-term benefits of enhanced security, including reduced risk of data breaches and improved operational efficiency, are likely to outweigh these initial hurdles. The Swedish market's robust digital infrastructure and commitment to data protection create a favorable environment for sustained market expansion throughout the forecast period (2025-2033). Competitive pressures are likely to intensify, driving innovation and potentially leading to price reductions, further stimulating market growth.

Sweden Data Center Physical Security Market: A Comprehensive Report (2019-2033)

This insightful report provides a meticulous analysis of the Sweden Data Center Physical Security Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Sweden Data Center Physical Security Market Composition & Trends

This section delves into the intricate composition of the Sweden Data Center Physical Security Market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and M&A activities. The market exhibits a moderately consolidated structure, with the top five players commanding approximately xx% of the market share in 2025. Key players include Honeywell International Inc, ABB Ltd, Securitas Technology, Cisco Systems Inc, and Siemens AG. Innovation is driven by the increasing demand for advanced surveillance technologies, AI-powered security solutions, and robust cybersecurity measures. The regulatory landscape, shaped by GDPR and other data protection laws, strongly influences market dynamics. Substitute products, such as cloud-based security solutions, pose a moderate competitive threat. End-users are predominantly concentrated in the IT & Telecommunication, BFSI, and Government sectors. M&A activity has been moderate, with a total deal value of approximately xx Million observed between 2019 and 2024.

- Market Share Distribution (2025): Honeywell (xx%), ABB (xx%), Securitas (xx%), Cisco (xx%), Siemens (xx%), Others (xx%).

- M&A Deal Value (2019-2024): Approximately xx Million.

- Key Regulatory Influences: GDPR, Swedish national security regulations.

Sweden Data Center Physical Security Market Industry Evolution

The Sweden Data Center Physical Security Market has witnessed significant evolution over the past few years. Driven by the increasing digitization of the Swedish economy and the rising awareness of data center security threats, the market has experienced robust growth. Technological advancements, particularly in areas such as AI-powered video analytics, biometric access control, and perimeter security systems, have fueled this growth. The adoption rate of advanced security solutions, particularly video surveillance and access control systems, is increasing steadily, with a projected xx% adoption rate by 2033. The demand for integrated security solutions is also growing, pushing system integrators and service providers to adapt their offerings. Shifting consumer demands favor solutions that offer enhanced scalability, flexibility, and ease of management. Market growth is further stimulated by increasing investments in data centers across various sectors, particularly in the IT and telecommunications industries. We forecast a compound annual growth rate (CAGR) of xx% between 2025 and 2033.

Leading Regions, Countries, or Segments in Sweden Data Center Physical Security Market

The Stockholm region is the undisputed leader in Sweden's data center physical security market, fueled by a high concentration of data centers and robust IT infrastructure. This dominance is further segmented as follows:

- By Service Type: Professional services command the largest market share, surpassing consulting and system integration services. This reflects the significant demand for expert security consultation and meticulous implementation of advanced security solutions.

- By End-User: The IT & Telecommunications sector holds the most substantial market share, closely followed by the BFSI (Banking, Financial Services, and Insurance) and Government sectors. This prioritization underscores the critical need for robust security measures to protect highly sensitive data from breaches.

- By Solution Type: Video surveillance systems retain a dominant market position, outpacing access control solutions. This trend is driven by the increasing sophistication of surveillance technologies, particularly the rise of AI-powered video analytics and proactive threat detection capabilities. The demand for robust and intelligent video surveillance solutions continues to grow as organizations prioritize real-time threat assessment and response.

Key Drivers for Dominant Segments:

- IT & Telecommunication: This sector's dominance stems from high data center density, stringent regulatory compliance requirements for data security, and substantial investments in comprehensive cybersecurity strategies.

- Professional Services: The demand for specialized expertise and proven implementation capabilities in deploying intricate security systems is a primary driver of this segment's growth. Organizations increasingly rely on experienced professionals to navigate the complexities of modern security landscapes.

- Video Surveillance: The widespread adoption of AI-powered video analytics and cutting-edge surveillance technologies fuels this segment's expansion. These advancements enable proactive threat detection, improved response times, and more efficient security management.

Sweden Data Center Physical Security Market Product Innovations

Recent innovations include AI-powered video analytics capable of detecting anomalies and threats in real-time, biometrics-based access control systems offering enhanced security and convenience, and integrated security platforms streamlining security management. These advancements improve efficiency and accuracy, reduce response times, and offer enhanced security measures compared to traditional solutions.

Propelling Factors for Sweden Data Center Physical Security Market Growth

Technological advancements such as AI and IoT, increasing cybersecurity threats leading to higher investments in security, stringent government regulations demanding robust data protection, and the rise of cloud computing, all contribute to market expansion. The growing adoption of sophisticated security measures by various industries further fuels this growth.

Obstacles in the Sweden Data Center Physical Security Market

High initial investment costs for advanced security systems and the potential for supply chain disruptions impacting the availability of components pose significant challenges. The complexity of integrating various security systems can also be a barrier. Furthermore, intense competition from established and emerging players increases pressure on pricing and profitability.

Future Opportunities in Sweden Data Center Physical Security Market

The expanding adoption of 5G technology, growth in edge computing, and the rising demand for integrated security solutions present significant growth opportunities. The increasing need for robust cybersecurity measures, especially in light of evolving threats, will further drive market expansion. Furthermore, there's potential growth from government initiatives promoting secure infrastructure.

Major Players in the Sweden Data Center Physical Security Market Ecosystem

- Honeywell International Inc

- ABB Ltd

- Securitas Technology

- Cisco Systems Inc

- Siemens AG

- Johnson Controls

- Schneider Electric

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- AMAG Technology Inc

- Dahua Technology Co Ltd

- ASSA ABLOY

Key Developments in Sweden Data Center Physical Security Market Industry

- Q1 2023: Honeywell launched a new AI-powered video analytics platform.

- Q3 2022: ABB acquired a smaller security firm specializing in access control solutions.

- Q4 2021: Securitas Technology expanded its service offerings to include managed security services. (Further developments can be added here as they become available)

Strategic Sweden Data Center Physical Security Market Forecast

The Sweden Data Center Physical Security Market is poised for continued growth, driven by technological advancements, increasing cybersecurity concerns, and supportive government regulations. The market's future trajectory is optimistic, with significant potential for expansion in various segments, particularly those related to AI-powered security solutions and integrated security platforms. The increasing adoption of advanced security technologies across various end-user sectors will significantly contribute to market expansion over the forecast period.

Sweden Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Sweden Data Center Physical Security Market Segmentation By Geography

- 1. Sweden

Sweden Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Video Surveillance is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Securitas Technology

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Controls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch Sicherheitssysteme GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axis Communications AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AMAG Technology Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ASSA ABLOY

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Sweden Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: Sweden Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Sweden Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Sweden Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Sweden Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Sweden Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 8: Sweden Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 9: Sweden Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Sweden Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Data Center Physical Security Market?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the Sweden Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Securitas Technology, Cisco Systems Inc, Siemens AG, Johnson Controls, Schneider Electric, Bosch Sicherheitssysteme GmbH, Axis Communications AB, AMAG Technology Inc, Dahua Technology Co Ltd, ASSA ABLOY.

3. What are the main segments of the Sweden Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth.

6. What are the notable trends driving market growth?

Video Surveillance is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

The High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Sweden Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence