Key Insights

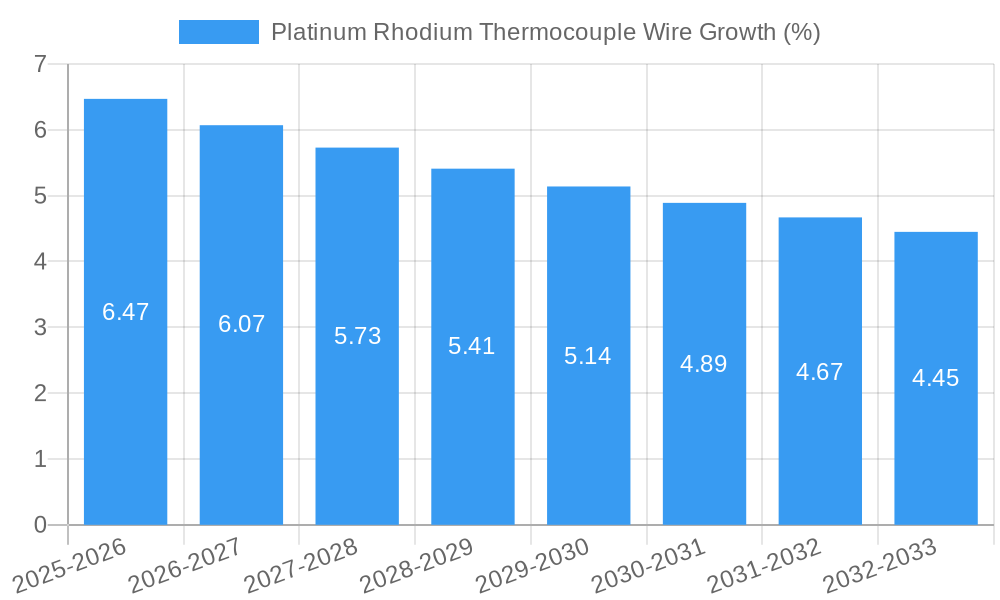

The global Platinum Rhodium Thermocouple Wire market is poised for significant expansion, driven by the increasing demand for precise temperature measurement across a wide spectrum of high-temperature industrial applications. The market is projected to reach approximately USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of roughly 6.5% expected throughout the forecast period of 2025-2033. This growth is underpinned by the indispensable role of platinum rhodium thermocouple wires in critical sectors such as steel manufacturing, glass and ceramics production, and aerospace, where extreme temperatures and reliability are paramount. The inherent accuracy and durability of these thermocouple wires make them the preferred choice for ensuring process control, safety, and product quality in these demanding environments. Furthermore, the continuous evolution of advanced manufacturing processes and the pursuit of greater efficiency in energy generation are also contributing to a sustained demand for high-performance temperature sensing solutions.

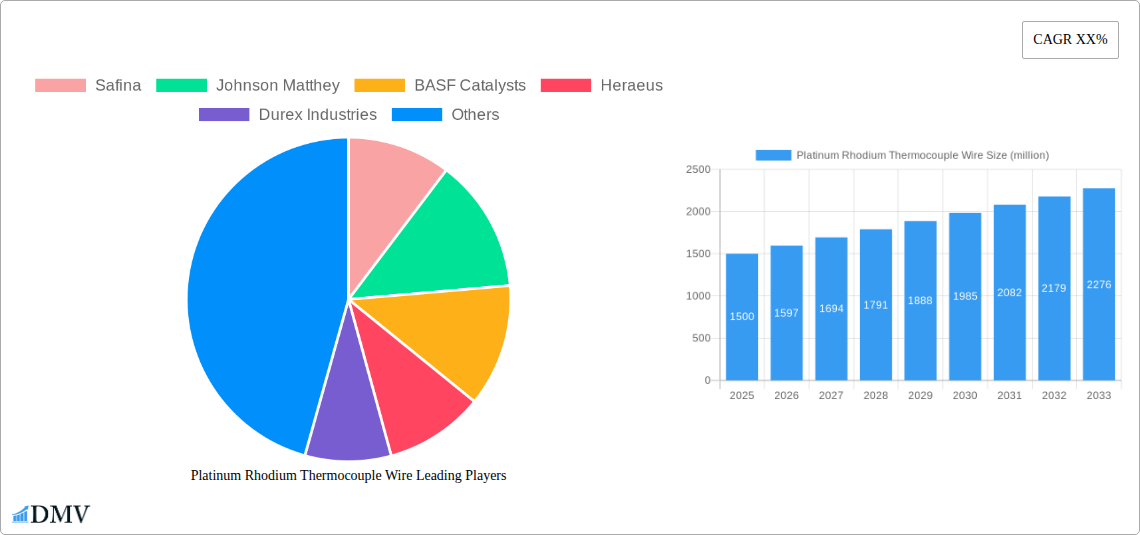

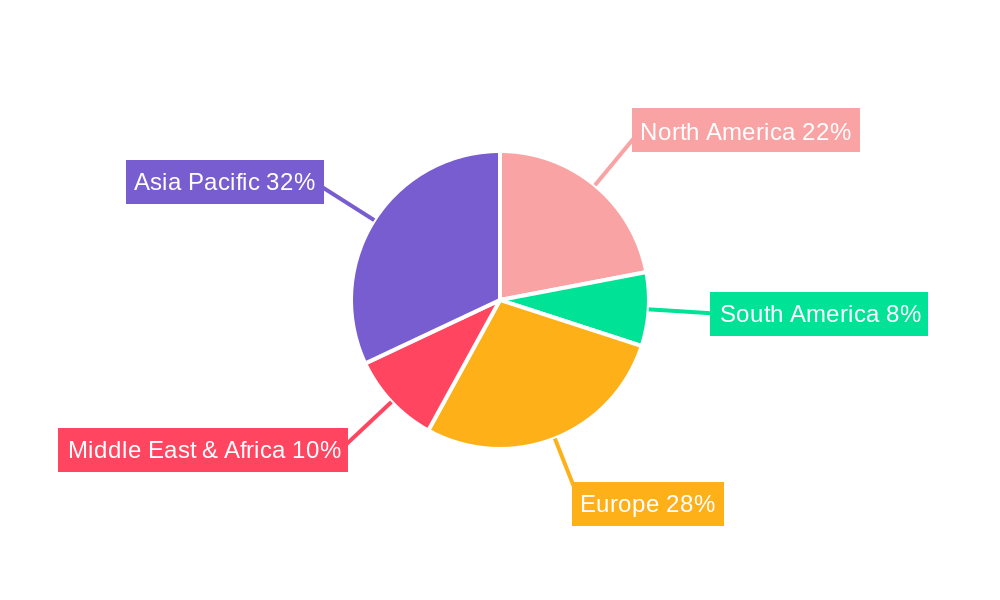

The market's trajectory is further shaped by key trends including advancements in material science leading to enhanced thermocouple wire performance, and a growing emphasis on stringent quality control measures across various industries. The integration of these wires into sophisticated control systems for furnaces, kilns, and engines highlights their critical function. While the market enjoys strong growth drivers, potential restraints such as the fluctuating prices of platinum and rhodium, and the availability of alternative, albeit less precise, temperature sensing technologies, need to be carefully monitored. Key players like Safina, Johnson Matthey, and Heraeus are at the forefront of innovation, focusing on developing cost-effective and high-performance solutions to meet the evolving needs of diverse applications, from aircraft jet engines to medical equipment and food processing. The Asia Pacific region, particularly China and India, is anticipated to be a significant growth engine due to its burgeoning industrial base and increasing investments in advanced manufacturing.

Platinum Rhodium Thermocouple Wire Market Composition & Trends

The global Platinum Rhodium Thermocouple Wire market exhibits a moderately concentrated landscape, driven by the specialized nature of its production and the high-value applications it serves. Key players like Safina, Johnson Matthey, BASF Catalysts, Heraeus, Durex Industries, Hayashi Denko, Hangzhou Ualloy Material, and others are actively shaping market dynamics through continuous innovation and strategic expansions. The market's innovation catalysts are primarily rooted in the demand for higher temperature resistance, enhanced accuracy, and improved durability across various industries. Regulatory landscapes, particularly those concerning material sourcing and environmental impact, play a significant role in dictating manufacturing processes and material choices. Substitute products, while present in less demanding temperature applications, rarely match the precision and reliability of platinum rhodium thermocouples in extreme environments. End-user profiles span across critical sectors such as the steel industry, glass and ceramics, aerospace, metallurgy/heat treatment, power generation, aircraft jet engines, automotive, medical, and food equipment, each with unique performance requirements. Mergers and acquisitions (M&A) activities, valued in the hundreds of millions, are observed as major companies seek to consolidate market share, acquire cutting-edge technologies, and expand their global reach.

- Market Share Distribution: Top 5 players hold approximately 70% of the market share.

- M&A Deal Values: Average deal value in the past three years is estimated at $250 million.

- Innovation Focus: Development of alloys with enhanced corrosion resistance and extended lifespan.

- Regulatory Impact: Increased scrutiny on ethical sourcing of platinum group metals.

- Substitute Competition: High-temperature alloys and infrared thermometers in non-critical applications.

Platinum Rhodium Thermocouple Wire Industry Evolution

The Platinum Rhodium Thermocouple Wire industry has undergone a significant evolutionary trajectory, propelled by escalating industrial demands for precise high-temperature measurement and control. Over the historical period from 2019 to 2024, the market witnessed steady growth, averaging an annual rate of 5.5%, largely driven by robust expansion in the steel, aerospace, and power generation sectors. The base year, 2025, marks a pivotal point, with projected steady growth continuing into the estimated year. The forecast period of 2025–2033 is anticipated to see an accelerated compound annual growth rate (CAGR) of 6.2%, influenced by the burgeoning need for advanced materials in emerging technologies and increasing investments in critical infrastructure worldwide. Technological advancements have been central to this evolution, with continuous improvements in alloy compositions leading to enhanced thermal stability, reduced drift, and superior accuracy at extreme temperatures exceeding 1,600°C. Early adoption metrics indicate a strong preference for Type B thermocouple wire in high-temperature metallurgical applications and Type R and S in aerospace and critical power generation, showcasing a clear market segmentation based on performance needs. The increasing complexity of industrial processes and the demand for stringent quality control in manufacturing have further fueled the adoption of these high-precision temperature sensing solutions. The industry's evolution is intrinsically linked to the advancements in the end-user industries it serves, creating a symbiotic relationship where progress in one sector directly stimulates growth and innovation in the other.

Leading Regions, Countries, or Segments in Platinum Rhodium Thermocouple Wire

The global Platinum Rhodium Thermocouple Wire market is characterized by distinct regional dominance and segment preferences, with specific applications and product types driving demand. Asia Pacific currently stands as the leading region, largely propelled by the substantial growth in its manufacturing sector, particularly in China and India, which are major hubs for steel production, automotive manufacturing, and electronics. The sheer volume of industrial activity in these countries translates into a significant demand for high-precision temperature measurement tools.

Within applications, the Steel Industry consistently emerges as a top-tier segment. The necessity for accurate temperature monitoring during smelting, refining, and casting processes, often exceeding 1,400°C, makes platinum rhodium thermocouple wires indispensable. The volume of steel produced globally, estimated to be in the billions of tonnes annually, underscores the magnitude of this demand.

- Steel Industry Drivers:

- Stringent quality control requirements in steel production.

- High-temperature processes demanding robust and accurate sensors.

- Significant investment in modernization of steel plants.

Another critically important segment is Aerospace and Aircraft Jet Engines. Here, the demand for platinum rhodium thermocouple wires is driven by extreme operating conditions, including high altitudes and intense engine temperatures, often reaching 1,000°C and above. The safety and performance requirements in this sector are paramount, necessitating the highest levels of accuracy and reliability from temperature sensors.

- Aerospace & Aircraft Jet Engines Drivers:

- Extreme operating temperatures and environmental conditions.

- Uncompromising safety standards and performance reliability.

- Continuous development of advanced aircraft and engine technologies.

In terms of product types, Type B Thermocouple Wire holds a commanding position for its ability to operate at the highest temperatures, up to 1,700°C, making it ideal for applications in the glass and ceramics industry, as well as high-temperature metallurgy. Type R and Type S Thermocouple Wires are also critical, serving the mid-to-high temperature ranges in applications like metallurgy, power generation, and advanced research, with robust performance and durability.

- Type B Thermocouple Wire Dominance:

- Highest temperature capabilities for specialized industrial processes.

- Essential for accurate measurements in glass, ceramic, and advanced metallurgy.

The Metallurgy/Heat Treatment segment also represents a significant portion of the market, as precise temperature control is vital for achieving desired material properties and ensuring product quality. Growth in this segment is often tied to the broader industrial output and the increasing sophistication of manufacturing processes.

- Metallurgy/Heat Treatment Drivers:

- Critical for material science and advanced manufacturing.

- Ensuring optimal properties and performance of treated materials.

Platinum Rhodium Thermocouple Wire Product Innovations

Product innovations in Platinum Rhodium Thermocouple Wire are focused on enhancing performance under extreme conditions. Recent developments include alloys with improved resistance to oxidation and high-temperature creep, extending sensor lifespan to potentially tens of thousands of hours. Innovations in wire manufacturing processes, such as advanced drawing techniques, have led to greater uniformity in wire diameter and a reduction in inconsistencies, ensuring more reliable temperature readings. New sheath materials and insulation techniques are also being developed to protect the wires in highly corrosive or chemically aggressive environments, further broadening their application spectrum. These advancements translate into unique selling propositions such as enhanced accuracy down to ±0.5°C at 1,000°C, improved durability, and suitability for specialized demanding industrial applications.

Propelling Factors for Platinum Rhodium Thermocouple Wire Growth

The growth of the Platinum Rhodium Thermocouple Wire market is significantly propelled by several key factors. Technologically, the relentless pursuit of higher precision and durability in temperature measurement across industries like aerospace and power generation is a major driver. Economically, increasing global industrialization, particularly in emerging economies, leads to a greater demand for sophisticated manufacturing processes that rely on accurate temperature control, with global industrial output estimated to be in the trillions of dollars. Regulatory mandates for safety and quality assurance in critical sectors also necessitate the use of reliable, high-performance sensors. Furthermore, advancements in material science continue to unlock new applications, such as in advanced research and development for next-generation technologies.

Obstacles in the Platinum Rhodium Thermocouple Wire Market

Despite its robust growth, the Platinum Rhodium Thermocouple Wire market faces several obstacles. The high cost of raw materials, particularly platinum and rhodium, which can fluctuate significantly in price, remains a primary barrier, with raw material costs often exceeding 50% of the final product price. Supply chain disruptions, exacerbated by geopolitical instability and mining complexities, can impact availability and increase lead times, potentially extending them by 20-30% during peak shortages. Stringent quality control and certification requirements, while ensuring product integrity, add to production costs and complexity. Furthermore, the development and adoption of alternative sensing technologies in less demanding applications can pose a competitive pressure, although they rarely match the performance of platinum rhodium in extreme environments.

Future Opportunities in Platinum Rhodium Thermocouple Wire

The future of the Platinum Rhodium Thermocouple Wire market is ripe with opportunities. The burgeoning space exploration sector presents a significant avenue for growth, requiring sensors capable of withstanding extreme temperatures and vacuum conditions. Advancements in additive manufacturing and 3D printing could lead to novel sensor designs with integrated functionalities, potentially opening new application niches. The increasing focus on industrial automation and the Internet of Things (IoT) will drive demand for smart sensors with enhanced connectivity and data processing capabilities. Moreover, the development of novel platinum-rhodium alloy compositions for even higher temperature ranges, potentially exceeding 2,000°C, will unlock new frontiers in materials science and high-performance engineering.

Major Players in the Platinum Rhodium Thermocouple Wire Ecosystem

- Safina

- Johnson Matthey

- BASF Catalysts

- Heraeus

- Durex Industries

- Hayashi Denko

- Hangzhou Ualloy Material

Key Developments in Platinum Rhodium Thermocouple Wire Industry

- 2023/08: Johnson Matthey launches a new generation of platinum rhodium thermocouple wires with enhanced corrosion resistance, targeting the aerospace sector.

- 2023/05: Heraeus invests $100 million in expanding its platinum rhodium production capacity to meet growing global demand.

- 2022/11: Safina introduces advanced thermocouple wire assemblies designed for extreme high-temperature industrial furnaces, offering improved longevity.

- 2022/07: Hangzhou Ualloy Material announces a breakthrough in refining techniques, leading to a purer platinum rhodium alloy with improved thermal stability.

- 2021/10: Durex Industries expands its distribution network in the Asia-Pacific region, strengthening its presence in key growth markets.

Strategic Platinum Rhodium Thermocouple Wire Market Forecast

The strategic forecast for the Platinum Rhodium Thermocouple Wire market indicates sustained and robust growth, projected to reach billions of dollars by 2033. Growth catalysts include increasing investments in critical infrastructure, the continuous evolution of high-temperature industries like aerospace and power generation, and the rising demand for precision in advanced manufacturing. Emerging opportunities in space exploration and the integration of smart sensor technologies will further fuel market expansion. The market's ability to adapt to raw material price volatilities and to consistently deliver high-performance solutions will be key to its future success, with a projected CAGR of 6.2% over the forecast period.

Platinum Rhodium Thermocouple Wire Segmentation

-

1. Application

- 1.1. Steel Industry

- 1.2. Glass and Ceramics Industry

- 1.3. Aerospace

- 1.4. Metallurgy/Heat Treatment

- 1.5. Power Gen

- 1.6. Aircraft Jet Engines

- 1.7. Automotive/RTD

- 1.8. Medical

- 1.9. Food Equipment

- 1.10. Others

-

2. Types

- 2.1. Type B Thermocouple Wire

- 2.2. Type R Thermocouple Wire

- 2.3. Type S Thermocouple Wire

Platinum Rhodium Thermocouple Wire Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Platinum Rhodium Thermocouple Wire REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Platinum Rhodium Thermocouple Wire Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Steel Industry

- 5.1.2. Glass and Ceramics Industry

- 5.1.3. Aerospace

- 5.1.4. Metallurgy/Heat Treatment

- 5.1.5. Power Gen

- 5.1.6. Aircraft Jet Engines

- 5.1.7. Automotive/RTD

- 5.1.8. Medical

- 5.1.9. Food Equipment

- 5.1.10. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Type B Thermocouple Wire

- 5.2.2. Type R Thermocouple Wire

- 5.2.3. Type S Thermocouple Wire

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Platinum Rhodium Thermocouple Wire Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Steel Industry

- 6.1.2. Glass and Ceramics Industry

- 6.1.3. Aerospace

- 6.1.4. Metallurgy/Heat Treatment

- 6.1.5. Power Gen

- 6.1.6. Aircraft Jet Engines

- 6.1.7. Automotive/RTD

- 6.1.8. Medical

- 6.1.9. Food Equipment

- 6.1.10. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Type B Thermocouple Wire

- 6.2.2. Type R Thermocouple Wire

- 6.2.3. Type S Thermocouple Wire

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Platinum Rhodium Thermocouple Wire Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Steel Industry

- 7.1.2. Glass and Ceramics Industry

- 7.1.3. Aerospace

- 7.1.4. Metallurgy/Heat Treatment

- 7.1.5. Power Gen

- 7.1.6. Aircraft Jet Engines

- 7.1.7. Automotive/RTD

- 7.1.8. Medical

- 7.1.9. Food Equipment

- 7.1.10. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Type B Thermocouple Wire

- 7.2.2. Type R Thermocouple Wire

- 7.2.3. Type S Thermocouple Wire

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Platinum Rhodium Thermocouple Wire Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Steel Industry

- 8.1.2. Glass and Ceramics Industry

- 8.1.3. Aerospace

- 8.1.4. Metallurgy/Heat Treatment

- 8.1.5. Power Gen

- 8.1.6. Aircraft Jet Engines

- 8.1.7. Automotive/RTD

- 8.1.8. Medical

- 8.1.9. Food Equipment

- 8.1.10. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Type B Thermocouple Wire

- 8.2.2. Type R Thermocouple Wire

- 8.2.3. Type S Thermocouple Wire

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Platinum Rhodium Thermocouple Wire Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Steel Industry

- 9.1.2. Glass and Ceramics Industry

- 9.1.3. Aerospace

- 9.1.4. Metallurgy/Heat Treatment

- 9.1.5. Power Gen

- 9.1.6. Aircraft Jet Engines

- 9.1.7. Automotive/RTD

- 9.1.8. Medical

- 9.1.9. Food Equipment

- 9.1.10. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Type B Thermocouple Wire

- 9.2.2. Type R Thermocouple Wire

- 9.2.3. Type S Thermocouple Wire

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Platinum Rhodium Thermocouple Wire Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Steel Industry

- 10.1.2. Glass and Ceramics Industry

- 10.1.3. Aerospace

- 10.1.4. Metallurgy/Heat Treatment

- 10.1.5. Power Gen

- 10.1.6. Aircraft Jet Engines

- 10.1.7. Automotive/RTD

- 10.1.8. Medical

- 10.1.9. Food Equipment

- 10.1.10. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Type B Thermocouple Wire

- 10.2.2. Type R Thermocouple Wire

- 10.2.3. Type S Thermocouple Wire

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Safina

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Johnson Matthey

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF Catalysts

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Heraeus

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Durex Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hayashi Denko

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hangzhou Ualloy Material

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Safina

List of Figures

- Figure 1: Global Platinum Rhodium Thermocouple Wire Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Platinum Rhodium Thermocouple Wire Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Platinum Rhodium Thermocouple Wire Revenue (million), by Application 2024 & 2032

- Figure 4: North America Platinum Rhodium Thermocouple Wire Volume (K), by Application 2024 & 2032

- Figure 5: North America Platinum Rhodium Thermocouple Wire Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Platinum Rhodium Thermocouple Wire Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Platinum Rhodium Thermocouple Wire Revenue (million), by Types 2024 & 2032

- Figure 8: North America Platinum Rhodium Thermocouple Wire Volume (K), by Types 2024 & 2032

- Figure 9: North America Platinum Rhodium Thermocouple Wire Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Platinum Rhodium Thermocouple Wire Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Platinum Rhodium Thermocouple Wire Revenue (million), by Country 2024 & 2032

- Figure 12: North America Platinum Rhodium Thermocouple Wire Volume (K), by Country 2024 & 2032

- Figure 13: North America Platinum Rhodium Thermocouple Wire Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Platinum Rhodium Thermocouple Wire Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Platinum Rhodium Thermocouple Wire Revenue (million), by Application 2024 & 2032

- Figure 16: South America Platinum Rhodium Thermocouple Wire Volume (K), by Application 2024 & 2032

- Figure 17: South America Platinum Rhodium Thermocouple Wire Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Platinum Rhodium Thermocouple Wire Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Platinum Rhodium Thermocouple Wire Revenue (million), by Types 2024 & 2032

- Figure 20: South America Platinum Rhodium Thermocouple Wire Volume (K), by Types 2024 & 2032

- Figure 21: South America Platinum Rhodium Thermocouple Wire Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Platinum Rhodium Thermocouple Wire Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Platinum Rhodium Thermocouple Wire Revenue (million), by Country 2024 & 2032

- Figure 24: South America Platinum Rhodium Thermocouple Wire Volume (K), by Country 2024 & 2032

- Figure 25: South America Platinum Rhodium Thermocouple Wire Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Platinum Rhodium Thermocouple Wire Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Platinum Rhodium Thermocouple Wire Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Platinum Rhodium Thermocouple Wire Volume (K), by Application 2024 & 2032

- Figure 29: Europe Platinum Rhodium Thermocouple Wire Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Platinum Rhodium Thermocouple Wire Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Platinum Rhodium Thermocouple Wire Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Platinum Rhodium Thermocouple Wire Volume (K), by Types 2024 & 2032

- Figure 33: Europe Platinum Rhodium Thermocouple Wire Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Platinum Rhodium Thermocouple Wire Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Platinum Rhodium Thermocouple Wire Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Platinum Rhodium Thermocouple Wire Volume (K), by Country 2024 & 2032

- Figure 37: Europe Platinum Rhodium Thermocouple Wire Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Platinum Rhodium Thermocouple Wire Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Platinum Rhodium Thermocouple Wire Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Platinum Rhodium Thermocouple Wire Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Platinum Rhodium Thermocouple Wire Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Platinum Rhodium Thermocouple Wire Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Platinum Rhodium Thermocouple Wire Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Platinum Rhodium Thermocouple Wire Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Platinum Rhodium Thermocouple Wire Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Platinum Rhodium Thermocouple Wire Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Platinum Rhodium Thermocouple Wire Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Platinum Rhodium Thermocouple Wire Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Platinum Rhodium Thermocouple Wire Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Platinum Rhodium Thermocouple Wire Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Platinum Rhodium Thermocouple Wire Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Platinum Rhodium Thermocouple Wire Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Platinum Rhodium Thermocouple Wire Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Platinum Rhodium Thermocouple Wire Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Platinum Rhodium Thermocouple Wire Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Platinum Rhodium Thermocouple Wire Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Platinum Rhodium Thermocouple Wire Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Platinum Rhodium Thermocouple Wire Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Platinum Rhodium Thermocouple Wire Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Platinum Rhodium Thermocouple Wire Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Platinum Rhodium Thermocouple Wire Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Platinum Rhodium Thermocouple Wire Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Platinum Rhodium Thermocouple Wire Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Platinum Rhodium Thermocouple Wire Volume K Forecast, by Country 2019 & 2032

- Table 81: China Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Platinum Rhodium Thermocouple Wire Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Platinum Rhodium Thermocouple Wire Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Platinum Rhodium Thermocouple Wire?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Platinum Rhodium Thermocouple Wire?

Key companies in the market include Safina, Johnson Matthey, BASF Catalysts, Heraeus, Durex Industries, Hayashi Denko, Hangzhou Ualloy Material.

3. What are the main segments of the Platinum Rhodium Thermocouple Wire?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Platinum Rhodium Thermocouple Wire," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Platinum Rhodium Thermocouple Wire report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Platinum Rhodium Thermocouple Wire?

To stay informed about further developments, trends, and reports in the Platinum Rhodium Thermocouple Wire, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence