Key Insights

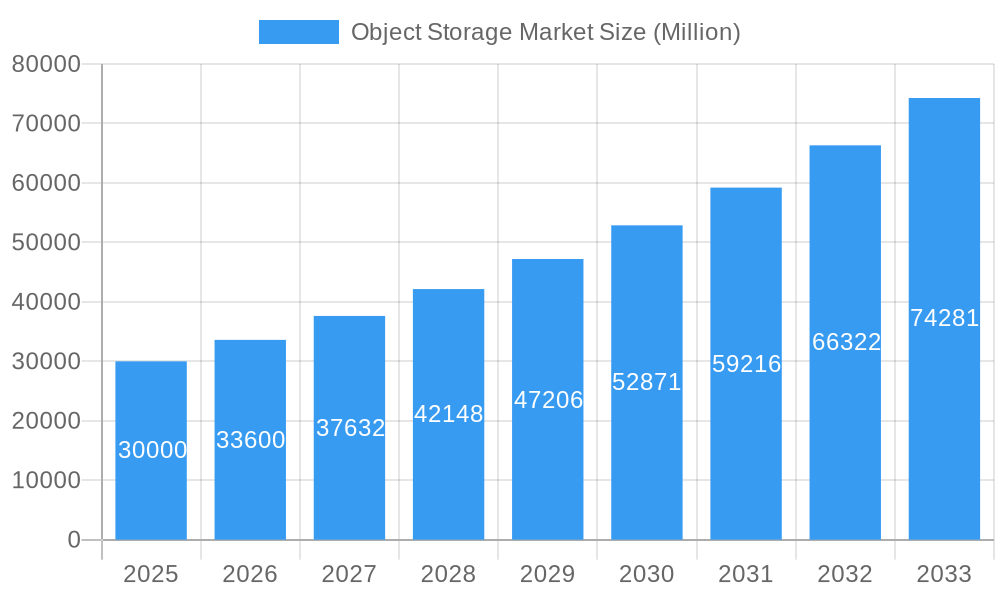

The global Object Storage Market is poised for significant expansion, projecting a robust market size of approximately $30,000 million by 2025, fueled by a compelling Compound Annual Growth Rate (CAGR) of 12.00%. This impressive trajectory is primarily driven by the escalating demand for scalable, cost-effective, and flexible data storage solutions across a multitude of industries. The proliferation of unstructured data, generated from sources like social media, IoT devices, and multimedia content, necessitates advanced storage architectures that object storage readily provides. Furthermore, the growing adoption of cloud computing and the increasing need for data analytics, machine learning, and artificial intelligence applications are key accelerators. Businesses are recognizing the inherent advantages of object storage, including its durability, availability, and ease of integration with cloud-native applications, making it the preferred choice for managing vast datasets. The market's dynamism is further evidenced by the continuous innovation in storage technologies and the competitive landscape shaped by leading players.

Object Storage Market Market Size (In Billion)

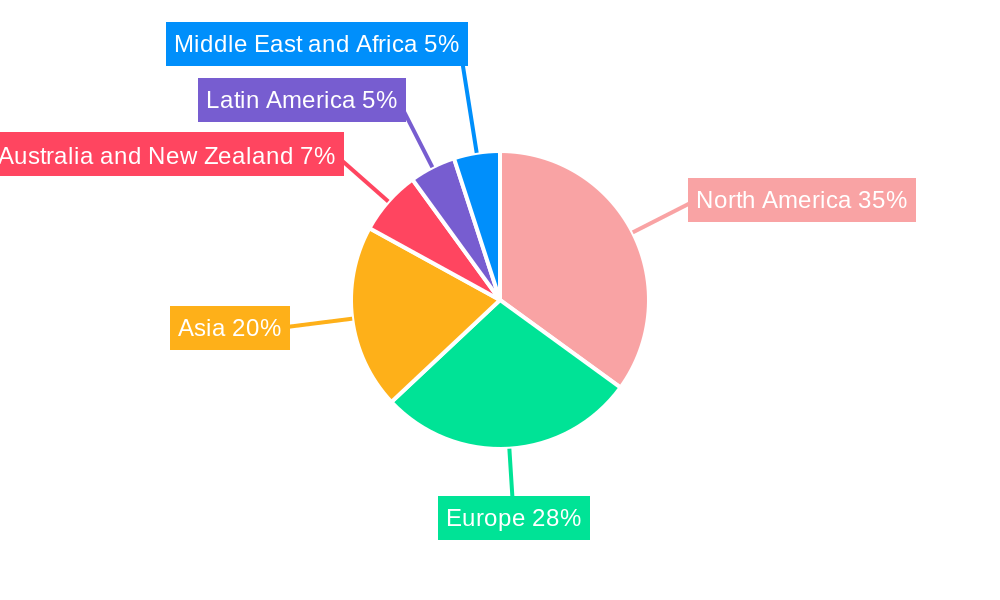

The object storage market is segmented into Cloud-based and On-Premise solutions, with cloud-based offerings expected to dominate due to their inherent scalability, agility, and reduced upfront investment. Key trends shaping the market include the rise of hybrid cloud strategies, the increasing focus on data security and compliance, and the development of intelligent storage management solutions. However, certain restraints, such as the initial integration complexity for some legacy systems and concerns around vendor lock-in, may temper growth in specific segments. Geographically, North America and Europe are expected to maintain their leading positions, driven by early adoption of advanced technologies and a strong presence of major cloud providers and enterprises. Asia is emerging as a significant growth region, propelled by rapid digital transformation initiatives and a burgeoning IT infrastructure. Companies like Amazon Web Services (AWS), Microsoft, Google, Oracle, and IBM are at the forefront, continuously enhancing their offerings to cater to the evolving needs of a data-centric world.

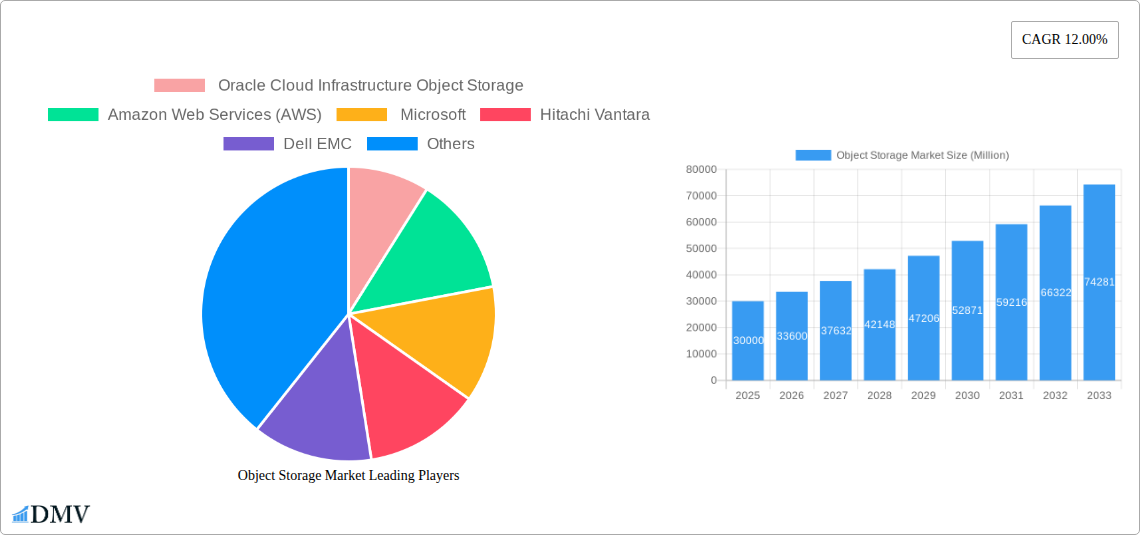

Object Storage Market Company Market Share

Unlock the future of scalable and cost-effective data storage. This in-depth report delivers a strategic analysis of the global Object Storage Market, providing critical insights for stakeholders seeking to capitalize on the explosive growth of unstructured data. With a meticulous study period from 2019 to 2033, a base and estimated year of 2025, and a detailed forecast from 2025 to 2033, this report is your definitive guide to understanding market dynamics, key players, and future opportunities. Dive deep into the technologies driving innovation, the evolving regulatory landscape, and the competitive strategies shaping this multi-billion dollar industry.

Object Storage Market Market Composition & Trends

The Object Storage Market is characterized by a moderate to high level of concentration, with hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure Cloud Storage, and Google dominating a significant portion of the market share. However, niche players and specialized vendors such as Cloudian, NetApp, and Pure Storage are increasingly carving out their spaces by offering tailored solutions for specific enterprise needs and hybrid cloud environments. Innovation catalysts are primarily driven by the relentless demand for cost-effective, scalable storage solutions to manage the ever-increasing volume of unstructured data generated by Big Data analytics, AI/ML workloads, IoT devices, and rich media content. The regulatory landscape is evolving, with data sovereignty and privacy regulations (e.g., GDPR, CCPA) influencing deployment strategies and driving demand for geographically distributed storage options. Substitute products, such as traditional block and file storage, are gradually being replaced or augmented by object storage for specific use cases due to its inherent scalability and cost efficiencies. End-user profiles are diverse, spanning hyperscalers, large enterprises, mid-sized businesses, and research institutions, all seeking robust solutions for data archiving, backup, disaster recovery, and content distribution. Mergers and acquisitions (M&A) activities are a constant feature, as larger players seek to consolidate market share and acquire innovative technologies, with M&A deal values expected to reach several hundred million dollars in the coming years.

- Market Concentration: Moderate to High

- Innovation Catalysts: Big Data analytics, AI/ML, IoT, Media & Entertainment, Regulatory Compliance

- Regulatory Landscape: Data Sovereignty, Data Privacy (GDPR, CCPA)

- Substitute Products: Traditional Block and File Storage

- End-User Profiles: Hyperscalers, Enterprises, SMBs, Research Institutions

- M&A Activities: Ongoing, targeting technology acquisition and market consolidation.

Object Storage Market Industry Evolution

The Object Storage Market has witnessed a dramatic evolution, driven by the exponential growth of unstructured data and the increasing reliance on cloud-native architectures. Over the historical period (2019–2024), the market has transitioned from being a niche solution for archival and backup to a foundational element for a wide range of modern applications. This transformation has been fueled by significant technological advancements. The advent of S3-compatible APIs has become an industry standard, fostering interoperability and simplifying integration across diverse platforms and applications. Cloud-based object storage solutions, spearheaded by AWS S3, Azure Blob Storage, and Google Cloud Storage, have experienced unparalleled growth, offering unparalleled scalability, durability, and cost-effectiveness. This has democratized access to petabyte-scale storage, making it accessible to businesses of all sizes.

Concurrently, on-premise and hybrid object storage solutions have also evolved, addressing concerns around data sovereignty, security, and performance for latency-sensitive applications. Companies like Hitachi Vantara, Dell EMC, and IBM Cloud Object Storage have invested heavily in developing robust on-premise and hybrid offerings that integrate seamlessly with cloud environments. The market has seen a growing adoption of software-defined storage (SDS) approaches within object storage, allowing for greater flexibility and management from commodity hardware.

Shifting consumer demands have played a pivotal role in this evolution. Organizations are increasingly seeking solutions that can not only store vast amounts of data but also facilitate advanced analytics, AI/ML model training, and content delivery at scale. The rise of the data lake concept, where object storage serves as the central repository, has further accelerated adoption. Performance metrics such as throughput, latency, and durability have become critical differentiators, pushing vendors to innovate. For instance, the demand for faster data ingestion and retrieval for real-time analytics has led to advancements in caching mechanisms and tiered storage strategies. The estimated Compound Annual Growth Rate (CAGR) for the object storage market is projected to be between 25% and 30% during the forecast period (2025–2033), with the market size projected to exceed $50 Billion by 2033, driven by these ongoing technological advancements and escalating data demands. The adoption of object storage for primary workloads, beyond traditional backup and archive, is a key trend, indicating a maturing market that now relies on object storage for core operational functions.

Leading Regions, Countries, or Segments in Object Storage Market

The Cloud-based segment of the Object Storage Market is undeniably dominant, significantly outpacing its On-Premise counterpart in terms of market share and growth trajectory. This supremacy is largely attributable to the inherent scalability, flexibility, and cost-efficiency offered by cloud platforms, which align perfectly with the burgeoning demand for data storage solutions. North America, particularly the United States, stands out as the leading region, driven by the presence of major cloud providers like AWS, Microsoft, and Google, coupled with a highly digitized economy and a strong appetite for advanced technologies such as AI, Big Data, and IoT.

Key Drivers for Cloud-based Dominance and North American Leadership:

- Hyperscale Infrastructure: The extensive data center footprints of AWS, Microsoft Azure, and Google Cloud within North America provide a robust and readily accessible infrastructure for object storage services. This proximity to users reduces latency and enhances performance.

- Early Adoption and Innovation: North America has consistently been an early adopter of cloud technologies. This has fostered a culture of innovation, with businesses readily integrating cloud-based object storage into their IT strategies for diverse use cases ranging from data archiving and backup to content distribution and big data analytics.

- Venture Capital Investment: Significant venture capital investment in cloud computing and data management startups within North America fuels innovation and market growth, further solidifying the region's leadership.

- Mature Enterprise Market: The presence of a vast number of large enterprises with substantial data storage needs in North America creates a consistent and high-volume demand for scalable and cost-effective cloud-based object storage solutions.

- Regulatory Support and Compliance: While data sovereignty regulations are a global concern, North American enterprises are adept at navigating these requirements through the strategic utilization of geographically distributed cloud regions and hybrid cloud models. The regulatory frameworks, while evolving, have also spurred innovation in data security and management within cloud environments.

- Cost-Effectiveness: The pay-as-you-go model of cloud object storage is a significant attraction, allowing organizations to scale their storage capacity dynamically and optimize costs, a crucial factor given the escalating data volumes. On-premise solutions, while offering greater control, often involve substantial upfront capital expenditure and ongoing maintenance costs, making them less appealing for many organizations primarily focused on agility and cost optimization.

The dominance of cloud-based object storage, particularly within North America, is expected to persist and even strengthen as businesses continue to prioritize digital transformation and leverage the power of scalable, on-demand data infrastructure. The interplay between technological advancements, economic incentives, and evolving business needs firmly positions cloud-based object storage as the market's leading segment and North America as its premier geographical hub.

Object Storage Market Product Innovations

Object storage product innovations are rapidly enhancing performance, cost-efficiency, and data management capabilities. A key advancement is the development of intelligent tiering capabilities, which automatically move data between different storage classes (e.g., hot, cool, archive) based on access patterns, optimizing costs without manual intervention. Vendors are also integrating advanced data analytics and AI/ML services directly into object storage platforms, enabling organizations to perform complex analyses directly on stored data, reducing data movement and accelerating insights. Innovations in erasure coding and data compression are significantly improving storage density and reducing the overall cost per gigabyte. Furthermore, the emergence of S3-compatible object storage solutions designed for specific workloads, such as time-series data or high-performance computing, is expanding the applicability of object storage. Performance metrics like sub-millisecond latency for hot data access and petabyte-scale throughput are becoming increasingly common. The integration of object storage with Kubernetes and containerized environments is also a significant innovation, simplifying data management for cloud-native applications.

Propelling Factors for Object Storage Market Growth

The object storage market is propelled by several key factors, primarily driven by the ever-increasing volume of unstructured data generated by digital transformation initiatives. The proliferation of IoT devices, the explosion of rich media content, and the growing adoption of AI/ML workloads are creating an insatiable demand for scalable and cost-effective storage solutions. Cloud computing continues to be a major catalyst, with hyperscale providers offering highly durable, available, and cost-efficient object storage services. Regulatory compliance requirements, such as data retention policies and data sovereignty laws, are also driving adoption as organizations seek robust solutions for data archiving and management. Furthermore, the inherent scalability and cost-effectiveness of object storage compared to traditional storage systems make it an attractive choice for long-term data preservation and accessibility. The integration of object storage with big data analytics platforms and data lakes is also a significant growth driver, enabling businesses to derive valuable insights from their vast datasets.

Obstacles in the Object Storage Market Market

Despite its robust growth, the Object Storage Market faces several obstacles. Security concerns remain a prominent barrier, with organizations often hesitant to entrust sensitive data to cloud-based or even on-premise object storage solutions without stringent security measures and clear data governance policies. The complexity of managing vast amounts of data across different tiers and locations can also be a challenge, requiring sophisticated management tools and expertise. Vendor lock-in is another concern, as migrating large datasets between different object storage providers can be time-consuming and costly. Integration challenges with existing legacy systems can also pose a hurdle for some enterprises. Finally, performance for certain latency-sensitive applications may still favor traditional storage solutions, limiting object storage's applicability for all use cases. The ongoing evolution of data protection regulations and the need for strict compliance can also add complexity and cost to object storage deployments.

Future Opportunities in Object Storage Market

The future of the Object Storage Market is rife with opportunities. The increasing adoption of AI and machine learning will continue to drive demand for vast, scalable storage for training datasets. Edge computing will create new opportunities for localized object storage solutions that can process data closer to the source. The metaverse and Web3 developments are expected to generate enormous amounts of 3D content and decentralized data, requiring highly scalable object storage architectures. Furthermore, the growing trend of data democratization will necessitate user-friendly and accessible object storage solutions that can be easily managed by a wider range of users. Advancements in quantum computing may also lead to new encryption and storage paradigms, creating opportunities for innovation in object storage security and resilience. The integration of object storage with blockchain technology for immutable data storage and verifiable data integrity also presents a significant emerging opportunity.

Major Players in the Object Storage Market Ecosystem

- Amazon Web Services (AWS)

- Microsoft

- Oracle Cloud Infrastructure Object Storage

- Dell EMC

- Hitachi Vantara

- IBM Cloud Object Storage

- Azure Cloud Storage

- Cloudian

- NetApp

- Pure Storage

Key Developments in Object Storage Market Industry

- November 2022: Timescale announced a private beta launch for an Amazon S3-based, consumption-based object storage layer for Timescale Cloud. This innovation allows customers to store unlimited data while paying only for used space, expanding the capabilities of managed databases with a novel cloud-native architecture.

- February 2022: European cloud operator OVHcloud released a High-Performance Object Storage solution targeted at Big Data, AI, e-commerce, and streaming. Priced competitively with Amazon S3 offerings, it provides local storage for European consumers with a monthly fee of EUR 25 (USD 28) per terabyte, plus EUR 0.01 per outgoing gigabyte.

Strategic Object Storage Market Market Forecast

The object storage market is poised for sustained and significant growth, driven by the unrelenting surge in unstructured data and the increasing adoption of cloud-native strategies. Key growth catalysts include the expansion of Big Data analytics, the pervasive integration of AI/ML across industries, and the burgeoning Internet of Things (IoT) ecosystem. The continued migration of enterprise workloads to the cloud, coupled with a growing emphasis on data archiving and disaster recovery, will further bolster demand. Emerging opportunities in edge computing and the metaverse will also contribute to market expansion, necessitating highly scalable and cost-effective storage solutions. Innovations in data management, security, and intelligent tiering will enhance the value proposition of object storage, making it an indispensable component of modern IT infrastructure. The market's future potential is immense, promising continued innovation and substantial revenue growth as organizations worldwide prioritize efficient and scalable data management.

Object Storage Market Segmentation

-

1. Type

- 1.1. Cloud-based

- 1.2. On-Premise

Object Storage Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Object Storage Market Regional Market Share

Geographic Coverage of Object Storage Market

Object Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low acquisition costs of object-based solutions (especially for large-scale storage); Technological advancements such as multi-cloud data management and introduction of ML In storage analytics

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Interoperability

- 3.3.3 and Security Concerns

- 3.4. Market Trends

- 3.4.1. Cloud based Deployment to Dominate the Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Object Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cloud-based

- 5.1.2. On-Premise

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Object Storage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cloud-based

- 6.1.2. On-Premise

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Object Storage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cloud-based

- 7.1.2. On-Premise

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Object Storage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cloud-based

- 8.1.2. On-Premise

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Object Storage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cloud-based

- 9.1.2. On-Premise

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Object Storage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cloud-based

- 10.1.2. On-Premise

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Object Storage Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Cloud-based

- 11.1.2. On-Premise

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Oracle Cloud Infrastructure Object Storage

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Amazon Web Services (AWS)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Microsoft

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hitachi Vantara

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dell EMC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Google

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cloudian

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NetApp

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Pure Storage

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 IBM Cloud Object Storage

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Azure Cloud Storage

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Oracle Cloud Infrastructure Object Storage

List of Figures

- Figure 1: Global Object Storage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Object Storage Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Object Storage Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Object Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Object Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Object Storage Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Object Storage Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Object Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Object Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Object Storage Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Object Storage Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Object Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Object Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Object Storage Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Australia and New Zealand Object Storage Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Australia and New Zealand Object Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Object Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Object Storage Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Latin America Object Storage Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Latin America Object Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Object Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Object Storage Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Middle East and Africa Object Storage Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East and Africa Object Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Object Storage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Object Storage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Object Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Object Storage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Object Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Object Storage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Object Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Object Storage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Object Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Object Storage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Object Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Object Storage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Object Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Object Storage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Object Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Object Storage Market?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the Object Storage Market?

Key companies in the market include Oracle Cloud Infrastructure Object Storage , Amazon Web Services (AWS), Microsoft, Hitachi Vantara, Dell EMC, Google , Cloudian, NetApp, Pure Storage, IBM Cloud Object Storage, Azure Cloud Storage .

3. What are the main segments of the Object Storage Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Low acquisition costs of object-based solutions (especially for large-scale storage); Technological advancements such as multi-cloud data management and introduction of ML In storage analytics.

6. What are the notable trends driving market growth?

Cloud based Deployment to Dominate the Market Share.

7. Are there any restraints impacting market growth?

Costs. Interoperability. and Security Concerns.

8. Can you provide examples of recent developments in the market?

November 2022: Timescale, the company behind Timescale Cloud, a cloud-native PostgreSQL for time series, analytics, and events, announced a private beta launch for an Amazon S3-based, consumption-based object storage layer. Customers of Timescale Cloud can now store unlimited data to run their apps while only paying for the space used. With novel cloud-native architecture incorporating elements typically found in data warehouses and data lakes, Timescale's new capabilities expand the capabilities of conventional managed databases. PostgreSQL developers can now easily grow their data for a fraction of the cost of conventional storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Object Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Object Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Object Storage Market?

To stay informed about further developments, trends, and reports in the Object Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence