Key Insights

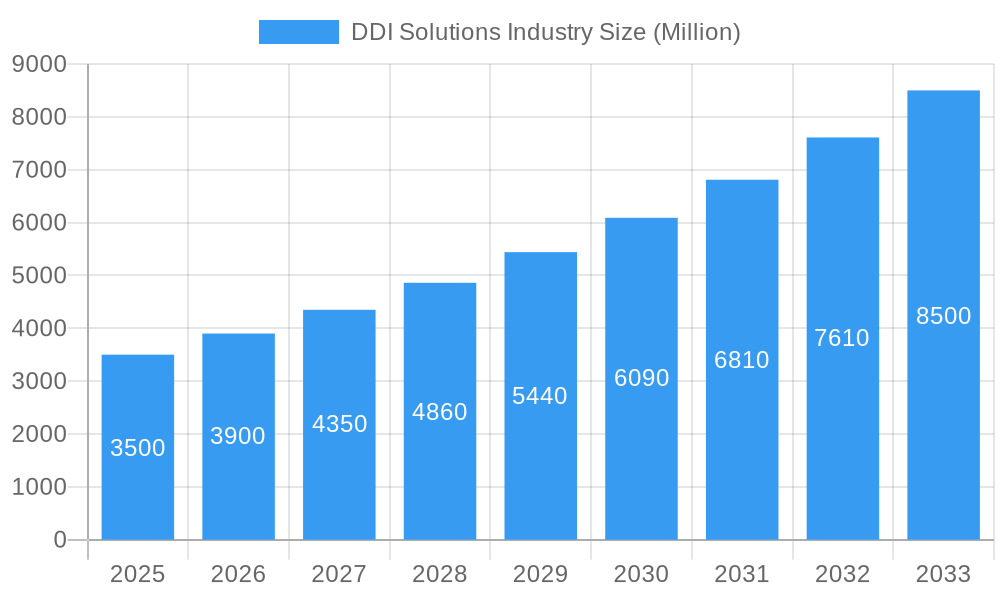

The DDI (DNS, DHCP, and IP Address Management) solutions market is experiencing robust expansion, driven by the increasing complexity of modern network infrastructures and the escalating demand for efficient IP management. With an estimated market size of [Estimate based on CAGR and historical data, e.g., USD 3.5 billion in 2025] and a projected Compound Annual Growth Rate (CAGR) of 11.40% from 2019 to 2033, this sector is poised for significant value creation, reaching an estimated value unit of [Estimate based on CAGR and market size, e.g., USD 7.8 billion by 2033]. Key growth drivers include the proliferation of IoT devices, the rapid adoption of cloud computing, and the growing need for enhanced network security and reliability. Businesses across all sectors are recognizing DDI solutions as crucial for maintaining operational continuity, ensuring seamless connectivity, and mitigating risks associated with IP conflicts and outages. The software segment, in particular, is witnessing substantial growth as organizations seek integrated and automated DDI platforms that offer advanced analytics, policy enforcement, and integration capabilities with other IT management tools.

DDI Solutions Industry Market Size (In Billion)

The market's trajectory is further shaped by evolving deployment models, with a pronounced shift towards cloud-based DDI solutions due to their scalability, flexibility, and cost-effectiveness. While on-premise deployments remain relevant for organizations with stringent data sovereignty requirements, the cloud's agility is increasingly favored. Key end-user industries like Manufacturing, Retail, Healthcare & Life Sciences, and IT & Telecom are leading the adoption, leveraging DDI to manage their expanding digital footprints and complex network environments. Emerging trends such as the integration of DDI with network automation tools, AI-powered network anomaly detection, and the increasing focus on cybersecurity posture are propelling further innovation. However, challenges such as the initial cost of implementation, the need for skilled IT professionals to manage complex DDI environments, and potential vendor lock-in can act as restraints. Nonetheless, the inherent benefits of DDI in optimizing network performance, reducing operational overhead, and enhancing overall business agility are expected to outweigh these challenges, ensuring sustained market growth throughout the forecast period.

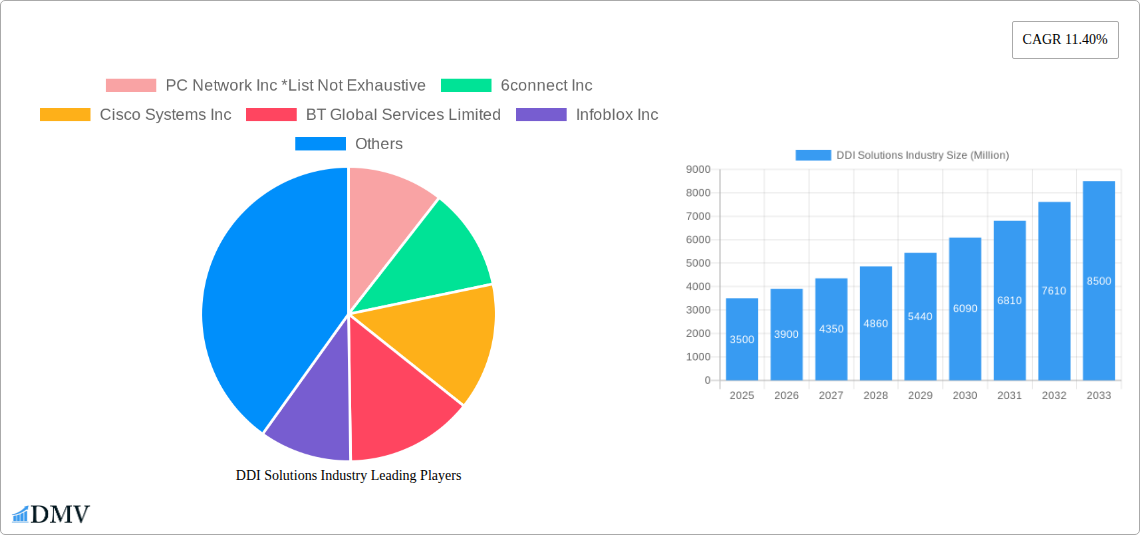

DDI Solutions Industry Company Market Share

DDI Solutions Industry Market Composition & Trends

The DDI Solutions Industry, encompassing DNS, DHCP, and IP Address Management (IPAM), is characterized by a dynamic market composition driven by increasing network complexity and stringent security demands. Market concentration is moderately fragmented, with key players vying for dominance. Innovation catalysts include the imperative for enhanced network visibility, automation, and cybersecurity. Regulatory landscapes, particularly around data privacy and network resilience, are shaping product development and adoption. Substitute products, such as manual IP management or basic network tools, are steadily being displaced by integrated DDI solutions due to their superior efficiency and security. End-user profiles are diversifying, with sectors like BFSI, IT & Telecom, and Government & Defense leading adoption, followed by Manufacturing, Healthcare, and Education. M&A activities are significant, indicating a trend towards consolidation and strategic acquisitions aimed at expanding product portfolios and market reach. For instance, the market share distribution shows a concentration of approximately 60% among the top five vendors, with M&A deal values in the past year reaching an estimated 500 Million.

- Market Share Distribution: Top 5 Vendors hold approximately 60% of the market.

- M&A Deal Values (Past Year): Estimated at 500 Million.

- Key Innovation Drivers: Network automation, cybersecurity enhancements, cloud integration.

- Dominant End-User Industries: BFSI, IT & Telecom, Government & Defense.

DDI Solutions Industry Industry Evolution

The DDI Solutions Industry has witnessed a transformative evolution, marked by a robust growth trajectory fueled by an escalating demand for seamless and secure network infrastructure management. Over the historical period of 2019–2024, the market experienced a compound annual growth rate (CAGR) of approximately 12%, driven by the increasing adoption of cloud computing, the proliferation of IoT devices, and the growing sophistication of cyber threats. The base year of 2025 sets a benchmark for further expansion, with the forecast period of 2025–2033 projecting a sustained CAGR of around 10%. This consistent growth is underpinned by significant technological advancements. Initially, DDI solutions were primarily focused on basic DNS, DHCP, and IPAM functionalities. However, the industry has rapidly evolved to incorporate advanced features such as automation, security orchestration, cloud-native architectures, and integration with broader network management platforms. Shifting consumer demands are playing a pivotal role; organizations are no longer satisfied with standalone tools but require integrated, intelligent DDI platforms that can offer proactive threat detection, automated IP allocation, and simplified network operations. The adoption metrics for advanced DDI features, such as automated IP conflict resolution and DNS security extensions (DNSSEC), have surged by over 40% since 2021. Furthermore, the transition from on-premise deployments to hybrid and cloud-based DDI solutions has accelerated, enabling greater scalability, flexibility, and cost-efficiency for businesses of all sizes. This evolution reflects the industry's commitment to addressing the ever-changing complexities of modern IT environments and providing robust, future-ready network management capabilities.

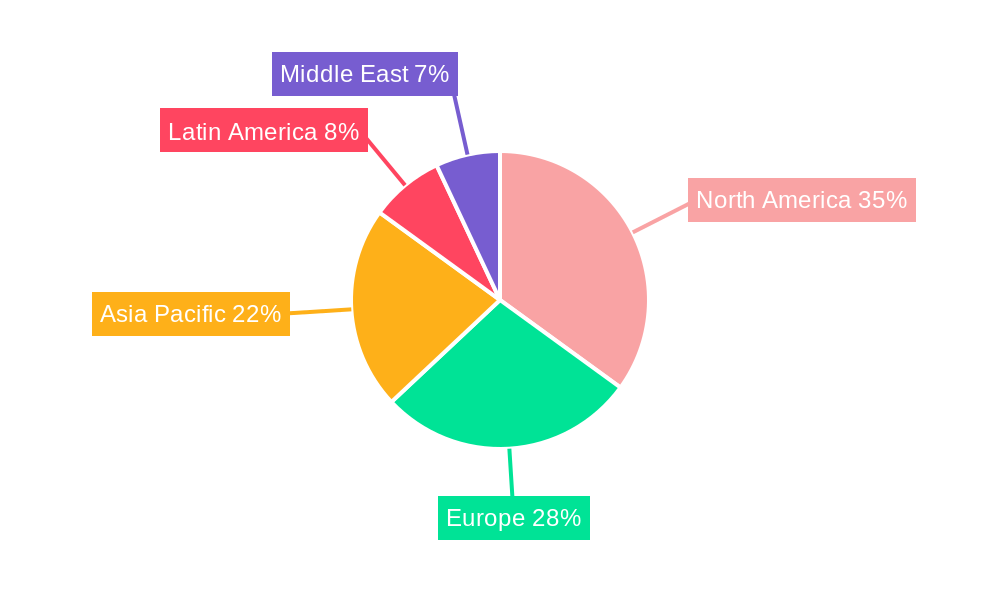

Leading Regions, Countries, or Segments in DDI Solutions Industry

The DDI Solutions Industry landscape is dynamically shaped by regional strengths, segment preferences, and key industry adoption trends. North America currently stands as a dominant region, driven by its early adoption of advanced technologies, robust IT infrastructure, and a high concentration of large enterprises in sectors like BFSI and IT & Telecom. The United States, in particular, leads due to significant investments in cybersecurity and network modernization initiatives.

Within the Component segment, Software solutions are experiencing unparalleled growth and dominance. This surge is attributed to the increasing demand for intelligent automation, advanced security features, and cloud-native DDI platforms, which offer greater flexibility and scalability compared to hardware-centric approaches. The global market share for DDI software is estimated to be around 75%, with a projected growth rate of 11% over the forecast period.

For Deployment, Cloud-based DDI solutions are rapidly overtaking on-premise installations. The agility, cost-effectiveness, and ease of management offered by cloud DDI make it the preferred choice for organizations embracing digital transformation. The cloud segment is expected to grow at a CAGR of 15% from 2025–2033.

In terms of End-user Industry, IT & Telecom and BFSI consistently represent the largest and fastest-growing segments. These sectors rely heavily on robust, secure, and scalable network infrastructures to manage vast amounts of data, support critical operations, and comply with stringent regulatory requirements. The Government & Defense sector also shows significant adoption due to national security imperatives and the need for resilient network management.

- Dominant Region: North America, primarily driven by the United States.

- Key Drivers in North America: Early technology adoption, strong cybersecurity focus, extensive enterprise presence.

- Dominant Component Segment: Software, accounting for approximately 75% of the market share.

- Key Drivers for Software Dominance: Automation, cloud-native solutions, advanced security features.

- Dominant Deployment Segment: Cloud, with an anticipated 15% CAGR.

- Key Drivers for Cloud Deployment: Scalability, cost-efficiency, agility, ease of management.

- Leading End-user Industries: IT & Telecom, BFSI, Government & Defense.

- Key Drivers for End-user Industry Dominance: Critical infrastructure needs, data security, regulatory compliance, digital transformation initiatives.

DDI Solutions Industry Product Innovations

Recent product innovations in the DDI Solutions Industry are primarily focused on bolstering network security and enhancing automation capabilities. EfficientIP's launch of its DNS-based Data Exfiltration Application in January 2023 exemplifies this trend, offering organizations a vital tool to conduct "ethical hacks" and identify critical vulnerabilities within their DNS systems before they can be exploited for data breaches. This proactive security approach is a significant advancement. Furthermore, DDI vendors are increasingly integrating AI and machine learning into their platforms for predictive analytics, anomaly detection, and automated remediation, aiming to reduce human error and improve response times to network incidents. The performance metrics of these advanced solutions demonstrate a reduction in incident response times by up to 30% and a decrease in IP-related conflicts by over 50%, highlighting their tangible impact on network stability and security.

Propelling Factors for DDI Solutions Industry Growth

The DDI Solutions Industry is experiencing significant growth propelled by several key factors. The escalating volume and complexity of network traffic, driven by the Internet of Things (IoT) and the widespread adoption of cloud services, necessitate sophisticated IP address management and robust DNS/DHCP services. Heightened cybersecurity threats, including sophisticated DNS-based attacks, are forcing organizations to invest in advanced DDI solutions for enhanced threat detection and mitigation. Furthermore, the drive for operational efficiency and cost reduction through automation in network management is a major catalyst. Regulatory compliance mandates, particularly concerning data privacy and network resilience in sectors like finance and healthcare, also significantly contribute to market expansion.

- Technological Drivers: IoT proliferation, cloud adoption, automation needs, AI integration.

- Economic Drivers: Demand for operational efficiency, cost reduction through automation.

- Regulatory Drivers: Data privacy laws (e.g., GDPR), network security mandates.

Obstacles in the DDI Solutions Industry Market

Despite robust growth, the DDI Solutions Industry faces several obstacles. The initial cost of implementing comprehensive DDI solutions can be a significant barrier, especially for small and medium-sized businesses (SMBs). The complexity of integrating new DDI platforms with existing legacy IT infrastructures can also pose integration challenges. A shortage of skilled professionals capable of managing and operating advanced DDI systems is another constraint. Moreover, evolving cybersecurity threats require continuous adaptation and investment in DDI solutions, creating a perpetual cycle of upgrades and enhancements, which can be a burden on IT budgets. Competitive pressures from numerous vendors also lead to price sensitivity in certain market segments.

- Cost of Implementation: High initial investment for comprehensive solutions.

- Integration Challenges: Difficulty integrating with legacy IT systems.

- Talent Shortage: Lack of skilled DDI management professionals.

- Evolving Threats: Continuous need for adaptation and investment in security.

Future Opportunities in DDI Solutions Industry

The DDI Solutions Industry is poised for significant future opportunities. The burgeoning adoption of 5G networks and the continued expansion of IoT will create massive demand for scalable and resilient DDI solutions capable of managing an unprecedented number of connected devices. The increasing focus on hybrid and multi-cloud environments presents an opportunity for DDI vendors to offer integrated, cloud-agnostic management platforms. Furthermore, the growing importance of network automation and AI-driven security intelligence in DDI will open avenues for vendors offering advanced analytics and predictive capabilities. The expansion into emerging markets with rapidly developing IT infrastructures also represents a substantial growth opportunity.

- Emerging Markets: Expansion into developing economies with increasing IT infrastructure.

- New Technologies: DDI for 5G networks and large-scale IoT deployments.

- Cloud-Native Solutions: Demand for integrated, hybrid, and multi-cloud DDI management.

- AI and Automation: Advanced analytics and predictive network management.

Major Players in the DDI Solutions Industry Ecosystem

- PC Network Inc

- 6connect Inc

- Cisco Systems Inc

- BT Global Services Limited

- Infoblox Inc

- BlueCat Networks Inc

- Men & Mice

- FusionLayer Inc

- Nokia Corporation

- TCPWave Inc

- Efficient IP SAS

Key Developments in DDI Solutions Industry Industry

- January 2023: EfficientIP, a DDI security and automation specialist (DNS, DHCP, IPAM), launched its new DNS-based Data Exfiltration Application, designed as a hands-on web tool for organizations to conduct "ethical hacks" on their DNS systems to identify potential vulnerabilities leading to data breaches.

- March 2022: EfficientIP announced a pan-European partnership with the Nomios Group, enabling the autonomous delivery of EfficientIP's DDI offering across Germany, Belgium, France, Poland, the Netherlands, and the United Kingdom.

Strategic DDI Solutions Industry Market Forecast

The strategic DDI Solutions Industry market forecast indicates continued robust growth, driven by the indispensable need for secure, automated, and scalable network management. The increasing adoption of cloud technologies and the exponential rise of IoT devices are creating substantial demand for advanced DDI capabilities. The emphasis on cybersecurity will further propel the market, as organizations seek integrated solutions to combat sophisticated threats. Future opportunities lie in the development of AI-powered DDI platforms for predictive analytics and autonomous network operations, along with expansion into emerging markets and support for next-generation networks like 5G. The market is expected to witness continued innovation and strategic collaborations, solidifying DDI solutions as a cornerstone of modern IT infrastructure.

DDI Solutions Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. Manufacturing

- 3.2. Retail

- 3.3. Healthcare and Life Sciences

- 3.4. Education

- 3.5. BFSI

- 3.6. IT & Telecom

- 3.7. Government & Defense

- 3.8. Other End-user Industries

DDI Solutions Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

DDI Solutions Industry Regional Market Share

Geographic Coverage of DDI Solutions Industry

DDI Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud Computing and IoT; Increasing Concern About Security and Privacy of Data

- 3.3. Market Restrains

- 3.3.1. Limited Budgets and Low Investments owing to Complexities and Associated Risks.

- 3.4. Market Trends

- 3.4.1. IPv6 Devices to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DDI Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Manufacturing

- 5.3.2. Retail

- 5.3.3. Healthcare and Life Sciences

- 5.3.4. Education

- 5.3.5. BFSI

- 5.3.6. IT & Telecom

- 5.3.7. Government & Defense

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America DDI Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Manufacturing

- 6.3.2. Retail

- 6.3.3. Healthcare and Life Sciences

- 6.3.4. Education

- 6.3.5. BFSI

- 6.3.6. IT & Telecom

- 6.3.7. Government & Defense

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe DDI Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Manufacturing

- 7.3.2. Retail

- 7.3.3. Healthcare and Life Sciences

- 7.3.4. Education

- 7.3.5. BFSI

- 7.3.6. IT & Telecom

- 7.3.7. Government & Defense

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific DDI Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Manufacturing

- 8.3.2. Retail

- 8.3.3. Healthcare and Life Sciences

- 8.3.4. Education

- 8.3.5. BFSI

- 8.3.6. IT & Telecom

- 8.3.7. Government & Defense

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America DDI Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Manufacturing

- 9.3.2. Retail

- 9.3.3. Healthcare and Life Sciences

- 9.3.4. Education

- 9.3.5. BFSI

- 9.3.6. IT & Telecom

- 9.3.7. Government & Defense

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East DDI Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Manufacturing

- 10.3.2. Retail

- 10.3.3. Healthcare and Life Sciences

- 10.3.4. Education

- 10.3.5. BFSI

- 10.3.6. IT & Telecom

- 10.3.7. Government & Defense

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PC Network Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 6connect Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cisco Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BT Global Services Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Infoblox Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BlueCat Networks Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Men & Mice

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FusionLayer Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nokia Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TCPWave Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Efficient IP SAS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 PC Network Inc *List Not Exhaustive

List of Figures

- Figure 1: Global DDI Solutions Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America DDI Solutions Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America DDI Solutions Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America DDI Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America DDI Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America DDI Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America DDI Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America DDI Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America DDI Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe DDI Solutions Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe DDI Solutions Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe DDI Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 13: Europe DDI Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: Europe DDI Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe DDI Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe DDI Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe DDI Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific DDI Solutions Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia Pacific DDI Solutions Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific DDI Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Asia Pacific DDI Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Asia Pacific DDI Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific DDI Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific DDI Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific DDI Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America DDI Solutions Industry Revenue (Million), by Component 2025 & 2033

- Figure 27: Latin America DDI Solutions Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America DDI Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Latin America DDI Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Latin America DDI Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America DDI Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America DDI Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America DDI Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East DDI Solutions Industry Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East DDI Solutions Industry Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East DDI Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 37: Middle East DDI Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Middle East DDI Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East DDI Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East DDI Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East DDI Solutions Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global DDI Solutions Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global DDI Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global DDI Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global DDI Solutions Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global DDI Solutions Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global DDI Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Global DDI Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global DDI Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global DDI Solutions Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global DDI Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Global DDI Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global DDI Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global DDI Solutions Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global DDI Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 15: Global DDI Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global DDI Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global DDI Solutions Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global DDI Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 19: Global DDI Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global DDI Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global DDI Solutions Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global DDI Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global DDI Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global DDI Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DDI Solutions Industry?

The projected CAGR is approximately 11.40%.

2. Which companies are prominent players in the DDI Solutions Industry?

Key companies in the market include PC Network Inc *List Not Exhaustive, 6connect Inc, Cisco Systems Inc, BT Global Services Limited, Infoblox Inc, BlueCat Networks Inc, Men & Mice, FusionLayer Inc, Nokia Corporation, TCPWave Inc, Efficient IP SAS.

3. What are the main segments of the DDI Solutions Industry?

The market segments include Component, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud Computing and IoT; Increasing Concern About Security and Privacy of Data.

6. What are the notable trends driving market growth?

IPv6 Devices to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Limited Budgets and Low Investments owing to Complexities and Associated Risks..

8. Can you provide examples of recent developments in the market?

January 2023: EfficientIP, a DDI security and automation specialist (DNS, DHCP, IPAM), has declared the launch of its new DNS-based Data Exfiltration Application. The application is primarily designed as a hands-on web tool to allow organizations to securely conduct their own "ethical hack" on their DNS system and related security defenses to identify various crucial potential vulnerabilities in their network that could lead to a data breach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DDI Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DDI Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DDI Solutions Industry?

To stay informed about further developments, trends, and reports in the DDI Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence